Losses persist, yet the momentum is unmistakably upward.

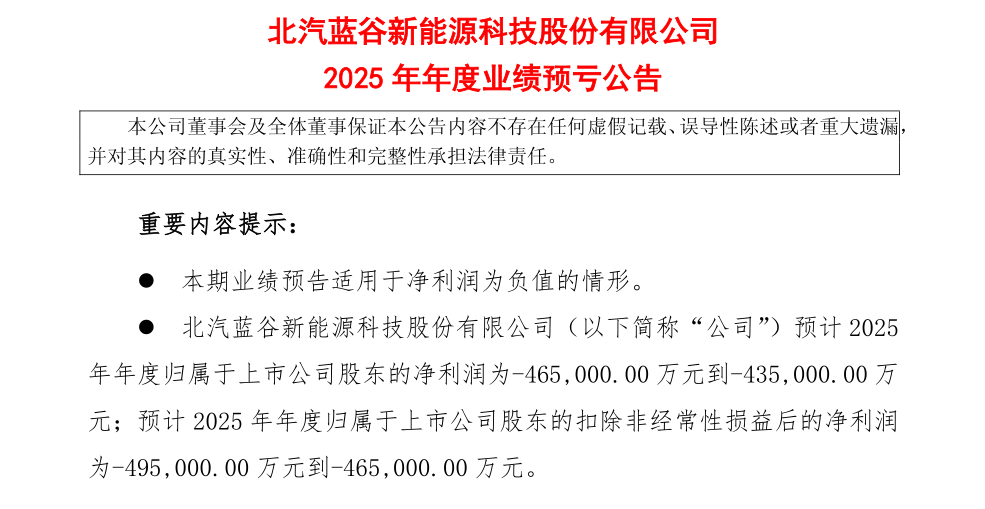

On January 19, BAIC BluePark New Energy Technology Co., Ltd. released its 2025 annual performance forecast. The company projects a net loss attributable to shareholders of 4.35 billion to 4.65 billion yuan, with a net loss of 4.65 billion to 4.95 billion yuan after deducting non-recurring items.

Image source: Screenshot of BAIC BluePark announcement

BAIC BluePark remains in the red, but there is a silver lining: the deficit has narrowed significantly from 6.948 billion yuan in 2024. Meanwhile, full-year sales surged 84.06% year-on-year to 209,576 units. This legacy EV maker's path to recovery is well underway.

Yet, as the NEV industry shifts from rapid expansion to high-quality competition, the critical question remains: when will BAIC BluePark's strategic investments finally translate into profitability?

BAIC BluePark's Performance Dilemma Amid Heavy Investment

For BAIC BluePark, 2025 was a year of soaring sales coexisting with persistent losses.

Data shows annual sales breached the 200,000-unit mark, climbing 84.06%—far outpacing the industry average. Arcfox brand sales alone surpassed 160,000 units, a 99% jump. Meanwhile, the Stelato S9 pure electric edition secured the top spot in the 400,000 yuan luxury EV sedan segment, serving as the core engine driving the brand upward.

Behind this impressive sales report lies a high-intensity investment drive, fueled by the company's firm commitment to its "Three-Year Leap" strategy. According to BAIC BluePark's roadmap, 2025 to 2027 is a critical window for building a scaled market base. To achieve this, the company is doubling down on product R&D and channel expansion.

On the R&D front, BAIC BluePark has prioritized the Stelato brand, deploying an average of over 1,200 personnel monthly to advance technical cooperation with Huawei. Simultaneously, it is accelerating Arcfox's product iteration, adding range-extended models and MPVs to build a dual-track lineup of pure electric and range-extended vehicles. On the channel front, Arcfox added a net 80 stores in 2025, bringing the total to 400. This achieved 100% coverage in Tier-3 cities and above, and over 85% coverage across Tier-1 to Tier-5 cities—though the push into lower-tier markets sent operating and construction costs climbing in tandem.

Image source: Arcfox

Such sustained spending is directly reflected in the financials. A comparison of the net loss attributable to shareholders and the net loss after deducting non-recurring items reveals that the profitability of BAIC BluePark's core business has yet to see fundamental improvement in 2025.

Compared to the cost control paths of industry leaders, BAIC BluePark's shortcomings are stark. The company still lags in supply chain autonomy, with high reliance on external core components. Combined with sales volumes that have not yet reached the break-even point, fixed costs per vehicle remain stubbornly high.

Looking at the industry landscape, competition in the NEV sector reached a fever pitch in 2025. BYD set a new record with 4.6024 million sales, while Geely's new energy sales jumped 90%. Independent brands like Changan and Chery accelerated their rise, and joint ventures also seized market share by matching smart features in ICE vehicles to their EV offerings.

Squeezed by both price and technology wars, BAIC BluePark achieved rapid sales growth, but maintaining competitiveness required ceding profit margins. This further exacerbated the dilemma of growing revenue without growing profit.

Profitability Within Reach, Glimmers of Recovery Appear

Despite short-term performance pressure, positive signals are emerging in BAIC BluePark's operational data.

The first-quarter report for 2025 shows revenue climbing 151% year-on-year, while the average selling price per vehicle rose by 9,000 yuan. Gross margins improved by 4.1 percentage points, and the net loss attributable to shareholders narrowed by 600 million yuan. These marginal improvements confirm that BAIC BluePark's development efforts are yielding preliminary results.

As the new product matrix rolls out and cost-reduction measures deepen, a turning point toward profitability is brewing.

According to the plan, BAIC BluePark will launch a slew of heavy-hitting models between 2025 and 2026. In the second half of 2025 alone, several models hit the market: the Arcfox T1 on September 11; the Stelato S9T on September 16; and the all-new Alpha T5—featuring Arcfox's first range-extended version—on October 28.

More models are expected in 2026. The Arcfox S3, a mid-size sedan, has completed MIIT filing for its pure electric version, with powertrain options expected to include both pure electric and range-extended variants. Arcfox's first MPV, positioned as a mid-to-large luxury vehicle, has also completed filing and will feature a plug-in range-extended hybrid powertrain.

Image source: Harmony Intelligent Mobility Alliance

Special mention must go to the Stelato brand. Stelato is set to introduce SUV and MPV models. Leveraging Huawei's technological advantages in smart cockpits and autonomous driving, Stelato models are poised to consolidate their position in the 300,000 to 500,000 yuan luxury NEV market, driving overall gross margin improvements through higher product premiums.

Furthermore, deepening cost-reduction and efficiency gains will accelerate the arrival of the profit inflection point. BAIC BluePark has elevated cost control to a top-priority initiative, compressing costs through supply chain optimization and improved production efficiency while safeguarding R&D investment.

On one hand, the company is deepening cooperation with industry leaders like CATL and Huawei to lower component costs through large-scale procurement. On the other, it is adopting advanced industry practices to drive digital transformation in manufacturing, reducing hidden waste through lean production.

The global strategy is also opening up incremental space for BAIC BluePark. Under its three-year leap plan, the company is pushing into five core markets: the Middle East, Latin America, Central Asia, Asia-Pacific, and Africa. Currently, demand for luxury NEVs is robust in the Middle East, while Latin America offers vast potential in lower-tier markets. With its dual-brand matrix of Arcfox and Stelato, BAIC BluePark aims to replicate its domestic growth trajectory abroad.

Looking at future trends, BAIC BluePark's dual-brand strategy captures both the mainstream and luxury segments, while its deep cooperation with Huawei builds a technological moat. As progress continues toward the 2027 sales target of 500,000 units for Arcfox, scale effects will continue to release, driving unit costs down further.

Overall, 2025 is a pivotal year for strategic investment and a period of accumulating strength for profitability at BAIC BluePark. With the continuous rollout of new products, the implementation of cost-reduction measures, and the release of scale effects, the company is poised to hit a profit inflection point between 2026 and 2027.

Of course, it must be noted that BAIC BluePark's recovery will take time—and market patience. Whether it truly achieves its goals depends on the strength of its strategic execution and its ability to seize market opportunities. In the survival-of-the-fittest world of the NEV industry, this legacy automaker's transformation is destined to be a long game.