On January 9, 2026, the China Passenger Car Association (CPCA) released full-year 2025 passenger-car market data, drawing a line under the final year of the 14th Five-Year Plan. Retail sales for 2025 came in at 23.744 million units, a 3.8% increase, marking steady progress despite global economic swings, policy shifts and changing consumer sentiment. December, typically a sprint finish, told a different story: retail sales were 2.261 million units, down 14% year on year and up just 1.6% from November — a sharp contrast to the usual year-end buying rush.

Behind that divergence sit overlapping policy factors and market dynamics. Speaking at a media briefing on January 9, CPCA secretary-general Cui Dongshu outlined why the market eased into year-end: on one hand, the exemption on new-energy vehicle purchase tax was set to expire at year-end, which would normally spark a rush to buy; on the other, budgets for most provincial and municipal trade-in programs had been depleted, with some regions sharply revising subsidies — creating a "hedging" effect on incentives. Together, those forces heightened consumer caution, blunting December's finish and setting the tone for 2026.

Domestic brands' share hits 65%, a shifting market order

If one theme defined China's passenger-car market in 2025, it was the broad lead of homegrown marques.

CPCA data show domestic brands captured a 65% retail market share for January–December, 4.8 percentage points higher than a year earlier. Even with December under pressure, their domestic retail share reached 64.3%, up 2.2 percentage points year on year — a display of resilience. Put simply: of every 10 cars sold in China, 6.5 were domestic. That record share confirms a structural shift from joint ventures once in command to domestic brands now in the lead.

The steady climb wasn't accidental; it's the payoff from years of focus on the new-energy transition. The core driver is a first-mover edge in electrification, which has become the engine behind share gains.

In new energy, domestic brands have built a rounded advantage. In December 2025, new-energy models accounted for 59.1% of overall passenger-car retail — 9.6 percentage points higher than a year earlier — while the penetration within domestic brands hit 80.9%. In other words, more than eight out of 10 cars sold by domestic brands were new-energy.

Luxury brands, by comparison, saw a 39.1% new-energy penetration, while mainstream joint ventures were at just 8.2% — a gap of a different generation. That gap reflects sustained investment by domestic marques in technology, product definition and supply-chain integration: BYD's DM-i super hybrid and Blade Battery, Geely's SEA (Sustainable Experience Architecture), and Changan's DEEPAL new-energy platform have formed technological moats. At the same time, domestic brands have zeroed in on smart cabins and driver-assistance — pulling ahead of joint ventures on the in-car experience.

Mainstream joint ventures, by contrast, remain under strain. In December 2025, their retail sales were 510,000 units, down 27% year on year and up 5% month on month — materially weaker than the market overall. The slide was most pronounced for German and Japanese marques: German-brand retail share was 14.9%, 1.3 percentage points lower year on year; Japanese-brand share was 12.1%, also down 1.3 percentage points.

At the heart of the joint ventures' challenge is a lagging transition to new energy. In a market where overall penetration is nearing 60%, the JVs' 8.2% penetration is a direct drag on share. Long anchored by combustion-engine strengths and brand equity, many JVs are constrained by global decision cycles and conservative technical roadmaps — slowing product launches and missing key preferences of Chinese consumers.

U.S., Korean and other European brands showed mixed performance. U.S. brands' December retail share was 6.8%, up a modest 0.2 percentage points, helped by pockets of progress in new energy and a steadier combustion lineup. Korean and other European brands saw slight share gains, leaving the broader order stable — but their position remains niche. Without a faster pivot on electrification, joint ventures risk further erosion of share.

Amid broader market swings, the luxury segment showed notable resilience. In December 2025, luxury retail reached 290,000 units, down just 1% year on year and up 17% month on month, for a 12.8% share — 2 percentage points higher than a year earlier. Part of that steadiness comes from the relative stability of high-end buyers, less swayed by macro and policy changes. Part comes from accelerating new-energy rollouts that are beginning to lift growth.

In December, new-energy penetration among luxury brands hit 39.1%. Though below domestic brands, it's far ahead of mainstream joint ventures. BMW, Mercedes-Benz and Audi are pushing dedicated EVs and tilting smart features toward China, gradually reversing earlier weaknesses in their electric portfolios.

Luxury growth is also tilting higher and smarter. As consumers trade up and replace older cars, brand cachet alone no longer suffices; buyers want technology, intelligent experiences and personalization. That trend is pushing luxury marques to accelerate electrification and digitalization — reinforcing their positions.

New-energy retail topped 12.809 million — exports stood out

If domestic brands' rise was 2025's main score, the sustained surge of new energy was the driving beat. From January to December, retail sales of new-energy passenger cars totaled 12.809 million units, up 17.6% year on year and accounting for 53.9% of all passenger-car retail. December alone saw 1.337 million units — a 2.6% annual increase and 1.2% above November — strong growth despite policy shifts and buyer caution.

Combustion cars, meanwhile, continued to shrink. Conventional fuel-passenger car retail was 10.94 million units for the year, down 9%, with December at 920,000 units — a 30% drop. The contrast with new energy is stark, underscoring that China's market has entered a new-energy-led phase.

New-energy penetration reached 59.1% in December, 9.6 percentage points higher than a year ago. "That level shows demand for new-energy cars is much stronger than for combustion models," Cui said. "In past years, penetration typically fell at year-end and ICE purchases heated up. This time was different; the usual year-end rush for fuel cars didn't materialize."

That shift speaks to a deeper change in buying attitudes. With maturing technology, lower running costs and superior digital experiences, new-energy vehicles have moved from policy-driven to market-driven — the first choice for more consumers. Among younger buyers, acceptance already exceeds that of combustion cars. In county-level markets, improving charging access and better value are pushing penetration up fast.

At nearly 60% penetration, the market has structurally moved from "ICE-first" to "NEV-first" — entering a phase change. What defines this stage: NEV demand becomes essential rather than optional; competition shifts from price to technology and experience; and policy support pivots from direct subsidies to standards and infrastructure. Cui emphasized that policy should now move from pushing volumes to lifting quality and efficiency, enabling high-quality, harmonious industry development.

Within the 12.809 million NEV tally, performance differed by camp — forming a competitive landscape of domestic brands in command, startups climbing, and joint ventures in pursuit.

Domestic brands remain the main force. In December, their NEV retail share was 64.4%. Though 6.7 percentage points lower year on year, they still dominated. The EV upstarts served as the growth engine: their share reached 23.5%, up 4.9 percentage points, the fastest-rising cohort.

Mainstream joint ventures are still catching up. In December, their NEV share was just 3.7%, up 0.9 percentage points — a slow advance. Despite quicker EV rollouts at Volkswagen, Toyota and Honda, conservative roadmaps, product misalignment and lagging digital experiences held back results.

Overseas, China's NEVs were a standout in 2025. Scale advantages, stronger technology and improving channels are pushing more Chinese-made NEVs abroad, with recognition steadily rising. CPCA data point to NEV exports growing more than 40% year on year, with plug-in hybrids making up 40% of NEV exports — up from 37% — and acting as a key driver.

Domestic players showed muscle in exports. In December 2025, BYD led with 131,637 exported vehicles, entering multiple countries and regions with a dual-track of PHEVs and BEVs tailored to local demand. Chery, Geely, Leapmotor and SAIC Passenger Vehicle each topped 10,000 units, creating a "leaders in front, many points of growth" pattern. Tesla China, Beijing Automobile Works (BAW) and Changan also reached meaningful export scale — widening China's global NEV footprint.

Image source: Chery Group

Just as important, export models are shifting from shipping products to building global footprints. CPCA notes high shares of CKD (complete knock-down) exports at some brands: Great Wall Motor's CKD exports account for 53.2%, while SAIC-GM-Wuling's are 38%. CKD helps lower tariffs and sidestep trade barriers, supports local jobs and supply chains, and enables localized production and sales — a pivotal step in global strategy for domestic marques.

2026 outlook: policy support for stability, new pressures ahead

Looking to 2026 — the opening year of the 15th Five-Year Plan — China's passenger-car market faces a mix of policy backstops and persistent pressures.

Cui noted that 2025 tracked an inverted-U: softer early on, stronger through the middle, then easing late in the year, with replacement demand released over 2024–2025. CPCA had expected 2% retail growth in 2025; the actual result was 4%. For NEVs, the forecast was 20% retail growth and 57% penetration — close to the outturn.

Asked by Gasgoo about the 2026 trajectory, Cui projected a U-shaped year — strong at the start, softening mid-year, then firming toward year-end. He expects overall sales to be roughly flat versus 2025 domestic retail, with exports still growing at more than 10%. Domestic de-stocking pressure, however, remains heavy; manufacturer wholesale shipments are forecast to edge up about 1%.

On the demand base, 2026 retains growth potential, anchored by ongoing replacement cycles and a gradual lift in lower-tier markets.

China's vehicle parc reached 346 million in 2024. With a population of 1.4 billion, passenger-car ownership stood at 219 per 1,000 people. That signals a shift from first-time purchases to replacements, making replacement demand the primary driver over the next few years. Replacement was already well released in 2024–2025, yet continued growth in the parc and longer vehicle lifecycles should keep 2026 replacement demand steady — with mid-to-high-end NEVs likely the top choice.

Lower-tier (county and township) markets deserve attention. CPCA estimates there are 300 million migrant workers, including 180 million who return home at year-end. As construction hiring eases and manufacturing and services add jobs, later returns tend to boost buying. Auto consumption still peaks before Lunar New Year, making the holiday's timing critical. With the 2026 holiday falling on February 16, January offers a fuller production and sales window, supportive of lower-tier demand. Even so, county-level market share slipped notably in Q4 2025, and the magnitude of a January rebound remains uncertain — requiring automakers and dealers to deepen channels and promotion, and win buyers with value-for-money products and convenient services.

First-time buyers still matter. Despite macro pressure, younger consumers continue to embrace NEVs, especially in top-tier cities. As NEV prices push below CNY 100,000, entry-level models' value proposition is clearer — drawing more first-time buyers into electrified options.

Policy will also help steady the market. National scrap-and-replace programs and local trade-in policies supported consumption in 2025, but retail growth turned to a 5% contraction in the fourth quarter as year-end caution grew — which, paradoxically, stored up some momentum for early 2026.

Cui said 2026's trade-in subsidies, though stepped down in tiers, will start earlier than last year — helpful for stabilizing expectations and delivering a strong January.

He added that a strong January has long been a joint goal for local governments and automakers. With Lunar New Year in February, some wholesale is typically pulled forward into January; and with pre-order models now prevalent, several companies still have sizable order backlogs to deliver. As the 15th Five-Year Plan kicks off and 2026 is seen as a "big year" for auto consumption, January's year-on-year sales should show a modest increase.

On December 30, 2025, the National Development and Reform Commission issued its Notice on Implementing Large-scale Equipment Upgrade and Trade-in of Consumer Goods in 2026 — a policy expected to further support domestic auto consumption and add momentum to January sales.

Also notable: the Electric Vehicle Traction Battery Safety Requirements (GB38031-2025) take effect in July 2026. Some carmakers will pre-emptively clear inventories that don't meet the new standard, while compliant models — offering higher safety and energy density — are poised to become replacement buyers' top picks, lifting the mid-to-high-end segment.

Even with policy support and a solid demand base, 2026 brings challenges that could cap growth.

Externally, complexity is deepening: inflation pressures are re-emerging, global growth is diverging, and China's economy is in a period of structural adjustment. With high debt constraints and stronger fiscal expansion, the economy remains broadly stable and progressing, yet faces weak domestic demand and pockets of risk — factors that will indirectly shape the auto market in 2026.

De-stocking looms large. As year-end caution built in 2025, inventories rose at some automakers. With the July 2026 battery standard approaching, non-compliant stock must be digested — pressuring prices and channels. If de-stocking falls short, a renewed price war could follow, squeezing margins.

Competition will intensify. Rivalry among domestic brands is shifting from scale to quality; leaders will push technology upgrades, product refreshes and brand elevation to extend share. EV upstarts will double down on intelligent features to grab mid-to-high-end customers. Joint ventures may accelerate their NEV pivots via technology tie-ups and local R&D — trying to arrest declines.

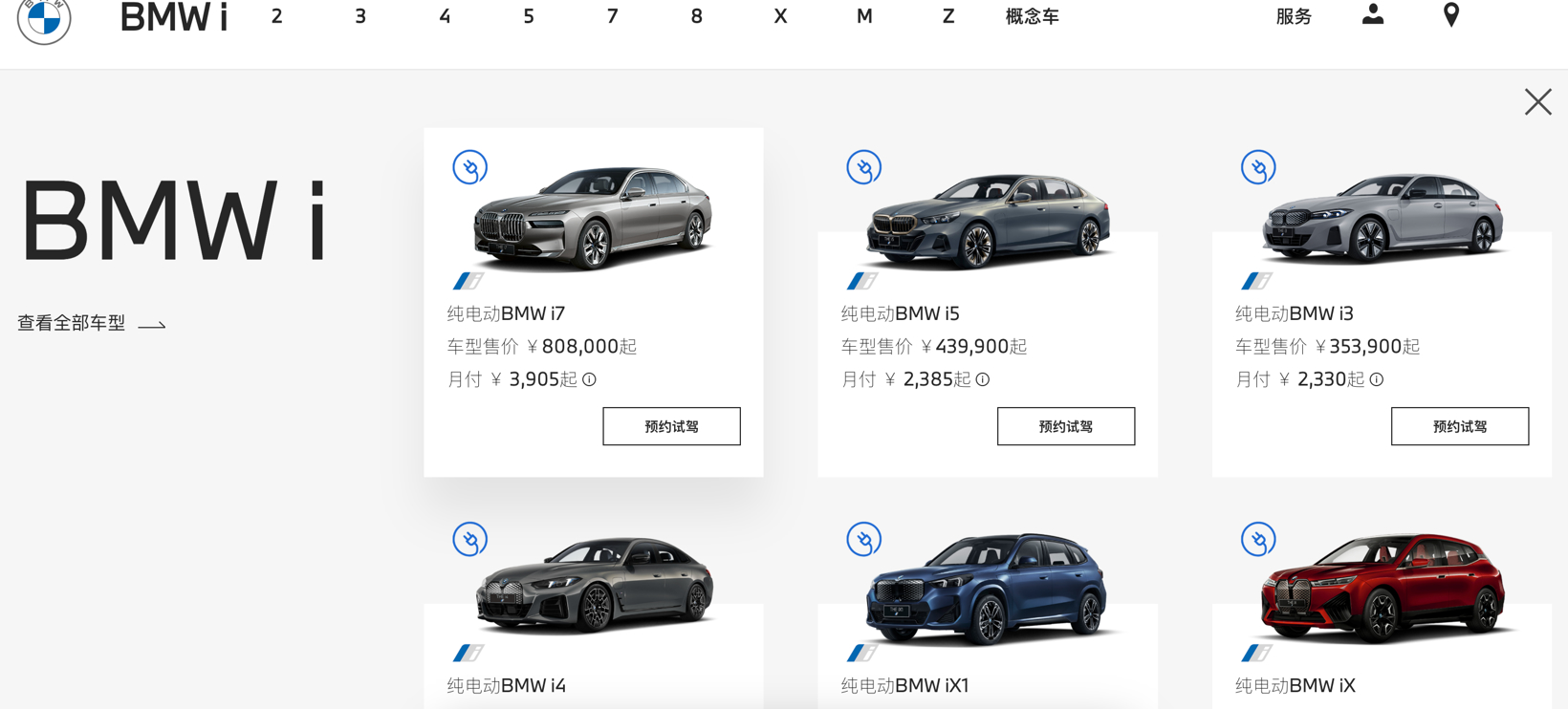

Signs of warming competition are already visible. More than a dozen automakers have rolled out promotions, and BMW, notably, announced cuts to the MSRP of 31 core models — sparking chatter about a renewed price war.

Image source: BMW China

In an interview with Gasgoo, Cui offered a measured view: "Recent pricing moves by BMW and others adjust official guide prices, not transaction prices. We haven't seen clear changes at the retail end. The main purpose is to bring previously inflated sticker prices back to reasonable levels — lowering the purchase-tax base for consumers — rather than shifting the competitive landscape. It's too early to call a price war on the basis of guide-price cuts by luxury brands alone; we need to keep watching the market."

Finally, infrastructure and standards still have room to improve. Even with NEV penetration near 60%, charging networks remain uneven — especially in lower-tier and remote areas — and aftersales for NEVs (maintenance, battery recycling and more) is still developing, with standards fragmented. Those gaps can weigh on buying and ownership confidence.