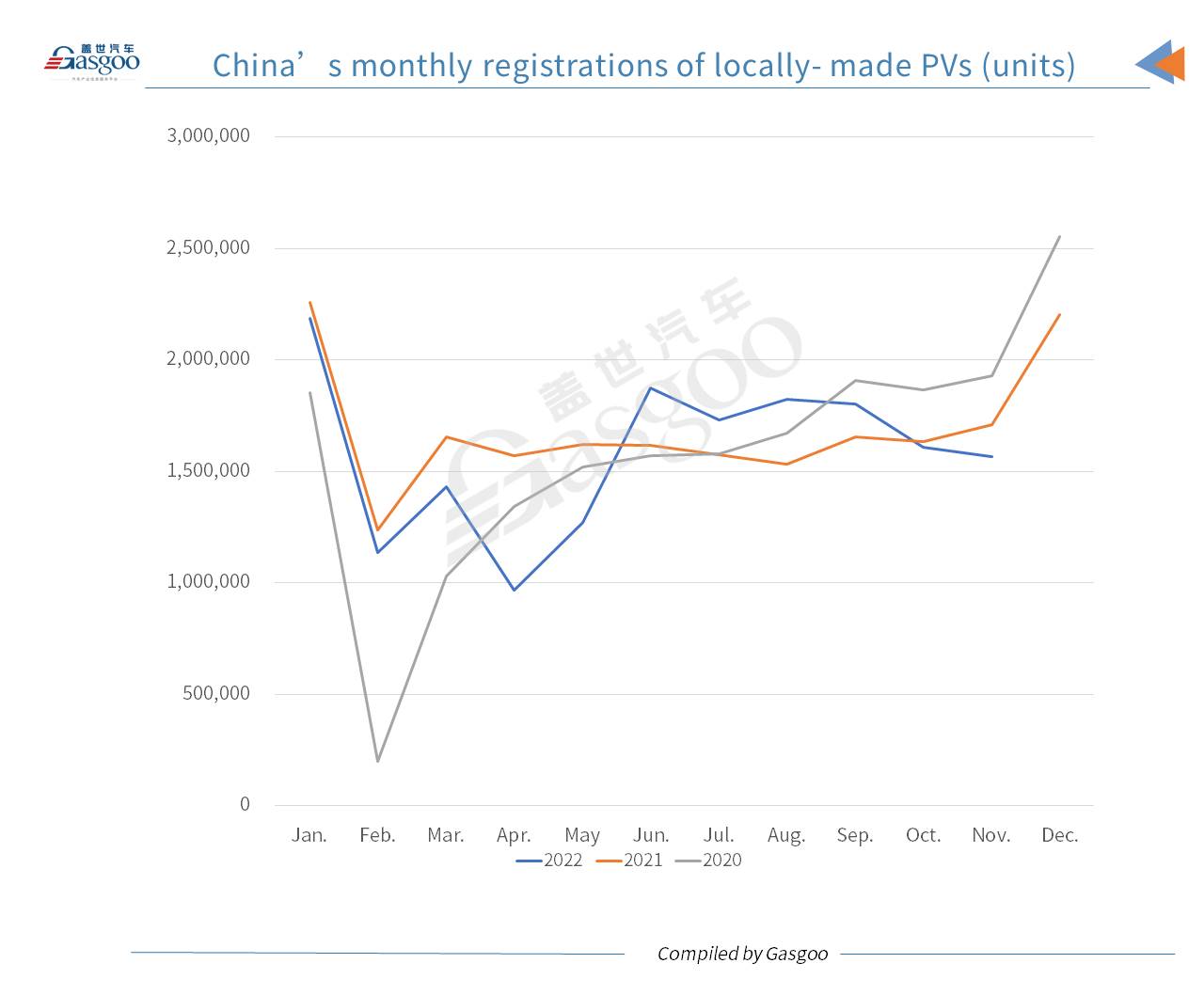

China's monthly registrations of locally-made passenger vehicles ("PVs") reached 1,567,358 units in Nov. 2022, falling 8.33% from the previous year, while also dipping 2.43% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

For the first eleven months of 2022, there were 17,397,696 domestically built PVs registered across the Chinese mainland, representing a 3.71% decrease from a year earlier, 0.49 percentage points higher than the drop in the Jan.-Oct. volume.

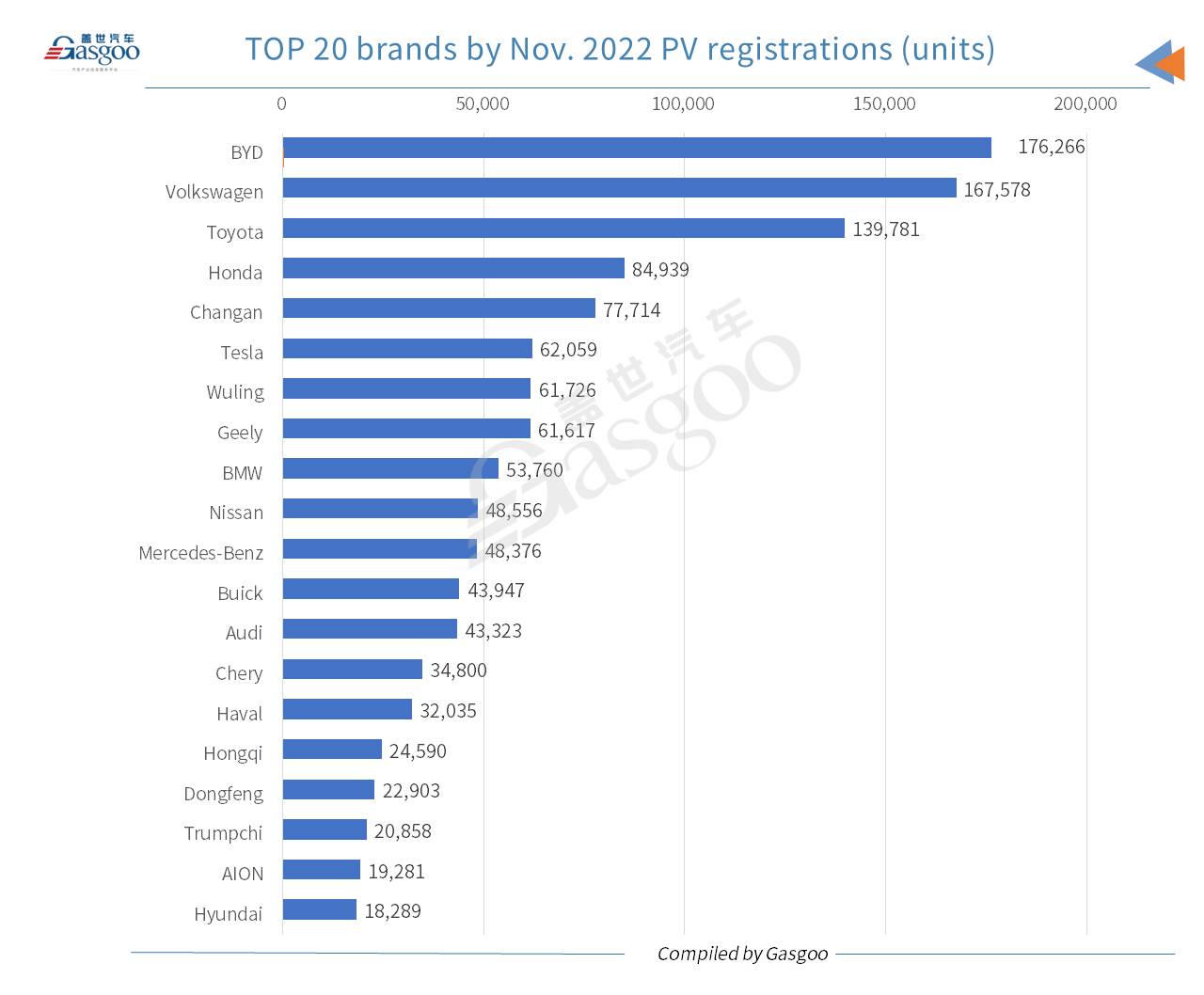

Regarding the Nov. registrations of China-made PVs, BYD, Volkswagen, and Toyota outshone other brands with their registrations all topping 100,000 units. It would be remiss not to mention that BYD transcended Volkswagen to the highest place. The Chinese indigenous NEV-focused brand is continuously refreshing its monthly sales record, injecting major impetus to the growth of China's self-owned brands.

Compared to the previous-month rankings, Tesla moved up 14 spots to the 6th. With only battery-electric vehicles (BEV) registered, AION climbed to the 19th. The three German luxury brands—BMW, Mercedes-Benz, and Audi—ranked 9th, 11th, and 13th, respectively.

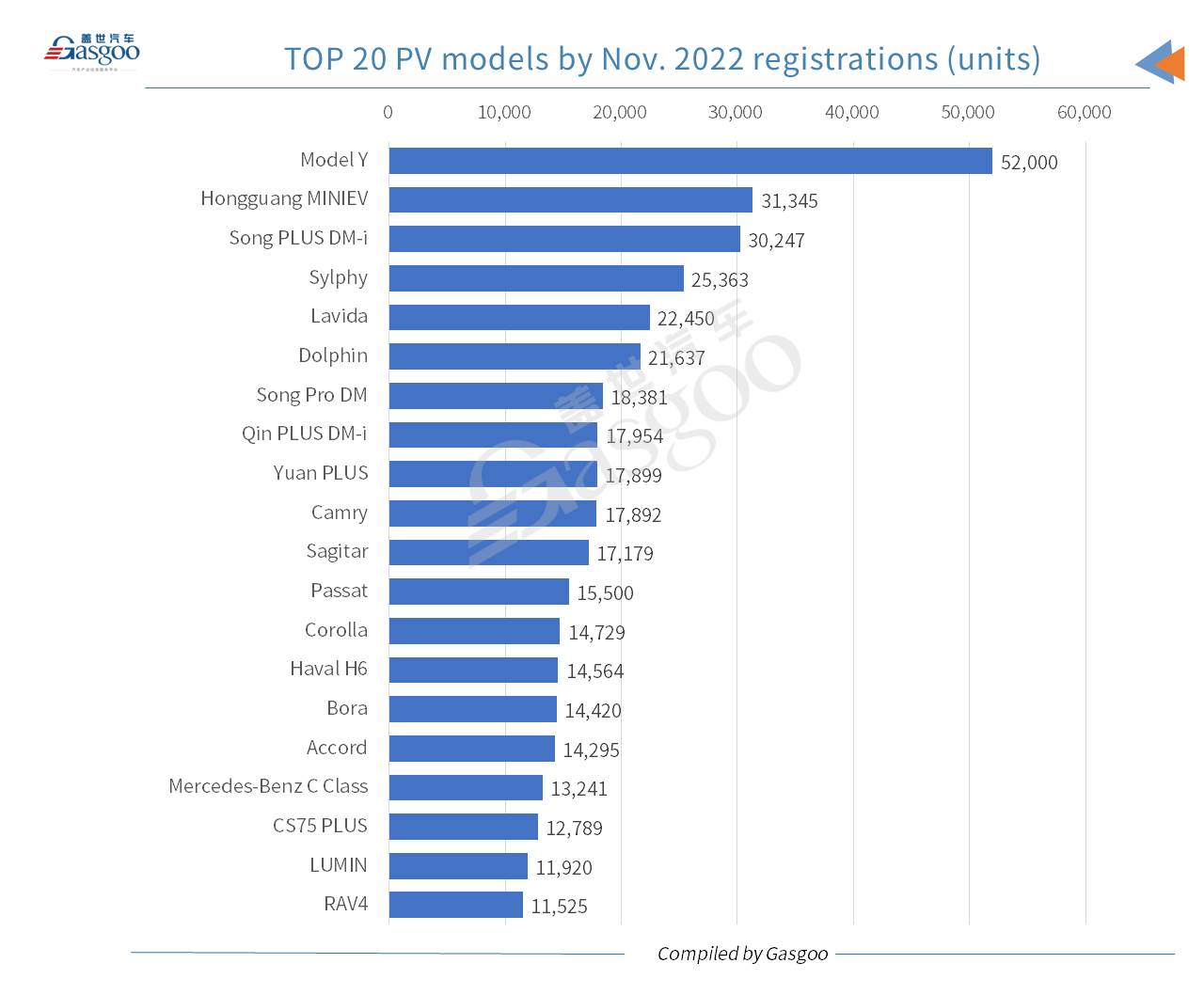

In Nov., Tesla's Model Y was honored the best-performing locally-made PV model in China with 52,000 units registered, 20,655 units more than that of the runner-up, the Wuling Hongguang MINIEV. On the top 10 PV models list by Nov. registrations, five were under BYD brand, including three PHEV (plug-in hybrid electric vehicle) models and two BEV models. The Nissan Sylphy was the highest-ranking oil-fueled model. In addition, Changan Auto's LUMIN all-electric car entered the rankings of top 20 PV models, standing at the 19th place.

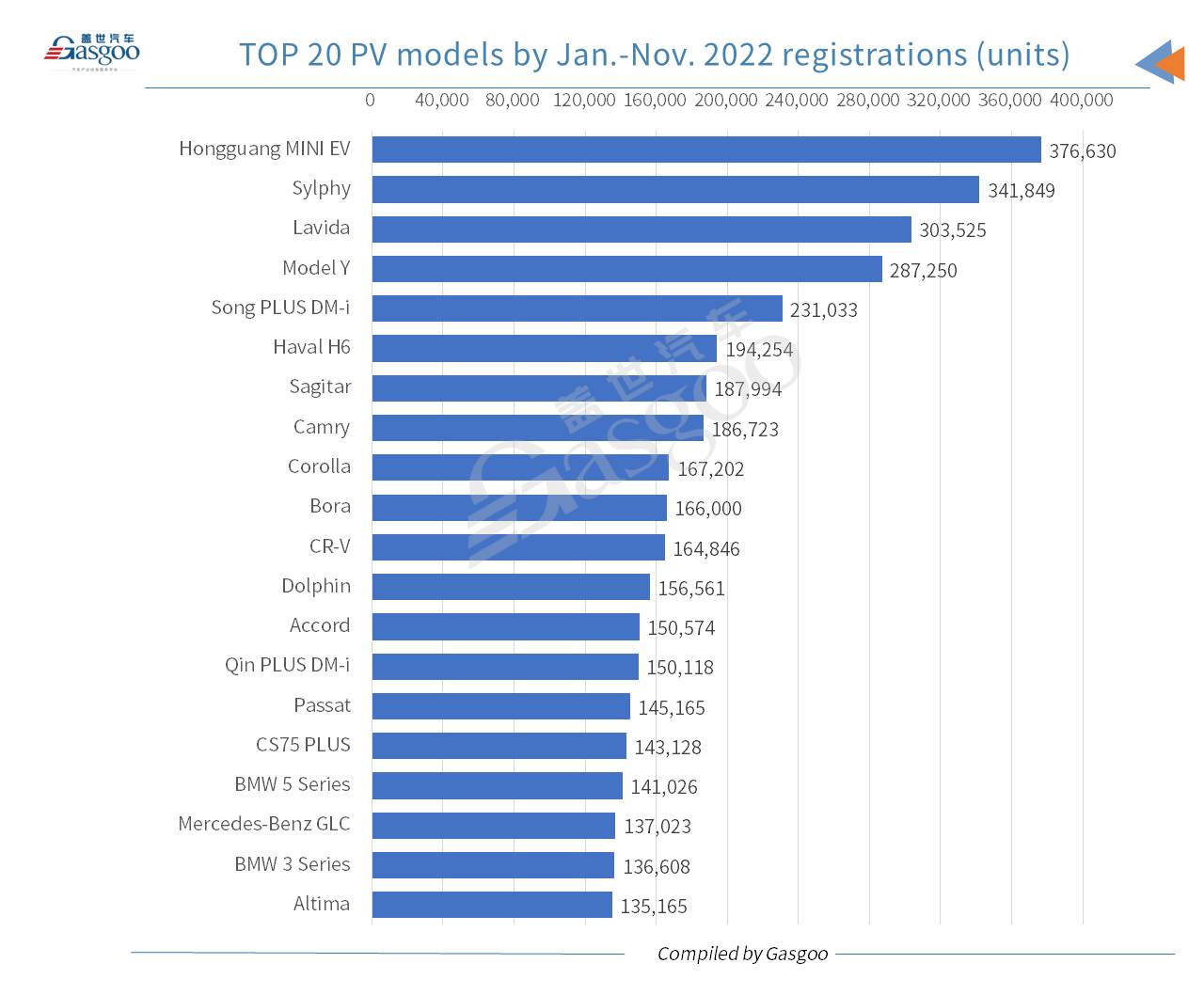

The Hongguang MINIEV, the Sylphy, and the Lavida were the only three PV models with over 300,000 units registered across the first eleven months of 2022. Besides, three models under German luxury brands—the BMW 5 Series, the Mercedes-Benz GLC, and the BMW 3 Series—were included on the top 20 models list by the Jan.-Nov. registrations.

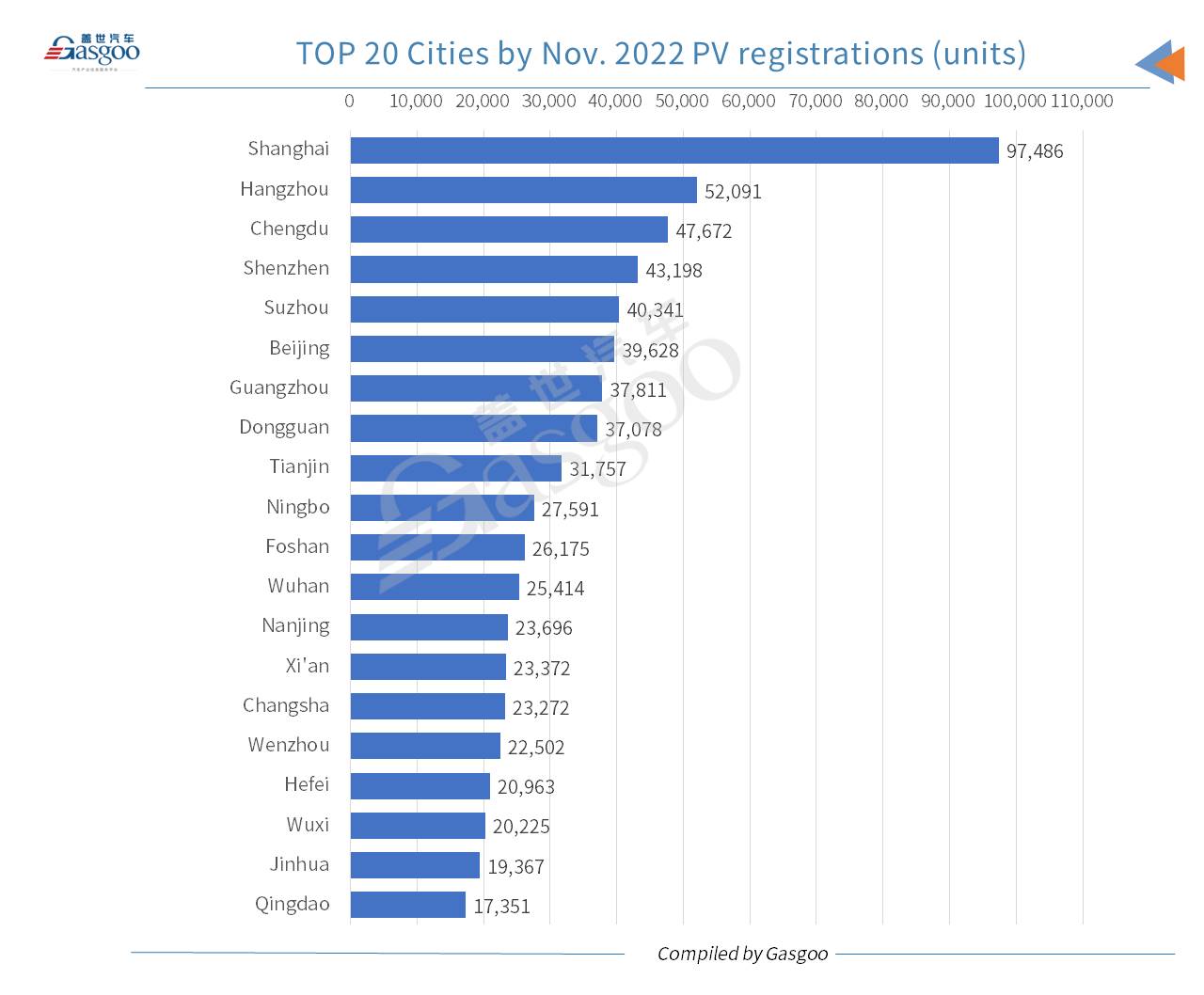

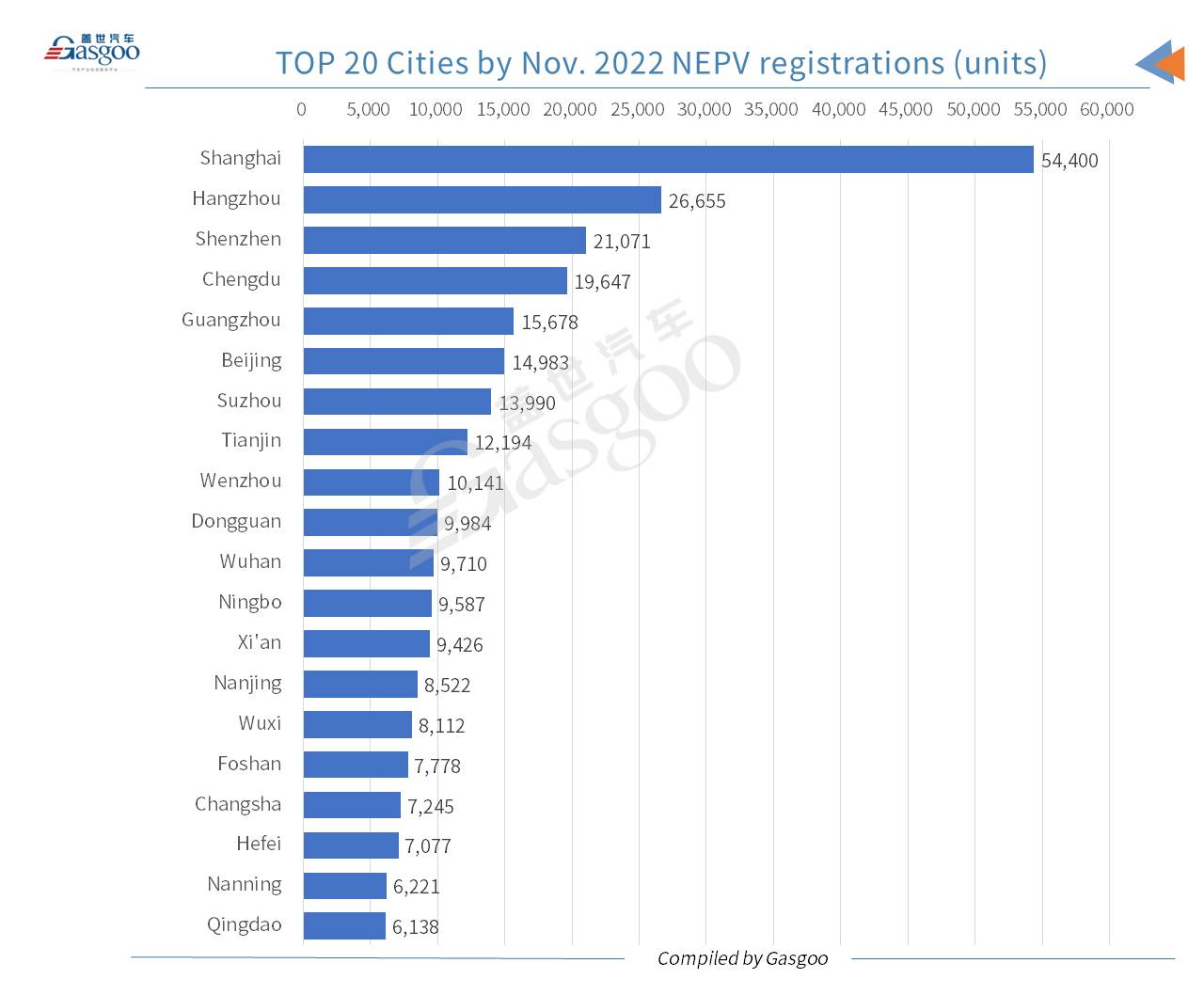

Regarding regional distribution in Nov., Shanghai still registered the most locally-built PVs, outselling the runner-up, Hangzhou, by 45,395 units. Chengdu dropped one spot from the previous month to the third place in Nov. The three metropolises, namely, Shenzhen, Beijing, and Guangzhou, ranked fourth, sixth, and seventh, respectively.

Among the top 20 cities by Nov. PV registrations, there were eight provincial capitals, two cities fewer than Oct.

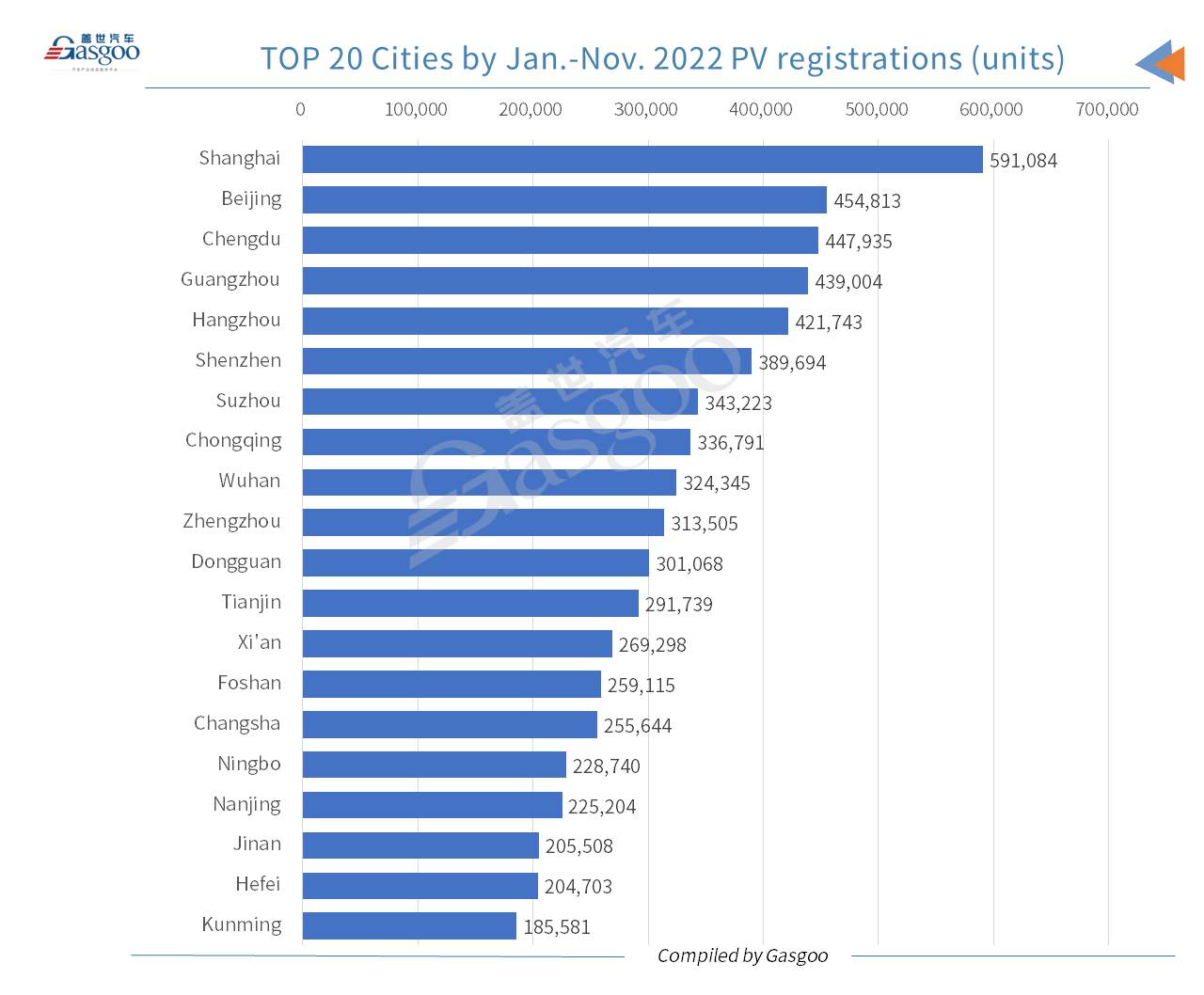

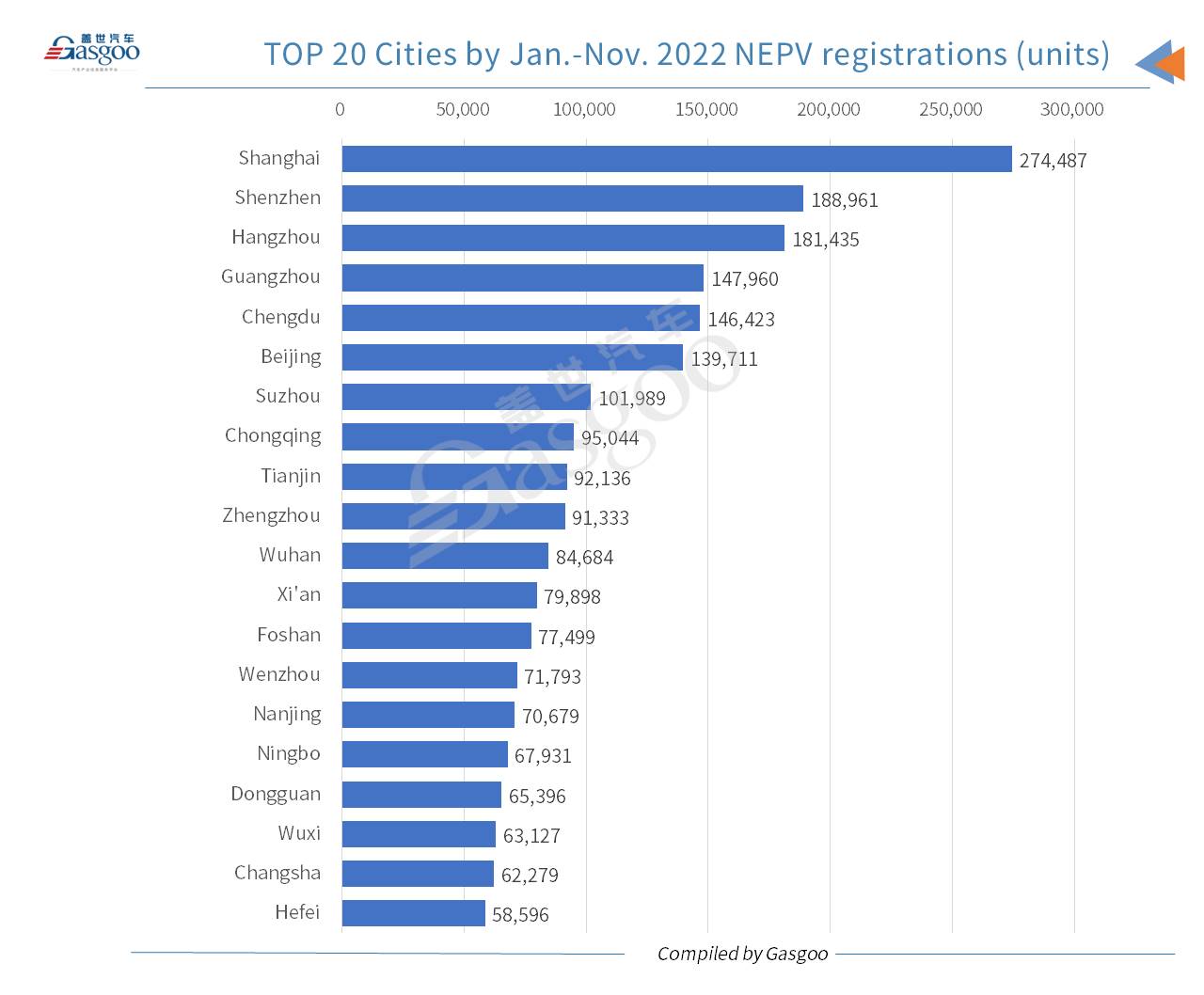

The top-ranking city by Jan.-Nov. 2022 PV registrations was still Shanghai. The top 5 cities all recorded a Jan.-Nov. registration volume above 400,000 units.

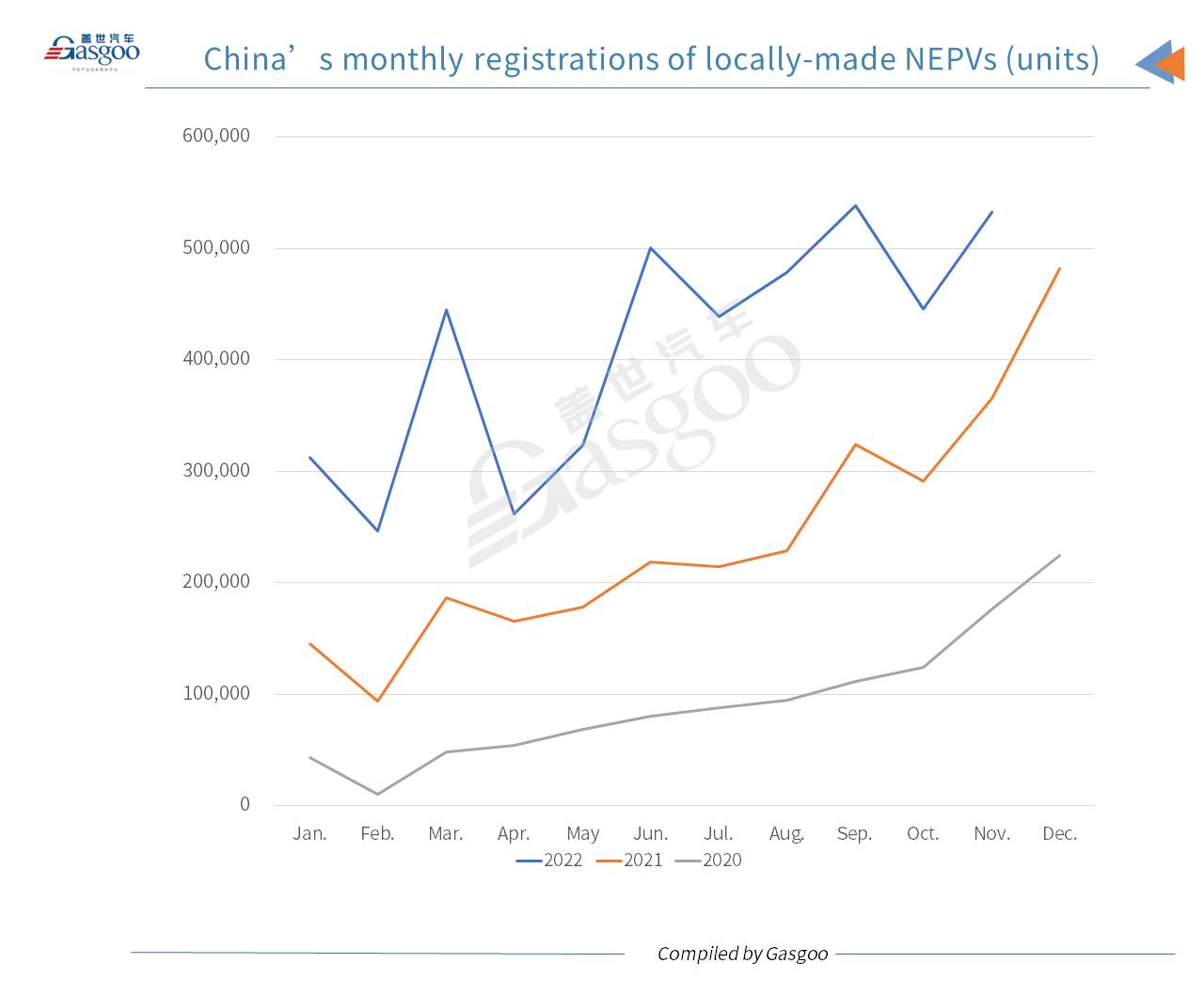

In Nov., China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 532,401 units, surging 45.74% from the previous year, while also rising 19.41% over a month ago.

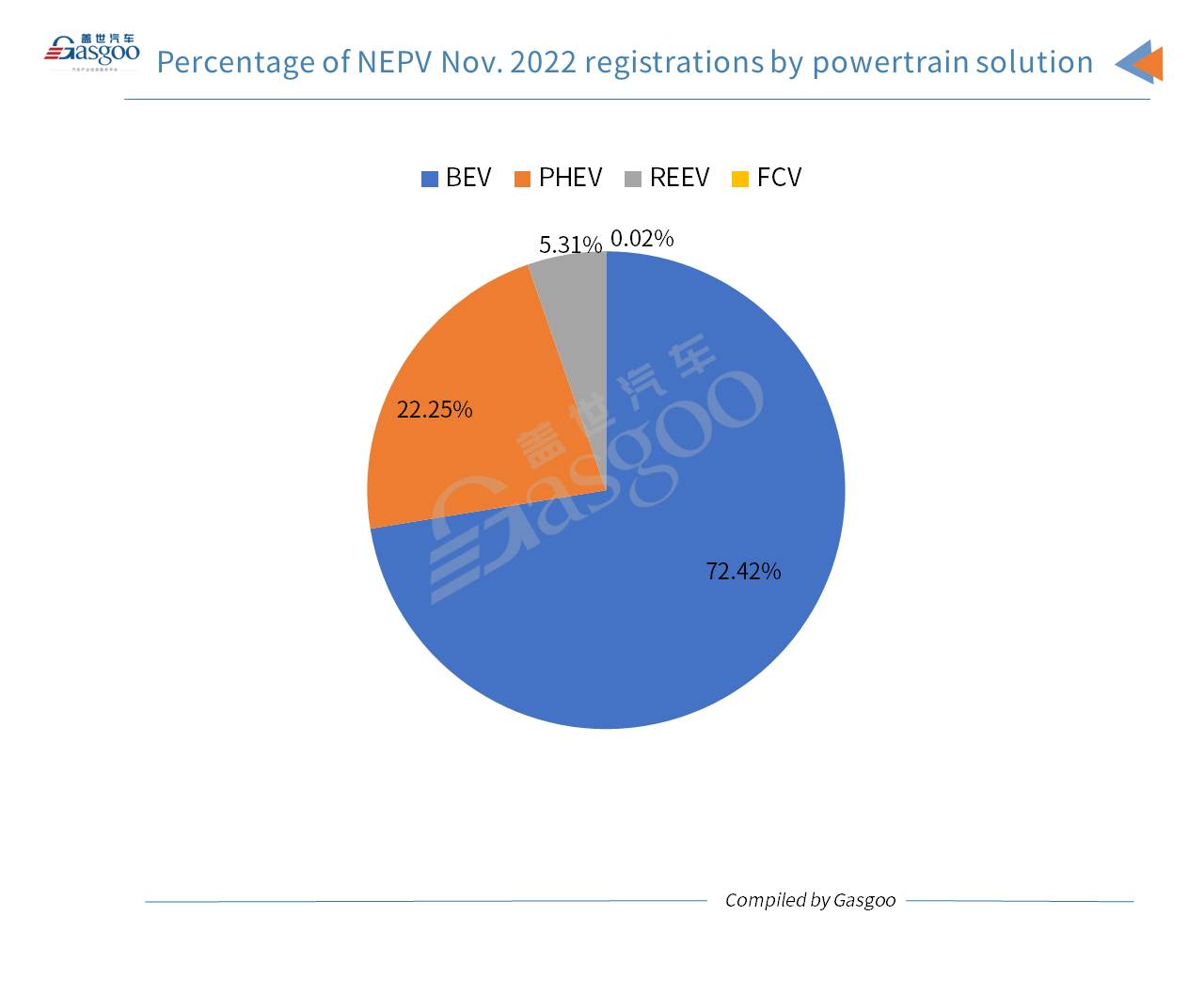

By specific powertrain solutions, BEVs logged a registration volume of 385,586 units in Nov., accounting for 72.42% of the country's total NEPV registrations. The PHEV registrations reached 146,731 units (including 28,280 REEVs).

Notably, there were 84 fuel cell vehicles registered across the Chinese mainland last month.

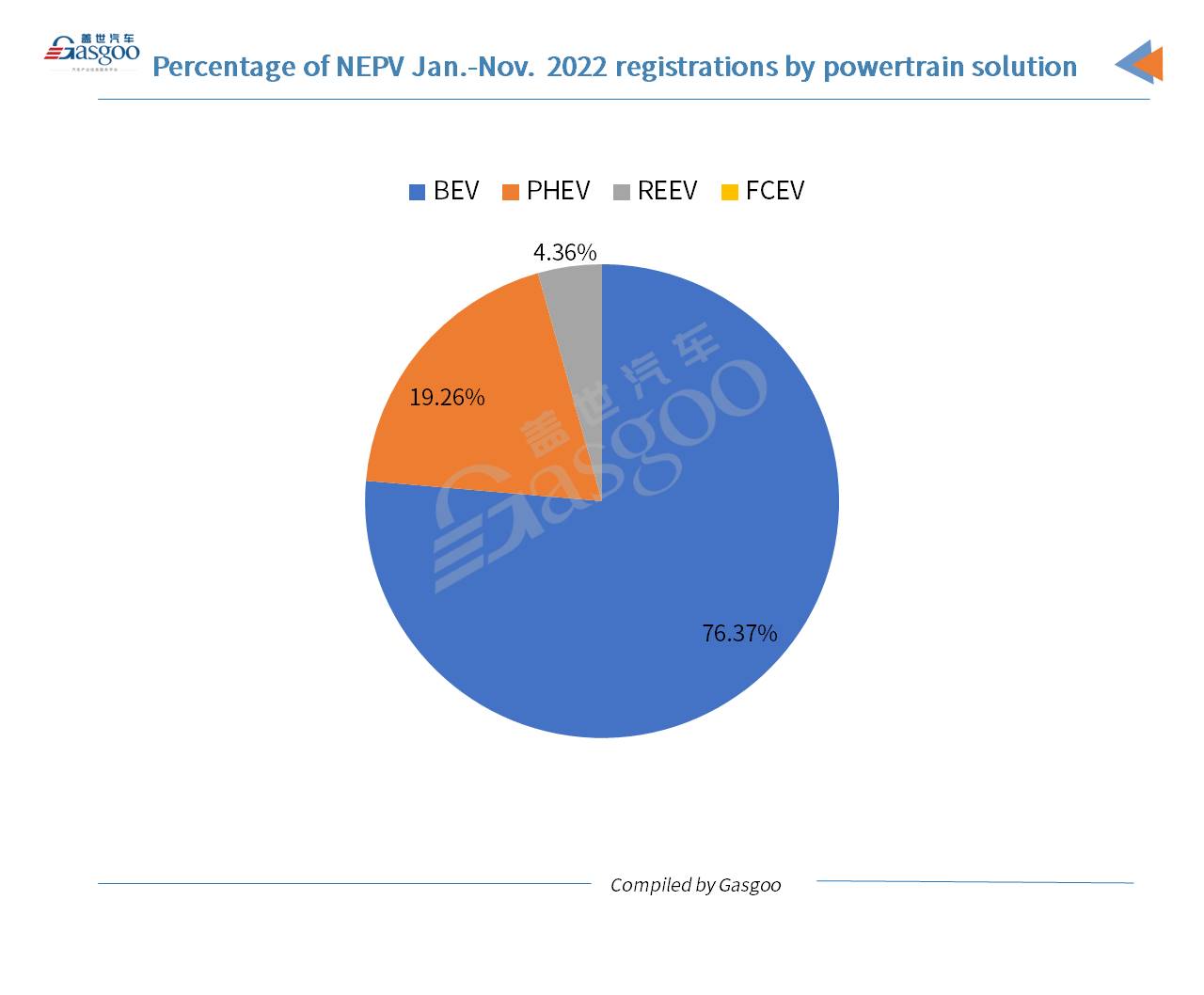

Of the NEPVs registered in the first eleven months of 2022, 76.37% and 23.63% were contributed by BEVs and PHEVs (including REEVs), respectively.

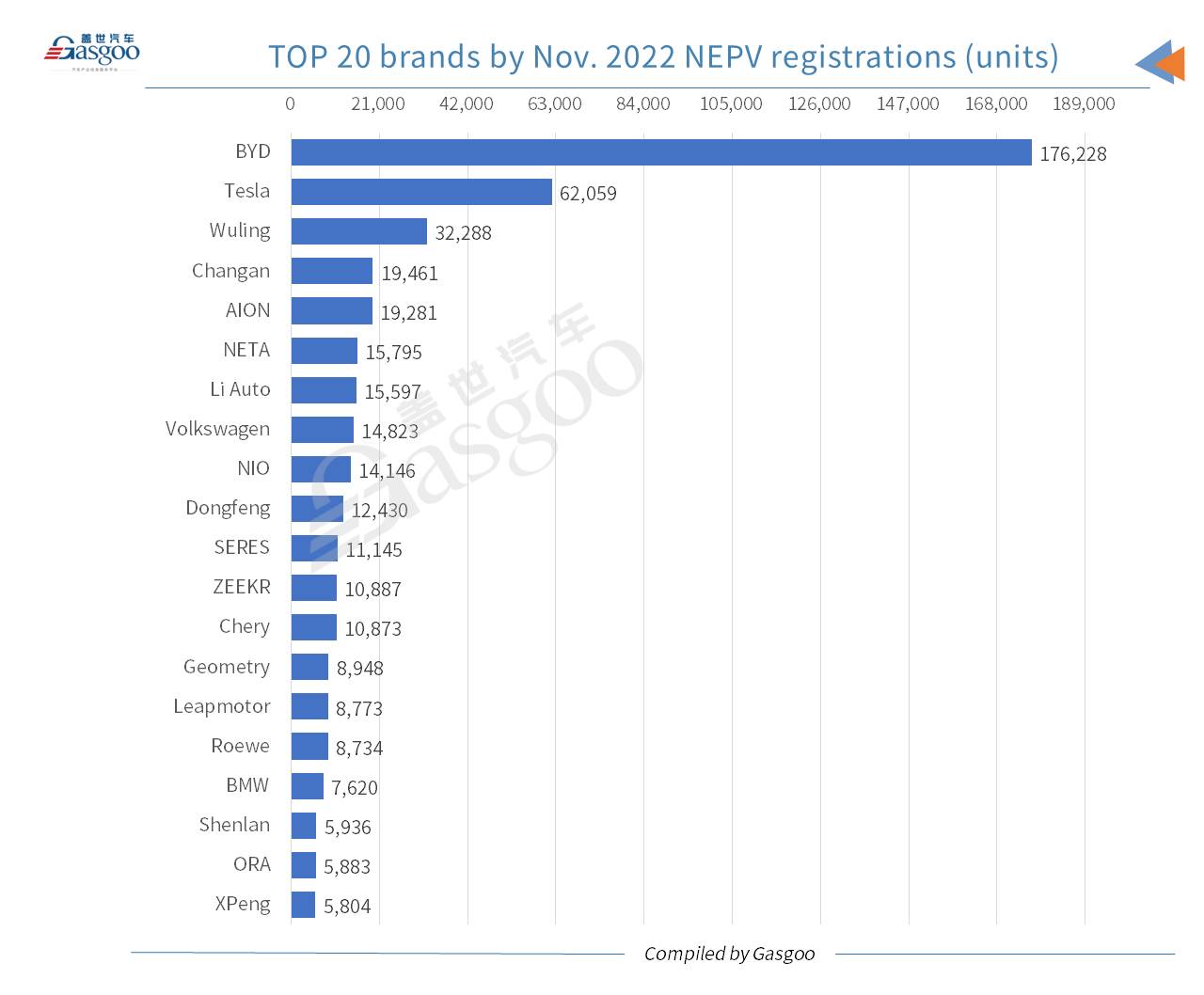

Regarding the NEPV registrations in Nov., BYD took a major lead over other brands. It had 176,228 NEPVs registered last month, which were even more than the sum of the No.2-No.7 occupants.

Thanks to the blooming sales of the Model Y and the Hongguang MINIEV, Tesla and Wuling were credited the runner-up and second runner-up, respectively, among brands by Nov. NEPV registrations. NETA had 15,795 vehicles registered in Nov., outselling the likes of Li Auto, NIO, Leapmotor, and XPeng. Geely-backed ZEEKR, ranking 12th, saw its monthly registrations exceed 10,000 units for the first time.

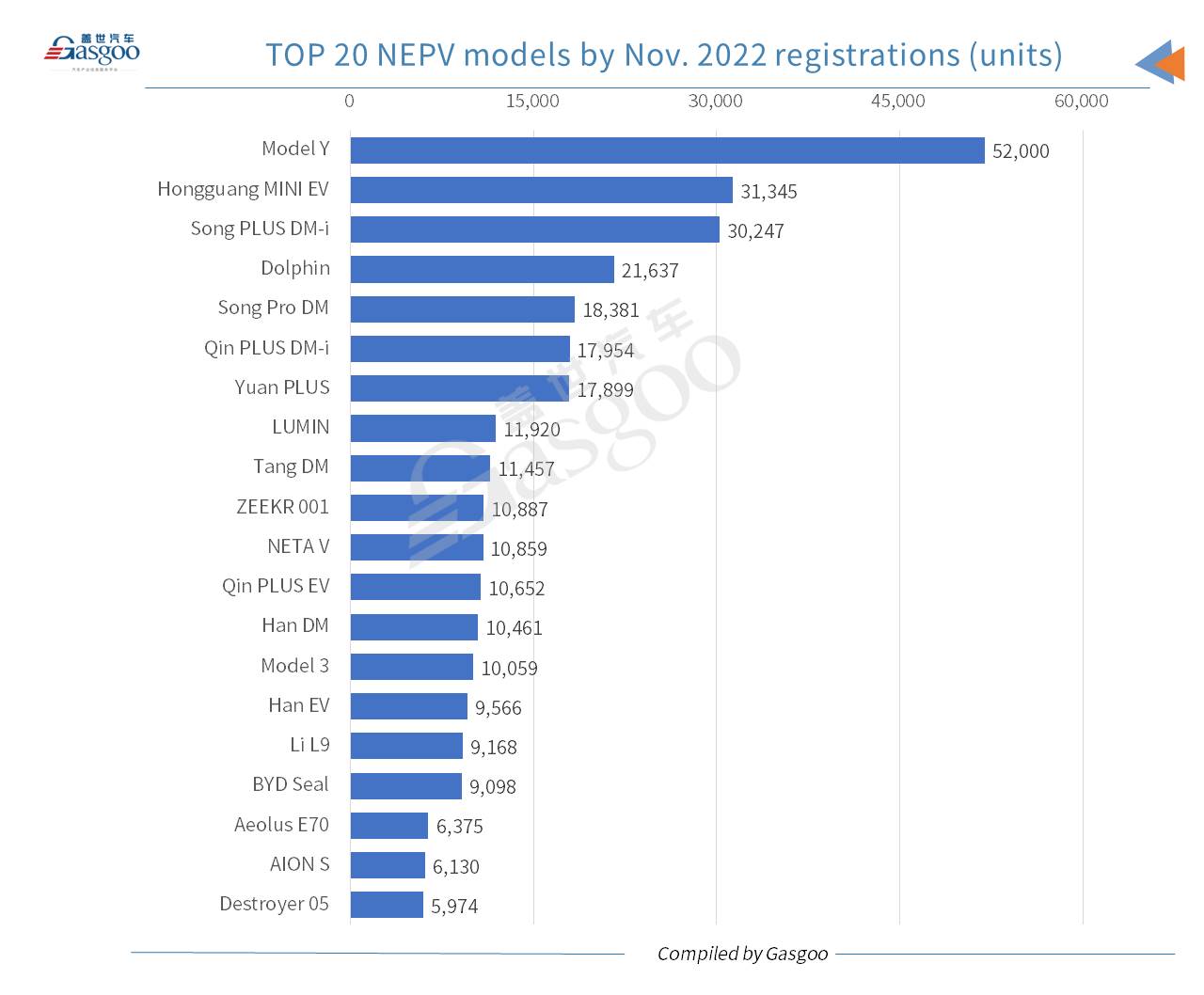

With respect to Nov. registrations, the Model Y ranked highest among all homemade NEPV models. On the top 20 NEPV models list, there were ten from BYD brand, six of which entered the top 10 rankings. The NETA V features the most Nov. registrations among those models owned by Chinese NEV startups.

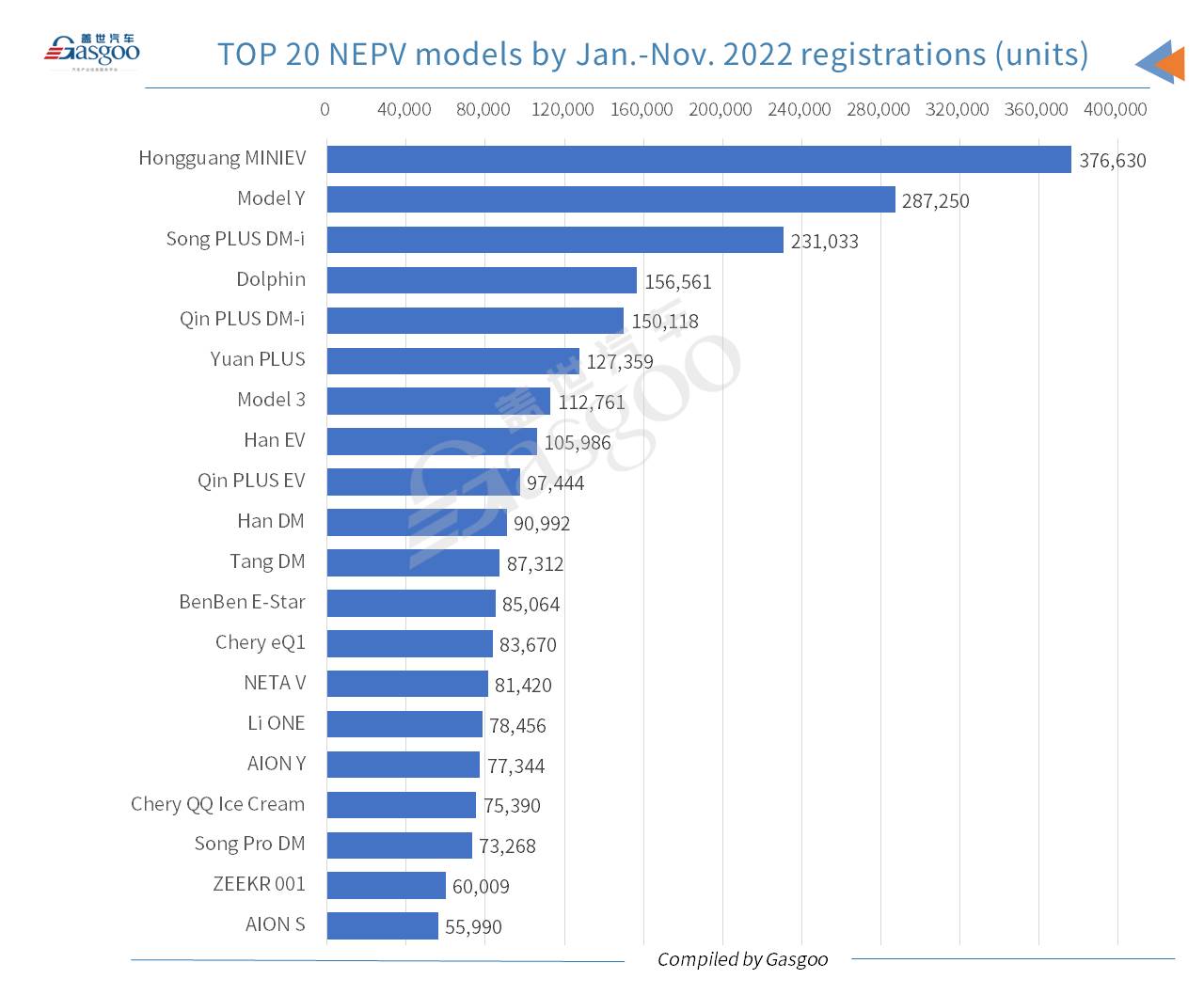

In terms of Jan.-Nov. 2022 registrations, both the Model Y and the Model 3 were included by the rankings of the top 10 NEPV models. BYD gained nine seats on the top 20 NEPV models list, seven of which were in the top 10 rankings.

Shanghai were the only city whose NEPV registrations exceeded 50,000 units in Nov. Notably, NEPVs accounted for up to 55.8% of Shanghai's PV registrations in the month. Both Hangzhou and Shenzhen recorded an NEPV registration volume of over 20,000 units last month.

In Jan.-Nov. 2022, there were seven cities with over 100,000 NEPVs registered each, and twelve cities seeing their respective NEPV registrations stand between 60,000 units and 100,000 units.