BYD scores over 140% YoY spike in April PV registrations, greatly driven by NEVs

In April 2022, China's registrations of locally-made passenger vehicles ("PV") reached 969,092 units, but BYD weathered the general slowdown unscathed.

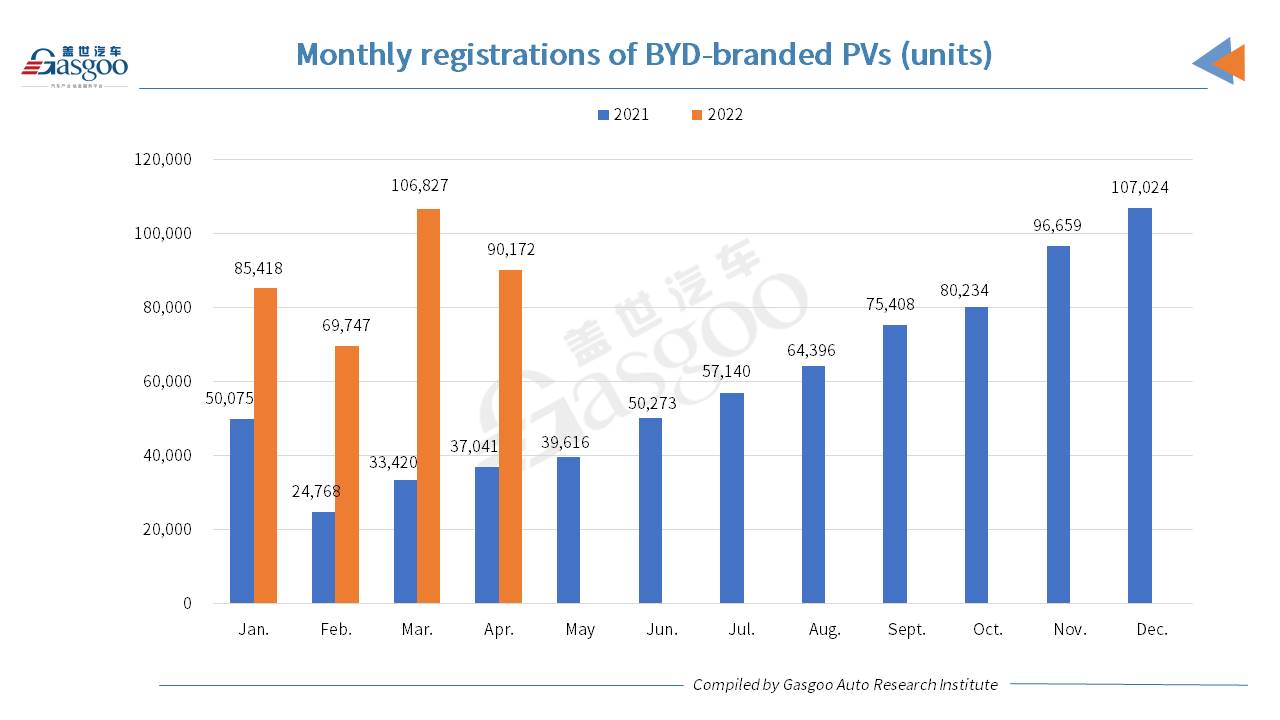

According to the data compiled by Gasgoo Auto Research Institute, the brand had 90,172 PVs registered across China last month, achieving a remarkable growth of 143.3% compared to the same span in 2021.

With 352,164 units registered in total, BYD saw its PV registrations for the Jan.-Apr. 2022 period zoom up 142.4% from a year earlier, versus the 3.8% year-on-year decrease in China's overall homemade PV registrations.

Shifting focus on NEV business

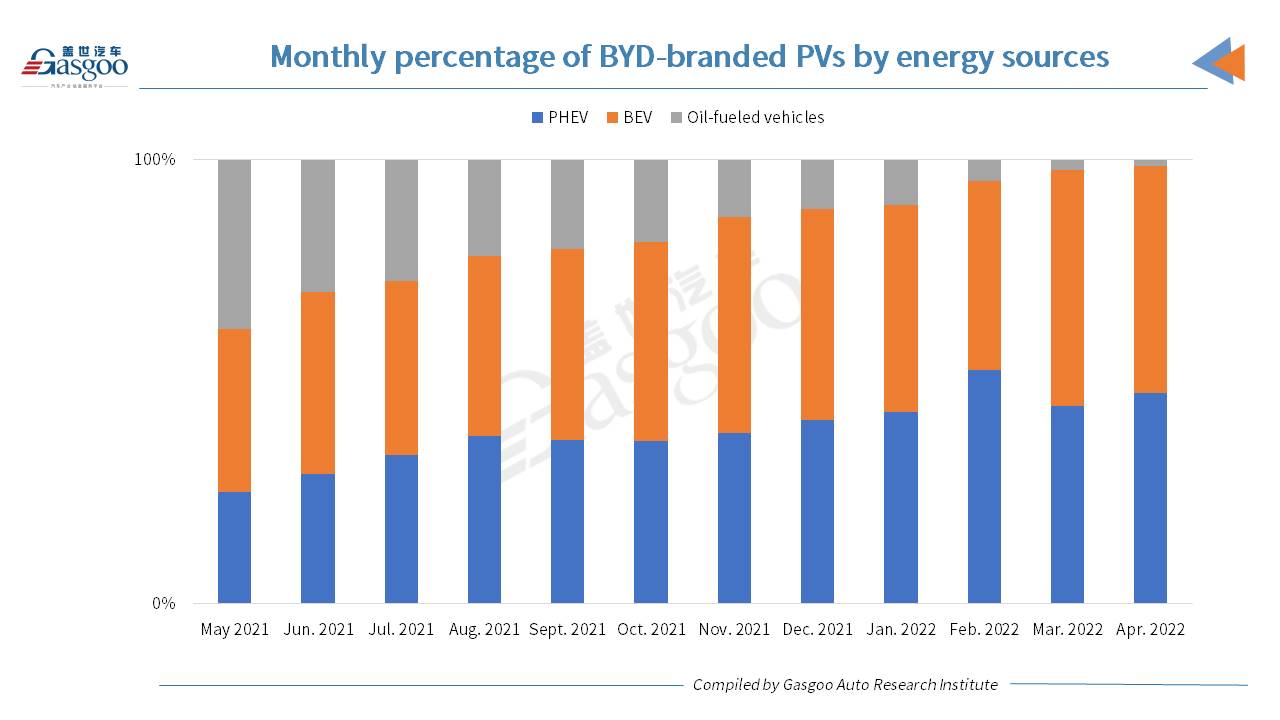

The automaker announced last month it had discontinued the production of oil-fueled vehicles in March and would only make NEVs in the future.

In April, NEVs accounted for up to 98.6% of BYD's total PV registrations, growing by 39.4 percentage points from the year-ago period.

BYD's focus on the NEV business is also partly reflected by the expansion of NEV lineup. According to the data compiled by GARI, there were a total of 37 BYD-branded PV models registered in the Jan.-Apr. 2021, including 9 PHEVs, 17 BEVs, and 11 oil-fueled vehicles. In the same span of 2022, the number of BEV models was increased to 21. Notably, the four new comers—the Dolphin, the Qin PLUS EV, the Yuan Pro EV, and the Yuan PLUS—all recorded April registrations of over 18,000 units.

Although the number of PHEV models remained unchanged, most of them achieved significant year-on-year growth in April registrations. Nevertheless, the April registrations of main oil-fueled models all tumbled over the year-ago period.

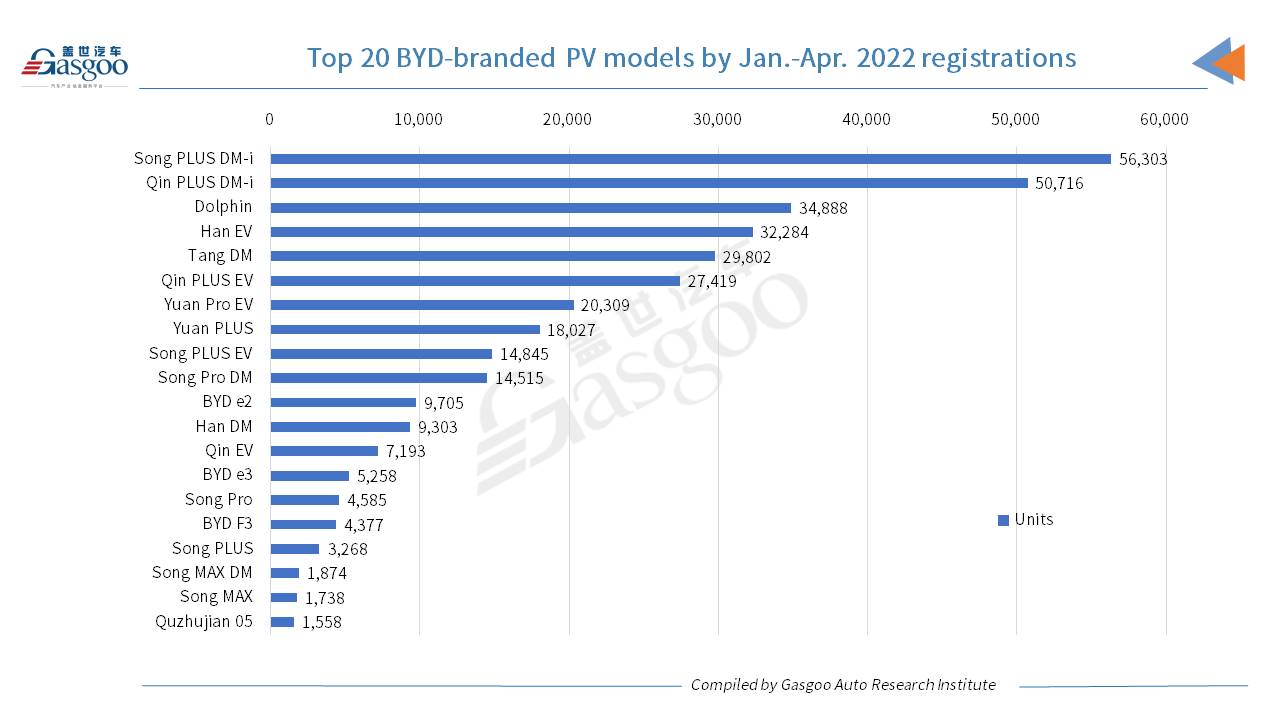

There were up to 18 NEV models among the top 20 BYD-branded PV models by Apr. 2022 registrations, including 7 PHEVs and 11 BEVs.

Regarding Jan.-Apr. registrations, the top 20 BYD PV models only contained four oil-powered ones, namely, the Song Pro (15th), the BYD F3 (16th), the Song PLUS (the 17th), and the Song MAX (19th).

Where BYD PVs are sold to

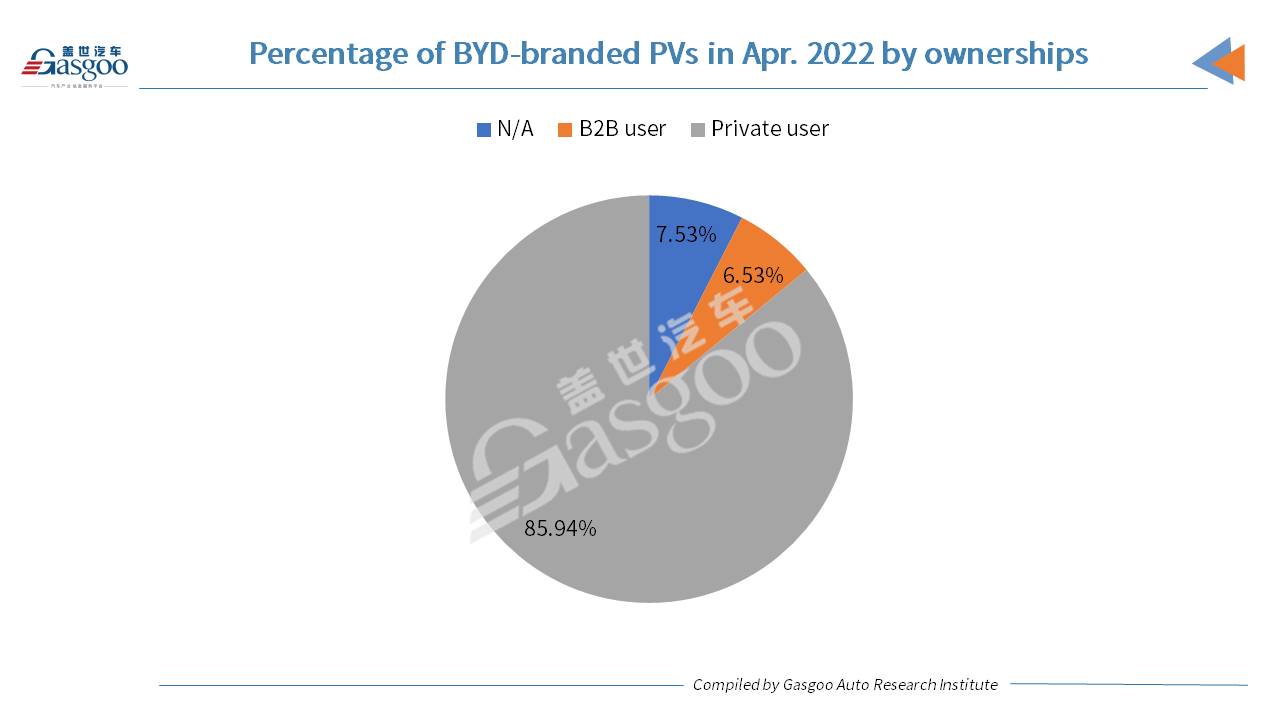

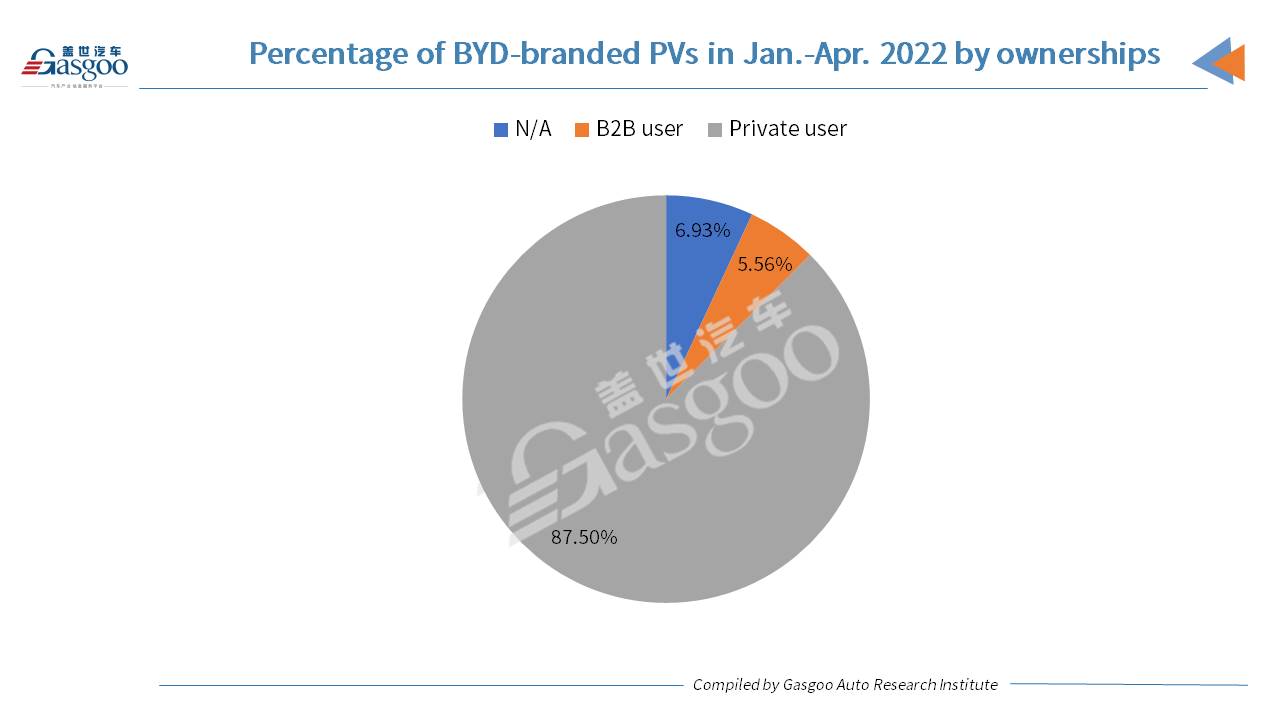

With regard to ownerships, 85.94% of BYD-branded PVs were registered by private users in April 2022.

For the first four months of the year, private users contributed to 87.5% of BYD's total PV registrations.

It is not surprising that Shenzhen ranked highest among cities by April registrations of BYD PVs, as it is where the automaker is headquartered. The runner-up Foshan is also from China’s Guangdong province. Tianjin ranked third and was also the highest-ranking city from northern China. Chengdu and Guangzhou were the top 2 provincial capital cities.

Although Shanghai was not among the top 20 cities by April registrations of BYD-branded PVs, it was credited the runner-up by Jan.-Apr. registrations.

On the list of top 20 cities by Jan.-Apr. registration volume, the cities from northern China occupied only 5 spots, namely, Tianjin (4th), Xi’an (6th), Beijing (8th), Zhengzhou (11th), and Qingdao (20th), indicating BYD’s PVs were mainly sold to southern China.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com