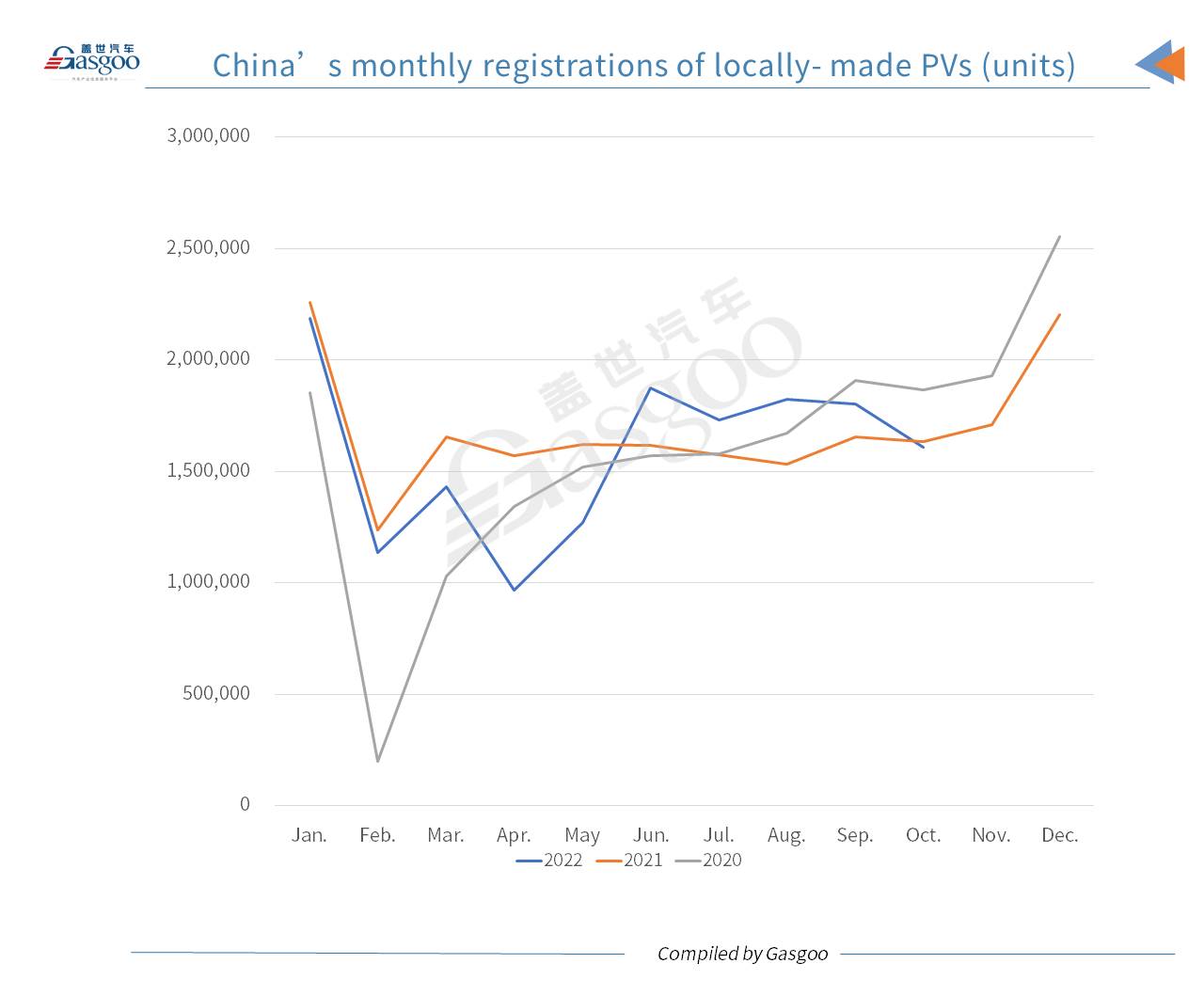

China's monthly registrations of locally-made passenger vehicles ("PVs") reached 1,606,383 units in Oct. 2022, edging down 1.75% from the previous year, while also dipping 10.98% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

For the first ten months of 2022, there were 15,830,338 domestically built PVs registered across the Chinese mainland, representing a 3.22% decrease from a year earlier, 0.17 percentage points fewer than the drop in the Jan.-Sept. volume.

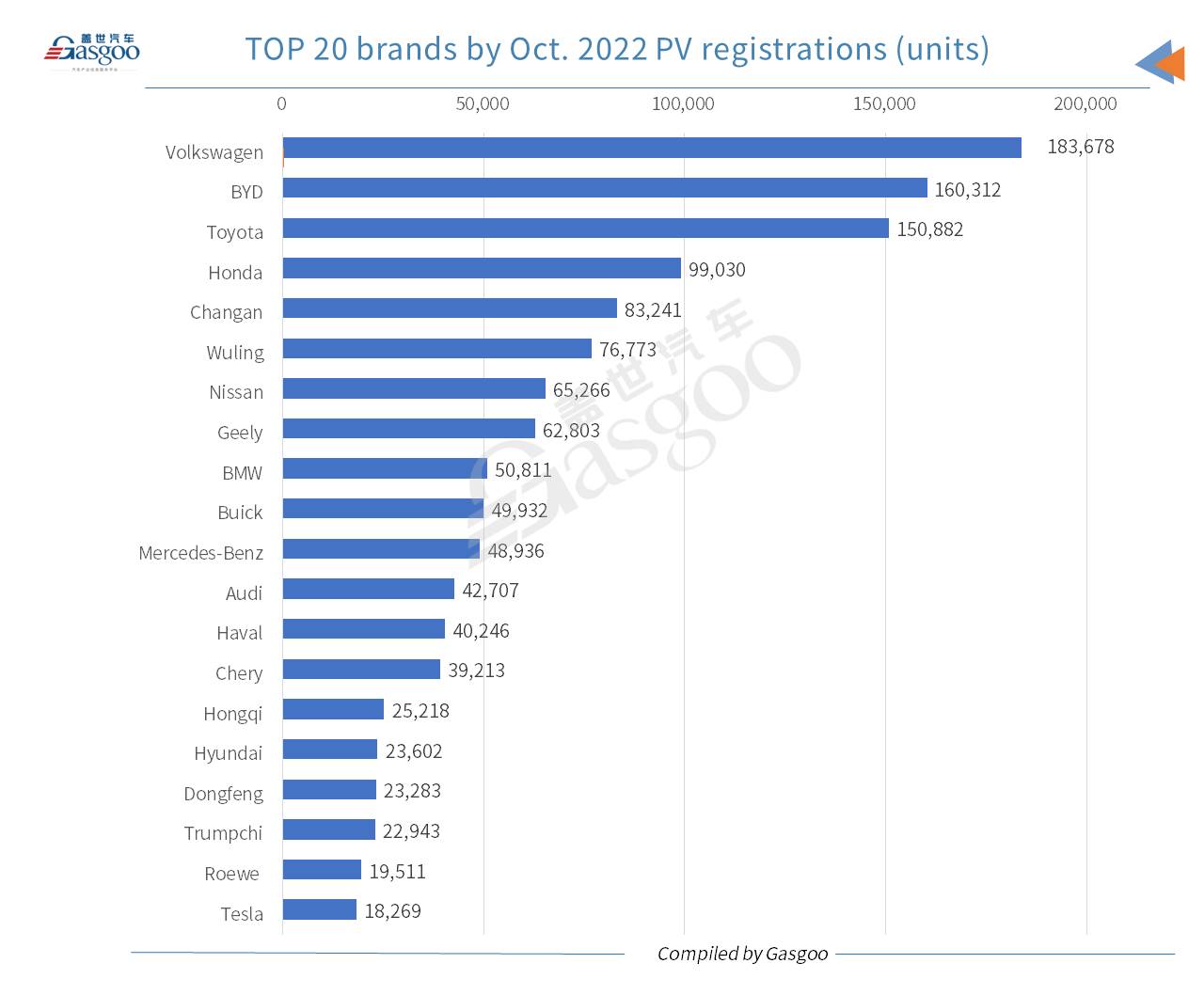

Regarding the Oct. registrations of China-made PVs, Volkswagen, BYD, and Toyota outshone other brands with their registrations all exceeding 100,000 units, of which BYD was still the highest-ranking local brand of China. Compared to the previous-month rankings, Tesla dropped 14 spots to the 20th with only full-electric vehicles registered. The three German luxury brands—BMW, Mercedes-Benz, and Audi—ranked 9th, 11th, and 12th, respectively.

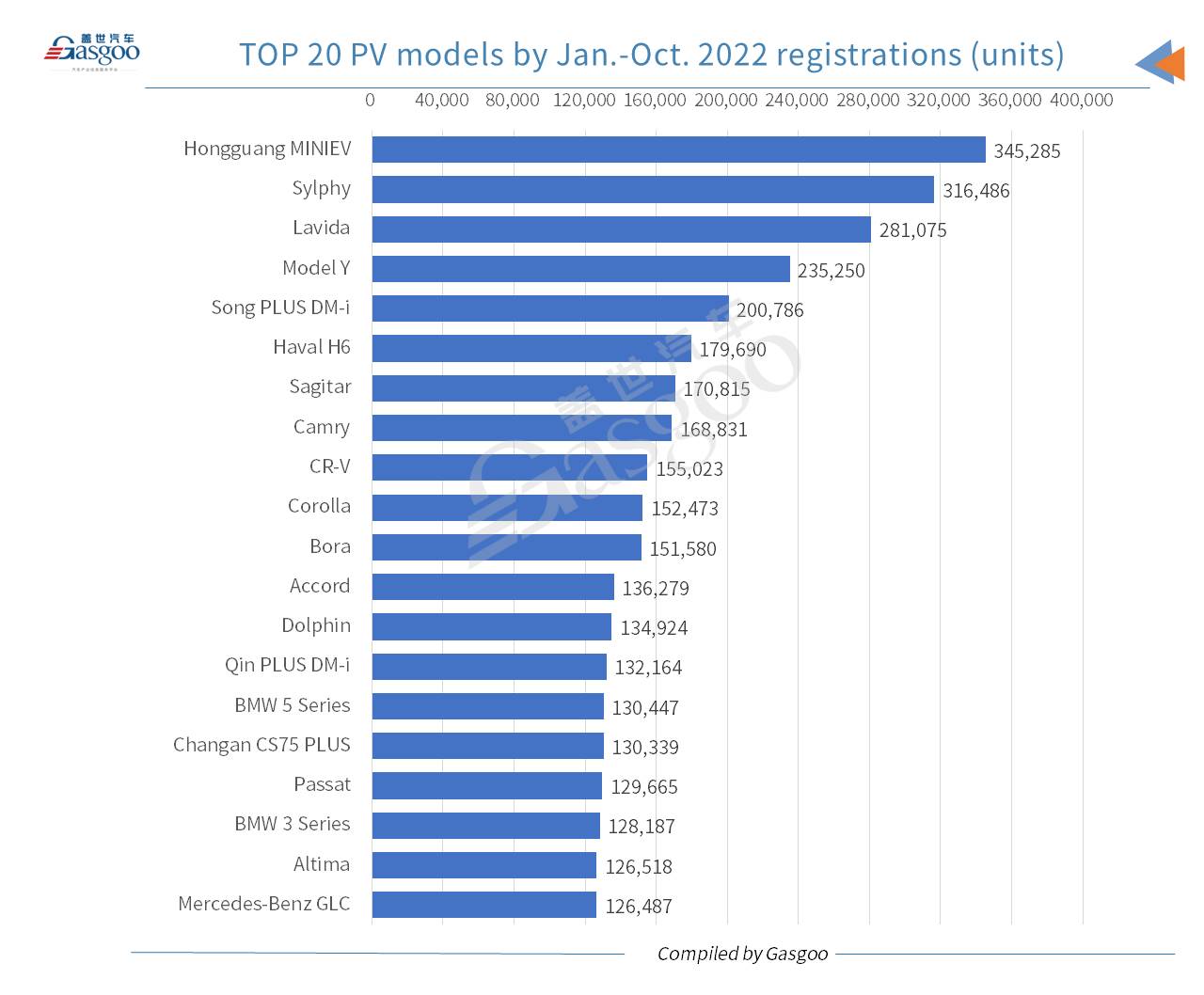

The Wuling Hongguang MINIEV moved up one spot from Sept. to be the best-performing PV model by Oct. registrations. The Tesla Model Y slid 11 spots from the previous month to the 12th place. BYD had five models on the top 20 models list, including four plug-in hybrid electric vehicle (PHEV) models. The BYD Song PLUS DM-i and the Haval H6 were the top 2 SUV models.

Regarding the Jan.-Oct. registrations, the top 12 PV models were the same as that of the rankings by Jan.-Sept. registrations. The Hongguang MINIEV and the Sylphy were the only two models with over 300,000 units registered in the Jan.-Oct. period each. Besides, three models under German luxury brands—the BMW 5 Series, the BMW 3 Series, the Mercedes-Benz GLC, were included in the top 20 models list.

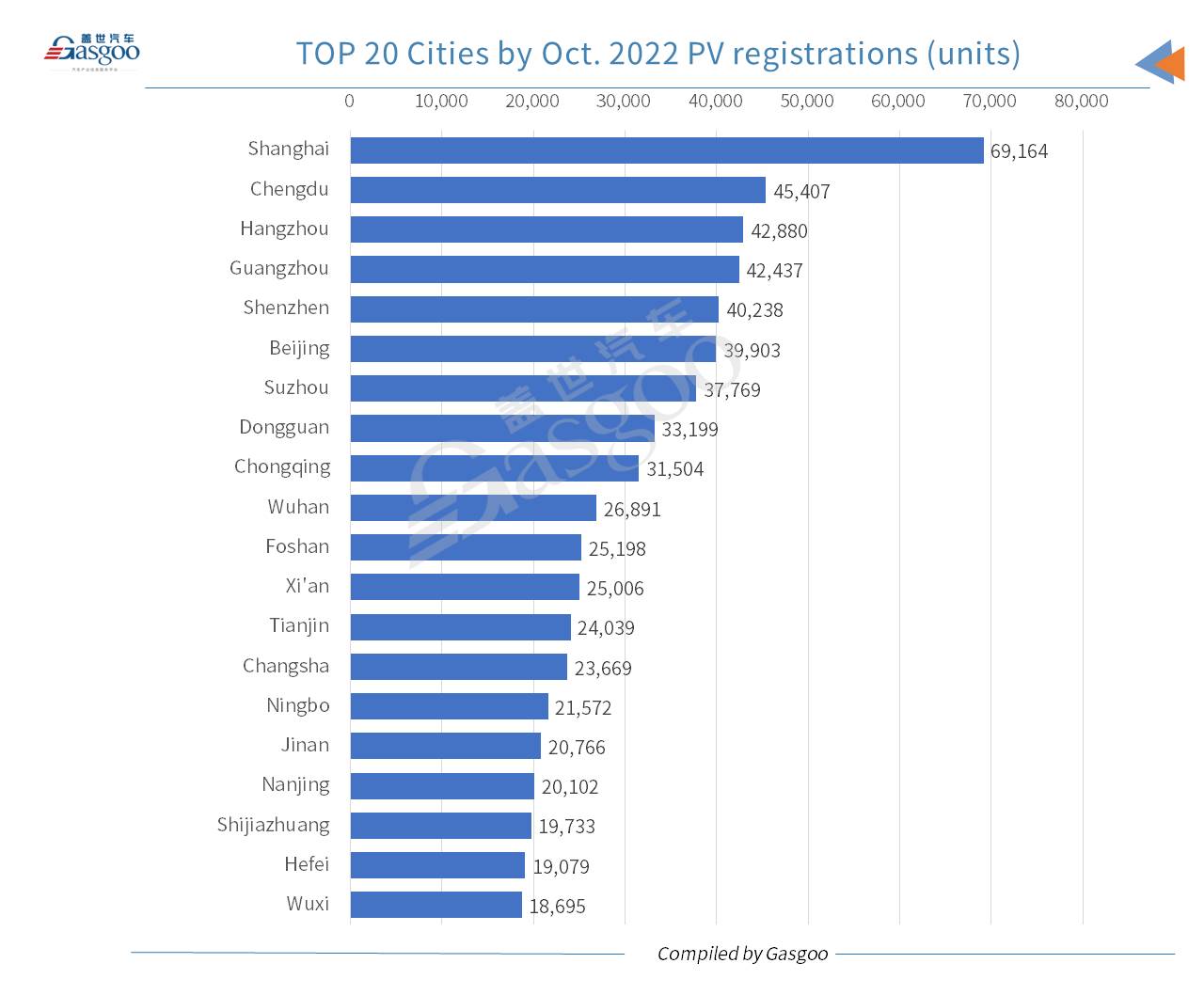

Regarding regional distribution in Oct., Shanghai still registered the most homemade PVs, outselling the runner-up, Chengdu, by 23,757 units. Compared to the previous month, Beijing fell four spots to the sixth place. Hangzhou, Guangzhou, and Shenzhen ranked third, fourth, and fifth, respectively.

Among the top 20 cities by Oct. PV registrations, there were 10 provincial capitals. Such metropolises as Chongqing and Tianjin were all on the top 20 cities list.

The top-ranking city by Jan.-Oct. 2022 PV registrations was still Shanghai. The top 5 cities all recorded a Jan.-Oct. registration volume above 400,000 units.

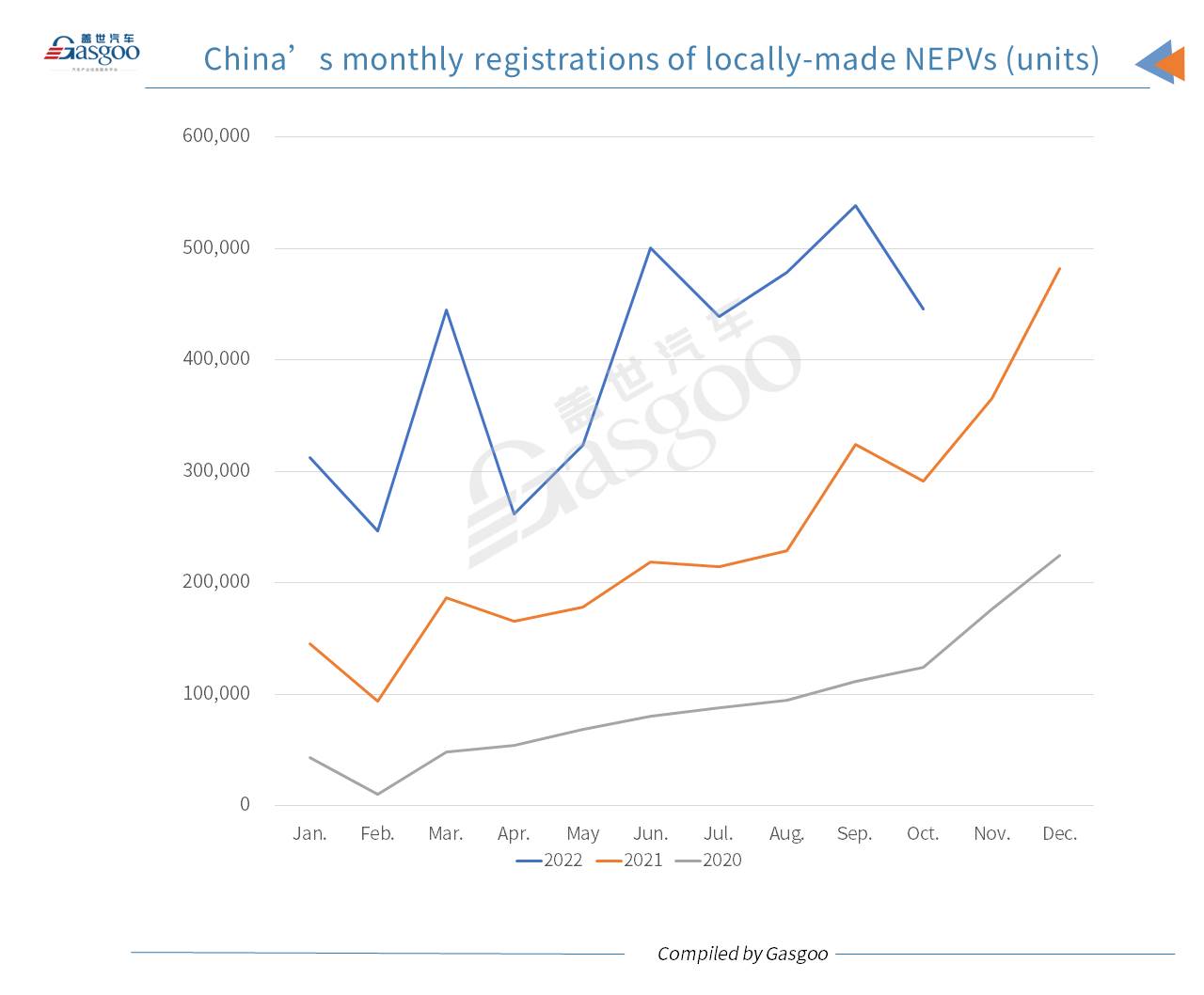

In Oct., China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 445,869 units, shrinking 17.25% from the previous month, while still surging 53.12% over a year ago.

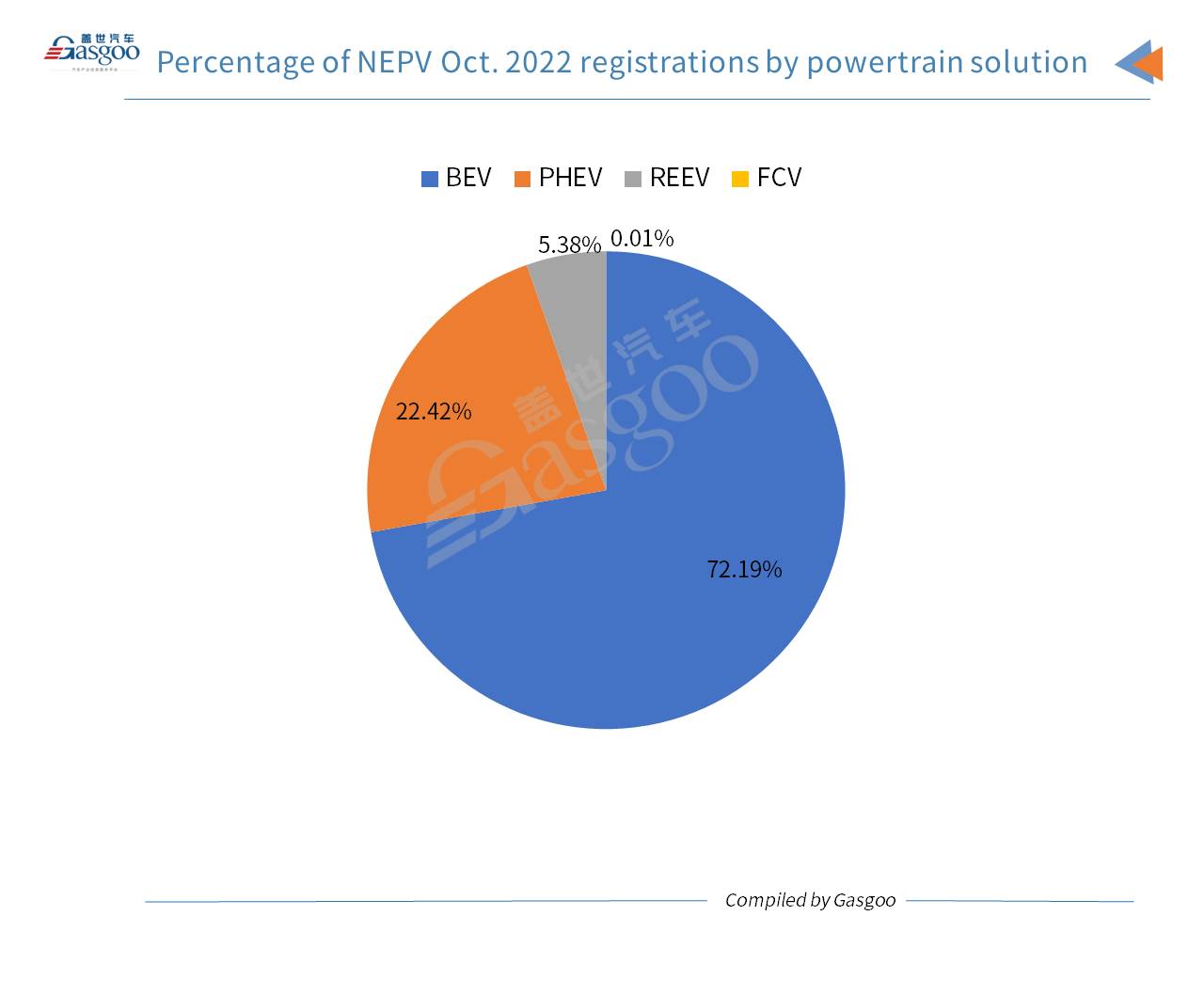

By specific powertrain solutions, BEVs posted a registration volume of 321,873 units in Oct., accounting for 72.19% of the country's total NEPV registrations. The PHEV registrations reached 123,953 units (including 24,003 REEVs).

Notably, there were 43 fuel cell vehicles registered across the Chinese mainland last month.

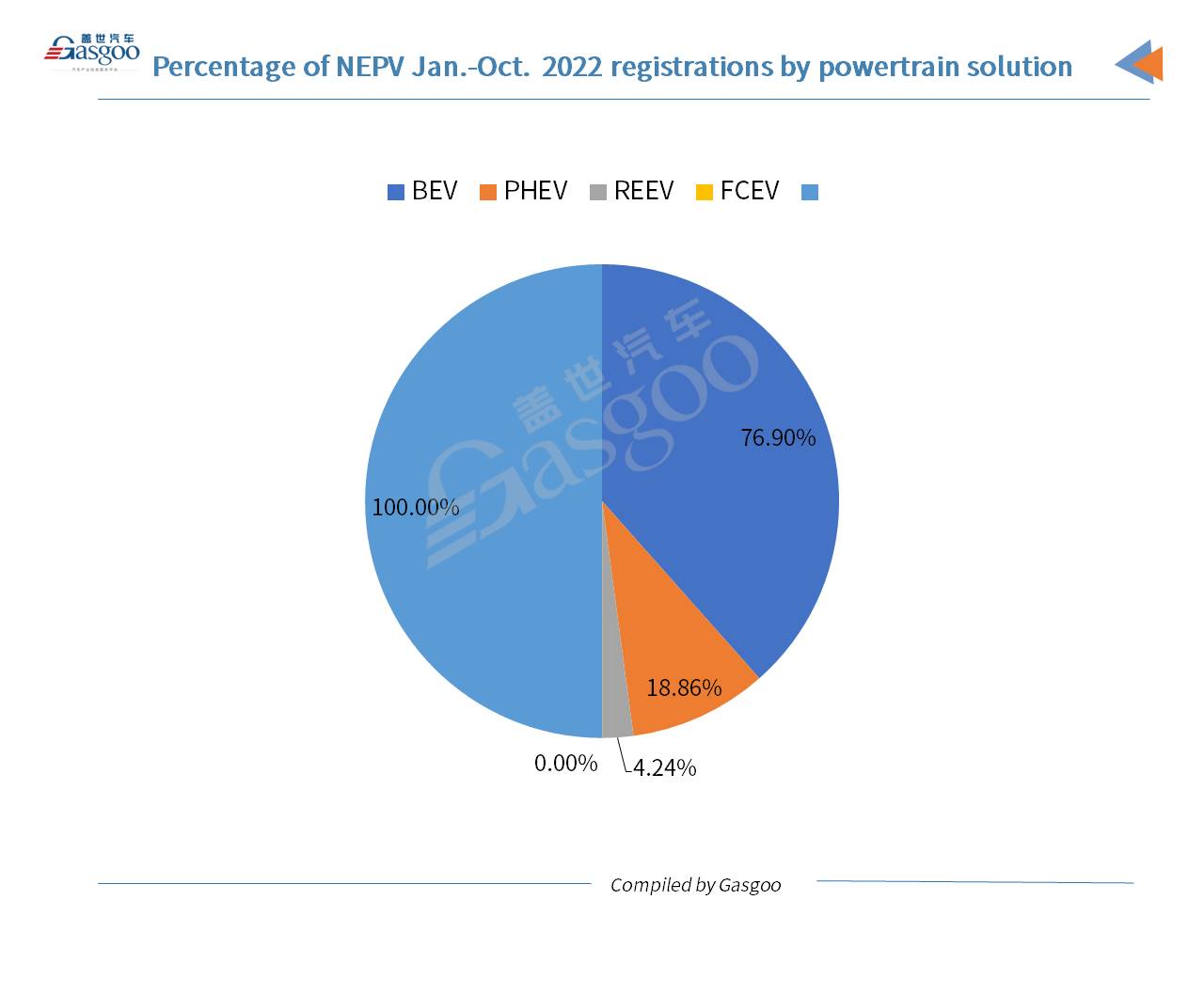

Of the NEPVs registered in the first ten months of 2022, 76.9% and 23.1% were contributed by BEVs and PHEVs (including REEVs), respectively.

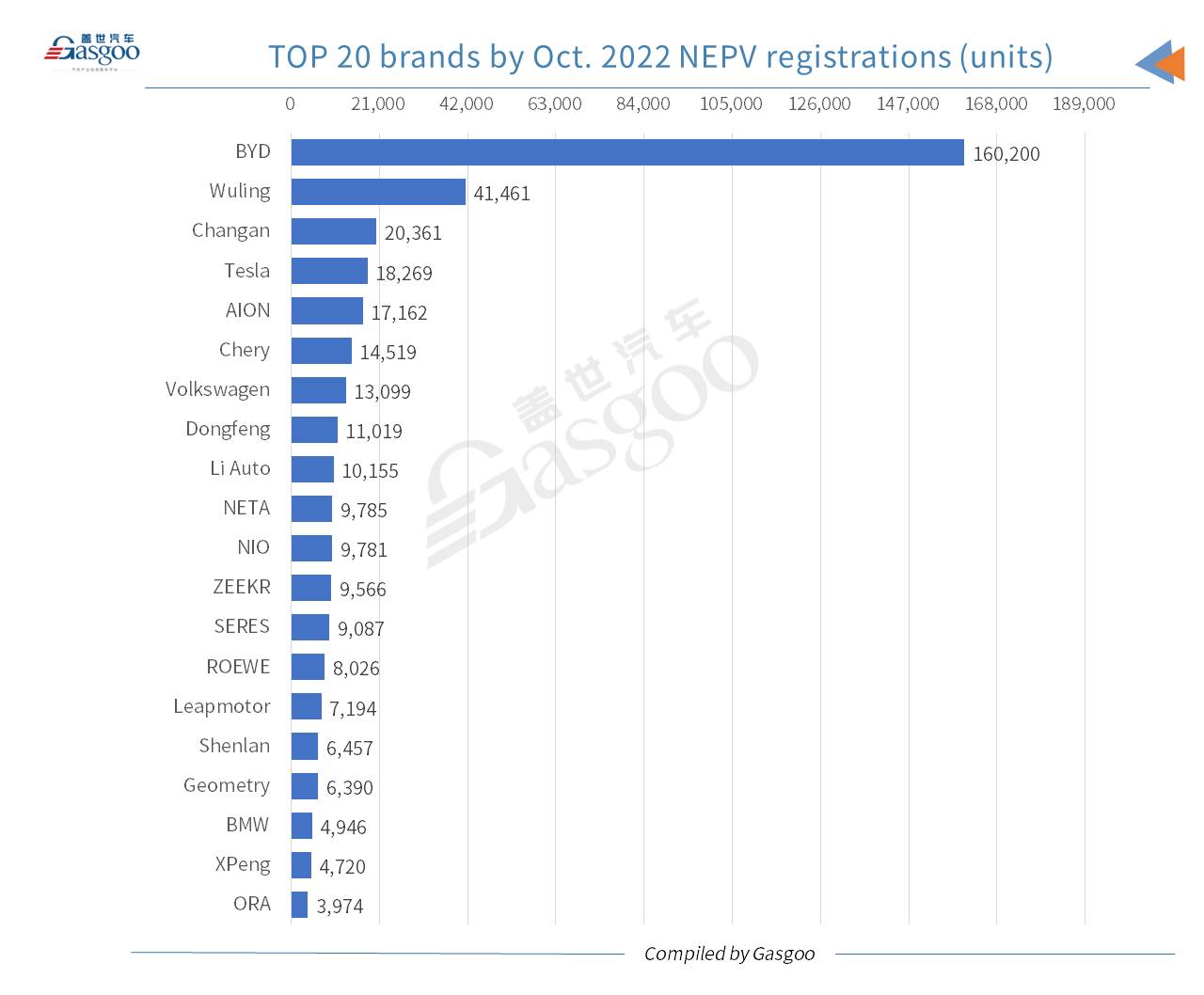

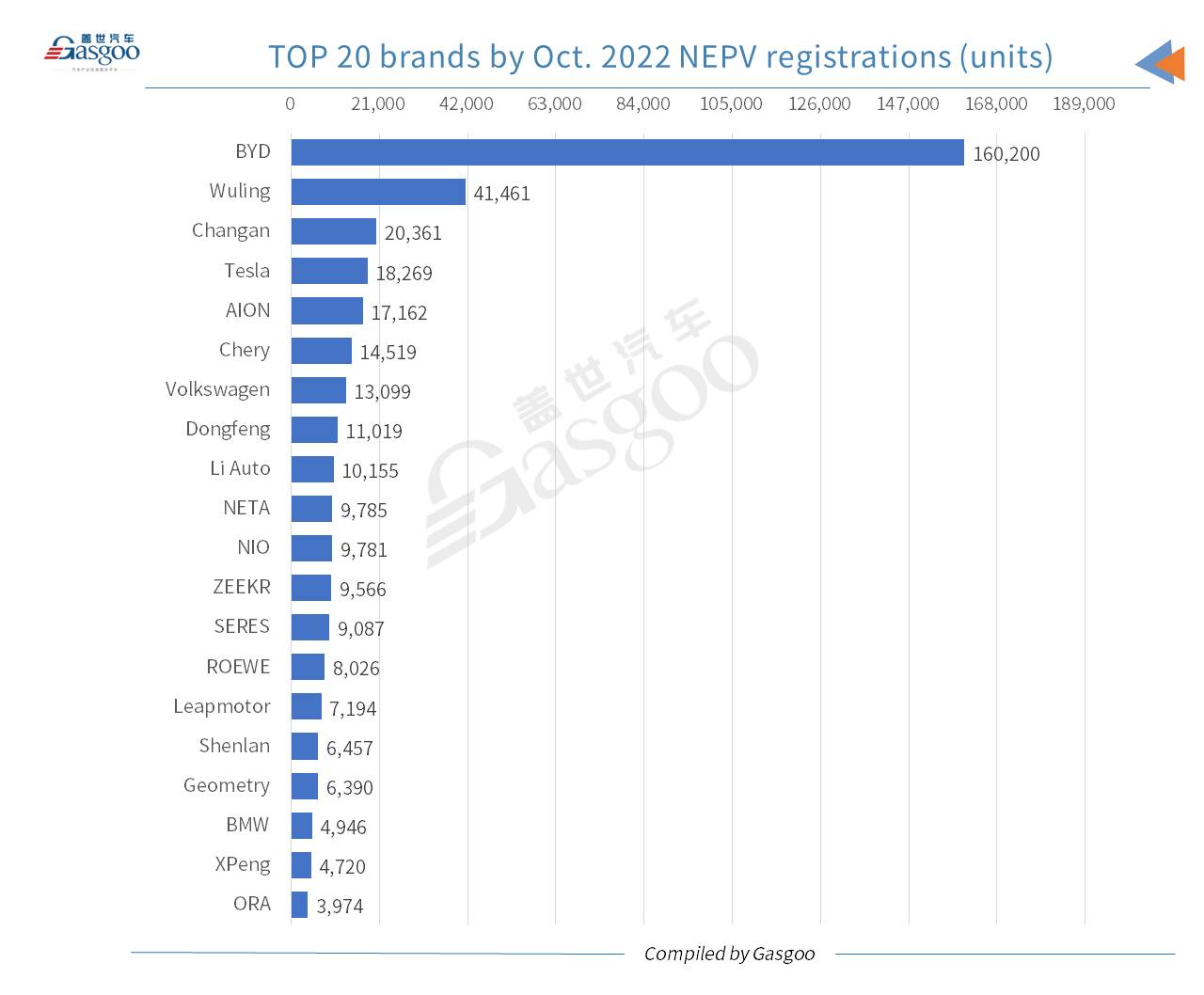

Regarding the NEPV registrations in Oct., BYD was streets ahead of other brands. It had 160,200 NEPVs registered last month, which were even more than the sum of the No.2-No.10 occupants.

Volkswagen ranked 7th with 13,099 NEPVs registered last month, 73.2% of which were contributed by its ID. series. Li Auto had 10,155 vehicles registered in Oct., outselling the likes of NETA, NIO, Leapmotor, and XPeng.

With respect to Oct. registrations, the Hongguang MINIEV outperformed other NEPV models. On the top 20 NEPV models list, there were eleven from BYD brand, six of which entered the top 10 rankings. The Li L9 features the highest Oct. registrations among those under Chinese NEV start-up brands.

In terms of Jan.-Oct. 2022 registrations, both the Model Y and the Model 3 were included by the rankings of the top 10 NEPV models. BYD gained nine seats on the top 20 NEPV models list.

Shanghai were the only city whose NEPV registrations exceeded 30,000 units in Oct. Notably, NEPVs accounted for up to 46.12% of Shanghai's PV registrations in the month. Both Hangzhou and Shenzhen recorded an NEPV registration volume of over 18,000 units last month.

In Jan.-Oct. 2022, there were six cities with over 100,000 NEPVs registered each, of which the first three cities—Shanghai, Shenzhen, Hangzhou—saw their respective NEPV registrations exceed 150,000 units.