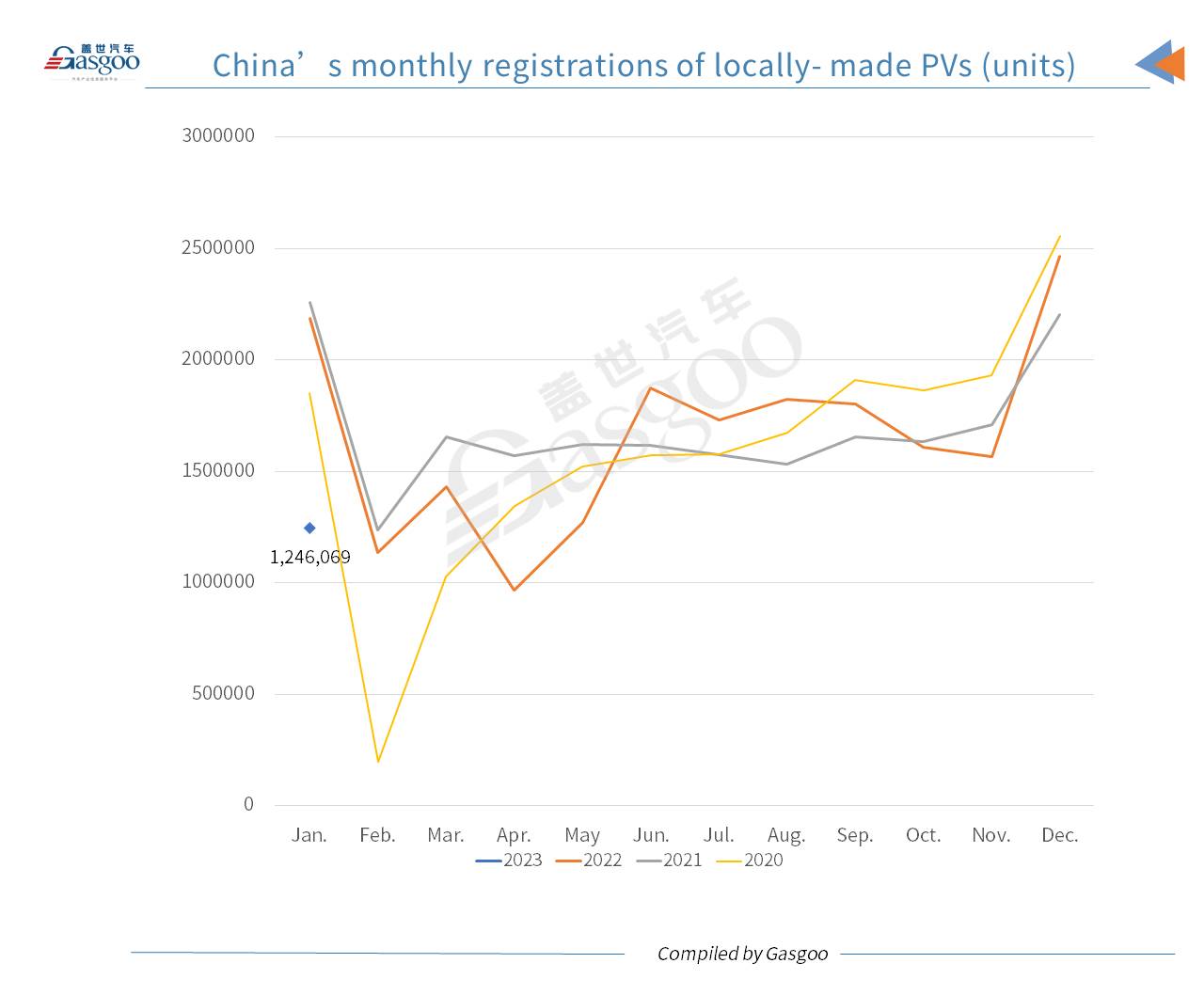

China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,246,069 units in Jan. 2023, plunging 42.99% year on year and also tumbling 49.44% month on month, according to the data compiled by Gasgoo Auto Research Institute (“GARI”).

The steep YoY and MoM decrease in Jan. largely resulted from the New Year’s Day and Spring Festival holidays. Besides, the government's withdrawal of the yearslong generous subsidies on new energy vehicles and the 50 percent off purchase tax on some gasoline cars also weighed on automobile sales in China last month.

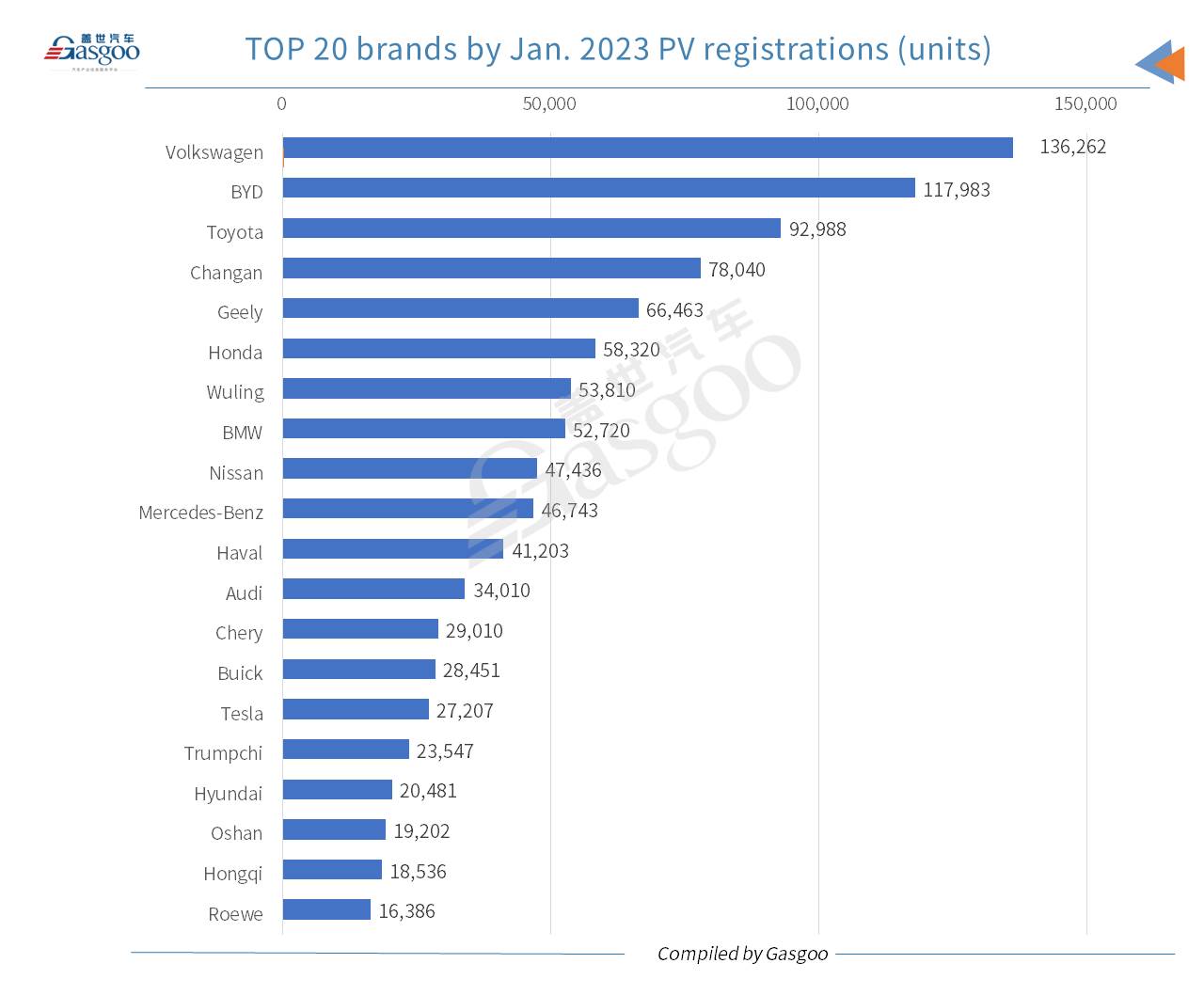

In the first month of 2023, Volkswagen and BYD were the only two brands with over 100,000 locally-made PVs registered in China, while Toyota ranked third with a registration volume of nearly 93,000 units. Two Chinese indigenous brands, Changan and Geely, occupied the fourth and fifth places, outselling the other major Japanese brand, Honda.

The German trio BMW, Mercedes-Benz, and Audi ranked 8th, 10th, and 12th, respectively, by Jan. China-made vehicle registrations. In the same period, Tesla had 27,207 Shanghai-made vehicles registered, representing a 38.8% year-on-year growth mainly thanks to the substantial price cut it issued in early Jan.

The South Korean brand Hyundai was also among the top 20 brands list with over 20,000 made-in-China PVs registered last month.

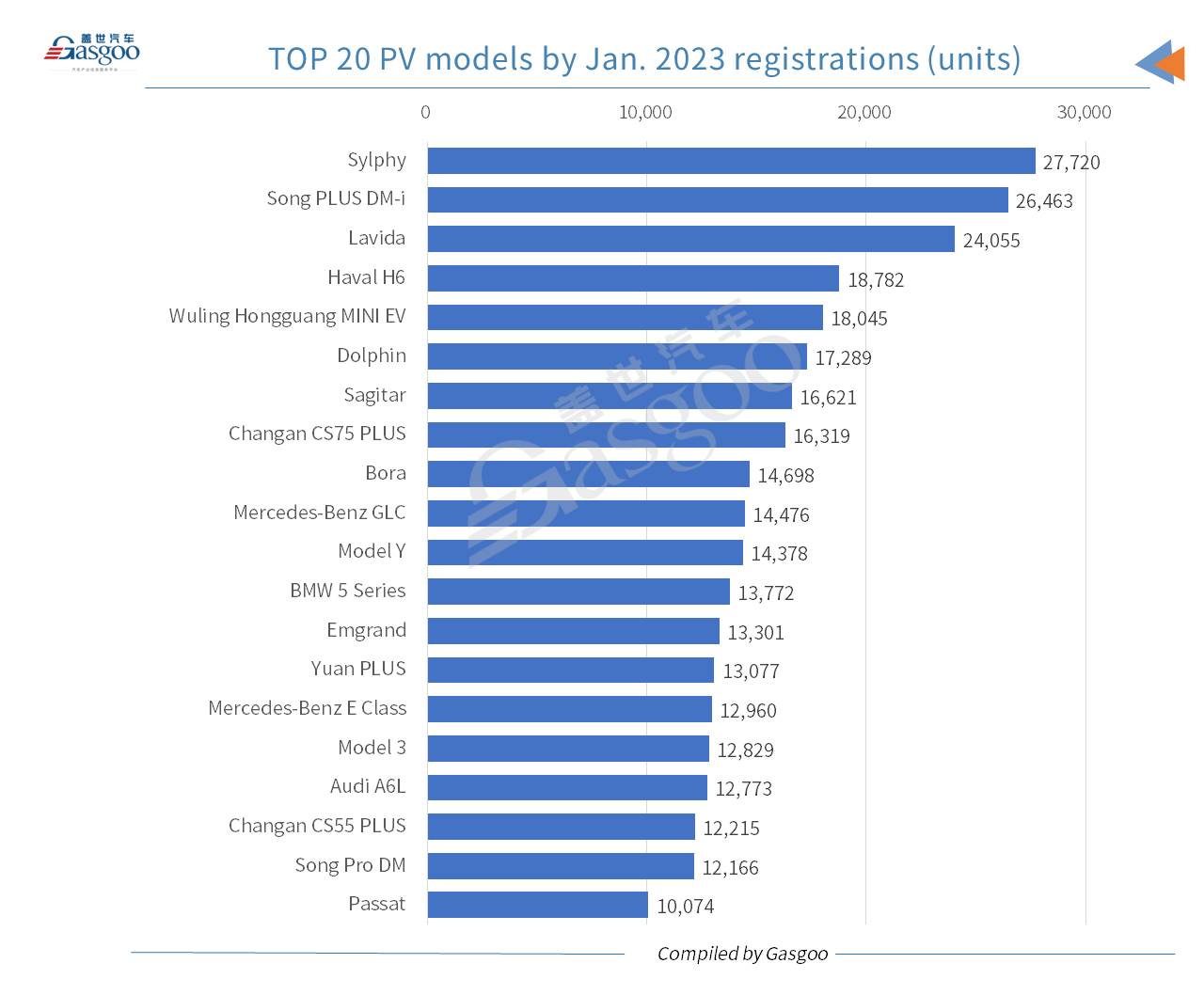

Among all China-made PV models, the Sylphy still ranked highest in terms of Jan. registrations, but the Lavida dropped one spot over the previous month to the third place last month. The runner-up model was BYD’s Song PLUS DM-i PHEV, which was also the best-selling SUV model.

On the list of the top 20 homemade PV models by Jan. registrations, there were seven new energy vehicle (NEV) models, namely, the Song PLUS DM-i, the Wuling Hongguang MINIEV, the Dolphin, the Model Y, the Yuan PLUS, the Model 3, and the Song Pro DM, four of which were under BYD brand.

Regarding regional distribution, Shanghai dropped to the second place among Chinese cities by Jan. registrations, while Chengdu became the highest-ranking one. Aside from the top 2 cities, both Zhengzhou and Chongqing also recorded a registration volume of over 30,000 homemade PVs each.

The five cities ranking 5th to 9th—Xi'an, Beijing, Wuhan, Guangzhou, and Shenzhen—all posted a Jan. registration volume between 20,000 units and 30,000 units.

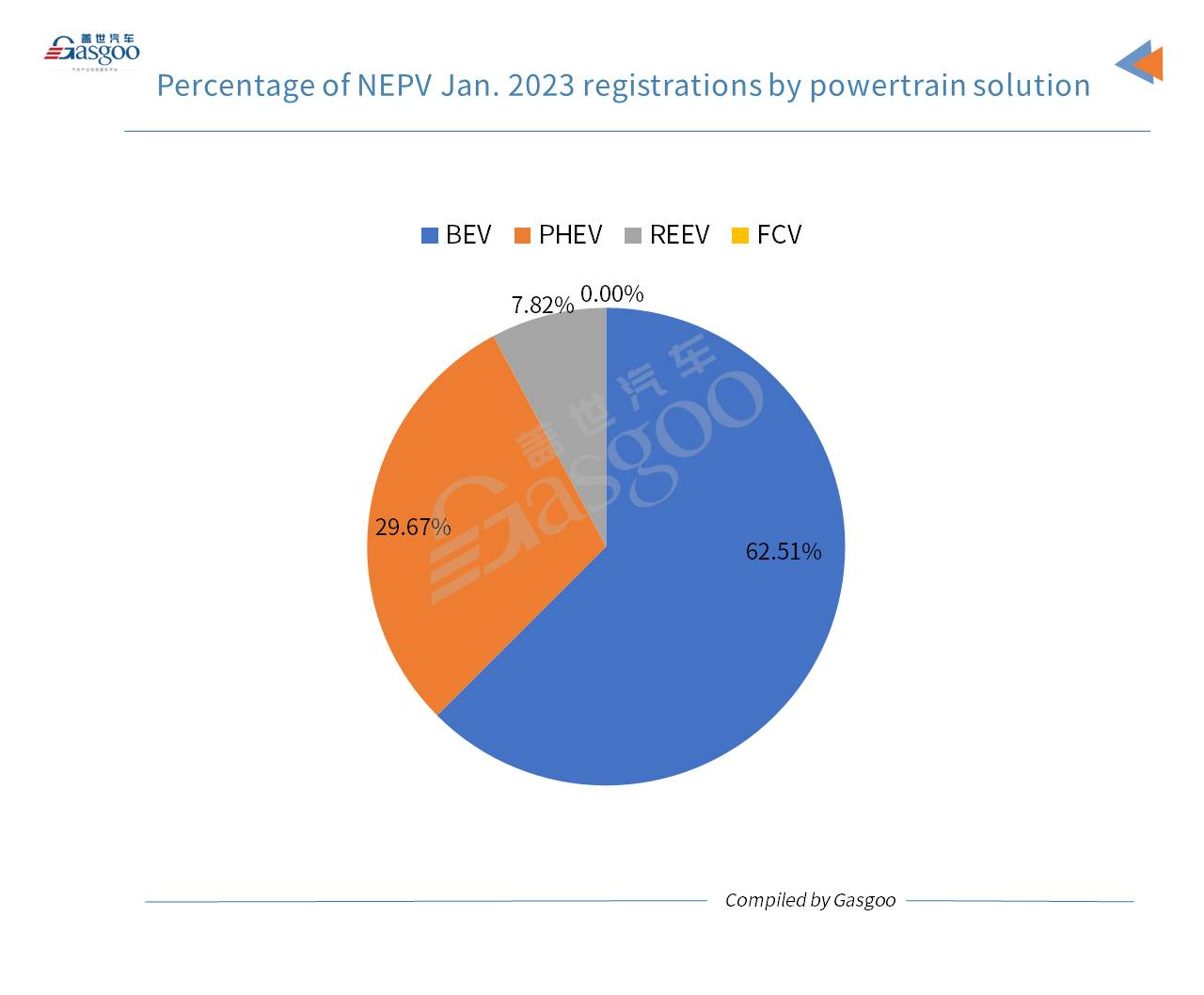

In Jan. 2023, China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 290,894 units, sliding 6.99% from the previous year, while also plummeting 58.71% over a month ago.

By specific powertrain solutions, battery-electric vehicles (BEVs) logged a registration volume of 181,844 units in Jan., accounting for 62.51% of the country's total NEPV registrations. The plug-in hybrid electric vehicle (PHEV) registrations reached 109,048 units, which included 86,314 range-extended electric vehicles (REEVs).

There were 2 fuel cell electric vehicles (FCEVs) registered on the Chinese mainland last month. Nevertheless, its market share was hereby omitted due to its tiny quantity.

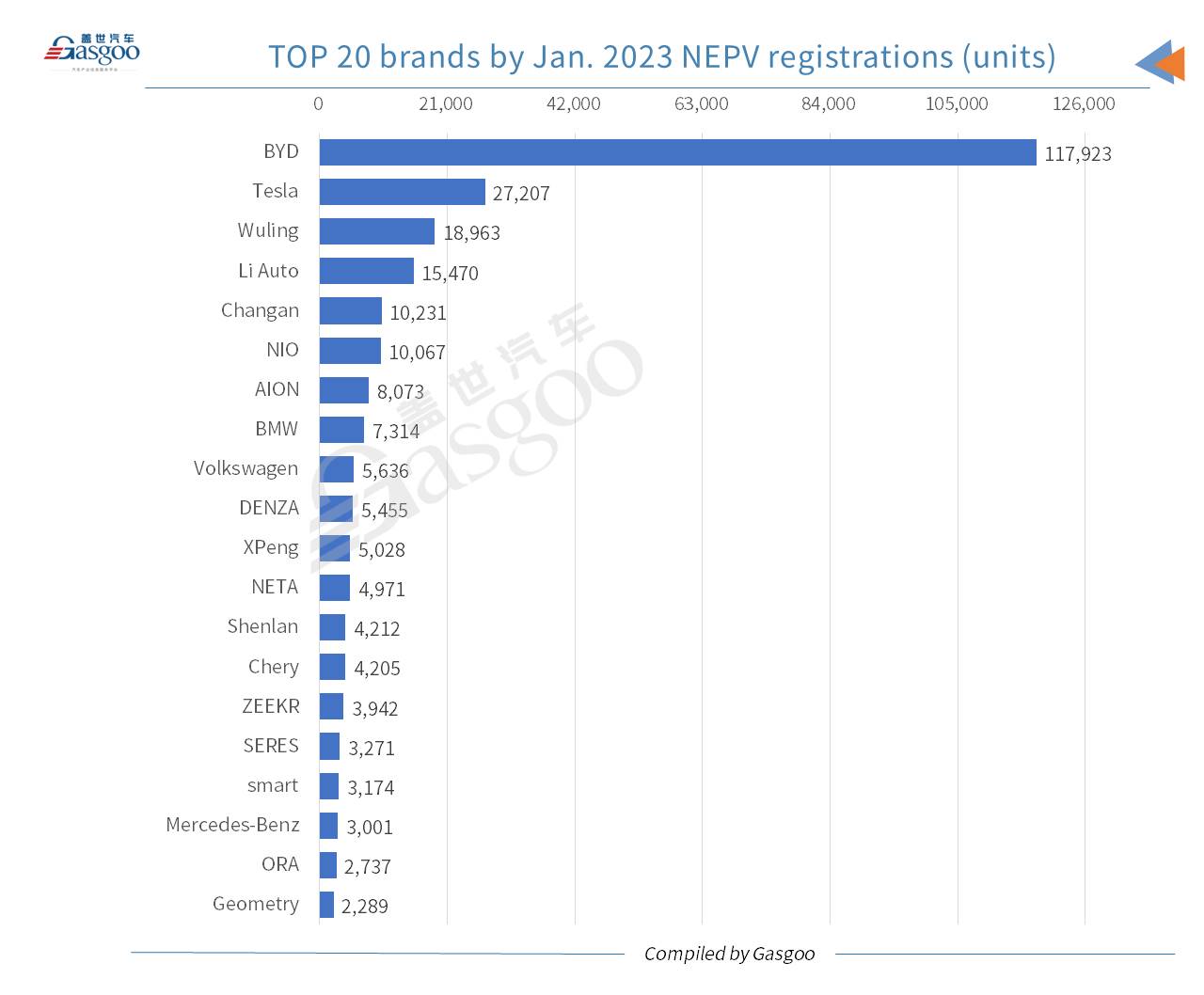

Regarding the NEPV registrations in Jan., BYD took a remarkable lead over other brands. It had 117,923 NEPVs registered last month, which were even more than the sum of the No.2-No.11 occupants. The U.S. EV brand Tesla was still credited the runner-up.

Among Chinese NEV startups, Li Auto was the best-performing one, ranking fourth among all brands by Jan. NEPV registrations. NIO also cracked the top 10 brand rankings with over 10,000 vehicles registered last month.

Some young NEV brands launched by Chinese legacy automakers, such as GAC Group’s AION, Changan Auto’s Shenlan, and Geely’s ZEEKR were among the top 20 brands list as well.

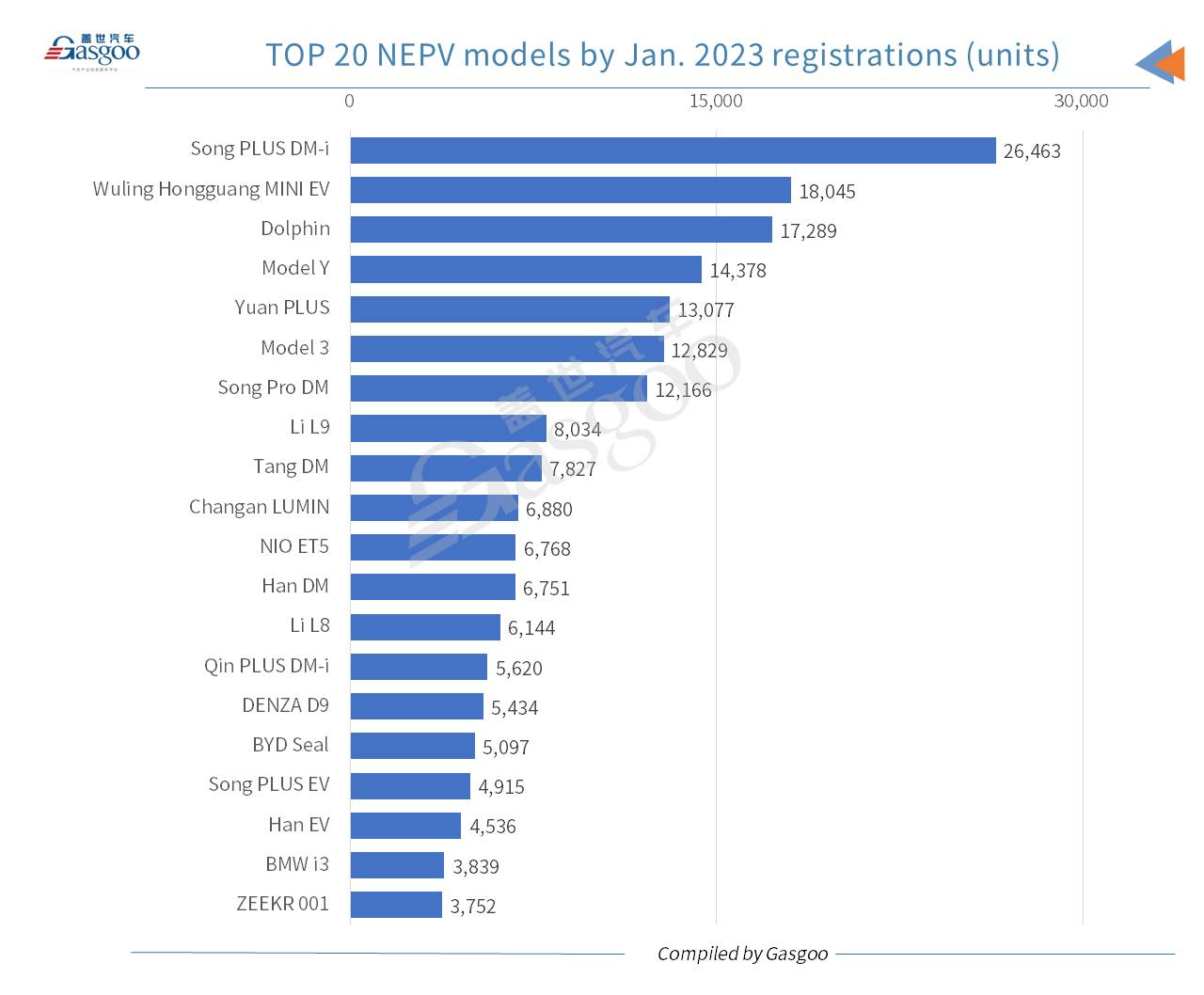

With respect to Jan. registrations, the Song PLUS DM-i topped other homemade NEPV models. On the top 20 NEPV models list, there were 11 under BYD brand, six of which entered the top 10 rankings. Notably, the DENZA D9, which ranked 15th, was also BYD Auto’s product.

Both the Model Y and Model 3 entered the top 10 NEPV models list. The Li L9 featured the most Jan. registrations among those owned by Chinese NEV startups.

In Jan. 2023, Shanghai outdid other cities on the Chinese mainland with 12,218 China-made NEPVs registered, which accounted for 37.69% of the city's overall PV registrations. It outsold the runner-up Shenzhen city by only 210 units.