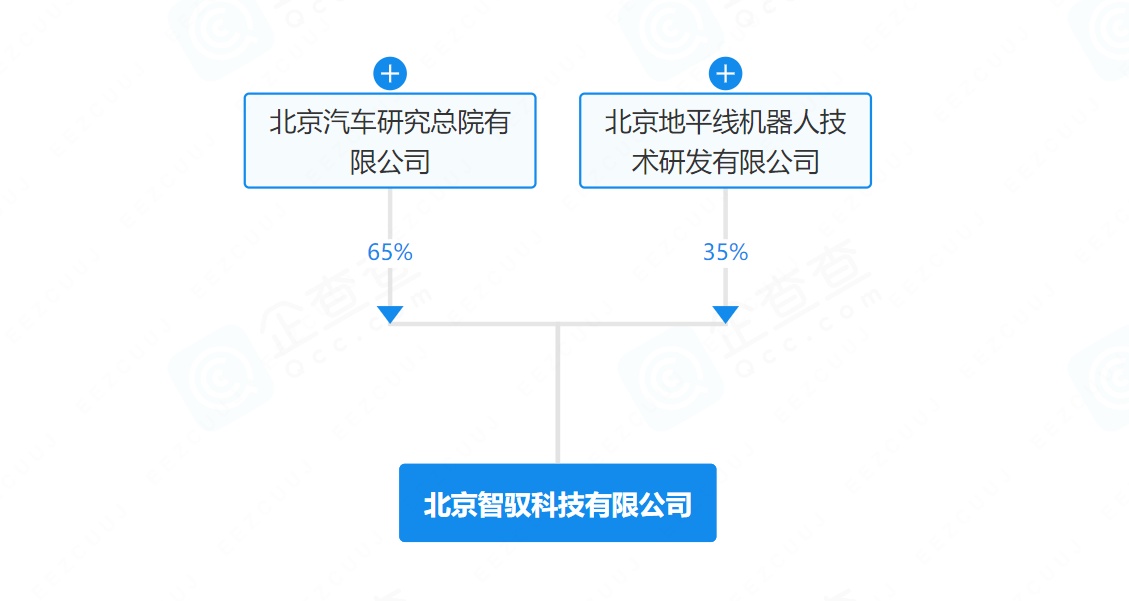

As 2026 gets underway, China's smart-driving sector has a new tie-up drawing attention. Corporate registry data from Qichacha show that Beijing Zhiyu Technology Co., Ltd. has been officially registered in Beijing with a registered capital of 3 million yuan. Its ownership is split between BAIC Motor Technical Center, holding 65%, and Horizon Robotics with 35%.

Image source: Qichacha

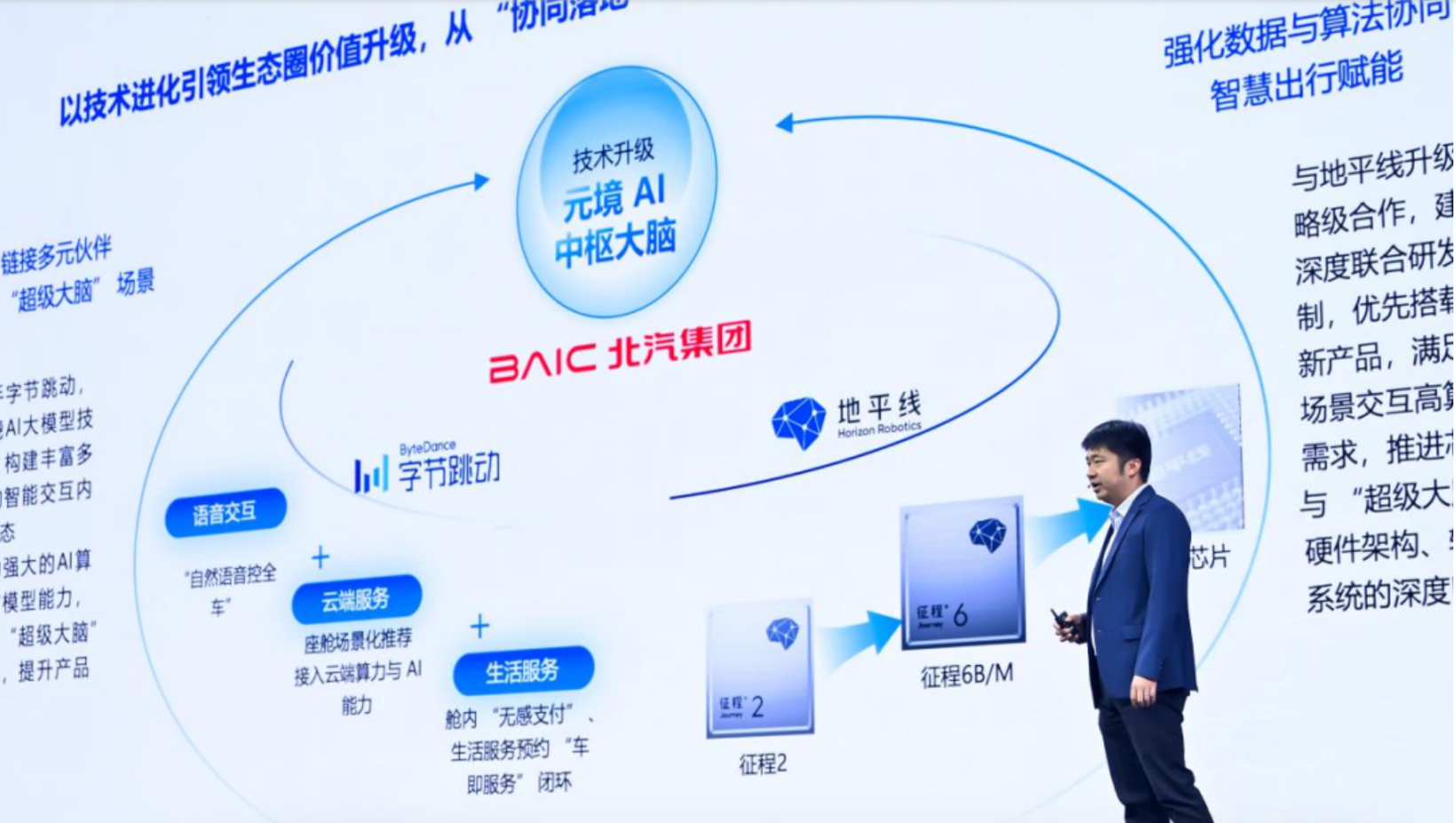

The partnership didn't come out of the blue. Twenty days before the new company was formed, Feng Shuo — Assistant to the President and Head of the Intelligent Connected Center at BAIC Motor Technical Center — told the industry at Horizon Robotics' Technology Ecosystem Conference that BAIC Group would establish a deep joint R&D mechanism with Horizon to upgrade BAIC's "Yuanjing AI Central Brain."

With the joint venture now in place, that strategic alignment is moving from blueprint to industrialization at speed.

From supply to symbiosis, reshaping the smart-driving value chain

The BAIC–Horizon model breaks past the simple buy–sell relationship between OEMs and suppliers. As Feng Shuo framed it at Horizon's conference: "Horizon Robotics brings powerful compute, algorithms and data closed-loop training — it's the industry's mainline technology platform," while BAIC, built around its product matrix and user scenarios, develops differentiated strengths on the "branch line."

People often ask: if smart driving comes from suppliers like Horizon, Huawei's HI/"Smart Selection," or Momenta, how can each carmaker still be different? That "mainline vs. branch line" split answers exactly that.

In October 2025, BAIC Group unveiled its all-domain intelligent technology architecture — "Yuanjing Intelligent," built on "full-domain fusion," and especially "cockpit–driving fusion." Deep alignment with Horizon, now crystallized in a specialized joint venture, is BAIC's way of accelerating the rollout and application of its intelligent platform through open collaboration.

Feng Shuo, Assistant to the President and Head of the Intelligent Connected Center at BAIC Motor Technical Center; Image source: Horizon Robotics

Unlike Huawei's HI — a closed, full-stack approach — Horizon emphasizes enablement and collaboration through a replicable engineering support system. This "semi-open" strategy, balancing depth with openness, may become the new template for chipmakers working with automakers.

Zooming out, such models are rapidly reshaping the competitive landscape across the smart-driving chain. The shakeout is intensifying and resources are concentrating at the top. Haomo has reportedly halted operations entirely, while ZongMu Technology and Qingyan MicroVision — both once backed by multiple funding rounds — have fallen into bankruptcy, liquidation or deep restructuring.

In sharp contrast, capital and talent are flocking to leading players and proven alliances. DeepRoute.ai, after securing an exclusive USD 100 million investment from Great Wall Motor, delivered 200,000 sets of its urban pilot assist package within a year of mass production. Zhuoyu Technology received more than 3.6 billion yuan in strategic investment from China FAW, pushing its post-money valuation above 10 billion yuan.

BAIC and Horizon's joint venture is a strategic move born of that backdrop. By binding through capital, the two form a community of interest — avoiding the high-investment risk of full-stack self-development while sidestepping the pitfalls of total supplier dependence.

Horizon Robotics founder and CEO Yu Kai's new idea of "going high together" captures the shift.

He said Horizon is evolving from "striving upward alone" to "advancing upward with partners," moving from "pushing the limits and setting benchmarks" to "empowering the industry and benefiting the many," with the goal of speeding every company and every user into the era of smart cars and general-purpose robots. It's not just one firm's strategy update; it's a clear sign that the smart-driving value chain is pivoting from one-way supply to mutualistic co-creation.

In a time of fast iterations and mounting cost pressure, this deep, division-of-labor symbiosis may be the key engine to scale and democratize smart-driving deployment.

Diversified collaboration, BAIC's path to intelligent transformation

Amid the upheaval in smart cars, traditional OEMs' transformation paths invite reflection. Closed self-development, or open symbiosis? BAIC Group has opted for a clear, diversified collaboration track — forging wide and deep ties with chipmakers, algorithm houses, mobility platforms and tech giants to pursue a distinct leap in intelligence.

BAIC started early and cast a wide net.

"The first automaker to establish a strategic partnership with DiDi Autonomous Driving"

"The only automaker simultaneously working deeply with Huawei under both the HI model and the Smart Selection model"

"One of Baidu Apollo's earliest key partners"

"Among the first automakers to launch L3 autonomous driving operations in specific scenarios"

…

This multi-track, open strategy laid the groundwork for deeper partnerships to follow.

As technologies evolve, BAIC's ecosystem has grown more three-dimensional and deeper. On Robotaxis, BAIC's driverless model co-developed with Pony.ai is already in on-road testing and commercial operations, aiming squarely at scalable deployment and cost discipline.

At the foundational layer that sets the ceiling on the intelligent experience, BAIC and Horizon Robotics have begun "full-stack co-development." Building on the Journey 6 chip, the two are jointly developing an urban NOA system that integrates BAIC's "Yuanjing AI Central Brain," seeking differentiated experiences through deep hardware–software co-optimization.

Most eye-catching is BAIC's unique dual-track partnership with Huawei. As the only automaker deeply involved in both HI and Smart Selection, BAIC and Huawei have moved beyond individual products to an ecosystem alliance, announcing five dedicated integration frameworks and end-to-end collaboration from R&D to channels. The aim is sustained access to core technology while preserving BAIC's product definition and brand distinctiveness.

Diversified collaboration is becoming the industry mainstream, and BAIC isn't alone. SAIC, once adamant about keeping the "soul" in-house, now embraces partners including Momenta and Huawei. Changan has long been tied to Huawei and Horizon. Chery, for its part, is building a collaborative ecosystem with Huawei, NVIDIA and Horizon, shifting from "independent, full-stack R&D" to "open innovation, joint ecosystems and shared growth."

The road is not without hurdles. How to balance interests among partners? In deep alignments, how to retain product definition and brand independence? And when tech firms' solutions serve many OEMs, how do carmakers avoid homogeneity? These are questions BAIC — and its peers — will keep wrestling with.

BAIC's transformation is an incremental journey of open collaboration and progressive focus. It no longer seeks absolute control over the full chain, but rather aims to build and embed in powerful ecosystems, occupying key nodes. From early exploration, to commercialization, then to chip-level co-development and ecosystem co-creation, each step has tracked the industry's pulse. Whether this path succeeds will take time to tell, but it offers a vivid, instructive case for traditional auto groups going intelligent.

Ecosystem games: who will lead smart driving in the next decade?

Smart driving has entered deep waters. Who will lead over the next ten years? BAIC's partnership with Horizon offers a glimpse of what the future order might look like.

Three main models dominate today: Tesla's vertically integrated path of full-stack self-development; Horizon Robotics' technology platform approach, focused on compute; and Huawei's end-to-end solution model that spans hardware and software.

Image source: Horizon Robotics

Horizon founder and CEO Yu Kai expects only a few players to remain at the main table. Even so, automakers' resolve shouldn't be underestimated. NIO, XPENG, Li Auto — alongside giants like BYD and Geely — are pouring into self-development to keep the "soul" in their own hands. The battleground is shifting fast from spec-sheet duels at the top to a bruising fight for scale.

"Cost" and "accessibility" are the new watchwords.

Yu Kai posed a sharp question: "Mass-market cars priced around 100,000 yuan — which make up roughly half of China's market — don't they deserve usable urban assisted driving?"

His answer is Horizon's HSD (Horizon SuperDrive), built on a single Journey 6M chip and aimed at bringing urban assisted driving to 100,000-yuan mainstream models. That contrasts with Huawei's focus on the 200,000-yuan-and-up mid-to-high end and luxury segments — a sign the fight is spreading from high-end tech showcases to the largest part of the market.

The push for mass adoption is already on. BYD and Geely have announced broad rollouts of advanced smart-driving features into lower price bands. Among third-party suppliers, the land-grab is even tougher.

Scale is concentrating at the top: Momenta's cumulative awarded programs now exceed 160 models, and together with Huawei it controls nearly 90% of the third-party urban NOA market. As a later entrant, Horizon's HSD has shown solid human-like driving capabilities, but as of end-2025 it was in production on just two models, with about 12,000 activations. To hit its flag of "10 million-level city AD mass production in the next 3–5 years," Horizon must climb two steep hills — Huawei and Momenta.

Technology direction will also shape the outcome. Su Qing, vice president and chief architect at Horizon, said at the conference that deep learning is approaching a "Scaling Law" ceiling, and the autonomous-driving industry is entering an era of extreme optimization.

In his view, the single-stage end-to-end revolution has run its course. The next big breakthrough will require rebuilding core theory at the foundation. In the coming years, the industry may be optimizing within the current paradigm — bracing for lean times and more exacting engineering work.

It's not just a tech showcase; it's a test of systemic capabilities in cost structure, integration efficiency and service. And Yu Kai is clear-eyed: a company can move fast, but only an ecosystem can go healthier and longer.

Leadership over the next decade may be layered rather than dominated by one. A handful of tech giants will likely lead chips and compute platforms; strong automakers will sustain differentiation via self-development at the vehicle level; smaller OEMs may lean on platform solutions.

The BAIC–Horizon model maps a possible symbiotic path forward. By forming a joint venture for joint R&D, the two create a community of interest that preserves the technology provider's output while giving the OEM a measure of control over core technologies. Expect more companies to borrow from this "joint R&D + JV entity" approach.

In the end, smart driving's true leadership will belong to those who build the most vibrant ecosystems.