According to the newly released 2025 EU Industrial R&D Investment Scoreboard, the global pattern of innovation spending in 2024 continued to diverge, with the auto sector's performance emerging as a key focus.

Image source: Screenshot from the "2025 EU Industrial R&D Investment Scoreboard"

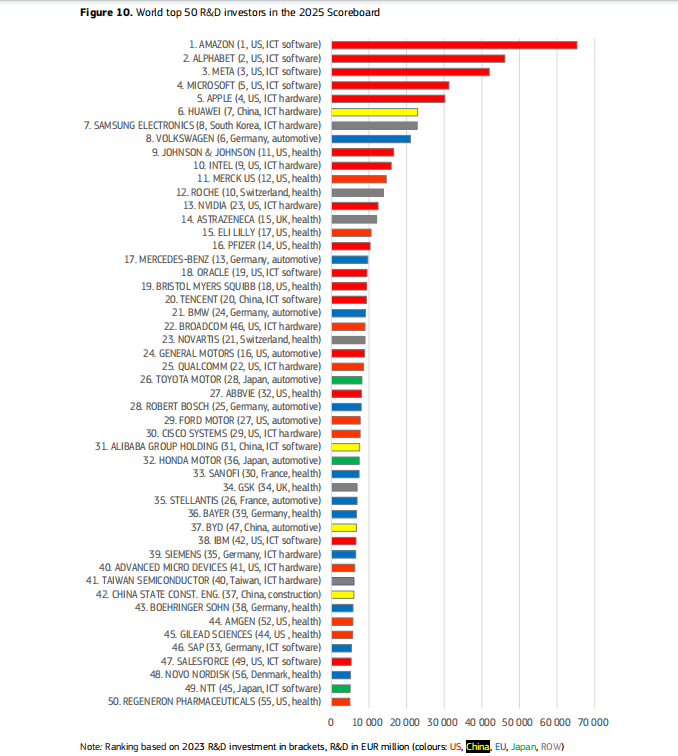

The data show R&D investment is heavily concentrated among top players. The leading 50 companies spent €633 billion on R&D last year, equal to 44% of the scoreboard's global total — a concentration up 1.5 percentage points from 2023. Geographically, U.S. companies swept the top five and make up half of the top 50 (25 firms), accounting for 62.9% of the group's spending. The EU has 11 firms and China 5, ranking second and third by count.

Notably, 10 companies from the automobile manufacturing sector are in the global top 50 for R&D investment, half of them from Germany — Volkswagen, Mercedes-Benz, BMW, Bosch and Stellantis. The U.S. has General Motors and Ford; Japan counts Toyota and Honda. China has just one automaker on the list — BYD, ranking 37th.

Among the ten companies with the largest absolute declines in R&D outlays, three are from the auto industry: Volkswagen fell 4%, General Motors 7%, and Stellantis 8% — a combined reduction of about €2.1 billion. Volkswagen is the only member of the global top 10 by R&D investment to post a drop, cutting €781 million from last year and slipping two places. Even so, the report emphasizes that the biggest cuts in 2024 remained relatively mild overall.

The report notes that top-ranked firms generally show stronger profitability. The leading five posted an operating margin of 27.5%, well above the averages for the top 10 and top 50 — a sign that gains may stem from improved efficiency, as well as shifts in market power.

Compiled by the European Commission's Joint Research Centre together with the Directorate‑General for Research and Innovation, the scoreboard is a key reference for tracking corporate R&D worldwide.