Product is king

On July 15, Chinese NEV maker Li Auto began rolling out the OTA 6.0 update for the Li L series and Li MEGA vehicles. This update focuses on enhancing the experience across three main areas: intelligent driving, intelligent space, and intelligent electrification.

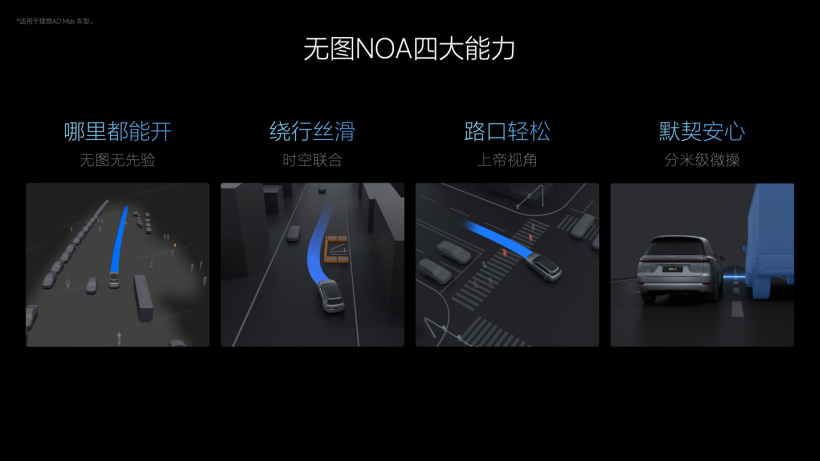

In the realm of intelligent driving, the AD Max’s HD map-free NOA (Navigate on Autopilot) was officially rolled out. For intelligent space, the capabilities of the smart voice assistant Li Xiang Tong Xue's Q&A system were expanded to include sports events and news updates. In the field of intelligent electrification, Li Auto's supercharging stations and high-power third-party charging stations were updated and optimized, significantly improving the charging experience.

Photo credit: Li Auto

While the updates in intelligent space and electrification were notable, it was the advancements in intelligent driving that garnered the most attention. At the 2024 China Auto Chongqing Summit held on June 8, Li Xiang, the CEO of Li Auto, introduced the company’s new breakthroughs in the field of autonomous driving.

Inspired by the book "Thinking, Fast and Slow," Li Auto’s autonomous driving team divided autonomous driving into System 1 and System 2. System 1 applies end-to-end autonomous driving technology, a highly efficient mode where input directly results in output, bypassing the cumbersome processes of traditional modules like perception, planning, and execution.

System 2, on the other hand, introduced a Vision Language Model (VLM) that understands navigation like a human, addressing complex and generalized issues that end-to-end technology cannot handle. The VLM not only provides a safety net for the end-to-end system but also resolves driving problems in various complex road conditions without relying on HD maps.

To ensure the smooth operation of both systems, Li Auto equipped its autonomous driving system with two chips: one for running the end-to-end technology and the other for the compressed VLM model. The validation results of this system were exciting, and Li Xiang anticipated that true supervised L3 autonomous driving could be achieved by the end of 2024 or early 2025.

The ultimate product manager: Li Xiang

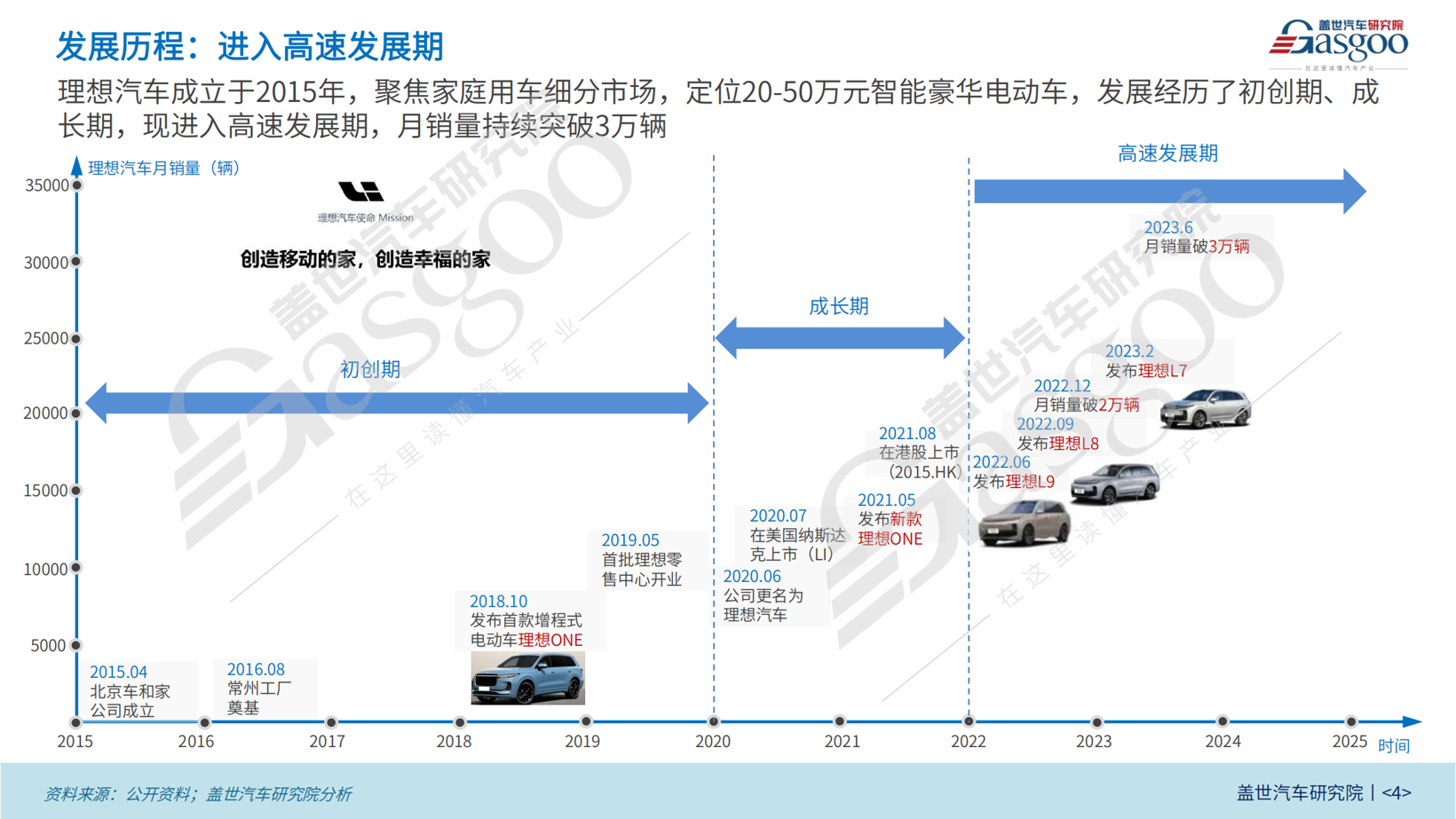

In June 2015, Li Xiang officially resigned from his position as President of Autohome. A month later, he re-emerged in the public with his new venture, Chehejia. At this time, the domestic NEV market was burgeoning, with NIO and XPENG just recently established.

Amid the hype, Li Xiang didn’t follow the trend of creating dazzling new concepts. Instead, he focused on solving consumers' pain points. Unlike his current high profile, Li Xiang was less active in the media then and repeatedly emphasized his role as an industrialist, asserting that Chehejia was not an internet car manufacturing company.

Li Xiang’s career trajectory has always leaned towards practicality. Chehejia marked his foray into the industrial sector. Combining consumer insights from his time at Autohome with the automotive industry, Li Xiang positioned Chehejia as an urban smart mobility service provider.

He planned two products for Chehejia: a SEV focusing on short-distance travel and a large, robust SUV. The SEV, similar to low-speed electric vehicles, featured a compact body, DC fast charging, and a removable battery. The all-around SUV aimed to meet the needs of family travel and was the predecessor of the Li ONE.

Though the two models appeared to have little in common, both shared a key feature: independence from basic charging infrastructure. The SEV could achieve convenient battery swapping, while the SUV utilized range extender technology. At a time when new energy vehicles were not yet mainstream, and range anxiety and charging difficulties hindered industry development, Li Xiang’s consumer-centric approach to addressing these issues was commendable.

However, mass production proved challenging.

The SEV fell into a regulatory gray area as a low-speed electric vehicle without legal status in China. Consequently, Li Xiang had to export the SEV to markets where it could legally operate, such as Europe and North America, for carsharing services. In 2017, Chehejia signed agreements with French carsharing company Clem and American carsharing company SCOOT Networks to offer free-floating carsharing services. Despite temporarily finding a market for the SEV, the capital-intensive nature and low profitability of carsharing couldn’t support large-scale production. Consequently, the SEV project was halted in early 2018, and Li Xiang shifted all focus to the all-around SUV.

Unlike the SEV, the SUV required passenger car production qualifications for mass production. While NIO and XPENG opted for traditional OEM manufacturing, Li Auto chose a different path. In 2018, Li Auto acquired a 100% stake in Lifan Motors’ Chongqing facility for 650 million RMB, securing new energy vehicle production qualifications and paving the way for the Li ONE’s launch.

Li ONE; photo credit: Li Auto

The Li ONE marked the beginning of Li Auto’s single product strategy. This 7-seater SUV, over 5 meters long with a maximum range exceeding 1,000 kilometers, was designed to compete with the likes of the Lexus RX450L, the Tesla Model X, and the BMW X5.

The Li ONE focused on addressing family travel needs, such as range, seating configuration, rear space, and trunk capacity. By defining and designing for various scenarios, the Li ONE offered comprehensive convenience, such as electric adjustment and seat heating for all six seats, as well as ventilation and massage functions for the first two rows, making it highly family-friendly for long journeys.

By addressing real user needs and lowering the entry price for a mid-to-large SUV to around 300,000 RMB, the Li ONE became the top choice for many family users, especially parents. Officially hit the market in December 2019, the Li ONE received a strong market response.

According to the Gasgoo Auto Research Institute, the Li ONE sold 32,700 vehicles in 2020. By October 28, 2021, Li Auto had achieved the sales milestone of 100,000 vehicles in just over two years, establishing the Li ONE as an industry hit despite skepticism about range extender technology.

Before the success of the Li ONE, the industry labeled range extending technology as “backward technology.” Investors pressured Li Auto to pursue a battery-electric path, but this didn’t shake Li Xiang’s resolve.

According to the China Passenger Car Association, in July 2024, range-extended electric vehicles (REEVs) secured 13% of China’s new energy passenger car market with 122,000 units (+115% YoY) wholesaled. In 2023, China’s wholesale volume of REEVs reached 642,000 units. At this growth rate, REEV sales could surpass 1 million units in 2024.

In addition to Li Auto, several other NEV brands like AITO, DEEPAL, VOYAH, Leapmotor, and NETA Auto have launched extended-range models, with AVATR and IM Motors set to follow. This growing lineup is pushing REEVs to become a mainstream market choice, continuously reaching new sales heights.

Compared to other leading automakers, Li Xiang has a keen understanding of genuine user needs and is willing to overcome any obstacles to meet them, embodying the traits of an exceptional product manager.

Matryoshka tactics: the strategy behind Li Auto's growth

Even before the official delivery of the Li ONE, Li Xiang was already strategizing for greater expansion.

In May 2019, Li Auto launched its first retail centers in major Chinese cities such as Beijing, Tianjin, Shanghai, Guangzhou, and Shenzhen. On June 26 of the same year, the company officially announced the standardization of its brand and product names, with both the company and brand being unified under the name Li Auto and the product series named Li ONE. The previous names, Chehejia and Lixiang Zhizao, were retired. The establishment of retail centers and the unification of brand identity laid a solid foundation for the success of the Li ONE, infusing Li Auto with strong vitality.

On July 30, 2020, Li Auto successfully went public on the U.S. stock market.

According to its IPO prospectus, Li Auto’s total revenue in the second quarter of 2020 reached 1.9 billion RMB ($275 million), a quarter-on-quarter increase of 128.6%. Deliveries reached 6,604 vehicles, up 128% quarter-on-quarter. Meanwhile, the company’s gross margin rose from 8% in Q1 to 13.3% in Q2 2020, and operating cash flow turned positive, reaching 450 million RMB. Considering that deliveries of the Li ONE began only in late 2019, it took Li Auto just six months to achieve positive operating cash flow.

On February 22, 2021, Li Xiang issued an internal letter announcing Li Auto's 2025 strategy, with an ambitious goal of capturing 20% of the Chinese auto market and becoming the top seller. Li Xiang predicted that by 2025, China would sell over 8 million smart electric vehicles, meaning Li Auto would need to sell 1.6 million units annually to meet its goal.

In addition, Li Auto announced the establishment of an R&D center in Shanghai, dedicated to cutting-edge smart electric vehicle technologies, including high-voltage platforms, ultra-fast charging technology, autonomous driving, and next-generation smart cockpits. The center was expected to employ over 2,000 people, with recruitment started in early 2021.

On August 12, 2021, Li Auto was listed on the Hong Kong Stock Exchange, raising approximately 11.55 billion HKD. This made Li Auto the second startup carmaker after XPENG to be listed in Hong Kong.

In October 2021, Li Auto completed the acquisition of Beijing Hyundai's first factory and made significant investments to transform it into a digital, flexible smart manufacturing facility, beginning R&D on complete vehicles, key components, and autonomous driving technologies.

With advancements in R&D and production capacity, Li Auto reached new heights in 2021.

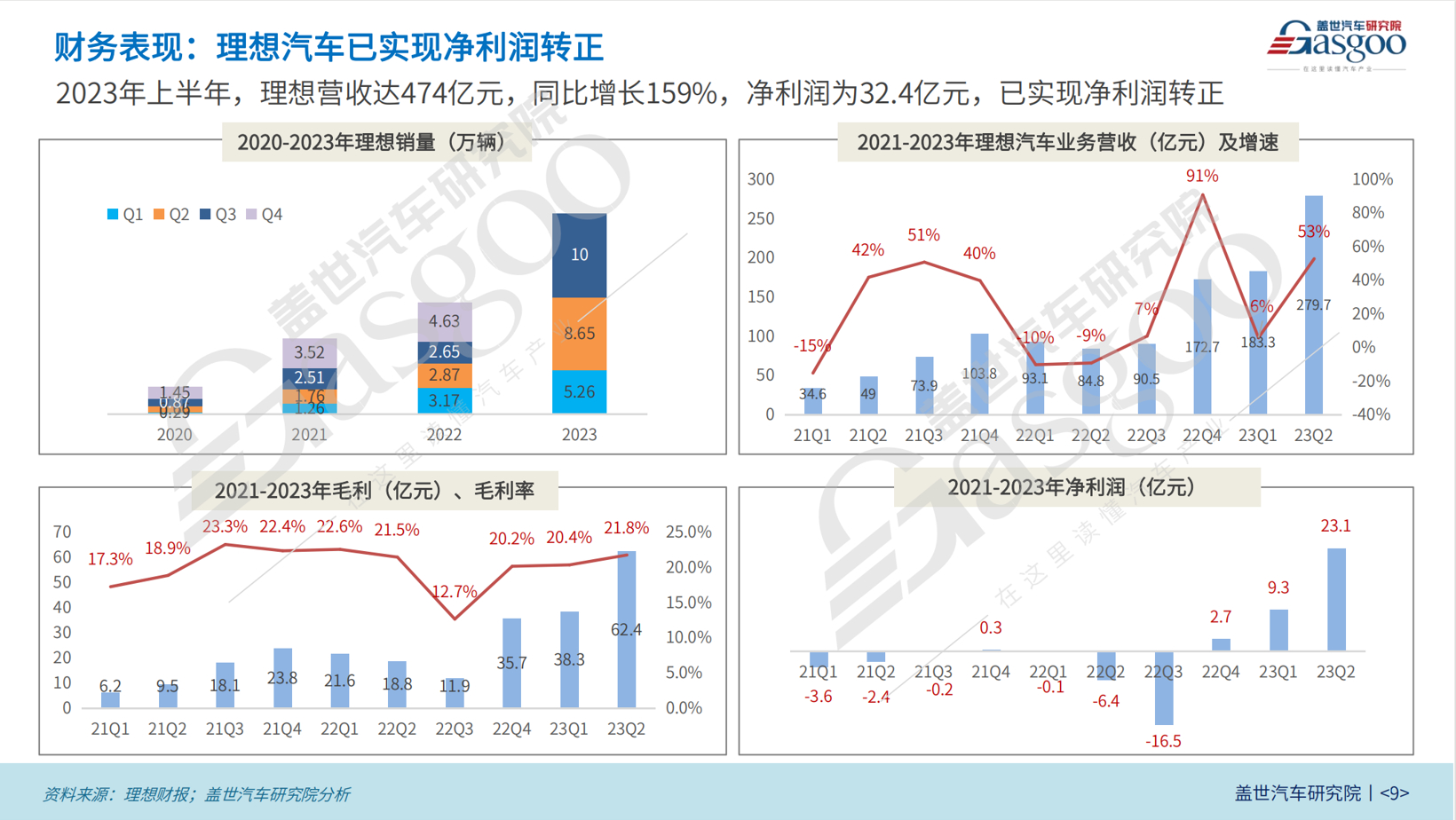

According to the Gasgoo Auto Research Institute, Li Auto sold 90,500 new cars in 2021 with only one model, the Li ONE. In Q4 alone, the Li ONE achieved record quarterly sales of 35,200 units. Alongside this sales peak, Li Auto posted its first positive net profit in Q4 2021, amounting to 30 million RMB.

However, market competition remained fierce.

Li Auto's rapid growth in 2021 did not continue into 2022. In the first two quarters of 2022, its sales were 31,700 and 28,700 units, respectively, with net losses of 10 million RMB and 640 million RMB.

In July 2022, AITO, the premium new energy SUV brand co-developed by Huawei and SERES, released the AITO M7 onto the market with three variants priced between 319,800 and 379,800 RMB. At its launch, AITO announced that the M7 had already secured over 10,000 units of pre-orders. Both the Li ONE and the AITO M7 are mid-to-large SUVs with range-extender technology, targeting similar customer bases. With Huawei’s backing, the AITO M7 became Li ONE’s first formidable competitor. In Q3 2022, Li ONE’s sales fell to 26,500 units, down 7.67% quarter-on-quarter, while net loss plummeted to a quarterly record of 1.65 billion RMB.

To better counter the AITO M7, Li Auto reached a key consensus at a strategy meeting in late September 2022. The company would fully adopt AITO's approach and rapidly upgrade to a matrix organization. In October 2022, Li Auto swiftly discontinued the Li ONE, replacing it with the new Li L8.

Before the Li L8 officially replaced the Li ONE, the flagship SUV Li L9 was launched on June 21, 2022, with deliveries beginning on August 30. The sudden discontinuation of the Li ONE shocked the industry, but Li Auto quickly created a situation where the L8 and L9 models could suppress the AITO M7.

The first challenge posed by the AITO M7 was effectively neutralized.

In Q4 2022, Li Auto achieved sales of 46,300 vehicles. In December of that year, Li Auto’s monthly sales surpassed 20,000 vehicles for the first time, with both the Li L8 and Li L9 models each selling over 10,000 units. In February 2023, Li Auto followed up by launching the smaller, more affordable Li L7, with deliveries started in March. By November 8, in just over nine months, the Li L7 had already reached cumulative deliveries of 100,000 units.

Using a product lineup of the Li L9, L8, and L7, Li Auto effectively released its competitive power in stages, yielding significant results. In 2023, Li Auto delivered 376,000 vehicles, a 182.2% year-on-year surge, generating more than 123 billion RMB in revenue, a 173.5% soar, with net profit reaching 11.8 billion RMB, marking its first full-year profitability. By the end of 2023, Li Auto’s cash reserves had reached about 103 billion RMB, demonstrating its formidable strength.

As Li Auto achieved breakthrough growth, AITO continued to enhance its competitiveness.

In September 2023, AITO launched the newly revamped M7 SUV, developed at a cost of 500 million RMB. The new M7 featured significant upgrades in body design, chassis, and intelligent systems, and most of all, the starting price was reduced to 289,800 RMB. It also came equipped with the advanced HUAWEI ADS 2.0 intelligent driving system, significantly boosting its market competitiveness. The improved product capabilities led to a surge in sales, attracting pre-orders of over 50,000 units within 25 days of its market launch. Four months later, the new M7 secured over 130,000 pre-orders. With the M7’s strong performance, AITO’s sales continued to climb. In January 2024, AITO achieved monthly sales of 32,973 units, surpassing Li Auto for the first time to become the monthly sales leader among startup new energy carmakers.

Li Auto responded by replicating its successful strategy and launched the smaller Li L6 model in April 2024. The Li L6, priced at 249,800 RMB, was Li Auto's first model under 300,000 RMB. Its high cost-effectiveness quickly gained market recognition, with orders surpassing 20,000 units within 12 days of its market release. In July 2024, Li Auto delivered 47,774 vehicles.