As Leapmotor marked its 10th anniversary, "chief" Zhu Jiangming appeared with more than a dozen core executives for a joint media interview. "This is our 10th-anniversary event. By putting the management team on stage, we hope everyone can understand Leapmotor better," Zhu said.

Photo: Leapmotor Technology core management team (image: Leapmotor)

Many of the executives, including Zhu himself, did not start in the auto industry. Even so, they steered Leapmotor through China’s brutal car market. What did they learn from the past decade? And with a new goal to become a world-class automaker with annual sales of 4 million, how will they plan the next ten years?

The group session skipped platitudes and slogans. It leaned into candid sharing — spanning cost control, supply-chain management, a new direction with FAW, updated company positioning, and the strategy ahead.

Ten years of building: how did "outsiders" find speed?

"Many of us don’t come from automotive, but we’ve mastered the core technologies necessary for new energy vehicles," Zhu said, calm and certain, when asked why non-auto people could still build good cars.

Zhu Jiangming, Founder, Chairman and

CEO of Leapmotor Technology (image: Leapmotor)

From day one, Leapmotor chose the hardest, slowest path — full-stack in-house development. Over ten years, its R&D system has covered vehicle architecture, E/E architecture, batteries, e-drive, cockpit systems and ADAS, with in-house R&D and manufacturing now accounting for 65% of vehicle cost. Core components developed in-house not only make technology controllable, but also put cost optimization in its own hands from the source.

Beyond R&D, Leapmotor built out a manufacturing system for core parts, with 17 component plants covering cells, battery systems, e-drive systems, e-controls, lighting, AR-HUD, thermal management, seats and more. This vertical integration brings key supply-chain links in house, sharply reducing procurement and coordination costs.

Image: Leapmotor

Platforming is another advantage. As Zhu explained, Leapmotor uses "two boxes" — a high-spec combo of Qualcomm Snapdragon 8295 and 8650, and a mid/low-spec based on Qualcomm 8155 — to underpin a wide range of models, driving cost cuts and efficiency.

In-house core components and platforming together enable Leapmotor’s "cost-based pricing" strategy, giving the brand a distinctive edge in a fierce price war: good yet not expensive.

That approach has fueled steady growth in recent years, with new models ramping fast. Sales topped 300,000 in 2024, doubled to 600,000 in 2025, and exceeded 70,000 in a single month — lifting Leapmotor to No. 1 among China’s new car-making entrants.

Image: Leapmotor

In Zhu’s view, the core parts of today’s smart EVs were all new ten years ago — the industry had no set playbook. Starting as a blank sheet, Leapmotor came light and unencumbered by legacy manufacturing thinking, carving out its own path. "That’s the advantage of a new carmaker," he said, "though the downside is less experience — you do take detours."

Asked whether he would choose to build cars again knowing how hard it would be, he smiled: "I never regret making products. It’s my passion, and the sense of achievement is huge." Still, he added, any industry looks much tougher once you’re in it — competition is fierce. The candor captures a decade of entrepreneurship: love and persistence for technology, paired with a clear-eyed view of the market’s brutality.

How do they weigh investment and payoff for new tech?

Even with a focus on in-house R&D and manufacturing, Leapmotor doesn’t invest without limits — it takes a pragmatic line.

First, for new technologies where the path and prospects aren’t clear, it follows before pushing harder. Zhou Hongtao, Senior Vice President (Electronics & Information product line), cited Leapmotor’s practical approach to autonomous driving: "Early on, when the route was unclear, we followed. Now that we can see where L3 is heading, we’ll step up investment over the next few years and gradually catch up."

Second, balance input with returns. On the current buzz around AI and embodied intelligence, Zhu showed an engineer’s pragmatism: "If we put these systems in, how many people can we reduce? Can we get payback within three years? That’s our yardstick — not blindly saying the robot era has arrived and everything should be automated first."

As Leapmotor's in-house scope widens, the question arises: will it share core components with the industry? Li Tengfei, Vice President (Finance & Capital), said: "Strategically, we are an automaker and focus on our core business. Generating profit by exporting technology isn’t our main line. Externally, we work primarily with two key partners — FAW and Stellantis — to help them and us grow better, both in China and overseas."

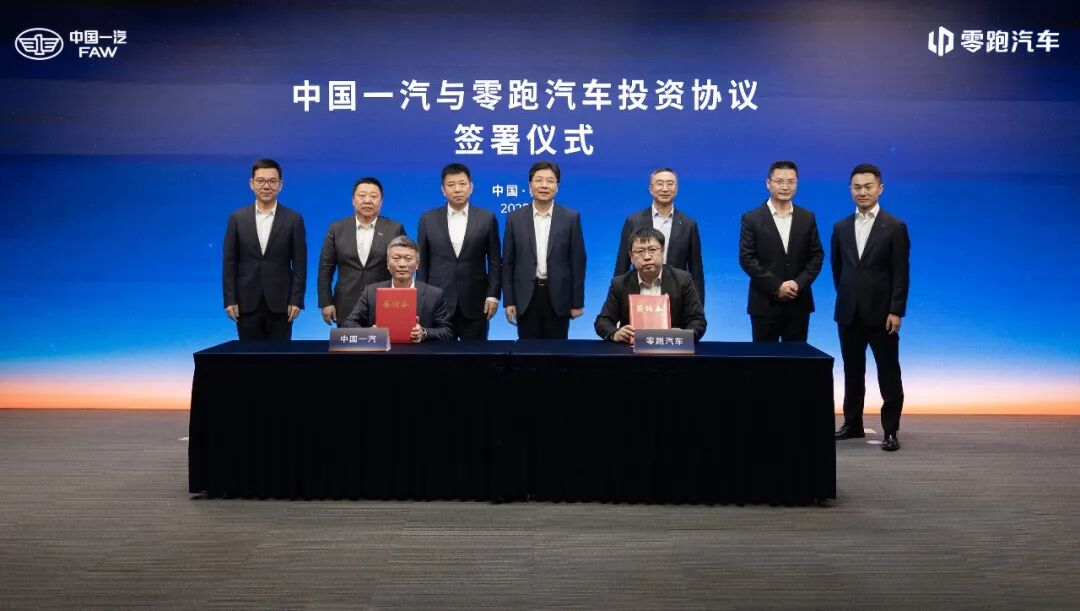

What does FAW's investment mean? How do they view the new ecosystem partnerships?

One day before the event, Leapmotor announced a strategic investment and cooperation agreement with China FAW, becoming a focus of the industry. Under the deal, FAW subsidiaries will invest about 3.744 billion yuan to subscribe to Leapmotor’s new shares, taking roughly a 5% stake on completion as a key strategic shareholder.

Image: Leapmotor

Li Tengfei, Vice President of Leapmotor Technology (Finance & Capital) Li Tengfei, spent 12 years at FAW and five at Leapmotor, giving him dual perspective on the partnership. He summed up the significance in five points:

1. National and industry recognition: It's the first time a central state-owned enterprise has made a strategic investment in a new-entrant carmaker — an endorsement of Leapmotor's ten years of innovation.

2. Brand trust reinforced: FAW's investment will markedly lift Leapmotor's brand awareness in China and strengthen user trust.

3. Complementary strengths: FAW's advantages in traditional manufacturing, capacity deployment and policy alignment pair with Leapmotor's technology in batteries, e-drive and intelligence.

4. Technology and supply-chain synergy: The two will deepen cooperation in core component procurement. Hongqi models have adopted Leapmotor technology, while FAW's powertrains will support Leapmotor's product line.

5. Stabilized shareholding structure: Together with Stellantis's earlier investment, Leapmotor now has a stable triangle — founding team + global auto giant + domestic central SOE — improving resilience and sustainability.

Zhu noted that with major shareholders such as FAW and Stellantis behind them — and cooperation spanning strategy, products and supply chain — Leapmotor's stability improves. As the NEV race faces uncertainty in coming years, that support strengthens its ability to weather turbulence.

Even so, he stressed that the founding team will retain actual control — that will not change.

How is the "borrow-a-ship" plan going?

With 2025 the first full year of its international push, Leapmotor chalked up cumulative exports of 60,000 units — taking the overseas sales crown among China's new EV players.

Behind that is an efficient, distinctive route built with Stellantis. It's neither "building your own ship" with a full self-run system nor merely "hitching a ride" through simple exports, but a tightly bound, resource-swapping model — "borrowing a ship." The tie-up let Leapmotor skip the long slog of building overseas channels, logistics and after-sales on its own.

According to Xu Jun, Senior Vice President and COO in charge of marketing and service, leveraging Stellantis's global marketing network, finance and logistics, Leapmotor has quickly entered 35 countries with more than 700 retail outlets. "Our cooperation on marketing and channel development is mutually supportive — truly 1+1>2."

Separately, Cao Li, Senior Vice President (brand and vehicle product line), said the two sides are moving fast on local production of Leapmotor’s products. Stellantis’s global procurement muscle can work in tandem with Leapmotor's in-house components system to optimize cost and supply efficiency.

"Rising overseas sales show Leapmotor's products, technology, quality and service can satisfy consumers in many countries," Xu said. He cited another confidence boost: Hong Kong. "In Hong Kong — an international market that's extremely picky — we sold more than 300 units in under three months and have begun deliveries. It's a strong signal our products can go global."

With the D-series duo unveiled, how do you sell a not-cheap Leapmotor?

At the anniversary event, Leapmotor debuted its first tech-luxury flagship SUV, the D19, and its first tech-luxury flagship MPV, the D99. The D-series marks a push upmarket.

Leapmotor’s "good yet not expensive" and "high value" positioning is well known. So how do you persuade buyers to accept a not-cheap Leapmotor?

"We aim to be a world-class automaker, with our own character. Whether ABC or D-series, we will stick to 'cost-based pricing.' Although the D-series sits at 250,000–300,000 yuan — higher than past ABC models — its sense of quality and value can go head-to-head with cars priced from 500,000 to 1 million yuan. With Leapmotor, you can always be confident you’re getting exceptional value."

On how "luxury" will show up in channels, Xu said: "We define 'luxury' as the luxury of experience. We’ll build Moments of Truth (MOT) touchpoints along the user journey so consumers feel what Leapmotor’s luxury means. That raises the bar for channels. We’ll tier and certify partners, and designate dealers against a 'luxury journey' standard."

How to manage automaker–supplier ties amid a price war?

As price cuts ripple across the market, profitability has become a central challenge, with pushing the supply chain to reduce costs now standard practice. That can strain automaker–supplier relations, especially around payment terms.

On this, Shu Chuncheng, Vice President responsible for the supply chain, said Leapmotor stands by long-termism — growing through mutual trust and win-win. In talks, the company analyzes costs to define what’s reasonable, then negotiates with suppliers on that basis. The "good yet not expensive" idea should permeate every component partnership — thin margins, higher volume. Scale should deliver genuine win-win.

Regarding the much-watched 60-day payment term, he added: Since its founding, Leapmotor has kept payment within 60 days for all partners. Mutual trust and win-win are the only way to sustain development.

As sales grow, supply resilience matters. Song Yining, Vice President in charge of the battery product line, said Leapmotor has used three standard cell sizes across all models since 2019 — including about 600,000 deliveries this year. "We buy only the cells and build the modules, packs and BMS ourselves. Those standardized cell sizes are available from multiple core suppliers. If one gets tight, we can switch fast and won’t get choked."

Song also revealed that a joint-venture cell plant with partners will start mass production in July–August 2026, with standards aligned to external suppliers. The in-house ratio will be capped below 50%, creating a robust 'self-made + outsourced' supply system.

Over the next ten years, how to sit at the world-class "table"?

At the event, Zhu set a new flag: in the next decade, Leapmotor will strive to become a 4 million–annual-sales, world-class automaker. In 2026, it will mount a full challenge for 1 million annual sales.

After ten years, Leapmotor no longer sees itself as a mere "new force." It wants to judge its ranking and economics against the entire auto market — and the global industry — to grow better.

Globally, the top ten automakers are mostly around 4 million units, so Leapmotor set that as its ten-year target. "If ten Chinese companies reach more than 4 million, the endgame should resemble 3C and smartphones — with China taking 50%–60% of the global share."

Leapmotor expects sales of around 600,000 in 2025. Jumping to 4 million in ten years implies sustained high compound growth.

On this, Zhu said Leapmotor has long insisted on ''begin with the end in mind''. After setting the goal of becoming a world-class, 4 million–sales automaker, all design and planning will align to it. Management-wise, responsibilities are clear — from product planning, R&D, engineering, manufacturing and delivery to quality and service — with end-to-end owners accountable for the final outcome.

"Our lesson these years is to ''begin with the end in mind'' and use end-to-end accountability. Versus a polished matrix, this may work better," Zhu said.

Conclusion

From a blank-sheet startup to a player with clear tech roadmaps, a complete product matrix, around 600,000 annual sales, a stable shareholder base and eyes on the global stage, Leapmotor has set its own pace over ten years. Behind it sits a plainspoken, diligent, efficient engineer culture that proved critical.

Leapmotor’s decade shows that on a capital-soaked, concept-heavy NEV track, a model built on deep in-house R&D, cost discipline, pragmatic iteration and open partnerships can also go far. Whether it reaches "world-class automaker" status in the next ten years remains to be seen. For now, the route map is clear — and the run has begun.

![]()