China achieves best-ever monthly new energy passenger vehicle registrations in June 2022

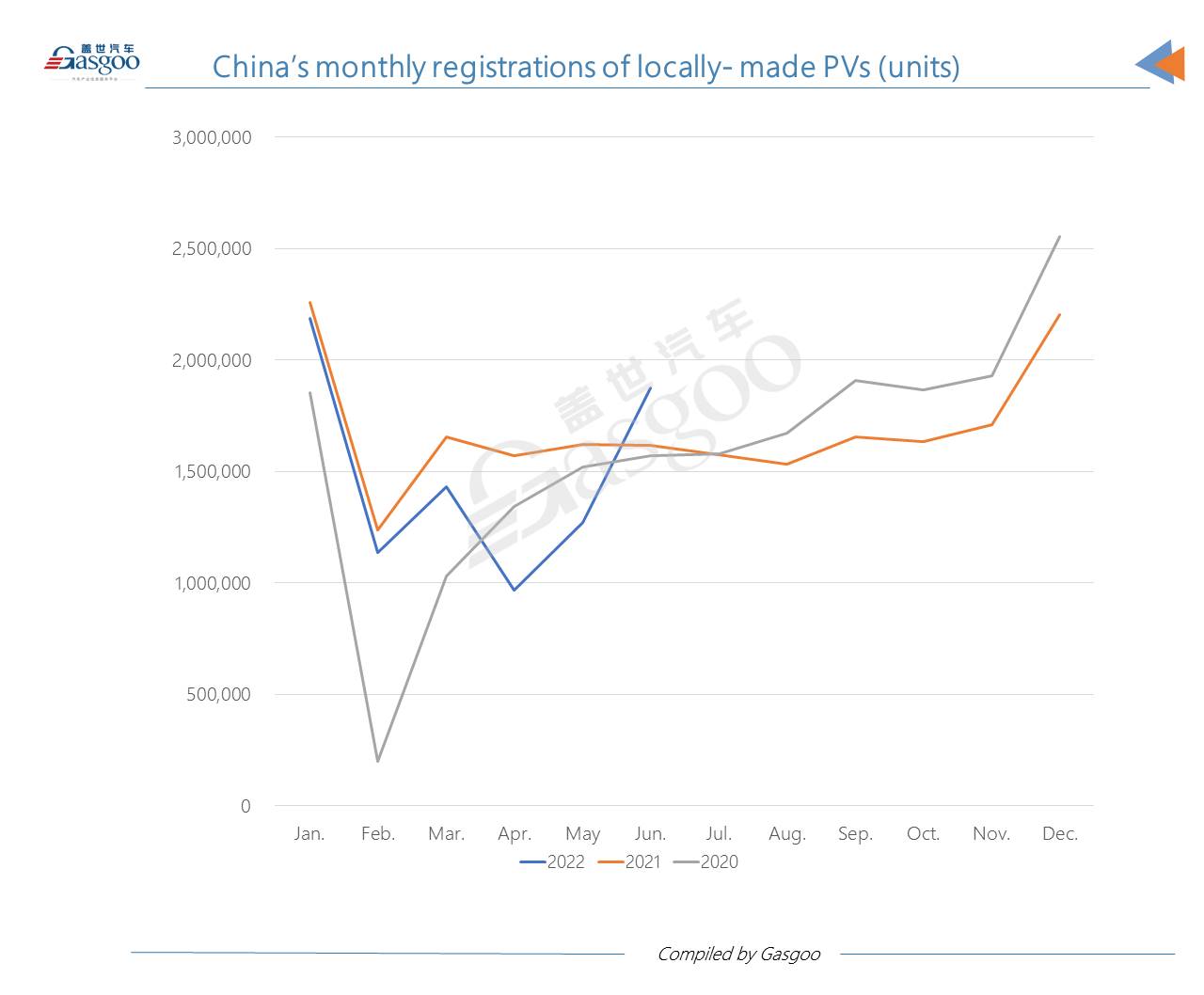

China's monthly registrations of locally-made passenger vehicles (“PVs”) reached 1,874,644 units in June 2022, jumping 16% from the previous year, according to the data compiled by Gasgoo Auto Research Institute (“GARI”). It was the first time for China’s PV market to gain a year-on-year increase in monthly registrations this year.

For the first half of 2022 (“H1 2022”), there were 8,866,479 locally-built PVs registered across the country, representing an 11% decrease from a year earlier, 5.22 percentage points lower than the drop in Jan.-May volume.

Regarding the June registrations of China-made PVs, the top three brands—Volkswagen, Toyota, and Honda—all have two joint ventures in China. BYD ranked fourth, the highest spot among China's indigenous brands. With only all-electric PVs sold, Tesla stood at the eighth spot, indicating a surging performance compared to May when the U.S. brand failed to enter the top 20 rankings. The three German luxury brands—Audi, BMW, and Mercedes-Benz—occupied the 10th to 12th places.

In terms of the PV registrations for the first six months of 2022, the top 6 brands were the same as the rankings of June registrations, all of which had over 400,000 PVs registered. Geely ranked one spot higher than Nissan. Tesla concluded the first half of the year with 198,221 Shanghai-made vehicles registered. The South Korean brand Hyundai registered the least vehicles among the top 20 brands.

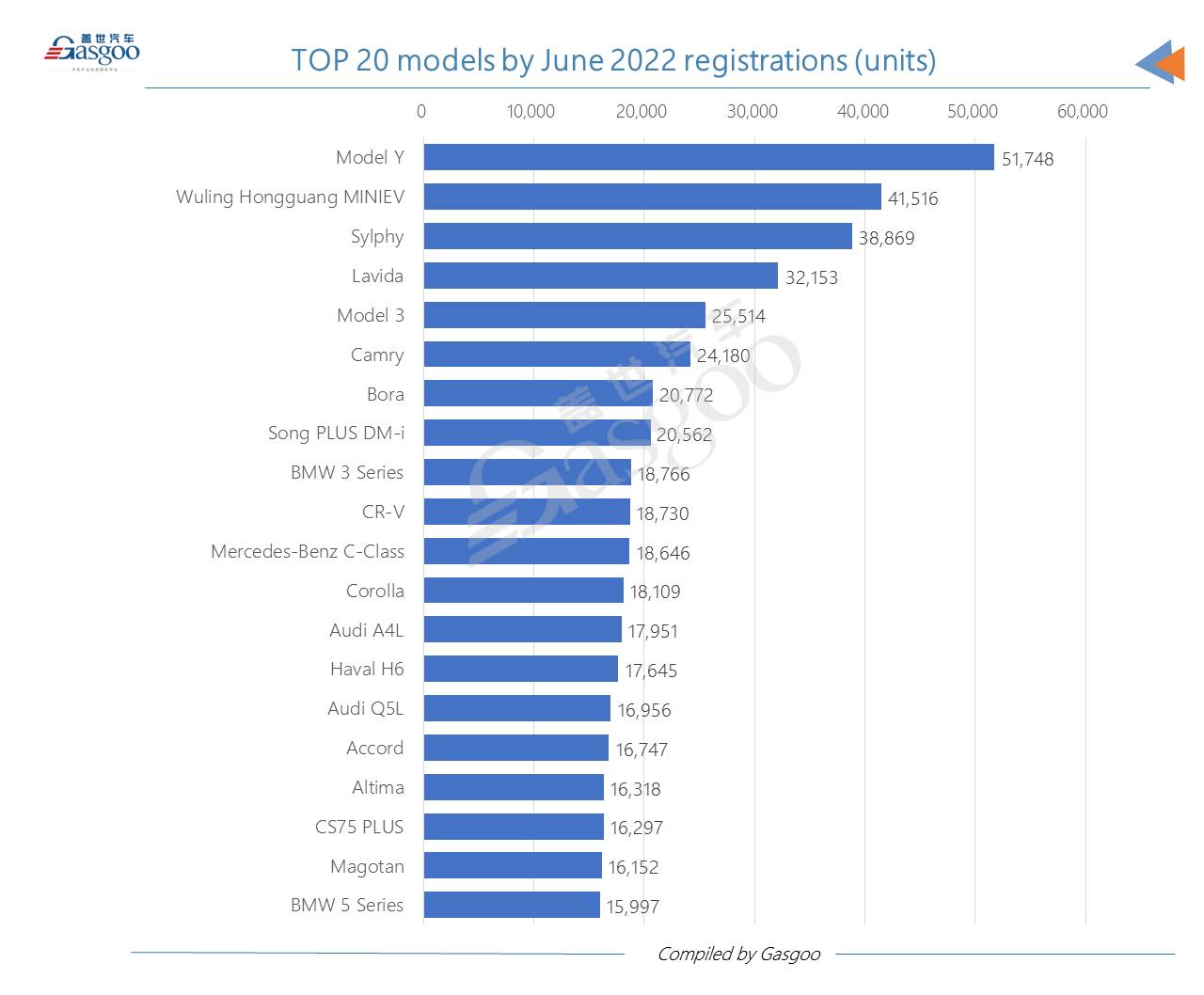

Tesla's Model Y was credited the best-selling PV model by June registrations, recording a 739% spike over the previous month.

Apart from the Model Y, there were still three new energy vehicle (“NEV”) models among the top 20 models by June registrations, including two BEVs (the Wuling Hongguang MINIEV and the Model 3) and one PHEV (the BYD Song PLUS DM-i). The highest-ranking oil-fueled model was the Sylphy from Nissan brand.

Five luxury models appeared on the top 20 models list, namely the BMW 3 Series, the Mercedes-Benz C-Class, the Audi A4L, the Audi Q5L, and the BMW 5 Series. Nevertheless, none of them had a registration volume exceeding 20,000 units in June.

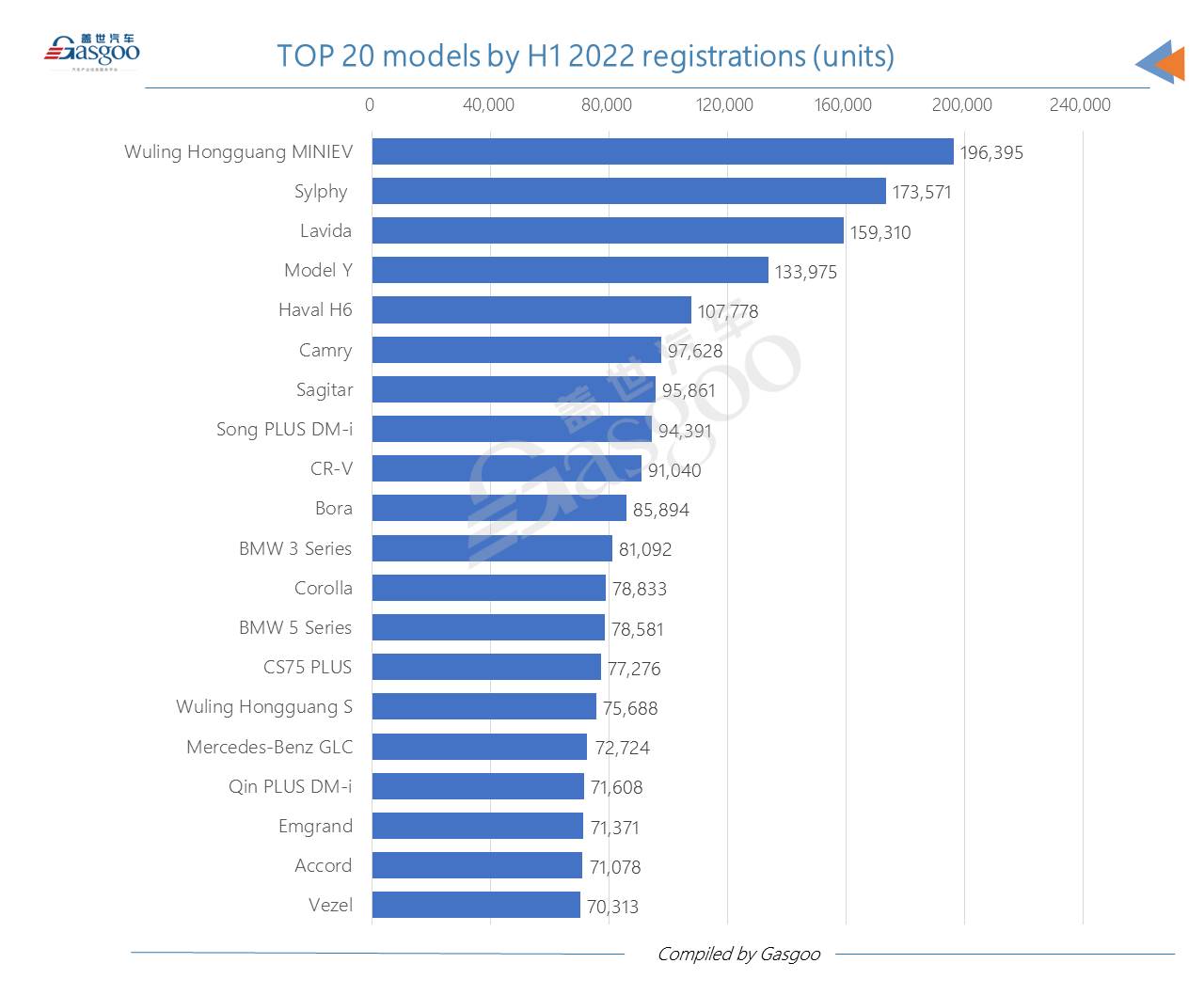

For the Jan.-Jun. period, the top 20 PV models by cumulative registrations all had over 70,000 vehicles registered. The Wuling Hongguang MINIEV was the most popular model, while the Model Y ranked 4th and was honored the hottest-selling SUV. The Haval H6 was the best-performing SUV model from a Chinese local brand. Besides, the Wuling Hongguang S was the highest-ranking MPV model.

As for the regional distribution of vehicles, Shanghai registered the most homemade PVs in June, outselling the runner-up, Chengdu, by 14,264 units.

Among the top 20 cities by June PV registrations, there were nine provincial capital cities. Aside from Shanghai, such metropolises as Beijing, Shenzhen, Chongqing, and Tianjin were all on the top 20 cities list.

The title-winning city by H1 2022 PV registrations was Chengdu. Both Guangzhou and Beijing had over 200,000 new PVs registered through the first six months. Affected by the epidemic resurgence, Shanghai only ranked 4th by the Jan.-Jun. volume.

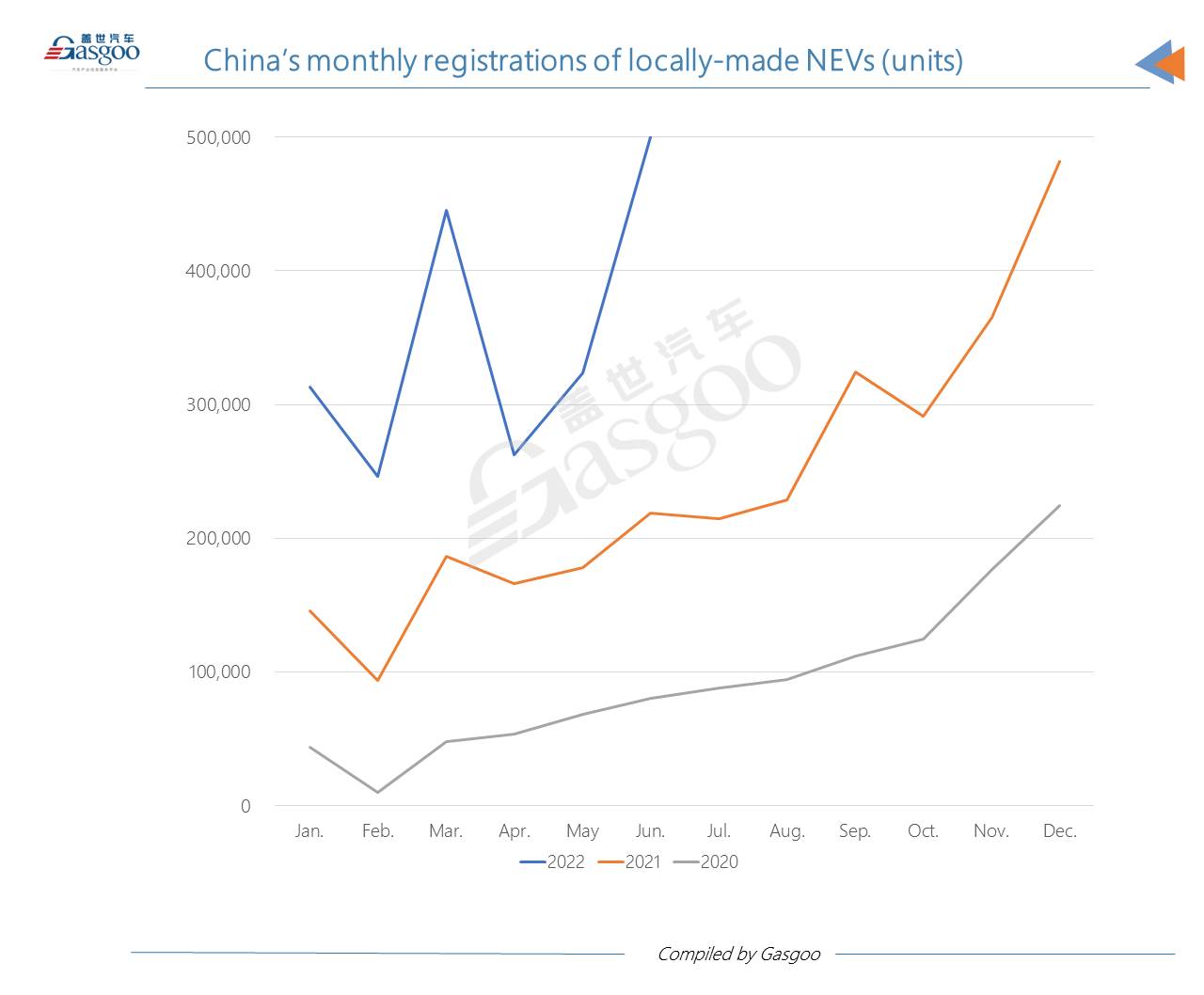

Despite the downturn in overall PV registrations, the NEV market in China still gained a 111.45% year-on-year hike in H1 2022 registrations, which stood at 2,090,047 units.

Notably, the monthly registrations of domestically built new energy passenger vehicles (“NEPV”) hit an all-time high of 500,296 units in June, for the first time surpassing 500,000 units.

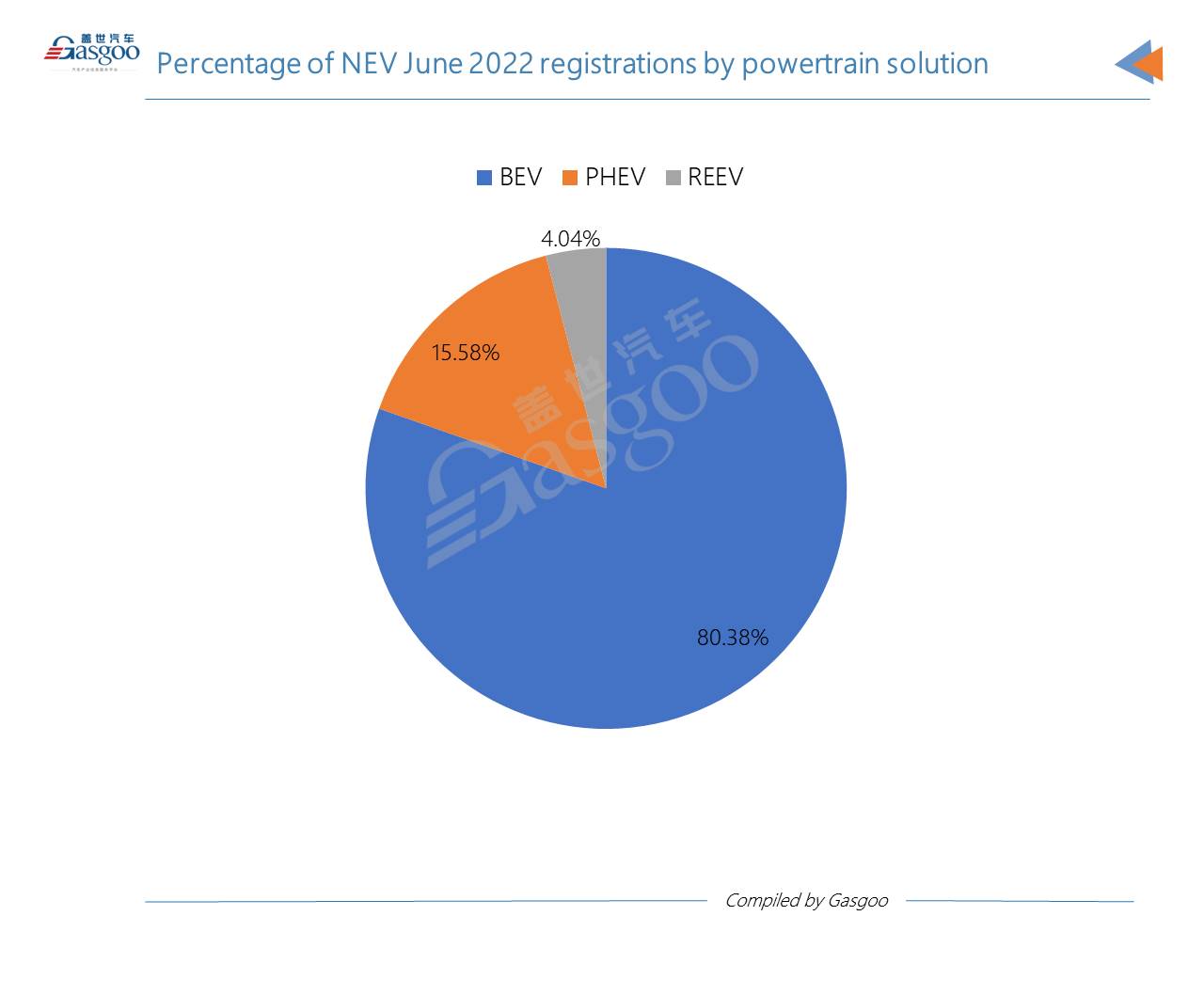

By powertrain solutions, battery-electric vehicles (“BEV”) accounted for 80.38% of the overall NEPV registrations in June. The registrations of plug-in hybrid electric vehicles (“PHEV”) amounted to 98,181 units last month, including 20,219 range-extended electric vehicles (“REEVs”).

Of the NEPVs registered in H1 2022, 78.22% and 21.78% were contributed by BEVs and PHEVs (including REEVs), respectively.

According to data compiled by GARI, there were 3 fuel-cell passenger vehicles registered in the first two quarters of this year.

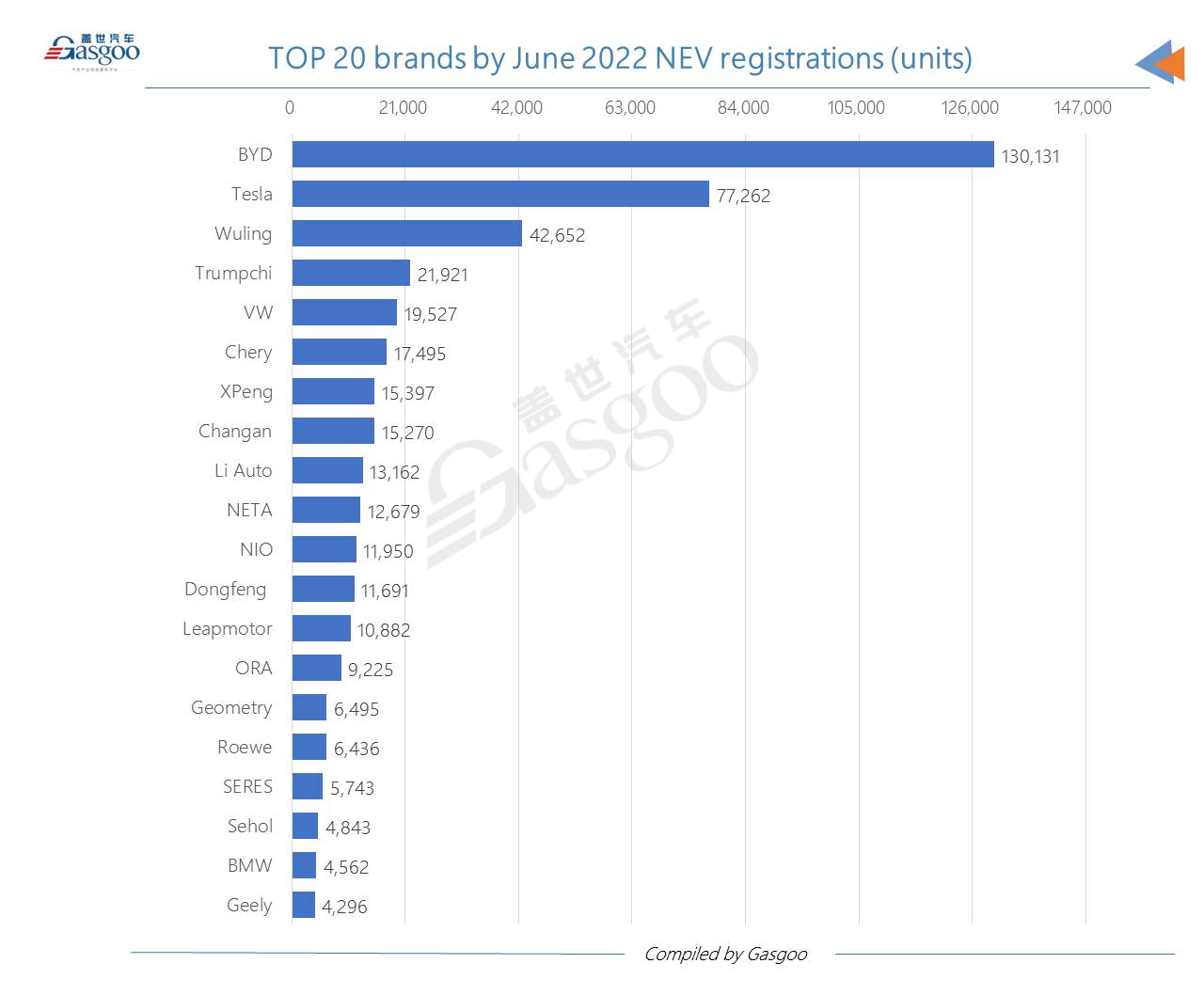

Regarding the NEPV registrations in June, BYD topped other brands with a significant lead. It had 130,131 NEPVs registered last month, which were even more than the sum of the runner-up (Tesla) and the second runner-up (Wuling).

XPeng ranked highest among Chinese NEV startups in terms of June NEPV registrations. Other main NEV innovators—Li Auto, NETA, NIO, and Leapmotor—all cracked into the top 20 brands list with over 10,000 vehicles registered.

BYD's leading presence in China's NEV market was also reflected by its H1 2022 NEPV registrations. China's indigenous brands, such as Wuling, Chery, and Trumpchi (including AION), all entered the top 5 brand rankings by Jan.-Jun. NEPV registrations.

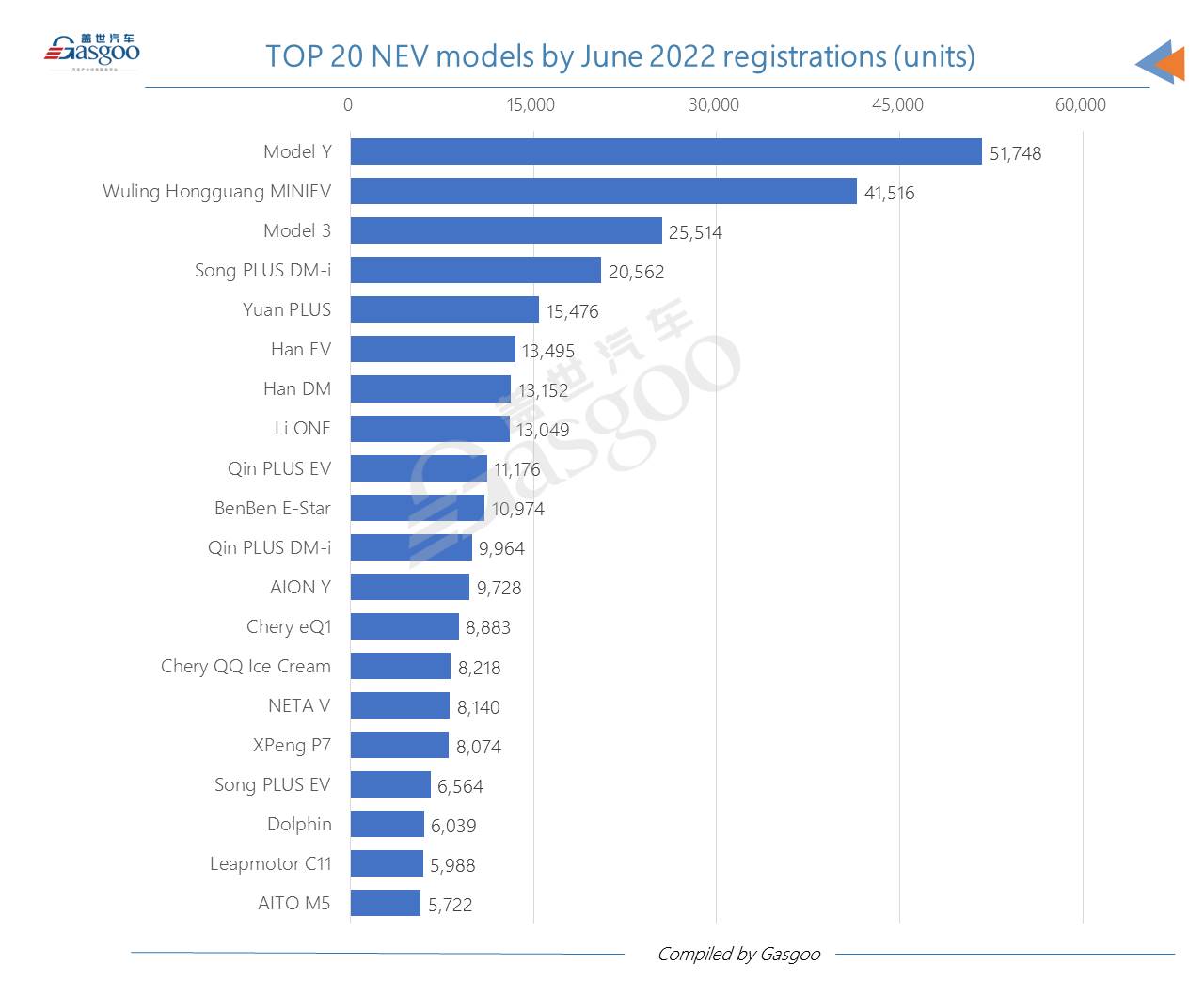

With respect to June registrations, both the Model Y and the Model 3 gained a seat among the top 3 NEPV models. The Wuling Hongguang MINIEV dropped to the runner-up place with 41,516 units registered.

BYD had eight models on the top 20 NEPV models list by June registrations. The company's rich product portfolio greatly contributed to its leading position in the NEV sector.

In terms of H1 2022 registrations, the affordable Wuling Hongguang MINIEV was crowned the best-selling NEPV model. Moreover, four models from Chinese NEV startups—the Li ONE, the NETA V, the XPeng P7, and the Leapmotor T03—came into the top 20 NEPV models list.

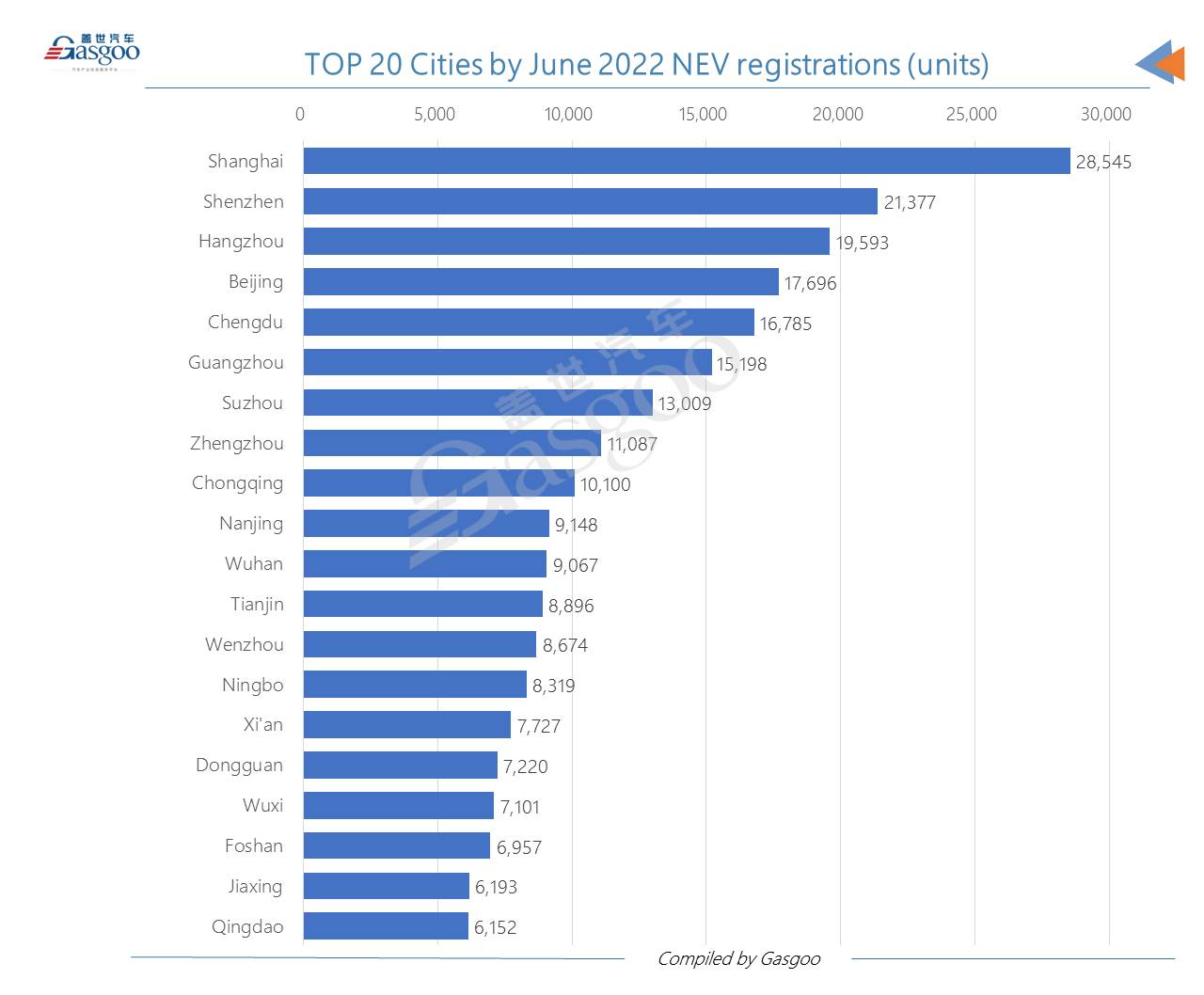

Shanghai and Shenzhen were the only two cities whose June NEPV registrations exceeded 20,000 units. Notably, NEVs accounted for up to 47% of Shanghai's PV registrations in June.

In H1 2022, there were five cities with over 60,000 NEPVs registered. Shenzhen and Shanghai also outperformed other cities with their Jan.-Jun. registrations both exceeding 80,000 units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com