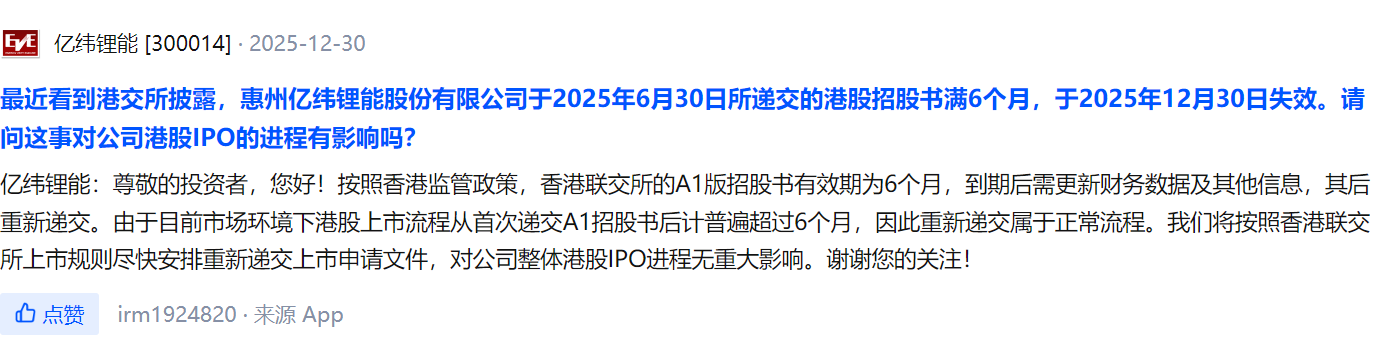

January 4 — Recent HKEX disclosures show that EVE Energy's Hong Kong prospectus has lapsed after its six-month validity period.

In response, EVE Energy said on the SZSE's Interactive Easy platform that under Hong Kong regulations, an A1 prospectus filed with the Hong Kong Stock Exchange is valid for six months; once it expires, companies must update financials and other information before resubmitting. With most Hong Kong listings now taking longer than six months from the initial A1 filing, re-submission is a normal step. EVE Energy emphasized that it will, in line with Hong Kong Stock Exchange listing rules, move quickly to refile the application documents, with no material impact on the company's overall Hong Kong IPO timeline.

Image source: SZSE Interactive Easy screenshot

According to an HKEX disclosure on January 2, Huizhou EVE Energy Co., Ltd. filed a Main Board listing application with the exchange, with CITIC Securities as its sole sponsor. The company previously filed a listing application on June 30, 2025.

Image source: EVE Energy official website

According to the prospectus, EVE Energy is among the very few lithium battery platform companies globally that lead in consumer batteries, power batteries and energy-storage batteries, serving full-spectrum applications across the economy. The company says it has built an end-to-end R&D platform spanning materials, cells, BMS and systems, with products widely used in smart living, green transport and energy transition.

On the financials, EVE Energy posted revenue of 45.002 billion yuan in the first three quarters of 2025 — a 32.17% year-on-year increase, extending a high-growth streak. Third-quarter revenue came in at 16.832 billion yuan, up 35.85% from a year earlier. Net profit attributable to shareholders for the first three quarters was 2.816 billion yuan, down 11.70%; excluding non-recurring items, net profit fell a steeper 22.51% to 1.937 billion yuan. The decline mainly reflected a sharp rise in administrative expenses — driven by stock-based compensation amortization — and higher credit impairment losses as receivables risk increased.

Notably, third-quarter net profit attributable to shareholders reached 1.211 billion yuan, up 15.13% year on year and 30.43% quarter on quarter — an early sign of profit recovery. Stripping out share-based compensation and one-off bad-debt provisions, net profit for the first three quarters would have been 3.675 billion yuan, up 18.40%, indicating a clearer improvement in underlying operations.