Shanghai (Gasgoo)- CATL is likely to launch a new power battery technology this month, a local media outlet revealed on April 20, citing a person with direct knowledge with the matter.

Shortly afterwards the company replied that it has no such plan in the near future and expects the rumor not to be further spread.

Photo credit: CATL

On the same day, CATL's shares opened lower and further slid, declining over

7% in intraday trading with a turnover topping 7 billion yuan ($1.091

billion). The company’s stock price hit a new low in this around of

adjustment and its market value dropped below 1 trillion yuan ($155.882

billion).

The Ningde-based company currently holds a safe lead over other power battery manufacturers in China in terms of market share. However, as for technology innovation, it is facing a growing competition from such players as BYD, GAC AION, and SVOLT.

In July 29 last year, CATL launched its first-generation sodium-ion battery with a cell energy density of 160Wh/kg. At room temperature, the battery can be charged to 80% of its capacity within 15 minutes.

CATL is pushing ahead with the industrial deployment of its sodium-ion battery business and expects the volume production to start in 2023.

Around three months ago, the battery giant launched the battery swap service brand "EVOGO" and the "Modular Battery Swap Solution" through its wholly-owned subsidiary Contemporary Amperex Energy Service Technology Ltd. The solution is composed of three products, namely, the battery block, the fast battery swap station, and an app.

The EVOGO battery swap service was put into operation first in Xiamen city, Fujian province on April 18.

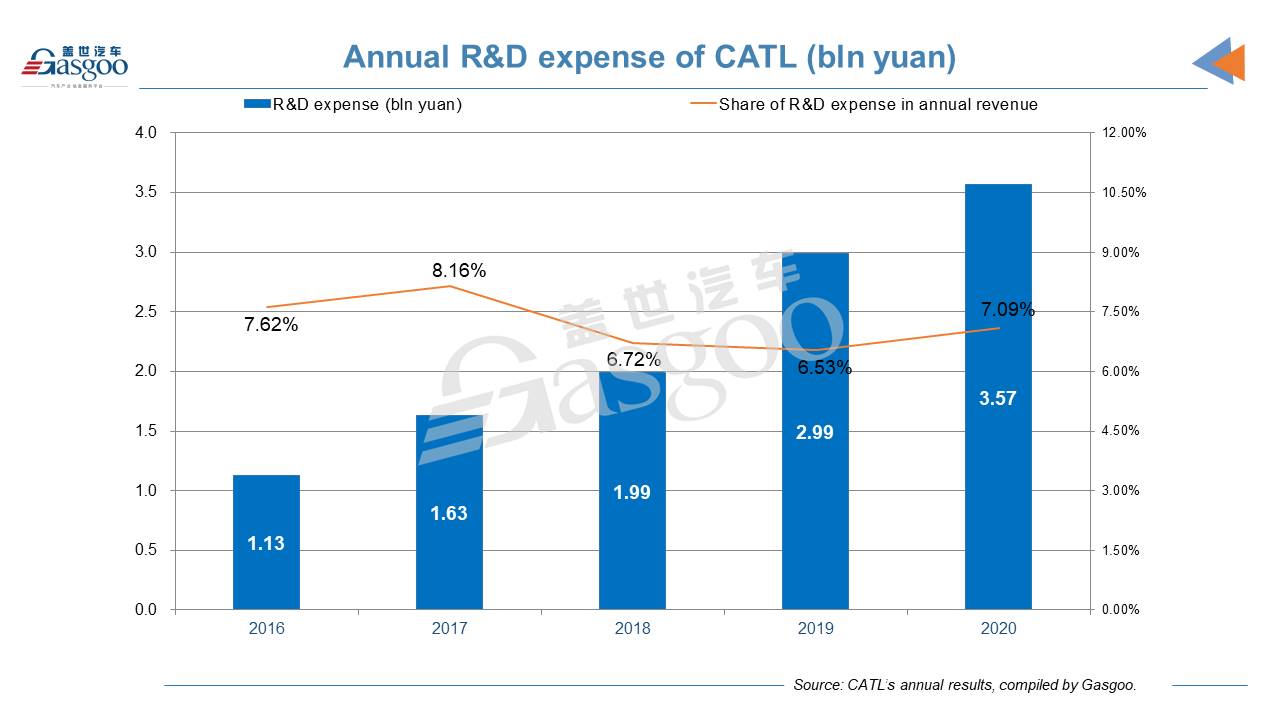

CATL’s R&D expense in 2021 still remains unknown now. As for previous years, CATL saw its annual R&D expense consecutively grow year by year to around 3.57 billion yuan ($560 million) in 2020, accounting for 7.09% of the company’s full-year revenue.

On April 20, CATL's shares opened lower and further slid, declining over 7% in intraday trading with a turnover topping 7 billion yuan ($1.091 billion). The company’s stock price hit a new low in this around of adjustment and its market value dropped below 1 trillion yuan ($155.882 billion).