NIO Inc. Reports Unaudited Fourth Quarter and Full Year 2021 Financial Results

SHANGHAI, China, March 24, 2022 (GLOBE NEWSWIRE) -- NIO Inc. (“NIO” or the “Company”) (NYSE: NIO; HKEX: 9866), a pioneer and a leading company in the premium smart electric vehicle market, today announced its unaudited financial results for the fourth quarter and full year ended December 31, 2021.

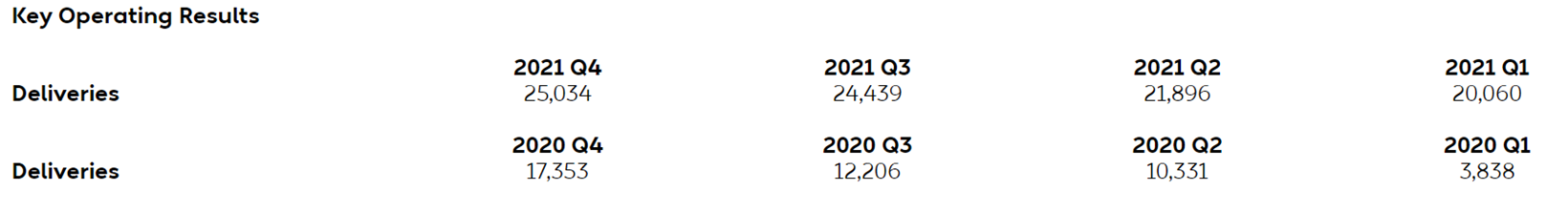

Operating Highlights for the Fourth Quarter and Full Year of 2021

Deliveries of vehicles were 25,034 in the fourth quarter of 2021, including 5,683 ES8s, 12,180 ES6s and 7,171 EC6s, representing an increase of 44.3% from the fourth quarter of 2020 and an increase of 2.4% from the third quarter of 2021.

Deliveries of vehicles were 91,429 in 2021, representing an increase of 109.1% from 2020.

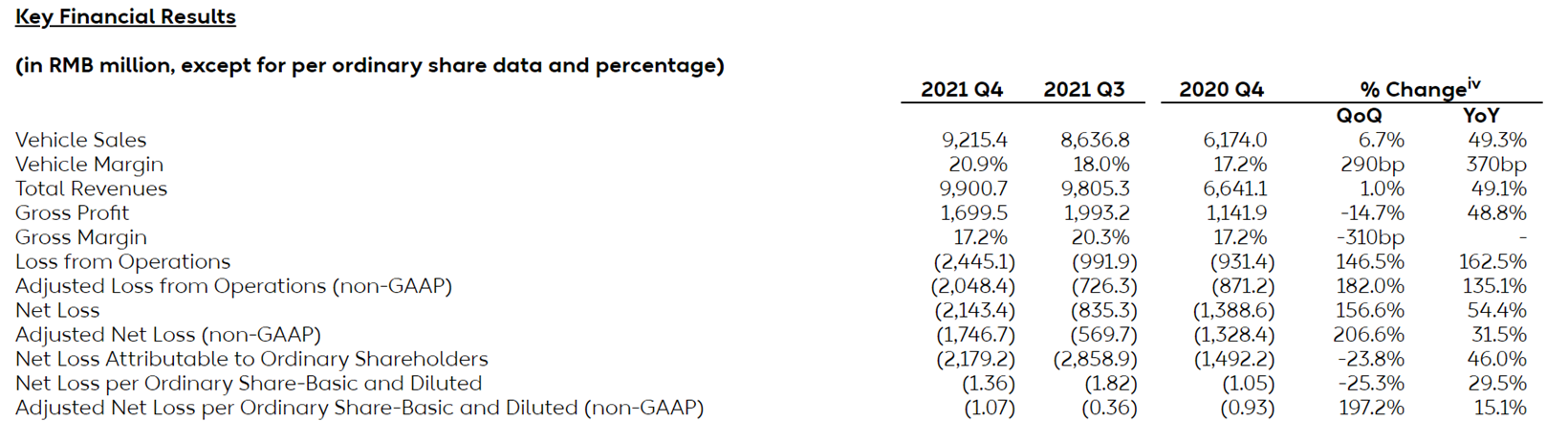

Financial Highlights for the Fourth Quarter of 2021

Vehicle sales were RMB9,215.4 million (US$1,446.1 million) in the fourth quarter of 2021, representing an increase of 49.3% from the fourth quarter of 2020 and an increase of 6.7% from the third quarter of 2021.

Vehicle marginii was 20.9% in the fourth quarter of 2021, compared with 17.2% in the fourth quarter of 2020 and 18.0% in the third quarter of 2021.

Total revenues were RMB9,900.7 million (US$1,553.6 million) in the fourth quarter of 2021, representing an increase of 49.1% from the fourth quarter of 2020 and an increase of 1.0% from the third quarter of 2021.

Gross profit was RMB1,699.5 million (US$266.7 million) in the fourth quarter of 2021, representing an increase of 48.8% from the fourth quarter of 2020 and a decrease of 14.7% from the third quarter of 2021.

Gross margin was 17.2% in the fourth quarter of 2021, compared with 17.2% in the fourth quarter of 2020 and 20.3% in the third quarter of 2021. The decrease of gross margin from the third quarter of 2021 was mainly resulted from the sales of automotive regulatory credits in the third quarter of 2021 which contributed a higher gross margin.

Loss from operations was RMB2,445.1 million (US$383.7 million) in the fourth quarter of 2021, representing an increase of 162.5% from the fourth quarter of 2020 and an increase of 146.5% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,048.4 million (US$321.4 million) in the fourth quarter of 2021, representing an increase of 135.1% from the fourth quarter of 2020 and an increase of 182.0% from the third quarter of 2021.

Net loss was RMB2,143.4 million (US$336.4 million) in the fourth quarter of 2021, representing an increase of 54.4% from the fourth quarter of 2020 and an increase of 156.6% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,746.7 million (US$274.1 million) in the fourth quarter of 2021, representing an increase of 31.5% from the fourth quarter of 2020 and an increase of 206.6% from the third quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders was RMB2,179.2 million (US$342.0 million) in the fourth quarter of 2021, representing an increase of 46.0% from the fourth quarter of 2020 and a decrease of 23.8% from the third quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,715.7 million (US$269.2 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.36 (US$0.21) in the fourth quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.07 (US$0.16).

Cash and cash equivalents, restricted cash and short-term investment were RMB55.4 billion (US$8.7 billion) as of December 31, 2021.

Financial Highlights for the Full Year of 2021

Vehicle sales were RMB33,169.7 million (US$5,205.1 million) for the full year of 2021, representing an increase of 118.5% from the previous year.

Vehicle margin was 20.1% for the full year of 2021, compared with 12.7% for the previous year.

Total revenues were RMB36,136.4 million (US$5,670.6 million) for the full year of 2021, representing an increase of 122.3% from the previous year.

Gross profit was RMB6,821.4 million (US$1,070.4 million) for the full year of 2021, representing an increase of 264.1% from the previous year.

Gross margin was 18.9% for the full year of 2021, compared with 11.5% for the previous year.

Loss from operations was RMB4,496.3 million (US$705.6 million) for the full year of 2021, representing a decrease of 2.4% from the previous year. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB3,486.2 million (US$547.1 million) in 2021, representing a decrease of 21.1% from the previous year.

Net loss was RMB4,016.9 million (US$630.3 million) for the full year of 2021, representing a decrease of 24.3% from the previous year. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB3,006.8 million (US$471.8 million) for the full year of 2021, representing a decrease of 41.2% from the previous year.

Net loss attributable to NIO’s ordinary shareholders was RMB10,572.3 million (US$1,659.0 million) for the full year of 2021, representing an increase of 88.4% from the previous year. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB2,975.6 million (US$466.9 million).

Basic and diluted net loss per ADS were both RMB6.72 (US$1.05) for the full year of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.89 (US$0.29).

Recent Developments

Deliveries in January and February 2022

Deliveries of the ES8, ES6 and EC6 were 9,652 vehicles in January 2022 and 6,131 vehicles in February 2022, representing an increase of 33.6% and 9.9% year-over-year, respectively. As of February 28, 2022, cumulative deliveries of the ES8, ES6 and EC6 reached 182,853 vehicles.

Completion of At-The-Market Offering

On September 7, 2021, NIO entered into an Equity Distribution Agreement with certain distribution agents to sell up to an aggregate of US$2,000,000,000 of our ADSs through an at-the-market equity offering program. Such sales were completed on November 19, 2021 and settled on November 23, 2021, with the sale of 53,292,401 ADSs resulting in gross proceeds of US$2 billion, before deducting commissions paid to the sales agents of approximately US$26 million and certain offering expenses.

Launch of ET5

On December 18, 2021, NIO held NIO Day 2021 in Suzhou and launched the ET5, a mid-size premium smart electric sedan, with delivery expected to start in September 2022. With a 0.24 drag coefficient and a high-efficiency electric powertrain, featuring a front 150 kW induction motor and a rear 210 kW permanent magnet motor with a Silicon Carbide (SiC) power module, the ET5 accelerates from 0 to 100 km/h in 4.3 seconds, and brakes from 100km/h to a complete stop in 33.9 meters. It is engineered for five-star Chinese and European New Car Assessment Program safety standards. The pre-subsidy price of the ET5 starts from RMB328,000.

Hong Kong Stock Exchange Listing

On March 10, 2022, NIO successfully listed, by way of introduction, its Class A ordinary shares on the Main Board of The Stock Exchange of Hong Kong Limited under the stock code of 9866 in board lots of 10 shares. In connection with the listing, all of the 128,293,932 Class B ordinary shares of the Company, held by entities affiliated with Tencent Holdings Limited, were converted to Class A ordinary shares.

Appointment of New Audit Committee Member

On March 16, 2022, our board of directors appointed Ms. Yu Long, our independent director, as a new member of the audit committee, effective March 25, 2022. Starting from March 25, 2022, the audit committee of our board of directors will consist of three members: Mr. Denny Ting Bun Lee, Mr. Hai Wu, and Ms. Yu Long.

CEO and CFO Comments

“We concluded the year of 2021 on a strong note with an annual delivery of 91,429 vehicles in total, representing an increase of 109.1% year-over-year, despite all the challenges including the supply chain volatilities in particular. In light of the seasonality and the Chinese New Year holiday, NIO delivered 9,652 vehicles in January and 6,131 vehicles in February, representing a growth of 34% and 10% year-over-year, respectively. We expect to deliver a total of 25,000 to 26,000 vehicles in the first quarter of 2022,” said William Bin Li, founder, chairman and chief executive officer of NIO. “2021 had been a year of making decisive investments in products and technologies, as well as in power and service infrastructures. It had also been a year of elevated operations in fast iteration, supply chain response and innovation, production capacity expansion and systematic quality management to make comprehensive preparations for our development in the next phase. On top of our growing user base in China, 2021 also marked the beginning of our global market expansion starting from the launch and deliveries of NIO vehicles in Norway in September 2021.”

“2022 will be a year of reacceleration for NIO. We will deliver three new products based on NIO Technology Platform 2.0 this year. In March, we kicked off the test drive of ET7 and will start its delivery on March 28, 2022. After the launch of ET5 in December 2021, we have received great feedback from prospective users, and expect to start its delivery in September 2022. In addition, we plan to offer our products and services in more countries and regions in 2022 to further expand our global user community,” concluded Mr. Li.

“On March 10, 2022, thanks to the trust and support of our users, investors and partners, NIO started to be listed by way of introduction on the Main Board of The Stock Exchange of Hong Kong Limited,” added Steven Wei Feng, NIO’s chief financial officer. “With steadily increasing deliveries, stable average selling price, and improving manufacturing efficiency, we have achieved solid financial performance for the fourth quarter and full year of 2021 with the vehicle margin reaching 20.1% in 2021. To provide better experience to our growing global user base and accelerate our market expansion, we will continue to make decisive investments in products, core technologies and services for the years ahead.”

Financial Results for the Fourth Quarter and Full Year of 2021

Revenues

Total revenues in the fourth quarter of 2021 were RMB9,900.7 million (US$1,553.6 million), representing an increase of 49.1% from the fourth quarter of 2020 and an increase of 1% from the third quarter of 2021.

Total revenues for the full year of 2021 were RMB36,136.4 million (US$5,670.6 million), representing an increase of 122.3% from the previous year.

Vehicle sales in the fourth quarter of 2021 were RMB9,215.4 million (US$1,446.1 million), representing an increase of 49.3% from the fourth quarter of 2020 and an increase of 6.7% from the third quarter of 2021. The increase in vehicle sales over the fourth quarter of 2020 was mainly attributed to higher deliveries. The increase in vehicle sales over the third quarter of 2021 was mainly attributed to higher average selling price, decrease in subsidization in user vehicle financing arrangements and higher deliveries.

Vehicle sales for the full year of 2021 were RMB33,169.7 million (US$5,205.1 million), representing an increase of 118.5% from the previous year.

Other sales in the fourth quarter of 2021 were RMB685.4 million (US$107.5 million), representing an increase of 46.8% from the fourth quarter of 2020 and a decrease of 41.3% from the third quarter of 2021. The increase in other sales over the fourth quarter of 2020 was mainly attributed to the increased revenues derived from the sales of service and energy packages and accessories in line with the incremental vehicle sales, as well as the increased revenues from used car sales and auto financing services in the fourth quarter of 2021, which was partially offset by the sales of automotive regulatory credits in the fourth quarter of 2020. The decrease in other sales over the third quarter of 2021 was mainly attributed to the sales of automotive regulatory credits in the third quarter.

Other sales for the full year of 2021 were RMB2,966.7 million (US$465.5 million), representing an increase of 175.9% from the previous year.

Cost of Sales and Gross Margin

Cost of sales in the fourth quarter of 2021 was RMB8,201.2 million (US$1,286.9 million), representing an increase of 49.1% from the fourth quarter of 2020 and an increase of 5.0% from the third quarter of 2021. The increase in cost of sales over the fourth quarter of 2020 and the third quarter of 2021 was mainly driven by the increase in delivery volume in the fourth quarter of 2021 as compared with previous periods.

Cost of sales for the full year of 2021 was RMB29,315.0 million (US$4,600.2 million), representing an increase of 103.8% from the previous year.

Gross Profit in the fourth quarter of 2021 was RMB1,699.5 million (US$266.7 million), representing an increase of 48.8% from the fourth quarter of 2020 and a decrease of 14.7% from the third quarter of 2021.

Gross Profit for the full year was RMB6,821.4 million (US$1,070.4 million), representing an increase of 264.1% from the previous year.

Gross margin in the fourth quarter of 2021 was 17.2%, compared with 17.2% in the fourth quarter of 2020 and 20.3% in the third quarter of 2021. The decrease of gross margin from the third quarter of 2021 was mainly resulted from the sales of automotive regulatory credits in the third quarter of 2021 which contributed a higher gross margin.

Gross margin for the full year of 2021 was 18.9%, compared with 11.5% for the full year of 2020.

Vehicle margin in the fourth quarter of 2021 was 20.9%, compared with 17.2% in the fourth quarter of 2020 and 18.0% in the third quarter of 2021. The increase of vehicle margin over the fourth quarter of 2020 was mainly driven by the higher average selling price with higher take rate of 100 kWh battery. The increase of vehicle margin over the third quarter of 2021 was mainly attributed to decrease in subsidization in user vehicle financing arrangements.

Vehicle margin for the full year of 2021 was 20.1%, compared with 12.7% for the full year of 2020.

Operating Expenses

Research and development expenses in the fourth quarter of 2021 were RMB1,828.5 million (US$286.9 million), representing an increase of 120.5% from the fourth quarter of 2020 and an increase of 53.3% from the third quarter of 2021. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB1,639.0 million (US$257.2 million), representing an increase of 102.1% from the fourth quarter of 2020 and an increase of 49.7% from the third quarter of 2021. The increase of research and development expenses over the fourth quarter of 2020 and the third quarter of 2021 was mainly attributed to the increased personnel costs in research and development functions as well as the incremental design and development costs for new products and technologies.

Research and development expenses for the full year 2021 were RMB4,591.9 million (US$ 720.6 million), representing an increase of 84.6% from the previous year. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB4,184.9 million (US$656.7 million). The increase in research and development expenses was mainly attributed to the increased personnel costs in research and development functions as well as the incremental design and development costs for new products and technologies.

Selling, general and administrative expenses in the fourth quarter of 2021 were RMB2,358.2 million (US$370.1 million), representing an increase of 95.4% from the fourth quarter of 2020 and an increase of 29.2% from the third quarter of 2021. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB 2,163.0 million (US$ 339.4 million), representing an increase of 85.3% from the fourth quarter of 2020 and an increase of 29.7% from the third quarter of 2021. The increase in selling, general and administrative expenses over the fourth quarter of 2020 and the third quarter of 2021 was primarily due to the increase in personnel costs in sales and service functions and costs related to sales and service network expansion as well as the incremental marketing and promotional expenses, including for the host of NIO Day in December 2021.

Selling, general and administrative expenses for the full year of 2021 were RMB6,878.1 million (US$1,079.3 million), representing an increase of 74.9% from the previous year. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB6,308.9 million (US$990.0 million). The increase in selling, general and administrative expenses was primarily due to the increase in personnel costs in sales and service functions and costs related to sales and service network expansion as well as incremental marketing and promotional expenses.

Loss from Operations

Loss from operations in the fourth quarter of 2021 was RMB2,445.1 million (US$383.7 million), representing an increase of 162.5% from the fourth quarter of 2020 and an increase of 146.5% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,048.4 million (US$321.4 million) in the fourth quarter of 2021, representing an increase of 135.1% from the fourth quarter of 2020 and an increase of 182.0% from the third quarter of 2021.

Loss from operations for the full year of 2021 was RMB4,496.3 million (US$705.6 million), compared with loss from operations of RMB4,607.6 million in 2020. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB3,486.2 million (US$547.1 million) in 2021.

Share-based Compensation Expenses

Share-based compensation expenses in the fourth quarter of 2021 were RMB396.7 million (US$62.3 million), representing an increase of 559.0% from the fourth quarter of 2020 and an increase of 49.4% from the third quarter of 2021. The increase in share-based compensation expenses over the fourth quarter of 2020 and the third quarter of 2021 was primarily attributed to additional options and restricted shares granted.

Share-based compensation expenses for the full year of 2021 were RMB1,010.1 million (US$158.5 million), compared with RMB187.1 million for the previous year.

Net Loss and Earnings Per Share

Net loss in the fourth quarter of 2021 was RMB2,143.4 million (US$336.4 million), representing an increase of 54.4% from the fourth quarter of 2020 and an increase of 156.6% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,746.7 million (US$274.1 million) in the fourth quarter of 2021, representing an increase of 31.5% from the fourth quarter of 2020 and an increase of 206.6% from the third quarter of 2021.

Net loss for the full year of 2021 was RMB4,016.9 million (US$630.3 million), compared with net loss of RMB5,304.1 million in 2020. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB3,006.8 million (US$471.8 million) in 2021.

Net loss attributable to NIO’s ordinary shareholders in the fourth quarter of 2021 was RMB2,179.2 million (US$342.0 million), representing an increase of 46.0% from the fourth quarter of 2020 and a decrease of 23.8% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,715.7 million (US$269.2 million) in the fourth quarter of 2021.

Net loss attributable to NIO’s ordinary shareholders for the full year of 2021 was RMB10,572.3 million (US$1,659.0 million), compared with net loss attributable to NIO’s ordinary shareholders of RMB5,610.8 million in 2020. NIO repurchased equity interests in NIO China from a minority strategic investor for a total consideration of RMB8.0 billion and recorded an amount of RMB6,586.6 million (US$1,033.6 million) in accretion on redeemable non-controlling interests to redemption value in 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB2,975.6 million (US$466.9 million) in 2021.

Basic and diluted net loss per ADS in the fourth quarter of 2021 were both RMB1.36 (US$0.21). Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.07 (US$0.16).

Basic and diluted net loss per ADS for the full year of 2021 were both RMB6.72 (US$1.05). Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.89 (US$0.29) in 2021.

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB 55.4 billion (US$8.7 billion) as of December 31, 2021.

Business Outlook

For the first quarter of 2022, the Company expects:

Deliveries of the vehicles to be between 25,000 and 26,000 vehicles, representing an increase of approximately 24.6% to 29.6% from the same quarter of 2021.

Total revenues to be between RMB9,631 million (US$1,511 million) and RMB9,987 million (US$1,567 million), representing an increase of approximately 20.6% to 25.1% from the same quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com