It is widely accepted that competition in China's auto market reached a boiling point in 2025. Yet a closer look at the sales targets major carmakers are now setting for 2026 reveals a narrative that is far more telling than headline-grabbing rivalry alone.

These figures are not simply performance benchmarks; they are carefully calibrated strategic statements that lay bare sharply different philosophies on growth, risk and the future of mobility. By unpacking these targets, this report identifies five key "unspoken messages" shaping Chinese carmakers' choices at a critical moment of industry transition.

1. An unexpected easing off the accelerator: the turn toward "slower growth, higher quality"

Contrary to expectations of aggressive expansion, some leading automakers are opting for a more measured path, signalling a shift toward what could be described as "slowing down to improve quality".

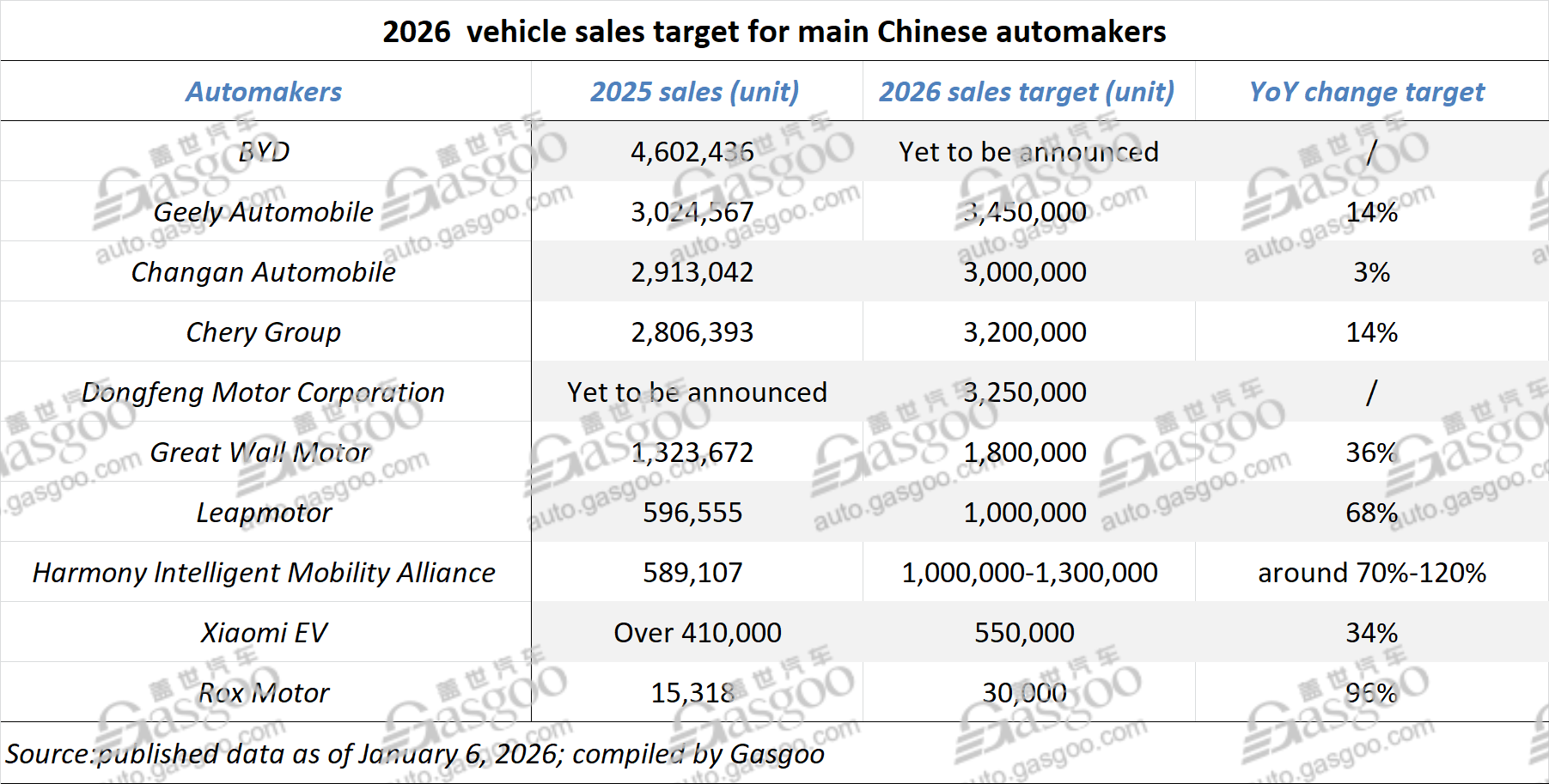

Great Wall Motor ("GWM") offers the clearest case study. Following adjustments to its employee shareholding scheme, the company cut its 2026 sales assessment target sharply, from an original 2.49 million vehicles to 1.8 million. On the surface, this appears to be a decisive pullback. In reality, the picture is more nuanced. Based on estimated 2025 sales of around 1.32 million units, the revised target still implies year-on-year growth of roughly 36%—hardly a timid ambition.

The underlying message is strategic recalibration. While keeping net profit targets unchanged, GWM is deliberately stepping back from the pursuit of sheer scale and refocusing on profitability and higher-quality growth.

Geely Auto is sending a similar, if subtler, signal. Its 2026 target calls for 14% year-on-year growth to 3.45 million vehicles. The deeper story lies in its brand mix. The core Geely brand is expected to deliver 2.75 million units, while premium marques ZEEKR (300,000 units) and Lynk & Co (400,000 units) together account for 700,000 vehicles—well below the previously floated ambition of a combined one million units.

Commentary:

At a time when the industry is preoccupied with talk of cut-throat "involutionary" competition, this deliberate choice by leading players to prioritise quality over speed runs counter to instinct. The key question for 2026 is whether a focus on profitability will build a durable competitive moat—or whether caution risks ceding critical market share to more aggressive rivals.

2. The bold push for the "million-unit club": a high-stakes bet by new challengers and ecosystem players

In stark contrast to the restraint of established giants, emerging manufacturers and ecosystem-driven players are setting audacious targets that reflect a determination to break into the so-called "million-unit club".

Leapmotor stands out as an early standard-bearer. On the back of nearly 600,000 vehicles sold in 2025, the company has publicly declared its ambition to reach one million units in 2026, implying growth of around 68%. Its confidence rests not only on the brand uplift from its higher-end D-series models and overseas expansion, but more importantly on the launch of its new A-series. Positioned as a more affordable, high-volume line-up, the A-series is designed to penetrate the mass market through extreme value-for-money, providing the volume backbone for Leapmotor's million-unit aspiration.

Another closely watched contender is Harmony Intelligent Mobility Alliance (HIMA), the automotive ecosystem spearheaded by Huawei. In early December, Yu Chengdong—Huawei Executive Director, Chairman of the Investment Review Board, Chairman of the Board of Directors of the Consumer BG—revealed that HIMA's 2026 sales target ranges from 1 million to 1.3 million vehicles, requiring annual growth of more than 70%.

HIMA's edge lies in Huawei's distinctive "ecosystem empowerment" model. Through its expanding portfolio of brands—AITO, LUXEED, STELATO, SAIC-backed Shangjie, and the ultra-premium MAEXTRO—it aims to cover a price spectrum from 150,000 yuan to 1 million yuan. The scale and leverage of this ecosystem underline its ambition to reshape the competitive landscape.

Commentary:

Leapmotor and HIMA represent a disruptive force in the market. Rather than settling for incremental growth, they are pursuing a high-reward strategy built on in-house technology development, ecosystem construction and rapid scaling.

3. Two engines of future growth: new energy vehicle and global expansion as non-negotiables

A review of growth plans across the sector makes one point unmistakably clear: new energy vehicles (NEVs) and overseas expansion have become the two indispensable pillars underpinning 2026 sales targets.

The numbers illustrate this reliance vividly. Dongfeng Motor Corporation has yet to release its full-year 2025 sales figures, but based on January–November data, total sales are estimated at around 1.9 million vehicles. To reach its 2026 target of 3.25 million units—an increase of roughly 70%—growth would depend almost entirely on these two engines. Dongfeng Motor plans to sell 1.7 million NEVs and export 600,000 vehicles, a combined total of 2.3 million units, accounting for more than 70% of its overall target.

Changan Automobile tells a similar story. Its headline target of 3 million vehicles is explicitly split between two pillars: 1 million NEVs and 1 million overseas sales, together representing two-thirds of the total.

Photo source: Chery Group

The importance of going global is becoming ever more pronounced. Chery Group, for example, has ranked first among Chinese passenger car brands by exports for 23 consecutive years. In 2025 alone, its overseas shipments reached 1.344 million vehicles. Such deep internationalisation offers a crucial outlet beyond increasingly saturated domestic demand.

Commentary:

These targets leave little doubt that China's domestic auto market has entered a phase of zero-sum competition. A full transition to new energy vehicles and the pursuit of growth in global markets are no longer strategic options—they are mandatory courses that will determine which companies survive and which fall behind.

4. The rise of the "value war": moving beyond price cuts to system-level competition

Competition in China's auto market in 2026 will no longer revolve around straightforward price cutting. Instead, it is set to escalate into a higher-dimensional "value war" — an evolution from destructive cost compression to head-to-head competition between industrial systems. This is a comprehensive stress test of a company's technological depth, organisational capabilities, cost control, execution of intelligent features, and ability to operate overseas markets."

The concept of a "value war" is broad, and it probes the thickness of an automaker's overall capabilities:

● Core technologies:

This is where the value war becomes most tangible. Competition is shifting away from cutting sticker prices toward delivering step-change advances in core technologies. For instance, Leapmotor's insistence on full-stack in-house R&D across key systems forms the backbone of its competitive moat.

● Intelligence and ecosystems:

Ecosystem-driven models, exemplified by HIMA, are pushing competition beyond individual vehicles to confrontations between entire ecosystems. What is being tested is no longer a single car, but the completeness of an integrated intelligent experience.

● Platform capability:

Platformisation is central to cost control and efficiency gains. GWM's newly unveiled "Guiyuan" platform integrates multiple powertrain options — petrol, diesel, plug-in hybrid, pure electric and hydrogen — demonstrating deep technical reserves and system-level competence. Such platform strength forms the foundation for prevailing in a value-centric battle.

5. Xiaomi's "calm mindset": steady progress amid noise

Against a backdrop of sharp polarisation between aggressive expansion and conservative retrenchment, Xiaomi EV has offered a notably different answer.

Xiaomi EV has set a 2026 sales target of 550,000 vehicles, up 34% from its estimated 410,000 units in 2025. The market has broadly described this target as "neither aggressive nor cautious".

Photo source: Xiaomi EV

From a production capacity perspective, meeting the target of 550,000 units in 2026 poses no issue at all. Despite Xiaomi EV's new factory only beginning operations in the second half of 2025, the company still achieved sales of 410,000 vehicles that same year. Therefore, having sufficient capacity to support the sales target for 2026 is well within reach.

In other words, the 550,000-unit target is not limited by manufacturing capability, but reflects a deliberate strategic judgement based on demand expectations and product line expansion.

Whether Xiaomi succeeds will hinge on whether upcoming models — including range-extended SUVs — can effectively take over from the company's first vehicle, converting its enormous initial traffic and attention into sustained brand loyalty.

Commentary:

For 2026, Xiaomi — arguably at the peak of its public attention — has opted for a relatively "stable" target. That choice alone is telling. It may signal a cautious assessment of supply-chain maturity and market pacing, revealing a rare sense of composure amid the industry's prevailing clamour.

Conclusion

The sales targets set for 2026 are far more than abstract numbers. They amount to strategic manifestos — and survival rules — for China's auto industry in an era of profound divergence. Some companies are choosing stability and quality, reinforcing profit moats; others are betting on aggressive expansion, trading scale today for a promised future; still others are seeking breakthroughs through powerful ecosystems or deeply entrenched global footprints.

As the curtain rises fully on 2026, a final test of competing growth philosophies is already under way. Will victory belong to disruptive technologies, sprawling ecosystems, or disciplined global expansion? Time will deliver the verdict. What is certain is that every participant has already begun writing the opening chapter of its own answer.