NIO Inc. Reports Unaudited Third Quarter 2021 Financial Results

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer and a leading company in the premium smart electric vehicle market, today announced its unaudited financial results for the third quarter ended September 30, 2021.

Operating Highlights for the Third Quarter 2021

Deliveries of vehicles were 24,439 in the third quarter of 2021, including 5,418 ES8s, 11,271 ES6s and 7,750 EC6s, representing an increase of 100.2% from the third quarter of 2020 and an increase of 11.6% from the second quarter of 2021.

Financial Highlights for the Third Quarter 2021

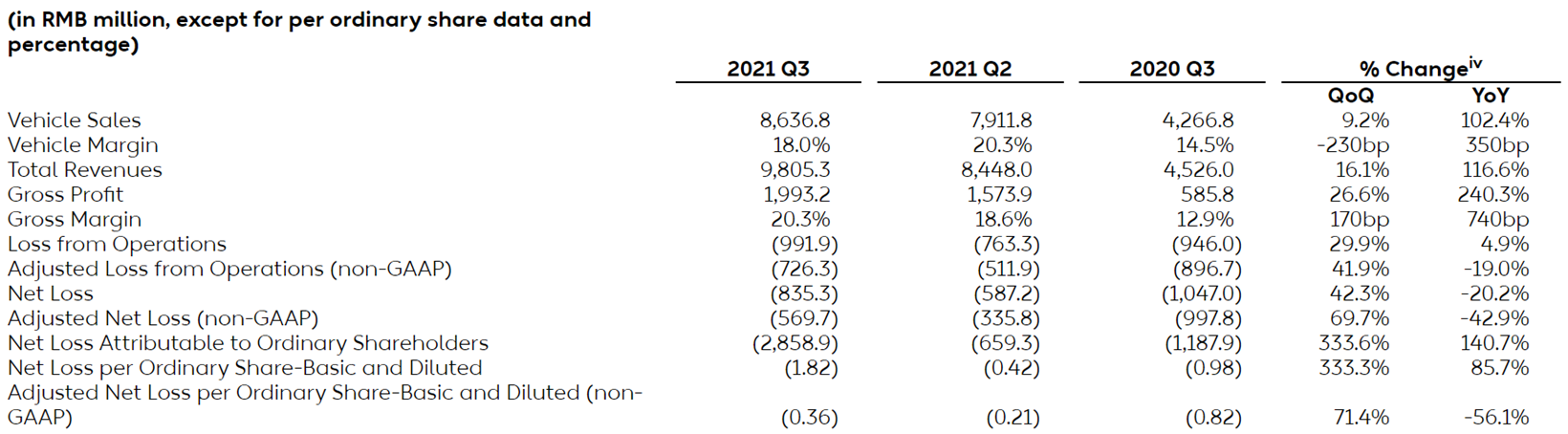

Vehicle sales were RMB8,636.8 million (US$1,340.4 million) in the third quarter of 2021, representing an increase of 102.4% from the third quarter of 2020 and an increase of 9.2% from the second quarter of 2021.

Vehicle marginii was 18.0%, compared with 14.5% in the third quarter of 2020 and 20.3% in the second quarter of 2021.

Total revenues were RMB9,805.3 million (US$1,521.8 million) in the third quarter of 2021, representing an increase of 116.6% from the third quarter of 2020 and an increase of 16.1% from the second quarter of 2021.

Gross profit was RMB1,993.2 million (US$309.3 million) in the third quarter of 2021, representing an increase of 240.3% from the third quarter of 2020 and an increase of 26.6% from the second quarter of 2021.

Gross margin was 20.3%, compared with 12.9% in the third quarter of 2020 and 18.6% in the second quarter of 2021.

Loss from operations was RMB991.9 million (US$153.9 million) in the third quarter of 2021, representing an increase of 4.9% from the third quarter of 2020 and an increase of 29.9% from the second quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB726.3 million (US$112.7 million) in the third quarter of 2021, representing a decrease of 19.0% from the third quarter of 2020 and an increase of 41.9% from the second quarter of 2021.

Net loss was RMB835.3 million (US$129.6 million) in the third quarter of 2021, representing a decrease of 20.2% from the third quarter of 2020 and an increase of 42.3% from the second quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB 569.7 million (US$88.4 million) in the third quarter of 2021, representing a decrease of 42.9% from the third quarter of 2020 and an increase of 69.7% from the second quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders was RMB2,858.9 million (US$443.7 million) in the third quarter of 2021, representing an increase of 140.7% from the third quarter of 2020 and an increase of 333.6% from the second quarter of 2021. In the third quarter of 2021, NIO repurchased 1.418% equity interest in NIO China from a minority strategic investor for a total consideration of RMB2.5 billion and recorded an amount of RMB2,023.5 million (US$314.0 million) in accretion on redeemable non-controlling interests to redemption value. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB569.7 million (US$88.4 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.82 (US$0.28) in the third quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.36 (US$0.06).

Cash and cash equivalents, restricted cash and short-term investment were RMB47.0 billion (US$7.3 billion) as of September 30, 2021.

Key Financial Results

Recent Developments

Deliveries in October 2021

NIO delivered 3,667 vehicles in October 2021, representing a decrease of 27.5% year-over-year due to restructuring and upgrades of the manufacturing lines, preparation for new products introduction and certain supply chain volatilities. As of October 31, 2021, cumulative deliveries of the ES8, ES6 and EC6 reached 145,703 vehicles.

Completion of Increase of Controlling Equity Interests in NIO China

In September 2021, NIO completed the increase of its controlling equity interests in NIO China through the purchase of certain investor’s equity interests and the subscription for newly increased registered capital. The Company currently holds an aggregate of 92.114% controlling equity interests in NIO China.

At-The-Market Offering

As of the date of this press release, NIO has sold 33,175,896 ADSs under the on-going at-the-market offering program as previously announced on September 7, 2021, and has raised gross proceeds of approximately US$1,200.6 million, including the commissions paid to the distribution agents of approximately US$15.6 million and certain offering expenses.

CEO and CFO Comments

“We achieved another all-time high quarterly delivery of 24,439 for the third quarter of 2021, representing a solid growth of 100.2% year-over-year. Our demand continues to be strong and our new orders reached a new record high in October,” said William Bin Li, founder, chairman and chief executive officer of NIO. “Despite the continued supply chain volatilities, our teams and partners are working closely together to secure the supply and production for the fourth quarter of 2021. Meanwhile, we are fully dedicated to accelerating our products and technologies development and bringing the three new products based on NIO Technology Platform 2.0 to users in 2022 to lead the smart EV transformation and adoption,” concluded Mr. Li.

“We achieved new heights with our third quarter delivery while upholding a healthy financial performance with a 18.0% vehicle margin and a 20.3% gross margin, including the sales of regulatory credits,” added Steven Wei Feng, NIO's chief financial officer. “As we broaden our user base and enter global new markets, we are determined to further expand our sales and service network and expedite the swapping and charging infrastructure deployment to better reach and serve more users worldwide.”

Financial Results for the Third Quarter 2021

Revenues

Total revenues in the third quarter of 2021 were RMB9,805.3 million (US$1,521.8 million), representing an increase of 116.6% from the third quarter of 2020 and an increase of 16.1% from the second quarter of 2021.

Vehicle sales in the third quarter of 2021 were RMB8,636.8 million (US$1,340.4 million), representing an increase of 102.4% from the third quarter of 2020 and an increase of 9.2% from the second quarter of 2021. The increase in vehicle sales over the third quarter of 2020 and the second quarter of 2021 was mainly attributed to the increase of vehicle delivery volume in the third quarter of 2021.

Other sales in the third quarter of 2021 were RMB1,168.5 million (US$181.4 million), representing an increase of 350.8% from the third quarter of 2020 and an increase of 117.9% from the second quarter of 2021. The increase in other sales over the third quarter of 2020 and the second quarter of 2021 was mainly due to the sales of automotive regulatory credits and battery upgrade service, as well as other revenues which increased in line with the incremental vehicle sales in the third quarter of 2021.

Cost of Sales and Gross Margin

Cost of sales in the third quarter of 2021 was RMB7,812.1 million (US$1,212.4 million), representing an increase of 98.3% from the third quarter of 2020 and an increase of 13.6% from the second quarter of 2021. The increase in cost of sales over the third quarter of 2020 and the second quarter of 2021 was in line with revenue growth, which was mainly driven by the increase of vehicle delivery volume in the third quarter of 2021.

Gross Profit in the third quarter of 2021 was RMB1,993.2 million (US$309.3 million), representing an increase of 240.3% from the third quarter of 2020 and an increase of 26.6% from the second quarter of 2021.

Gross margin in the third quarter of 2021 was 20.3%, compared with 12.9% in the third quarter of 2020 and 18.6% in the second quarter of 2021. The increase of gross margin compared to the third quarter of 2020 was mainly driven by the increase of vehicle margin and the sales of automotive regulatory credits in the third quarter of 2021. The increase of gross margin compared to the second quarter of 2021 was mainly due to the sales of automotive regulatory credits.

Vehicle margin in the third quarter of 2021 was 18.0%, compared with 14.5% in the third quarter of 2020 and 20.3% in the second quarter of 2021. The increase of vehicle margin compared to the third quarter of 2020 was mainly driven by the higher average selling price, as well as lower material cost. The decrease of vehicle margin compared to the second quarter of 2021 was mainly driven by the increased financing at subsidized rates for vehicle purchases which resulted in a deduction of vehicle revenue and an increase in tooling depreciation cost.

Operating Expenses

Research and development expenses in the third quarter of 2021 were RMB1,193.1 million (US$185.2 million), representing an increase of 101.9% from the third quarter of 2020 and an increase of 35.0% from the second quarter of 2021. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB1,095.0 million (US$169.9 million), representing an increase of 89.5% from the third quarter of 2020 and an increase of 36.7% from the second quarter of 2021. The increase of research and development expenses over the third quarter of 2020 and the second quarter of 2021 was mainly attributed to the increased personnel costs in research and development functions as well as the incremental design and development costs for new products and technologies.

Selling, general and administrative expenses in the third quarter of 2021 were RMB1,824.9 million (US$283.2 million), representing an increase of 94.1% from the third quarter of 2020 and an increase of 21.8% from the second quarter of 2021. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB1,667.5 million (US$258.8 million), representing an increase of 84.2% from the third quarter of 2020 and an increase of 24.7% from the second quarter of 2021. The increase in selling, general and administrative expenses over the third quarter of 2020 and the second quarter of 2021 was primarily due to the increase of personnel costs in sales and service functions and costs related to sales and service network expansion.

Loss from Operations

Loss from operations in the third quarter of 2021 was RMB991.9 million (US$153.9 million), representing an increase of 4.9% from the third quarter of 2020 and an increase of 29.9% from the second quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB726.3 million (US$112.7 million) in the third quarter of 2021, representing a decrease of 19.0% from the third quarter of 2020 and an increase of 41.9% from the second quarter of 2021.

Share-based Compensation Expenses

Share-based compensation expenses in the third quarter of 2021 were RMB265.6 million (US$41.2 million), representing an increase of 439.8% from the third quarter of 2020 and an increase of 5.6% from the second quarter of 2021. The increase in share-based compensation expenses over the third quarter of 2020 was primarily attributed to additional options and restricted shares granted. Share-based compensation expenses remained relatively stable compared to the second quarter of 2021.

Net Loss and Earnings Per Share

Net loss was RMB835.3 million (US$129.6 million) in the third quarter of 2021, representing a decrease of 20.2% from the third quarter of 2020 and an increase of 42.3% from the second quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB569.7 million (US$88.4 million) in the third quarter of 2021, representing a decrease of 42.9% from the third quarter of 2020 and an increase of 69.7% from the second quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders in the third quarter of 2021 was RMB 2,858.9 million (US$443.7 million), representing an increase of 140.7% from the third quarter of 2020 and an increase of 333.6% from the second quarter of 2021. In the third quarter of 2021, NIO repurchased 1.418% equity interest in NIO China from a minority strategic investor for a total consideration of RMB2.5 billion and recorded an amount of RMB2,023.5 million (US$314.0 million) in accretion on redeemable non-controlling interests to redemption value. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB569.7 million (US$88.4 million) in the third quarter of 2021.

Basic and diluted net loss per ADS in the third quarter of 2021 were both RMB1.82 (US$0.28). Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.36 (US$0.06).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB47.0 billion (US$7.3 billion) as of September 30, 2021.

Business Outlook

For the fourth quarter of 2021, the Company expects:

Deliveries of the vehicles to be between 23,500 and 25,500 vehicles, representing an increase of approximately 35.4% to 46.9% from the same quarter of 2020, and a decrease of approximately 3.8% to an increase of approximately 4.3% from the third quarter of 2021.

Total revenues to be between RMB9,376.0 million (US$1,455.1 million) and RM10,105.6 million (US$1,568.4 million), representing an increase of approximately 41.2% to 52.2% from the same quarter of 2020, and a decrease of approximately 4.4% to an increase of approximately 3.1% from the third quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com