Hello everyone, welcome to Gasgoo. This is the first episode (Part II) of the "Wheels of Change: Stories of Chinese Auto Giants" series. Today, let's continue our talk about BYD.

While focusing on the mass market, it's crucial to go upscale.

For BYD, beyond achieving a significant advantage in overall sales volume, improving its product portfolio is equally crucial.

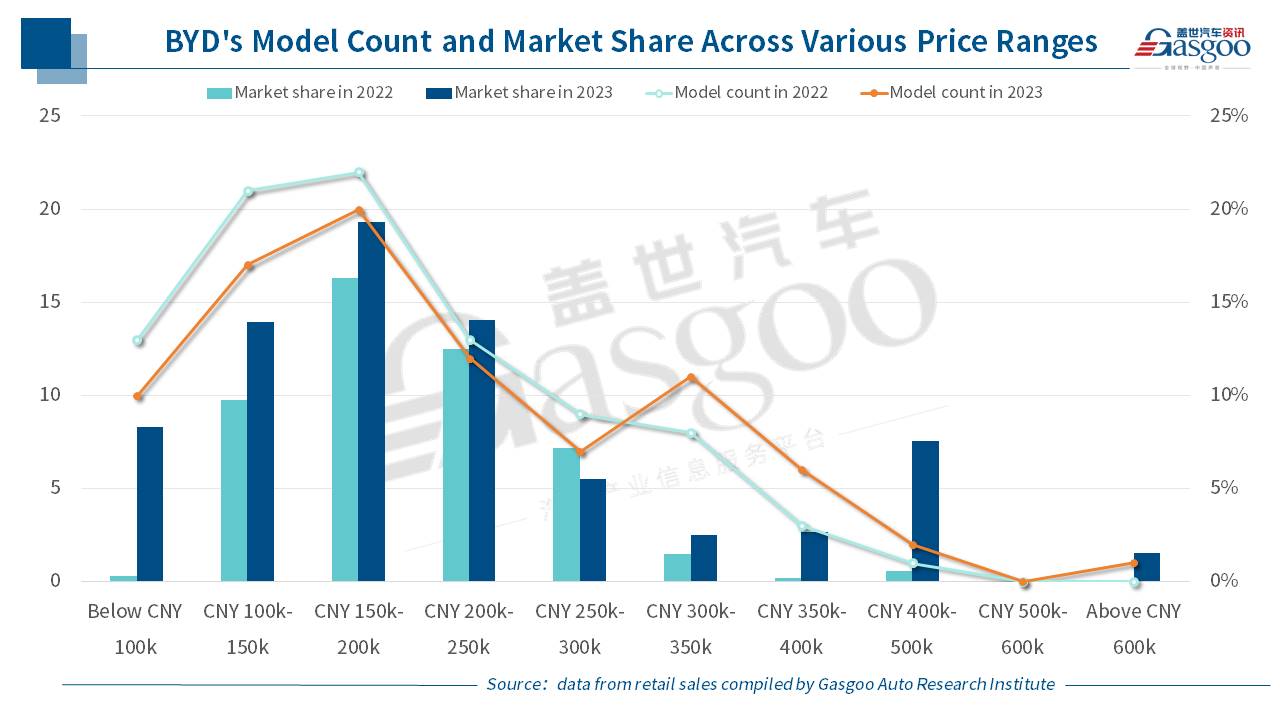

In 2023, BYD achieved a robust surge in both sales volumes and market share; notably, its automotive gross margin surpassed Tesla's starting from the second quarter, and maintained the lead through the latter half of the year. Beyond BYD's scale and supply chain vertical integration capabilities, this success can also be attributed to its ongoing move towards high-end product development. The average price of BYD cars exceeded 170,000 RMB in 2023, already far surpassing Volkswagen's average selling price.

According to data from the Gasgoo Auto Research Institute, in 2023, BYD's DENZA brand, with products priced between 299,800 RMB and 465,800 RMB, sold 113,900 vehicles last year, securing a 3.04% market share, which climbed 2.83 percentage points from the previous year. This placed it ahead of traditional luxury brands like Jaguar Land Rover, Lincoln, Cadillac, and on par with Volvo Cars. Looking at the average transaction price, DENZA is the only domestic brand in China that has surpassed 100,000 units in annual sales with an average price over 400,000 RMB (at 413,900 RMB).

Another brand, FANGCHENGBAO, focusing on professional personalization and also targeting the price range exceeding 300,000 RMB, drew great attention in 2023 as well.

Its first production model, the FANGCHENGBAO BAO 5, built on a non-loading-bearing frame designed for PHEVs, shines with its system power of 505kW and traction force of 32,000N offered by the DMO (Dual Mode Off-road) Super Hybrid Platform, the robust 485kW from two electric motors, the 100km of range on battery power alone, the fuel consumption of 8-9L/100km, as well as its superior off-road capability, resulting in 10,623 units of fixed orders received within 72 hours upon its market launch.

In December 2023, FANGCHENGBAO achieved sales of 4,373 vehicles in its first full month of delivery. This was accomplished even before the delivery of the DiSus-powered version, which accounted for 60% of the total order volume for the BAO 5 model.

Equally noteworthy is BYD's YANGWANG brand. YANGWANG, a name familiar to many, drew great attention at last year's Auto Shanghai, where long lines formed with some people waiting an hour just to get a close look at the YANGWANG U8,—a vehicle model acclaimed for its ability to "move laterally and go swimming."

Within less than two months of starting deliveries in 2023, the YANGWANG U8 achieved a retail sales volume of nearly 2,000 units with a price of over one million RMB.

In the price range from 300,000 RMB to 400,000 RMB, BYD's car sales zoomed up by 184.12% year over year in 2023, with its market share rising from 1.04% in 2022 to 2.55%. In the 400,000 RMB to 450,000 RMB price bracket, BYD's sales skyrocketed by 1,680.99% over a year ago, with over 80,000 units sold last year, boosting its market share by 6.97 percentage points from the previous year. Moreover, in the price segment above 500,000 RMB, BYD made its mark with the YANGWANG brand.

Setting sail for broader development horizons

Aiming to become a global company, BYD officially announced the strategy to expand its passenger car presence in global markets in 2021. In less than three years, BYD has expanded into 59 countries and regions, including Germany, Japan, France, Brazil, Australia, and the UAE, spanning more than 400 cities.

In 2023, BYD introduced five models into 19 European countries, opening over 230 sales and service stores. Notably, in October 2022, SIXT, one of Europe's largest car rental companies, placed an order for 100,000 new energy vehicles from BYD.

According to Automotive News Europe, BYD sold a total of 15,600 new energy vehicles in Europe during 2023, with the ATTO 3 alone accounting for 12,300 units, making it the year's best-selling all-electric compact SUV model in Europe.

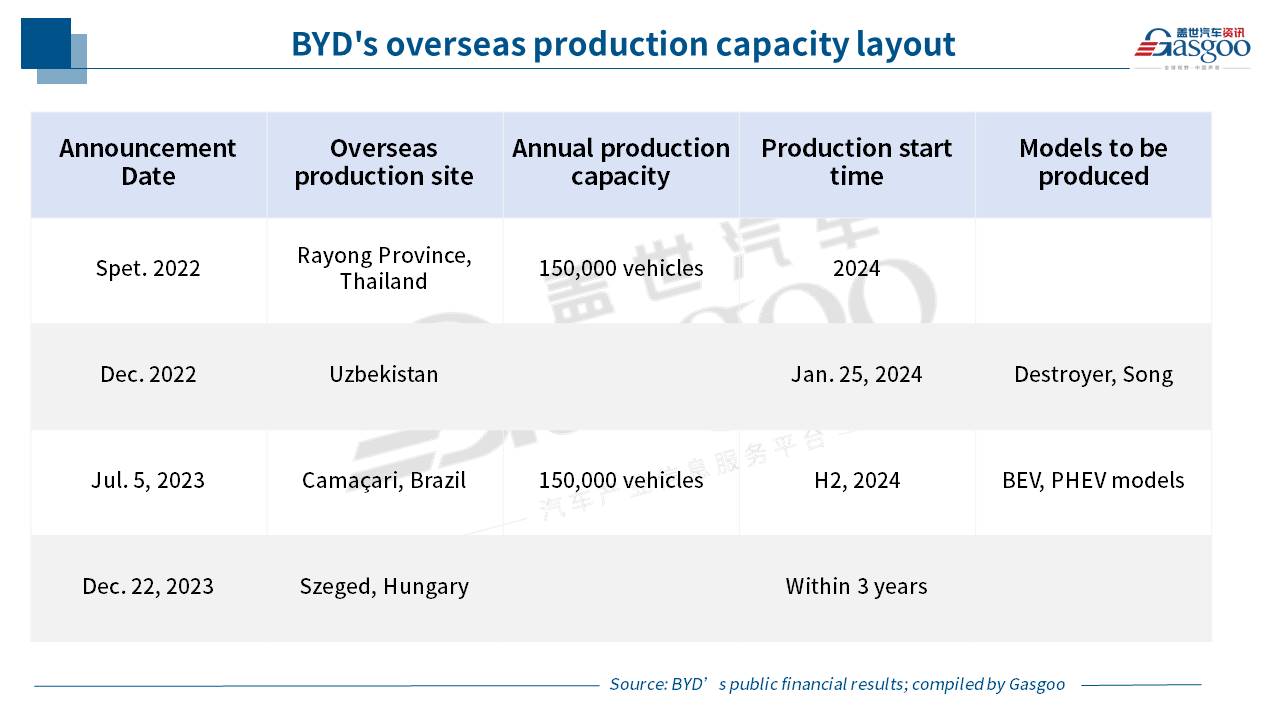

As we move into 2024, BYD is not only looking at how to introduce more brands and car models to the European market, but is also fast-tracking its passenger vehicle project in Hungary. On January 30, BYD formally signed a land pre-purchase agreement with the government of Szeged city for a new passenger vehicle plant, which is expected to go into operation within three years.

Beyond Europe, BYD has also deployed production bases in Thailand for Southeast Asia, Uzbekistan for Central Asia, and Brazil for South America. The Uzbekistan factory has already begun production, and as planned, the factories in Thailand and Brazil are poised to start operations in 2024.

On February 28, Stella Li, BYD's Executive Vice President, revealed that the company is scouting locations in Mexico for a new factory, with plans to finalize this year. The facility is expected to produce 150,000 passenger vehicles annually. This news comes amid continuous rumors of BYD exploring factory setups in countries such as India, Vietnam, and Italy.

BYD EXPLORER NO.1; photo credit: BYD

In addition, BYD is improving its logistics capabilities by establishing an automobile transport company and investing 5 billion RMB in buying eight large roll-on/roll-off ships. On January 9 2024, the "BYD EXPLORER NO.1," capable of carrying 7,000 vehicles, was officially delivered and departed from Yantai city, Shandong province. This vessel represents the first of the eight large car transport ships BYD has ordered, with the rest expected to be launched by around 2025.

Gasgoo Auto Research Institute predicts that BYD's annual passenger vehicle exports could hit a new high of 400,000 units in 2024.

Shoring up weaknesses, launching a vigorous push toward intelligence

BYD's relentless market expansion is deeply rooted in its technology expertise and the vertical integration of its supply chain. It has already proven its strength in electrification. The real challenge now is its ability to stand out in the intelligence race, which is crucial for its path forward.

As early as 2009, in the 2G era, BYD introduced smart access features and later innovated with such technologies as "Cloud Key," Bluetooth keys, NFC car keys, and UWB digital keys. Moreover, its infotainment system compatible with 3rd-party Apps, large rotatable screens, and responsive voice recognition has also earned it praise.

However, in the intelligent driving domain, despite strategic collaborations with tech giants like Baidu, Huawei, Alibaba Group, Horizon Robotics, Pony.ai, RoboSense, Momenta, and NVIDIA, BYD has struggled to launch a standout product.

In July 2023, the DENZA N7 hit the market as BYD’s first model to carry its high-level ADAS (advanced driver assistance system) “God’s Eyes”, and then achieved over 1,000 units of monthly sales in just two months. This performance was eclipsed by other new energy vehicle brands focusing on smart driving, such as AITO, AVATR, IM Motors, and XPENG.

On January 16 this year, at the Dream Day 2024, BYD unveiled several new technological breakthroughs, with a core focus on advancing intelligence.

So, following its lead in electrification, how will BYD enhance its capabilities in intelligence? Gasgoo Automotive Research Institute believes BYD's full-stack in-house R&D ability underpins its confidence in advancing intelligence strength.

BYD has launched its self-developed XUANJI Architecture that serves as both the brain and neural network of the vehicle, enabling an efficient blend of electrification and intelligence. This architecture integrates multiple sub-systems, including the e4 Platform, DMO, DiSus, chassis system, body control system, smart cockpit, and intelligent driving.

BYD's Chairman and President Wang Chuanfu; photo credit: BYD

Look ahead, BYD's DiLink intelligent cockpit platform will debut the chip that integrates cockpit control and intelligent driving systems with a computing power of 1,000T and 2,000T, aiming to enhance vehicle performance while further reducing costs.

Another invaluable asset for BYD is its user base of over 6.5 million new energy vehicle owners, including more than 2.5 million vehicles equipped with Level 2 or higher-level intelligent driving assistance features. It can provide continuous data input for the XUANJI architecture.

Wang Chuanfu revealed that BYD's high-level ADAS system would be an optional feature on models priced above 200,000 RMB and standard for those over 300,000 RMB. Besides, the BYD Han EV Honor Edition went on sale in late February as BYD’s first model to be equipped with the "God's Eyes” DiPilot 100 platform, introducing the upgrades to the NOA available in expressways and highways, as well as AVP (automated valet parking).

To boost its R&D of intelligent technologies, BYD plans to pour 100 billion RMB, and has set up a new intelligent technology research institute by merging its intelligent connectivity and intelligent driving R&D centers. Clearly, BYD is ready for an all-out advancement in intelligence in 2024.

Aiming to hit annual sales volume of 3.4 million vehicles in 2024

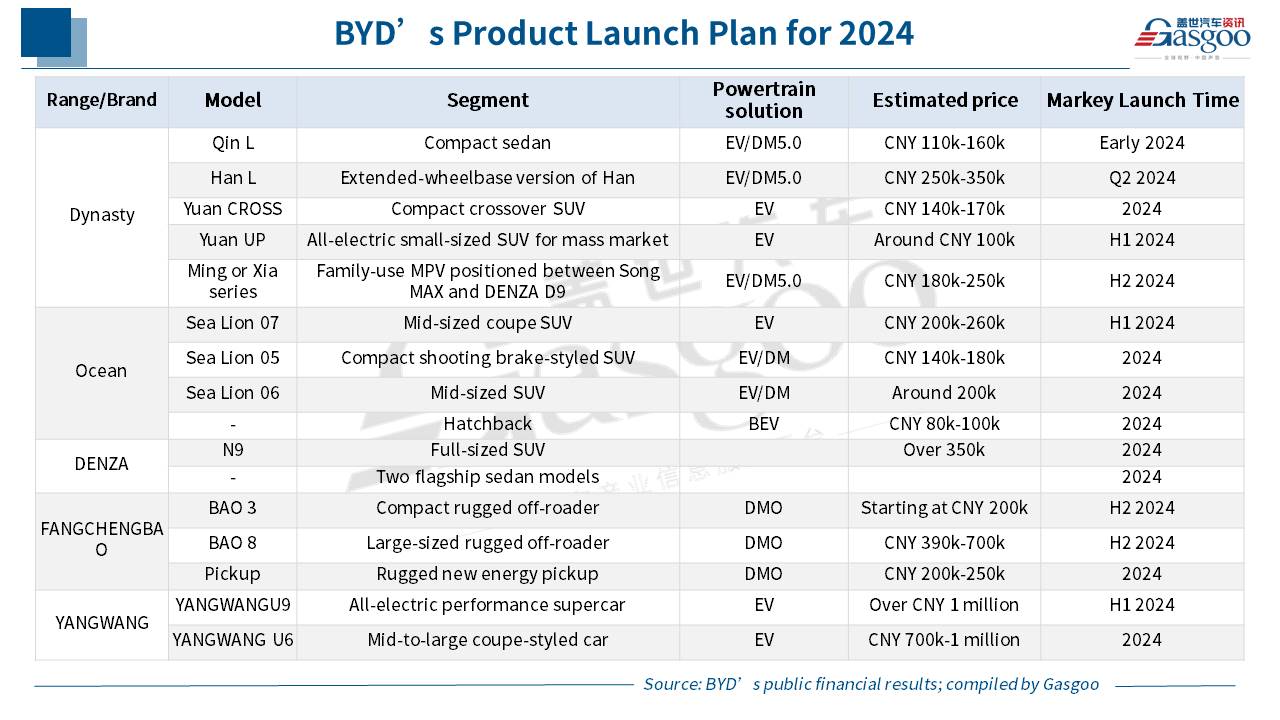

Heading into 2024, BYD is gearing up to launch over 10 new vehicle models, spanning categories from pickups and RVs (recreational vehicles) to coupes. It will be a big year for BYD's push of premium offerings and leap forward in the intelligent driving field.

The upcoming BYD Qin L model is expected to feature the fifth-generation DM hybrid technology, equipped with a new hybrid-specific chassis code-named P5.

On the battery front, the second-generation Blade Battery is expected for launch later this year, aiming for an energy density of up to 180Wh/kg, a range of over 700km, lighter weight, and lower energy consumption.

But, as BYD rolls out these innovations, the market landscape is heating up with fierce competition and escalating price wars, potentially impacting BYD's dominance across each segment. Besides, BYD is also facing internal challenges due to some price overlaps within its own product lineup.

Take the Song model as a case in point, with its diverse lineup including the Song Pro DM-i, Song MAX DM-i, Song PLUS DM-i, Song PLUS EV, and Song L. The once-clear distinctions between model tiers and price ranges are now blurring. To balance resources of its Dynasty and Ocean ranges, BYD placed the hot-selling Song PLUS in the Ocean sales channel, leading to some consumer confusion with the model being split across two distribution channels.

YANGWANG U9; photo credit: YANGWANG

Despite these challenges, BYD's strides in the new energy vehicle sector and its growing brand presence are unmistakable. Gasgoo Auto Research Institute predicts that BYD's vehicle sales would climb by nearly 13% year on year to 3.4 million units in 2024.