From 2023 to 2025, the global auto industry's market-cap map was markedly redrawn — from regional tables to the worldwide league, shifts in automaker rankings reflect both evolving technology paths and the subtler turns in consumer preference and investor confidence.

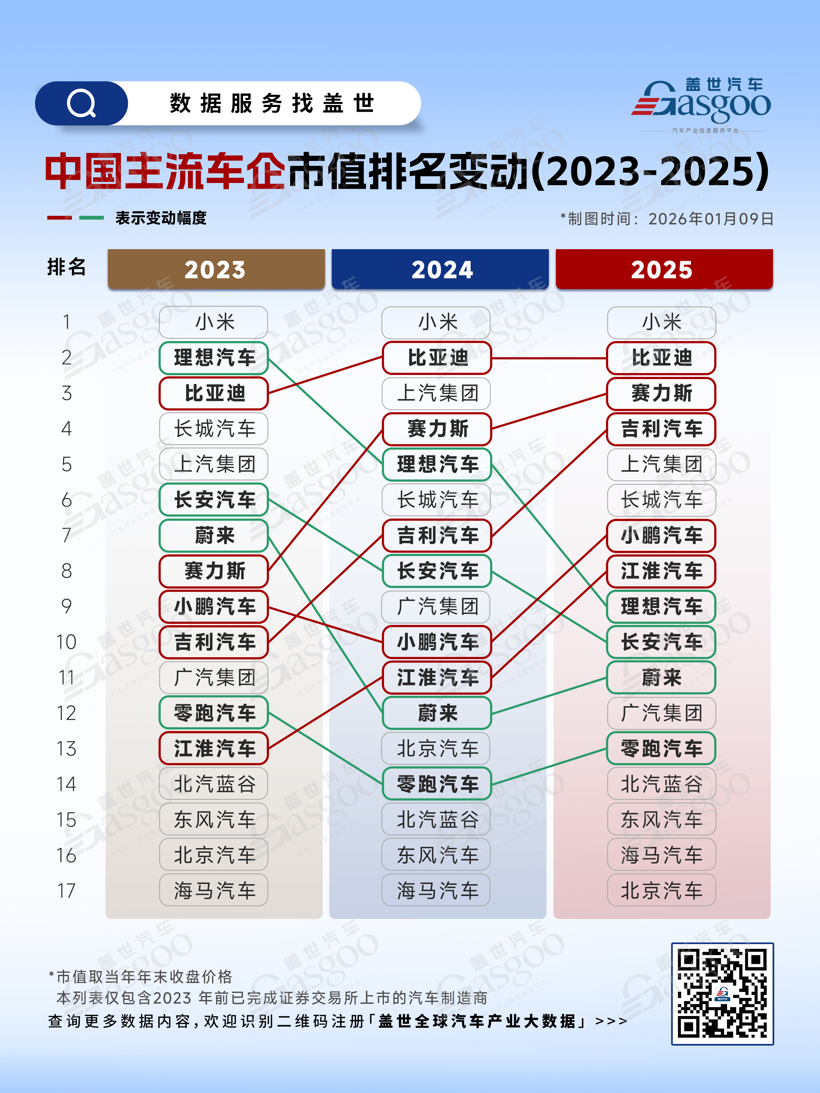

According to Gasgoo's global auto industry big data, China shows a pattern of "stable leaders, choppy middle": SERES and Geely Automobile stood out, with the former rising from No. 8 in 2023 to No. 3 in 2025, and the latter from No. 10 to No. 4 — gains fueled by growth in new‑energy vehicle deliveries and overseas expansion. Meanwhile, Li Auto and Changan Automobile edged lower. Among emerging car brands, Xiaomi EV has attracted outsized attention thanks to its parent’s tech ecosystem; even so, by the scale of its auto business, delivery volume and industry standing, it is still climbing, leaving a gap with traditional players and the leading startups.

In the United States, the picture is “incumbent steady, newcomers under pressure”: Tesla kept its lead on technology and capacity expansion; Lucid slipped from No. 2 in 2023–2024 to No. 6 in 2025, underscoring the volatility in EV upstart valuations. General Motors and Ford moved up the ranks, helped by electrification efforts taking hold and a cleaner profit mix that rekindled investor confidence.

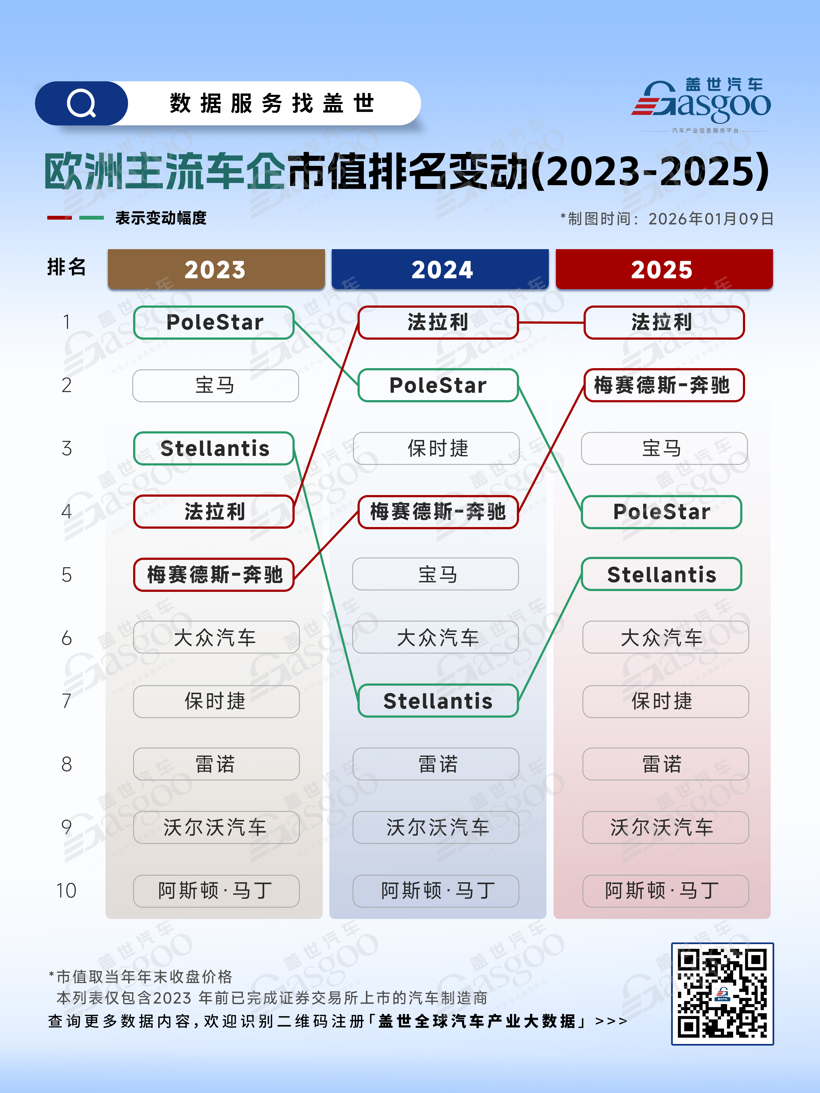

In Europe, the reshuffle centers on the contest between luxury marques and new entrants: Ferrari displaced Polestar at the top in 2024 and held the crown through 2025, with resilient high‑end demand supporting a steady market cap. Polestar fell from No. 1 in 2023 to No. 4 in 2025. Mercedes‑Benz climbed back (No. 2 in 2025), suggesting traditional luxury brands are beginning to show results in electrification and smart tech.

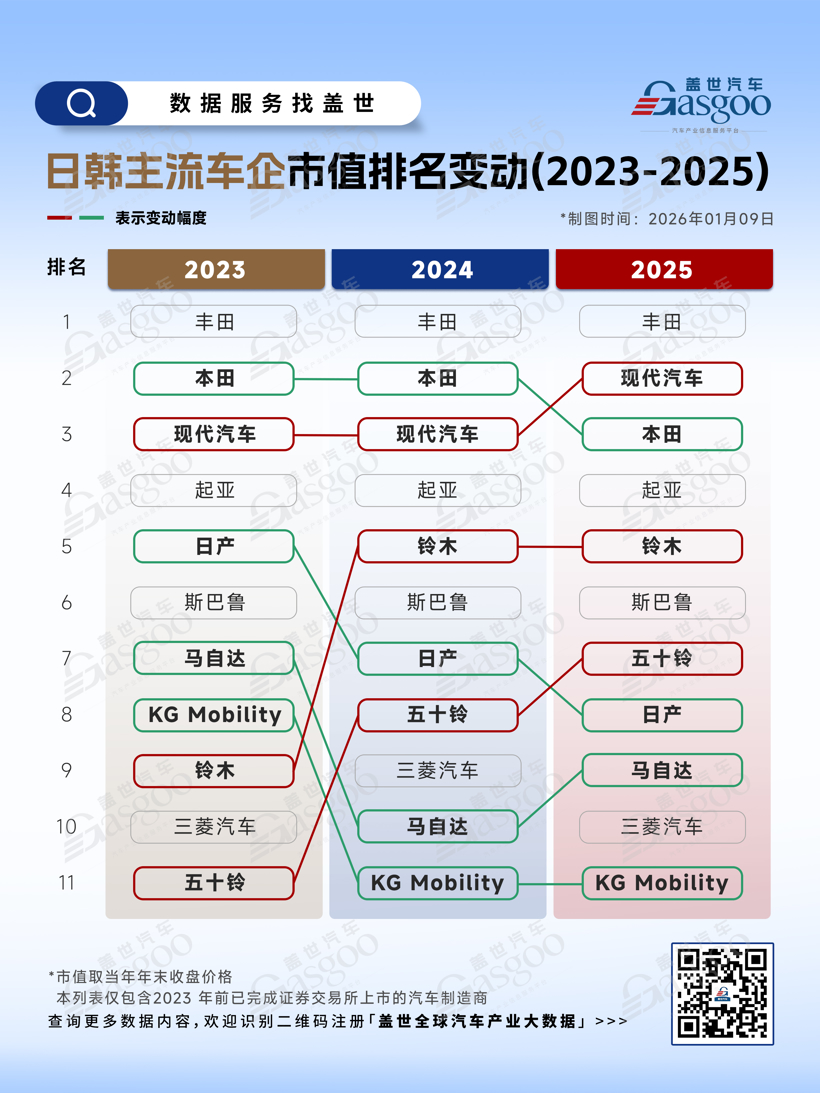

Japan and South Korea saw milder moves, but the “internal reshuffle among legacy giants” is evident: Toyota, leveraging global capacity and hybrid technology, stayed No. 1 for three straight years; Hyundai Motor rose from No. 3 in 2023–2024 to No. 2 in 2025 as its new‑energy push won broader investor recognition. Nissan and KG Mobility slipped slightly, constrained by product refresh cadence and demand fit.

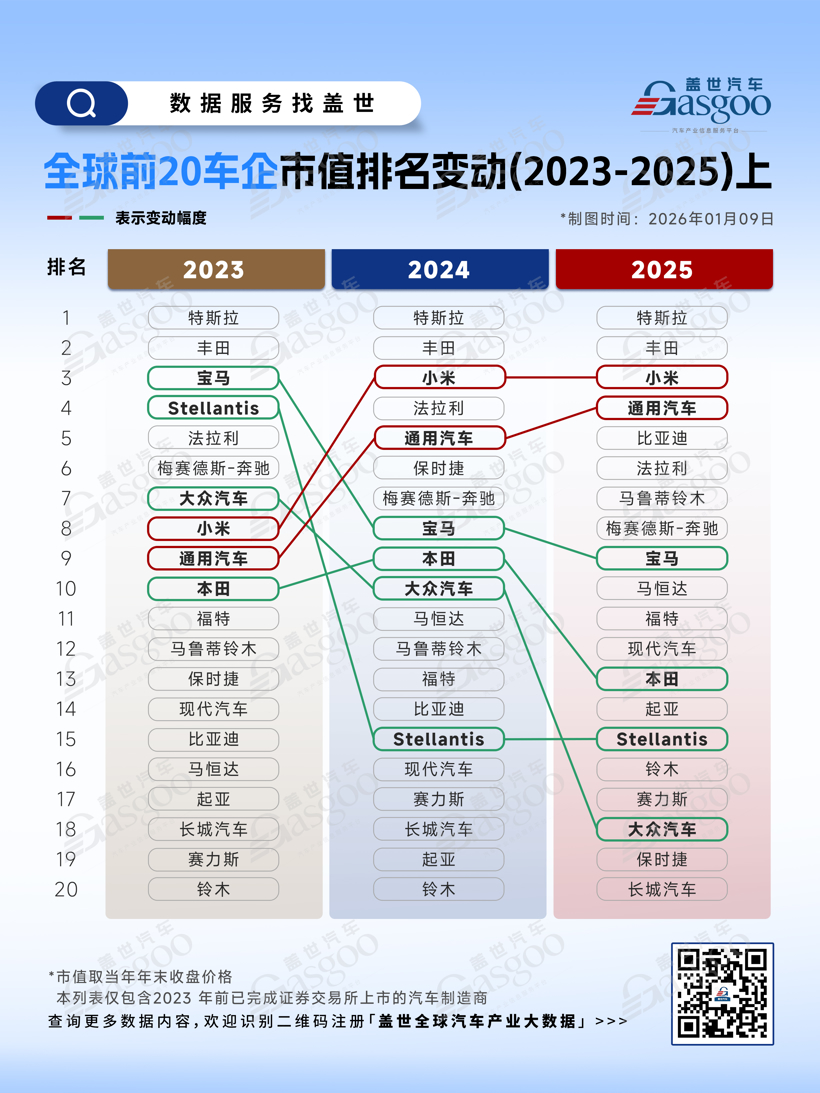

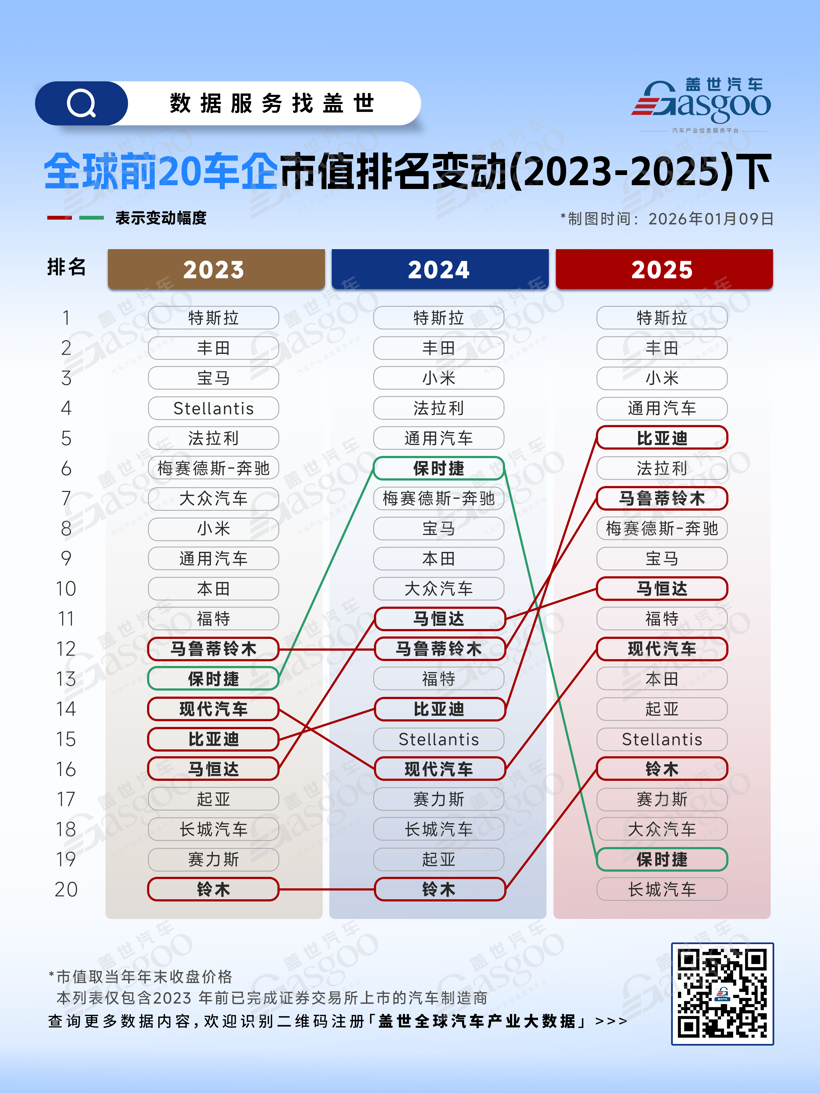

Looking at the global top‑20, the handover of influence between old and new is hard to miss: Tesla and Toyota remained out front on technology and scale; Chinese automakers gained ground, with BYD jumping from No. 15 to No. 5 to become one of the fastest market‑cap growers worldwide; BMW, Volkswagen and other European stalwarts edged lower, a shift tied to the pace of electrification and changes in regional market share.

Behind this market‑cap reshuffle lies a simple logic: execution on technology plus speed of expansion. Companies that can sustain deliveries in electrification and intelligence — while steadily building out overseas — tend to win more favor with capital. As the global auto industry moves into the “second half” of electrification and the deep waters of smart tech, the ranking order remains in flux.