"In 2026, will any EV upstarts exit the stage?"

To probe that question, Gasgoo spoke with more than 20 industry insiders from automakers, suppliers, investment firms and peer media. Views varied, but one consensus emerged: the mainstream EV startups are unlikely to vanish overnight. The real uncertainty lies with the second tier and fringe players.

The split opinions, beneath the surface, mirror how these upstarts are faring after a decade of churn.

Image source: WM Motor

A decade on, nine in ten are gone

2014 is widely regarded as Year One for China's EV startups.

Back then, entrants jumped in from all corners — internet firms sought to remake the car with software thinking; property developers hunted for new growth curves; industrial capital tried to incubate vehicle programs. Some veteran executives also left legacy automakers to bet on new energy.

With capital, policy and market tailwinds, "building cars" briefly looked like a hurdle that could be cleared. Public records suggest that at the peak there were more than 100 would-be car programs in China. Beyond the now-familiar NIO, XPENG, Li Auto and Leapmotor, brands such as WM Motor, Singulato, Youxia and ENOVATE sprang up in quick succession.

Stories of raising hundreds of millions of yuan off a single pitch deck or a concept car were not uncommon. As one securities professional put it, the track was red hot and capital rushed in, but with limited understanding of manufacturing. "If the brand could tell a good story, the money followed."

By 2020, data show seven fast-rising EV startups had raised more than $18 billion.

Yet carmaking is, at its core, a contest of long-termism, systems capability and scale economies. As China's auto market shifted from high-speed growth to stock competition — and capital cooled — the weaknesses of brands that hadn't built self-sustaining cash generation and relied on continual financing came to the fore: difficulty industrializing and delivering, broken funding chains, and underpowered products.

So began the shakeout. Since then, mid- to lower-tier startups have slipped away almost every year.

Image source: Byton

Examples abound: Youxia stalled as funding dried up; Singulato collapsed on the eve of mass production; Byton burned through 8.4 billion yuan before declaring bankruptcy. Bordrin and Saleen also ran into trouble. Even brands with cars on the road — WM Motor, HiPhi and JIYUE — ended up in bankruptcy.

After a decade of sifting, only about a tenth of the peak cohort remains. Among those with real name recognition and steady sales, the list is short: NIO, XPENG, Li Auto, Leapmotor — plus latecomer Xiaomi Auto. Outside that circle sit Skyworth Auto, ROX Motor, Dayun and others, still in "small-scale pilot" or "specific-market validation" mode.

For the fallen, three themes dominate.

First, the capital chain snapped before products reached scale. Some firms burned vast resources at the concept and prototype stages yet never established stable delivery capability; once funding conditions tightened, they lost room to breathe. Byton and Bordrin are emblematic.

Second, product positioning drifted away from the market. A few tried to go premium before building brand equity, mispricing against consumer perception. The result: buzz but few buyers — not enough sales to sustain operations. HiPhi and Aiways are often cited.

Third, the lack of system capability. Some upstarts launched eye-catching models but stumbled on quality consistency, delivery efficiency or internal management — and couldn't keep going. WM Motor and Neta Auto are among the examples.

The bar for new-energy carmaking hasn't fallen; the contest has simply changed. In autos, building one car or telling a good story isn't enough. Success still hinges on becoming a company that can keep building good cars — and keep evolving.

Who won't fall?

The first big purge of the last decade is largely over. The upstarts now face a "finals" round.

Asked which brands are certain to be around in 2026, most interviewees pointed to NIO, XPENG, Leapmotor, Li Auto and Xiaomi. Through this window at least, their overall risk looks manageable; a sudden exit is unlikely.

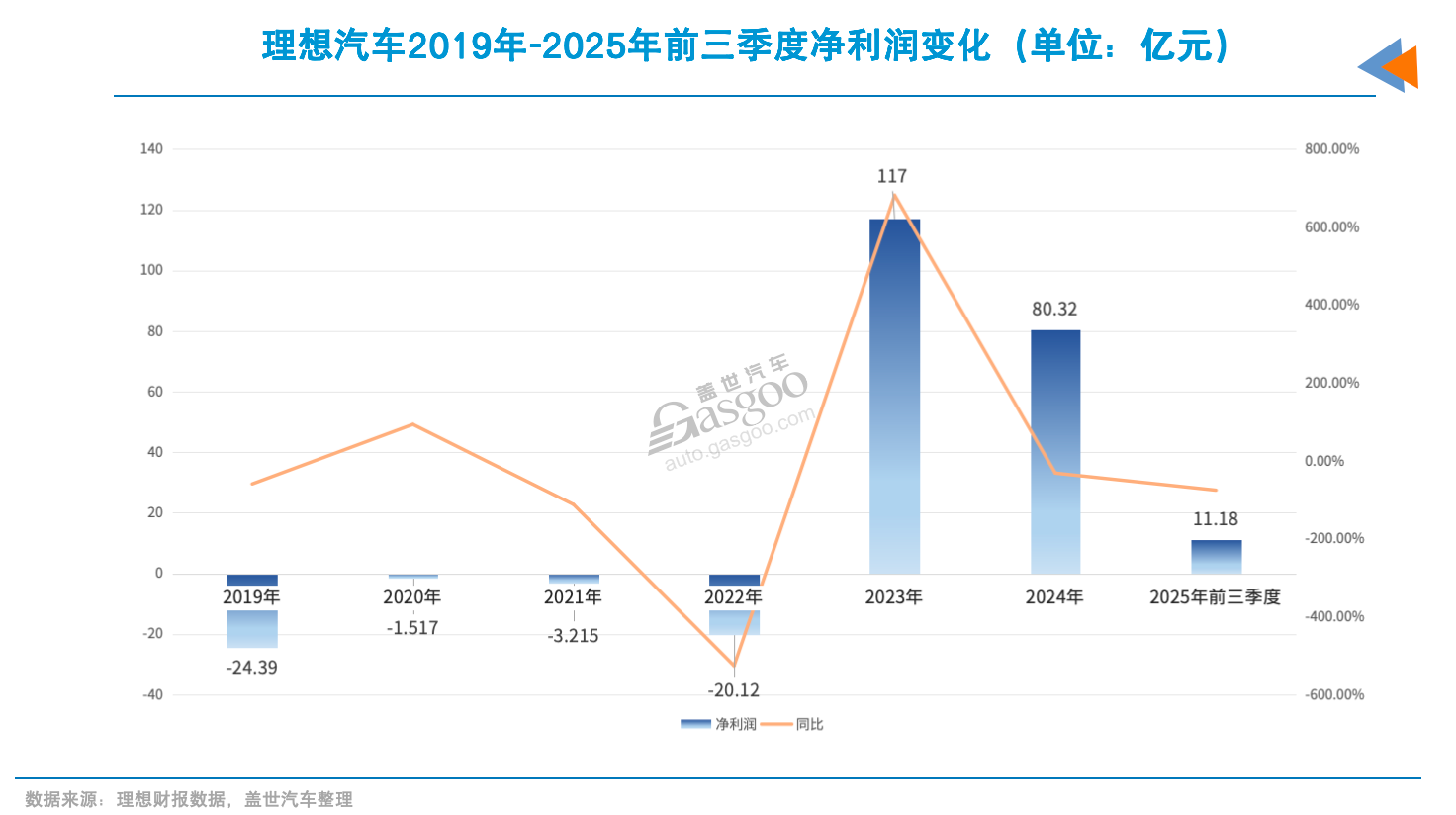

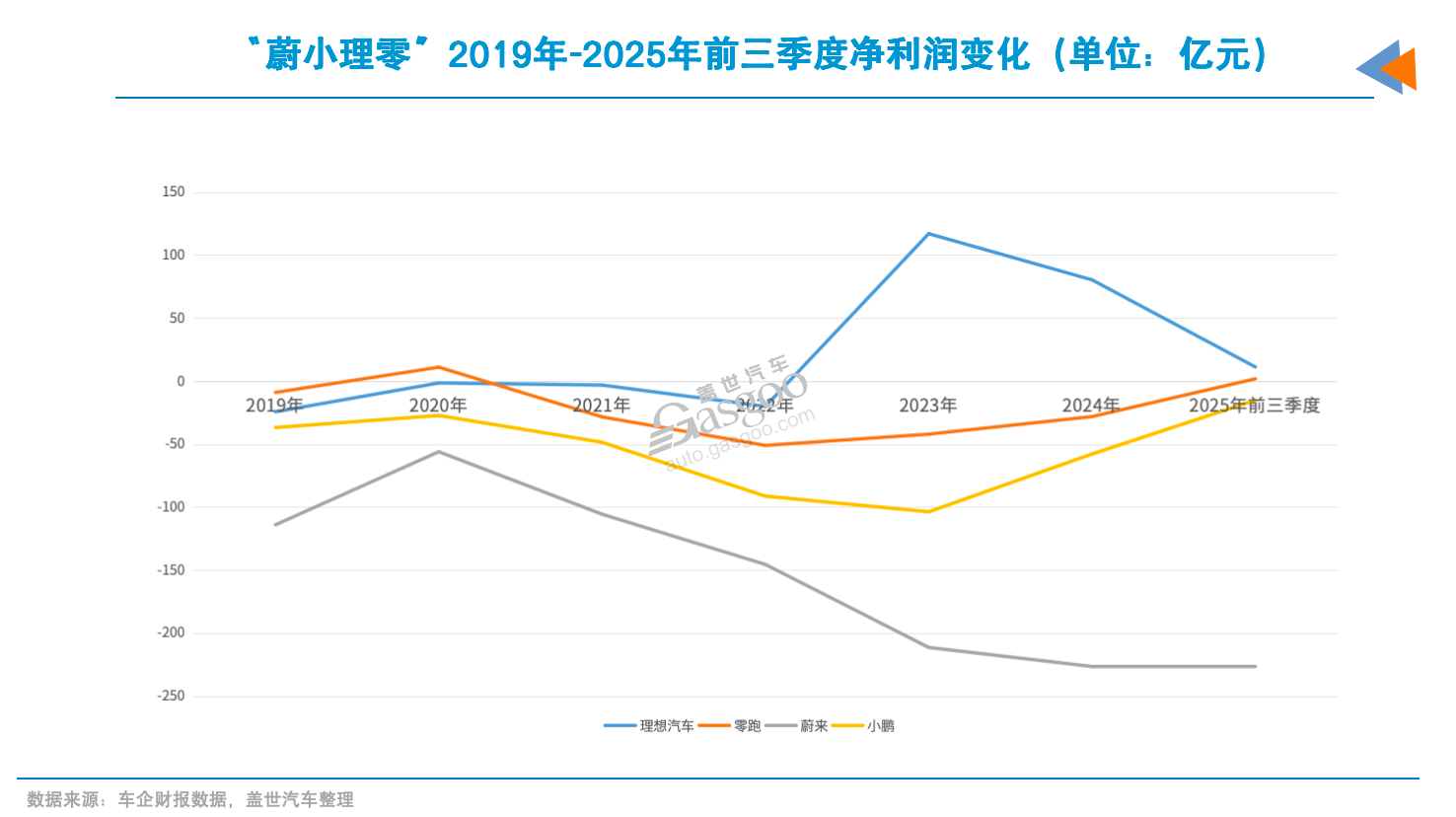

Li Auto, despite an underwhelming 2025 with just over 400,000 deliveries, still stayed in the black. In the first three quarters of last year, net profit attributable to shareholders was 1.12 billion yuan. For full-year 2023 and 2024, net profit came in at 11.7 billion yuan and 8.03 billion yuan, respectively.

Its profitability stems from tight cost control and an instinct for blockbusters. The Li L series pursued a single-hit strategy, trimming SKU (trim variants) complexity to cut R&D and manufacturing costs. The pure-electric i series is also slimming SKUs. A focused lineup and clear positioning have kept per-vehicle gross margin around 20%.

"Li Auto's biggest edge is that it doesn't need outside cash — it funds itself," one analyst said. "As long as it stays profitable, it won't fall in the medium term." The company holds 51.3 billion yuan in cash reserves. Longer term, its tests are the headroom for growth and the consistency of its product roadmap.

XPENG and Leapmotor are also seen as "relatively safe," thanks to heavyweight backers. "With anchor shareholders in place, the capital chain is much less likely to snap," the analyst added.

XPENG has weathered performance swings while sticking to full-stack, in-house assisted-driving software — a stance that helped it stay at the frontier of vehicle intelligence and win Volkswagen's backing. The tie-up not only brings direct technical service revenue — 2.33 billion yuan in the third quarter of 2025 — but also plugs XPENG into VW's vast global supply chain.

That "technology for market access, capital for survival" formula gives XPENG a multinational seal of approval — and materially lifts its odds of making it.

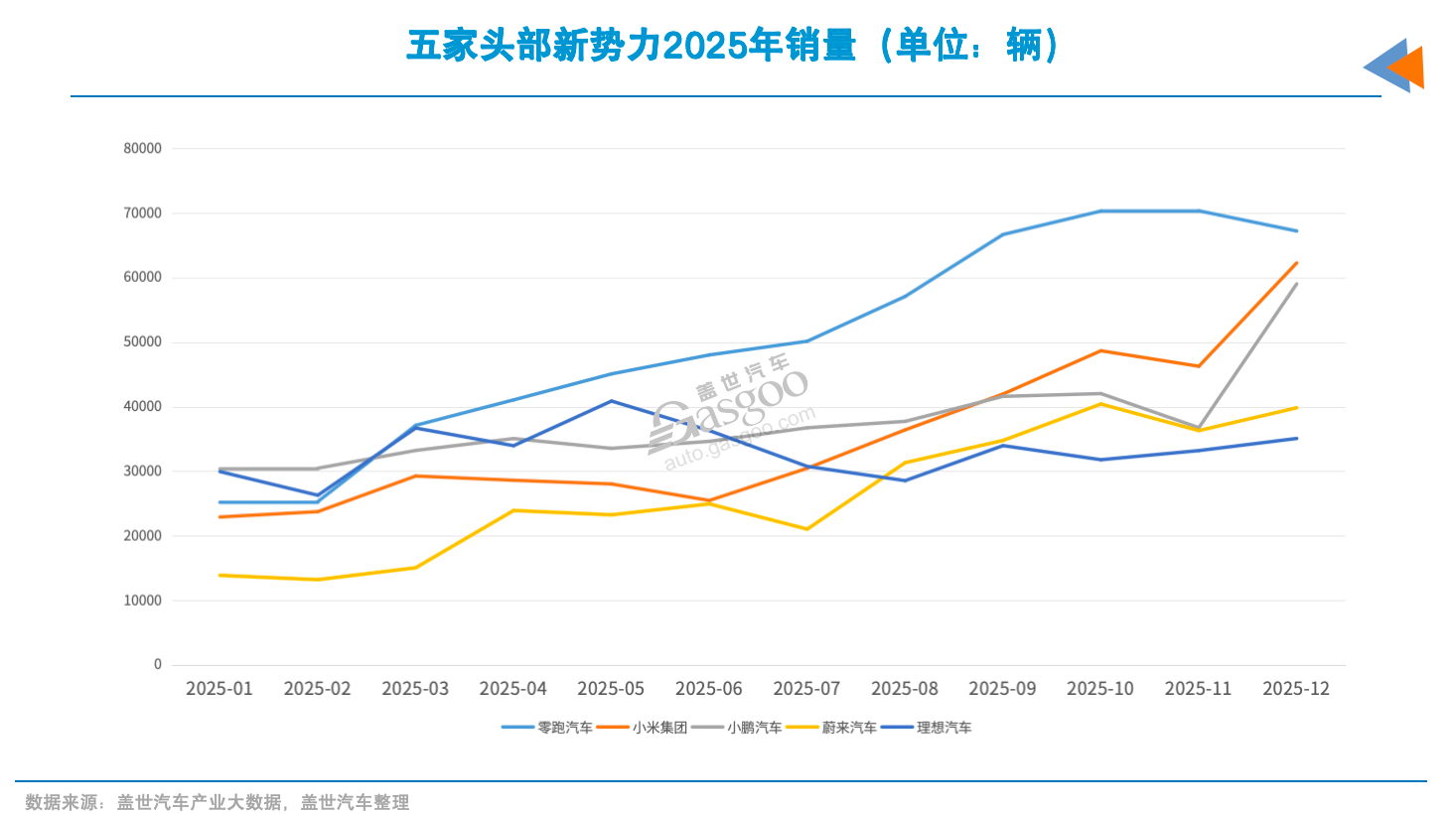

Leapmotor, for its part, drove extreme cost control through across-the-board in-house development, selling nearly 600,000 cars in 2025 and posting its first annual profit. Another card it holds: deep cooperation with Stellantis and China's FAW Group.

Stellantis provides overseas distribution, helping Leapmotor move from shipping cars abroad to building them there. FAW's investment injected 3.7 billion yuan and brought Leapmotor into FAW's electrification supply chain.

As a newcomer that only began deliveries in 2024, Xiaomi Auto's outlook is broadly positive — a function of how its cars have been received and the Xiaomi Group halo.

In 2025, Xiaomi Auto lifted deliveries to 410,000 across two models and booked a single-quarter profit of 700 million yuan in the third quarter. Xiaomi's long-built brand in consumer electronics and its industrial supply chain are part of the lift.

On top of that, Xiaomi Group's financial firepower and ecosystem synergies give the auto unit room to absorb heavy near-term investment.

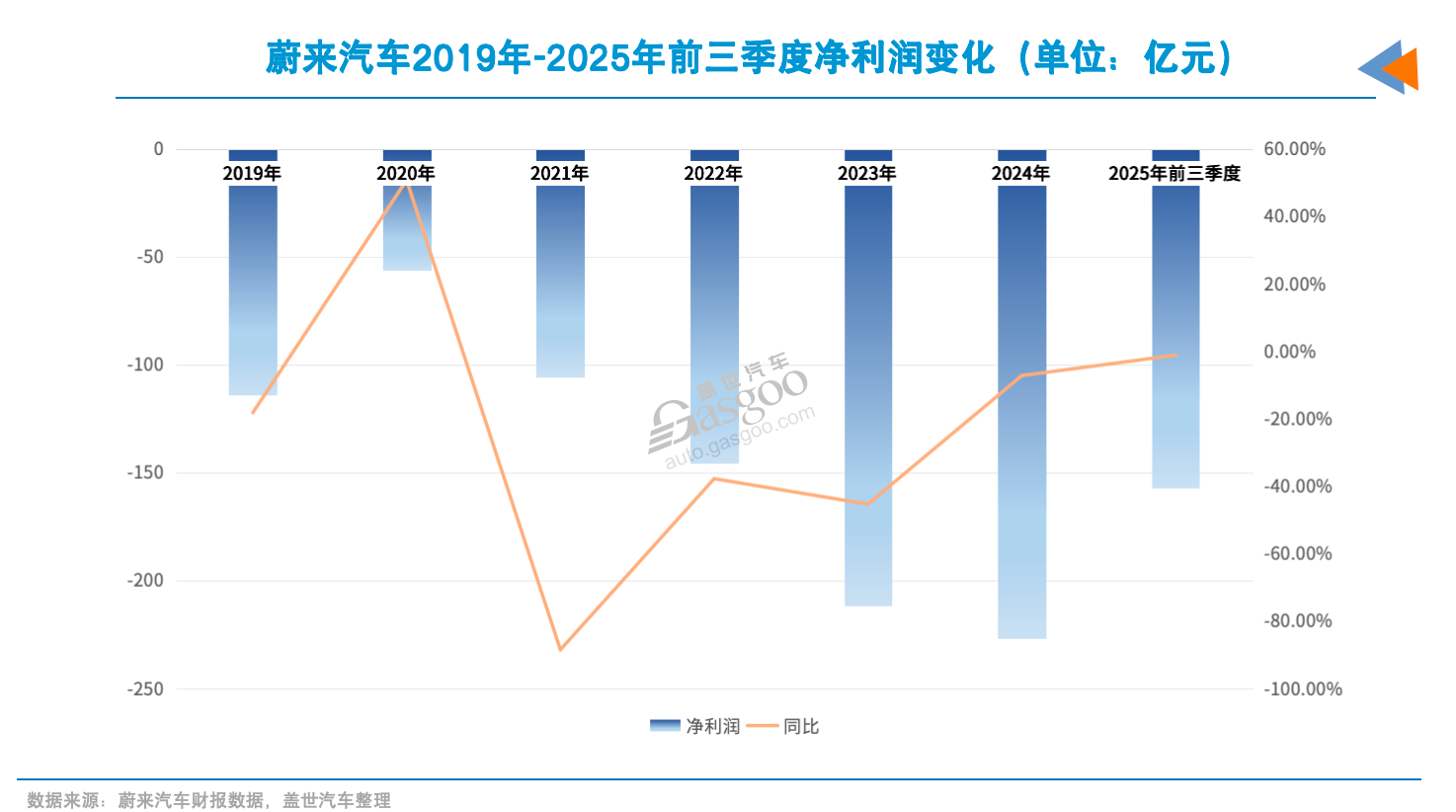

NIO, by contrast, draws more nuanced reviews — "promising short term, harder to read longer term." Its biggest issue is profitability, an institutional analyst said. By Gasgoo's tally, cumulative losses since 2019 exceed 100 billion yuan. On volume, NIO's scale — 326,000 sales in 2025 — and growth pace are already trailing Xiaomi, Leapmotor and XPENG.

Even so, NIO still holds more than 10 billion yuan in cash and equivalents and can tap multiple financing tools. By some estimates, its current liquidity can cover at least a year of operations.

The uncertain

Shifting the lens to mid- and lower-tier names — including ROX Motor, Dreame Auto, Skyworth Auto, Dayun and the "revived" WM Motor and Zhidou — respondents were split. Some believe a brand may fall this year or leave an unfinished program behind.

ROX Motor and Dreame Auto surfaced most often — and are relatively favored. Both have powerful shareholders, reducing the risk of an abrupt cash crunch. ROX is backed by Fortune Global 500 member Shandong Weiqiao Pioneering Group; Dreame Technology, a major shareholder of Dreame Auto, has posted a compound annual growth rate above 100% for six straight years.

Neither has gone all-in on China's cutthroat mainstream market. Both are leaning into exports.

ROX, for instance, targets the off-road niche and ships primarily to the Middle East, which contributes 70% of its sales. Its second model, the ADAMAS, recently launched with a Royal Edition tailored for Middle Eastern royalty at 998,800 yuan. After debuting in the UAE, Qatar and Saudi Arabia, the model drew 2,000 monthly orders.

Chen Weiwei, an analyst at Gasgoo Research Institute, said ROX's products look more like "high-priced toys" in the Middle East. As long as exports remain steady, it could form a small, relatively closed loop.

Dreame Auto follows a similar logic. Its bet is on a shareholder-proven global supply chain from robot vacuums and other fields. Targeting the world from day one, Dreame aims to pair China-based R&D with European manufacturing to build an ultra-luxury brand "born global," with the first model slated for 2027. It plans its first global plant in Berlin and claims 15 billion yuan in orders.

Compared with ROX and Dreame, Skyworth Auto and Dayun face a tougher road. Skyworth's leap from TVs to cars hasn't gone smoothly. Gasgoo Industry Database shows monthly sales are only in the low hundreds. Its new SUV, the Skyworth Rock — once planned for a third-quarter 2025 launch — has gone quiet.

Image source: WM Motor

Dayun started in commercial vehicles and now spans the NEV passenger-car market from entry level to 1 million yuan. With both top-tier upstarts and legacy automakers racing across all segments, Dayun lacks obvious brand and product advantages; monthly sales are under 1,000. As for "revived" names like Zhidou and WM Motor, their outlook is uncertain. The question is whether, after restarting, they have a sustainable business model.

"There's a process from exiting to truly disappearing," auto analyst Zhong Shi noted. Some brands "aren't dead, but they're not alive either." They may keep the legal entity and occasionally send revival signals, but have largely pulled back on product updates, market presence and user services.

The leaders are no longer 'new'

From the vantage point of 2026, the "EV upstarts" label isn't about being new anymore — it's shorthand for a market camp.

Sales tell the story most plainly. In 2025, Leapmotor sold nearly 600,000 vehicles, on par with joint ventures like Dongfeng Nissan and SAIC-GM. XPENG, Li Auto and Xiaomi each delivered more than 400,000 vehicles last year, putting them in the mid-to-upper tier. NIO topped 300,000 deliveries. Even the off-roster member Harmony Intelligent Mobility logged 590,000 in annual sales. Together, the six accounted for 15% of the NEV market.

On technology, user operations and business models, the upstarts have reshaped the competitive logic of China's auto industry.

NIO, for one, has dug deep into energy services, building 3,682 battery-swap stations and 4,860 charging stations, and partnering with multiple automakers. Li Auto created the range-extender niche, forcing others to follow. XPENG's full-stack in-house AD software and Leapmotor's vertically integrated cost-down playbook have both offered templates for the industry.

Against that backdrop, the next decade is about a new set of goals: not just surviving, but building durable advantages in scale, efficiency and globalization.

Leapmotor's founder Zhu Jiangming says the company no longer sees itself as an "upstart," but aspires to be a "sustainable, respected world-class automaker." The targets: 1 million sales in 2026, and 4 million by 2035.

Image source: Leapmotor

To back that ambition, Leapmotor is upgrading from exporting cars to building them overseas, using a global supply chain and localized production to hedge geopolitical risks — and to shift from a domestic "follower" to a global "leader."

XPENG's next-decade goal is to lead global AI mobility, with focus areas spanning AI cars, AI robots and flying cars. Narrowing to 2026, XPENG will pursue a "one model, two powertrains" strategy — offering both pure electric and range-extended versions of a given model.

NIO's future remains contested. Founder William Li said in a 2026 New Year all-hands that the company has entered a third phase of development and a fresh period of fast growth. Even so, profitability remains the biggest external concern.

"It's fine if investors keep backing it, but without real profitability it's hard to hold out," one institutional analyst said. If NIO can't quickly improve returns once its multi-brand matrix is in place — turning heavy infrastructure into actual earnings — it may struggle over a longer cycle.

For brands like ROX and Dreame, 2026 will hinge on how far they can push differentiation. As for "revived" names such as WM Motor and Neta, they are no longer in the industry's spotlight.

Whether another upstart will fall in 2026 is hard to predict. After all, "the ones with weak cash flow didn't make it past 2025." "Some have already faded from view or become marginal — whether they fall or not almost doesn't matter," one insider quipped.

What is clear: competition will only intensify in 2026. Carmakers have long anticipated that. In his all-hands note, Li said the smart EV race has entered the "finals," where efficiency decides life or death. Selling cars will be tougher this year.

That shows up on several fronts. First, policy: the NEV purchase tax moved from fully exempt to a 5% levy, directly raising out-of-pocket costs. Second, rivals: Tesla plans a 200,000-yuan model for China, and Xiaomi will round out its 2026 lineup with range-extended and performance cars — ratcheting up the fight.

Today's car market isn't a contest of features and buzzwords, but of cost structure, channel efficiency and organizational resilience.

As XPENG founder He Xiaopeng put it, there's no magic sword in this industry — it's a long, all-around contest. "You grind, clear a hurdle every three years, store up momentum for years, and in the end push yourself up."