Rankings of ADAS component suppliers in China (Jan.-Sept. 2025): Dominance reshaped by rising Chinese suppliers

From January to September 2025, China's passenger vehicle market saw accelerated domestic breakthroughs in ADAS segments. Chinas local suppliers steadily increased their market share in air suspension system, LiDAR, APA solution, and high-precision positioning through technology, cost control, and local adaptation, driving large-scale adoption of high-end features.

Meanwhile, leading companies consolidated their positions through technology, scale, and ecosystem partnerships, while China's local players increasingly matched or overtook foreign competitors. This trend highlights the resilience of China's automotive supply chain and the shift toward local-led, diversified growth in smart vehicle components.

Top air suspension system suppliers

Tuopu Group: 280,892 sets installed, 35.4% market share

KH Automotive Technologies: 259,091 sets installed, 32.7% market share

Baolong Automotive: 161,458 sets installed, 20.4% market share

Vibracoustic: 68,310 sets installed, 8.6% market share

Continental: 21,561 sets installed, 2.7% market share

Others: 1,659 sets installed, 0.2% market share

From January to September 2025, China's local suppliers continued to strengthen their lead in air suspension market. Tuopu Group, KH Automotive Technologies, and Baolong Automotive remained the top 3, accounting for 88.5% of the market, while foreign brands like Vibracoustic and Continental saw their market share further squeezed. This structure highlights the Chinese suppliers' advantages in technology, cost control, and responsiveness. Combined with deep mastery of core technologies, these strengths accelerated the adoption of air suspension in passenger vehicles and underscored the rising influence of China's auto parts industry in high-end segments.

Top LiDAR suppliers

Huawei Technologies: 789,924 units installed, 41.3% market share

Hesai Technology: 643,414 units installed, 33.6% market share

RoboSense: 360,824 units installed, 18.9% market share

Seyond: 119,043 units installed, 6.2% market share

Others: 197 units installed, 0.01% market share

From January to September 2025, the LiDAR market grew rapidly, led by Huawei Technologies (41.3%), Hesai Technology (33.6%), and RoboSense (18.9%), which together held 93.8% of the market. Seyond and others accounted for less than 7%. The top suppliers' technological edge and influence remain strong, while smaller players face growing challenges, reinforcing a "head-concentrated, strong-get-stronger" market pattern.

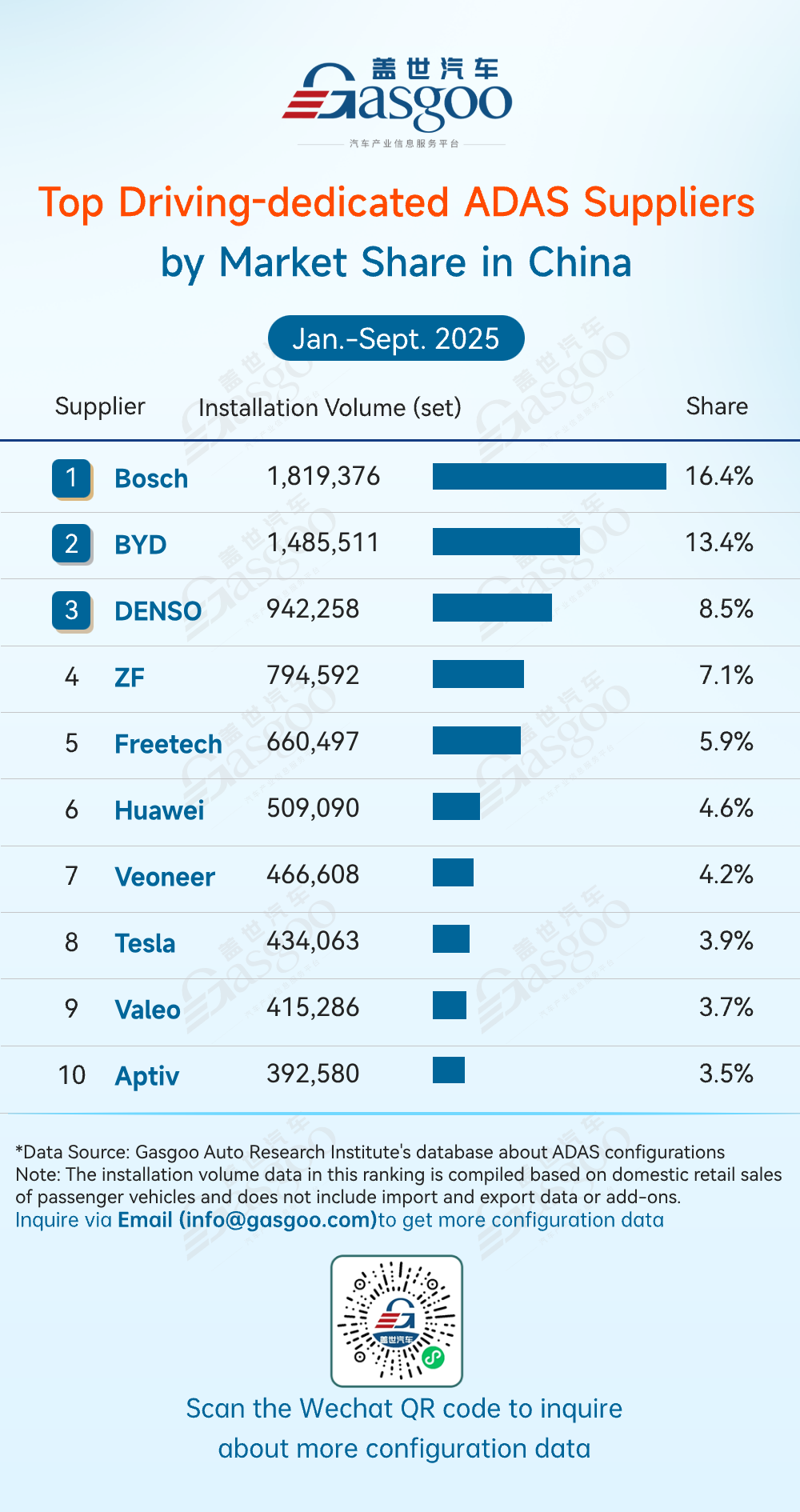

Top driving-dedicated ADAS suppliers

Bosch: 1,819,376 sets installed, 16.4% market share

BYD: 1,485,511 sets installed, 13.4% market share

DENSO: 942,258 sets installed, 8.5% market share

ZF: 794,592 sets installed, 7.1% market share

Freetech: 660,497 sets installed, 5.9% market share

Huawei: 509,090 sets installed, 4.6% market share

Veoneer: 466,608 sets installed, 4.2% market share

Tesla: 434,063 sets installed, 3.9% market share

Valeo: 415,286 sets installed, 3.7% market share

Aptiv: 392,580 sets installed, 3.5% market share

From January to September, the driving-dedicated ADAS market remained highly competitive. Bosch led the pack with a 16.4% share, followed by BYD at 13.4% with strong in-house ADAS adoption. Traditional Tier-1 suppliers like DENSO and ZF held solid positions through mature technologies and OEM partnerships, while tech players such as Huawei broke into the top 10. Tesla, Valeo and Aptiv also maintained distinct advantages. Front-view integrated systems continued as the mainstream architecture, highlighting the maturity of current ADAS commercialization. With intelligent-driving penetration rising, competition will tighten further, making rapid tech iteration and ecosystem collaboration increasingly critical.

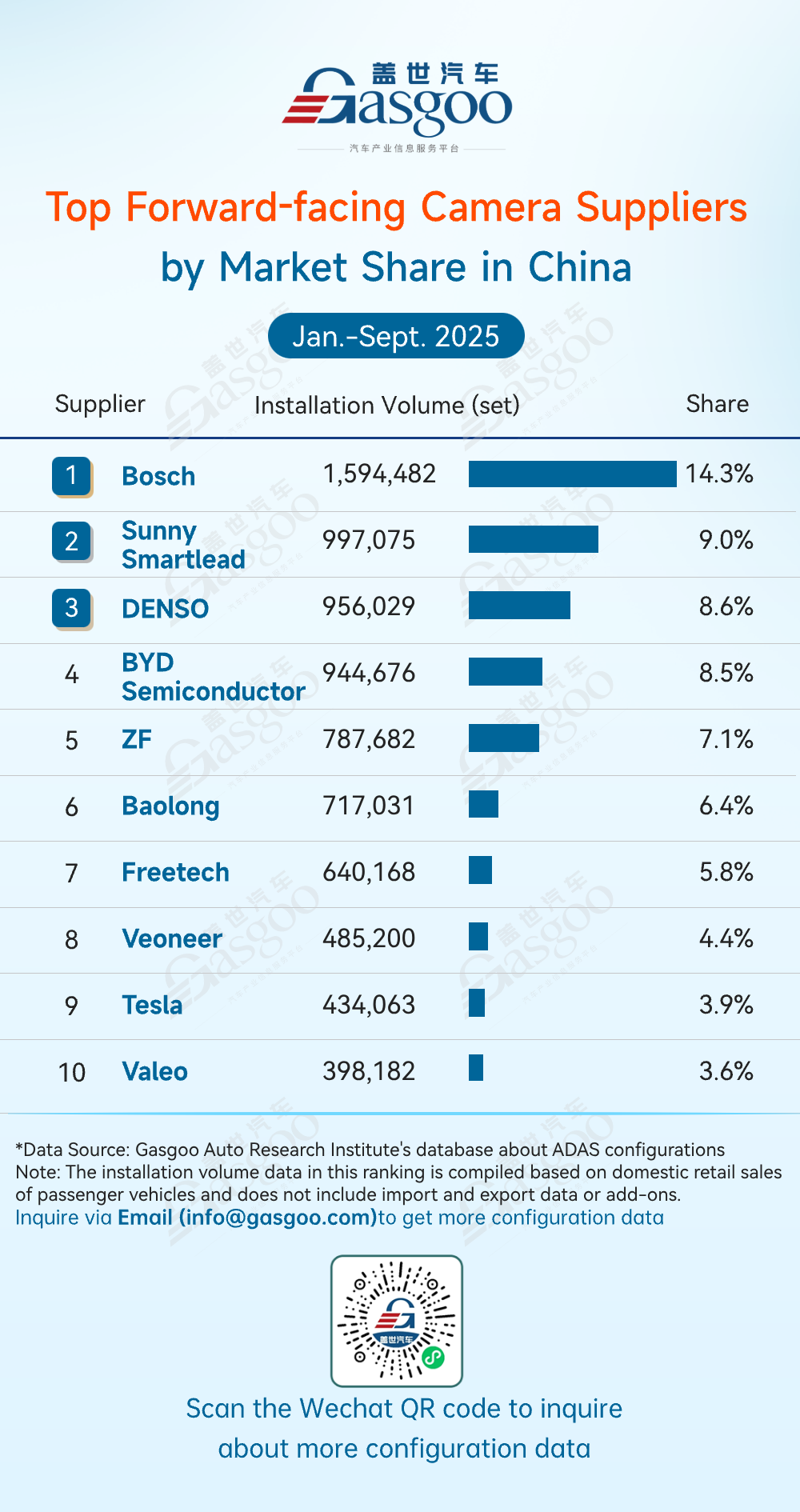

Top forward-facing camera suppliers

Bosch: 1,594,482 sets installed, 14.3% market share

Sunny Smartlead: 997,075 sets installed, 9.0% market share

DENSO: 956,029 sets installed, 8.6% market share

BYD Semiconductor: 944,676 sets installed, 8.5% market share

ZF: 787,682 sets installed, 7.1% market share

Baolong: 717,031 sets installed, 6.4% market share

Freetech: 640,168 sets installed, 5.8% market share

Veoneer: 485,200 sets installed, 4.4% market share

Tesla: 434,063 sets installed, 3.9% market share

Valeo: 398,182 sets installed, 3.6% market share

From January to September, Bosch led the forward-facing camera market with a 14.3% share, maintaining its benchmark position among foreign suppliers. China's local players, however, are becoming the core drivers of market change: Sunny Smartlead held 9.0%, BYD Semiconductor reached 8.5%, and Baolong Automotive and Freetech continued expanding with strong technical capabilities and local integration advantages.Together, these shifts reflect a clear acceleration of localization. The forwad-facing camera sector is moving from long-time foreign dominance toward a more balanced landscape where Chinese suppliers rapidly scale, strengthen competitiveness, and play an increasingly central role in next-generation ADAS perception hardware.

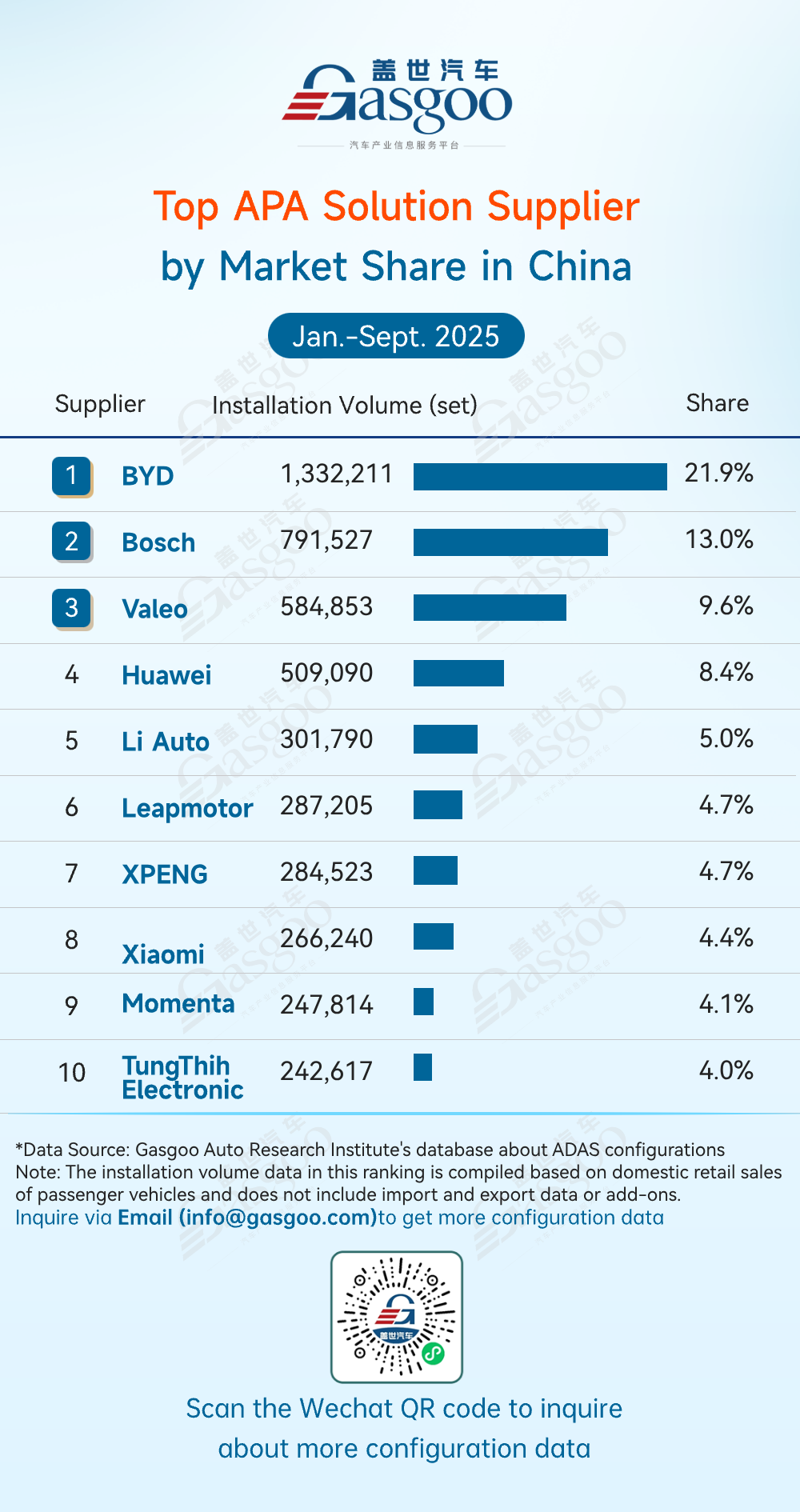

Top APA solution suppliers

BYD: 1,332,211 sets installed, 21.9% market share

Bosch: 791,527 sets installed, 13.0% market share

Valeo: 584,853 sets installed, 9.6% market share

Huawei: 509,090 sets installed, 8.4% market share

Li Auto: 301,790 sets installed, 5.0% market share

Leapmotor: 287,205 sets installed, 4.7% market share

XPENG: 284,523 sets installed, 4.7% market share

Xiaomi: 266,240 sets installed, 4.4% market share

Momenta: 247,814 sets installed, 4.1% market share

TungThih Electronic: 242,617 sets installed, 4.0% market share

From January to September, China's APA solution market continued to show a clear rise in domestic players' market share. BYD led the field with a 21.9% share, while Huawei, Li Auto, XPENG, and Xiaomi joined Bosch and Valeo in an increasingly competitive landscape. Overall, China's local APA solutions are gaining strength through faster technology iteration, cost efficiency, and strong local adaptation. This is accelerating the mainstream adoption of intelligent parking features and further elevating the autonomy of China's intelligent-driving supply chain.

Top HD map suppliers

AutoNavi: 902,895 sets installed, 53.7% market share

Tencent: 207,268 sets installed, 12.3% market share

Langge Technology: 197,208 sets installed, 11.7% market share

NavInfo: 108,617 sets installed, 6.5% market share

Others: 264,614 sets installed, 15.7% market share

From January to September, China's HD map market showed a structure of "top-heavy dominance with a fast-catching second tier." AutoNavi took the lead decisively with 902,895 sets installed (53.7% share). Tencent and Langge Technology followed as the core second-tier players with 12.3% and 11.7% shares respectively—Tencent leveraging its internet ecosystem for scenario-driven capabilities, while Langge relied on deep regional presence and customized services. NavInfo held a steady 6.5% share. All other suppliers together accounted for 15.7% of the market, indicating that while the top players are consolidating their lead, there remains room for diversified competition.

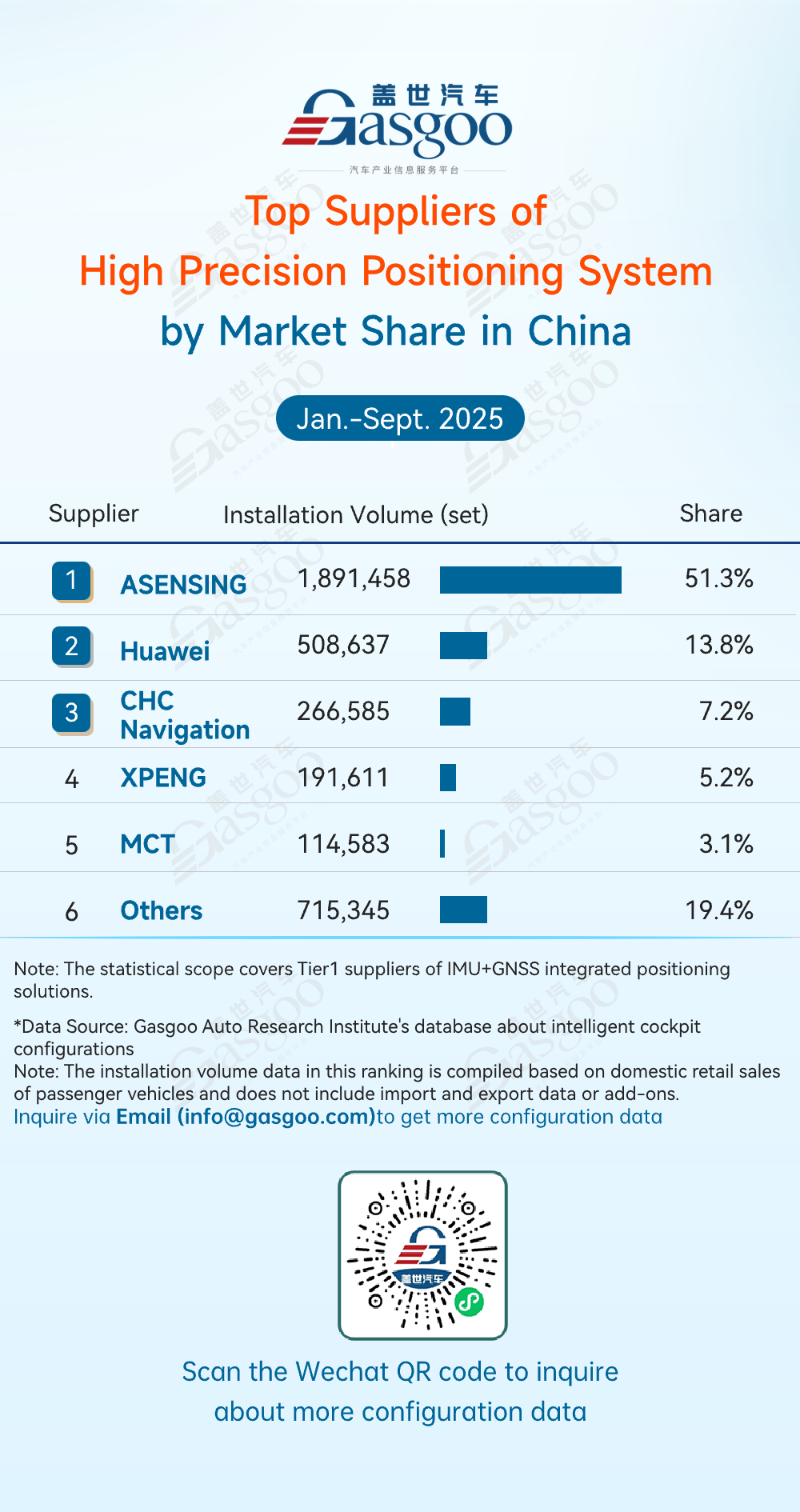

Top suppliers of high precision positioning system

ASENSING: 1,891,458 sets installed, 51.3% market share

Huawei: 508,637 sets installed, 13.8% market share

CHC Navigation: 266,585 sets installed, 7.2% market share

XPENG: 191,611 sets installed, 5.2% market share

MCT: 114,583 sets installed, 3.1% market share

Others: 715,345 sets installed, 19.4% market share

From January to September, China's high precision positioning market showed a landscape of "top-tier leadership and multi-player competition." ASENSING led the market with 1,891,458 sets installed (51.3% share), leveraging its strengths in fusion positioning and large-scale delivery to secure a dominant position. Huawei ranked second with a 13.8% share, underscoring its deep penetration in the intelligent vehicle technology ecosystem. CHC Navigation, XPENG, and MCT followed with 7.2%, 5.2%, and 3.1% respectively, reflecting diversified approaches across technologies and application scenarios. All other suppliers collectively held 19.4%, indicating continued competition in various niche segments.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com