China's auto industry stands at a historic crossroads.

The wave of electrification and smart technology is reshaping the core of the product — and upending the century-old pecking order. In this phenomenon-level transition, a cohort of Chinese brands is moving at unprecedented speed to storm the high-end heartland long dominated by German, Japanese and American incumbents. Names like NIO, Li Auto, ZEEKR, AITO and Avatr have anchored their offerings firmly in the 300,000- to 500,000-yuan-and-above bracket, earning striking early recognition from the market.

Data compiled by Gasgoo Auto Research Institute show that in the first three quarters of 2025, cumulative sales of high-end models in the domestic market reached 4.06 million, up 3.4% year on year, with premium products from new-energy players contributing the bulk of the incremental growth. In November 2025 alone, luxury-car sales totaled 612,000 — a 14.8% annual increase and a 12.2% gain from October. Of those, new-energy luxury models accounted for 390,000, up 33.4% year on year and 13.4% month on month, driving most of the expansion.

For now, the new-energy brands that have truly achieved scale are chiefly homegrown — in other words, Chinese names are steadily taking the lead in the premium NEV market. Take the AITO M8: it's the bestseller in the 350,000–450,000 yuan band, averaging more than 20,000 units a month. The AITO M9 has also topped the 500,000-yuan-and-up segment, with monthly sales clearing the 10,000 mark. Set against the trajectory of China’s premium-car market, these upmarket breakthroughs by domestic brands are milestones in their own right.

Yet beneath the surface prosperity, a deeper — and tougher — test is already underway.

Early wins often come from a surgical strike on a single niche, from fixing a specific pain point with ruthless focus, or from a novel business model. But once the applause fades and the track gets crowded, these high-end upstarts face a different challenge: not how to enter the market, but how to keep leading; not how to launch a smash hit, but how to win at scale; not how to celebrate a few star products, but how to build a sustainable luxury brand. Looming large is the “scale trap” that haunts almost all disruptors — rapid expansion off the back of initial success exposes systemic shortfalls in brand equity, organizational capability and management, leading to growth stalls, reputational slippage and, in severe cases, existential risk.

This breakout, at its core, is a deep contest to push China's auto industry from product-level advances to system maturity, from market catch-up to value leadership. The fight will center on several fronts: building and extending brand value, evolving and tempering organizational capabilities, and navigating the opportunities and hazards of globalization. For every participant, this is an unavoidable stress test. And 2026 may well prove a watershed that sets the pecking order for the next decade in China's premium-car market.

The perception ceiling and the user-base tug-of-war

For new premium brands, early success typically hinges on one “explosive” product or a tightly knit series. That product, via extreme performance specs, groundbreaking scenario definitions (think “family hauler,” “mobile living room”) or disruptive service models (battery swapping, ultra-fast charging), sliced into a niche overlooked or addressed too slowly by incumbents.

But the moment a brand tries to broaden its lineup — moving into wider price bands, pushing further up, or covering more diverse user groups — it hits the deep waters of brand extension.

The first test is the perception bottleneck in moving upmarket. A brand that won favor at 300,000–400,000 yuan on the back of intelligence and comfort — can its brand equity truly support products priced at 600,000 yuan or even 1 million?

Luxury perception is a complex psychological construct — built on history, technical totems, social prestige and emotional resonance. Traditional luxury marques spent decades, even centuries, forging an unshakeable pricing pyramid through motorsport, the trickle-down of cutting-edge tech, and the continuity of signature design language. China’s upstarts have, in just a few years, redefined functional luxury — the so-called “fridge, TV, big sofa,” high-level driver assistance and blistering acceleration — but the deeper codes of identity and emotional luxury remain a work in progress.

Reality offers cautionary tales. Some brands, despite stacking finer materials and more power into higher-end models, saw weaker-than-expected market response. The reason: high-end buyers pay a hefty premium not just for the product, but for the brand narrative and the sense of belonging it confers. When a brand’s origin story and core user profile (family-first, tech early adopters, and so on) clash with the mystery, exclusivity and historical gravitas the luxury tier demands, the push upward becomes arduous.

Brands must execute a risky leap in perception — not a mere product refresh, but a systemic reconstruction of brand value. That spans an elevated top-level narrative, a thorough upgrade of retail and ownership experience, and meticulous stewardship of user communities.

Potential conflicts within the user base will surface as well. A brand’s core tone is a precious asset. When first-generation products set a clear persona (sporty handling, family warmth, tech geek), later models aiming at very different users — say, a pivot from families to single elites or business clientele — can blur and dilute the brand image. Tougher still, different cohorts have very different expectations for service, community culture and brand communication. Mishandle that, and loyal users feel betrayed, sensing the brand lost its roots; new users, meanwhile, may find the tone misaligned with their identity, hindering recognition.

How to expand breadth without tearing the brand's core — via product-line planning, sub-brand strategy or differentiated services under a master brand — is a test of strategic craftsmanship.

The path forward is to move from the early phase where products define the brand to the more advanced phase where the brand defines the products.

That means the brand must prefigure its worldview, values and aesthetic system — with enough inclusivity and stretch — while products become concrete expressions of that system across scenarios.

It also argues for a cautious use of master-brand plus series or ecosystem-brand strategies, rather than blindly stretching a single line. After the master brand is firmly established, launch a high-end series or sub-brand with its own narrative — even a new badge — to attack the summit while protecting the core. BYD's Yangwang and Denza, and Geely's nurturing of ZEEKR, reflect this strategic logic.

Image credit: ZEEKR

Growing pains: from “special forces” to a full army

Almost all new automakers start as a lean, passionate, flat and focused strike team. At a scale of a few hundred to a couple thousand people, cross-department communication is frictionless; the founder’s vision transmits cleanly to the front lines; everyone sprints around a core project — delivering astonishing China speed.

But as annual sales push past 100,000 and toward several hundred thousand, headcount swells to tens of thousands, R&D expands from a single platform to multiple in parallel, and production grows from one plant to many across the country, the organization faces a full-on stress test.

The management system hits its limits first. The informal trust and people-driven style of the startup phase quickly stops working.

Multi-region, multi-model R&D and manufacturing demand standardized, process-driven and digital collaboration — tightly choreographed from product definition, engineering design and supply-chain management to manufacturing, marketing, sales, after-sales and user operations. Complexity explodes at every step. Multiple R&D streams can scatter resources and create conflicts in technical roadmaps; multi-site production raises the bar for quality consistency; and a fast-expanding sales and service network, without robust training and oversight, can undercut the promise of a premium experience.

Issues that were hidden — or harmless — in the “workshop” phase erupt in the “army” phase, dragging down efficiency and stoking internal friction. The product-delivery delays, software-version chaos and uneven service quality seen recently at some brands are, at their core, symptoms of organizational capabilities falling out of step with business scale.

A deeper risk lies in the dilution and distortion of culture. The mission and entrepreneurial spirit that bind an early team are hard to transmit as waves of new hires arrive. Many recruits come from traditional automakers, internet firms or other industries, with their own habits and value systems. Without strong cultural onboarding and integration, tribalism can take hold, silos rise, and the early spirit of all-in collaboration fades. As layers of management multiply, the seeds of bureaucracy and formalism sprout — the opposite of the agility and openness an innovative company needs. Founders and senior leaders hit the limits of their management span. Running by systems rather than charisma, and ensuring culture reaches every capillary of the organization, will prove a tougher challenge than any R&D task.

To overcome this trap, companies must shift from founder-led to excellence-in-systems-led. That calls for architectural redesign: structures that secure group-level strategic cohesion while energizing business units — for example, evolving toward platform organizations or a BU model. GAC Group has already kicked off a BU reform for its self-owned brands; GAC Hyper and GAC Aion have been folded into the newly formed Hyper–Aion BU.

Processes need tempering too — codify proven best practices into company workflows, drive them through with digital tools, and ensure operations are replicable and quality is stable. At the same time, accelerate the talent engine and cultivate culture: build a systematic talent framework, and translate core values into concrete behavioral norms and evaluation metrics, so culture stays alive at scale.

This is a painful self-revolution, demanding resolve and managerial wisdom from founders. Only those who pass through this furnace steadily will gain the hard power for sustained growth.

Globalization’s double-edged sword

For Chinese premium brands aiming to break out, the domestic market is vast — but relying on it alone won’t create a true global luxury brand, nor hedge the risks of geopolitics and market cycles. Going overseas, especially into mature premium markets like Europe, has become a necessity.

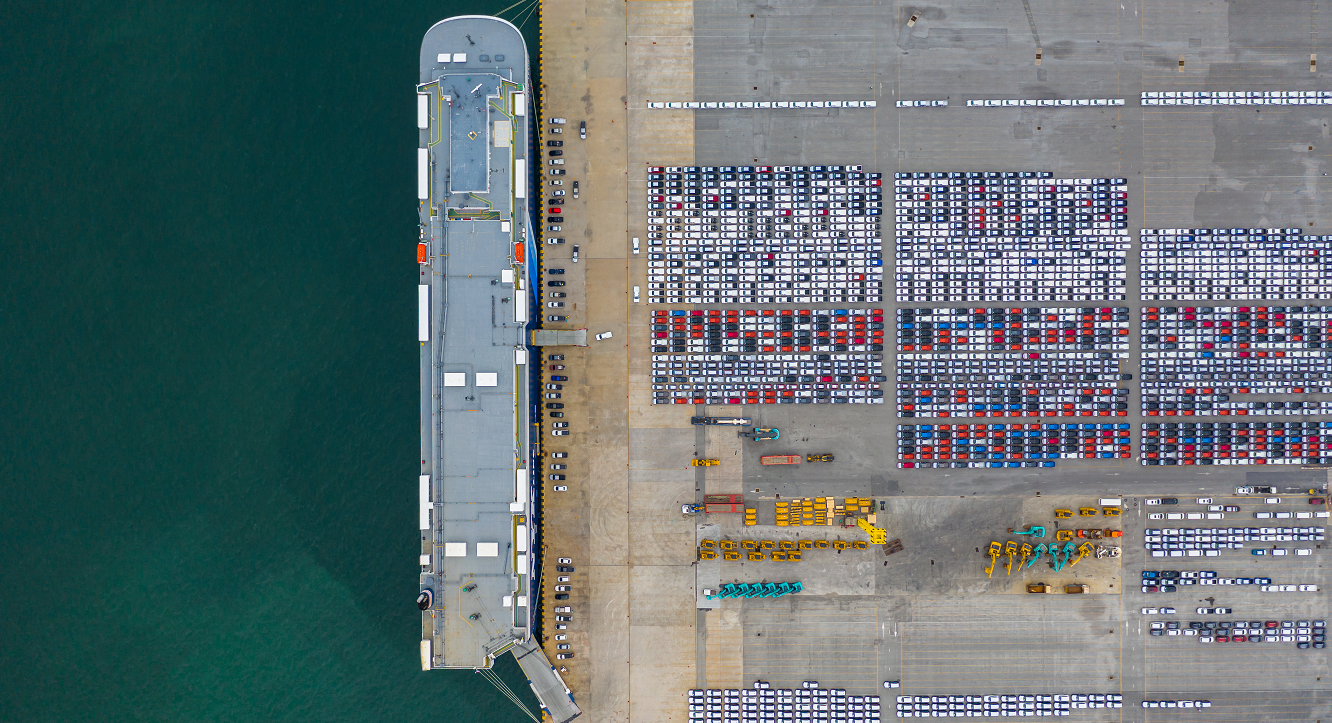

Image credit: Shetu

Over the past two years, we’ve seen a stream of moves by Chinese brands in Europe. Entering 2026, more Chinese premium players — with stronger product lineups — are poised to land on the continent. That trajectory looks set.

But those waters, while tempting, may prove an even harsher battleground.

Overseas markets — Europe in particular — are anything but a simple extension of China. They run on a very different rulebook.

Cultural difference and brand perception are a high wall. European consumers have deep historical emotion and a distinct aesthetic philosophy about cars. Their view of premium leans toward heritage, driving feel, design beauty and sustainability — markedly different from China’s current emphasis on screen count, voice interaction and scenario innovation.

Chinese brands need a story that can be understood and appreciated in Europe’s cultural context — not a copy-paste of their domestic playbook. That could mean elevating the fusion of design and engineering, an obsession with dynamic driving performance, and a genuine commitment to environmental responsibility and sustainability.

Then come the compliance walls. From data security, carbon regulations and circular materials to vehicle certification standards, Europe has the world’s most complex and stringent framework. It adds R&D and certification costs, and imposes foundational demands on data handling and supply-chain traceability. Any compliance lapse can block market entry or trigger hefty fines — killing the overseas effort outright.

Building a heavy-asset service network is another hurdle. The premium experience hinges on service quality. Establishing sales, delivery, charging/swapping and after-sales networks across key European countries is slow and capital intensive. Self-built networks are costly; partnering with local dealers risks loss of control and uneven experience. Crafting a network that protects brand tone while staying economical is a formidable operational task.

Geopolitics and media climate add risk. The collective push overseas by Chinese automakers has drawn scrutiny from European industry and some politicians; trade barriers like “anti-subsidy” probes remain a threat. Local media and public opinion will examine Chinese brands more strictly; any flaw in product quality or data security can be magnified, with long-term damage.

To face these challenges, upstarts must drop the simple export mindset and shift to system-led expansion and deep localization.

The path shouldn’t chase breadth from day one. Pick one or two core countries or niches — say, electric SUVs — and build a benchmark, then radiate outward. Early on, prioritize significance over scale. On localization, assemble teams heavy with local talent to drive product fit, marketing, user relations and government affairs. Respect local habits; bake local needs into design and engineering early. While aligning with regulations and culture, convey your distinctive brand value with care. And move fast to partner with quality local players — dealer groups, charging operators, finance and insurance providers, even tech firms — to plug into the ecosystem more flexibly and reduce upfront heavy-asset risk.

Globalization is a marathon — a test of patience, persistence and system capability. The higher you aim in traditional stronghold markets, the steeper the climb. Play to your strengths, prepare thoroughly, and don’t expose your weak spots.

Winners will unlock a second growth curve. Laggards may burn through resources with little to show.

In brief:

The collective move upmarket by China’s premium brands is a historic opportunity seized amid a technological revolution. Early victories show sharpness and capability in product innovation, market insight and business model. But the real test starts now: scale magnifies glory — and exposes problems.

The road from upstart to establishment, from breakout to leadership, will be thorny. It demands winning multiple hard battles in parallel. First, the brand-value battle: move beyond features and scenarios to build a brand soul with emotional pull, cultural depth and endurance. The ceiling of brand sets the ceiling of price — and loyalty. Second, the organizational-systems battle: transform from a “guerrilla” able to mint a single hit into a “regular army” driven by processes, institutional culture and a talent ladder. Organizational health determines the speed, quality and sustainability of growth. Third, the globalization perception battle: evolve from a China-market winner into a contributor to global value — with local wisdom, global vision and long-term grit — and build new moats in unfamiliar terrain.

The next few years will mark a clear watershed. Markets will be less tolerant of trial and error; capital will favor companies with systemic strengths. Those that patiently reinforce brand foundations, bravely drive organizational change, and approach globalization with respect will clear the scale trap — and stand atop the global auto industry.

In the end, victory in this “upstart breakout” won’t be measured just by sales or market share, but by whether Chinese brands can forge an aspirational luxury image that endures in the minds of global consumers. That’s more than an automotive breakout — it's a long journey in projecting the values of China's industrial civilization.