From January to August 2025, China's passenger vehicle market saw continued growth in ADAS, with local suppliers gaining share across air suspension system, HD map, LiDAR, and other key segments. Their advances in technology and cost control are accelerating the mass adoption of intelligent features.

Meanwhile, market restructuring is accelerating. Leading players are strengthening their positions through technological expertise, scale advantages, and ecosystem partnerships. The landscape of "China's local strength and global competition" is taking shape, underscoring the resilience of China's automotive supply chain and marking a new phase of faster localization in core intelligent vehicle components.

Top air suspension system suppliers

KH Automotive Technologies: 228,173 sets installed, 34.7% market share

Tuopu Group: 227,909 sets installed, 34.6% market share

Baolong Automotive: 129,465 sets installed, 19.7% market share

Vibracoustic: 52,958 sets installed, 8.0% market share

Continental: 18,633 sets installed, 2.8% market share

Others: 847 sets installed, 0.1% market share

From January to August, Chinese suppliers led the air suspension market. KH Automotive Technologies (34.7% share), Tuopu Group (34.6% share), and Baolong Automotive (19.7% share) together held 89% of the market, outpacing foreign brands. Their strengths in technology, cost, and responsiveness have driven faster adoption of air suspension systems and highlighted China's growing competitiveness in high-end automotive components.

Top LiDAR suppliers

Huawei Technologies: 643,826 units installed, 41.1% market share

Hesai Technology: 514,189 units installed, 32.8% market share

RoboSense: 305,171 units installed, 19.5% market share

Seyond: 104,700 units installed, 6.7% market share

Others: 184 units installed, 0.01% market share

From January to August, China's LiDAR market maintained strong growth with rising concentration among leading players. Huawei Technologies led with a 41.1% share, followed by Hesai Technology (32.8%) and RoboSense (19.5%), together commanding over 93% of the market. This dominance highlights the strengthening technological barriers and growing influence of top suppliers. As advanced driving systems continue to expand, demand will keep rising, but smaller players will face increasing challenges in a "strong-get-stronger" market landscape.

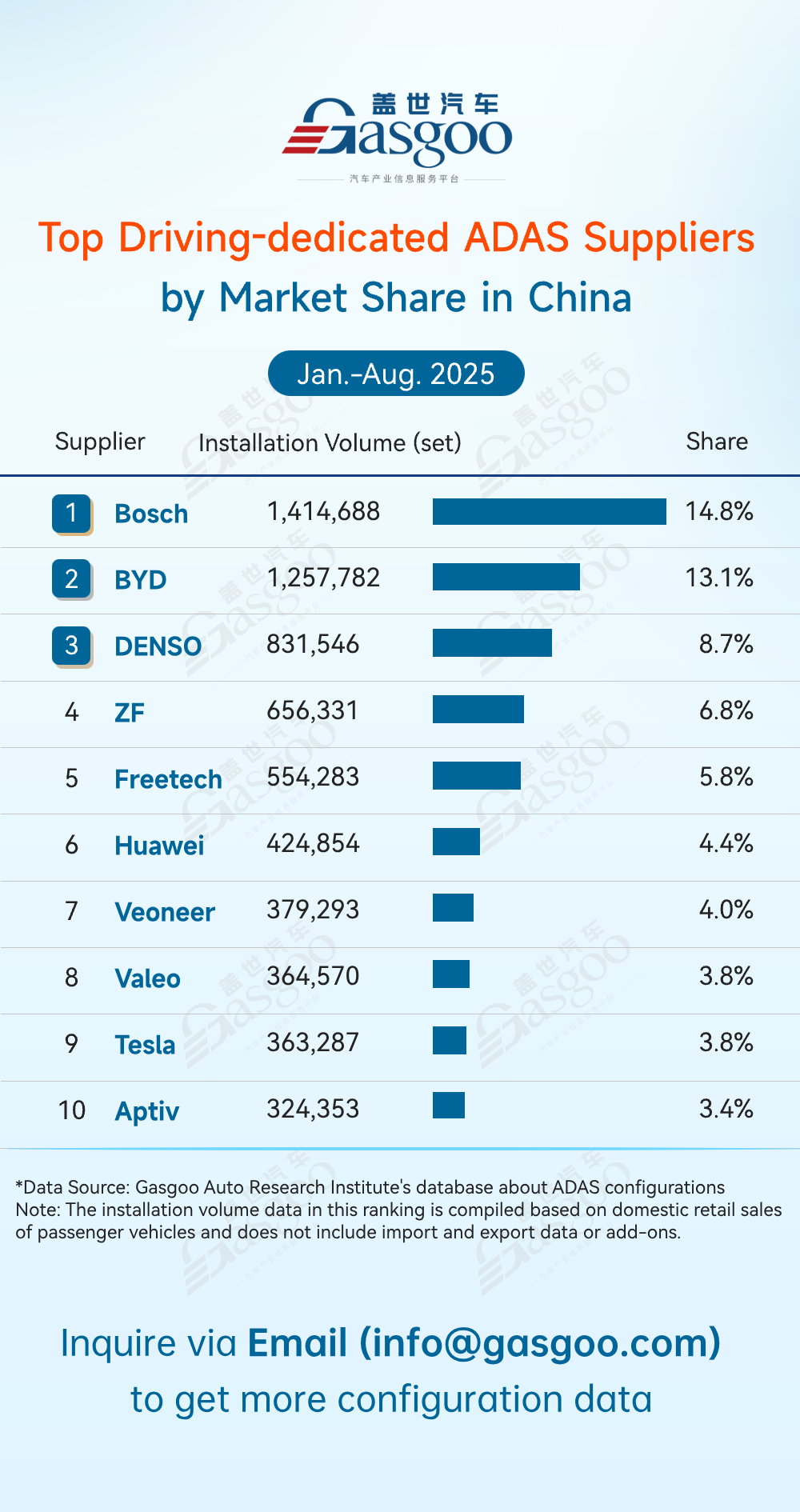

Top driving-dedicated ADAS suppliers

Bosch: 1,414,688 sets installed, 14.8% market share

BYD: 1,257,782 sets installed, 13.1% market share

DENSO: 831,546 sets installed, 8.7% market share

ZF: 656,331 sets installed, 6.8% market share

Freetech: 554,283 sets installed, 5.8% market share

Huawei: 424,854 sets installed, 4.4% market share

Veoneer: 379,293 sets installed, 4.0% market share

Valeo: 364,570 sets installed, 3.8% market share

Tesla: 363,287 sets installed, 3.8% market share

Aptiv: 324,353 sets installed, 3.4% market share

From January to August, the driving-dedicated ADAS market showed diversified competition. Bosch led the pack with 14.8% market share, while Tier 1 suppliers like DENSO (8.7% share) and ZF (6.8% share), OEMs like BYD (13.1% share), and tech companies like Huawei (4.4% share) strengthened their positions. Front-view integrated solutions remain dominant, reflecting a mature commercial path and the evolving competition among traditional suppliers, OEMs, and tech firms.

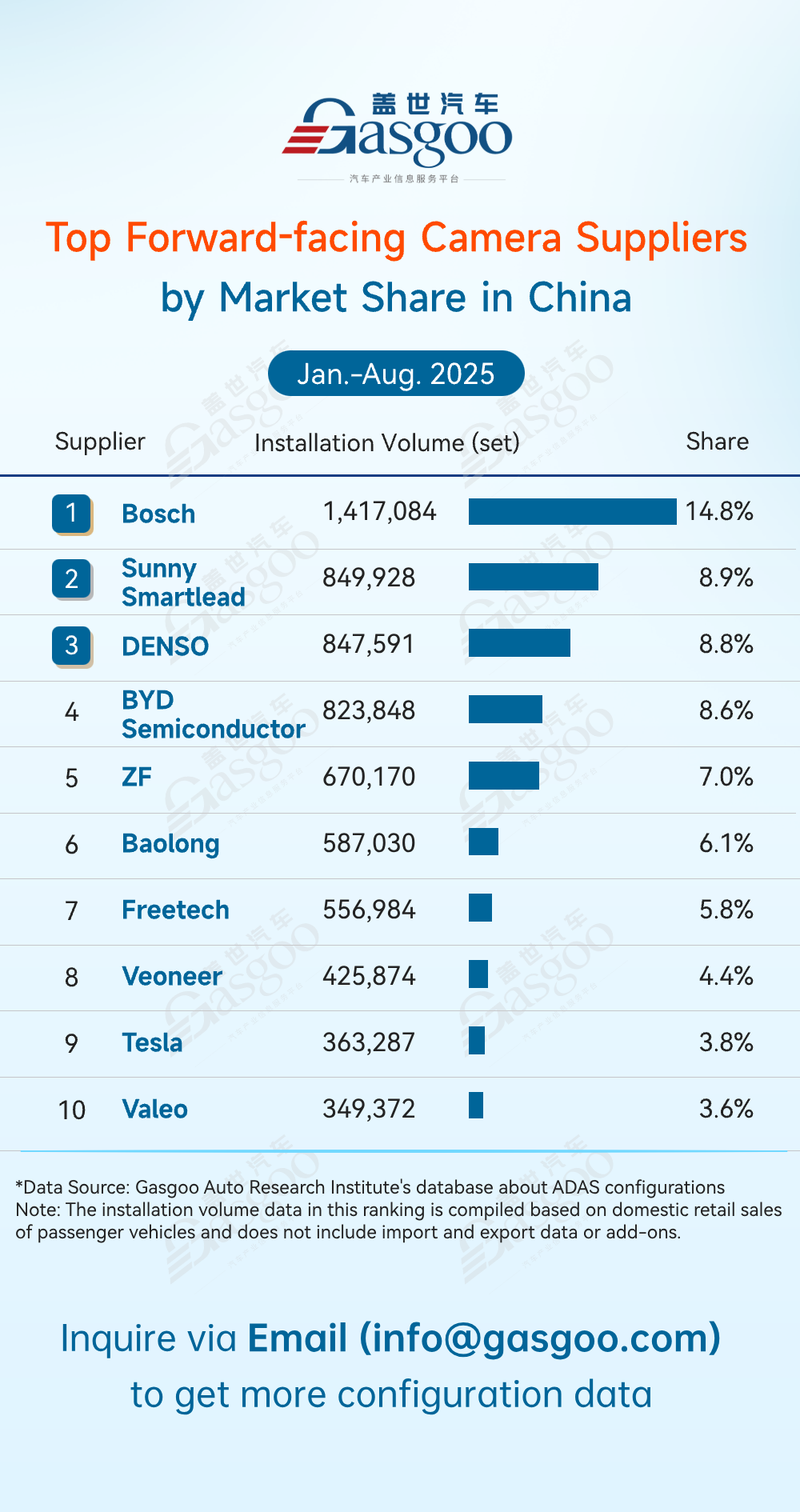

Top forward-facing camera suppliers

Bosch: 1,417,084 sets installed, 14.8% market share

Sunny Smartlead: 849,928 sets installed, 8.9% market share

DENSO: 847,591 sets installed, 8.8% market share

BYD Semiconductor: 823,848 sets installed, 8.6% market share

ZF: 670,170 sets installed, 7.0% market share

Baolong: 587,030 sets installed, 6.1% market share

Freetech: 556,984 sets installed, 5.8% market share

Veoneer: 425,874 sets installed, 4.4% market share

Tesla: 363,287 sets installed, 3.8% market share

Valeo: 349,372 sets installed, 3.6% market share

From January to August, Bosch maintained its lead in the forward-facing camera market with a 14.8% share. However, China's local suppliers like Sunny Smartlead (8.9% share), BYD Semiconductor (8.6% share), and Baolong (6.1% share) gained significant ground, highlighting China's growing strength in smart driving hardware and import substitution. While foreign brands like DENSO and ZF remain competitive, local manufacturers are reshaping the market, driving cost efficiency and local adaptation in the industry's evolution.

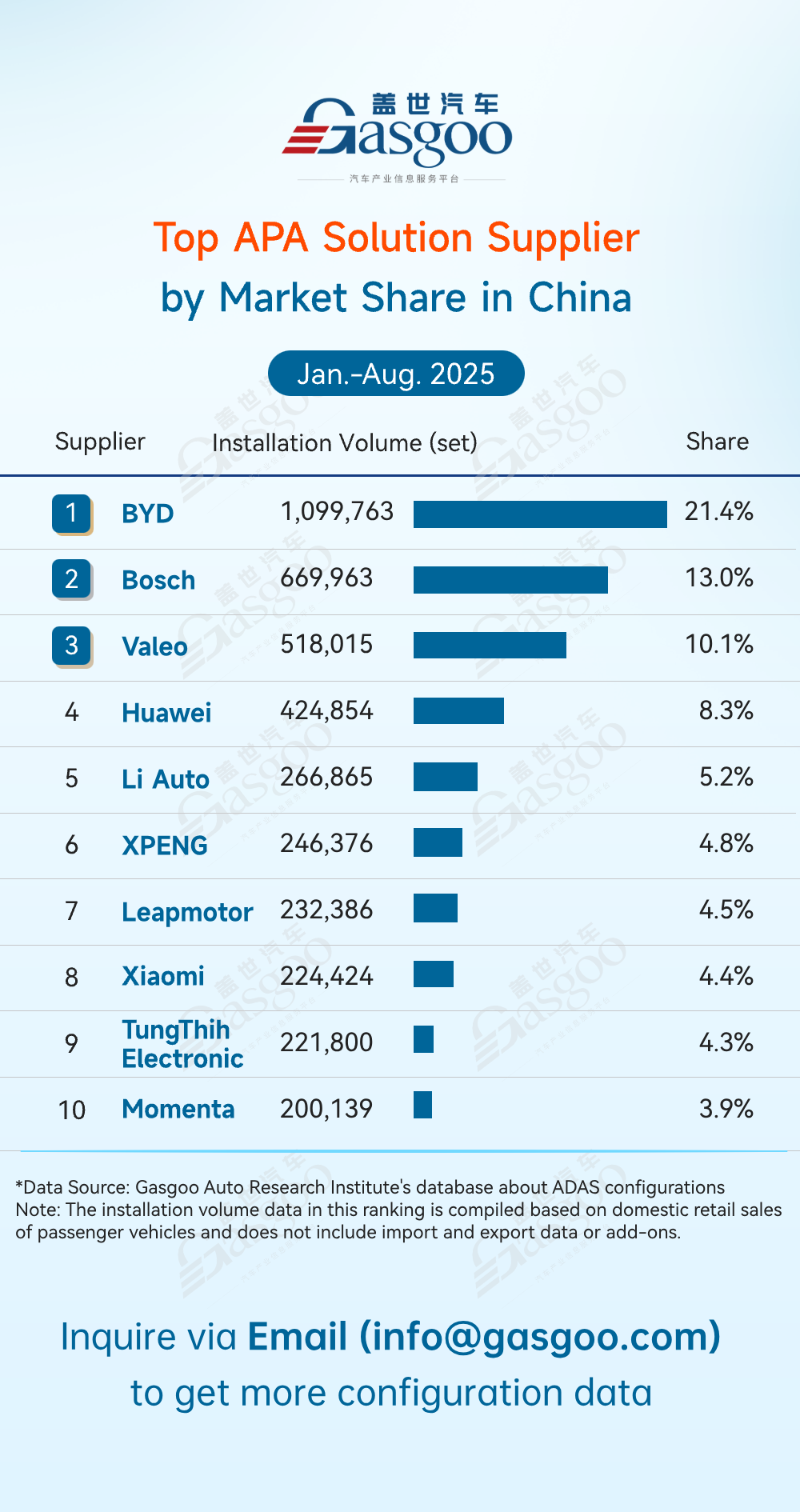

Top APA solution suppliers

BYD: 1,099,763 sets installed, 21.4% market share

Bosch: 669,963 sets installed, 13.0% market share

Valeo: 518,015 sets installed, 10.1% market share

Huawei: 424,854 sets installed, 8.3% market share

Li Auto: 266,865 sets installed, 5.2% market share

XPENG: 246,376 sets installed, 4.8% market share

Leapmotor: 232,386 sets installed, 4.5% market share

Xiaomi: 224,424 sets installed, 4.4% market share

TungThih Electronic: 221,800 sets installed, 4.3% market share

Momenta: 200,139 sets installed, 3.9% market share

From January to August, China's local suppliers continued to gain ground in the APA solution market. BYD took the lead with a 21.4% share, followed by Huawei, Li Auto, XPENG, and Xiaomi, forming a competitive landscape alongside global players like Bosch and Valeo. The surge of local automakers and tech firms highlights the rapid commercialization of APA technology and China's growing supply chain strength. With ongoing tech upgrades and cost optimization, China's local APA solutions are becoming increasingly competitive, driving wider adoption of intelligent parking features.

Top HD map suppliers

AutoNavi: 754,703 sets installed, 54.3% market share

Tencent: 173,083 sets installed, 12.4% market share

Langge Technology: 160,870 sets installed, 11.6% market share

NavInfo: 93,630 sets installed, 6.7% market share

Others: 208,151 sets installed, 15.0% market share

From January to August, China's HD map market remained highly concentrated at the top. AutoNavi led the pack with 754,703 installations (54.3% share), solidifying its industry benchmark position through strong technical capabilities and broad OEM partnerships. Tencent (12.4%) and Langge Technology (11.6%) formed the second tier, while NavInfo held 6.7%, with others accounting for 15%. Overall, leading players continue to strengthen their dominance through scale and technology, while mid-sized firms seek growth via niche differentiation. AutoNavi's leadership in the high-precision map sector has become increasingly clear.

Top suppliers of high precision positioning system

ASENSING: 1,596,203 sets installed, 52.6% market share

Huawei: 424,463 sets installed, 14.0% market share

CHC Navigation: 224,768 sets installed, 7.4% market share

XPENG: 157,496 sets installed, 5.2% market share

MCT: 89,479 sets installed, 2.9% market share

Others: 544,969 sets installed, 17.9% market share

From January to August, China's high precision positioning market showed a "leader-plus-followers" structure. ASENSING led the pack with 52.6% market share and over 1.59 million installations, followed by Huawei (14.0%), CHC Navigation (7.4%), and XPENG (5.2%). Others held 17.9%. The market is increasingly driven by integration, with top players expanding their lead through technology and scale, while smaller suppliers seek breakthroughs in niche applications.