Roundup: March, first-quarter vehicle sales of Chinese major automotive groups

All of China’s major automotive groups achieved month-over-month sales growth in March, but compared with the same month of last year, not all of them had sales increase.

Among all the nine traditional automakers Gasgoo listed based on official sales data, Changan Auto had the largest sales increase versus the previous month while Dongfeng Motor Group Company (Dongfeng Group) was the only one with a single-digit sales rise. But monthly sales of SAIC Motor, Dongfeng Group, Great Wall Motor (GWM), JAC Group fell from a year earlier with JAC having the steepest decline.

GAC Group and BYD are the two which had a two-digit increase in both month-over-month and year-over-year changes.

Last month, GAC Group sold 227,471 new vehicles, ranking third among the nine groups. GAC Honda and GAC Toyota were still main sales contributors of the group even though the two joint ventures’ sales saw fluctuation in the past year because of automotive chip supply shortage. In the third month of this year, GAC Honda’s monthly sales jumped 21.46% year over year to 76,883 units while the joint venture with Toyota reported a year-over-year growth of 41% to 97,006 units.

GAC AION is enhancing its presence in the group. After a two-month sales decrease, the new energy vehicle arm’s monthly sales surpassed 20,000 units for the first time in March to 20,317 units, driven by the AION Y whose monthly sales amounted to 9,501 units.

But monthly sales of the other two joint ventures of the Guangzhou-based group, namely GAC FCA and GAC Mitsubishi, fell sharply in March. Notably, GAC Mitsubishi only sold 1 new vehicle last month. The company said it was due to such factors as production line retooling, chip supply shortage and the longer shipping period.

BYD had outstanding sales performance in March when the company stopped producing traditional oil-fueled vehicles and focuses on battery electric vehicles and plug-in hybrid electric vehicles. With 104,878 vehicles sold last month, BYD ranked fifth, surpassing Geely Auto and GWM, and became the first Chinese brand to sell over 100,000 new energy passenger vehicles in a single month.

Apart from BYD, whose monthly NEV sales more than quadrupled in March, Geely Auto and GAC Group also achieved substantial NEV sales growth. And for some automakers, the segment’s sales performance showed a sharp contrast to that of traditional internal combustion engine vehicles. For example, SAIC Motor’s March sales declined 10% from a year ago, but its monthly NEV sales jumped 19.61% to 74,509 units.

So did JAC Group. The Hefei-based company sold 21.6% fewer vehicles than the same month of last year, but its monthly battery electric passenger vehicles rose 55% year over year.

The surging sales of the NEV segment showed that the segment was little affected by the price hike spree in the month. According to the China Passenger Car Association, in March and April, automakers are delivering the orders placed before the price hike, so there was no immediate effect on March sales. Besides, many automakers set a grace period for the price increase, encouraging consumers to place orders before the price increase takes effect.

Will the price increase and sporadic COVID-19 cases cast a shadow on NEV sales in the future months? Probably not. The segment will maintain high-speed growth for this year will be the last year for NEV subsidies and such cities as Shanghai will not grant NEV license plates to plug-in hybrid electric vehicles from 2023 on, according to analysts of Gasgoo Auto Research Institute.

In terms of sales in the first quarter of this year, only SAIC Motor sold more than 1 million new vehicles while another three groups’ quarterly sales exceeded 500,000 units. Geely Auto, GWM and JAC Group sold fewer vehicles when compared with the same span of the previous year. BYD occupied the sixth place on the list, but the Shenzhen-based company had the highest increase from a year ago.

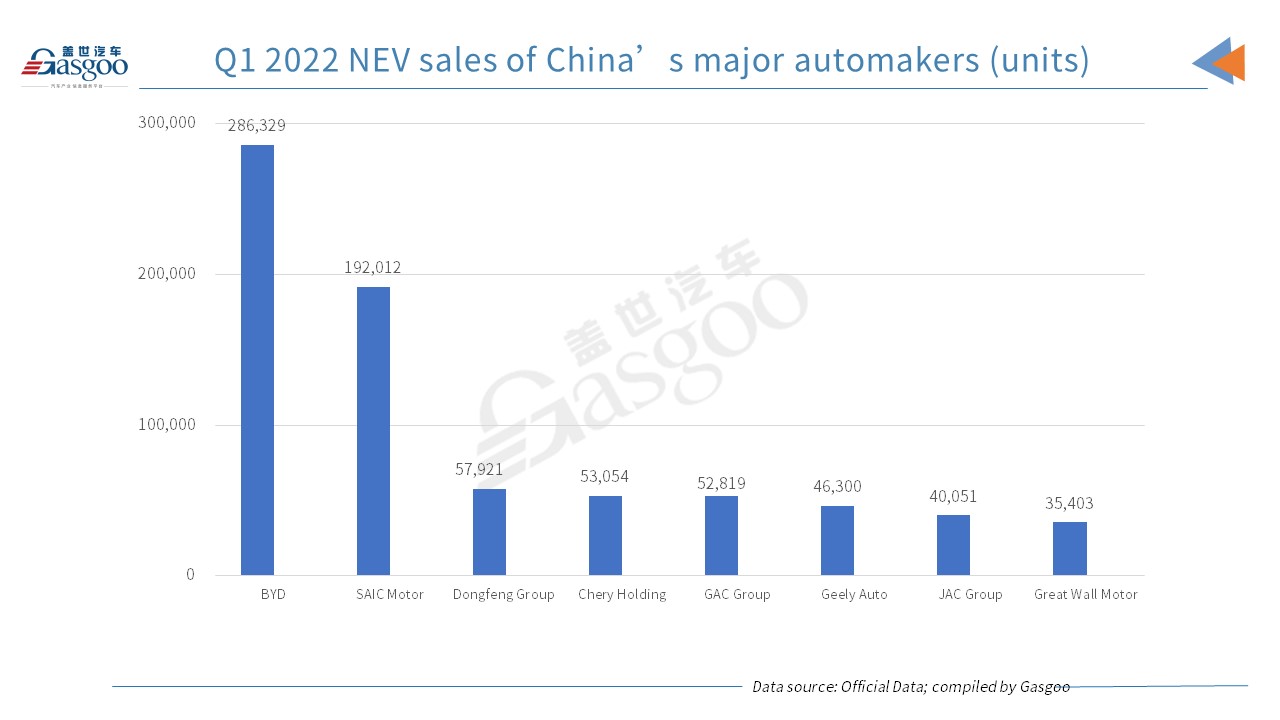

BYD has built a sizable lead in NEV sales in the first quarter, and SAIC was a distant second. The others all had quarterly NEV sales of fewer than 100,000 units. Changan Auto didn’t reveal its NEV sales data for March and the first quarter.

We also compiled a list of local automakers which had revealed its export/overseas sales data. Among the five players on the list, SAIC Motor’s sales in overseas markets jumped 44.9% year over year to 171,875 units. The Shanghai-based automaker said that its products and services have covered more than 80 countries and regions and aims to lift its annual sales in European markets to over 100,000 units this year.

In the first quarter of this year, MG brand’s global sales reached 135,000 units and became one of the top 10 brands in eighteen countries, including Australia and New Zealand.

Chery Holding and JAC Group also reported double-digit growth in first-quarter export volume.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com