Li Auto Inc. Announces Unaudited First Quarter 2022 Financial Results

Li Auto Inc. ("Li Auto" or the "Company") (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today announced its unaudited financial results for the quarter ended March 31, 2022.

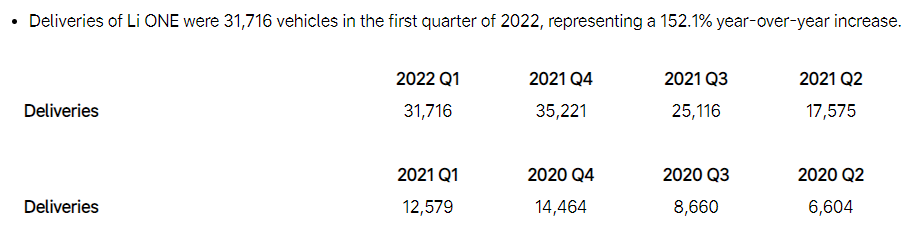

Operating Highlights for the First Quarter of 2022

As of March 31, 2022, the Company had 217 retail stores covering 102 cities, as well as 287 servicing centers and Li Auto-authorized body and paint shops operating in 211 cities.

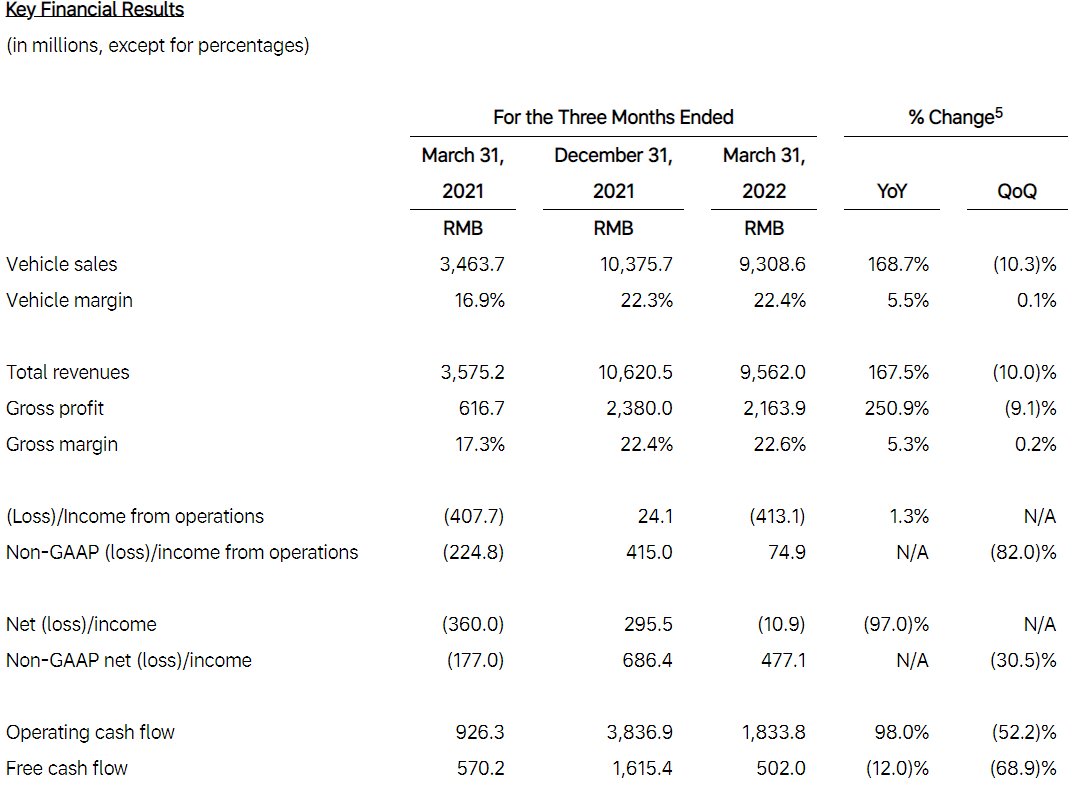

Financial Highlights for the First Quarter of 2022

Vehicle sales were RMB9.31 billion (US$1.47 billion) in the first quarter of 2022, representing an increase of 168.7% from RMB3.46 billion in the first quarter of 2021 and a decrease of 10.3% from RMB10.38 billion in the fourth quarter of 2021.

Vehicle margin was 22.4% in the first quarter of 2022, compared with 16.9% in the first quarter of 2021 and 22.3% in the fourth quarter of 2021.

Total revenues were RMB9.56 billion (US$1.51 billion) in the first quarter of 2022, representing an increase of 167.5% from RMB3.58 billion in the first quarter of 2021 and a decrease of 10.0% from RMB10.62 billion in the fourth quarter of 2021.

Gross profit was RMB2.16 billion (US$341.3 million) in the first quarter of 2022, representing an increase of 250.9% from RMB616.7 million in the first quarter of 2021 and a decrease of 9.1% from RMB2.38 billion in the fourth quarter of 2021.

Gross margin was 22.6% in the first quarter of 2022, compared with 17.3% in the first quarter of 2021 and 22.4% in the fourth quarter of 2021.

Loss from operations was RMB413.1 million (US$65.2 million) in the first quarter of 2022, compared with RMB407.7 million loss from operations in the first quarter of 2021 and RMB24.1 million income from operations in the fourth quarter of 2021. Non-GAAP income from operations3 was RMB74.9 million (US$11.8 million) in the first quarter of 2022, compared with RMB224.8 million non-GAAP loss from operations3 in the first quarter of 2021 and RMB415.0 million non-GAAP income from operations in the fourth quarter of 2021.

Net loss was RMB10.9 million (US$1.7 million) in the first quarter of 2022, compared with RMB360.0 million net loss in the first quarter of 2021 and RMB295.5 million net income in the fourth quarter of 2021. Non-GAAP net income3 was RMB477.1 million (US$75.3 million) in the first quarter of 2022, compared with RMB177.0 million non-GAAP net loss3 in the first quarter of 2021 and RMB686.4 million non-GAAP net income in the fourth quarter of 2021.

Operating cash flow was RMB1.83 billion (US$289.3 million) in the first quarter of 2022, representing an increase of 98.0% from RMB926.3 million in the first quarter of 2021 and a decrease of 52.2% from RMB3.84 billion in the fourth quarter of 2021.

Free cash flow4 was RMB502.0 million (US$79.2 million) in the first quarter of 2022, compared with RMB570.2 million in the first quarter of 2021 and RMB1.62 billion in the fourth quarter of 2021.

Recent Developments

Delivery Update

In April 2022, the Company delivered 4,167 Li ONEs. As of April 30, 2022, the Company had 225 retail stores covering 106 cities, in addition to 292 servicing centers and Li Auto-authorized body and paint shops operating in 211 cities.

Inaugural Environmental, Social and Governance Report

On April 19, 2022, the Company published its 2021 Environmental, Social and Governance (ESG) report (https://ir.lixiang.com/esg), highlighting the Company’s ESG initiatives and achievements.

Inclusion in the Shenzhen- and Shanghai-Hong Kong Stock Connect Programs

The Company’s Class A ordinary shares, which are listed and traded on the Stock Exchange of Hong Kong Limited, have been included in the Shenzhen- and Shanghai-Hong Kong Stock Connect programs, effective on March 14 and April 25, 2022, respectively.

CEO and CFO Comments

Mr. Xiang Li, founder, chairman, and chief executive officer of Li Auto, commented, “We sincerely appreciate our users’ consistent support, which, combined with our self-discipline for efficient operations, continued to drive robust financial performance in the first quarter of 2022 and ensured the scale and pace of our investments in research and development. While the recent pandemic resurgence and associated supply chain interruptions have been challenging for our industry, and uncertainty remains for the near future, we are confident in the resilience of our organization.”

“Despite recent pandemic-related bumps on the road, we are forging ahead with our plan to commence the deliveries of our second model, the L9, in the third quarter. The L9 is a flagship smart SUV for family users based on our new-generation EREV platform, offering best-in-class performance, safety, and intelligence. It features our fully self-developed range extension system, chassis control system, and central vehicle domain controller, which empower its flagship dynamic performance and drivability. Every L9 comes standard with our proprietary autonomous driving system, Li AD Max, capable of all-scenario Navigation on ADAS (NOA) for enhanced driving safety and convenience.”

Mr. Tie Li, chief financial officer of Li Auto, added, “Our solid performance in the first quarter of 2022 speaks to the enduring strength of our product. Driven by our strong vehicle deliveries despite the supply chain constraints facing the industry, we achieved revenues of RMB9.56 billion for the first quarter, up 167.5% year over year. Our vehicle margin in the first quarter remained healthy at 22.4%, and our cash flow from operations was positive for the eighth consecutive quarter at RMB1.83 billion. Amidst this volatile environment, we will continue to execute with discipline and further strengthen our financial flexibility and resilience, persevering through challenges while maintaining a steadfast commitment to innovation.”

Financial Results for the First Quarter of 2022

Revenues

Total revenues were RMB9.56 billion (US$1.51 billion) in the first quarter of 2022, representing an increase of 167.5% from RMB3.58 billion in the first quarter of 2021 and a decrease of 10.0% from RMB10.62 billion in the fourth quarter of 2021.

Vehicle sales were RMB9.31 billion (US$1.47 billion) in the first quarter of 2022, representing an increase of 168.7% from RMB3.46 billion in the first quarter of 2021 and a decrease of 10.3% from RMB10.38 billion in the fourth quarter of 2021. The increase in revenue from vehicle sales over the first quarter of 2021 was mainly attributable to the increase in vehicle deliveries in the first quarter of 2022. The decrease in revenue from vehicle sales over the fourth quarter of 2021 was mainly attributable to the decrease in vehicle deliveries which were affected by seasonal factors related to the Chinese New Year holiday in the first quarter of 2022.

Other sales and services were RMB253.4 million (US$40.0 million) in the first quarter of 2022, representing an increase of 127.2% from RMB111.5 million in the first quarter of 2021 and an increase of 3.6% from RMB244.7 million in the fourth quarter of 2021. The increase in revenue from other sales and services over the first quarter of 2021 was mainly attributable to increased sales of charging stalls, accessories and services in line with higher accumulated vehicle sales.

Cost of Sales and Gross Margin

Cost of sales was RMB7.40 billion (US$1.17 billion) in the first quarter of 2022, representing an increase of 150.1% from RMB2.96 billion in the first quarter of 2021 and a decrease of 10.2% from RMB8.24 billion in the fourth quarter of 2021. The increase in cost of sales over the first quarter of 2021 was in line with revenue growth, mainly driven by the increase in vehicle deliveries in the first quarter of 2022. The decrease in cost of sales over the fourth quarter of 2021 was mainly due to the decrease in vehicle deliveries in the first quarter of 2022.

Gross profit was RMB2.16 billion (US$341.3 million) in the first quarter of 2022, representing an increase of 250.9% from RMB616.7 million in the first quarter of 2021 and a decrease of 9.1% from RMB2.38 billion in the fourth quarter of 2021.

Vehicle margin was 22.4% in the first quarter of 2022, compared with 16.9% in the first quarter of 2021 and 22.3% in the fourth quarter of 2021. The increase in vehicle margin over the first quarter of 2021 was primarily driven by higher average selling price attributable to the increase of vehicle deliveries of 2021 Li ONE since its release in May 2021.

Gross margin was 22.6% in the first quarter of 2022, compared with 17.3% in the first quarter of 2021 and 22.4% in the fourth quarter of 2021.

Operating Expenses

Operating expenses were RMB2.58 billion (US$406.5 million) in the first quarter of 2022, representing an increase of 151.5% from RMB1.02 billion in the first quarter of 2021 and an increase of 9.4% from RMB2.36 billion in the fourth quarter of 2021.

Research and development expenses were RMB1.37 billion (US$216.7 million) in the first quarter of 2022, representing an increase of 167.0% from RMB514.5 million in the first quarter of 2021 and an increase of 11.7% from RMB1.23 billion in the fourth quarter of 2021. The increase in research and development expenses over the first quarter of 2021 was primarily driven by increased employee compensation as a result of our growing number of research and development staff as well as increased costs associated with new product development. The increase in research and development expenses over the fourth quarter of 2021 was mainly driven by increased employee compensation as a result of our growing number of research and development staff.

Selling, general and administrative expenses were RMB1.20 billion (US$189.8 million) in the first quarter of 2022, representing an increase of 135.9% from RMB509.9 million in the first quarter of 2021 and an increase of 6.8% from RMB1.13 billion in the fourth quarter of 2021. The increase in selling, general and administrative expenses over the first quarter of 2021 was primarily driven by increased employee compensation as a result of our growing number of staff, as well as increased marketing and promotional activities and rental expenses associated with the expansion of the Company’s sales network.

Loss/Income from Operations

Loss from operations was RMB413.1 million (US$65.2 million) in the first quarter of 2022, compared with RMB407.7 million loss from operations in the first quarter of 2021 and RMB24.1 million income from operations in the fourth quarter of 2021. Non-GAAP income from operations was RMB74.9 million (US$11.8 million) in the first quarter of 2022, compared with RMB224.8 million non-GAAP loss from operations in the first quarter of 2021 and RMB415.0 million non-GAAP income from operations in the fourth quarter of 2021.

Net Loss/Income and Net Loss/Earnings Per Share

Net loss was RMB10.9 million (US$1.7 million) in the first quarter of 2022, compared with RMB360.0 million net loss in the first quarter of 2021 and RMB295.5 million net income in the fourth quarter of 2021. Non-GAAP net income was RMB477.1 million (US$75.3 million) in the first quarter of 2022, compared with RMB177.0 million non-GAAP net loss in the first quarter of 2021 and RMB686.4 million non-GAAP net income in the fourth quarter of 2021.

Basic and diluted net loss per ADS6 attributable to ordinary shareholders were RMB0.01 (US$0.00) and RMB0.01 (US$0.00) in the first quarter of 2022, respectively. Non-GAAP basic and diluted net earnings per ADS attributable to ordinary shareholders3 were RMB0.49 (US$0.08) and RMB0.47 (US$0.07) in the first quarter of 2022, respectively.

Cash Position, Operating Cash Flow and Free Cash Flow

Balance of cash and cash equivalents, restricted cash, time deposits and short-term investments was RMB51.19 billion (US$8.07 billion) as of March 31, 2022.

Operating cash flow was RMB1.83 billion (US$289.3 million) in the first quarter of 2022, representing an increase of 98.0% from RMB926.3 million in the first quarter of 2021 and a decrease of 52.2% from RMB3.84 billion in the fourth quarter of 2021.

Free cash flow was RMB502.0 million (US$79.2 million) in the first quarter of 2022, compared with RMB570.2 million in the first quarter of 2021 and RMB1.62 billion in the fourth quarter of 2021.

Business Outlook

For the second quarter of 2022, the Company expects:

Deliveries of vehicles to be between 21,000 and 24,000 vehicles, representing an increase of 19.5% to 36.6% from the second quarter of 2021.

Total revenues to be between RMB6.16 billion (US$972.3 million) and RMB7.04 billion (US$1.11 billion), representing an increase of 22.3% to 39.8% from the second quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, in particular, the encouraging signs of recovery from the resurging pandemic in the Yangtze Delta region, which are all subject to change due to uncertainties related to factors such as the pace of pandemic recovery, among others.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com