"BBA sold 260,000 fewer units in a single year." That figure, emerging in early 2026, has turned heads across the industry.

Even as the overall luxury market expands, traditional giants like Mercedes-Benz, BMW, and Audi (BBA) are losing ground. The slump has served as a stark reminder that the halo surrounding these legacy brands is fading.

Some domestic premium brands have gone so far as to declare that "BBA is completely behind." That may be a subjective assessment, but the hard truth is undeniable: on the critical fronts of electrification and intelligence, BBA has failed to maintain its former lead. Strategic delays have left their sales and market share under intense pressure from domestic challengers.

According to Li Yanwei, a member of the expert committee at the China Automobile Dealers Association, the core objective for BBA and other traditional luxury brands in 2026 is no longer expansion. Instead, the priority has shifted to "stabilizing prices and holding market share."

Collective Stall in 2025

2025 was a brutal year for the German trio. The pain wasn't limited to a collective slowdown in China; it extended to a broader malaise across global markets.

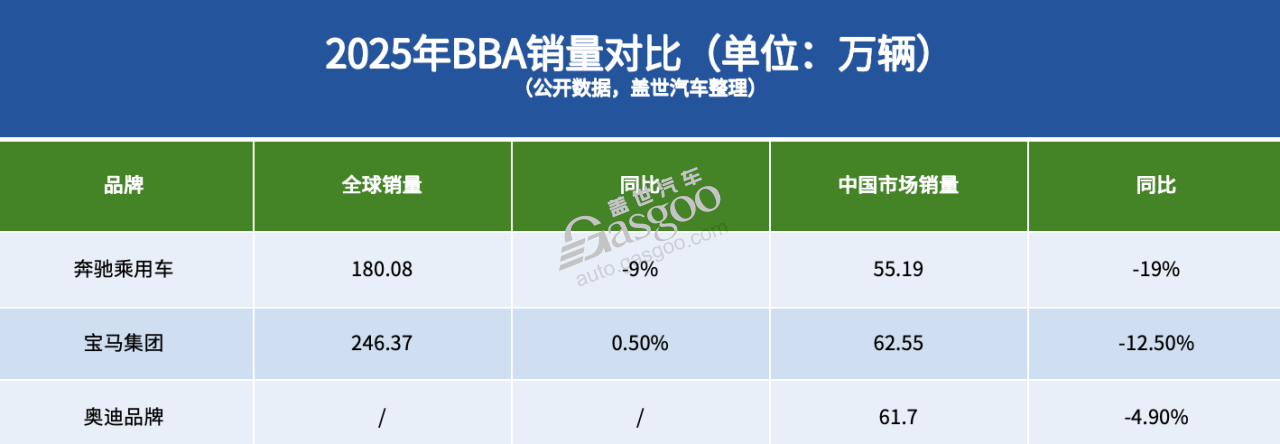

In China specifically, Mercedes-Benz delivered 552,000 vehicles in 2025 — a 19% plunge from the previous year. BMW sold 626,000 units, down 12.5%. Audi proved slightly more resilient, with combined sales from FAW-Audi and SAIC-Audi totaling roughly 617,000 units, a decline of about 4.9%.

The slump in China dragged down the group's global performance. BMW Group delivered 2.464 million vehicles worldwide in 2025, a scant 0.5% increase, relying on Europe and the U.S. to offset the retreat in China. Mercedes-Benz saw global sales drop to approximately 1.8 million, a 9% annual decline. Audi has yet to release full global figures, but the weakness in China is impossible to ignore.

The sales downturn quickly hit the bottom line. In the first half of 2025, profits at all three German automakers came under severe strain: Mercedes-Benz's net profit plunged 55.8%, nearly halving; Audi's net profit fell 37.5%, trapping it in a "revenue-up, profit-down" dilemma; and BMW saw its net profit slide 29%.

To spur demand, BBA ramped up incentives at the dealership level. According to Gasgoo, some BMW models are being offered with thousands of yuan worth of free accessories, driver-assistance systems, and heated seats. The BMW X5 starts at a sticker price of 500,000 yuan, with an additional 20,000-yuan subsidy and room to negotiate on "rebates."

For Mercedes-Benz, the Vito carries an 80,000-yuan discount for full cash payments, while the C260 offers a 100,000-yuan break for financing buyers and a 90,000-yuan discount for cash buyers.

Audi is offering 2,000-yuan vouchers worth 4,000 yuan on the older Q5L, with the base price starting at 255,000 yuan. The lineup comes standard with Level 2 driver assistance, with an option for Huawei's Qiankun Intelligent Driving ADS. "Discounts on the new models are actually steeper than the old ones," one sales consultant noted, a tactic aimed at driving promotion. The Q7 can be had for under 500,000 yuan out-the-door, with immediate availability.

Yet the steady descent in pricing failed to arrest the slide in market share, instead eroding brand premium power. This pressure isn't unique to BBA. Volvo sold roughly 150,000 units in China in 2025, down 4.9%; Cadillac fell from a peak of 200,000 annual sales to around 100,000; and Porsche moved just 32,000 units in China through the first three quarters of 2025, a 26% drop.

The strain on the traditional luxury camp is widespread. Standing in stark contrast is the continued ascent of China's homegrown premium brands.

Image Credit: FAW-Audi

AITO surpassed 420,000 sales in 2025, with its M9 firmly holding the top spot in the 500,000-yuan SUV segment — directly challenging traditional stalwarts like the Mercedes-Benz GLE and BMW X5. Li Auto also moved 400,000 units for the year, putting its single-brand volume on par with the mid-tier performers of BBA.

Brands like Zeekr, NIO, Denza, and LUXEED are also making inroads across various segments, creating a multi-pronged competitive landscape. Even in the ultra-luxury space above 700,000 yuan, Chinese brands like Yangwang and MAEXTRO are breaching the strongholds of traditional European marques. The MAEXTRO S800, for instance, racked up 6,500 orders in its launch month.

Symbolically, in the third quarter of 2025, emerging brands outsold BBA in volume for the first time within China's top 10 premium market ranking. Senior analyst Zhou Lijun defines these "emerging premium brands" as those established within the last decade, priced above 250,000 yuan, and showing strong momentum. He estimates that by the end of 2025, these upstarts will command nearly 60% of the premium market.

This doesn't imply traditional luxury brands will vanish overnight, but it confirms that the "stable leadership structure" they built over decades is steadily eroding.

The Rules Have Changed

The collective stumble of BBA in China isn't just a problem for individual automakers; it speaks to a broader market upheaval. In the era of intelligent EVs, the fundamental logic of competition in the luxury sector is being rewritten.

In this transition, BBA failed to match the breakneck speed of China's NEV market. Between 2020 and 2025, the penetration rate of new-energy passenger vehicles surged from under 10% to 54%, completing a leap from niche to mainstream. The market offered no lengthy grace period for legacy players.

While all three automakers pursued electrification, early efforts relied heavily on converted internal combustion engine platforms. The product cadence was slow and the technology conservative, failing to establish a scale advantage during the critical window. It wasn't until around 2025 that highly anticipated pure-electric platforms like Mercedes's MB.EA, BMW's Neue Klasse, and Audi's PPE began rolling out production models.

That strategic misalignment is evident in the numbers. BBA's penetration rate in China's new-energy luxury market has lingered around 15%, significantly lagging the broader market.

Virtually all new demand in China's luxury market is being captured by energy brands. Data from Gasgoo Automotive shows that between 2020 and 2024, sales of luxury NEVs surged from 220,000 to 2.88 million — a more than 12-fold increase — while sales of traditional luxury vehicles slipped from 2.458 million to 2.23 million.

Amid the onslaught from NEV rivals, BBA has struggled to grow volume, watching its share of the luxury market contract from a peak of 70% to roughly 35%.

Beyond timing, the pace of product evolution at BBA has failed to keep up with market iteration. For years, brand perceptions — "Mercedes for luxury, BMW for handling, Audi for tech" — and classic models like the 3 Series, 5 Series, and A4 formed a solid moat in China.

In the EV era, however, the value proposition has shifted. Software capabilities, smart cockpits, driver assistance, and ecosystem integration now matter far more. Legacy brands have been slower to update in these areas. Even with recent strategic adjustments, the overall experience gap in their EVs hasn't been wide enough to constitute a "generational leap," failing to reignite consumer desire.

In the internal combustion engine sector, core models like the BMW 5 Series, Mercedes E-Class, and Audi A6L have received mostly incremental updates on existing platforms. They lack the breakthrough innovations that reshape product form or usage. This stagnation mirrors the dilemma Tesla faces with its aging lineup — a loss of novelty for consumers.

The supply side has undergone a fundamental shift as well. The density of "good products" in China has changed dramatically. For a long time, choices in the 300,000 to 500,000 yuan range were highly concentrated, dominated by BBA and a handful of second-tier luxury brands.

In recent years, that price bracket has been flooded with domestic high-end NEVs spanning sedans, SUVs, and MPVs, offering distinct advantages in space, configuration, and intelligent features.

With 800V/900V architectures and "mapless" autonomous driving becoming standard, some of BBA's electric offerings lack clear advantages in range, driver assistance, or value for money. Their overall product matrix remains thin in the NEV era.

Specifically, in the 200,000 to 300,000 yuan bracket, the Xiaomi SU7 and Tesla Model 3 have limited the appeal of the Mercedes EQB and BMW i3 (which hover around 200,000 yuan after discounts). In the core 300,000 to 500,000 yuan range, the AITO M8 and NIO ES8 are siphoning off BBA's traditional customer base. Above 500,000 yuan, the AITO M9 and MAEXTRO S800 pose a substantial challenge to Mercedes and BMW.

Image Credit: Mercedes-Benz

A deeper shift is occurring on the demand side. The decision-making logic of a new generation of luxury car buyers diverges sharply from that of a decade ago. McKinsey's "2025 China Automotive Consumer Insight" report indicates that while German luxury brands still command high recognition in the combustion engine market, their brand premium in the EV sector has eroded significantly. About 50% of consumers explicitly stated they would not pay a premium for foreign-branded electric vehicles.

This shift is playing out in actual purchasing behavior. Surveys by Gasgoo reveal that in the replacement market, a "BBA plus NEV" combination is becoming the norm for many households. Pairings like "Mercedes plus AITO" or "BMW plus Li Auto" are increasingly common.

Xiaomi Chairman Lei Jun noted that 29% of SU7 buyers previously owned a BBA vehicle. NIO CEO William Li reported an even steeper figure, with BBA owners accounting for 70% to 80% of his customers. A leaked sales report for the Xiangjie S9T showed that over 90% of trade-in customers came from BBA.

The market has changed. Consumers have changed. And the rules of competition have changed. The "brand power plus mechanical quality" formula that BBA relied upon is gradually losing its potency in the intelligent electric age.

2026: A Tough Defense

Entering 2026, goals for BBA and other traditional luxury brands are turning pragmatic. Li Yanwei suggests that the core task for BBA is no longer expansion, but rather lowering sales targets to ease dealer pressure and holding onto existing market share. The reality, however, is that defending that turf is becoming harder.

First, competition in China's auto market is unlikely to let up in 2026. There is a broad consensus in the industry that as demand growth slows, the battle will only intensify. XPENG Chairman He Xiaopeng put it bluntly: the market in 2026 will be even more "cruel."

That assessment rests on the fact that China's passenger car market has entered a clear phase of stock competition. Roland Berger analysis suggests overall growth in 2026 may reach just 1 to 1.5 percentage points, significantly below historical levels. Many industry insiders expect China to enter a "high volume, low growth" phase.

Image Credit: BMW

Rising NEV penetration is also squeezing the survival space of traditional combustion engines. Chen Shihua, deputy secretary-general of the China Association of Automobile Manufacturers, predicts that overall NEV penetration could climb from 48% in 2025 to around 55% in 2026. With ICE vehicles still dominating BBA's sales mix, this structural conflict won't be resolved anytime soon.

Amid this intensifying rivalry, the price war is almost certain to persist. Over the past two years, price cuts have spread to the mainstream and luxury segments, becoming a normalized feature of the landscape. There is little sign of a retreat in early 2026.

BMW's moves are indicative of the trend. In January 2026, BMW China announced price adjustments for 31 models; 24 saw cuts exceeding 10%, and five dropped by more than 20%, spanning from entry-level to flagship vehicles.

Li Yanwei notes this is primarily aimed at relieving dealer cash flow pressure. While it may stabilize sales in the short term, it will further squeeze profit margins over time. For luxury brands, pricing isn't just a sales lever; it's a pillar of brand value. Once the pricing structure is frequently shaken, rebuilding premium becomes a long-term challenge.

A second wave of pressure comes from the relentless product offensive of competitors. Around 2026, Tesla, NIO, Xiaomi, and AITO are all planning to launch multiple new models across various segments and price points. These products typically boast clear technological identities and targeted use cases, entering the market with tight cadence and squeezing BBA across several price bands.

Moreover, domestic premium brands are accelerating their move upmarket. Flagship models from MAEXTRO, Yangwang, and M-Hero have entered the million-yuan class — a segment that has long been a key profit center for BBA. It is foreseeable that the competitive pressure facing BBA in 2026 will be even greater than in 2025.

Image Credit: SAIC Audi

To be sure, BBA isn't standing still. On the policy front, the new-energy vehicle purchase tax exemption is transitioning to a 50% reduction. Li Yanwei believes that raising the tax to 5% will objectively provide some slight relief from competitive pressure in the luxury market.

The more critical variable lies in the product lineup. 2026 is widely viewed as a pivotal node for BBA's new product cycle, with all three brands set to launch models based on entirely new platforms.

BBA is currently accelerating its localization transformation. BMW is co-developing driver-assistance systems with Momenta, partnering with Alibaba on smart cockpits and AI voice assistants, and integrating with Huawei's HarmonyOS ecosystem. Audi is introducing Huawei's Qiankun Intelligent Driving ADS into core models and bringing Momenta into its supply chain. Mercedes is collaborating with Momenta, investing in Qianli Tech, and adopting the Flyme Auto in-car system.

New-energy vehicles built on these fresh platforms are also set for delivery.

For BMW, the long-wheelbase version of the next-generation iX3, built on the Neue Klasse platform, is scheduled for delivery in summer 2026. It features 800V architecture, a panoramic iDrive system, a "super brain" for chassis control, and large cylindrical batteries, offering a range exceeding 900 kilometers. It has been localized for the Chinese market with a longer wheelbase, specific seat designs, and smart systems developed with Alibaba and Momenta.

Mercedes plans to launch a fully electric GLC based on the MB.EA platform in 2026, supporting 800V technology and featuring localized driver assistance and AI models, along with China-specific optimizations like a longer wheelbase. Additionally, the pure-electric CLA built on the new platform launched in late 2025.

For Audi, multiple models developed with Huawei will roll out in 2026, including core products like the Q5L — already launched with Huawei's Qiankun Intelligent Driving ADS — and the A6L.

The concentrated launch of these new models signals BBA's intent to reshape its competitiveness. But a deeper shift is occurring within the R&D apparatus itself.

Institutions like the Mercedes-Benz Shanghai R&D Center and Porsche China R&D Center are being granted greater R&D authority and decision-making power to shorten product cycles and align technology more closely with Chinese market needs. True localization transformation will only be achieved when local teams can deeply participate in, or even lead, the early development of the electric powertrain and intelligent software.

Overall, 2026 shapes up to be a high-intensity defensive battle for BBA. Stabilizing the pricing structure, maintaining market share, launching competitive new products, and driving localization — none of these tasks are easy, nor will they be resolved quickly. The final verdict may be pending, but 2026 will undoubtedly be a crucial determinant of the group's future trajectory.