In 2025, China's automotive industry finds itself at a far-from-easy turning point.

On the one hand, China remains the world's largest automotive market. New-energy vehicle penetration continues to rise, and the pace of intelligent transformation is steadily accelerating. On the other hand, a growing number of companies are feeling a very real and persistent pressure: selling more does not necessarily mean earning more. In some cases, the more vehicles are sold, the harder it becomes to make a profit. Price competition is intensifying, industry margins are being continuously squeezed, and corporate investment keeps rising—while payback periods grow ever longer. Terms such as "involution," "anti-involution," and "high-quality development" are no longer just buzzwords in industry debates; they have become unavoidable realities.

It is against this backdrop that the "15th Five-Year Plan" period is being mentioned with increasing frequency.

But the key question remains: what does the 15th Five-Year Plan really mean for China's automotive industry? Does it mark the beginning of a new growth cycle—or the onset of a deeper, more structural reshuffle across the sector?

In this episode of Tina's Talk, drawing on the latest research from the Gasgoo Automotive Research Institute, we will explore these questions and offer some initial observations to spark further discussion.

I. The Core Theme: From "High-Speed Growth" to "High-Quality Development"

Looking back from the end of 2025, China's automotive industry stands at an exceptionally critical historical juncture. Over the past decade or more, the industry has undergone a profound and rapid transformation:

In terms of market scale, China has ranked first globally for many consecutive years, with total sales expected to reach a new high in 2025.

In terms of technology pathways, electrification and intelligentization are advancing at the forefront of the global automotive industry, increasingly setting the pace rather than merely following it.

In terms of the industrial system, China has built the world's most complete automotive supply chain—one that is also the fastest to respond and adapt.

However, as the industry enters the 15th Five-Year Plan period, the core question it faces is changing. The focus of the industry is shifting—from whether vehicles can be made and sold, to whether the industry can sustain long-term, healthy, and resilient development. At the same time, the center of gravity is moving beyond domestic competition toward a new phase defined by global competition and cooperation.

High-quality development is no longer a slogan for China's automotive industry. It has become a concrete requirement jointly shaped by policy direction, regulatory pressure, and market dynamics.

Against this backdrop, several trends are unfolding simultaneously:

• Domestic market growth is slowing, with the industry entering a phase of structural adjustment.

• New-energy vehicle penetration continues to rise, but competition is intensifying markedly.

• Clear signals of "anti-involution" are emerging, accompanied by tighter and more sustained regulatory oversight.

• Going global has become a shared consensus, even as uncertainty in the global environment continues to increase.

• AI and software are becoming deeply embedded, reshaping vehicle products and redefining the boundaries of the automotive industry.

The "15th Five-Year Plan" period is therefore not a continuation of the previous growth logic. It represents a phase of systemic restructuring for China's automotive industry.

II. Market and Structure: Stabilizing Volumes, Intensifying Divergence

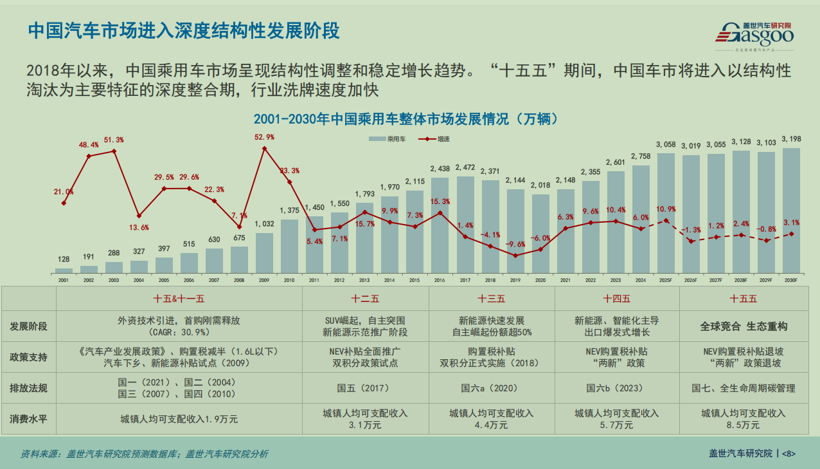

From a market perspective, China's automotive industry has clearly entered a new phase characterized by stable overall volumes and rapid structural change.

1 Total volume is no longer the sole driver; product structure becomes the key variable

Whether viewed through demographics, urbanization trends, new-energy vehicle penetration, or overall vehicle ownership levels, China's auto market has moved from a period of high-speed expansion into the early stage of a mature market. This marks a fundamental shift in the nature of demand:

• New-energy vehicles have become the primary source of incremental growth

• Export markets are emerging as an important supplement

• Premiumization and market segmentation are becoming more pronounced

• Obsolete capacity and uncompetitive brands will be phased out at an accelerating pace

Growth has not disappeared—but it is no longer evenly distributed.

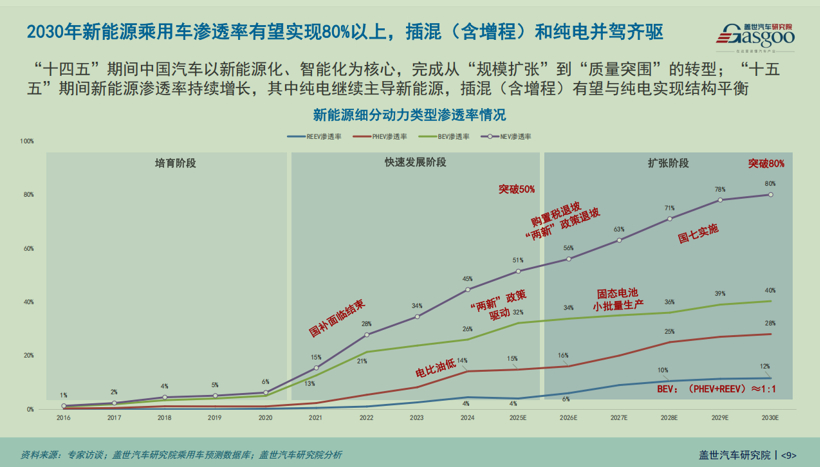

2 New Energy Vehicles Continue to Rise, with Multiple Powertrain Pathways Coexisting Over the Long Term

New-energy vehicles will remain one of the central growth drivers of China's automotive market over the next five years. Rather than converging on a single technological route, the industry is increasingly moving toward a pattern of long-term coexistence among multiple powertrain pathways, with several clear trends emerging:

1) Battery electric vehicles (BEVs) will continue to expand in scale

2) Plug-in hybrids and range-extended vehicles (PHEVs/REEVs) will maintain rapid growth momentum, with strong potential in export markets

3) For a considerable period ahead, multiple powertrain technologies will coexist in parallel, rather than one fully replacing the others.

This pluralistic powertrain landscape is likely to remain a defining feature of China's automotive market throughout the 15th Five-Year Plan period.

This assessment is driven not only by market choices, but also by a comprehensive set of factors—including policy orientation, infrastructure readiness, usage scenarios, and supply-chain support.

During the 15th Five-Year Plan period, the key to competitiveness in new-energy vehicles will not lie in betting on a single technological route, but in the ability to operate across multiple pathways in parallel and iterate rapidly.

III. Competitive Dynamics: From "Technology and Products" to "Systems and Ecosystems"

If the defining theme of the past decade for China's automotive industry was technological catch-up, then in the 15th Five-Year Plan period, the focus is clearly shifting toward system-level competition.

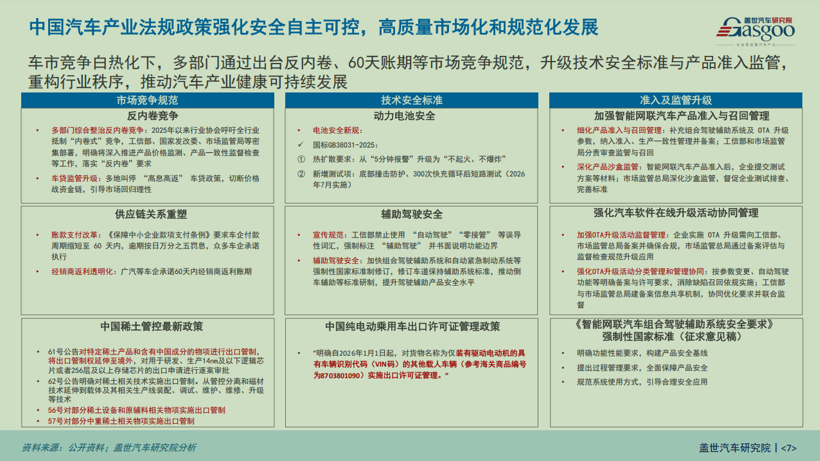

1 Stronger regulation becomes the new normal, with safety and responsibility as fundamental constraints

Over the past two years, a series of policy and regulatory signals surrounding the automotive industry have pointed in a highly consistent direction, including but not limited to:

• Clearer requirements for functional safety, data security, and liability boundaries in intelligent and connected vehicles

• OTA updates, software upgrades, and marketing claims being brought under stricter regulatory scrutiny

• Significantly higher safety standards for power batteries

• Greater oversight of pricing discipline, payment terms, and commercial practices

Together, these changes signal that regulatory compliance, safety assurance, and corporate responsibility are becoming baseline requirements rather than optional considerations in the competitive landscape.

These developments send a clear signal: future competition will no longer be about who pursues the most aggressive technologies, but about who can deliver products and services consistently and reliably under increasingly stringent constraints.

Safety, compliance, and responsibility are no longer merely "cost items"—they have become basic tickets to entry in the industry.

2 Localization of Critical Core Technologies Enters a Phase of "Policy–Industry Resonance"

Against the backdrop of industrial security concerns and growing global uncertainty, the localization of critical core technologies has shifted from an optional choice to a strategic necessity. During the 15th Five-Year Plan period, several areas will remain at the forefront of localization efforts, including but not limited to:

• Automotive-grade chips and computing platforms

• Automotive basic software, operating systems, and middleware

• Functional safety, cybersecurity, toolchains, and testing frameworks

• Critical materials and core components

It is important to emphasize that the objective of localization is not low-cost substitution, but the establishment of a sustainable, autonomous, and controllable industrial capability system.

IV. The Dual Divergence of Vehicle Product Definition

Driven by the combined forces of technology, regulation, and market dynamics, the very definition of the automobile is undergoing a profound transformation. During the 15th Five-Year Plan period, vehicles will no longer evolve along a single trajectory. Instead, two long-term product archetypes are beginning to diverge and coexist in parallel.

Path One: The "Basic Mobility Tool" Centered on Efficiency and Safety

The core objectives of this category are clearly defined, focusing primarily on:

• Higher mobility efficiency

• More reliable safety assurance

• More controllable total cost of ownership (TCO)

• Clearer and more well-defined liability boundaries

Typical application scenarios include daily commuting, intercity travel, second household vehicles, fleet and ride-hailing use, as well as commercial and logistics operations.

Under this product definition, intelligent technologies are primarily deployed in service of safety and efficiency. Technology choices tend to be more mature and conservative, while cost control and scalability become critical success factors. This represents a policy-friendly, scale-oriented development path.

Path Two: The "Mobile Intelligent Living Space" Centered on Experience and the Value of Time

The second product archetype is redefining how time is spent inside the vehicle, marking a shift from building cars to creating spaces. The core objective is no longer simply to transport people from point A to point B, but to enhance the value of in-vehicle time, deliver richer usage scenarios, and deeply integrate AI, software, and service ecosystems.

Under this product definition, smart cockpits and AI become the central sources of competitiveness. Software, services, and content take on greater strategic importance, while product differentiation and user stickiness become critical success factors. This represents a technology-led, experience-driven development path.

During the 15th Five-Year Plan period, not all vehicles are "becoming mobile homes." Instead, the industry is evolving toward two long-term, parallel product definitions: vehicles optimized for more efficient mobility, and vehicles designed for better in-vehicle living. Neither path is inherently superior, but each places fundamentally different demands on automakers in terms of technology stacks, cost structures, and business models.

V. AI-Defined Vehicles (AIDV): Not All Models Will Converge on the Same Destination

Against the backdrop of diverging product definitions, AI is deeply reshaping the automotive industry—but its impact will not be one-size-fits-all. It is foreseeable that AI, end-to-end algorithms, and agent-based architectures will first take root in "mobile intelligent living space"–type products. In contrast, along the efficiency- and safety-oriented path, AI is more likely to exist in tool-based and modularized forms, serving clearly defined functional objectives.

AI will not erase differences between product categories; rather, it will amplify the distinctions inherent in their underlying definitions. During the 15th Five-Year Plan period, the real challenge is not whether to adopt AI, but:

• Whether companies can industrialize AI—scaling it up and delivering it sustainably

• Whether AI systems can operate reliably under stringent regulatory and liability constraints

• Whether AI can create tangible, perceivable value for end users

These capabilities, rather than AI adoption itself, will determine competitive outcomes in the next phase of the automotive industry.

VI. Confronting the Challenge That "Scale Does Not Equal Profitability"

In any discussion of high-quality development in the automotive industry, one core issue is impossible to avoid: corporate profitability and the industry's overall profit pool. Over the past five years, China's automotive sector has been marked by a widespread phenomenon—volume growth without revenue growth, revenue growth without profit growth, and in a significant number of cases, prolonged losses.

This is not a problem of individual companies. It is a structural challenge facing the entire industry.

1 Hardware costs are becoming transparent, putting sustained pressure on traditional profit models

As the industry matures, technology diffusion accelerates and supply chains become highly developed, hardware costs are increasingly transparent. Profit models that rely primarily on vehicle hardware premiums are being steadily compressed.

Moreover, because past development has been heavily focused on investment in physical assets, the negative effects of extensive, repetitive capacity expansion are now becoming visible. In almost every product category, there are large numbers of highly homogeneous manufacturers. The result is oversupply, intense competition, and a situation where too many players are chasing too little value.

2 Going global is an important pathway—but not a universal "profit cure"

Expanding overseas has, to some extent, eased the extreme "involution" of the domestic market. However, going global does not automatically translate into improved profitability.

Overseas markets come with their own challenges: localization and compliance costs, long ramp-up cycles for scale, policy risks, and geopolitical uncertainty. If products and capabilities lack intrinsic profit elasticity, going global merely shifts competition from the domestic market to international markets—often with greater complexity and uncertainty.

3 Profit pools are shifting—rather than emerging automatically

During the 15th Five-Year Plan period, what deserves closer attention is the possibility that corporate profit logic will shift from "selling products" to "monetizing capabilities."

This shift is likely to manifest along three main directions:

1)Software and services

Not all software can—or should—be monetized. However, when software clearly replaces real costs or delivers measurable improvements in efficiency or safety, it provides a legitimate basis for payment. More realistically, software will function as a "profit stabilizer" or "margin repair tool", rather than a short-term profit engine.

2)Data and algorithmic capabilities

Data itself is difficult to sell directly. Its value lies primarily in enhancing R&D efficiency, operational performance, and supply-chain optimization, as well as in enabling external collaboration and service capabilities. Deep exploration of data value and the creation of viable commercialization loops will likely form one of the industry's next profit pools over the coming five years.

3)Capability spillover and second growth curves

Through electrification, intelligentization, engineering systems, and advanced manufacturing and supply-chain management, China's automotive industry is accumulating a set of general-purpose capabilities that can be reused across sectors. These capabilities provide a foundation for expansion into other strategic emerging industries. It is no coincidence that many automakers with strong in-house R&D capabilities are moving into areas such as embodied intelligence, the low-altitude economy, and AI-powered wearables—all of which are underpinned by their core, foundational strengths in R&D and manufacturing.

At its core, high-quality development is about enabling companies to earn healthy, sustainable profits—not merely to sell more vehicles.

VII. Globalization and the Industrial Ecosystem: From "Selling Products" to "Operating Markets"

For a long time, China's automotive expansion overseas has largely followed a product-centered export logic: selling vehicles into foreign markets to drive volume growth and capture scale. As overseas market conditions evolve, however, this model is increasingly reaching its limits.

During the 15th Five-Year Plan period, the globalization of China's automotive industry is entering a new phase. Going forward, "going global" will no longer be about exporting products alone, but about truly embedding into local markets and moving up the value chain. This requires automakers and suppliers to build multiple layers of capabilities overseas, including but not limited to:

• Local manufacturing or assembly capacity to mitigate trade barriers and policy uncertainty

• Localized supply-chain systems to improve responsiveness and compliance flexibility

• The ability to navigate diverse regulatory regimes, covering safety, environmental standards, data governance, and labor regulations

• A shift from project-based market entry to long-term market and brand operations, rather than short-term, opportunity-driven expansion

Globalization at this stage places demands on companies that are fundamentally different from the early, export-driven phase. Organizational capability, financial strength, compliance capacity, and risk management are becoming decisive factors in determining success abroad.

As a result, going global is no longer a choice that "every company can or should make." Instead, it is increasingly evolving into a process of capability-based differentiation across the industry.

VIII. From Manufacturing to Ecosystems: An "Evolution of Form" in the Automotive Industry

In parallel with shifts in globalization models, the automotive industry itself is undergoing a fundamental transformation in its underlying form.

During the 15th Five-Year Plan period, the industry is gradually moving beyond the boundaries of a single manufacturing sector and evolving toward a multi-layered industrial ecosystem, with a clear trend toward servicization. This transition is not simply about "selling a few more services," but about a broader expansion of how value is created within the automotive industry.

It is increasingly evident that the servicization of the automotive industry is taking shape along several key dimensions:

Software and subscription-based services

As vehicles become more intelligent, software is shifting from a one-time configuration to a model of continuous upgrades and ongoing services. The prerequisite, however, is that such software must deliver tangible improvements in safety, efficiency, or user experience.

Energy and charging services

The industry is extending beyond standalone vehicle sales toward charging networks, energy management, and system-level integration. Energy is gradually emerging as an important adjacent domain within the automotive value chain.

Data and platform capabilities

The value of data lies less in direct transactions and more in its ability to enhance R&D, operational efficiency, and service delivery, as well as to enable collaboration across multiple stakeholders.

Finance, insurance, and ecosystem collaboration

Across the full vehicle lifecycle, the automotive industry is forming deeper linkages with financial and insurance services, creating more integrated and synergistic ecosystems around vehicle ownership and usage.

It is important to emphasize that this trend does not mean every company must fully transform into a "platform" or a "service provider."

What it does make clear, however, is that value creation in the automotive industry is shifting from one-off delivery to long-term relationships and continuous services. Companies that can build stable, compliant, and sustainable service and ecosystem capabilities on top of their manufacturing strengths will be far better positioned to achieve more resilient growth during the 15th Five-Year Plan period.

It should be understood that the 15th Five-Year Plan period will not mark another phase of accelerated sprinting for China's automotive industry. Rather, it represents a systemic restructuring centered on structure, order, and sustainability.

What will truly shape the industry's landscape over the next five to ten years is not who moves the fastest, but who can move more steadily and endure longer in an increasingly complex environment—building healthy systems and a solid foundation for sustainable development. This, ultimately, is the true meaning of high-quality development.

Written by Xiaoying Zhou — CEO and Editor-in-Chief, Gasgoo International