In December 2025, Chinese automakers BYD, Geely Auto, and Chery Auto pursued distinct export strategies, showcasing the diversity of China's global automotive expansion. BYD led the Southeast Asian new energy market, Chery grew in Europe and emerging regions, and Geely strengthened the CIS and Africa while expanding into Europe. Together, their approaches highlight a new phase in the globalization of Chinese automotive brands.

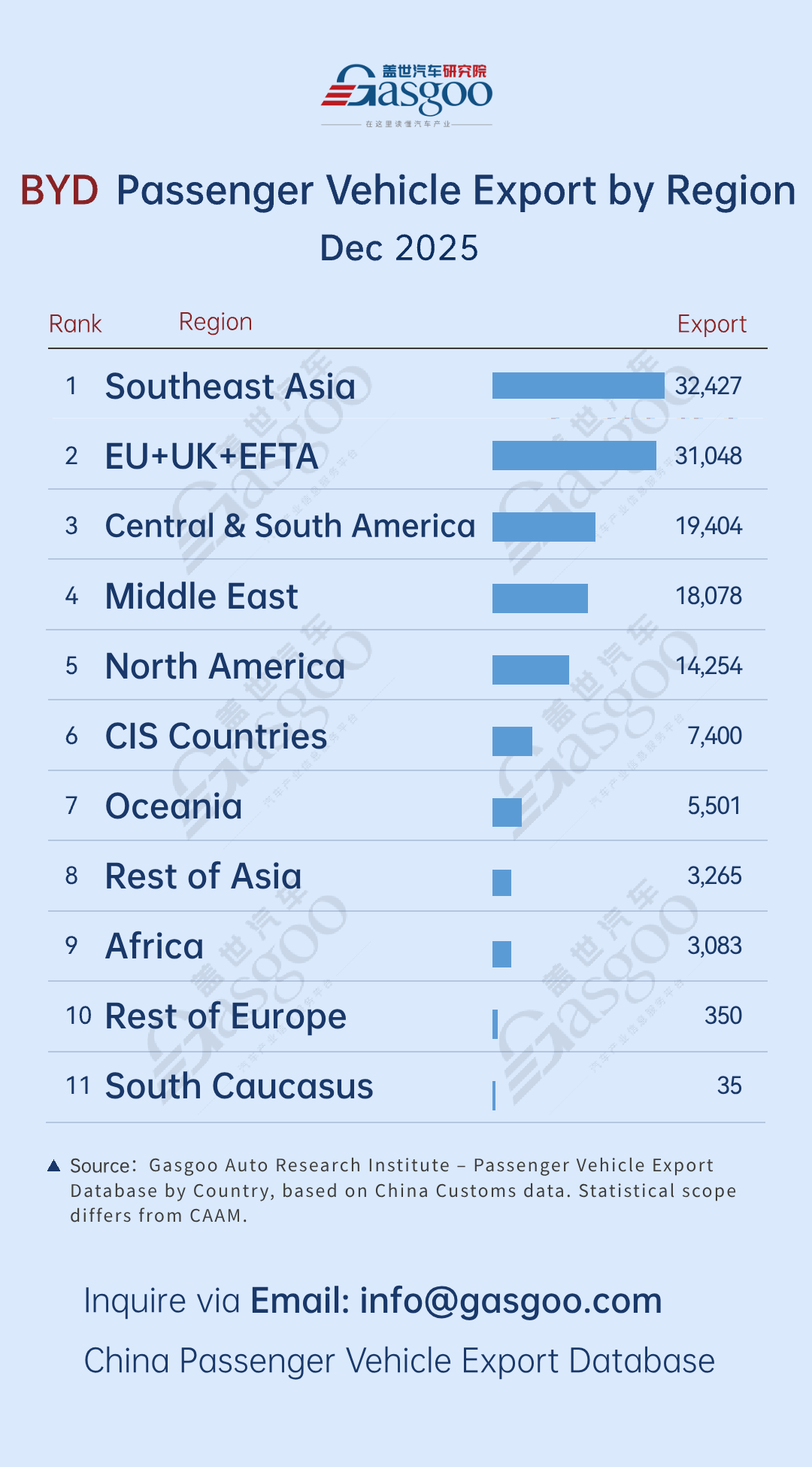

The regional export destination ranking of BYD passenger vehicles in December 2025 is as follows:

NO.1 Southeast Asia: In December, BYD exported 32,427 units to the region.

NO.2 EU + UK + EFTA: In December, BYD exported 31,048 units to the region.

NO.3 Central & South America: In December, BYD exported 19,404 units to the region.

NO.4 Middle East: In December, BYD exported 18,078 units to the region.

NO.5 North America: In December, BYD exported 14,254 units to the region.

NO.6 CIS countries: In December, BYD exported 7,400 units to the region.

NO.7 Oceania: In December, BYD exported 5,501 units to the region.

NO.8 Other Asia: In December, BYD exported 3,265 units to the region.

NO.9 Africa: In December, BYD exported 3,083 units to the region.

NO.10 Other Europe: In December, BYD exported 350 units to the region.

NO.11 South Caucasus: In December, BYD exported 35 units to the region.

According to Gasgoo Automotive Research Institute, BYD's December 2025 exports demonstrated a pattern of stable core markets alongside multi-point breakthroughs in emerging regions. Southeast Asia led the pack with 32,427 units, driven by BYD's long-term market cultivation, localized production, tailored product mix, and strong policy support, building a solid brand presence and distribution network. The EU + UK + EFTA followed closely with 31,048 units, reflecting growing consumer acceptance and the increasing competitiveness of BYD's new energy vehicles (NEVs) in Europe's mainstream markets. Other regions, including the Americas, Middle East, and Oceania, also saw notable shipments, illustrating BYD's broadening global reach and the deepening of its internationalization strategy.

Notably, December exports to North America dropped to 14,254 units, down sharply from 34,618 units in November. The surge in November was largely driven by BYD accelerating shipments ahead of anticipated 2026 tariff increases in Mexico. In December, the risk of shipments crossing into the new year caused volumes to decline. In addition, phased shipping schedules and supply chain arrangements also contributed to fluctuations, highlighting the ongoing uncertainty in mature markets due to policy and trade conditions. By contrast, emerging markets such as the Middle East, as well as Central and South America, maintained relatively stable growth, acting as a buffer within the overall export structure.

From a structural perspective, BYD's export pattern is gradually evolving toward a "multi-region balanced layout." Southeast Asia and Europe serve as the dual core markets, supporting overall export volumes while enhancing brand premium and technological image. Meanwhile, continued growth in the Middle East and Latin America strengthens the resilience and stability of its global footprint. Going forward, by maintaining scale expansion, optimizing overseas production capacity, improving local supply chain responsiveness, and flexibly adjusting product offerings across regions, BYD's leading position in the global electrification wave is likely to be sustained.

The regional export destination ranking of Geely Holding passenger vehicles in December 2025 is as follows:

NO.1 CIS countries, in December, Geely Holding exported 20,977 vehicles to the region.

NO.2 Africa, in December, Geely Holding exported 16,763 vehicles to the region.

NO.3 EU+UK+EFTA, in December, Geely Holding exported 11,883 vehicles to the region.

NO.4 Middle East, in December, Geely Holding exported 9,577 vehicles to the region.

NO.5 Southeast Asia, in December, Geely Holding exported 9,450 vehicles to the region.

NO.6 Central & South America, in December, Geely Holding exported 5,338 vehicles to the region.

NO.7 Other Asia, in December, Geely Holding exported 1,882 vehicles to the region.

NO.8 North America, in December, Geely Holding exported 1,601 vehicles to the region.

NO.9 Oceania, in December, Geely Holding exported 1,064 vehicles to the region.

NO.10 South Caucasus, in December, Geely Holding exported 302 vehicles to the region.

NO.11 Other Europe, in December, Geely Holding exported 178 vehicles to the region.

Based on December 2025 export data, Geely Holding's global strategy centers on emerging markets while gradually reaching higher-end regions. CIS countries and Africa together accounted for nearly half of exports, reflecting a stable presence in these markets. Through locally adapted models, flexible financing, and improving after-sales networks, Geely has steadily boosted brand awareness and channel penetration. However, this structure, while easing competition in mature markets, also leaves overall exports sensitive to factors like exchange rates and policy changes.

Compared with BYD's leading performance in Southeast Asia, Geely's export volume of 9,450 vehicles in the region remains at a developmental stage, indicating room for expansion in growth markets such as Southeast Asia and the Middle East. In contrast, the 1,601 vehicles exported to North America reflect the constraints Geely faces in mature markets—due to trade policies, channel networks, and brand recognition—leading to a more cautious approach in the short term.

In Europe, exports to the EU, UK, and EFTA regions exceeded 11,000 vehicles, reflecting Geely's phased progress in premiumization and electrification. Over the medium to long term, this trend may enhance overall brand value and strengthen Geely's participation in the global new energy vehicle (NEV) industry chain.

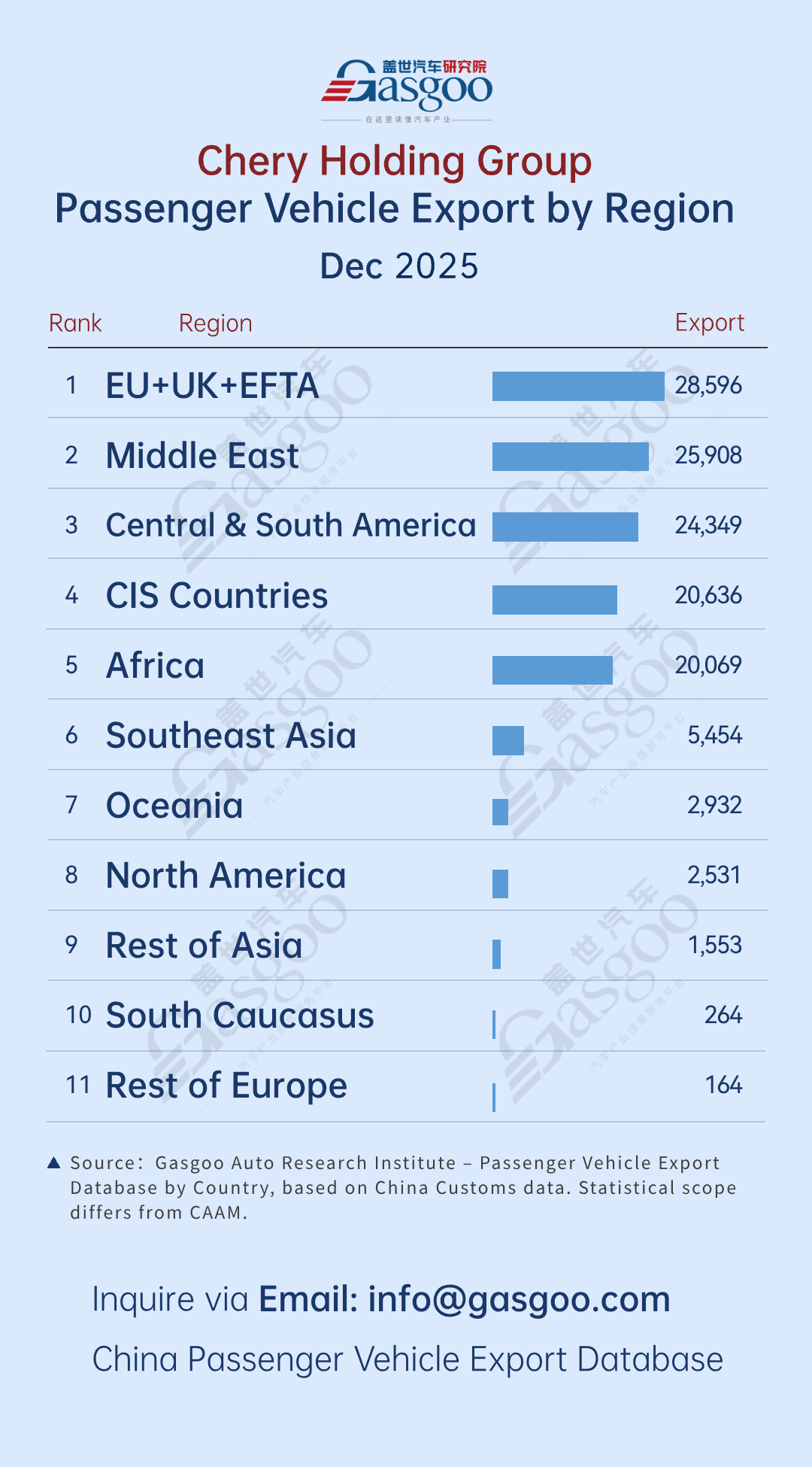

The regional export destination ranking of Chery Holding passenger vehicles in December 2025 is as follows:

NO.1 EU+UK+EFTA, in December, Chery Holding exported 28,596 vehicles to the region.

NO.2 Middle East, in December, Chery Holding exported 25,908 vehicles to the region.

NO.3 Central & South America, in December, Chery Holding exported 24,349 vehicles to the region.

NO.4 CIS countries, in December, Chery Holding exported 20,636 vehicles to the region.

NO.5 Africa, in December, Chery Holding exported 20,069 vehicles to the region.

NO.6 Southeast Asia, in December, Chery Holding exported 5,454 vehicles to the region.

NO.7 Oceania, in December, Chery Holding exported 2,932 vehicles to the region.

NO.8 North America, in December, Chery Holding exported 2,531 vehicles to the region.

NO.9 Other Asia, in December, Chery Holding exported 1,553 vehicles to the region.

NO.10 South Caucasus, in December, Chery Holding exported 264 vehicles to the region.

NO.11 Other Europe, in December, Chery Holding exported 164 vehicles to the region.

Based on Chery Holding's export data for December 2025, its global strategy shows a simultaneous push into both mature and emerging markets, with a relatively diversified regional distribution and a steady overall pace. The EU + UK + EFTA region led the pacl with 28,596 vehicles exported, indicating that Chery's products in premiumization and electrification are capable of entering mainstream European markets. The European market is gradually becoming a key pillar in its export structure.

At the same time, four regions—Middle East, Central & South America, CIS countries, and Africa—each recorded monthly exports exceeding 20,000 vehicles, together forming the core of Chery's export volume. This multi-region approach reduces reliance on any single market cycle, helping to smooth the impact of policy, exchange rate, and demand fluctuations across different regions. At the same time, it places higher demands on the company's product adaptation, channel coverage, and supply chain coordination.

Compared with BYD's established scale advantage in Southeast Asia, Chery's export volume of 5,454 vehicles in the region remains at a developmental stage, serving primarily a strategic and channel-establishing role rather than entering a high-volume phase. In North America, exports of 2,531 vehicles indicate that expansion in mature markets is still constrained by trade conditions, market entry barriers, and brand premium capabilities, making it unlikely to serve as a major growth source in the short term.

Overall, Chery's current globalization strategy leans toward a "broad coverage, steady advancement" approach: leveraging the European market to raise its technology and brand ceiling, while consolidating sales in emerging markets. If it can accelerate localized production in regions like Southeast Asia and replicate the electrification and compliance experience gained in Europe across emerging markets, the stability and risk resilience of its global export structure are likely to improve further.