Top 10 locally-produced PV, car, SUV models in China by Aug. wholesales

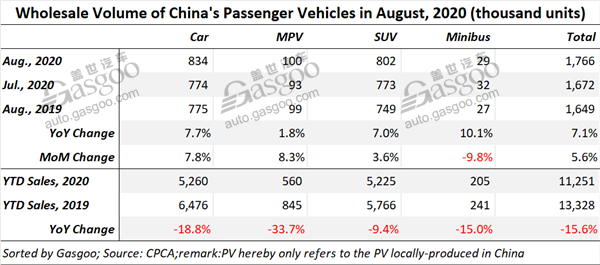

Shanghai (Gasgoo)- In August, automakers in China sold roughly 1.766 million locally-produced PVs (referring to cars, MPVs, SUVs and minibuses), representing a year-on-year growth of 7.1% and a month-on-month growth of 5.6%, according to the China Passenger Car Association (CPCA).

This was the fourth consecutive monthly year-on-year growth China's PV market has achieved this year.

Among the PVs sold last month, around 246,000 units were from premium car brands, which gained a robust year-on-year growth of 31%, while the wholesales of joint-venture brands and China's self-owned brands grew 1% and 7% respectively to 860,000 units and 627,000 units.

The slow growth in joint-venture brands' wholesales was connected to the high-temperature vacations major OEMs took in that month, according to Cui Dongshu, secretary general of the China Passenger Car Association (CPCA).

The year-to-date PV wholesales amounted to 11.251 million units, sliding 15.6% from a year ago, which were 3.2 percentage points lower than the drop in Jan.-Jul. sales thanks to the incessant rebound in monthly volume.

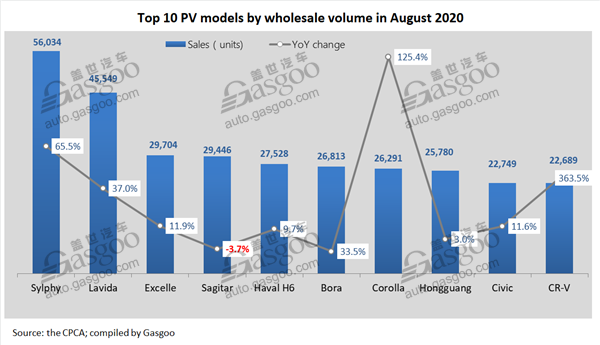

Among the top 10 locally-produced PV models by Aug. wholesale volume, there were seven car models, two SUV models and one MPV model. Aside from the Sagitar and the Bora, the other models all achieved year-over-year growth last month.

With 25,780 units sold in Aug., the Wuling Hongguang firmly held the honor of the best-selling MPV model in China. Its wholesales climbed 3.0% from a year earlier, while retail sales fell 8.2%, according to the CPCA.

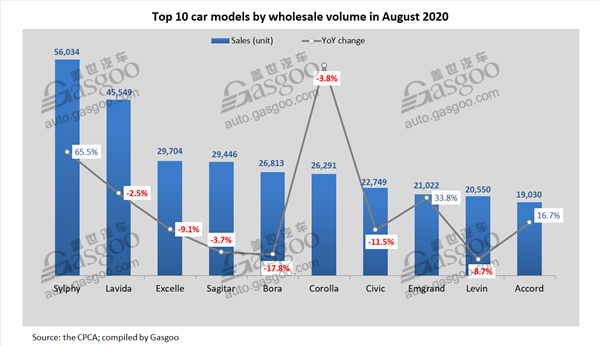

Top 10 car model list still dominated by Sino-German, Sino-Japanese brands

Both car and SUV units garnered growth in Aug. wholesales, while the former still outsold the latter. Last month, automakers in China sold 834,000 cars, recording a 7.7% increase over a year ago.

As for the top 10 car models by Aug. wholesales, the occupants of the first two places were still the Sylphy and the Lavida. Nevertheless, the Sylphy maintaining its championship was significantly due to the simultaneous sale of the old and the new versions.

The top 10 car model list was still dominated by joint-venture brands. Three models under the Volkswagen brand—the Lavida, the Sagitar and the Bora—all entered the top five, while only the Lavida had a wholesale volume more than that of the year-ago level.

(All-new Corolla, photo source: FAW-Toyota)

With regard to Sino-Japanese joint ventures, both Toyota and Honda got two car models on the top 10 list. The sales of Toyota's Corolla and Levin totaled 46,841 units, 5,062 units more than the aggregate of Honda's Civic and Accord. Nissan had only one model, namely, the aforesaid Sylphy.

The Excelle was the unique one from Sino-U.S. joint venture, moving up to the second runner-up place in August.

As the only China's self-owned model, the Geely Emgrand moved up two spots compared to July to the eighth place. Its Aug. wholesales surged 33.8% to 21,022 units.

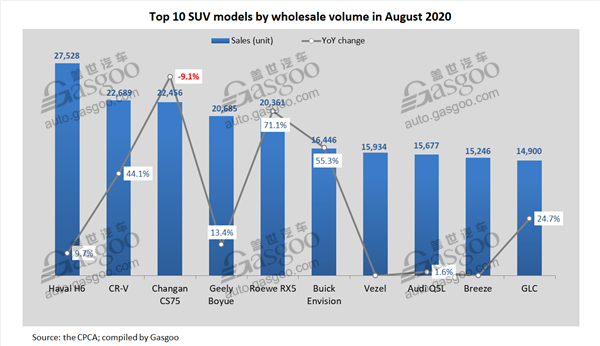

Chinese homegrown brands take four places of top 5 SUV models

The wholesales of China-built SUVs rose 7% from the year-ago period to 802,000 units in August, making the Jan.-Aug. volume add up to 5.225 million units, according to the CPCA.

In contrast to the car field, Chinese homegrown brands were more popular in SUV area. Among the top five SUV models by Aug. wholesales, there were four models made by China's indigenous PV makers—the Haval H6, the Changan CS75, the Geely Boyue and the Roewe RX5.

The Haval H6 was still the hottest-selling SUV with 27,528 units sold last month. With the third-generation Haval H6 hitting the market, consumers will be given more shopping options as the second-generation vehicles will be still available for sale.

(Honda CR-V; photo source: Dongfeng Honda)

The runner-up, the Honda CR-V, was the only joint-venture-made model among the top five SUVs. Going on sale on July 10, the 2021 CR-V offers up to 17 trim levels at one go. Consumers might be easily attracted by the new model for its diversified powertrain solutions, sportier exterior and fair resale value.

The Changan CS75 was the fastest-growing one among the top 10 SUV models. The 2021 CS75 hit the market earlier this month with more color options offered.

Compared to July, the Geely Boyue and Roewe RX5 climbed three and one spots respectively to the fourth and fifth place. Notably, the wholesales of the Roewe RX5 surged 71.1% partly thanks to the adoption of the all-new logo and design philosophy.

The occupants of the seventh to ninth places—the Vezel, the Audi Q5L and the Breeze—were all fail to enter the top 10 in July. Besides, the Audi Q5L and the Mercedes-Benz GLC were the only two from luxury auto brands.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com