Shanghai (Gasgoo)- BYD Company Limited ("BYD") released its latest quarterly financial results on Monday, showing a remarkable two-digit year-on-year growth in both revenue and net profit for the third quarter of 2023 (Q3 2023).

The report shows that the company recorded revenue of 162.151 billion yuan in Q3, reflecting a year-on-year jump of 38.49%.

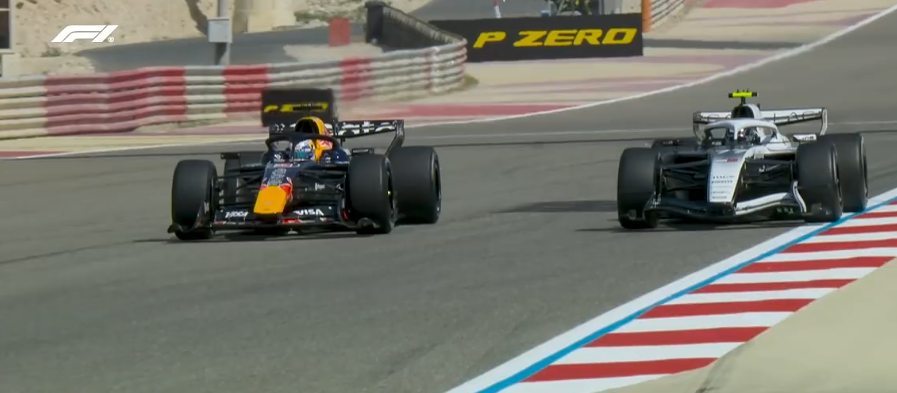

BYD Dolphin; photo credit: BYD

In the past quarter, BYD's net profit attributable to shareholders reached 10.413 billion yuan, surging 82.16% from the previous year. Excluding the impact of certain non-recurring gains and losses, its Q3 net profit belonging to shareholders still soared 80.95% year on year to 9.654 billion yuan.

Basic earnings per share of BYD stood at 3.58 yuan in Q3, zooming up 81.73% over a year earlier.

For the first three quarters of this year (Q1-Q3 2023), BYD scored a 57.75% year-over-year spike in its total revenue, which amounted to roughly 422.275 billion yuan. Meanwhile, its Q1-Q3 net profit attributable to shareholders zoomed up 129.47% over the year-ago period to 21.367 billion yuan.

BYD also reported an R&D expense of 24.938 billion yuan for the Q1-Q3 period of this year, representing a 129.42% spike compared to the same period of 2022.

Regarding the reasons for this outstanding performance, BYD has explained in a forecast public announced issued in mid-October, partly attributing to the robust financial growth to the continued strong growth momentum in the new energy vehicle industry in Q3 2023. BYD's new energy vehicle sales have consistently set historical records, securing its position as the global leader by new energy vehicle sales. In Q3, the company sold a total of 824,001 vehicles, up 52.96% from a year earlier.

Despite intensified competition in the third quarter, the company's strong brand influence, expanding scale advantages, and robust control over the industrial supply chain costs have all contributed to continued profitability, said BYD.

Additionally, regarding handset components and assembly business, BYD said its continuous improvement in capacity utilization, further optimization of the business structure, and the ongoing enhancement of profitability were mainly credited to its growing market share among overseas major clients and the resurgence in demands from Android users.