China PV wholesales in May: Hongguang MINIEV, Model 3 among top 10 PVs with only BEVs for sale

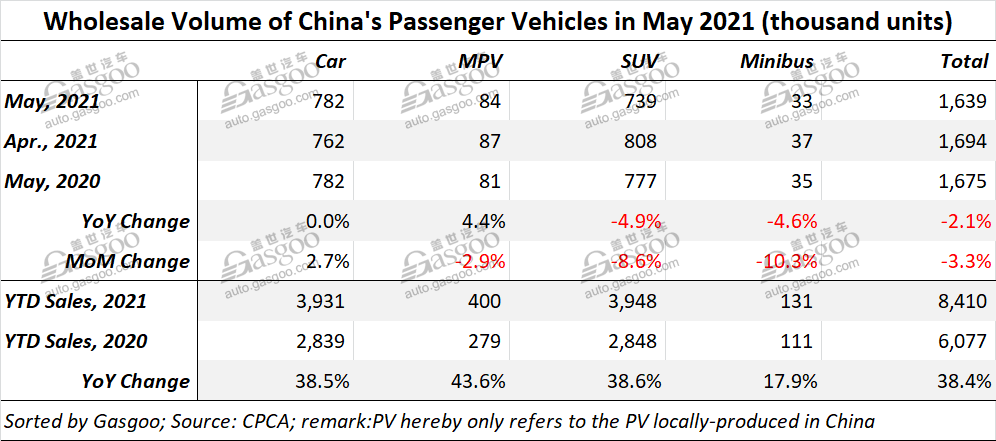

Shanghai (Gasgoo)- In May 2021, automakers in China sold around 1.639 million locally-produced passenger vehicles (only including cars, SUVs, MPVs, and minibuses), representing a year-on-year decrease of 2.1% and a month-on-month drop of 3.3%, according to the China Passenger Car Association (CPCA).

The sales decline significantly resulted from the industry-wide chip supply constraint which forced many automakers to reduce production volumes.

Compared to the prior-year period, the MPV is the only segment that achieved growth last month. Car wholesales remained flat over the previous year, while SUV sales fell 4.9%.

Regardless of the slight decline in May, year-to-date PV wholesales still leapt 38.4% from a year ago to 8.41 million units due to the low base for the year-ago period. The growth in car and SUV sales stood at 38.5% and 38.6% respectively.

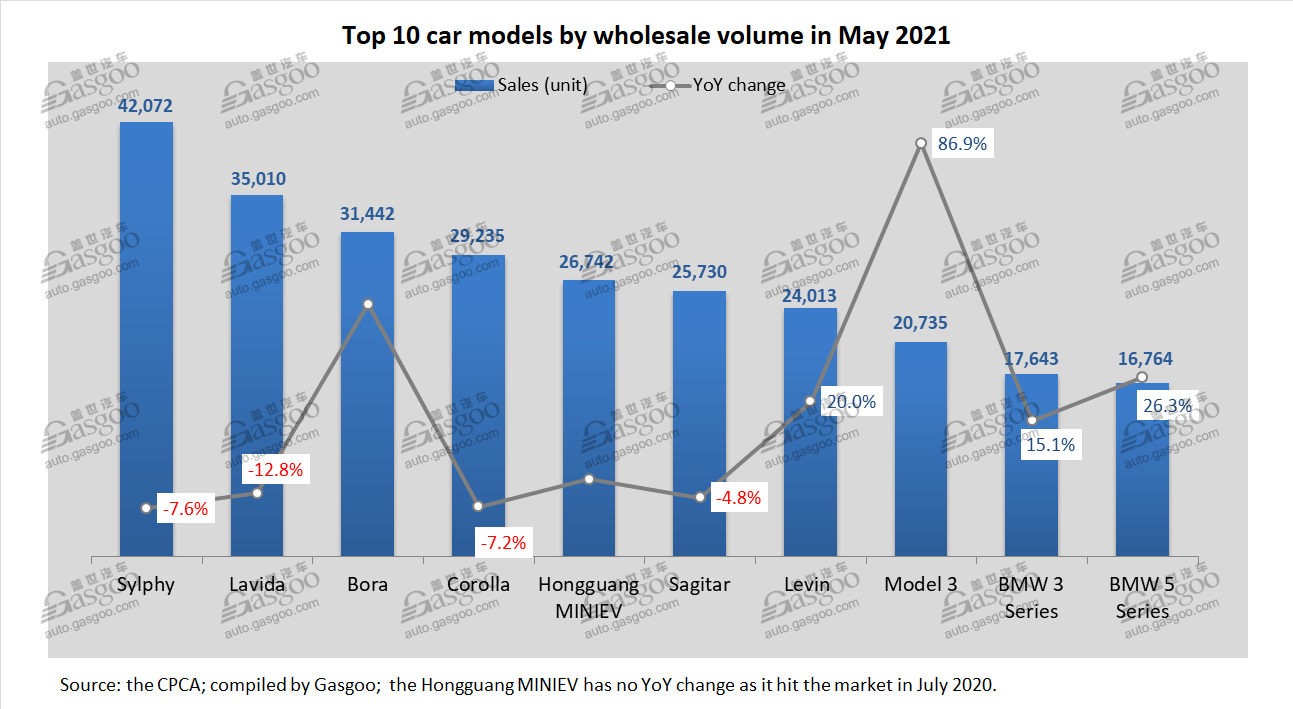

Among the top 10 locally-made PV models by May wholesales, there were eight car models and only two SUV models. Compared to April, the winners of the first two places were still the Sylphy and the Lavida. Bora surged to the third place with a year-on-year growth of 45.2%. The Hongguang MINIEV and the Tesla Model 3 were the only two on the top 10 PVs list with only all-electric models for sale.

The best-selling SUV was still the Haval H6, while it dropped two spots to the sixth place on the PV list. The Changan CS75 fell one place to the ninth.

The hotter-selling MPV model, the Wuling Hongguang, which ranked ninth in April, failed to enter the top 10 PV models list last month.

Two BMW-branded models enter top 10 car models list

The car wholesale volume in China ticked up 3.1% from a year earlier to 793 thousand units in May, resulting in 4.061 million units in the sales volume for Jan.-May period.

In terms of May wholesales, most models among the top 10 cars were regulars. Notably, BMW got two models, namely the 3 Series and the 5 Series, on the list, demonstrating its popularity among Chinese premium car consumers.

The Sylphy was once again honored the best-selling car model in May, and was the only one whose sales surpassed 40,000 units. The Lavida sustained the runner-up place, while faced a year-on-year decline of 3.7%. The strong sales for both the Sylphy and the Lavida were partly credited to the marketing strategy of selling the old and new versions through the same sales channel.

Compared to April, the Bora climbed six spots to the third place with its wholesale volume soaring 45.2% to 31,442 units. The Corolla climbed one spot to the fourth, while posting a year-over-year decrease of 7.2%.

Hongguang MINIEV; photo credit: SAIC-GM-Wuling

The Hongguang MINIEV was the only one from Chinese indigenous brands. The full-electric model's monthly wholesales have kept topping 20,000 units so far this year.

Top 3 SUV models all come from Chinese indigenous brands

Automakers in China sold roughly 739,000 SUVs in May, representing a 4.9% decline year over year. For the first five months, China's SUV wholesales jumped 38.6% to 3.948 million units.

In terms of May wholesales, the top 3 SUV models, namely the Haval H6, the Changan CS75, and the Boyue, were all from Chinese indigenous brands. Besides, the BYD Song/Song Pro and the Hongqi HS5 also entered the top 10 SUVs list as China's self-owned products.

The Haval H6 was still the No.1 SUV. Apart from its high cost effectiveness, the great diversity of variants is another factor contributing to its long-term championship. It is roughly estimated that there have been over 20 variants of the Haval H6 for sale.

CS75 Plus; photo credit: Changan Auto

The occupants of the second to fourth places all moved up one spot compared to April. Of them, the CS75 scored a double-digit growth from a year-ago period.

The BYD Song/Song Pro dropped two places to rank eighth. Its wholesales in May were down 15% to 16,369 units, 4,628 of which were the BEV and PHEV versions.

The BMW X3 was the one premium model among the top 10 SUVs. It slid three spots compared to April, while still logged two-digit year-on-year growth.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com