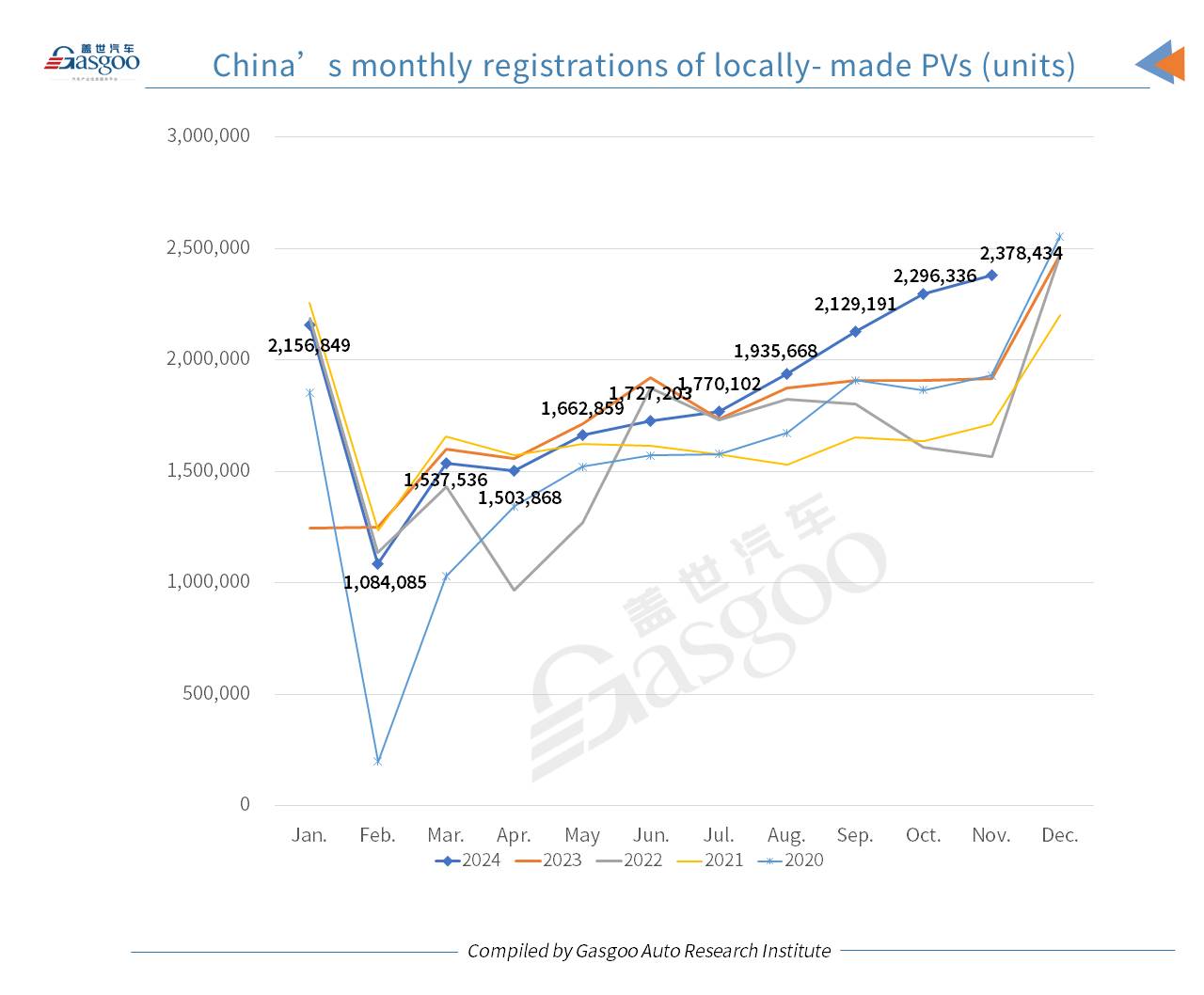

Shanghai (Gasgoo)- In November 2024, the registration volume of domestically produced passenger vehicles (PVs) on the Chinese Mainland reached 2,378,434 units, marking a year-on-year (YoY) jump of 24.07% and a month-on-month (MoM) growth of 3.58%, setting a new monthly high for the year, according to the data compiled by the Gasgoo Auto Research Institute ("GARI").

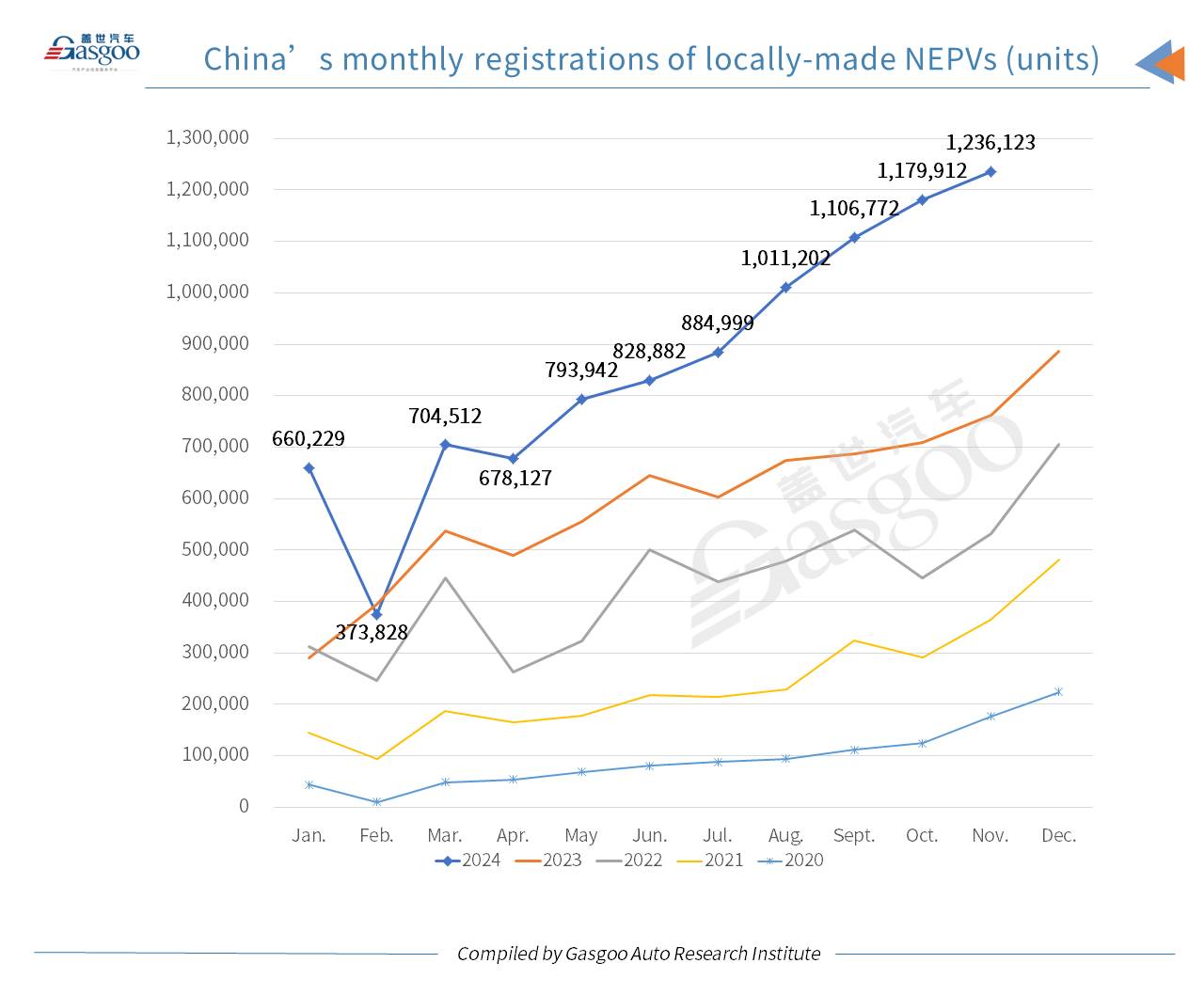

Of all PVs registered in November, 1,236,123 units were new energy vehicles (NEVs), achieving a penetration rate of 51.97% and hitting another record high for monthly registrations.

For clarity, the PVs hereby refer to the passenger vehicles locally produced and registered on the Chinese Mainland.

The strong market performance in November continued the positive momentum observed in October. The effects of policies promoting vehicle scrappage and trade-ins continued to stimulate the market, helping stabilize vehicle sales. Additionally, automakers leveraged events like the "Double 11" shopping festival and the Auto Guangzhou 2024 to boost consumer attention, further driving the market's growth.

The vehicle scrappage and trade-in policies, which have been more effective than previous real estate stimulus measures, have proven to be among the few subsidies with immediate impacts. According to the latest data from China's Ministry of Commerce, by November 18, the number of applications for both car scrappage and trade-in subsidies had exceeded 2 million, totaling more than 4 million. While the trade-in subsidy program has been in place for a shorter period, it has shown faster growth compared to the scrappage program, reflecting strong consumer demand for new car purchases.

The aforesaid national subsidy program offers differentiated incentives, such as a 20,000-yuan subsidy for purchasing NEVs and a 15,000-yuan subsidy for vehicles with engine capacities of 2.0 liters or below. As NEVs receive an additional 5,000 yuan in vehicle scrappage and trade-in subsidies compared to oil-fueled vehicles, combined with local subsidies offering around 3,000 yuan more for NEVs in trade-ins, the majority of users opting for car scrappage or replacement are choosing NEVs. This trend is particularly evident in the entry-level battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) markets, which are experiencing robust sales growth, further reinforcing the expansion of NEV market penetration.

For the first eleven months of 2024, the cumulative registration volume of domestically produced passenger cars on the Chinese Mainland stood at 20,182,131 units, a YoY increase of 8.31%. Of these, NEV registrations totaled 9,458,528 units, soaring by 48.93% YoY and accounting for 46.87% of the total PV market.

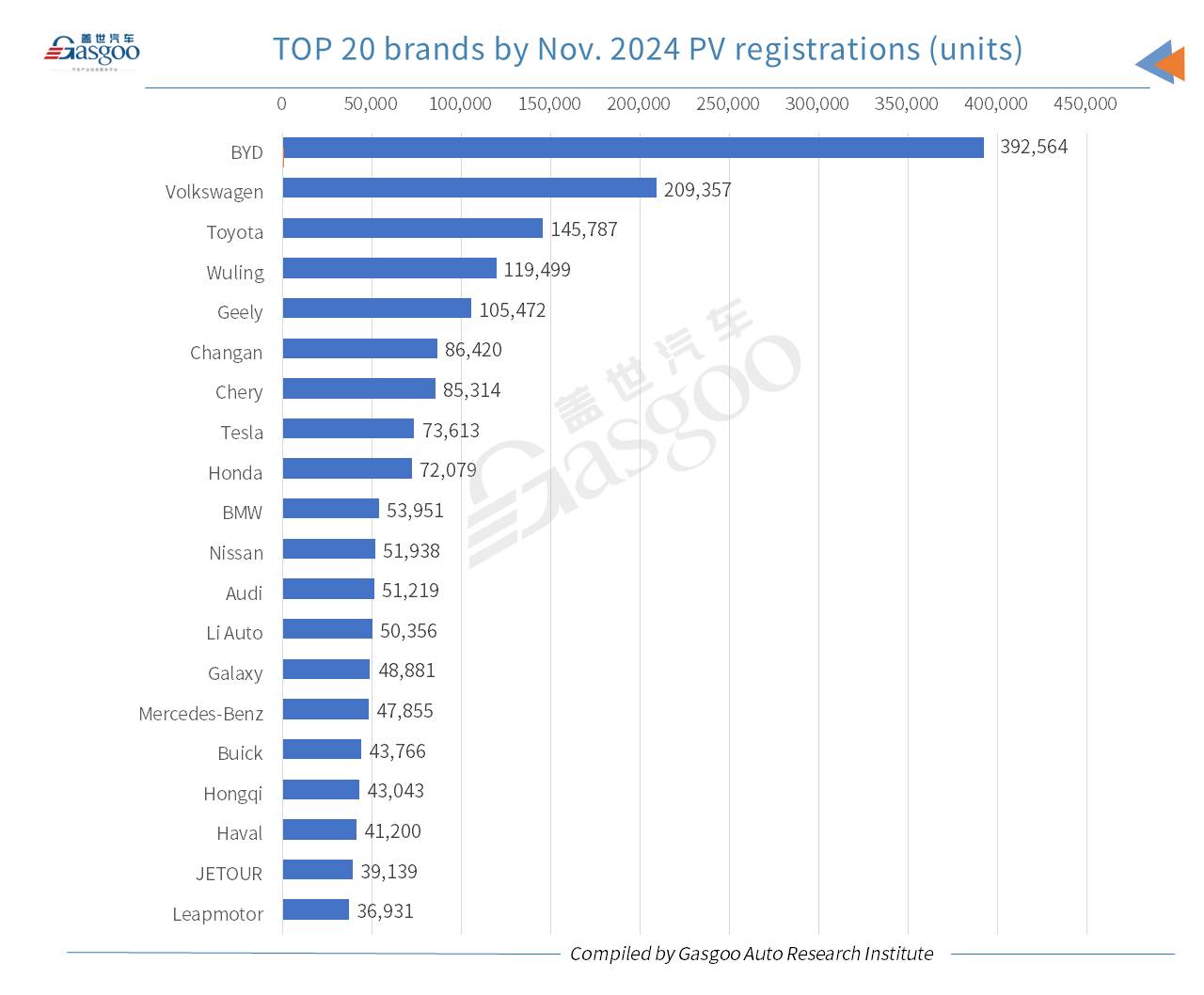

Top 20 brands by Nov. and YTD 2024 passenger vehicle registrations

Regarding November registrations of domestically made PVs, 11 out of the top 20 brands were China's self-owned ones, namely, BYD, Wuling, Geely, Changan, Chery, Li Auto, Galaxy, Hongqi, Haval, JETOUR, and Leapmotor. Five of these brands made it into the top ten.

BYD continued to lead the market by a significant margin, securing the top spot with over 390,000 vehicles registered in November, surpassing Volkswagen by 183,207 units. However, compared to October, this represented a 4.29% decline. In the month, BYD had 28 models registered under its Dynasty and Ocean Series, with 13 of them surpassing 10,000 units in registrations.

On November 18, BYD's 10 millionth NEV officially rolled off the production line. The milestone vehicle was the DENZA Z9, a luxury D-segment flagship sedan launched during the Auto Guangzhou 2024. BYD Chairman Wang Chuanfu announced that the company plans to invest 100 billion yuan in the R&D of the technologies integrating artificial intelligence and automobiles, aiming for comprehensive vehicle intelligence upgrades.

Wuling, Geely, Changan, and Chery maintained their rankings in fourth, fifth, sixth, and seventh place, with their November registration volumes staying consistent with the previous month. All four brands registered over 80,000 vehicles, with Wuling and Geely surpassing 100,000 units. Additionally, domestic NEV-focused brands Li Auto, Galaxy, and Leapmotor entered the top 20, ranking 13th, 14th, and 20th, respectively. However, AITO, which ranked 20th in October, did not appear in November's list.

Volkswagen and Toyota continued to hold the second and third positions. For Volkswagen, NEVs contributed 8.64% of its November registrations (18,092 units), including 850 PHEVs and 17,242 BEVs. Toyota, on the other hand, saw a lower NEV share of just 2.28% (3,224 units).

Tesla, the only foreign-funded brand in the top 20, ranked 8th with 73,613-unit registrations, up 3.61% year on year, and climbing 7 spots from October.

Among the German trio, BMW ranked highest at 10th, with two models—the 3 Series and X3—each surpassing 10,000-unit registrations in November. Audi and Mercedes-Benz were ranked 12th and 15th, respectively. Audi had two models, the A6L and Q5L, each exceeding 10,000-unit registrations, while Mercedes-Benz had three models: the E-Class, GLC, and C-Class.

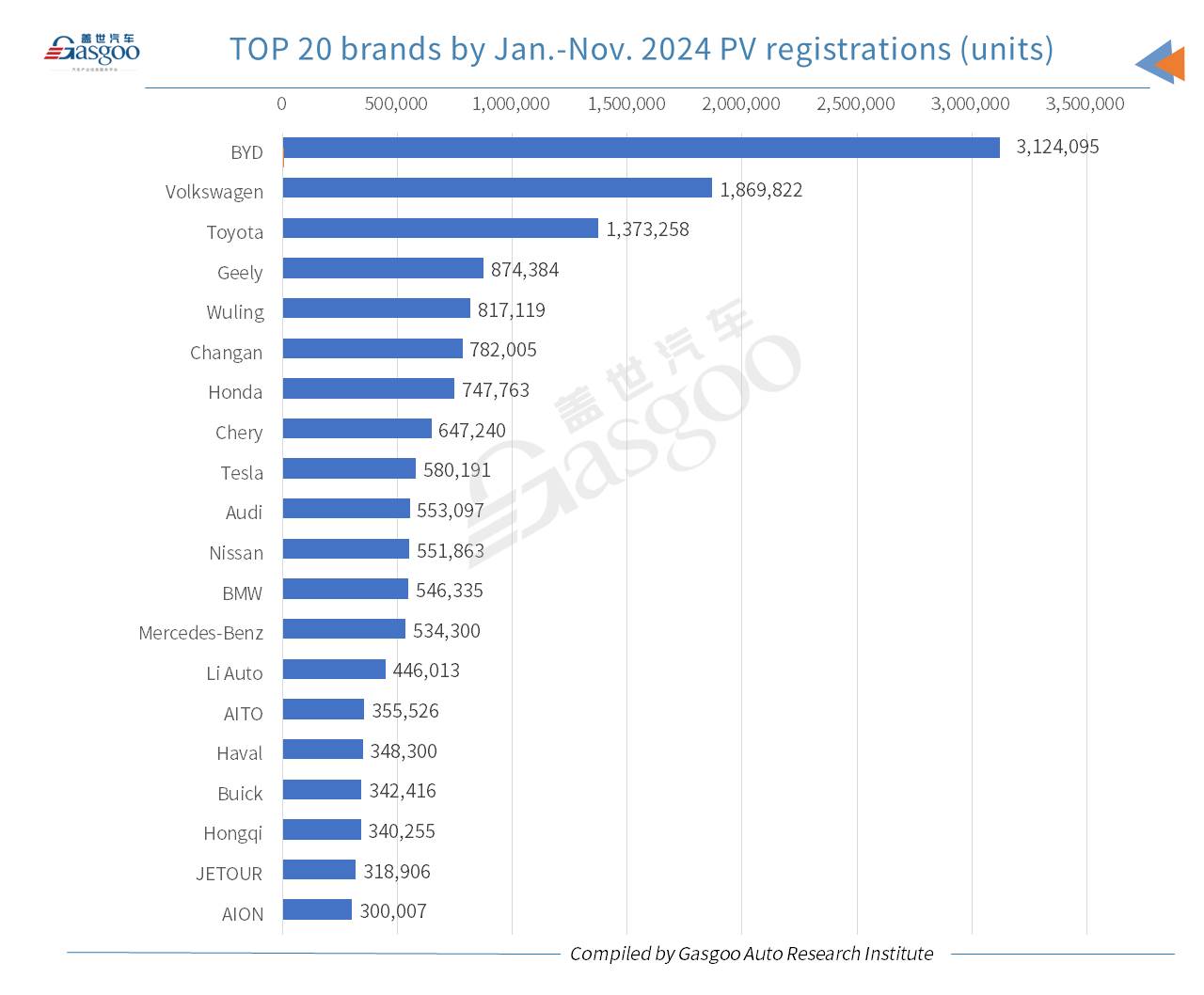

Looking at the total PV registrations for the first eleven months of 2024, BYD, Volkswagen, and Toyota remained the top three brands. BYD was the only brand with year-to-date (YTD) registrations surpassing 3 million units, while Volkswagen and Toyota's cumulative registrations remained below 2 million units. Among the top 20 brands, apart from BYD, 10 other China's self-owned brands made the list, including Geely, Wuling, Changan, Chery, Li Auto, AITO, Haval, Hongqi, JETOUR, and AION.

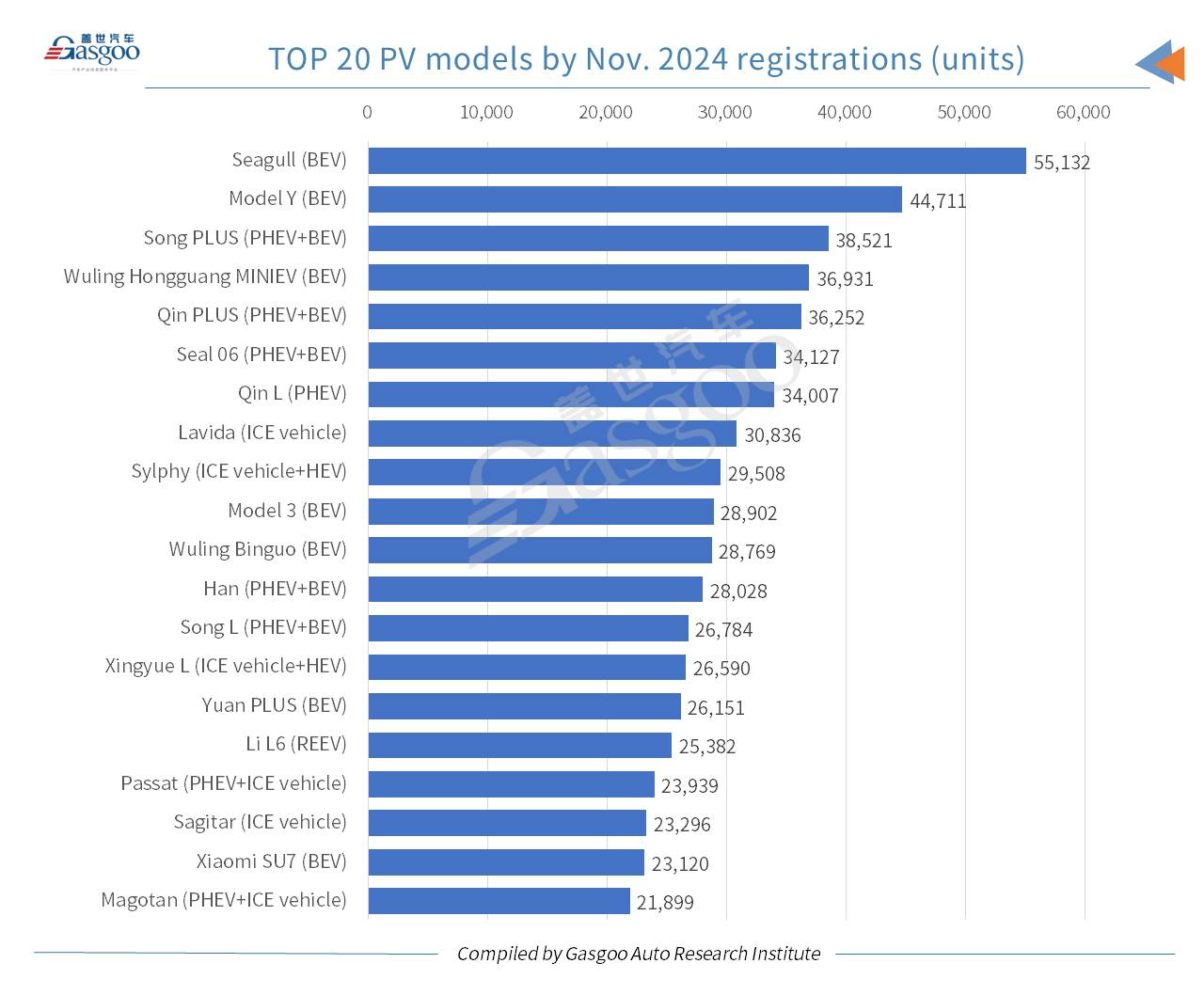

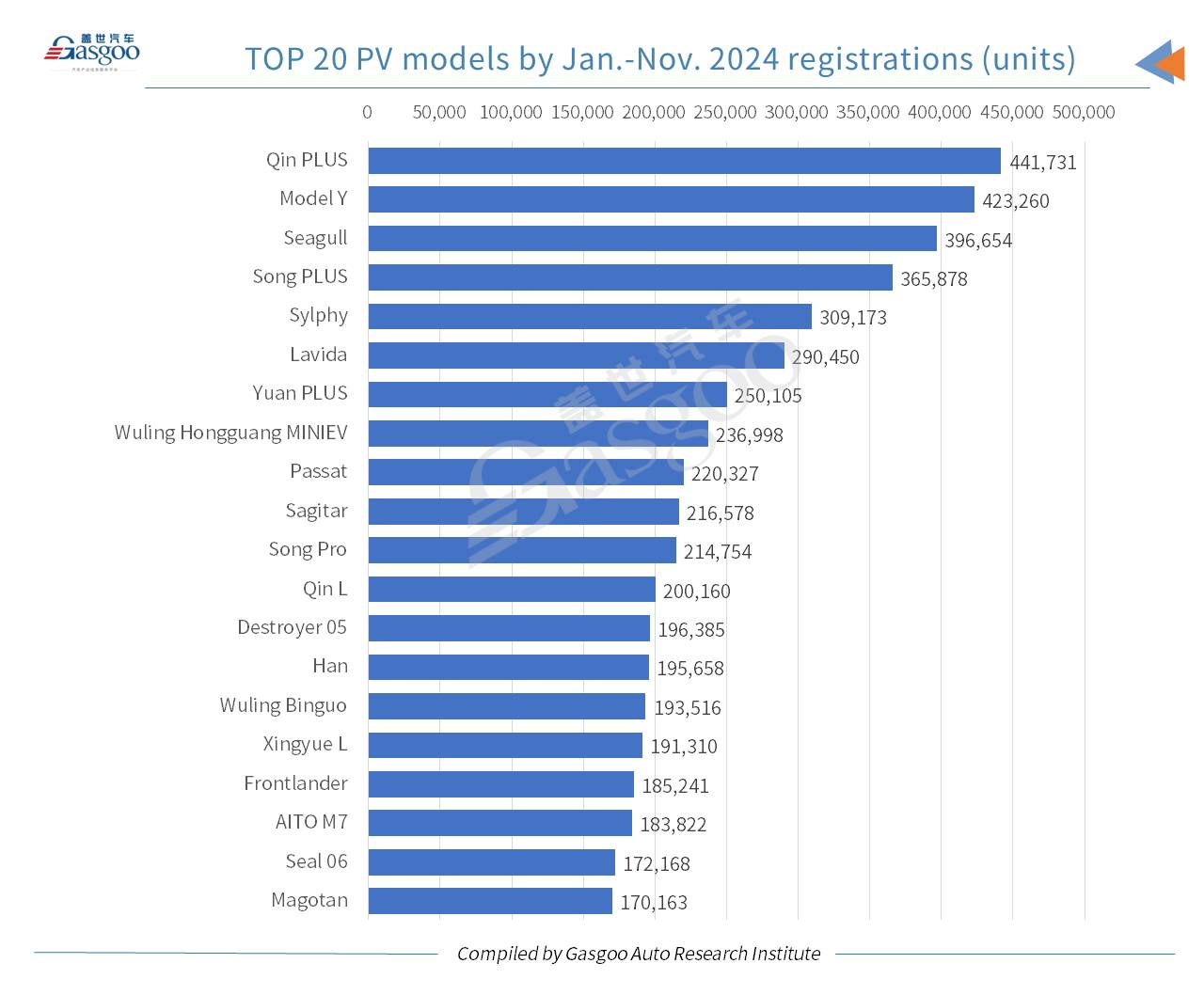

Top 20 PV models by Nov. and YTD 2024 registrations

Among the top 20 PV models by November registration volume, only four—the Volkswagen Lavida, the Nissan Sylphy, the Geely Xingyue L, and the Volkswagen Sagitar—lacked contributions from new energy vehicle (NEV) variants. Notably, none of the top seven models included traditional internal combustion engine (ICE) vehicle or hybrid electric vehicle (HEV) versions.

BYD models occupied five of the top seven positions, with the highest-ranked being the BYD Seagull, which has only BEV trims available for sale. The seventh-ranked Qin L was also available only as a PHEV. The third, fifth, and sixth-ranked models—BYD's Song PLUS, Qin PLUS, and Seal 06—were offered in both BEV and PHEV variants. BYD had a total of three models within the 8th to 20th ranking range as well.

Tesla's Model Y climbed five spots from 7th in October to reclaim the second place in November, while the Model 3 made significant strides, moving up to the 10th place.

A noteworthy entry was the Xiaomi SU7, which recorded a registration volume of 23,120 units in November, ranking 19th. The model's cumulative deliveries surpassed 100,000 units in mid-November, prompting Xiaomi EV to raise its annual delivery target to 130,000 units.

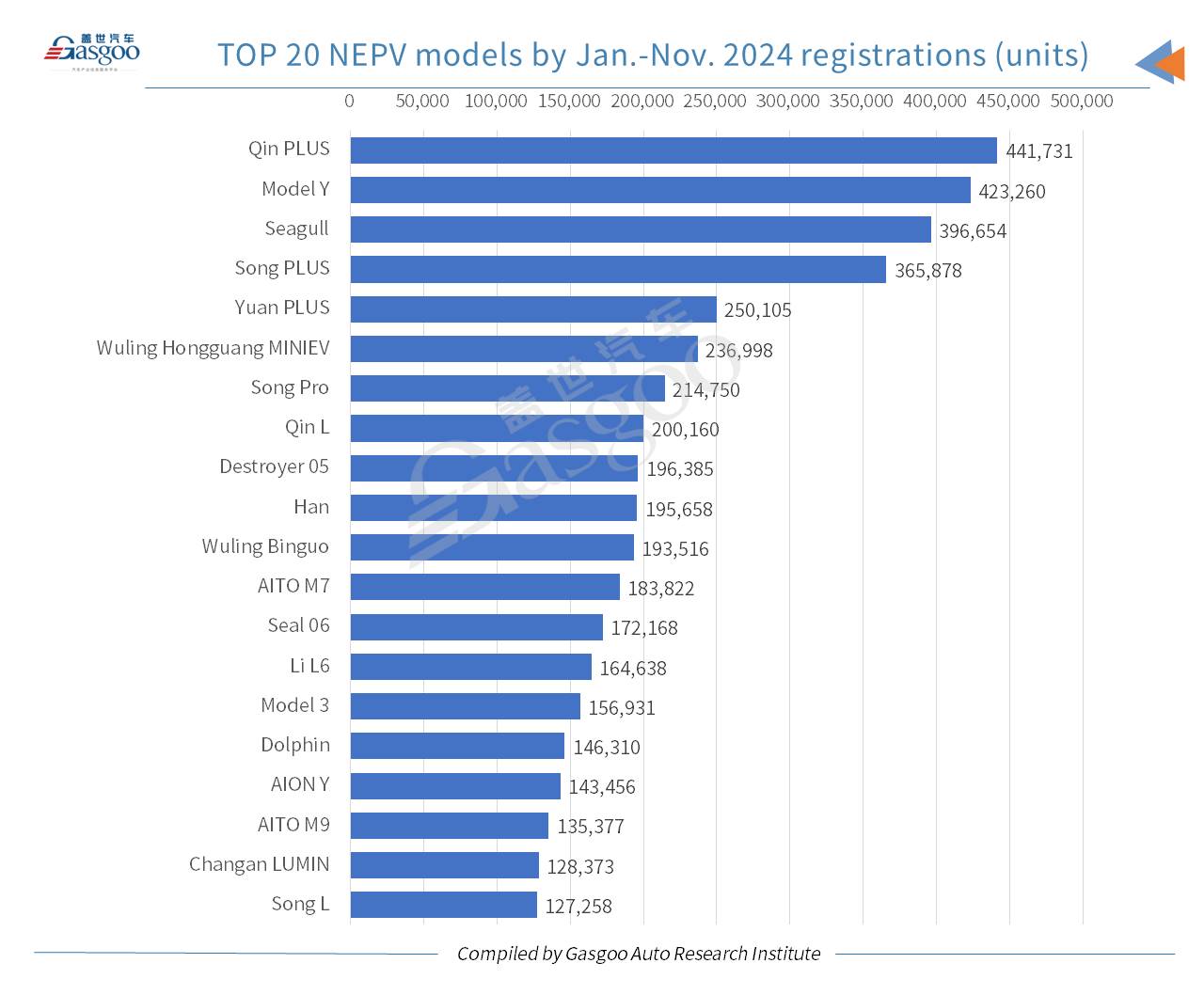

For the first eleven months of 2024, five PV models exceeded 300,000 units in cumulative registrations, with the Qin PLUS and Model Y each surpassing 400,000 units. Among joint-venture-made models, the Nissan Sylphy led the pack in fifth place, followed closely by the Volkswagen Lavida. BYD had eight models in the top 20.

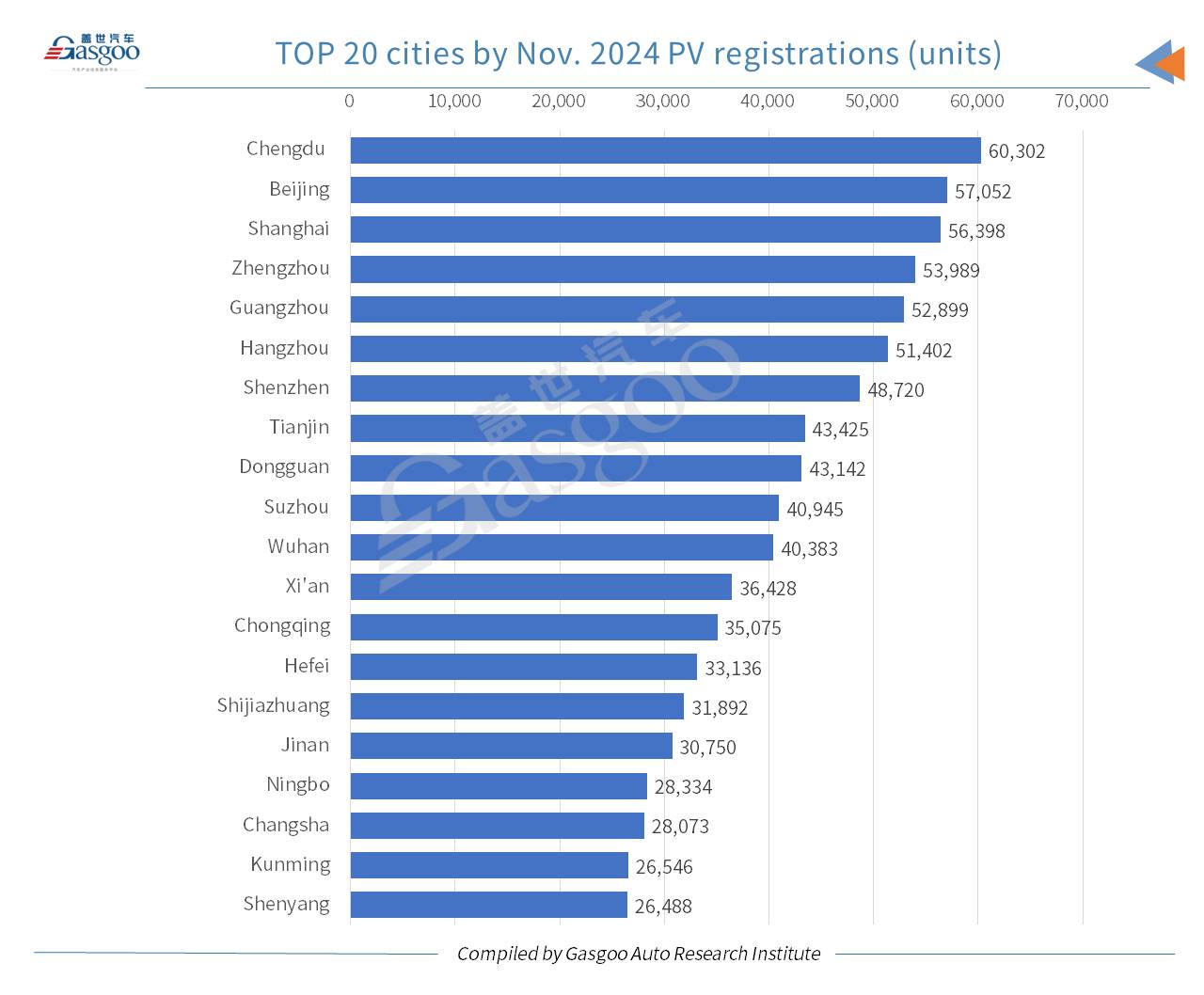

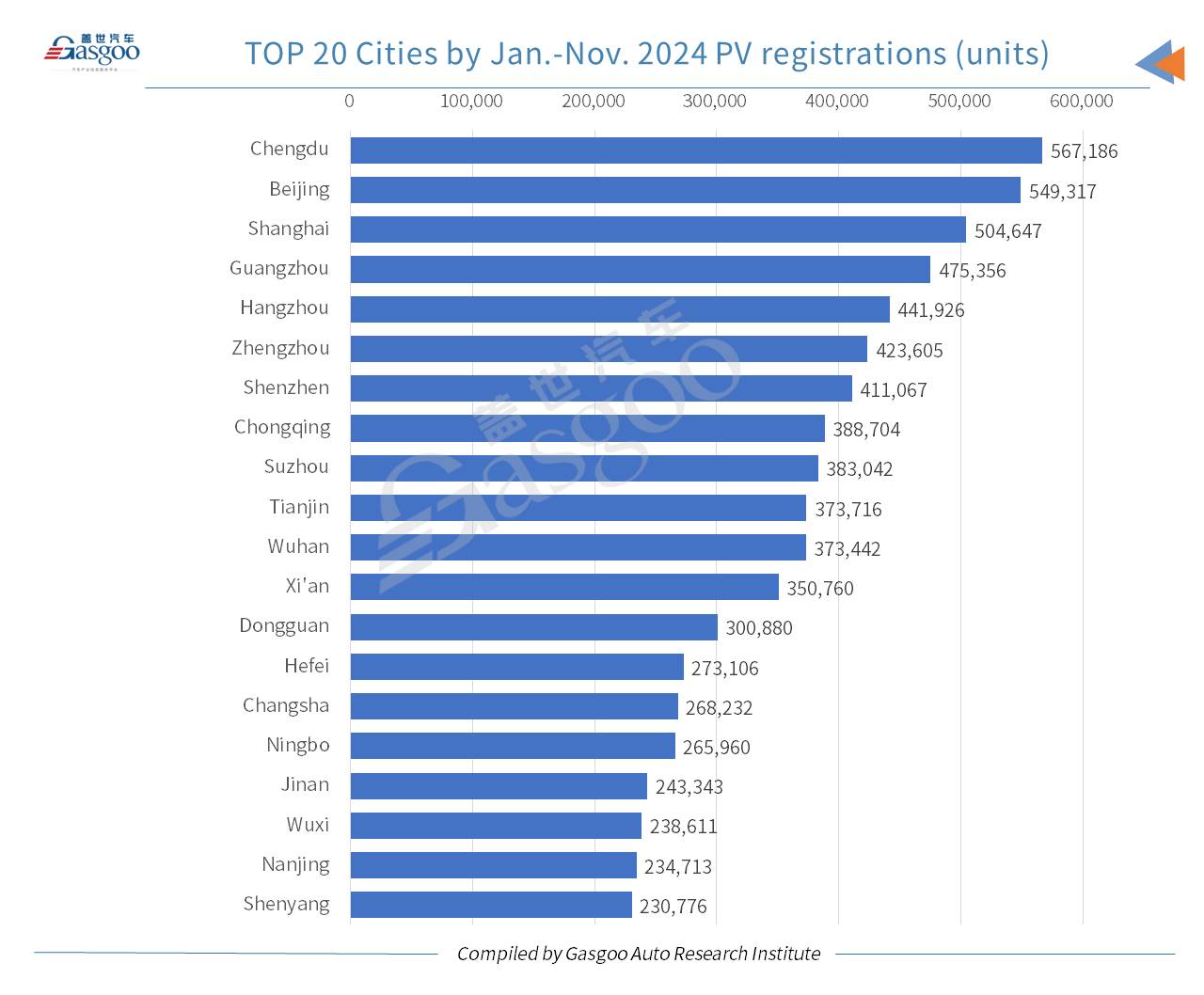

Top 20 cities by Nov. and YTD 2024 registrations

At the city level, 11 cities on the Chinese Mainland recorded over 40,000-unit registrations of locally produced PVs in November. Among these, six cities surpassed 50,000 units. Chengdu ranked first, registering over 60,000 vehicles, while Beijing and Shanghai ranked second and third with 57,052 units and 56,398 units registered, respectively.

For the Jan.-Nov. period, seven cities recorded cumulative registrations of over 400,000 vehicles, with Chengdu, Beijing, and Shanghai still leading the pack, each surpassing 500,000 units of registrations.

Monthly new energy passenger vehicle registrations and breakdown by powertrains

The Chinese domestic new energy passenger vehicle (NEPV) market continued its robust expansion in November, with registrations reaching 1,236,123 units. This represents a 62.09% year-on-year spike and a 4.76% rise compared to October.

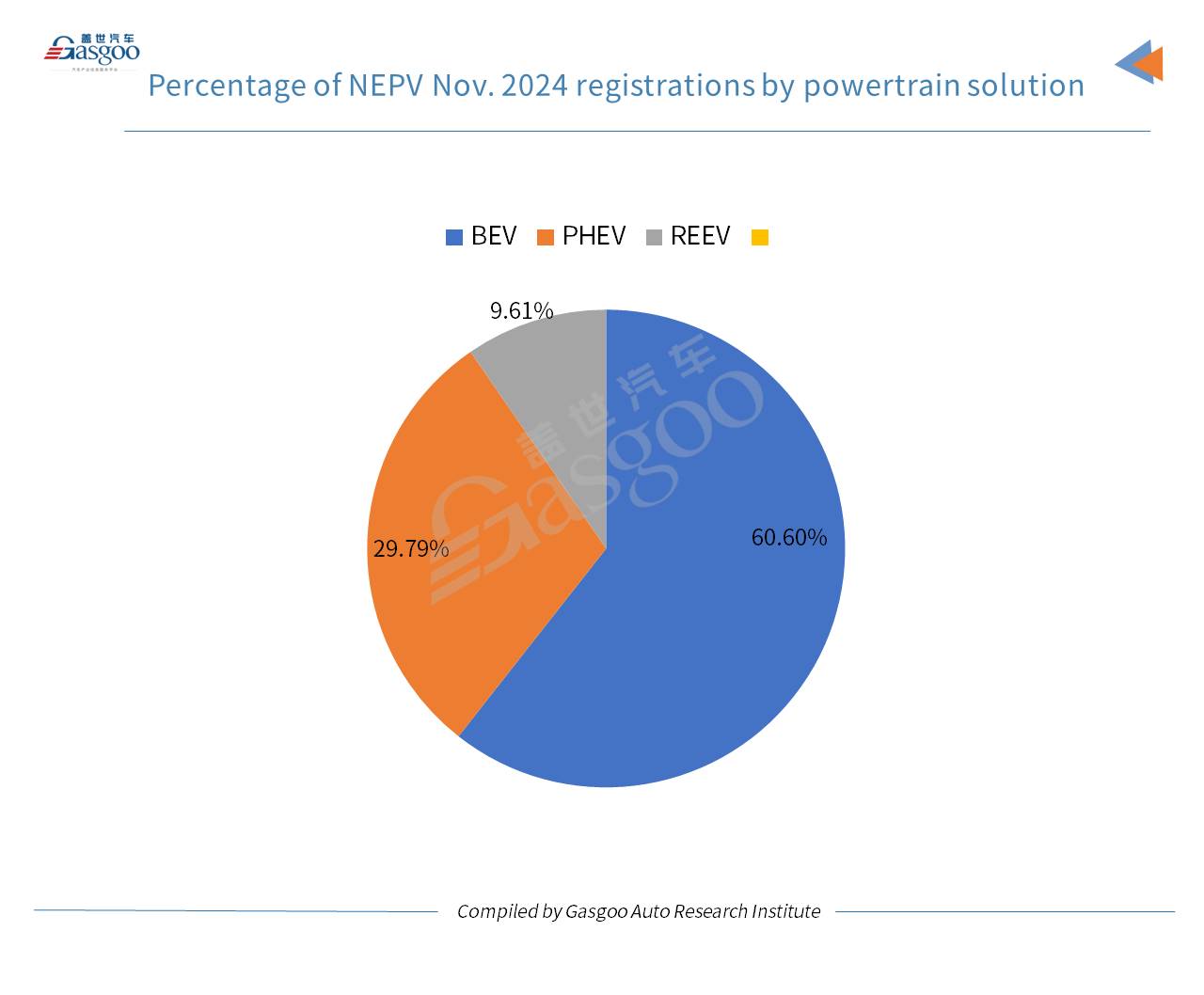

In terms of the powertrain types, BEVs remained the dominant category, accounting for 60.6% of the total NEPV registrations in November. PHEVs and range-extended electric vehicles (REEVs) took up 29.79% and 9.61% of market share, respectively.

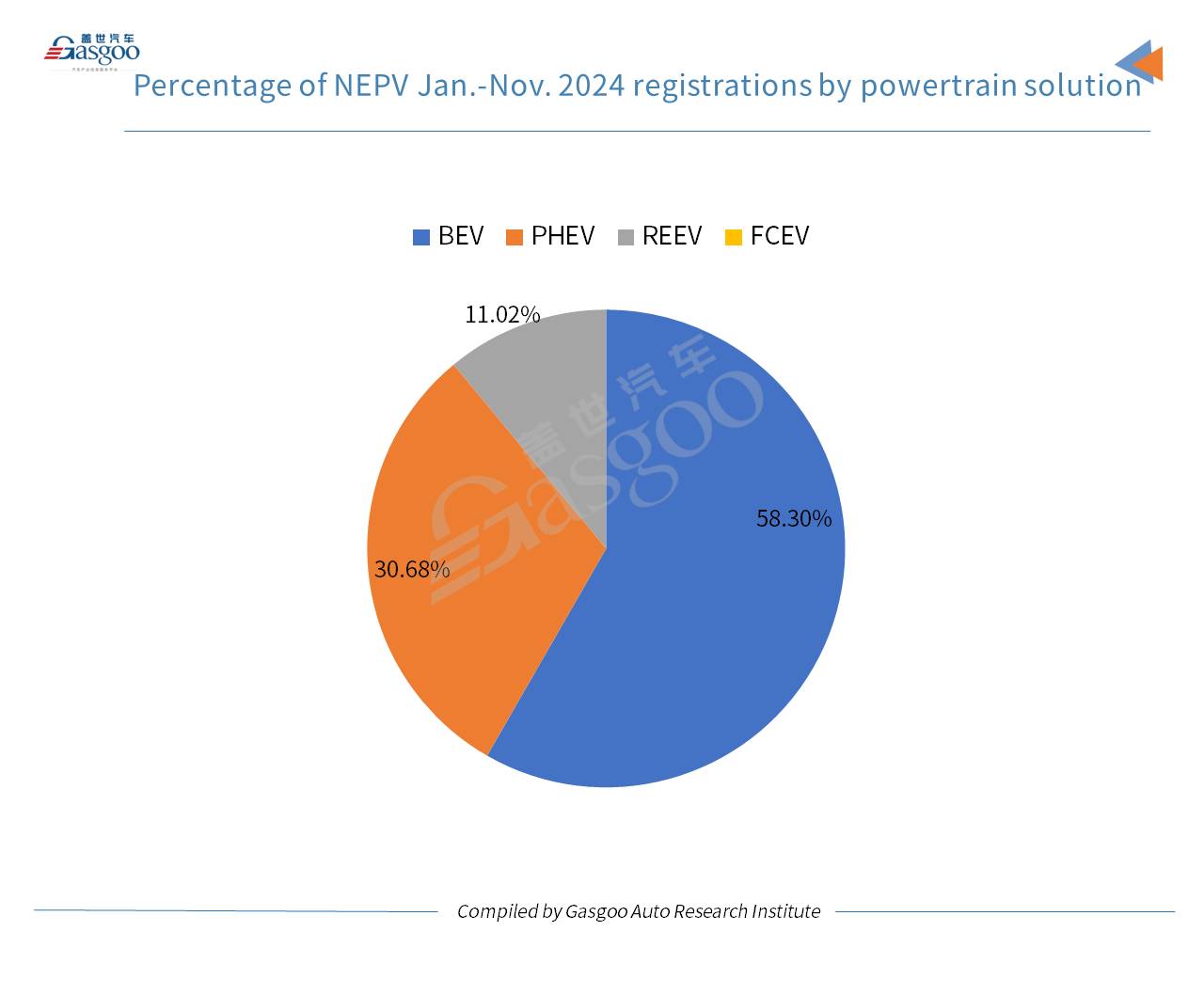

YTD data by November reveals a total of 9,458,528 NEPVs registered, marking a 48.93% hike compared to the same period in 2023. BEVs accounted for 58.3% of overall NEPV registrations, followed by PHEVs at 30.68% and REEVs at 11.02%. Additionally, 26 fuel cell vehicles were registered during this period, though the negligible number make their market share statistically insignificant.

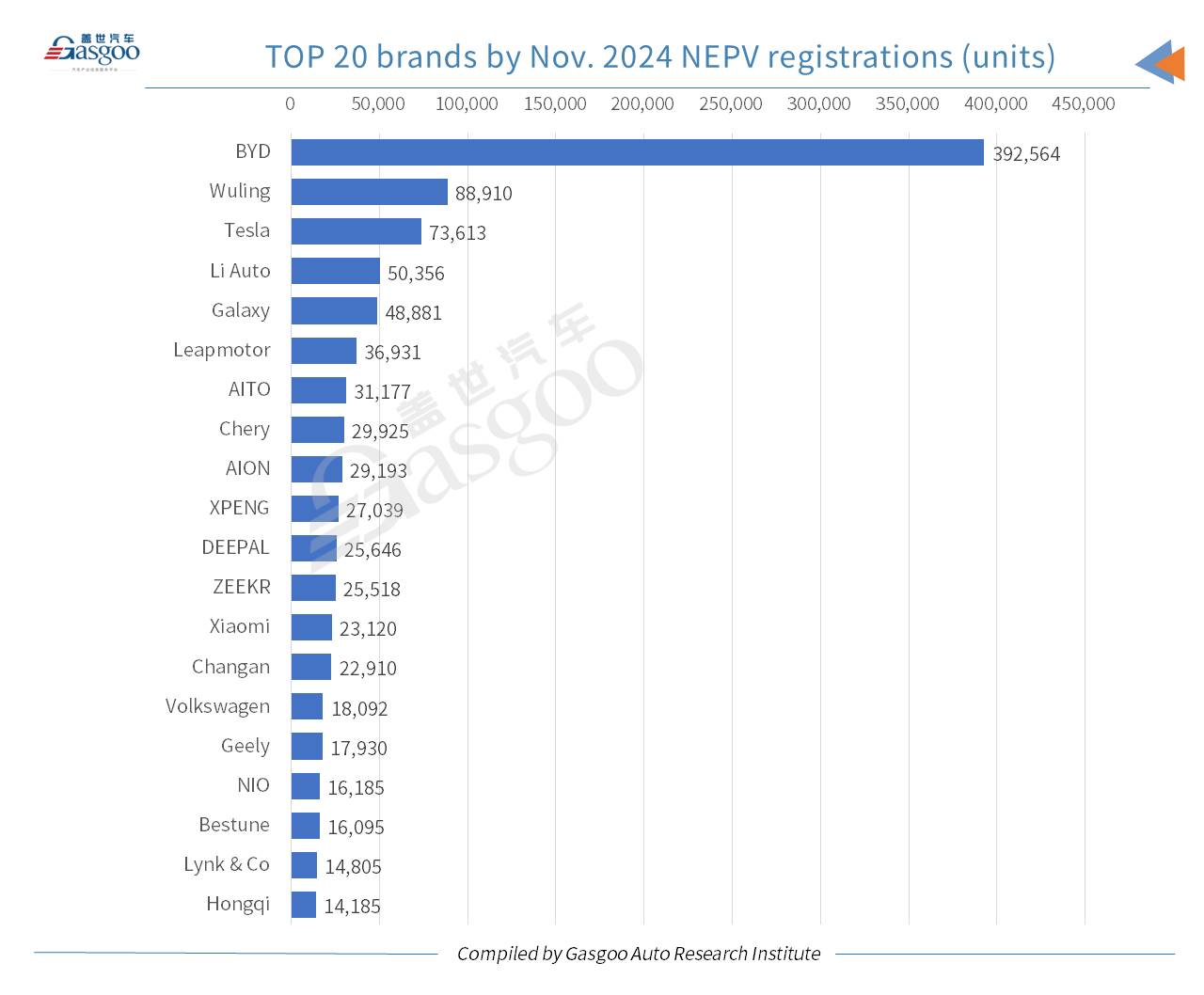

Top 20 brands by Nov. and YTD 2024 new energy passenger vehicle registrations

When considering the November NEPV registration data, the top 20 brand list was dominated by China's wholly-owned brands, with the exception of Tesla (3rd) and Volkswagen (15th). BYD, as the overall leader in passenger vehicle registrations, claimed the top spot on this list without doubt. In November, BYD's registrations outperformed the totals from brands ranking second to ninth. Wuling took the second place, with both the Hongguang MINIEV and the Binguo models performing particularly well, each surpassing 20,000 units in registration.

Li Auto ranked 4th, falling one spot compared to October. Brands from Geely Holding, such as Galaxy (5th) and ZEEKR (12th), secured strong positions, with Geely brand itself coming in 16th. Leapmotor and AITO each surpassed 30,000 units of registrations in November, ranking 6th and 7th, respectively.

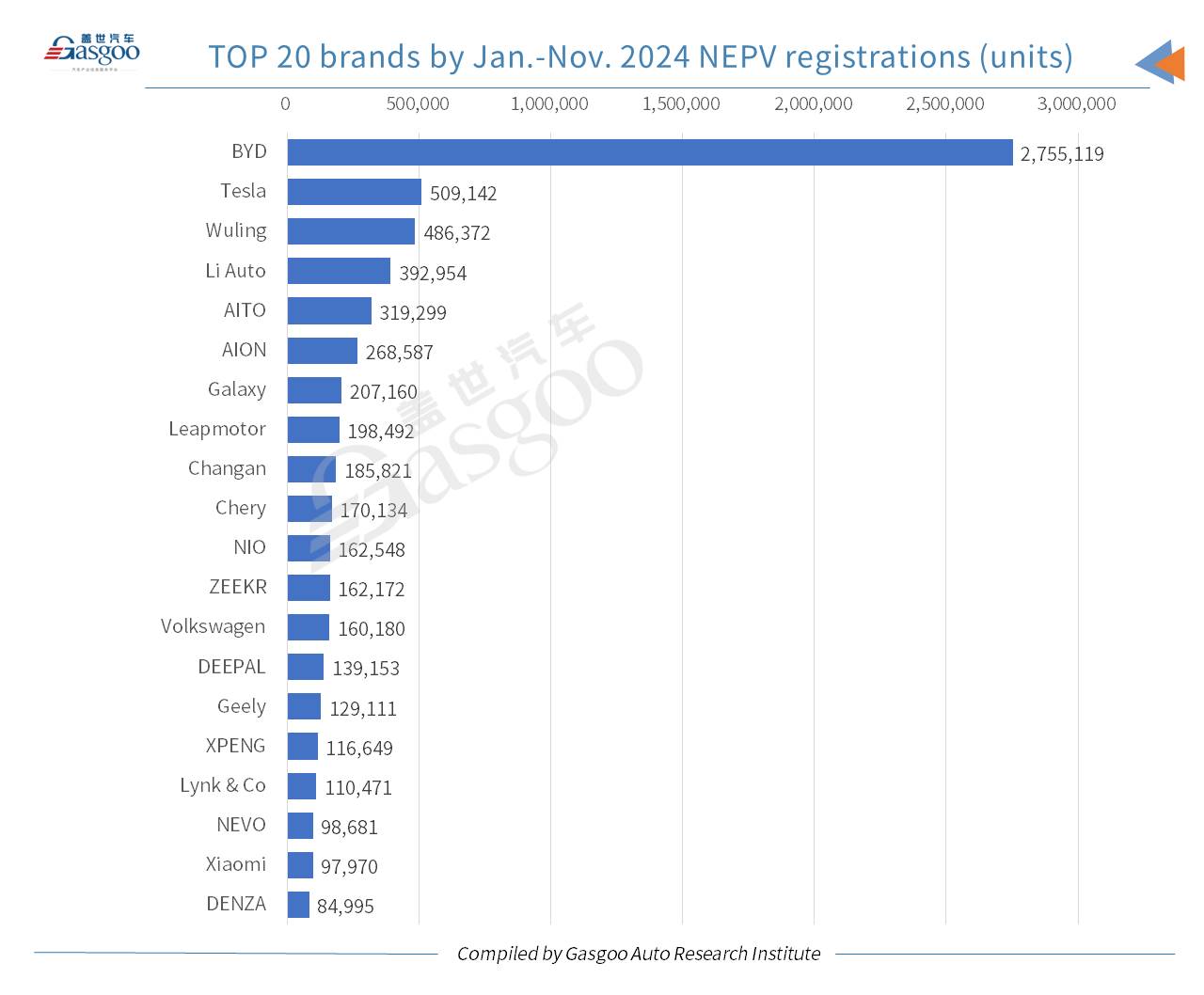

For the period from January to November, seven brands had cumulative NEPV registrations exceeding 200,000 units each. BYD led the pack with more than 2 million units, far outpacing the competition. Tesla ranked second, with its YTD registrations surpassing 500,000 units. Wuling, Li Auto, and AITO followed in third, fourth, and fifth places, while AION and Galaxy occupied the 6th and 7th spots.

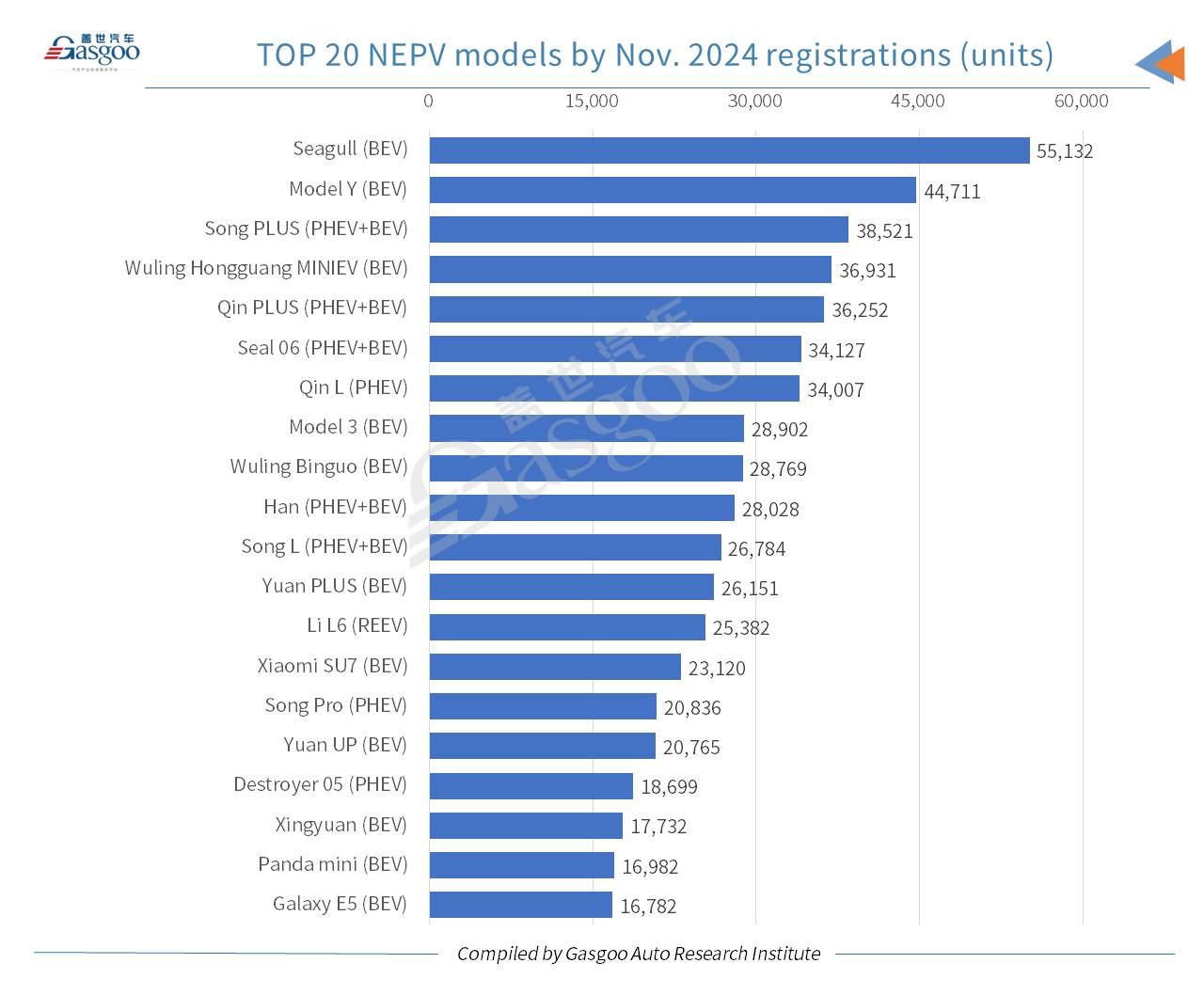

Top 20 new energy passenger vehicle models by Nov. and YTD 2024 registrations

In terms of November NEPV registrations, BYD's models dominated the top 20, claiming 11 positions, with six of those models ranking in the top ten. Among these, five models offered both BEV and PHEV variants. Tesla's two models also secured spots in the top 10. Additionally, the Geely Xingyuan, an A0-segment pure electric vehicle model just hitting the market in early October this year, ranked 18th with 17,732 units registered.

Regarding the cumulative registration data from January to November, BYD continued to show the strongest presence in the top 20 NEV models, with 11 of its models making the list. Wuling, AITO, and Tesla each had two models in the top 20.

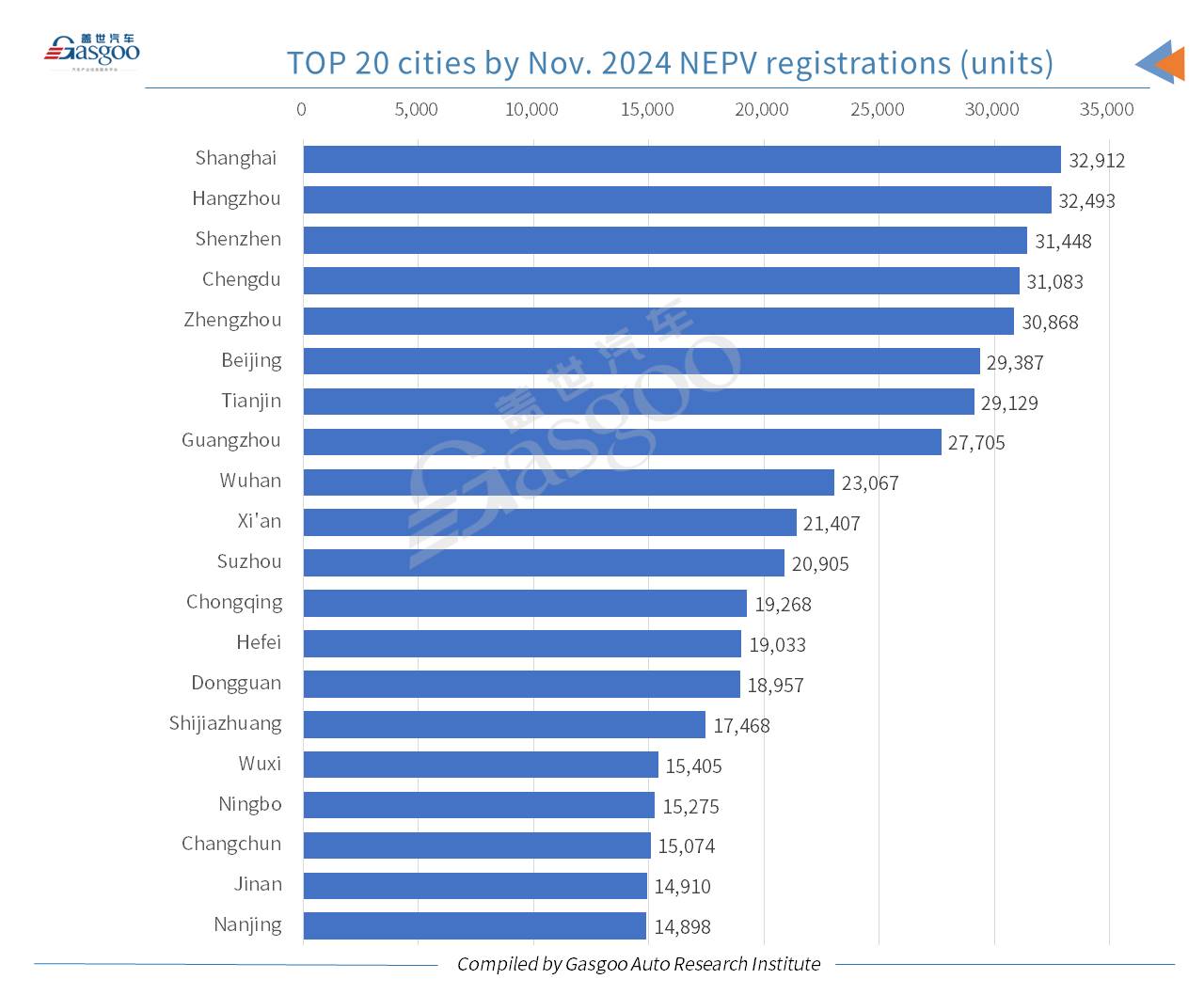

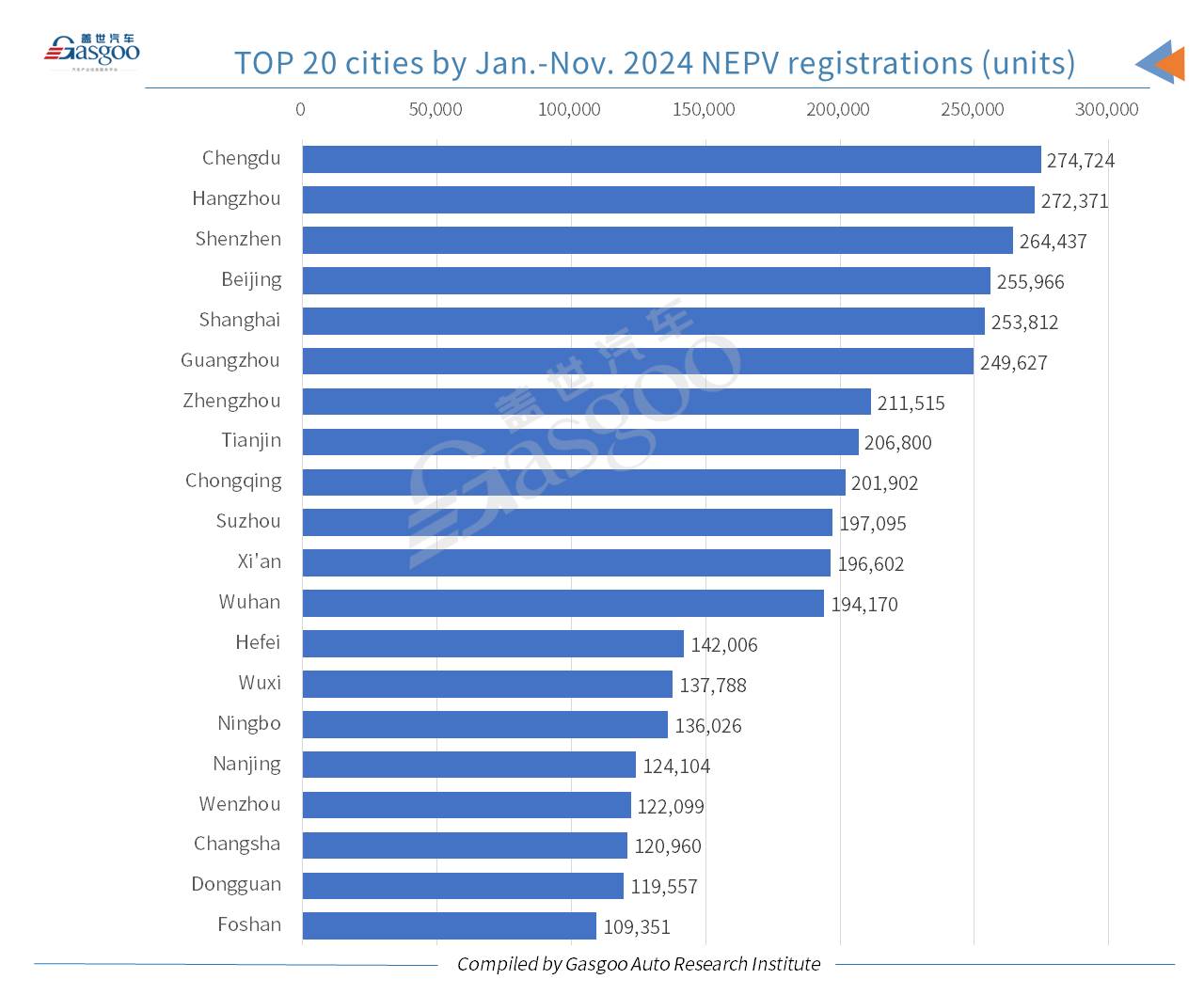

Top 20 cities by Nov. and YTD 2024 new energy passenger vehicle registrations

On the city level, Shanghai had the highest NEPV registration volume in November (32,912 units), representing 58.36% of the city's total domestically made PV registrations. Hangzhou ranked second, registering 32,493 NEPVs, which accounted for an impressive 63.21% of the city's overall PV registrations.

For the first eleven months, nine cities on the Chinese Mainland had cumulative NEPV insurance registrations exceeding 200,000 units. Chengdu, Hangzhou, and Shenzhen remained the top three, with year-to-date registrations exceeding 260,000 units each.