Top 10 China-made PV, car, SUV models by wholesale volume in Dec. 2019

Shanghai (Gasgoo)- In 2019, automakers in China sold a total of 21,469,065 locally-produced PVs (referring to cars, MPVs, SUVs and minibuses), a decrease of 9.3% over the previous year, according to the China Passenger Car Association (CPCA). This was the second year in a row for China posting downturn in PV sales.

The national PV wholesale volume edged down 1.3% year on year to 2,201,882 units in December. To be specific, the sales of MPVs and minibuses dropped 15.2% and 13.6% respectively, while their decrease was largely counteracted by the stable performance of car and SUV sales.

Compared with November, China's PV market boasted an evident growth of 6.6% with all of four sectors achieving increase. The noticeable growth owes much to the greater discounts offer by auto dealers in order to fulfill the annual tasks agreed with OEMs.

In December, China's Vehicle Inventory Alert Index (VIA), which measures the inventory level of automobile dealers, stood at 59.0%, dropping 7.1 percentage points from the year-ago period and 3.5 percentage points over the previous month, according to the China Automobile Dealers Association (CADA). As of December, 2019, China's VIA had been exceeding the official warning threshold for 24 consecutive months.

Among the top 10 PV models by Dec. wholesale volume, seven places were seized by cars. The other three were also regulars, including two SUVs—the Haval H6 and the Changan CS75, and one MPV, the sought-after Hongguang.

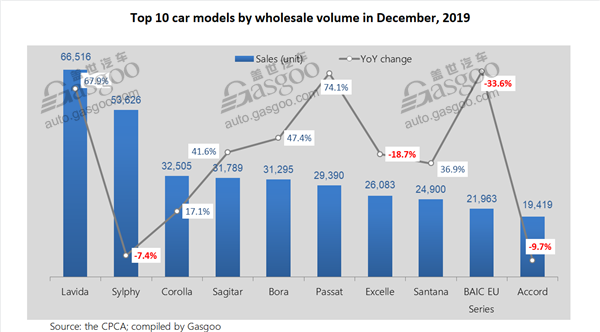

Car

China's car wholesale volume slightly fell 0.5% over a year ago to 1,014,659 units, making the annual volume aggregate 10,268,593 units (-10.9%).

With over 60,000 units sold last month, the Lavida regained the championship which was held by the Sylphy in October and November. The competition of the two hotter-selling models is getting increasingly fierce after SAIC Volkswagen launched in December the new entry-level version of the Lavida “Qihang”, which is priced between RMB99,900 and RMB122,900, a range closer to that of the Dongfeng Nissan's new Slyphy Classis (RMB99,800 to 118,600).

(Photo source: FAW-Toyota)

The Corolla was still the second runner-up, while sold 26,474 units less than the Sylphy. The Passat, ranked sixth, shrugged off the CIRI's crash test where a Passat car got it's A pillar fractured, boasting a vigorous sales increase of 74.1%.

Notably, BAIC BJEV's EU series entered into the top 10 car model list. At the end of 2018, the EV maker and the ride-hailing giant DiDi founded a joint venture that focuses on NEV operation and mobility services. Of course, it is also one of channels where the EU5 cars were sold through.

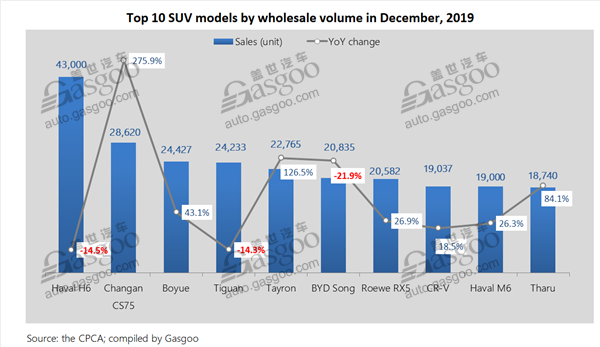

SUV

Automakers in China sold a total of 9,467,343 SUVs (-5.6%) throughout 2019, of which Dec. volume edged up 0.9% from the year-ago period to 999,500 units, according to the CPCA.

Compared to November, the Qashqai and the X-TRATL failed to appear on the top 10 SUV model list, and the Haval M6 and the Tharu moved up as their replacements.

(Photo source: Haval)

The Haval H6 was still the best-selling SUV, posting a monthly sales volume topping 40,000 units for the third month in a row. Driven by the advent of the CS75 PLUS, the sales volume of the Changan CS75 series skyrocketed 275.9% compared with the prior-year period.

Moreover, the sales of both the Tayron and the BYD Song were more than doubled over a year ago.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com