China's vehicle insurance registrations up by 6.6% YoY in 2021

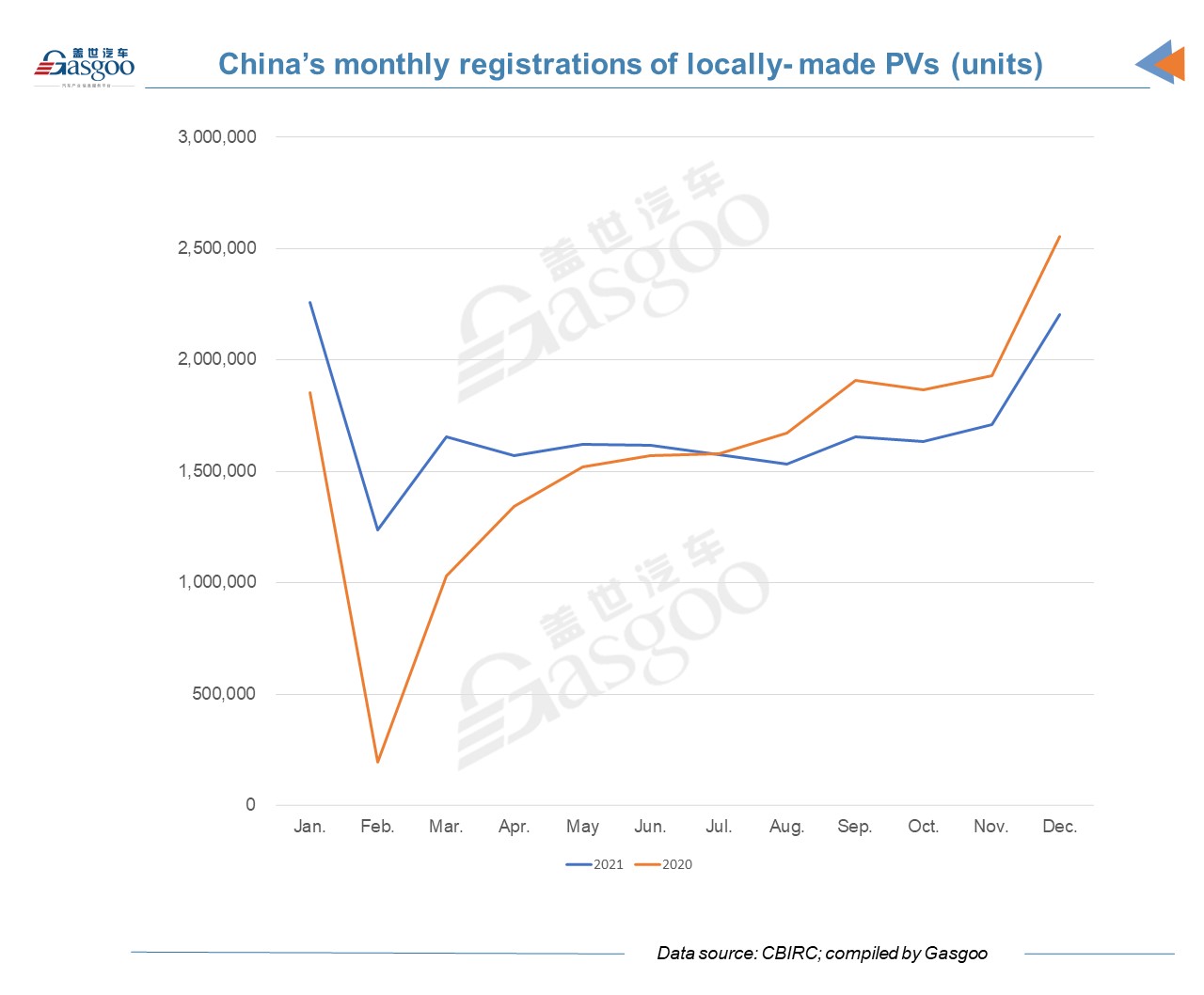

In the last month of 2021, the monthly insurance registrations of China-made passenger vehicles (PVs) continued to see year-over-year decrease, but the whole year’s registrations managed to increase thanks to the growth in the first half of last year.

In December, 2021, China’s insurance registrations of locally-made PVs exceeded 2 million units to 2,202,472 vehicles, the second highest volume in the year, but represented a year-over-year decline of 13.8%, according to data from the China Banking and Insurance Regulatory Commission (CBIRC).

The annual registration volume of last year managed to grow 6.57% from a year earlier to 20,270,073 vehicles. In the first six months of 2021, China’s PV insurance registrations continued to rise because of the relatively low base of the previous year when COVID-19 hit the industry hard. In the second half of 2021, supply chain disruptions and price increase of raw materials were plaguing the production.

TOP 20 brands and models

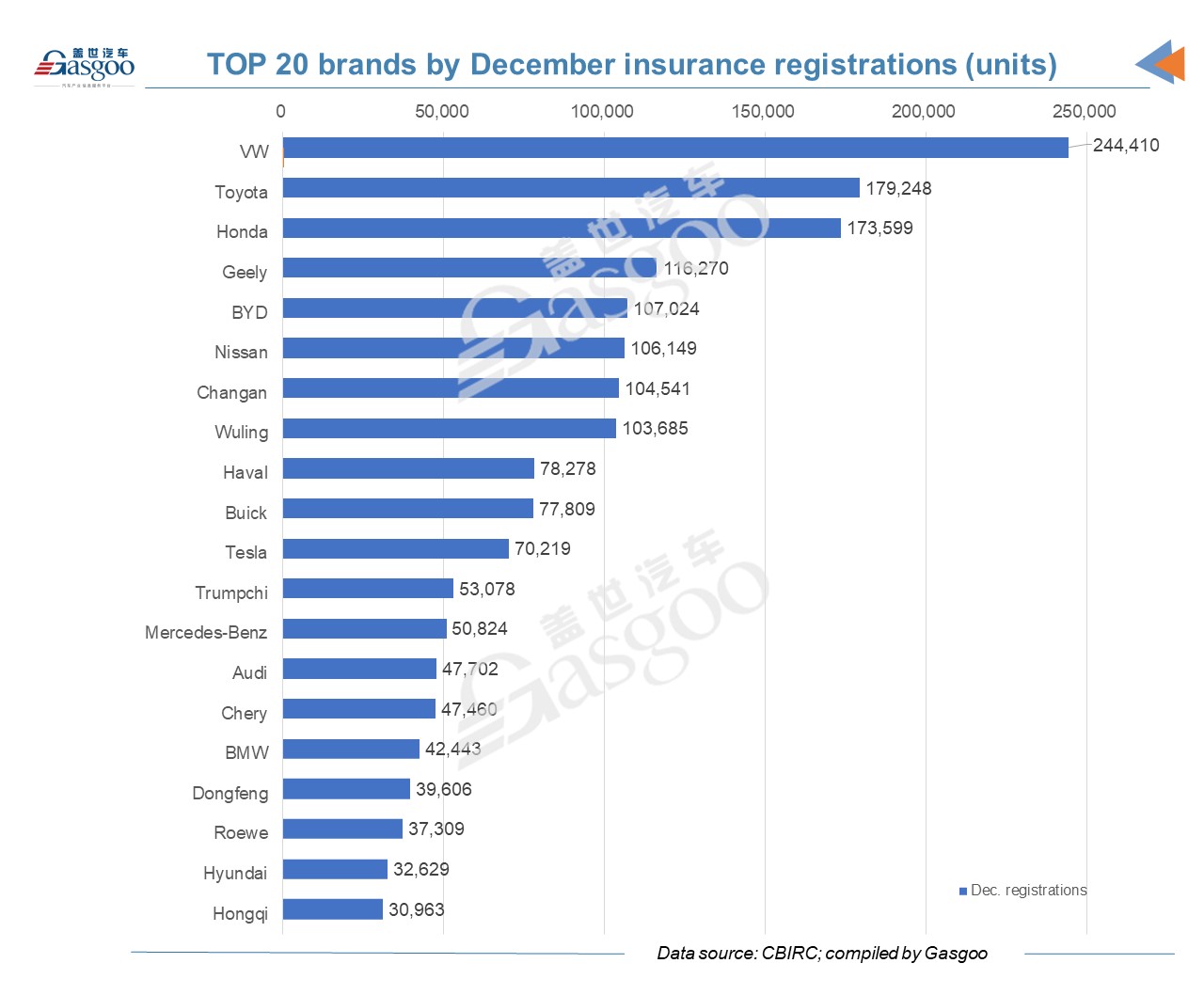

Eight brands had more than 100,000 vehicles registered in December, 2021 and Volkswagen was the only one with monthly registrations over 200,000 units. Geely ranked fourth on the December list, followed by BYD whose monthly registrations surged 78.3% when compared with the same period of the previous year.

Tesla’s monthly ranking jumped 5 spots to the eleventh from sixteenth of the previous month, because the American company usually exported few locally-made vehicles in the last month of a quarter to other countries. In December, 70,219 Tesla vehicles were registered in the world’s largest automotive market, the best-ever record for the company in China. With 311,828 registered in total last year, Tesla ranked nineteenth by annual insurance registrations.

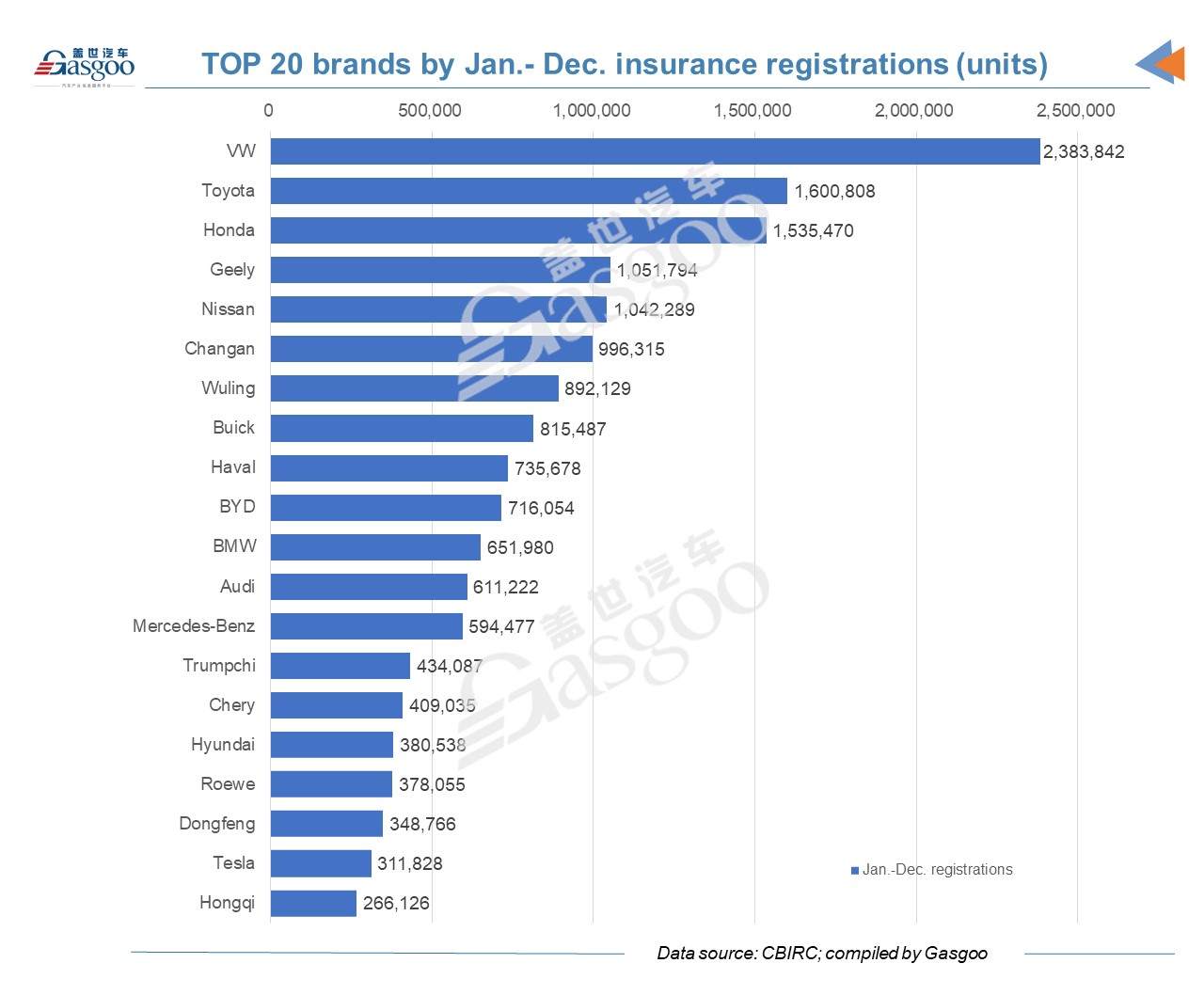

Volkswagen remained an obvious leader by 2021 registrations with a gap of over 2 million units with the twentieth on the annual ranking list. Geely was the most registered local brand in China in 2021 with over 1 million vehicles registered last year. Apart from the Hangzhou-based automaker, Changan, Wuling, Haval, BYD, Trumpchi, Chery, Roewe, Dongfeng and Hongqi were also on the annual list.

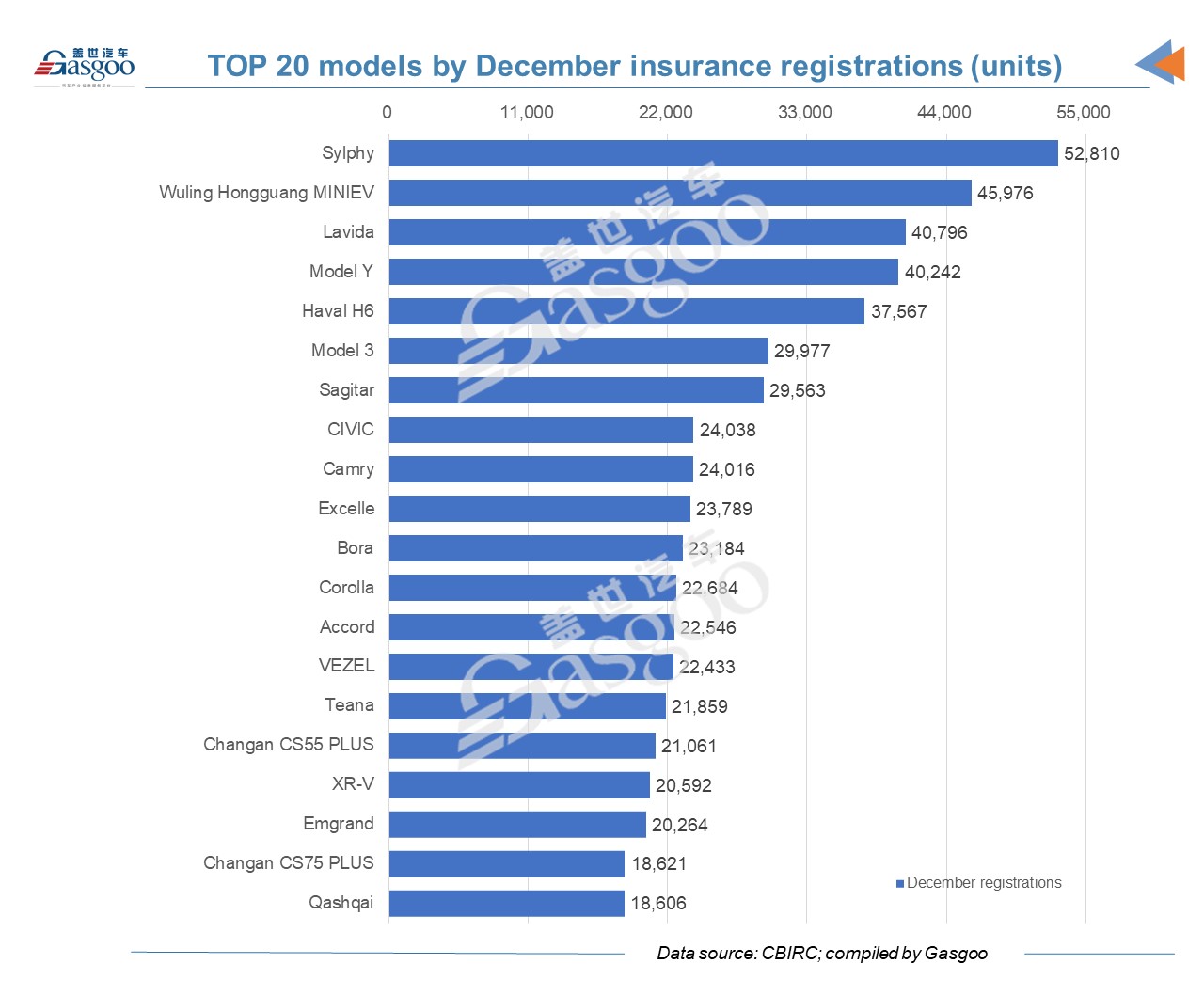

The Sylphy reclaimed the monthly championship in December after being displaced by the Wuling Hongguang MINIEV in November, and was the only one whose monthly registrations surpassed 50,000 vehicles. The Model Y from Tesla is the other electric vehicle among the top five models by December registrations, outselling the Model 3 by more than 10,000 vehicles. Changan brand had two models on the December model list, namely the CS55 PLUS and the CS75 PLUS. The Li ONE, ranking nineteenth on the November list, fell out of the December list.

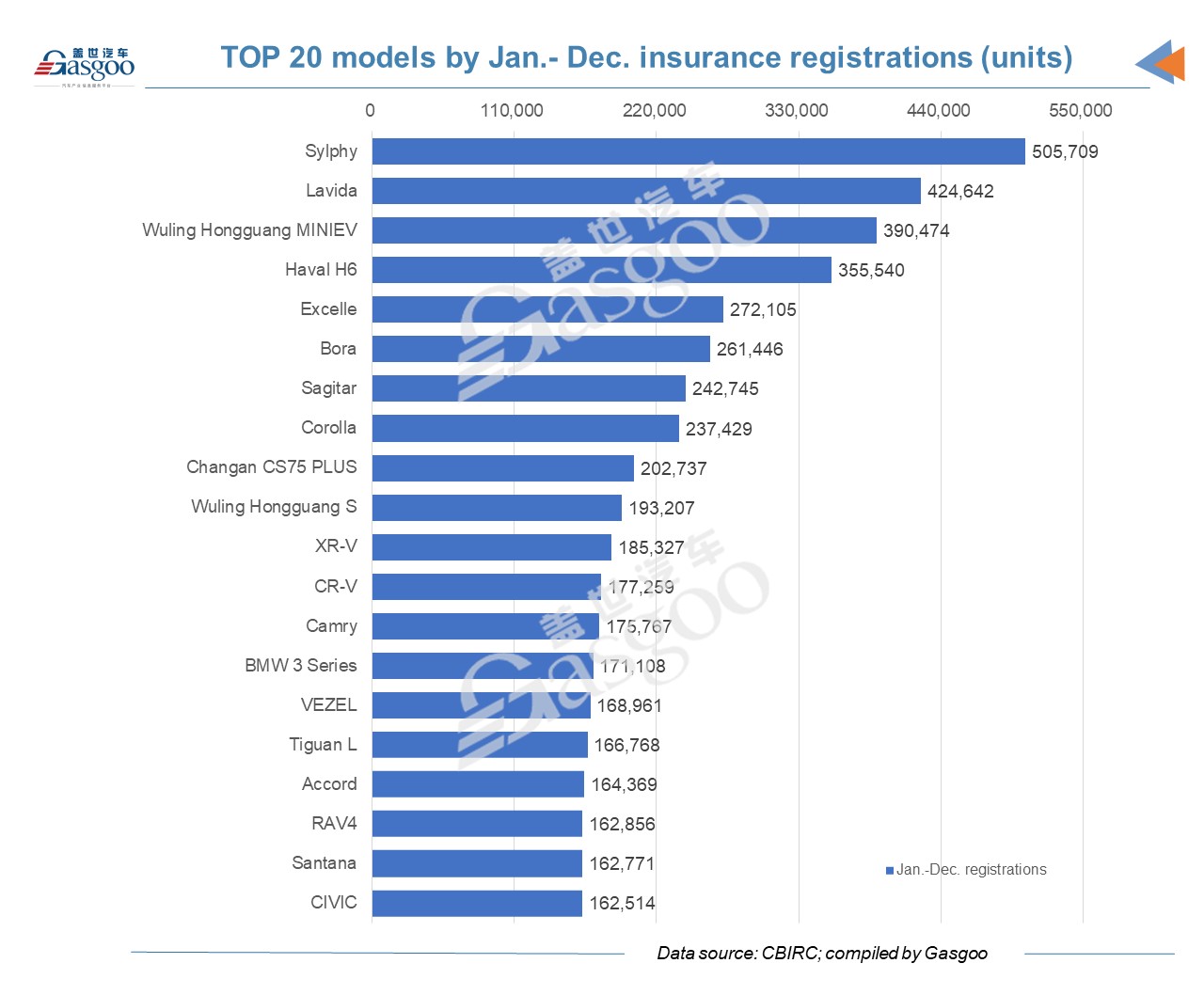

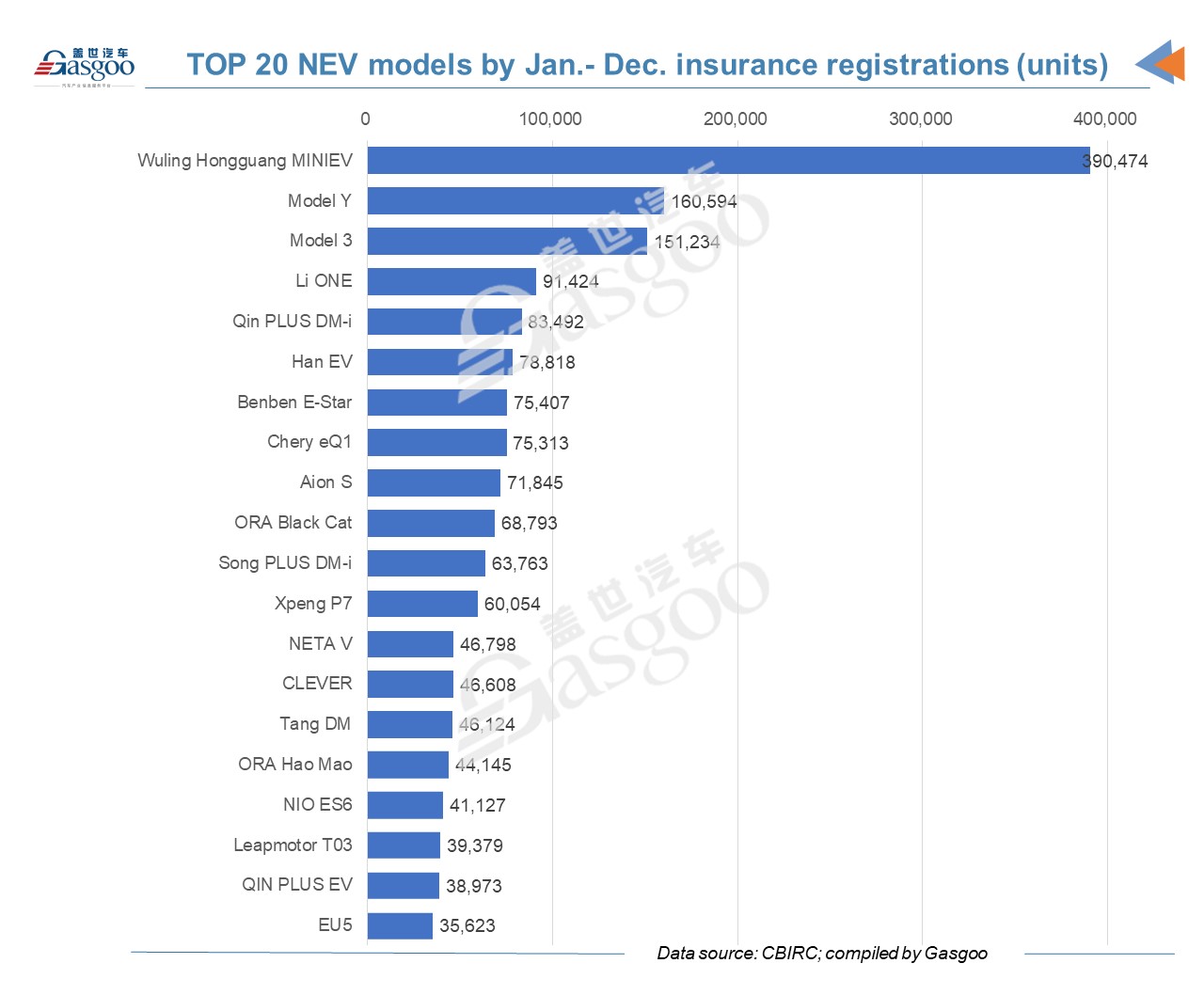

As to the annual model registration list, there were only four models from Chinese brands, with the mini electric car, the Wuling Hongguang MINIEV ranking the highest.

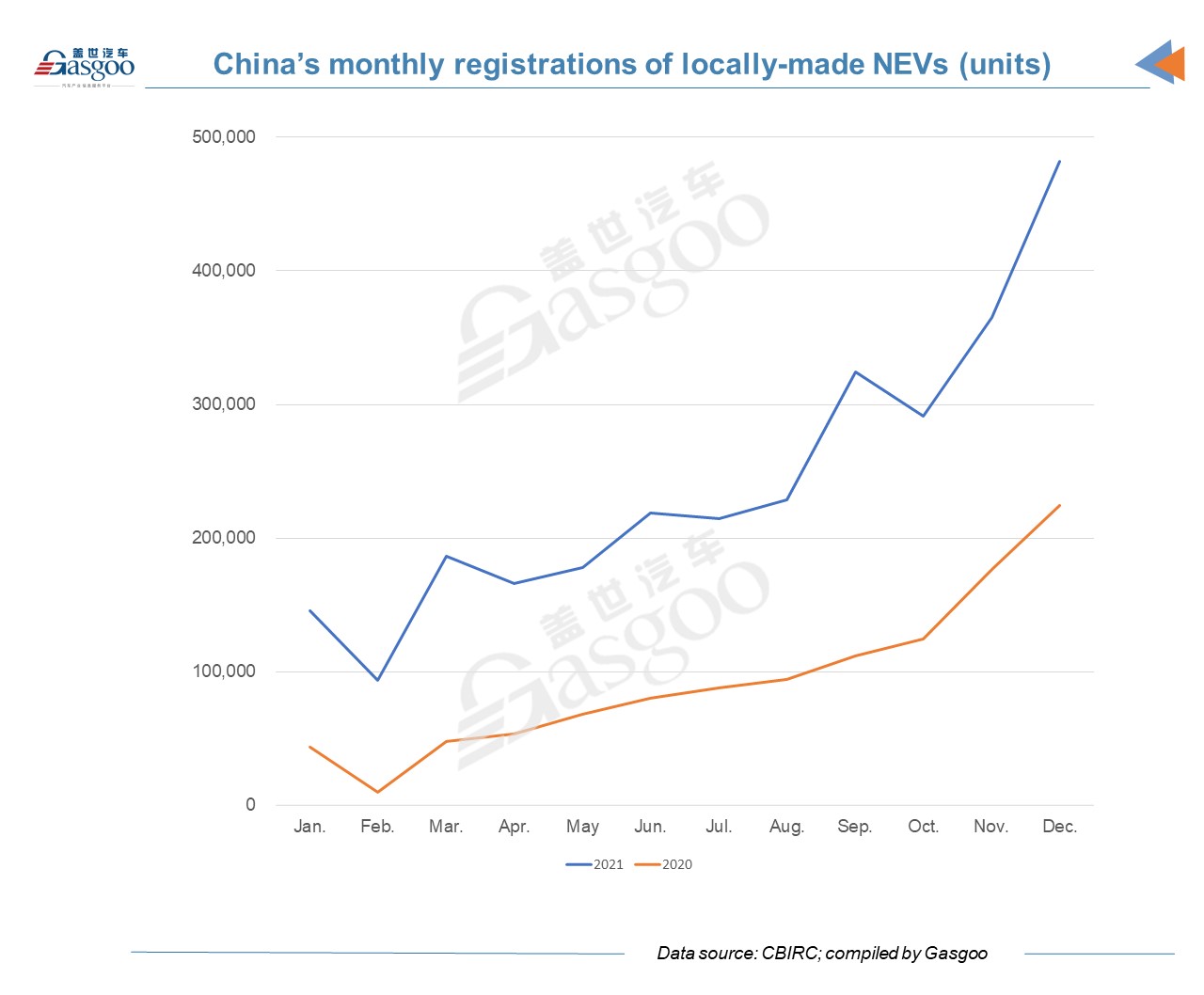

Monthly registrations of new energy passenger vehicles (NEPVs) kept increasing through 2021. In the last month of 2021, China registered a total of 481,642 locally-made new energy passenger vehicles, another new high for the market after hitting a new record in November. That represented a year-over-year jump of 115% and a month-over-month increase of 31.8%.

A total of 397,716 battery electric vehicles were registered in December, accounting for 82.58% of the overall monthly NEPV registrations, 1.7 percentage points more than the share in November. The registration volume of plug-in hybrid electric vehicles, including range-extended electric vehicles, totaled 83,919 units. The other 7 were fuel cell vehicles.

For the month, most of the registered NEPVs were for non-operation purpose while 61,435 were for renting and 459 for operation business.

Top 20 brands by NEPV registrations and top 20 NEPV models

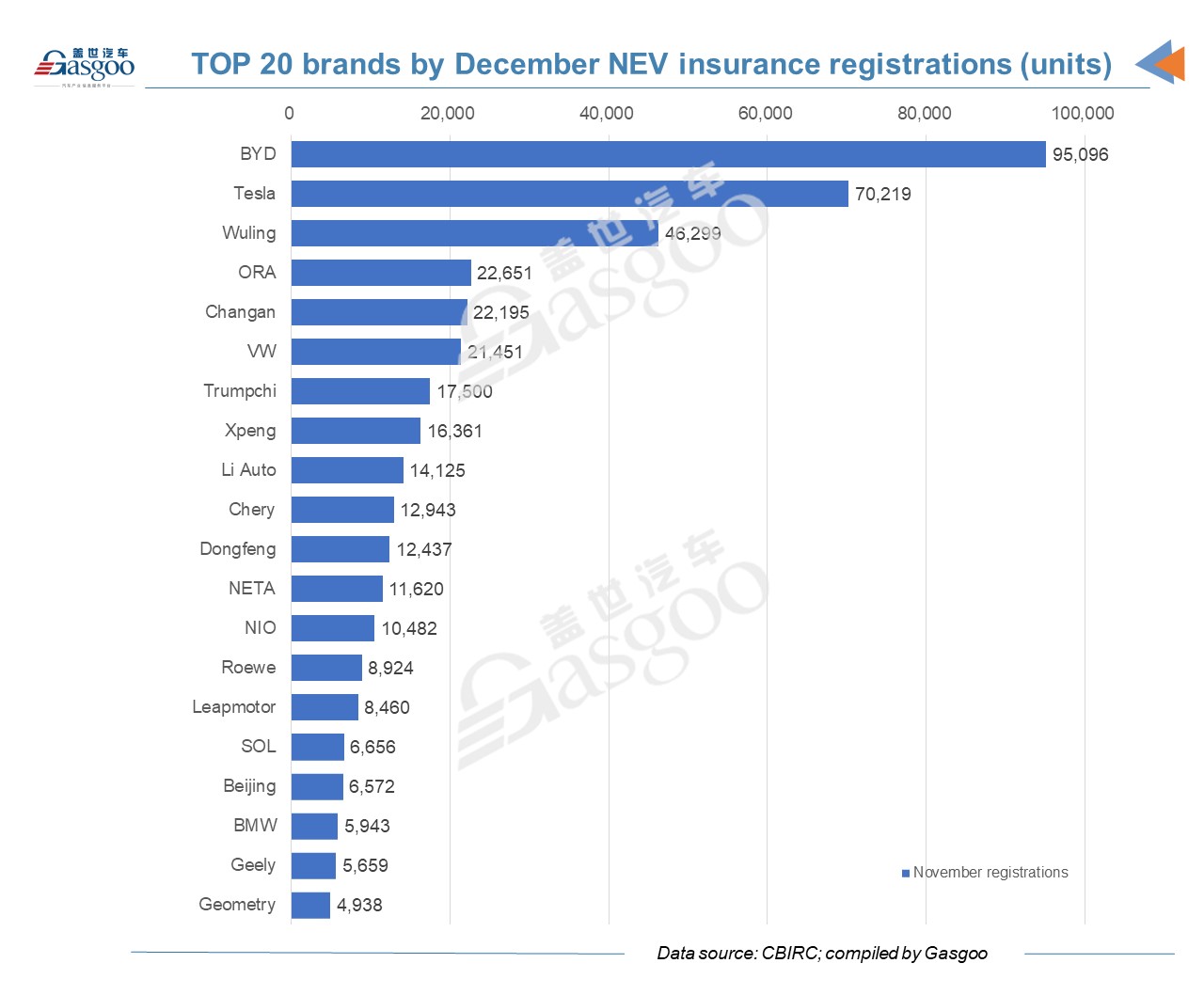

In December, BYD had 95,096 new NEPVs registered, the only one brand with nearly 100,000 NEPVs registered. Tesla surpassed Wuling, ranking second on the monthly list. ORA jumped to the fourth. Changan was the one that had the biggest jump in ranking, from the twelfth in November to the fifth. The list also had a newcomer, namely Geometry, whose monthly registrations were almost 5,000 units.

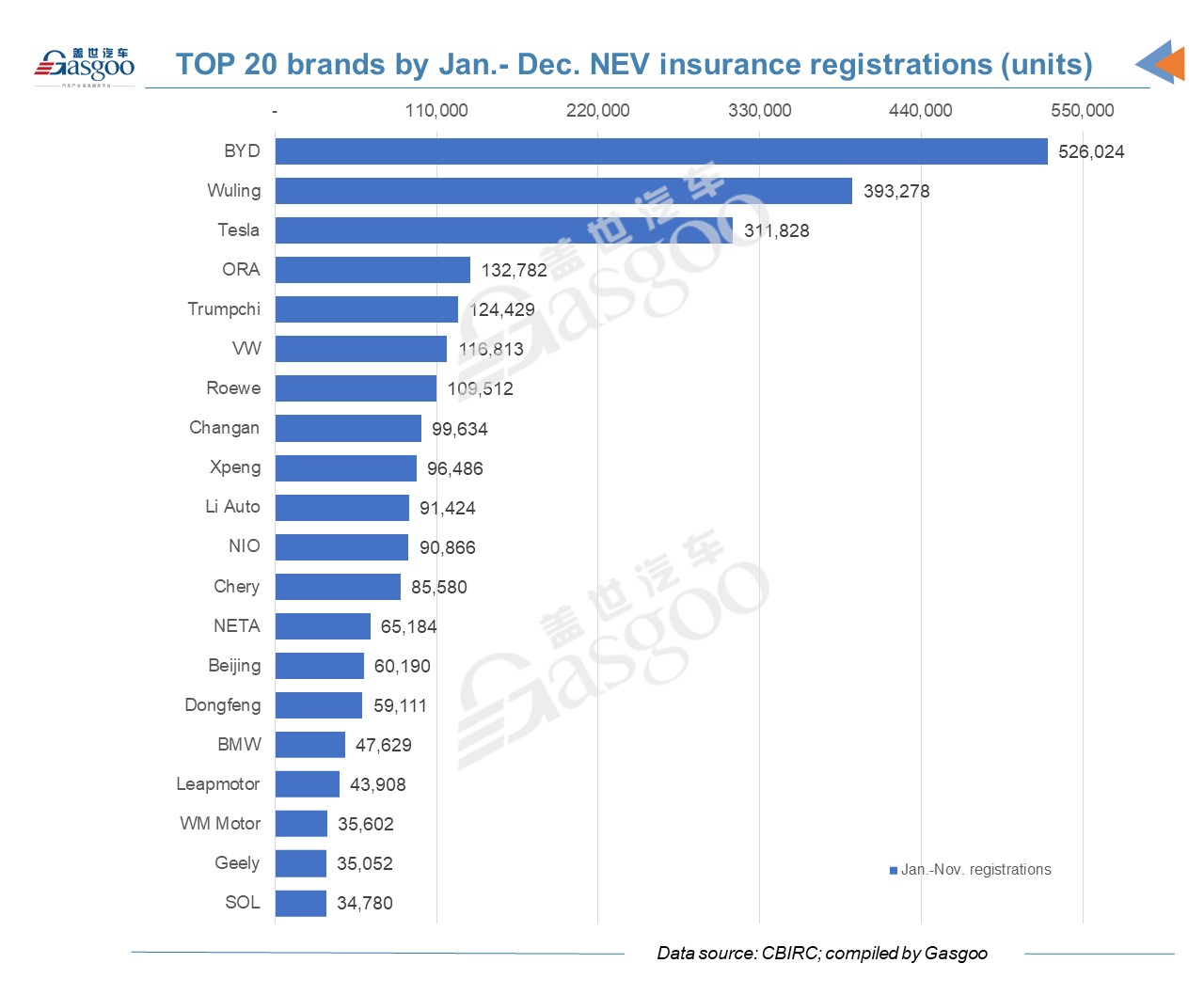

BYD had built a sizable lead over other brands by 2021 NEPV registrations with more than 500,000 NEPVs registered. Wuling and Tesla was a distant second and third. The other brands all had annual registration volume fewer than 150,000 vehicles. Volkswagen was the most registered foreign brand by 2021 NEPV registrations. Six local startups were on the annual list.

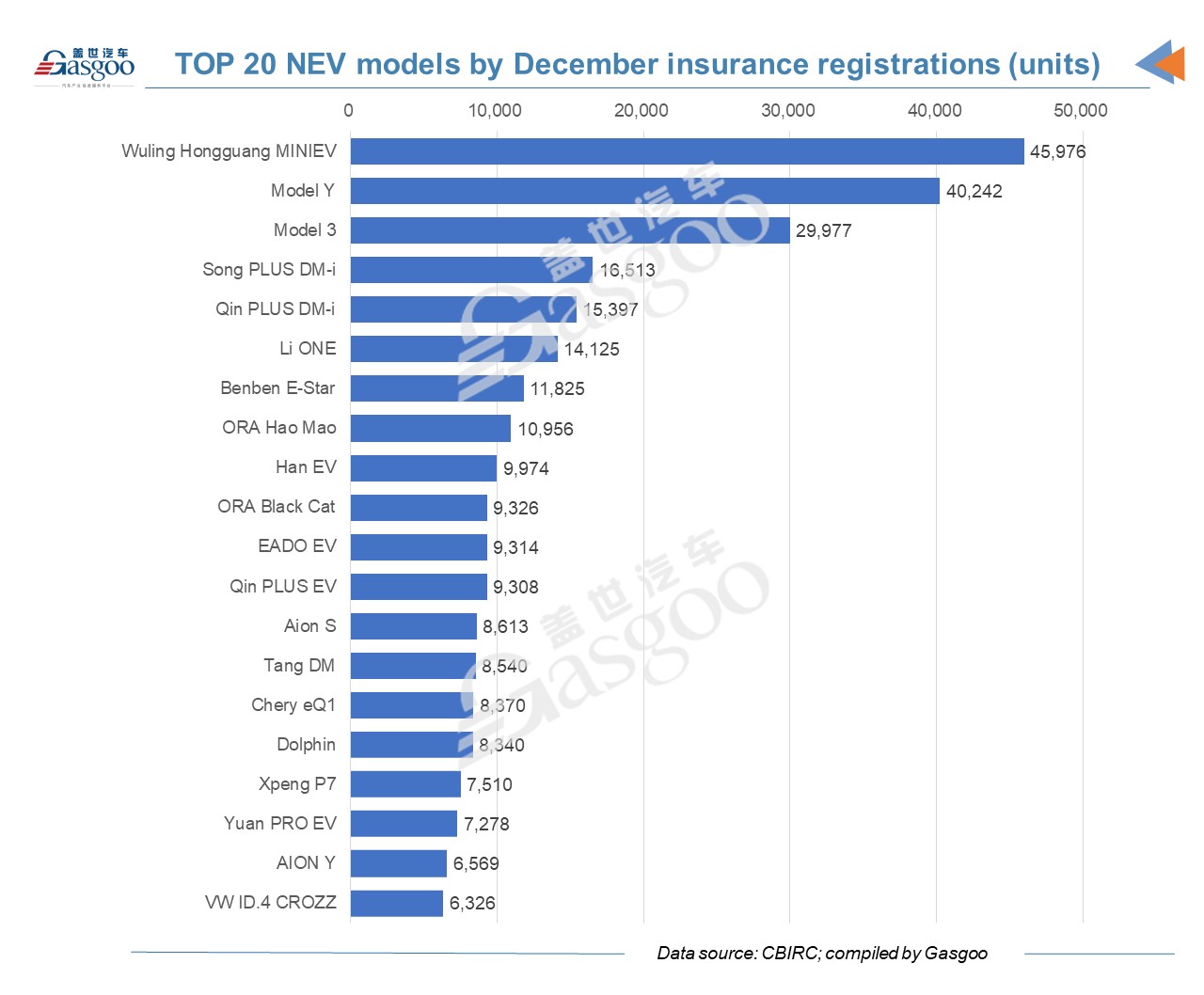

The MINIEV was the most popular model by both December registrations and 2021 annual registrations, followed by the two Tesla models. The Li ONE, Li Auto’s only model on the market, ranked fourth, topping the Qin PLUS DM-i and the Han EV, but by December registrations, the model from the Beijing-based startup was outsold by the two BYD-branded models. The VW ID.4 CROZZ entered the monthly top 20 list for the first time in December.

BYD was the biggest winner for the automaker had seven models on the monthly list and five models on the annual list. The Dolphin, whose deliveries started in August, ranked 16th, two spots higher than in November and had a cumulative registration volume of 20,192.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com