Gasgoo Munich- China's auto industry delivered a broadly steady performance in January, though passenger vehicle sales softened while the commercial vehicle segment maintained positive momentum. The new energy vehicle (NEV) market remained stable overall, and exports continued to expand. The dip in overall sales was largely attributed to the transition in NEV purchase tax incentives, the year-end rollover of regional car-buying subsidies, and demand that had been pulled forward into 2025.

At the start of 2026, policymakers rolled out a series of measures aimed at supporting both households and businesses. The so-called "Two New" initiatives are being implemented in an orderly manner, with local governments gradually issuing detailed guidelines. Meanwhile, a new action plan to foster growth in service consumption highlights key areas such as the automotive aftersales market. As these policies are refined and executed, they are expected to help stabilize demand and underpin a more balanced market recovery.

The upcoming 15th Five-Year Plan period is widely seen as a pivotal window for China's auto industry to shift toward higher-quality growth. The sector faces the dual task of maintaining stable volumes while improving efficiency and overall competitiveness.

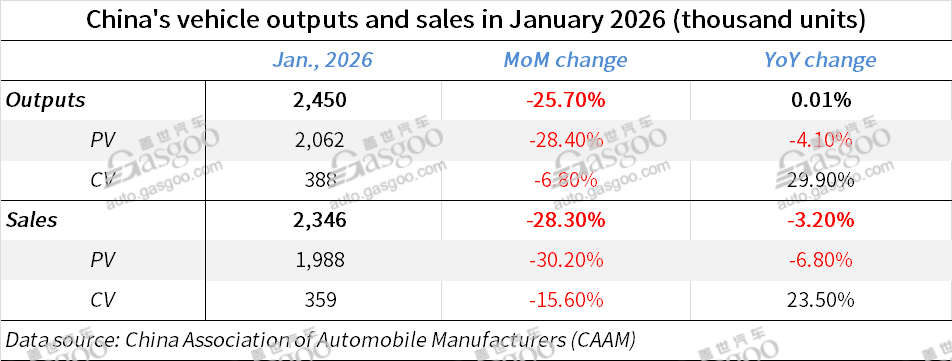

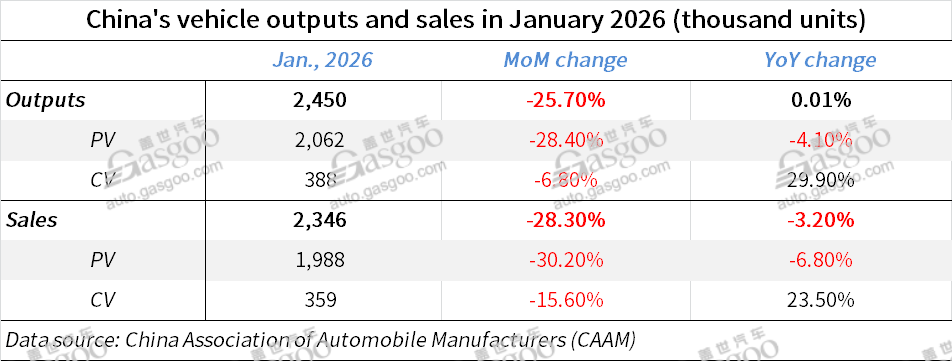

In January, China's automobile production reached 2.45 million units, while sales totaled 2.346 million units, according to data issued by the China Association of Automobile Manufacturers (CAAM). Output was essentially flat year-on-year, edging up 0.01%, whereas sales declined 3.2% compared with a year earlier. On a month-on-month basis, both production and sales fell sharply, down 25.7% and 28.3%, respectively, reflecting seasonal factors and policy transitions.

The top 15 automobile groups by sales accounted for a combined 2.192 million units in January, a 3.8% decline year-on-year. Together, they represented 93.4% of total vehicle sales, 0.6 percentage points lower than the same period last year.

Domestic automobile sales came in at 1.665 million units last year, down 14.8% year-on-year and 33.9% from December 2025. Of that total, traditional fuel-powered vehicles accounted for 1.022 million units, marking declines of 11.9% year-on-year and 7.9% month-on-month.

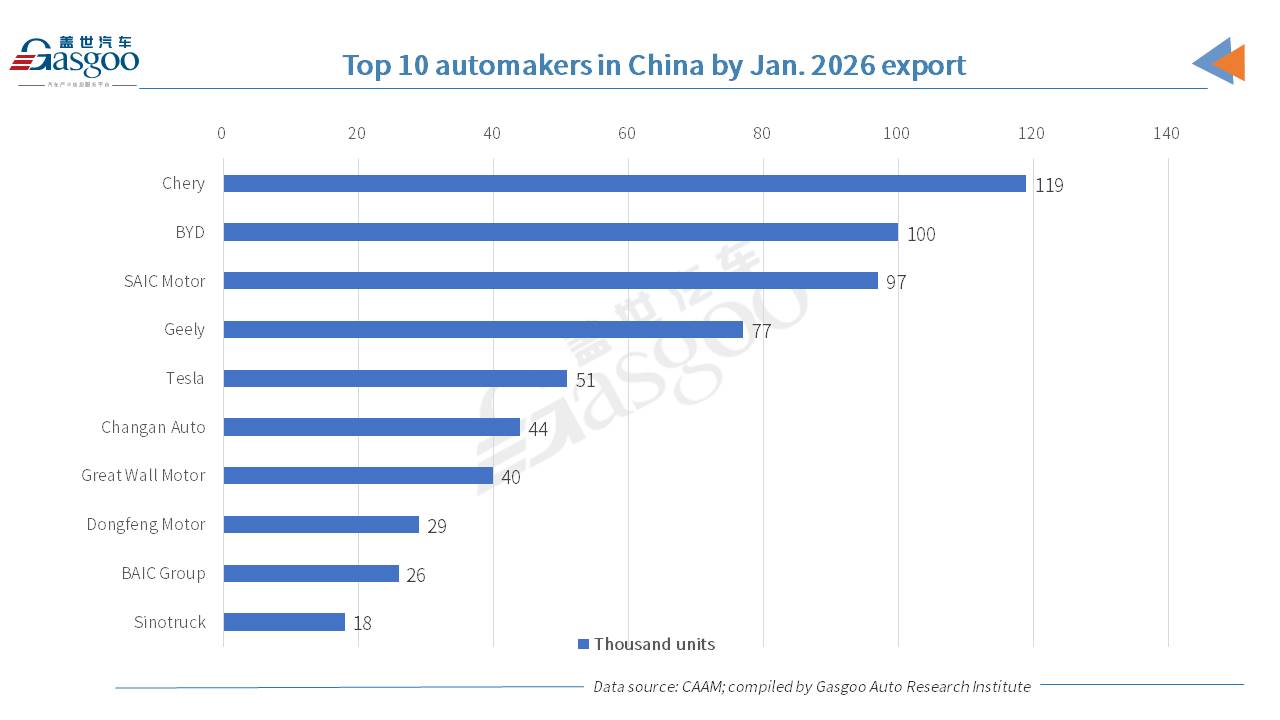

Exports remained a bright spot. China shipped 681,000 vehicles overseas in January, surging 44.9% from a year earlier, though slipping 9.5% compared with the previous month.

Among the top ten vehicle exporters, Chery led the pack with 119,000 units shipped abroad, up 47.2% year-on-year and accounting for 17.4% of total exports. Geely posted the fastest growth rate, exporting 77,000 vehicles, a 140% surge compared with the same period last year.

Passenger vehicle production reached 2.062 million units in January, while sales stood at 1.988 million units. Both metrics declined year-on-year, down 4.1% and 6.8%, respectively, and saw steeper drops from December levels.

Chinese domestic brands sold 1.329 million passenger vehicles during the month, a decrease of 8.9% year-on-year. Their market share stood at 66.9%, down 1.5 percentage points from a year earlier.

Within the traditional oil-fueled passenger vehicle segment, sales across A0- to C-segment vehicles declined to varying degrees. Demand remained concentrated in the A-segment category, which recorded 617,000 units sold, down 8.2% year-on-year.

In the NEV passenger vehicle market, sales of A00- and A-segment models fell, while the B-class segment emerged as the main growth driver. B-segment NEVs reached 281,000 units, up 12.5% compared with a year earlier.

By price band, traditional oil-fueled passenger vehicle sales were largely concentrated in the 100,000–150,000 yuan range, totaling 356,000 units, down 11.3% year-on-year.

For NEV passenger vehicles, sales declined in the sub-80,000 yuan and 150,000–250,000 yuan brackets, while other price segments posted gains. The bulk of NEV demand was centered in the 100,000–200,000 yuan range, where 352,000 units were sold, representing an 11.4% decrease from a year earlier.

In China's domestic market, passenger vehicle sales totaled 1.399 million units in January, down 19.5% from a year earlier and 36.6% lower than December. Conventional fuel-powered passenger vehicles accounted for 816,000 units of that total, a decline of 16.9% year-on-year and 10.9% month-on-month, representing a drop of 166,000 units compared with the same period last year.

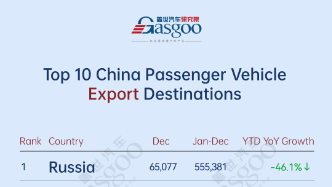

Passenger vehicle shipments overseas reached 589,000 units in January, surging 48.9% year-on-year, although easing 8.2% from the previous month.

The commercial vehicle segment extended its recovery trend. January production rose to 388,000 units and sales reached 359,000 units, marking year-on-year increases of 29.9% and 23.5%, respectively. On a month-on-month basis, both figures declined, reflecting seasonal factors.

Notably, natural gas-powered commercial vehicles stood out, with sales climbing to 23,000 units, up 65.7% from a year earlier and 41.1% from December.

Domestic sales of commercial vehicles totaled 266,000 units in January, up 23.4% year-on-year but down 15.1% month-on-month. Trucks remained the main growth engine, with 244,000 units sold domestically, representing a 29.7% year-on-year increase despite a modest monthly pullback.

Commercial vehicle exports reached 93,000 units in January, up 23.6% year-on-year, though down 17.1% from the previous month. Truck exports accounted for the bulk of shipments at 79,000 units, rising 22.7% over a year ago.

China's NEV sector began the year on a relatively stable footing. In January, NEV production reached 1.041 million units and sales came in at 945,000 units, representing year-on-year increases of 2.5% and 0.1%, respectively. NEVs accounted for 40.3% of total new vehicle sales during the month.

Battery electric vehicles (BEVs) continued to dominate the segment, with output of 659,000 units and sales of 597,000 units, up 3.8% and 4% year-on-year. Plug-in hybrid electric vehicles (PHEVs), by contrast, showed mixed performance. While production edged up 0.5% to 382,000 units, sales fell 5.9% compared with a year earlier, suggesting softer retail demand despite stable manufacturing volumes. Fuel cell vehicles remained a marginal presence in the market, with both production and sales posting double-digit declines; sales plunged 47% year-on-year.

Regarding the NEV sales, the top 15 automobile groups accounted for 909,000 units in January, down 0.7% year-on-year. Together, they represented 96.2% of total NEV sales, 0.8 percentage points lower than the same period last year.

Domestic NEV sales totaled 643,000 units last year, falling 18.9% year-on-year and more than halving from December levels. Within that figure, new energy passenger vehicles contributed 583,000 units, down 22.9% from a year earlier and 54.8% month-on-month. In contrast, new energy commercial vehicles posted robust year-on-year growth, with domestic sales reaching 60,000 units, up 61.9% from the year-ago period, though still sharply lower than the previous month due to seasonal factors.

NEVs made up 38.6% of total domestic automobile sales in January. Among passenger vehicles, their penetration rate stood at 41.7%, while new energy commercial vehicles accounted for 22.6% of their corresponding domestic market.

Exports once again served as a growth engine for NEV sales. China shipped 302,000 NEVs overseas in January, doubling year-on-year and edging up 0.5% from December. Passenger NEVs dominated export volumes at 295,000 units, up 110% compared with a year earlier. New energy commercial vehicle exports reached 6,000 units, slipping 1.4% year-on-year but rising 9.9% over a month ago.

Breaking down exports by powertrain, BEVs accounted for 202,000 units shipped abroad, marking a 100% year-on-year soar and a 16.9% gain from the previous month. PHEV exports totaled 99,000 units, up 97.3% from a year earlier, though down 21.8% month-on-month.