China’s passenger vehicle retail sales in Apr. dip YoY, but wholesales grow

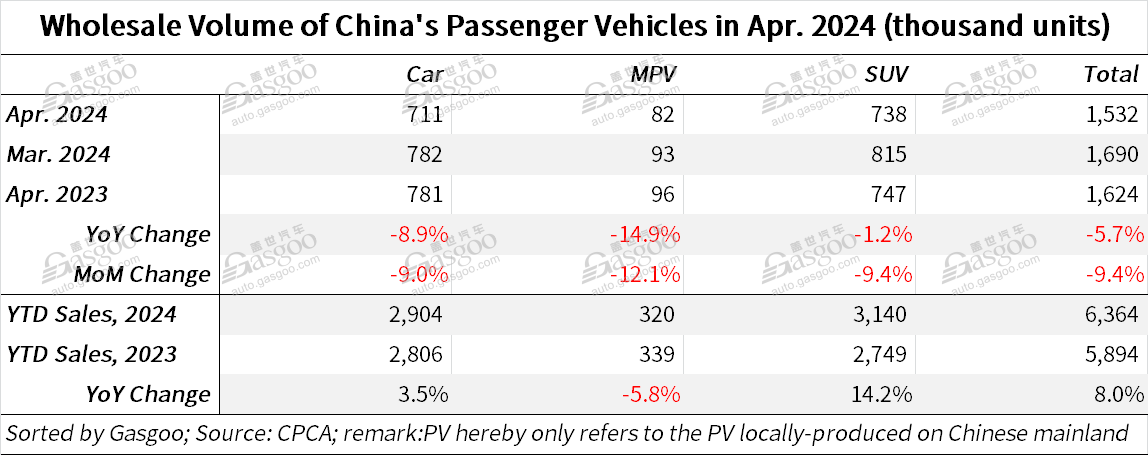

Shanghai (Gasgoo)- In April, China's domestic passenger vehicle (PV) market retailed 1.532 million units, marking a year-over-year decrease of 5.7% and a month-over-month decrease of 9.4%, according to data from the China Passenger Car Association ("CPCA").

For the first four months of this year, the country's PV retail sales totaled 6.364 million units, an increase of 8% compared to the same period last year.

For clarity, the passenger vehicles hereby refer to cars, MPVs, and SUVs locally produced on the Chinese Mainland.

In 2024, China's macroeconomic conditions are stable and improving, with the first-quarter (Q1) car market’s retail sales achieving a positive start as anticipated.

The CPCA said policy guidelines aimed at the automotive industry are being issued frequently at the national level to further stabilize and expand car consumption. Following the implementation and gradual rollout of trade-in and vehicle replacement policies, China’s Ministry of Commerce has organized nationwide promotional activities for car trade-ins. Additionally, car manufacturers and dealerships have initiated corresponding promotional events. Various regions have utilized energy conservation and emission reduction subsidy funds arranged by the central government to support eligible car trade-ins, which, along with corporate promotions, have effectively boosted the car market around the May Day holiday.

Despite having 22 working days in April, two more than the previous year, a strong wait-and-see sentiment prevailed among consumers due to unstable pricing, resulting in a cyclical month-over-month downturn in China's passenger car retail sales. While price wars in the new energy vehicle (NEV) sector brought some increase in sales, the sustainability of these gains was weak and the internal market became heavily segmented. Conventional oil-fueled vehicles, under continued price competition, had little room for further price reductions, leading to an accelerated market share erosion by new energy vehicles and causing some consumers to hold off on purchases, further suppressing potential sales growth.

In April, China's self-owned brands sold 880,000 PVs by retail, reflecting an 11% increase year-over-year but a 5% decrease from the previous month. For the month, these brands captured a 57.4% share of the domestic retail PV market, a growth of 9 percentage points compared to the same month last year. Cumulatively for 2024, their market share stood at 56%, up 6.3 percentage points from the same period last year.

Mainstream joint-venture brands retailed 450,000 PVs in April, a 26% decrease year-over-year and a 9% decrease month-over-month. German brands made up 19% of retail sales, down 2.2 percentage points year-over-year; Japanese brands captured 15.2%, a drop of 3.6 percentage points; and American brands secured a 5.9% market share, down 2.6 percentage points from last year.

Premium PV sales amounted to 200,000 units in April, marking a 12% decrease year-over-year and a 24% decrease month-over-month. Premium brands held a 13.2% share of the retail market, down 0.9 percentage points year-over-year, reflecting weak demand in the traditional luxury car segment.

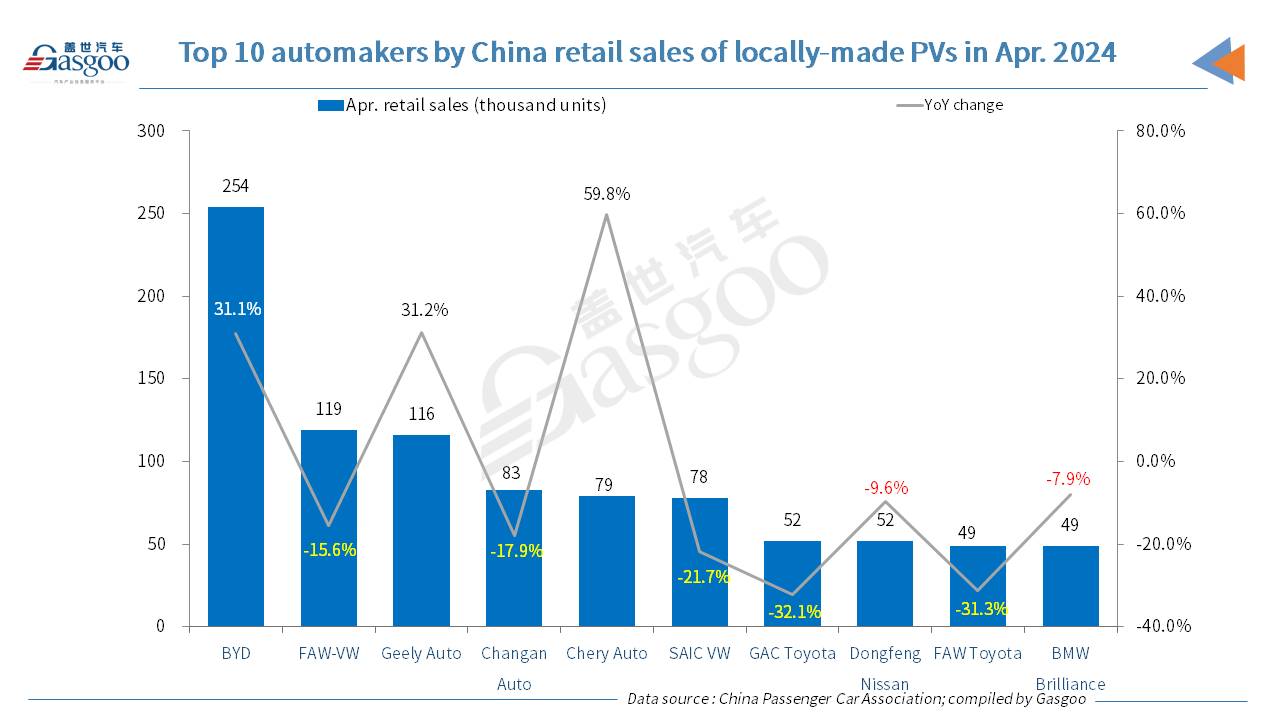

Among the top 10 automakers by homemade PV retail sales in Apr., there were only three companies seeing a rising movement year-on-year, namely, BYD, Geely Auto, and Chery Auto, all of which are China's local players. Both GAC Toyota and FAW Toyota faced a year-on-year decline of over 30%. The premium carmaker BMW Brilliance moved into the list at the 10th place.

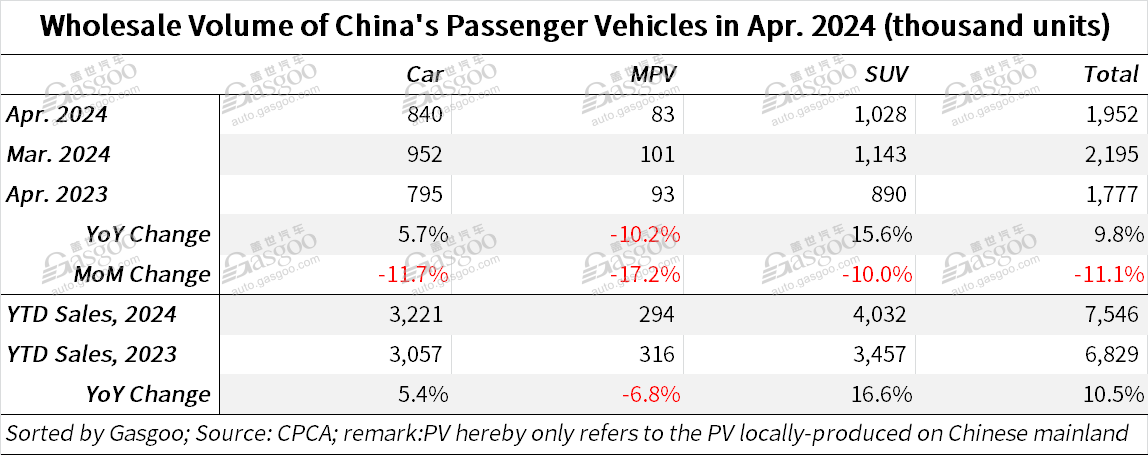

In April, PV manufacturers in China wholesaled 1.952 million units, marking a 9.8% increase year-over-year but an 11.2% decrease from the previous month. Chinese indigenous automakers wholesaled 1.246 million units, achieving a substantial year-over-year jump of 25% but a slight month-over-month decrease of 4%. Mainstream joint-venture automakers wholesaled 462,000 units, experiencing a 13% decline year-over-year and a 21% drop from the previous month. Premium car wholesalers moved 240,000 units, down 2% year-over-year and 22% month-over-month.

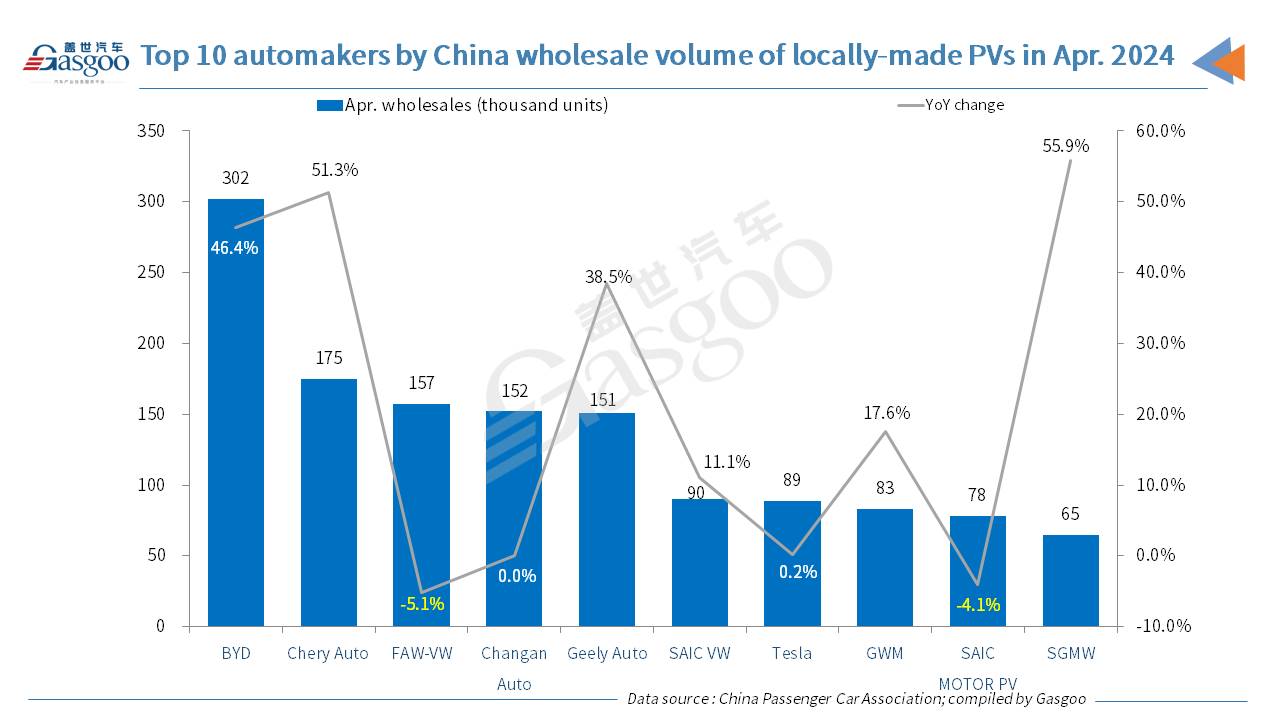

In April, leading carmakers like BYD, Chery, Geely, and Changan demonstrated overall strong performances. There were 32 manufacturers in China with wholesales exceeding 10,000 units (compared to 33 in March and 27 in the same period last year), accounting for 95.6% of the total market share. Of these, three manufacturers saw year-over-year growth exceeding 100%, 14 had growth over 10%, and 14 experienced a decline in sales. Additionally, nine of the manufacturers that sold over 10,000 units reported a month-over-month increase compared to March.

In April, China's passenger car production output reached 1.988 million units, an increase of 14.9% year-over-year and a decrease of 9.6% from the previous month. This production figure exceeded the previous historical high set in April 2018 by 18,000 units, establishing a new record. Production growth varied among different segments. To be specific, premium brands experienced a 7% increase year-over-year, despite a 13% decrease month-over-month; joint venture brands saw a 10% decrease year-over-year and an 18% decrease month-over-month; and China’s self-owned brands achieved a remarkable 30% increase year-over-year, even with a 5% decrease from the previous month.

Automobile exports continued their strong growth trajectory from the end of last year. In April, China’s customs reported vehicle exports of 556,000 units, reflecting a 31% increase year-over-year. From January to April, vehicle exports totaled 1.878 million units, up 26% year-over-year.

According to data reported by main PV manufactures, China's PV exports (including complete vehicles and CKD) reached 417,000 units in April, marking a 38% increase year-over-year and a 0.2% growth month-over-month, the highest monthly export volume in history. From January to April, cumulative PV exports were 1.491 million units, a 37% increase year-over-year. New energy vehicles accounted for 27.1% of total exports in April, down 2.9 percentage points from the same period last year.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com