No surprise: China's car market opened 2026 with a blitz of promotions.

From luxury marques to homegrown brands, from new-energy leaders to traditional gasoline models, more than a dozen automakers rolled out price cuts, subsidized financing and trade-in bonuses. The scale is broad and the incentives are substantial, yet after years of discounting, consumers are largely unfazed.

Starting the year with bare-knuckle price combat sends a clear signal: during a market reset, price wars will remain a key lever to defend share — and they won't exit the stage anytime soon.

Luxury brands lead the charge

This year's opening salvo came from luxury names led by Tesla and BMW, with others quickly following to create a promotional wave that spans every major segment.

Image: Tesla

On Jan. 6, Tesla China introduced a "7-year ultra-low interest" plan for the Model 3, Model Y and the newly added Model Y L. For example, the Model Y requires a down payment as low as CNY 79,900, with monthly payments from CNY 1,918 under the 7-year low-rate plan. Buyers can also opt for a 5-year 0% financing program.

The move helps offset higher costs from changes to NEV purchase taxes while avoiding list-price cuts that could dilute brand value, easing the cash burden for younger buyers.

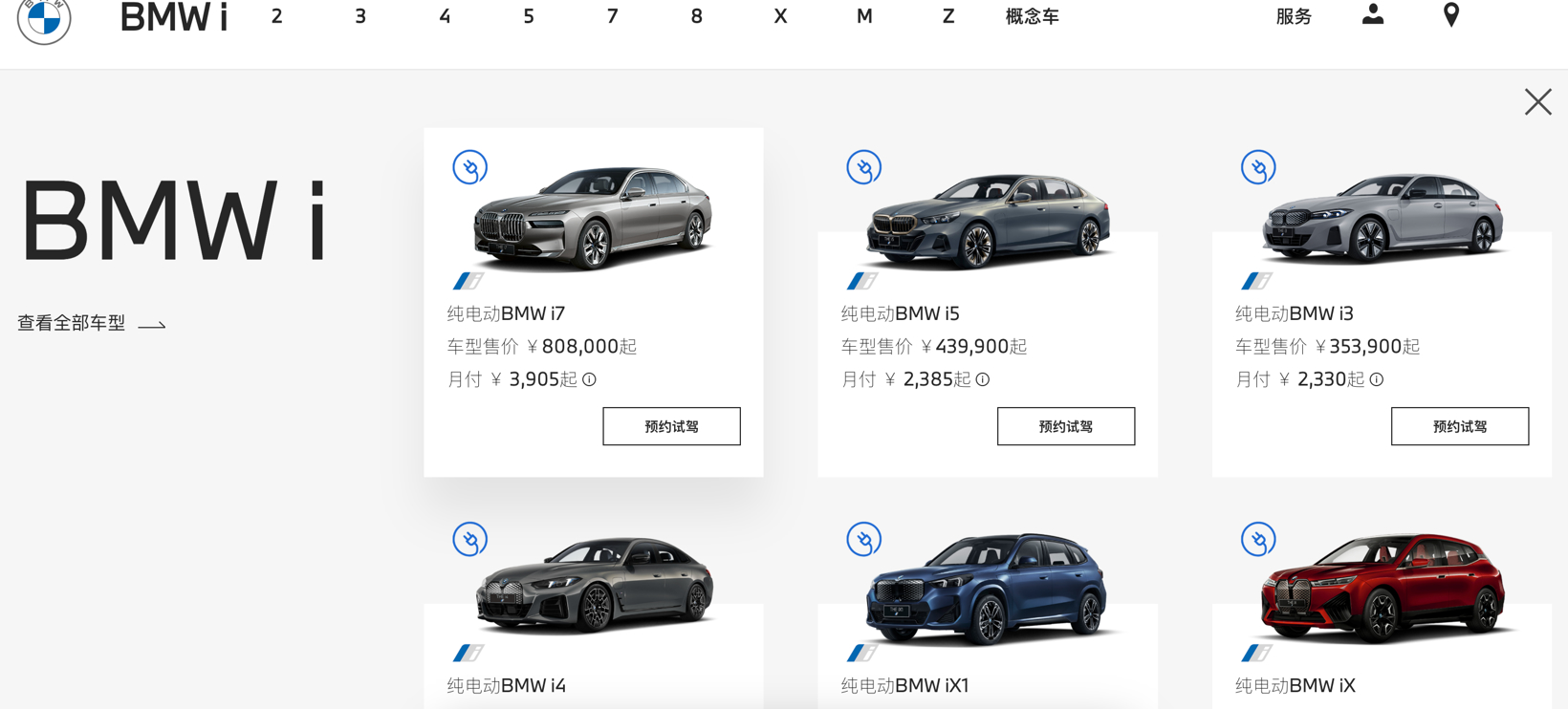

BMW went further, announcing list-price reductions across 31 core models right out of the gate — cuts that span sedans, SUVs, EVs and high-performance lines.

Image: BMW China

The flagship i7 M70L saw its suggested retail price reduced by CNY 301,000 — from CNY 1.899 million to CNY 1.598 million. The entry-level electric SUV iX1 took an official 24% cut, pushing its price band into the CNY 220,000 bracket.

Such sweeping list-price resets suggest legacy luxury brands, under pressure from electrification, are trying to remake pricing systems to defend market share.

Beyond those two, Xiaomi Auto, GAC Trumpchi, Volvo and others have joined in.

Volvo, for instance, is offering a direct CNY 14,000 purchase-tax subsidy and bundled ownership perks for the new XC70; NIO's Firefly brand is providing 10 years of intelligent pilot assist, a CNY 2,000 purchase-tax subsidy and rewards for repeat buyers; the Xiaomi YU7 range offers 3-year 0% financing, with CNY 48,000 in limited-time benefits for orders placed by end-February; GAC Trumpchi is touting government–enterprise subsidies of up to CNY 70,000; Wuling is covering purchase tax in full on several NEV models, plus up to CNY 8,000 in trade-in bonuses and CNY 5,000 in financed interest support...

Dongfeng, Chery and Deepal have also rolled out targeted incentives. Among joint ventures, FAW-Volkswagen and GAC Toyota are following suit across multiple volume models.

By powertrain, NEVs are the main focus — more than 60% of discounted models are electrified. ICE promotions lean on trade-in subsidies and financed interest, concentrated among core models of domestic legacy and JV brands, with the aim of clearing inventory and unlocking replacement demand.

A poisoned chalice?

Frequent, aggressive promotions are often likened to "drinking poison to quench thirst." Even so, in today’s market they remain the survival weapon many carmakers feel compelled to use.

The year-end pop expected for late 2025 never materialized. According to the China Automobile Dealers Association, sales in the first half of December were only 1.5% higher than the same period in November, and 23.7% lower than the second half of November. Retail passenger-vehicle sales for the month are estimated at 2.35 million, down 10.8% from a year earlier.

The main culprit was the wind-down of the national "old-for-new" auto trade-in subsidies. With funds exhausted, more than 20 cities suspended or adjusted applications. As incentives tapered, buyers turned cautious — many opting to wait for 2026 policies before deciding — which swelled year-end inventories.

Meanwhile, starting in 2026 the NEV purchase tax shifted from a full exemption to a 50% reduction, with the tax break capped at CNY 15,000. That raised out-of-pocket costs and further damped early-year demand.

Under the twin pressures of high stock and soft demand, promotions are the quickest way for carmakers to jolt the market and work down inventory.

But the late-2025 cooldown showed policy jolts and discounting aren't a lasting cure. Growth in the first 11 months of 2025 relied heavily on two "new" policy drives. Ministry of Commerce data show more than 11.2 million old-for-new auto trade-ins during that period, significantly lifting related consumption.

As subsidy pools ran dry, the policy boost faded fast and the domestic market slipped into adjustment; November’s domestic auto sales fell 4.4% year on year. The pattern of "policy steps down, demand cools" underscores an overreliance on incentives and price — and shows why promotions alone rarely deliver sustainable growth.

Chen Shihua, deputy secretary-general of the China Association of Automobile Manufacturers, noted that consumers' wait-and-see stance on policy tweaks reflects weak endogenous demand. Over-promotion, he said, only deepens that dependence, creating a vicious cycle where sales jump when discounts appear and drop when they stop.

Analysts say China's auto market has entered a deep adjustment in 2026 — slower incremental growth, tougher competition for existing stock. Morgan Stanley and others project that, excluding export gains, retail passenger-car sales could fall 7% this year.

Relying on a promotion war — the poisoned-chalice path — brings three costs: margins continue to be squeezed; brand equity erodes; and dealers' operating conditions worsen. A sizable share of dealers already faced cash-flow stress in 2025, and the risk may intensify in 2026.

To break that cycle, automakers and the industry need real breakthroughs. First, shift the core edge to technology: scale up 800V high-voltage fast charging, mass-produce L3-grade advanced driver-assistance, and develop AI chips in-house to widen product gaps.

Next, mine overseas markets for profit growth. With domestic competition overheated, going global is inevitable. China's auto exports topped 8 million in 2025 and could set another record in 2026. By building localized production and supply chains worldwide, carmakers can channel overseas profits back into R&D and operations at home.

Then pivot from selling cars to selling services. As the 15th Five-Year Plan gets underway, the industry should tap the aftermarket: certified used-car programs, smart-cockpit software subscriptions, and charging infrastructure tailored to rural markets — unlocking value across the full lifecycle rather than relying solely on new-car margins.

With luck, after this round of competition China's auto industry will move beyond low-level price fights toward value-led, higher-quality growth — and claim a larger place in the global auto landscape.