The passenger automobile market in China saw an upsurge of 3.4% in year-on-year sales growth in September. The SUV segment was a major driver of this growth, with its total monthly sales of 972,306 units representing year-on-year growth of 9.6% year-on-year. The SUV segment accounted for 42.3% of all passenger automobiles sold in the country in September, up 2.4 percentage points from last year.

Own brand manufacturers continued to dominate the SUV segment in September, accounting for 58.6% of all sales in the segment. Own brand SUV sales for the month totaled 570,070 units, up 9.6% year-on-year. 15 own brand manufacturers all managed to sell over 10,000 SUVs a piece. In second place were Japanese brands, whose combined SUV sales totaled 154,701 units, representing year-on-year growth of 20%. German SUV sales increased 38.7% year-on-year, totaling 98,599 units.

Meanwhile American SUV sales fell 20.6%, with only 60,096 models sold over the course of the month. Korean SUV sales decreased even more, contracting 31.8% to just 35,693 units. However that figure was nearly double the amount sold in August, thanks in large part to the strong performance of the Hyundai brand.

Compact SUVs accounted for 56.1% of all SUVs sold in the country in September. Compact SUV sales for the month totaled 545,627 units, up 7.6% year-on-year. Small SUVs totaled 209,200 units, down 3.6% year-on-year, while midsize SUV sales totaled 183,344 units, representing positive growth of 16.7% year-on-year. Fullsize SUV sales increased over fivefold, but still only accounted for 34,135 total sales.

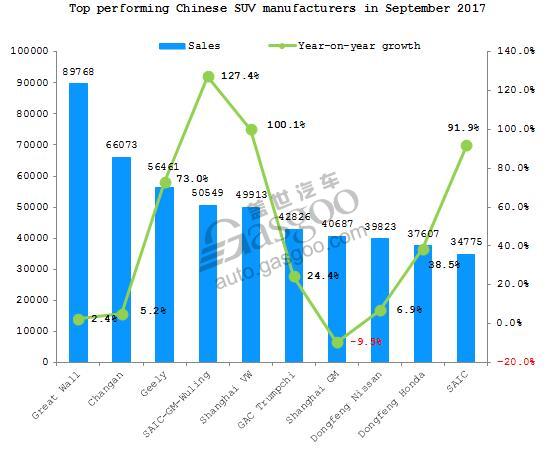

Great Wall Motor led the SUV sales charts in September, followed by Changan Automobile, Geely Motor, SAIC-GM-Wuling, Shanghai VW, Guangqi Trumpchi, Shanghai GM, Dongfeng Nissan, Dongfeng Honda and SAIC Car.

Great Wall’s dominant position was undisputed once again. Second place Changan saw sales of all of its models fall other than the CS75, whose strong performance held up the manufacturer to achieve positive year-on-year sales growth . By comparison, sales of all of Geely’s SUV models grew in September.

Fourth place SAIC-GM-Wuling benefited from the strong performance of the Baojun 510, whose monthly sales exceeded 40,000 units; however sales of the fellow Baojun 560 fell dramatically. Shanghai VW’s sales doubled from the previous year, surpassing GAC Trumpchi to take the top five spot. Shanghai GM, behind Trumpchi, saw sales of its Buick SUVs fall, with only the Chevrolet Captiva and Cadillac models managing to achieve positive year-on-year sales growth. Overall the joint venture’s sales fell 9.5% in September.

Dongfeng Nissan and Dongfeng Honda both saw their SUV sales slightly recover, totaling 39,823 units and 37,607 units respectively. Rounding out the top ten was SAIC’s passenger car division. The manufacturer has plans to release a variety of new models targeting different segments which may help increase its standing in the future.

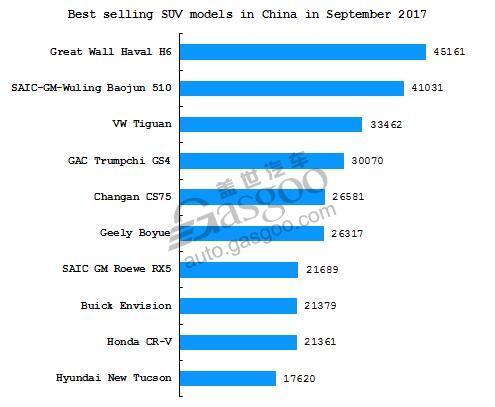

The Great Wall Haval H6 was once again the month’s best selling SUV model; it was followed by the SAIC-GM-Wuling Baojun 510, VW Tiguan, GAC Trumpchi GS4, Changan CS75, Geely Boyue, SAIC-GM Roewe RX5, Buick Envision, Honda CR-V and Hyundai New Tucson, which overtook the Nissan X-Trail.

Despite continuing to lead the monthly sales charts, the Haval H6 saw its sales decrease a further 15.2% year-on-year, bringing its monthly total to 45,161 units. Behind it was the Baojun 510, whose sales continued to grow from the previous month, with a total of 41,031 units sold. The third place VW Tiguan was once again the month’s best-selling JV SUV model; its sales totaled 33,462 units, once again representing positive year-on-year growth.

In fourth was the GAC Trumpchi GS4, whose sales fell 12.1%, while behind it was the Changan CS75, whose sales increased 7.1% from the previous year and also grew a considerable amount from August.

Outside of the top five, sales of the Geely Boyue recovered slightly, while sales of the models just behind it all fell to varying degrees. The New Tucson managed to stem its losses enough to finish in the top 10 this month.