According to data compiled by the Gasgoo Automotive Research Institute data, in October 2025, BYD, Geely Holding, and Chery Holding demonstrated a clear export trend of stable core markets alongside expansion into emerging regions. BYD advanced its repositioning in the EU, UK, and EFTA markets; Geely Holding built on its strengths in the CIS while achieving broader regional breakthroughs; and Chery Holding continued to reinforce its dual-core presence in the CIS and the Middle East. Collectively, their performance highlights the growing global competitiveness of Chinese automakers and the increasing diversification of China's auto export landscape.

The regional export destination ranking of BYD passenger vehicles in October 2025 is as follows:

EU + UK + EFTA: In October, BYD exported 19,164 units to the region.

Middle East: In October, BYD exported 16,514 units to the Middle East.

Central & South America: In October, BYD exported 14,658 units to Central and South America.

Southeast Asia: In October, BYD exported 13,757 units to Southeast Asia.

CIS countries: In October, BYD exported 8,077 units to CIS markets.

Other Asian markets: In October, BYD exported 5,015 units to other Asian regions.

Oceania: In October, BYD exported 3,415 units to Oceania.

North America: In October, BYD exported 3,204 units to North America.

Africa: In October, BYD exported 1,703 units to Africa.

Other European markets: In October, BYD exported 373 units to other European regions.

In October, BYD's passenger vehicle exports showed a clear pattern of Western Europe taking the lead and regional rankings reshuffling. The EU + UK + EFTA market topped the list with 19,164 units, overtaking Southeast Asia, which had led in September. This reflects stronger alignment of BYD's EV portfolio with Europe's regulatory requirements and the accelerated rollout of local sales channels. Southeast Asia slipped to fourth place with 13,757 units, likely due to shipping schedules or short-term inventory adjustments. Meanwhile, the Middle East climbed to second with 16,514 units, while Central & South America surged to 14,658 units, rising to third place and highlighting BYD's increasingly diversified export footprint.

In other regions, exports to the CIS reached 8,077 units, mainly driven by Uzbekistan, while North America recorded 3,204 units, with Mexico as the core market. Exports to Oceania declined from 4,284 to 3,415 units, and Africa fell from 2,074 to 1,703 units. Despite divergent performances across regions, each market's trajectory remains broadly aligned with BYD's global expansion strategy.

Overall, the top 3 regions in October accounted for about 53.8% of BYD's total exports. Compared with September's more concentrated "three-pillar" structure, the export mix became more diversified. This reshuffling of regional rankings reflects BYD's agile response to shifting market demand, while also highlighting the impact of external factors such as policy changes and shipping capacity.

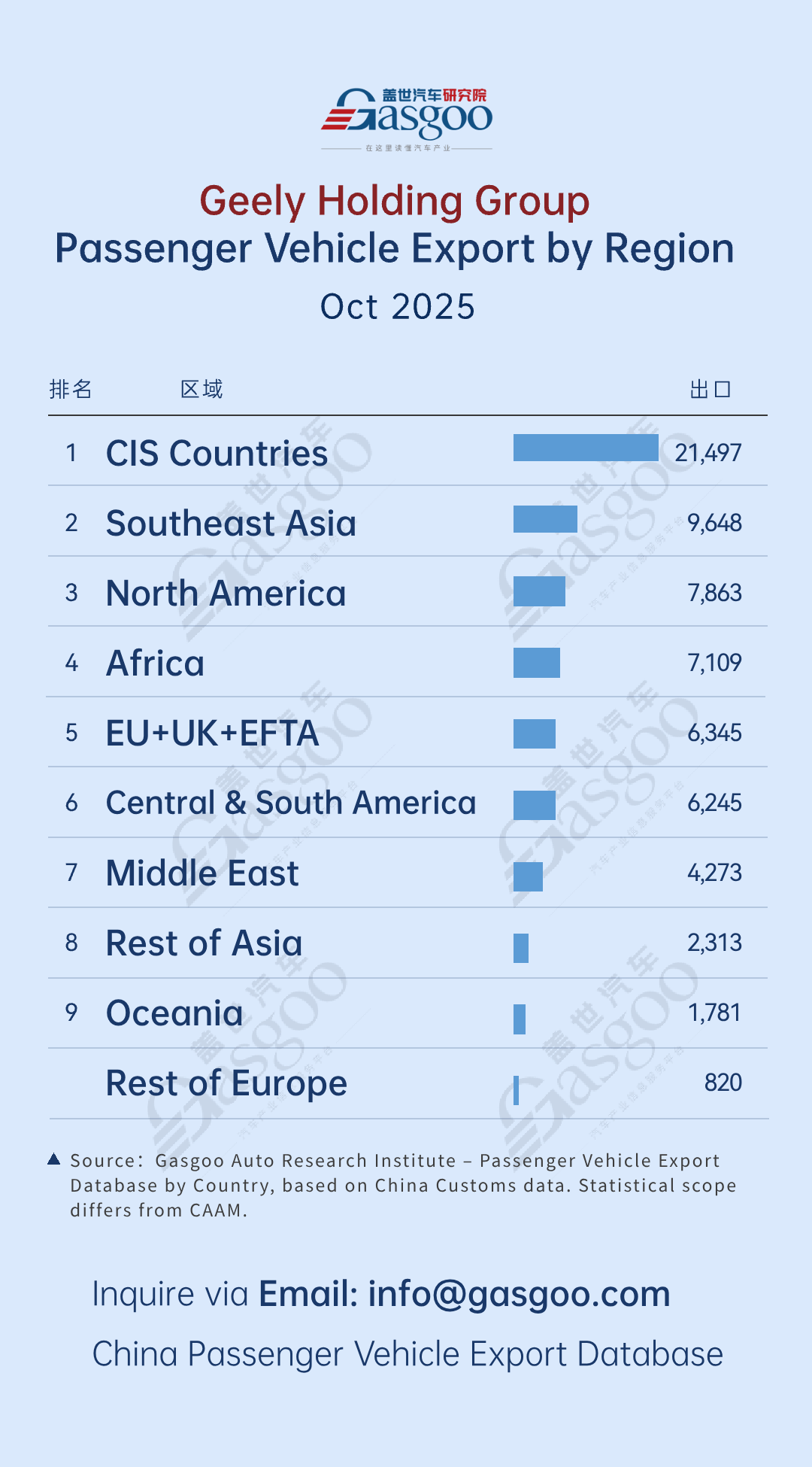

The regional export destination ranking of Geely Holding passenger vehicles in October 2025 is as follows:

CIS countries: In October, Geely Holding exported 21,497 units to the CIS.

Southeast Asia: In October, Geely Holding exported 9,648 units to Southeast Asia.

North America: In October, Geely Holding exported 7,863 units to North America.

Africa: In October, Geely Holding exported 7,109 units to Africa.

EU + UK + EFTA: In October, Geely Holding exported 6,345 units to the region.

Central & South America: In October, Geely Holding exported 6,245 units to Central & South America.

Middle East: In October, Geely Holding exported 4,273 units to the Middle East.

Other Asian markets: In October, Geely Holding exported 2,313 units to other Asian markets.

Oceania: In October, Geely Holding exported 1,781 units to Oceania.

Other European markets: In October, Geely Holding exported 820 units to other European markets.

In October, Geely Holding's passenger vehicle exports showed a new pattern of continued CIS leadership and multi-region momentum. The CIS market remained firmly in first place, with exports rising to 21,497 units, supported by a pre-window surge ahead of Russia's planned increase in vehicle import scrappage taxes in January. Southeast Asia jumped from fourth place in September to second in October, with exports climbing to 9,648 units, driven by stronger local demand and deeper channel expansion. North America also moved up the rankings, rising from fifth in September (3,992 units) to third in October (7,863 units).

Exports to the EU + UK + EFTA reached 6,345 units, ranking fifth. Africa slipped from third in September to fourth in October, but export volume still rose from 4,817 units to 7,109 units, underscoring its role as a growth engine among emerging markets. Elsewhere, performance was solid across regions, with Central & South America at 6,245 units and the Middle East at 4,273 units. Other Asian markets and Oceania also recorded modest growth, while the newly added "Other Europe" category helped refine the regional breakdown.

Overall, compared with September's pattern of "CIS-led, Europe strong", Geely Holding's October exports not only consolidated its advantage in core markets but also achieved rapid growth across multiple emerging regions, enhancing both the balance of market coverage and its resilience to external risks.

The regional export destination ranking of Chery Holding passenger vehicles in October 2025 is as follows:

CIS: In October, Chery Holding exported 41,152 units to CIS countries.

Middle East: In October, Chery Holding exported 29,947 units to the Middle East.

EU+UK+EFTA: In October, Chery Holding exported 15,939 units to the EU+UK+EFTA region.

Central & South America: In October, Chery Holding exported 15,339 units to Central & South America.

Africa: In October, Chery Holding exported 14,649 units to Africa.

Southeast Asia: In October, Chery Holding exported 8,800 units to Southeast Asia.

North America: In October, Chery Holding exported 8,676 units to North America.

Oceania: In October, Chery Holding exported 1,290 units to Oceania.

Other Asia: In October, Chery Holding exported 487 units to other regions in Asia.

Other Europe: In October, Chery Holding exported 316 units to other regions in Europe.

In October, Chery Holding's passenger vehicle exports maintained a "dual-core leadership" pattern. The CIS countries, forming the core base, remained the top market with 41,152 units exported, reflecting the year-end push by leading automakers ahead of Russia's upcoming increase in vehicle scrapping taxes. Exports to the Middle East reached 29,947 units, holding the second spot while continuing to amplify the "dual-engine" growth effect. The European region, measured as EU+UK+EFTA, remained third with 15,939 units, while Central & South America retained fourth place, supported by Chery's early market deployment and regional production capacity.

Exports to Africa increased from 12,860 units in September to 14,649 units in October, maintaining the growth momentum in emerging markets. Southeast Asia declined from 11,031 units to 8,800 units, remaining sixth but with a reduced volume. North America nearly doubled from 4,109 units to 8,676 units, rising from eighth to seventh place, driven largely by expanded channels in markets such as Mexico. Exports to Oceania, however, fell sharply from 7,559 units to 1,290 units, dropping to eighth place, likely affected by seasonal demand and logistics adjustments. Other regions in Asia saw slight declines.

Overall, compared with September's "dual-core plus multi-region" pattern, October saw the core markets' dominance further strengthened, while regions such as North America achieved notable gains. Fluctuations in some areas reflect Chery's dynamic adaptation to different markets within its global strategy, highlighting the continued diversification and resilience of its export footprint.