Gasgoo Munich- In December 2025, the MAEXTRO S800 recorded deliveries of 4,223 units in a single month — a record for a Chinese brand in the market above 700,000 yuan. Notably, it outperformed traditional competitors like the Porsche Panamera and BMW 7 Series.

Breaking Into the Ultra-Luxury Market

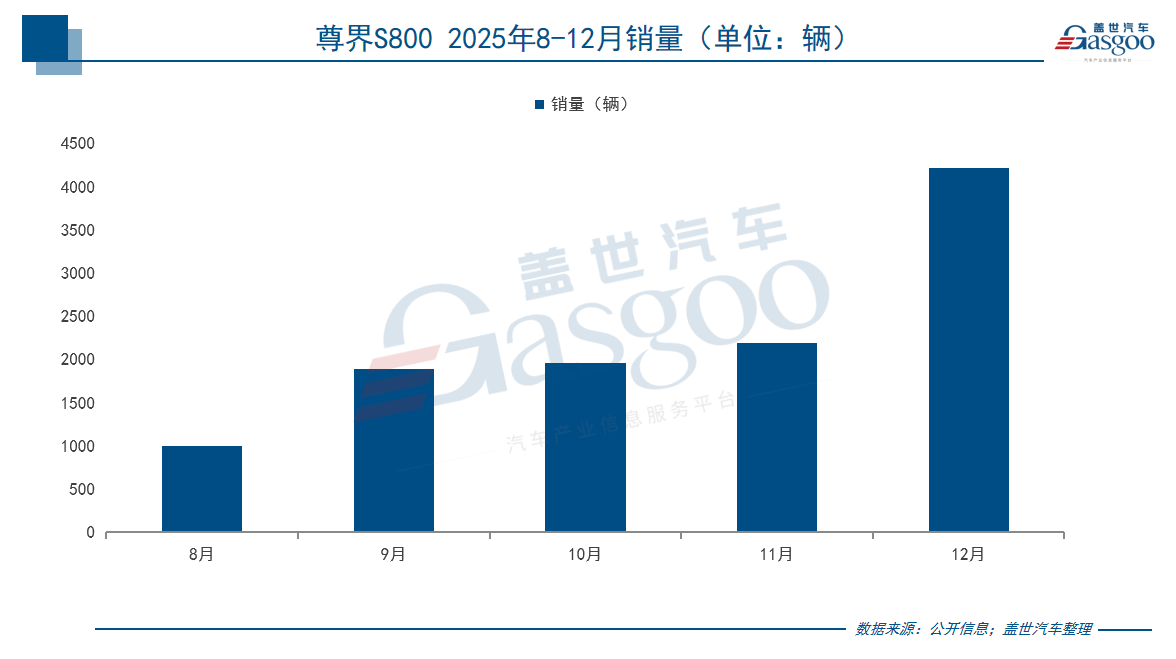

Deliveries began in August 2025 with an initial count of 1,006 units. Industry observers adopted a wait-and-see approach: could a Chinese brand lacking a luxury heritage establish a foothold in a million-yuan market dominated by German manufacturers?

Over the next four months, monthly deliveries rose steadily, with growth nearly doubling in September and December. By December, the S800 reached the 4,223-unit mark. This upward trajectory reflects not only product strength but also rapid acceptance among high-end consumers of the new value proposition: "technology defines luxury."

Industry forecasts suggest the S800 could sell 18,000 units in 2026. If achieved, MAEXTRO would capture roughly 15% of the million-yuan sedan market, evolving from a market entrant into a segment leader.

A direct sales comparison with rivals illustrates the trend. As the S800 gained momentum, traditional luxury competitors fell behind:

In December, the Porsche Panamera sold approximately 1,600 units, while the BMW 7 Series sold about 1,400. The Mercedes-Benz S-Class and Audi A8L did not exceed 1,000 units. The S800's December volume nearly equaled the combined sales of all four models.

Before the S800 arrived, the luxury sedan market above 700,000 yuan was dominated by German brands, with the top spot rotating among the BBA trio and Porsche. Now, a Chinese newcomer has held the top position for months.

The S800's strategy goes beyond stacking features or offering low prices. Its real innovation lies in positioning "tech luxury" as a new value anchor to replace traditional "mechanical luxury," targeting the core needs of high-net-worth individuals.

According to internal research, a significant portion of S800 owners previously drove ultra-luxury brands like Rolls-Royce, Maybach, and Porsche. For this group, a car is more than transportation; it is a status symbol, a mobile space, and a tech experience combined.

One owner, who owns a Porsche 911 and Panamera, explained her choice after testing various EVs: "Huawei's intelligent driving is the best." She noted the car is so long she prefers the rear seat to driving herself. This preference for being chauffeured underscores the S800's success in rear-seat luxury and comfort.

Satisfaction is notably high. Official data shows the S800 has a Net Promoter Score (NPS) exceeding 85 — a significant figure in the auto industry, especially among luxury brands. While a score of 60–75 is typically considered excellent for luxury brands, 85 indicates exceptional user experience and strong word-of-mouth potential.

Transaction data further confirms market acceptance. Within the 700,000 to 1 million yuan range, consumers favor high-spec trims, pushing the S800's average transaction price to 900,000 yuan. Price tolerance is a key metric for luxury brands; this figure suggests MAEXTRO has broken the long-standing monopoly of foreign luxury cars and entered their core pricing territory.

A closer look at the S800 reveals its success is built on creating a "generational difference in experience," not merely leading in specifications.

While traditional luxury cars emphasize the driving dynamics of "man and machine as one," the S800 markets a "pan-scenario intelligent space" for working and resting on the go.

The HarmonySpace creates a seamlessly connected ecosystem, integrating phones, tablets, and smart home devices. For a new generation of elite users, this cross-device consistency holds more value than leather seat texture or wood trim grain.

Leveraging NVH technology and active noise cancellation developed jointly by Huawei and JAC, the S800 outperforms the Maybach S680 and NIO ET9 in road noise at 60 km/h. For ultra-luxury brands, such marginal data differences translate into significant improvements in actual experience.

These technical advantages are not isolated; they combine through system integration to create synergy that defines the S800's new standard of "tech luxury."

Drivers of Aggressive Expansion in 2026

The S800's success disrupts the traditional luxury market, delivering a direct impact.

As S800 deliveries surged, sales of traditional models like the BMW 7 Series, Mercedes-Benz S-Class, and Audi A8L declined noticeably. This shift indicates changing preferences among high-end clientele.

Image source: MAEXTRO

The S800 proves the viability of the domestic high-end path and Huawei's "smart selection" model — where tech firms provide intelligent solutions and brand empowerment, while traditional manufacturers handle production and quality control to build a premium brand rapidly.

This success offers a template for other Chinese brands. Recently, several automakers announced deeper ties with tech firms to co-develop high-end EVs — a clear sign of this competitive effect rippling through the industry.

Within the Harmony lntelligent Mobility Alliance ecosystem, the S800's success has sparked new dynamics of collaboration and competition. As the highest-positioned series, MAEXTRO sets a value benchmark for sibling brands like AITO, STELATO, and LUXEED, proving the ecosystem can win approval in the million-yuan market.

Perhaps the S800's most revolutionary impact is breaking the psychological "price ceiling" for Chinese cars.

For years, Chinese brands attempted to move upmarket but mostly stalled in the 300,000 to 400,000 yuan range. 500,000 yuan was seen as a threshold, while entering the 700,000 yuan-plus market seemed nearly impossible.

With an actual average selling price surpassing 900,000 yuan, the S800 has not only surpassed that hurdle but also achieved volume sales in the core price band of traditional luxury. This means high-end consumers are now placing Chinese brands on the same consideration list as established rivals.

One S800 owner, interviewed by Gasgoo, expressed support for domestic brands: "Of course I support domestic products. This car is the pinnacle of new energy. I used to drive internal combustion cars and felt they lacked intelligence; I wanted to experience the real thing." Viewing the S800 as the "NEV pinnacle" and switching from fuel to intelligent EVs highlights the shift in how premium users value Chinese brands.

The impact of this psychological shift is profound. It extends beyond the MAEXTRO brand, opening possibilities for all Chinese automakers aspiring to move upmarket. Once a pioneer succeeds, market acceptance of those who follow rises significantly.

The fragmentation of the global luxury market is accelerating. The divide between the traditional "mechanical luxury" camp and the emerging "tech luxury" camp is becoming sharper. With their first-mover advantage in intelligence and electrification, Chinese brands are emerging as the leading force in the latter.

If the S800's success was a precise "single-point breakthrough," MAEXTRO's 2026 roadmap represents a full-scale "systematic campaign."

MAEXTRO plans to launch up to six new models in 2026, spanning the 400,000 to 1.3 million yuan price range to build a complete luxury matrix. This aggressive strategy aims to replicate AITO's success, evolving from a "single successful model" to a "systematic luxury brand."

Specific plans include a flagship S800 "High Custom" edition launching in July or August 2026, targeting the ultra-luxury custom market. The first MPV is expected in March or April, priced from around 400,000 yuan to over 800,000 yuan for the top trim. The first SUV, roughly a 600,000 yuan-class model, is scheduled for late 2026 or early 2027. Both the MPV and SUV will offer standard and long-wheelbase versions, completing a lineup covering sedans, MPVs, and SUVs.

Behind this product rollout lies ambitious sales targeting. The S800 series (including the high-custom edition) aims for 30,000 units in 2026. The MPV series has an initial annual target of 100,000 units, with a steady monthly expectation of 10,000. Achieving these goals would make MAEXTRO a significant player across multiple segments.

Image source: JAC Group

JAC is supporting this expansion with robust resources. It built the "MAEXTRO Super Factory," designed with a total capacity of 200,000 units per year. A second phase of production line modification has already begun to prepare for SUV production. On December 16, 2025, the 10,000th S800 rolled off the assembly line.

Financial support is also in place. In December 2025, JAC received regulatory approval for a 3.5 billion yuan private placement. The funds were raised, verified, and issued by February 2026, entirely financing the "200,000 mid-to-high-end intelligent pure electric passenger vehicle project" — securing the capital for MAEXTRO's future.

JAC has also strategically pivoted to prioritize MAEXTRO. Internal sources reveal a business restructuring that concentrates resources on the brand. A slogan circulating inside the company — "Everything for MAEXTRO, for everything of MAEXTRO" — underscores JAC's commitment.

As deliveries climb, MAEXTRO has signed long-term agreements with core suppliers to ensure the stable supply of key components, particularly Huawei's intelligent driving and cockpit systems.

Systematic Challenges Begin

Yet rapid systematic expansion brings challenges that cannot be ignored. Chief among them is managing multiple models while maintaining quality consistency.

Simultaneously developing, producing, and marketing several distinct high-end models is a significant test of any automaker's systemic capabilities. From design and engineering validation to manufacturing, every link must uphold the high standards promised by the brand. A single quality control issue could damage the entire brand image.

The S800 has established MAEXTRO's luxury tone, but sustaining that value is a different challenge. When introducing lower-priced MPVs and SUVs, how can the brand maintain its ultra-luxury positioning without diluting its value? This is a common challenge for luxury brands expanding downward.

Image source: Harmony lntelligent Mobility Alliance

Furthermore, Harmony lntelligent Mobility Alliance must effectively balance internal collaboration and competition. Future models like the MAEXTRO SUV and AITO M9, or the MAEXTRO MPV and LUXEED's future MPV, will inevitably overlap. Differentiating these similar models to avoid internal cannibalization will test the product planning wisdom of Huawei and JAC.

Despite the challenges, the business model shows considerable profit potential. Analysts suggest the S800 alone could contribute over 4.7 billion yuan in annual gross profit. If realized, this would provide a solid financial foundation for long-term R&D investment.

Profitability is critical for luxury brands. Unlike volume brands that rely on scale for profitability, luxury marques must continuously invest in cutting-edge R&D, premium materials, and top-tier service systems — all of which require ample profit support.

From an industry perspective, the S800's success means Chinese brands have finally gained a foothold in the most profitable segment of the market. Long dominated by multinational luxury brands, this sector is now seeing Chinese competitors not just participating, but potentially reshaping value distribution.

Reinvesting profits creates a virtuous cycle. More R&D funding leads to better products, which capture higher market share and profit, supporting the next round of technological upgrades. Once established, this positive loop guarantees long-term competitiveness.

Beyond the individual model, the S800's success has deeper industrial significance. It signals a shift for the Chinese auto industry from exporting "cost-effectiveness" to exporting "technical standards and high-end brands."

Previously, Chinese brands went global primarily through economy models, winning market share with low prices. The S800's path of "tech-defined luxury" is a bid for the authority to define the future of the segment — a prize more valuable than sales volume in a single market.

By penetrating the most profitable luxury market, MAEXTRO will drive value added across the entire Chinese smart EV supply chain — including chips, software, intelligent hardware, and high-end manufacturing.

As Chinese brands gain acceptance at the high end, the premium power of the entire supply chain will rise. This "rising tide lifts all boats" effect is crucial for the overall upgrade of China's automotive industry.

Conclusion:

The S800's sales figures mark a significant breakthrough for Chinese brands in the million-yuan luxury sedan market. Its success demonstrates that reconstructing the user experience around intelligent technology can penetrate traditional brand barriers and win over high-net-worth individuals.

However, the success of a single model is just the first step. The aggressive product expansion planned for 2026 will subject MAEXTRO to a true test of its systemic capabilities: managing multi-line operations, maintaining quality control, preserving brand value, and coordinating internal resources. Initial market acceptance has won MAEXTRO a seat at the high-stakes table, but evolving from a "market success" into a "sustainable luxury brand" remains a formidable challenge.

Regardless of the outcome, the S800 has provided an important case study for the high-end evolution of China's auto industry. Its future development — whether success or setback — will accumulate valuable experience for the sector's continued climb up the value chain.