Hongqi sales surged past 460,000 units, marking eight straight years of growth and making it the first Chinese luxury brand to surpass 2 million cumulative users. The group has set a new target of 550,000 units for the brand this year, with eyes on a million-unit scale by 2028.

Beneath the surface growth, however, lies an uncomfortable truth: new-energy vehicles (NEVs) accounted for only 32.3% of Hongqi's sales in 2025. That lagged far behind the broader market, where NEV penetration in China topped 51%.

460,000-Unit Glow vs. The 32.3% Penetration Trap

On paper, China FAW's 2025 report card looks respectable. Total group sales held steady at 3.30 million, while Hongqi delivered solid 11.9% growth with 460,000 units sold, continuing to lead the Chinese passenger car sector in brand value.

Look beneath the hood, though, and the picture shifts. Data from Gasgoo Automotive shows Hongqi sold roughly 149,000 NEVs in 2025. While that 29.2% growth rate sounds healthy, it represents just 32.3% of the brand's total volume.

Image Source: FAW Hongqi

That figure becomes awkward when viewed against the wider group. In the same year, FAW's self-owned NEV sector sold 327,000 units—a surge of over 65% year-on-year. The Bestune brand was the standout: of its 200,000 annual sales, 178,000 were NEVs, pushing its penetration rate to 86%, more than double the previous year.

Hongqi's 32.3% penetration rate not only trails Bestune by a wide margin but also lags behind the market's overall pace.

After the data dropped, a comment on Gasgoo's site caught the eye: “Are these numbers fake? I never see Hongqis on the road.” That blunt remark highlights a current reality for Hongqi: it remains the 'national car' in the spotlight, enjoying a unique prestige, yet it maintains a subtle distance from the daily view of ordinary consumers.

So, who is actually buying those 460,000 cars a year? Another comment offered a clue: “Wuhan deployed a lot of Hongqi sedans for ride-hailing last year.” Whether through government procurement or large-scale fleet sales, these channels create an invisible wall between Hongqi's volumes and the private consumer market.

Moreover, entering the ride-hailing market on a large scale often slaps a specific label on a model, deterring individual buyers. That's a lesson many brands have learned the hard way.

Compared to Bestune, which is anchored in the mainstream, Hongqi—tasked with moving the brand upmarket—certainly holds strong cards.

Image Source: Hongqi

Hardcore technologies like the Tiangong EV platform and Jiuzhang intelligent platform are in place, along with models like the E-QM5 and EH7. Yet, it still lacks that one electric 'blockbuster' capable of truly igniting the market and thrilling users.

Its NEV growth appears to be the sum of multiple models rather than the powerful pull of a single shining star.

As industry competition has evolved from 'who has an EV' to 'whose EV is smarter and more appealing,' FAW's self-owned sector penetration rate of 31.4% represents more than just a numerical shortfall.

Behind it lies a series of critical questions: Are product definitions precise? Is user perception on point? Is market response agile enough?

Beneath the halo of 460,000 units, how Hongqi clears the 32.3% hurdle remains a question demanding a full-throttle answer.

A Tale of Two Speeds Triggered by 'Separate Assessment'

Rewind to March 2024. SASAC Chairman Zhang Yuzhuo called out the three state-owned automakers at the 'Ministers' Corridor,' demanding separate assessments for their NEV businesses. This policy, hailed as a 'shackles-off' mandate, aimed to break the 'profit constraints' holding back SOEs during their energy transition, encouraging them to go all in.

After the starting gun fired, the three giants sprinted at vastly different speeds and postures. Nearly two years later, looking back at the 2025 scorecards, the divergence is unmistakable.

Dongfeng Motor is undoubtedly the most decisive 'transformer.' Driven by strategies like 'Dongfeng Rising' and 'Leap Action,' it introduced the electrification wave into its system with a near-burn-the-boats determination.

The results were direct and stunning. Data from Gasgoo shows that in 2025, the NEV penetration rate of Dongfeng's self-owned passenger vehicles hit a high of 77.04%. Put simply: for every four cars its independent sector sold, three were NEVs.

Brands like Voyah, Aeolus, eπ, and Nammi have gone fully electric, with the Voyah Dreamer firmly establishing itself in the MPV market.

On the intelligence front, Dongfeng moved just as fast. Voyah's entire lineup now features Qualcomm 8155 chips, and the company is pushing forward the deployment of its SOA electrical architecture. Its deepening partnership with Huawei to refine next-gen smart cockpits and advanced driving solutions demonstrates an aggressive 'software-and-hardware' approach.

Compared to Dongfeng's full-speed pivot, Changan Automobile—buoyed by its long-term 'Shangri-La' plan—delivered 930,000 NEV passenger vehicles, making it the country's fourth-largest NEV group.

Crucially, it built a distinct, full-coverage brand matrix: NEVO, Deepal, and Avatr, striking from the mainstream all the way to the high end.

Its intelligent tech is a trump card: the premium Avatr brand comes standard with Huawei ADS 4.0 across its lineup, selling over 120,000 units annually. Deepal, meanwhile, secured China's first formal L3 autonomous driving license, turning technical prowess into a tangible regulatory credential.

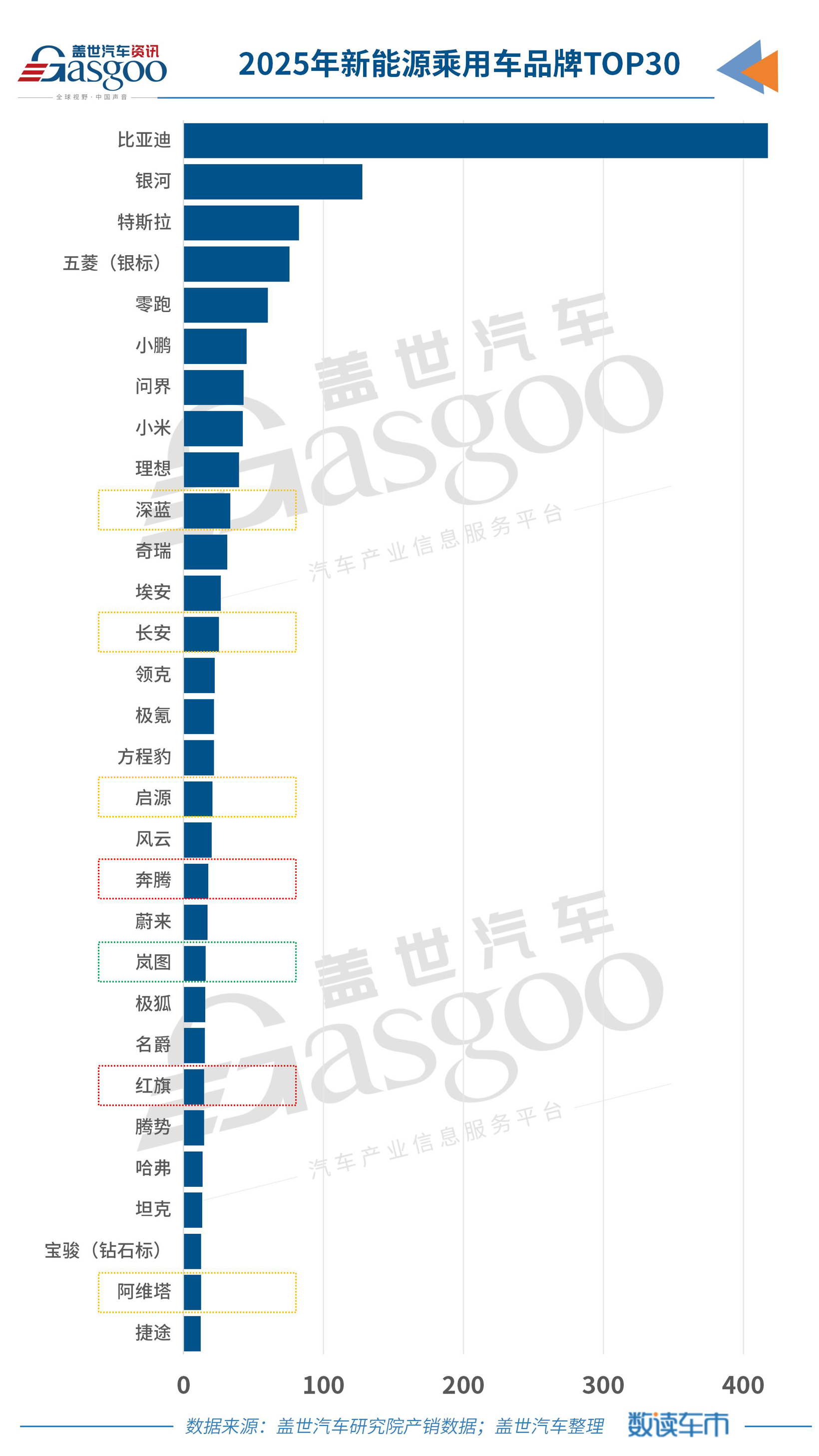

On Gasgoo's NEV brand rankings, names like Deepal and NEVO feature prominently. Through multi-brand synergy and top-tier intelligence, Changan proved it hasn't just kept pace with the market—it has taken the lead in key areas.

China FAW, by contrast, has moved with notable caution. While rivals went 'all in' on NEVs, FAW chose a dual strategy: 'NEVs at home, energy-efficient vehicles abroad.' While that global perspective has its merits, its domestic performance has felt somewhat 'low-key'.

Data from Gasgoo shows its 2025 NEV penetration rate for passenger vehicles at 49.03%, with the entry-level 'Bestune Little Ma' model contributing the bulk of those sales.

In the core arena of intelligence, FAW's Hongqi and others have deployed L2+ driving systems and partnered with tech firms. Yet, whether in terms of buzz or milestone breakthroughs like an L3 license, it has yet to leave a deep mark on consumers.

More alarming is the time factor. Gasgoo predicts Dongfeng's electrification rate will near 100% by 2030. FAW, meanwhile, might not reach Dongfeng's 2025 levels until around 2030. A five-year lag, in the window of a century-defining industry shift, amounts to the distance of an era.

This race, triggered by the policy shift, has its opening chapter already written.

Dongfeng sprints, Changan strides, and FAW strolls.

Assessment acts as a mirror. It reflects not just sales percentages, but strategic courage, technical decisiveness, and execution power in the face of industry disruption.

As electrization becomes the entry fee, intelligence is becoming the new tiebreaker. The next steps for these three giants—particularly their real investment in smart driving and ecosystem building, and how users perceive it—will determine whether this polarized landscape hardens into the final order or brings new variables.

Hongqi's Solo Dance and FAW's Big Test

Therefore, when we scrutinize Hongqi's 2026 sales target of 550,000 units, its significance goes far beyond a simple growth figure. It must be weighed against two harsh realities: the full-scale electrification encirclement by external competitors, and the unbalanced transition within the group itself.

A senior analyst at Gasgoo warns that for Hongqi, the real test isn't hitting the 550,000 total—it's how much of that comes from NEV models with genuine competitive muscle.

The first validation prototype of the E702 (P601) project, a key product in Hongqi's 9-Series lineup; Image Source: FAW Hongqi

If over 60% of those 550,000 units are still internal combustion engine cars, hitting the target would still signal a failure in brand upscaling and future competitiveness. Hongqi needs a flagship like the E-HS9 to establish a tech image—but even more, it needs a volume-driving NEV hit that defines the market, like Li Auto's L Series.

For the massive empire that is China FAW, a deeper test looms: how to revitalize its vast but uneven joint venture and self-owned resources, turning the NEV transition from 'Hongqi's solo dance' into a 'group chorus.'

Currently, FAW-Volkswagen and FAW Toyota remain the group's profit pillars and sales bedrock. Their electrization transitions—such as the ID. and bZ series—are underway, but their pace is constrained by global strategies, preventing the all-out sprint seen in the self-owned sector. Figuring out how to spark vitality in the joint venture camp to feed back into proprietary technology is a major challenge.

On another front, internal resources need efficient synergy. Bestune has proven it can build hot-selling NEVs—can that experience and technology rapidly empower Hongqi? Conversely, can Hongqi's high-end EV platform technology be cascaded down to accelerate the upgrade of the entire self-owned sector?

Breaking down internal resource barriers, avoiding 'siloed fighting,' and forming a united transition front is a management challenge far more complex and critical than simply setting sales targets.

Looking toward the 15th Five-Year Plan, FAW is laying out its future. All-solid-state batteries, full-domain intelligent architecture, and steer-by-wire chassis are the technological foundations it's betting on. These shouldn't just be weapons for Hongqi, but shared ammunition for the entire group.

Meanwhile, Changchun plans to build a trillion-yuan automotive cluster by 2030. With local supply chain advantages right in front of it, can FAW seize this opportunity to convert that local strength into cost and technological advantages for its own products? That, too, is vital.

550,000 units is a sprint point for Hongqi. For the FAW Group, however, it is a starting point for reflection and reorganization. It poses a fundamental question: Amidst the complex landscape of misaligned joint venture partners and divergent self-owned sectors, can the group's top leadership demonstrate the strategic resolve and resource integration capability needed to steer this giant ship—not with a slow turn, but at full speed—into the deep blue waters of the new energy era.

The market won't wait. With NEV penetration surpassing 50% in 2025, the industry has entered a low-margin elimination game. FAW's real war is bridging the gap between its current penetration and its future goals, and catching up with the first-mover advantage its rivals have already established.

This 'SOE survival story' is no longer about recording scale growth; it is about the determination and speed of transformation. Time has become the scarcest resource.