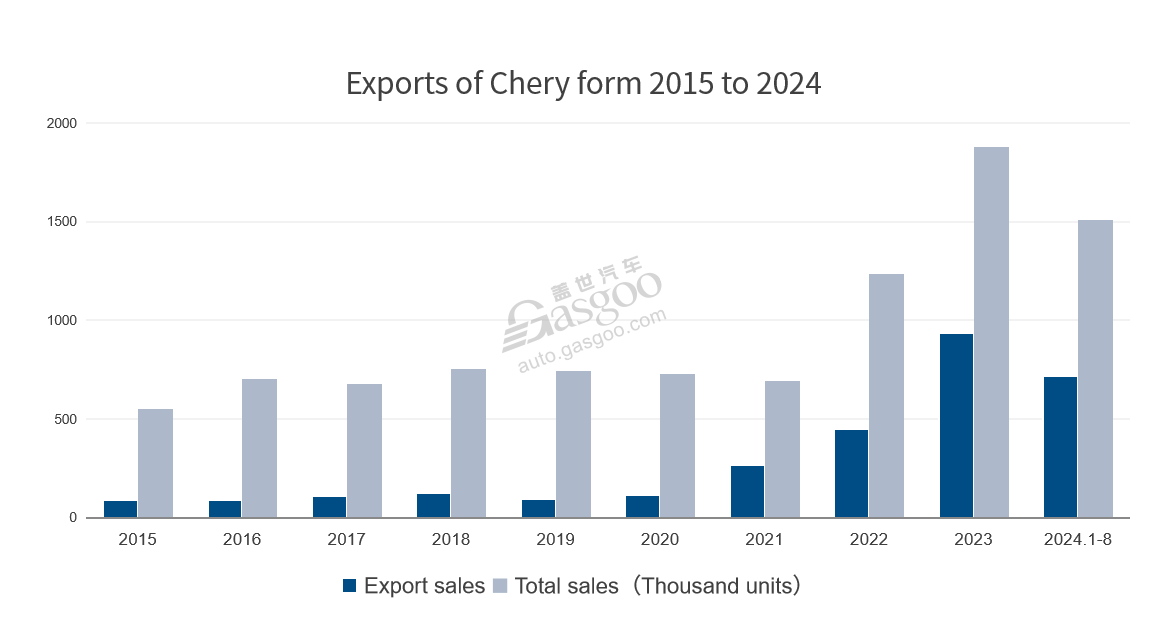

From January to August 2024, Chery Automobile achieved cumulative sales of 1.5 million units, marking a year-on-year increase of 41.9%. In terms of exports, Chery continued to hold the top spot among Chinese automakers, with exports growing by 25.2% to reach 720,000 units.

In 2023, Chery has also delivered an impressive performance, with annual sales reaching a historic 1.88 million units, a 52.6% year-on-year increase. Export sales hit 937,000 units, an increase of 101%, maintaining the top position in Chinese brand passenger car exports for 21 consecutive years.

As a former leader among Chinese car brands, Chery has experienced many ups and downs, but now Chery has returned to center stage.

Hi, welcome to Gasgoo. In this episode of "Wheels of Change: Stories of Chinese Auto Giants," let's talk about the global automotive tech giant - Chery Holding Group (Hereinafter referred to as Chery).

Rising from the Ashes: The Highs and Lows of Chery

In 1997, with support from the Anhui provincial and Wuhu municipal governments, Chery Automobile's predecessor—Anhui Automotive Parts Industrial Company—was established. At that time, Chinese auto market was largely dominated by foreign or joint-venture brands, leaving Chery, with no background or resources, seeking to break through independently. Starting from scratch, Chery began planning the development of its first-generation model in a thatched hut within an abandoned factory.

Thereafter, Chery's development can be roughly divided into three phases.

From 1997 to 2010: Laying the Foundation and Exploring Internationalization

During this phase, Chery focused on establishing basic industrial capabilities, accumulating technologies, and expanding its product lines. At the same time, Chery began exploring international markets, gradually increasing its export business and expanding its brand influence. The two core labels of "Technology-driven" and "Going Global" were established during this period.

In May 1999, Chery's first self-developed engine successfully rolled off the production line, laying the foundation for Chery’s image as a technology-driven company. In December of the same year, Chery launched its first sedan, the Fengyun, marking Chery’s breakthrough from "zero to one" in independent car manufacturing. This commitment to independent R&D continues to this day.

Photo Credit: Chery Automible

In 2001, Chery exported its first batch of ten Fengyun sedans to Syria, marking the beginning of its journey into international markets.

With popular models like the Fengyun and QQ, Chery quickly gained nationwide popularity. In 2006, Chery became the first Chinese brand to sell 300,000 passenger cars in a year. In August 2007, Chery's one-millionth vehicle rolled off the production line.

From 2001 to 2011, Chery consistently held the top spot in car sales among Chinese brands for 11 consecutive years. However, Chery was also branded as "cheap" and "low-end" during this time.

Photo Credit: Chery Automible

In 2009, in an effort to diversify product portfolio and improve brand image, Chery launched a multi-brand strategy centered around four core brands: Chery, Karry, Riich, and Rely, with product lines ranging from low-end to high-end vehicles and from vans to SUVs. However, the market performance was not satisfactory, and the multi-brand strategy ultimately failed.

As Chery pursued its multi-brand strategy, the market environment was also changing rapidly. The competition in the family car and SUV markets intensified, with other brands like Geely and Great Wall securing market shares with strong products, creating a more complex market environment for Chery.

At the same time, Chery’s high-end brands Riich and Rely also struggled.

On one hand, the products themselves lack of competitiveness, and consumers at the time generally associated Chinese cars with low prices, making it difficult for them to accept a Chinese high-end brand.

On the other hand, Chery has made relatively low investment in brand building and marketing, resulting in insufficient brand recognition and influence to support its high-end positioning.

Without sufficient brand strength and market basis, Chery's multi-brand strategy resulted in limited resources scattered and a lack of strategic focus, thus losing its first-mover advantage. After 2011, Chery's market performance began to decline significantly, and it quickly lost its position as the leading Chinese car brand, entering the second phase of its development.

From 2011 to 2020: Strategic Adjustment and Growth Plateau

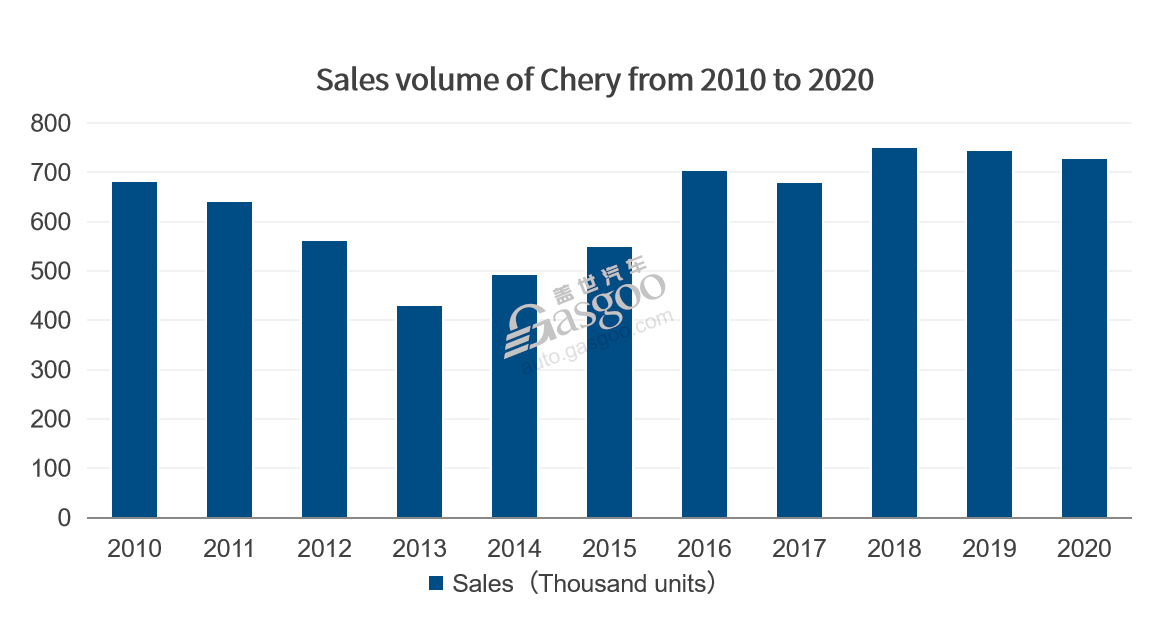

After 2012, Chery announced a new strategy to return to One Chery brand, but the results were not as expected. During this transition, Chery experienced a U-shaped sales curve and suffered many doubts and criticism.

Despite the disappointing sales, Chery remained committed to strategic adjustments, focusing on improving brand image and refining market positioning. During this period, Chery laid emphasis on enhancing product quality and technical content while continuing to expand its global influence. However, these efforts came with increased R&D and marketing expenses, putting significant pressure on Chery's financial situation.

Data shows that from 2015 to 2017, Chery Holding's total annual debt was 31.56 billion RMB, 32.89 billion RMB and 62.7 billion RMB respectively, with debt ratios of 73.3%, 73.15% and 80.78%. During the same period, Chery Automobile's total debt was 51.2 billion RMB, 58.12 billion RMB and 62.38 billion RMB, with debt ratios of 74.77%, 74.6%, and 75.08% respectively.

At that time, Chery had no choice but to sell assets to save the company. In 2016, Chery Automobile sold 100% of its transmission plant for 2.6 billion RMB. In 2017, Chery Automobile sold its stake in high-end brand Qoros for 6.5 billion RMB. In 2018, Chery sold a 51% stake in Kaiyi Auto for 27.1 billion RMB in cash.

However, these funds were insufficient to support subsequent development of Chery. Faced with the dual pressures of a capital winter and a downturn in the automotive market, Chery's “mixed-ownership reform” finally took shape.

In 2019, Qingdao Wudaokou New Energy Industrial Fund invested 19.6 billion RMB to acquire 51% of Chery Holding and 35.58% of Chery Automobile, becoming the largest shareholder in both companies.

Two years later, Qingdao Wudaokou sold part of its stake in Chery Automobile, and Luxshare Precision acquired 19.88% of Chery Holding, 7.87% of Chery Automobile, and 6.24% of Chery New Energy from Qingdao Wudaokou for 10.054 billion RMB, becoming Chery’s new strategic investor.

Through the reform, Chery successfully introduced external capital, easing its financial pressure. At the same time, the reform helped Chery improve its corporate governance structure, enhancing management efficiency and transparency. By bringing in investors with diverse backgrounds, Chery gained a more diversified perspective and advanced management experience, helping it better adapt to market changes and enhance competitiveness.

With a lighter burden and the previously established R&D, marketing, and manufacturing systems, Chery finally began to see positive results. Amid global market changes, Chery entered its 3.0 era of resurgence.

Since 2020, Chery entered a period of rapid overseas expansion and bagan to accelerate its transition to new energy vehicles (NEVs). After ten lost years, Chery is back.

Overseas Expansion: Chery's Export Boom

Starting from 2021, Chery began to return to the fast lane, achieving annual sales milestones of 960,000, 1.23 million, and 1.88 million units in a row, which can be largely attributed to its strong performance in overseas markets, with exports surged from 269,000 vehicles in 2021 to 937,100 units in 2023, an increase of 248%.

The proportion of exports in Chery’s total sales also increased significantly, from 28% in 2021 to 49.81% in 2023, making Chery the first Chinese auto brand whose overseas sales nearly accounted for half of its total sales, ranking first in passenger vehicle exports of Chinese auto brands for 21 consecutive years.

The strong performance of Chery in overseas markets can be attributed to two main factors. Firstly, Chinese automakers, including Chery, are capitalizing on the immense opportunities brought by the global shift toward NEVs. Secondly, due to the impacts of the pandemic and geopolitical issues, certain regions have experienced explosive growth in import demand, particularly the Russian market.

In 2022, the conflict between Russia and Ukraine reshaped Russian automotive market, with many international automakers exiting the market. This provided Chinese automakers, including Chery, with a rare opportunity for rapid growth.

According to Autostat, a Russian automotive market research institute, six Chinese car brands ranked in Russia's top ten in 2023. Chery led the Chinese brands, selling 119,000 vehicles with a twofold increase, capturing 11.2% of the market share. Additionally, Chery's EXEED brand ranked sixth with 42,000 vehicles sold, closely followed by the OMODA.

Chery’s ability to seize this opportunity is largely due to its over 20 years of foresight in overseas market expansion.

Over the years, Chery has consistently focused on developing both domestic and international markets. It was one of the first Chinese automakers to export complete vehicles, CKD kits, engines, and vehicle manufacturing technology and equipment to foreign markets.

Chery’s journey in overseas markets has gone through three stages: Overseas Sales, Localization and Brand Elevation. Before 2013, Chery mainly targeted developing countries like Egypt, Syria, and Iran, exporting vehicles to these markets.

After 2014, marked by the establishment of its Brazil plant, Chery started in-depth localization, expanding into emerging markets such as Brazil and Russia. Over time, Chery gradually developed comprehensive sales and service networks and set up production bases in key markets to supply local demands and nearby regions.

While exporting products, Chery has also been exporting its own technologies and standards.

In 2019, Chery officially launched its "Global Quality Management System". This system integrates international advanced standards and management practices with Chery’s own quality management experience, covering the entire product lifecycle from global product planning, design and development, supply chain management, manufacturing, marketing and quality assurance. This system has been implemented across Chery’s global plants and is one of the key factors behind its overseas success.

Over the past two decades, Chery has built its own global business network, establishing 10 overseas production bases and working with over 1,500 international dealerships, covering more than 80 countries and regions. To date, Chery has over 13 million users worldwide.

At present, the main export destinations of Chery are Russia, Latin America, and the Middle East, with fuel vehicles being the main export force. Among them,the Tiggo series has played a crucial role in Chery’s exports, achieving global sales of 940,000 units in 2023, making it the best-selling fuel-powered SUV among Chinese brands worldwide.

Looking at Chery’s journey into overseas markets, the automaker initially relied on affordable and economy cars to penetrate international markets, leveraging its price advantage to quickly capture market share in regions with less-developed automotive industries.

Judging by market outcomes, Chery’s strategy has proven successful. Thanks to its strong performance abroad, Chery’s fuel vehicle sales have continued to grow even as the Chinese market for fuel-powered vehicles shrinks.

Today, Chery takes brand elevation as its core objective, aiming to complete its global layout and become a globally competitive, world-class auto brand. As the brand evolves and international competition intensifies, Chery will need to make a series of strategic adjustments and upgrades, focusing on mature markets like Europe and the NEV sector to enhance its global competitiveness.

The EXEED brand could be the key to boosting Chery’s global brand value. Yin Tongyue, the Chairman of Chery, once stated that EXEED should become Chery’s version of “BBA” (refers to Mercedes-Benz, BMW and Audi), with ambitions to achieve export prices exceeding 1 million RMB per vehicle.

At the same time, Chery is turning its attention toward the European market. Jochen Tueting, General Manager of Chery Europe, announced that Chery plans to establish three brands in Europe by 2026, with three new models launched for each brand.

On April 19th, Chery signed an agreement with Spanish company Ebro-EV Motors to establish a new joint venture in Barcelona to jointly manufacture electric vehicles, with a total investment of 400 million euros. Chery will produce and distribute vehicles at a facility acquired from Nissan, which closed in 2021.

According to the agreement, production is expected to begin this year, with an initial annual output of 50,000 vehicles by 2027, increasing to 150,000 units by 2029. The OMODA 5, in both electric and fuel-powered versions, will be among the first models produced at the new plant.

With the expansion into Europe and the promising growth in key markets along the Belt and Road, such as the Middle East and Southeast Asia, Chery’s export volumes are expected to rise further.

Internationalization remains an ace of Chery and a key driver behind its resilience and resurgence. Chery’s global strategy is steadily yielding results, but ultimately, all the success depends on its ability to deliver products that win the favor of consumers both at home and abroad.

Dual Strategy of Fuel and Electric Vehicles: Four Major Brands Power Chery's Transformation and Growth

As the global automotive market undergoes significant changes driven by the surge of NEVs, China's homegrown brands are expanding at an unprecedented pace. To respond more quickly to market shifts, and to position and promote products more precisely, traditional automakers are launching sub-brands, creating diversified product portfolios that align with industry trends and meet consumers’ growing demand for personalized and varied products.

As a veteran in multi-brand strategies, Chery announced in April 2023 the establishment of a core brand matrix consisting of Chery, EXEED, JETOUR, and iCAR, complemented by the LUXEED brand developed in partnership with Huawei. This diverse lineup covers everything from economy models to high-end luxury models, and from traditional internal combustion engine (ICE) vehicles to NEVs.

According to Gasgoo Auto Research Institute, Chery's current multi-brand strategy is relatively clearer, targeting different user groups and market segments, with each brand following distinct development strategies, all with their unique characteristics.

Among them, EXEED and LUXEED focus on moving the brand upscale. EXEED's STERRA series is built on Chery’s own ecosystem and external technology providers, while the LUXEED products are developed through Huawei Smart Selection model, aiming to boost sales in the mid-to-high-end segments.

The Chery brand itself emphasizes hybrid technology, aiming to achieve an electrification transformation.

The iCAR brand, through its partnership with internet company Zhimi Technology, focuses on creating cars that resonate with young consumers’ lifestyles.

Meanwhile, the JETOUR brand, with its "Travel+" positioning, taps into the "travel boom" brought about by consumer upgrades.

Together, these brands form a matrix crucial to Chery’s accelerated transition to NEVs and its push for brand elevation.

In fact, Chery's entry into the NEV sector wasn’t late. As early as 1999, Chery began developing energy-saving and NEV technologies, launching its first hybrid car A5-BSG in 2008. In 2010, Chery New Energy was established, dedicated to the development of various NEV types, including pure electric, hybrid, and fuel cell vehicles.

However, in its early stages, Chery's NEVs primarily targeted the lower-end market, especially in the micro EV segment. While this strategy helped Chery gain a foothold in the entry-level market, it left the company with limited presence in the high-end NEV market.

By 2022, Chery had secured a spot in the NEV market with its two A00-class pure electric models, the eQ1 (Little Ant) and QQ Ice-cream, reaching sales of 230,000 units that year. However, as the NEV market underwent consumer upgrades, demand in the A00-class EV market shrank rapidly, and Chery’s limited offerings in mainstream family NEVs caused it to miss out on further market expansion.

Though Chery has not released its NEV sales in 2023, the data of China Passenger Car Association (CPCA) shows that in December 2023, Chery’s retail sales of new energy passenger vehicles totaled only 20,000 units, with the company failing to enter the top 10 NEV manufacturers that year.

Reflecting on Chery's NEV development, Yin Tongyue noted that Chery started early but failed to achieve good results. During the launch of the EXEED STERRA ET on May 9, he stressed that there will be no more holding back this year, predicting that Chery's NEV sales would soon enter the industry’s top 3.

Since 2023, Chery has accelerated the development of its NEV models. In addition to the STERRA ET, the EXEED STERRA series also features the pure electric sedan STERRA ES, which was launched at the end of 2023.

The Chery brand mainely promotes Fengyun series, with seven new models unveiled at the Beijing Auto Show on April 25, including the first mass-produced NEV concept car E06, Fengyun A9, Fengyun T9, Explore 06 C-DM, Explore 06 Secret Knight Edition, and the new Tiggo 8, of which the Fengyun T9 officially launched on May 21.

For the JETOUR brand, the newly created Shanhai lineup is its core NEV product series. The first model of this series, the Shanhai L9, was launched in November 2023, followed by the Shanhai T2 in April and the Shanhai L6 in August this year. JETOUR is also expected to release the Shanhai L7 models later this year.

The iCAR brand is Chery Group’s first NEV-focused brand, targeting young users with products that span SUVs and sedans. The iCAR 03, iCAR’s first model, built on the i-MS modular NEV platform, officially launched on February 28. The second model, the iCAR GT, is an electric two-door sports coupe.

Overall, Chery and JETOUR’s NEV series primarily feature the C-DM hybrid system, while EXEED STERRA and iCAR target the mid-to-high-end market with models priced between 200,000 and 300,000 RMB, and the pure electric segment priced at 100,000 RMB.

2024 is poised to be a pivotal year for Chery’s NEV products. In the first eight months of this year, Chery’s NEV sales nearly reached 273,000 units, a 187% year-on-year increase. However, this performance is still short of securing a spot in the industry’s top 3.

Gasgoo Auto Research Institute suggests that Chery faces challenges in becoming a top player in the NEV market this year. While Chery has launched multiple models across different segments, issues such as brand recognition, brand image, NEV-specific service channels, technological innovation, and supply chain ecosystems are still evolving. So far, A truly standout model that can drive blockbuster sales has yet to emerge.

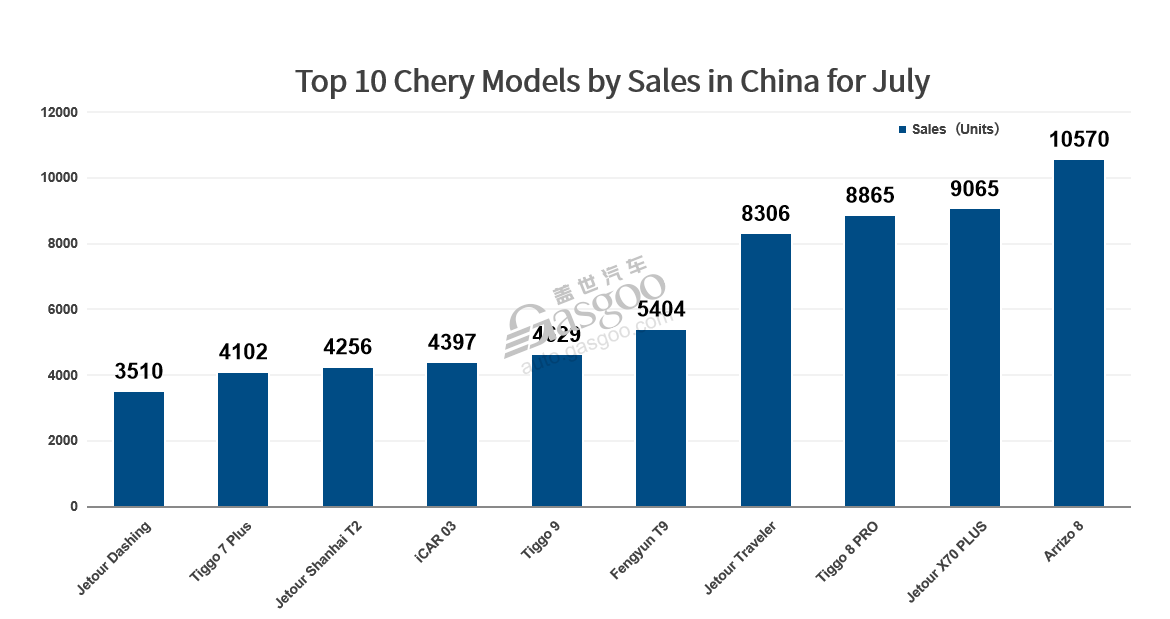

At present, the main force of Chery's sales is still ICE vehicles. According to the terminal data from Gasgoo Auto Research Institute, the top-selling Chery models in China this July remained the Arrizo 8 and Jetour X70 Plus.

In fact, Chery has no plans to fully phase out ICE vehicles like BYD. The company has consistently emphasized a dual-track strategy of “ICE+NEV”.

According to the plan of Chery Group, in addition to the iCAR brand focusing on electric models, in 2024, Chery brand will launch eight upgraded ICE models and five new hybrid models, while JETOUR will continue its dual strategy of ICE and hybrid vehicles, launching a total of 15 new models, including seven ICE and eight hybrid models, aiming for 500,000 annual sales.

EXEED will fully transition to NEVs but still plans to launch three ICE models alongside a product matrix featuring three C-DM hybrids, two pure electric models, and two range-extended vehicles, with the goal of achieving 300,000 annual sales.

Chery’s dual-track strategy is not a temporary measure. ICE vehicles still hold a significant share of the global market and remain profitable. Chery must maintain its competitiveness in this sector to sustain its current growth momentum.

Additionally, Chery’s export success, particularly in developing markets, still largely relies on its ICE vehicles. To solidify and expand its international influence, Chery must continue iterating its ICE models.

In conclusion, while Chery remains committed to deepening its presence in the ICE sector, it is steadily advancing its NEV development, focusing on hybrids in the short term and aiming for pure electric dominance in the long run.