Gasgoo Munich- When the China-made Model Y went on sale in early 2021, reports claimed it racked up 100,000-unit orders in just 10 hours. That year, the combined sales of NIO, XPENG, and Li Auto still fell short of Tesla's China sales.

In the years following that debut, a succession of models from Chinese startups hit the market, aiming to encircle the Model Y. This became the classic paradigm: Tesla defined the battlefield, and the new forces followed with their products.

But by 2025, that dynamic began to shift.

Tesla remains the first to move, but the startups are responding faster—and the scope of that response has expanded from "product layout" to financial tools, strategic positioning, and technology roadmaps. This isn't a sudden pivot. It is a gradual unfolding: from 2021, when product briefs were filled with "benchmark Model Y," to 2024, when autonomous driving teams used FSD as a live target, and finally to 2025, when two Chinese startups announced within the same week that they would become "embodied intelligence companies." The dimensions of this pursuit are opening up, layer by layer.

Financial Warfare: The "Tesla Rhythm" of Financial Innovation

January 2026 marked a new round of adjustments to sales financing policies in China's new energy vehicle market.

That month, Tesla introduced a limited-time "7-year ultra-low interest" purchase plan. Within two weeks, Xiaomi, Li Auto, and XPENG, among others, followed suit. This battle of financial tools—defined by "7 years" and "low interest"—compressed the cycle of manufacturer-subsidized competition from "months" to a matter of "days."

In April 2024, Tesla China rolled out a "0% interest" installment policy, offering official trade-in customers up to five years of zero interest or ultra-low rates. For the rear-wheel-drive Model Y, the three-year zero-interest plan required a down payment of 79,900 yuan and a maximum monthly payment of 5,111 yuan—saving roughly 27,000 yuan in interest compared to standard financing. It was the first time a long-term, zero-interest product subsidized by an OEM appeared in China's NEV market.

At the time, the industry largely viewed this as a short-term promotional tactic to cope with market competition. A year later, however, that tool had become the industry standard.

On February 5, 2025—the first workday after the Lunar New Year—Tesla announced it would extend its five-year zero-interest policy and add an 8,000-yuan insurance subsidy. On the very same day, XPENG followed suit, unveiling a "5-year 0% interest, 0 down payment" scheme covering the X9, G9, P7i, and G6, with subsidies reaching up to 57,000 yuan. Shortly after, NIO, IM Motors, and Avatr rolled out similar offers.

In March 2025, the National Financial Regulatory Administration issued a notice on developing consumer finance to boost consumption, clarifying that loan periods for personal consumption could be temporarily extended from five years to seven for those with long-term needs. Once that policy window opened, the first to pull the trigger was, again, Tesla.

Image source: Tesla

On January 6, 2026, Tesla launched its "7-year ultra-low interest plan," with down payments for the Model 3 and Y starting at 79,900 yuan, an annual rate of 0.98%, and monthly payments as low as 1,918 yuan.

Once Tesla fired the shot, a chain reaction unfolded by the day: On January 15, Xiaomi put its YU7 on a 7-year low-interest plan, with Lei Jun admitting in a livestream that "after Tesla's announcement, thousands of comments urged us to follow." On January 20, Li Auto joined in, stacking "3-year interest-free" offers on the MEGA and i8. On January 22, XPENG entered the fray with monthly payments as low as 1,355 yuan. By the end of the month, Voyah and Geely Galaxy had piled in. From Tesla's debut to widespread industry adoption, less than a month had passed.

From April 2024 to January 2026, Tesla played the leading role in both rounds of financial innovation. The response time of China's new forces shrank from "months" in 2024 to "days" in 2026.

Zhang Xiang, a visiting professor at Huanghe S & T College, told Gasgoo that low-interest plans lower the barrier to purchase and attract buyers, giving automakers a new lever for terminal competition. So far, he noted, this method of financial promotion remains compliant and orderly.

Regardless of how policy windows open and close, Tesla has consistently been the first to adjust its financial arsenal. The fact that Chinese startups have shortened their response time from months to days speaks volumes about the intensity of competition between 2025 and 2026.

But the real shift isn't happening only at the sales terminal. In late 2025, a deeper strategic alignment occurred simultaneously at two Chinese startups.

Strategic Warfare: The Identity Leap from "Automaker" to "AI Company"

"Tesla is not just a car company"—Elon Musk has repeated this often.

Image source: Tesla

In June 2024, at Tesla's annual shareholder meeting, Musk explicitly announced a strategic pivot toward artificial intelligence and robotics, elevating the Optimus humanoid robot project to core status. By September 2025, Tesla's "Master Plan Part 4" clarified that its strategic center of gravity was shifting from electric vehicles to AI and robotics. The company also launched the "TeslaAI" official account to showcase developments in humanoid robots and autonomous driving, formally declaring itself an "AI company" to the world.

On January 21, 2026, Tesla changed its mission statement from "accelerating the world's transition to sustainable energy" to "building a world of abundance and wonder."

From its founding in 2003 to the mission change in 2026, twenty-three years, Tesla completed its identity reshaping from "EV manufacturer" to "AI + robotics company."

Toward the end of 2025, Li Auto and XPENG also dove deeper into this migration within the same window of time.

On November 5, 2025, at the XPENG Tech Day in Guangzhou, He Xiaopeng stated: "When the digital and physical worlds merge, 'Physical AI' will be born." He announced that XPENG's positioning was upgrading to "an explorer of mobility in the Physical AI world, and an embodied intelligence company for the globe."

From "future mobility explorer" to the more ambitious "embodied intelligence company" focused on "Physical AI," this was a redefinition of corporate identity.

Image source: XPENG

In the subsequent technology presentation, XPENG demonstrated the productization capabilities of its Physical AI technology base:

Second-generation VLA large model: Achieving "end-to-end direct generation" from visual signals to action commands for the first time, capable of cross-domain driving of cars, robots, and flying cars. He Xiaopeng announced that the second-generation VLA would be open-sourced to global commercial partners, with Volkswagen as the launch customer.

New-generation IRON humanoid robot: Featuring 82 degrees of freedom, a humanoid spine structure, and 22 degrees of freedom in a single hand, it is the world's first humanoid robot to use an all-solid-state battery.

Flying car A868: Adopting a full tilt-rotor hybrid electric configuration with a range of 500 kilometers and a six-seat cabin.

He Xiaopeng also revealed a mass production timeline: Robotaxi will begin trial operations in 2026; the second-generation VLA model will see a full rollout in the first quarter of 2026; and the IRON humanoid robot will enter mass production by the end of 2026.

The vision for AI had been clear earlier. In August 2024, at the 10th-anniversary and MONA M03 launch event, He Xiaopeng explicitly proposed upgrading the company strategy from "software-defined vehicles" to "AI-defined vehicles," setting a goal for XPENG to become a global AI automotive company over the next decade.

On November 26, 2025, Li Auto held its Q3 earnings call. On the conference call, Li Xiang stated that in the next decade, Li Auto's products would no longer be electric vehicles or smart terminals, but embodied robots. This marked an AI-driven definition of the product essence at the corporate strategy level.

In early 2026, Li Xiang called an impromptu all-hands online meeting. The nearly two-hour agenda touched on no vehicle models or sales figures, focusing entirely on AI trends. He made it clear: Li Auto will definitely make humanoid robots and will launch them as soon as possible. 2026 is the "last window" to become a top-tier AI company. This meeting, which some employees said they "couldn't understand," became a key move in Li Auto's strategic pivot from "mobile living space" to embodied intelligence company.

Slightly different from XPENG's path, but identical in view: the car is no longer a means of transport, but a form of robot.

Li Auto's strategic turn toward AI had sent clear signals before. In late 2024 and May 2025, Li Xiang held two seasons of "AI Talk," systematically explaining his framework for artificial intelligence. He categorized AI tools into three levels—information tools, auxiliary tools, and production tools—and proposed a complete technical path for the VLA driver model. This was seen as a public declaration of Li Auto's shift from "vehicle manufacturer" to "AI terminal enterprise."

In 2025, XPENG and Li Auto further confirmed their pivot toward AI within the same time window. This was no coincidence; it was a simultaneous sensing of a paradigm shift signal. This "following" is not merely following Tesla as a company, but rather following a technological path that Tesla pioneered and has proven correct.

Tech Warfare: FSD—A "Target" Set Up By Hand

On December 9, 2025, at the Horizon Robotics Technology Ecosystem Conference, Vice President Su Qing offered a judgment on the state of the intelligent assisted driving industry:

The emergence of FSD V12 in 2024 was a "watershed event." It bridged the chasm between technical direction and practical implementation, proving the feasibility of the end-to-end data-driven paradigm. But once the paradigm is established, the industry must prepare for "hard times." In the next three years, there is unlikely to be a reconstruction of the theoretical core; competition will focus on the extreme optimization of existing systems.

In June 2024, He Xiaopeng experienced Tesla's FSD V12.3.6 in Silicon Valley. When comparing FSD with Waymo at the time, his assessment was that Waymo was better in downtown San Francisco, while FSD excelled in Silicon Valley and on highways.

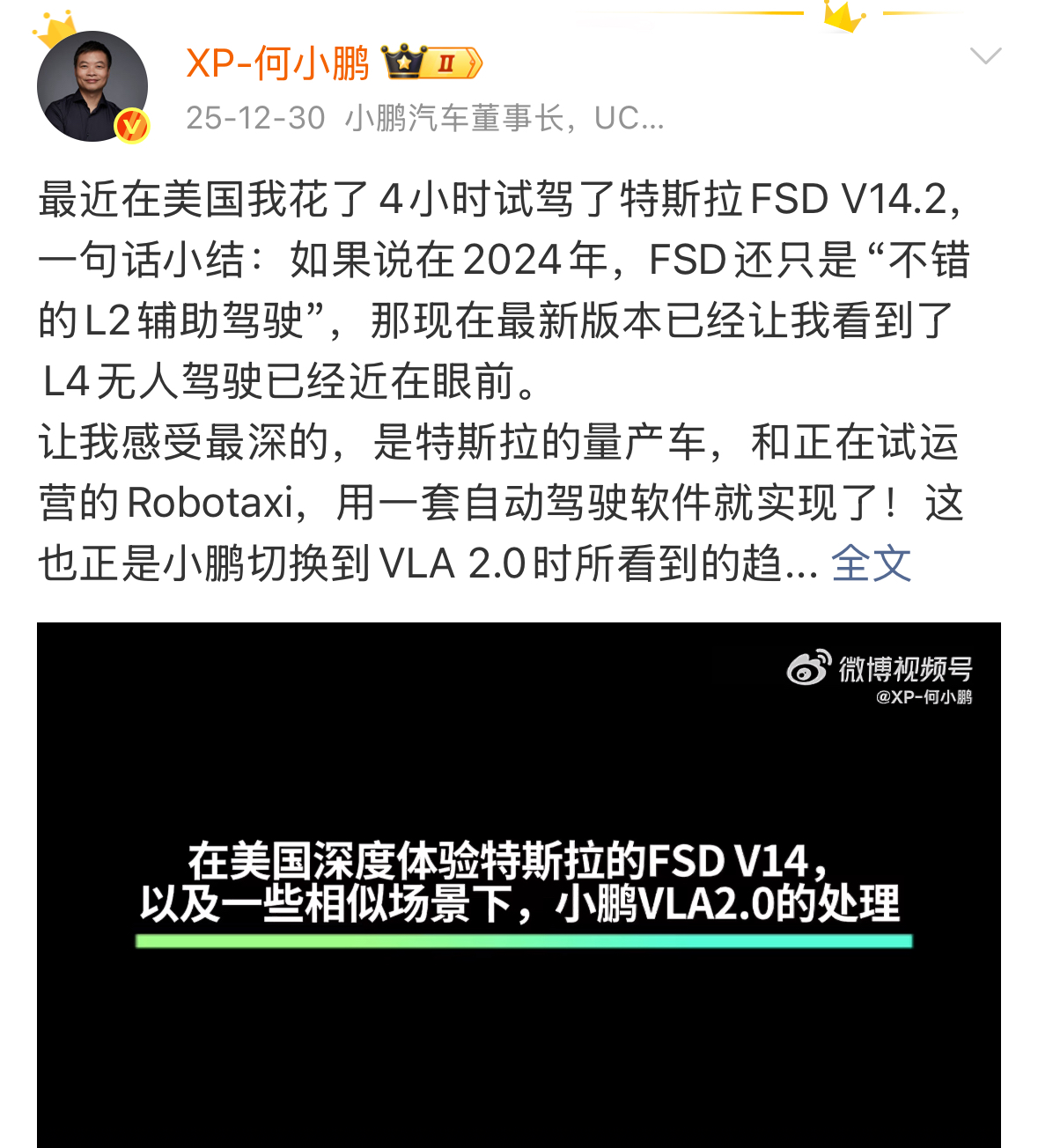

Image source: @XP-HeXiaopeng

A year and a half later, in December 2025, He Xiaopeng returned to the U.S. to experience FSD V14.2. This time, his assessment shifted fundamentally. He stated that if FSD in 2024 was merely "good L2 assisted driving," the latest version gave him a glimpse that L4 autonomous driving was "imminent." He also noted that Tesla uses the same autonomous driving software to support both mass-produced passenger cars and Robotaxi trial operations—a technical path highly consistent with the VLA 2.0 XPENG is advancing.

"Before August 30, 2026, XPENG's VLA system will achieve the overall effect of Tesla's FSD V14.2 in Silicon Valley within China." When He Xiaopeng wrote these words on social media, he attached a wager: if he wins, he will build a Chinese-style canteen in Silicon Valley; if he loses, his autonomous driving head, Liu Xianming, will run naked across the Golden Gate Bridge. This wager locked the catch-up target on the specific version of FSD V14.2 and set a clear deadline of August 30, 2026. FSD had become a live target.

And in China, XPENG is far from the only one using Tesla's FSD as a target.

In February 2025, just a week after Tesla FSD entered China, Li Auto CEO Li Xiang publicly posted a welcome for media nationwide to conduct comparative tests between Li Auto AD Max V13 and Tesla FSD V13, stating bluntly, "We have confidence."

At last month's 2026 Chery Auto AI Night, Yin Tongyue said, "We are constantly sending people to the U.S. to experience Tesla's FSD + Grok model combination to identify gaps and catch up quickly." Chery faced the gap with Tesla FSD directly, vowing to learn and to chase.

Beyond automakers, the intelligent driving supply chain is equally sensitive.

Late last year, Horizon Robotics VP Su Qing stated bluntly that Tesla FSD established the paradigm for end-to-end data-driven feasibility. Early this year, Horizon founder Yu Kai explicitly stated at a media gathering that the next-generation flagship chip, Journey 7, would launch "simultaneously" with Tesla's AI5 chip. From "FSD V12 verified the paradigm" to "Journey 7 launching alongside AI5," Tesla has effectively become the live target.

Image source: @Tesla

In January 2026, further signals emerged regarding Tesla FSD's entry into China. Musk predicted FSD would receive Chinese regulatory approval between February and March 2026. Tao Lin subsequently confirmed that the China training center had been built and localization was underway, though no specific launch date was set.

Tesla FSD has not yet officially played its hand in China, but this signal of "imminent entry" will undoubtedly further intensify competition in China's intelligent driving battlefield. FSD is not just a live target for the new forces; it is the technical wind vane for the entire Chinese intelligent assisted driving supply chain.

Conclusion:

By 2025, the relationship between China's new forces and Tesla has undeniably entered a new stage.

"Pixel-level benchmarking" at the product level hasn't disappeared, but it is no longer the sum total of competition. The truly profound changes are happening beneath the surface: the launch and follow-through on financial tools compressed cycles from months to days; the definition of corporate identity migrated from "EV manufacturer" to "embodied intelligence company"; and the method of catching up in intelligent driving shifted from "technical reference" to "target practice."

Tesla remains the one pulling the trigger first, defining FSD versions, financial innovation milestones, and the framework of the AI company discourse. China's new forces haven't rewritten this blueprint, but they have shortened their response time further, turning vague benchmarking into specific wagers and adjusting their corporate strategy from "product following" to "paradigm synchronization."

Looking ahead to 2026 and beyond, the following trends are becoming consensus:

The rollout of end-to-end, VLA, and world models in vehicles will move from a "technical verification phase" to an "engineering optimization phase." As Horizon's Su Qing noted, the next three years will likely see no reconstruction of the theoretical core; competition will focus on "endurance items" like computing efficiency, data closed-loops, and organizational execution.

FSD's entry into China is no longer a question of "if," but "in what rhythm and form." Regardless of the specific approval time, the stress test on local intelligent driving teams has already begun.

The boundaries between automakers and AI companies will continue to blur, especially for new forces. For example, Li Auto defining its products as "embodied robots" and XPENG recasting itself as an "explorer of the Physical AI world" suggests that the final outcome of competition in the auto industry may not be decided by sales rankings, but by who can secure a place in the underlying coordinate system of technology.