NIO Inc. Reports Unaudited Second Quarter 2020 Financial Results

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer in China’s premium smart electric vehicle market, today announced its unaudited financial results for the second quarter ended June 30, 2020.

Operating Highlights for the Second Quarter of 2020

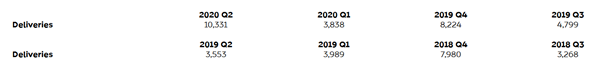

Deliveries of vehicles were 10,331 in the second quarter of 2020, including 8,068 ES6s and 2,263 ES8s, compared with 3,553 vehicles delivered in the second quarter of 2019 and 3,838 vehicles delivered in the first quarter of 2020.

Key Operating Results

| Financial Highlights for the Second Quarter of 2020 |

Vehicle sales were RMB3,486.1 million (US$493.4 million) in the second quarter of 2020, representing an increase of 146.5% from the second quarter of 2019 and an increase of 177.6% from the first quarter of 2020.

Vehicle marginii was 9.7%, compared with negative 24.1% in the second quarter of 2019 and negative 7.4% in the first quarter of 2020.

Total revenues were RMB3,718.9 million (US$526.4 million) in the second quarter of 2020, representing an increase of 146.5% from the second quarter of 2019 and an increase of 171.1% from the first quarter of 2020.

Gross profit in the second quarter of 2020 was RMB313.1 million (US$44.3 million), representing an increase of RMB817.3 million from a gross loss of RMB504.2 million in the second quarter of 2019 and an increase of RMB480.6 million from a gross loss of RMB167.5 million in the first quarter of 2020.

Gross margin was 8.4%, compared with negative 33.4% in the second quarter of 2019 and negative 12.2% in the first quarter of 2020.

Loss from operations was RMB1,160.0 million (US$164.2 million) in the second quarter of 2020, representing a decrease of 64.0% from the second quarter of 2019 and a decrease of 26.1% from the first quarter of 2020. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,114.7 million (US$157.8 million) in the second quarter of 2020, representing a decrease of 64.4 % from the second quarter of 2019 and a decrease of 27.5% from the first quarter of 2020.

Net loss was RMB1,176.7 million (US$166.5 million) in the second quarter of 2020, representing a decrease of 64.2% from the second quarter of 2019 and a decrease of 30.4% from the first quarter of 2020. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,131.4 million (US$160.1 million) in the second quarter of 2020, representing a decrease of 64.6% from the second quarter of 2019 and a decrease of 31.8% from the first quarter of 2020.

Net loss attributable to NIO’s ordinary shareholders was RMB1,207.8 million (US$171.0 million) in the second quarter of 2020, representing a decrease of 63.6% from the second quarter of 2019 and a decrease of 29.9% from the first quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,131.0 million (US$160.1 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.15 (US$0.16) in the second quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.08 (US$0.15).

Cash and cash equivalents, restricted cash and short-term investment were RMB11.2 billion (US$1.6 billion) as of June 30, 2020.

Key Financial Results

(in RMB million, except for per ordinary share data and percentage)

| 2020 Q2 | 2020 Q1 | 2019 Q2 | % Changeiv | |||||||

| QoQ | YoY | |||||||||

| Vehicle Sales | 3,486.1 | 1,255.6 | 1,414.5 | 177.6% | 146.5% | |||||

| Vehicle Margin | 9.7% | -7.4% | -24.1% | 1,710bp | 3,380bp | |||||

| Total Revenues | 3,718.9 | 1,372.0 | 1,508.6 | 171.1% | 146.5% | |||||

| Gross Profit/(Loss) | 313.1 | (167.5) | (504.2) | N/A | N/A | |||||

| Gross Margin | 8.4% | -12.2% | -33.4% | 2,060bp | 4,180bp | |||||

| Loss from Operations | (1,160.0) | (1,570.3) | (3,226.1) | -26.1% | -64.0% | |||||

| Adjusted Loss from Operations (non-GAAP) | (1,114.7) | (1,537.9) | (3,133.9) | -27.5% | -64.4% | |||||

| Net Loss | (1,176.7) | (1,691.8) | (3,285.8) | -30.4% | -64.2% | |||||

| Adjusted Net Loss (non-GAAP) | (1,131.4) | (1,659.4) | (3,193.6) | -31.8% | -64.6% | |||||

| Net Loss Attributable to Ordinary Shareholders | (1,207.8) | (1,722.8) | (3,313.7) | -29.9% | -63.6% | |||||

| Net Loss per Ordinary Share-Basic and Diluted | (1.15) | (1.66) | (3.23) | -30.7% | -64.4% | |||||

| Adjusted Net Loss per Ordinary Share-Basic and Diluted (non-GAAP) | (1.08) | (1.60) | (3.11) | -32.5% | -65.3% | |||||

Recent Developments

Deliveries in July 2020

Deliveries of the ES8 and ES6 were 3,533 vehicles in July 2020, representing a robust 322.1% year-over-year growth. The deliveries consisted of 2,610 ES6s, the Company’s 5-seater high-performance premium smart electric SUV, and 923 ES8s, the Company’s 6-seater and 7-seater flagship premium smart electric SUV. As of July 31, 2020, cumulative deliveries of the ES8 and the ES6 reached 49,615 vehicles, of which 17,702 were delivered in 2020.

EC6

NIO launched the EC6 on July 24, 2020 at the Chengdu Motor Show. The 5-seater premium smart electric coupe SUV starts at a pre-subsidy price of RMB 368,000, and is now available to order via the NIO app with delivery to start in September 2020.

The new model inherits NIO family design language with a touch of its stylish and sporty coupe silhouette. The EC6 boasts an excellent lightweight architecture and a drag coefficient of only 0.26Cd. Its superior dimensions and 2.9-meter long wheelbase offer a generous cabin space.

The EC6 excels in performance. Featuring a 160 kW PM motor in the front and a 240 kW induction motor in the rear, the electric drive system of the EC6 realizes 544 PS in max power and 725 N·m in peak torque. Enabled by its intelligent electric all-wheel-drive system, the EC6 accelerates from 0 to100 km/h in a snap of 4.5 seconds. Equipped with the optional 100 kWh battery pack, it can reach an NEDC range of up to 615 km.

Outstanding in both design and performance, the NIO EC6 presents itself as a highly competitive model for a younger and broader user base, and an excellent addition to our existing product lineup of ES8, the 6-seater and 7-seater flagship premium smart electric SUV, and ES6, the 5-seater high-performance premium smart electric SUV.

Substantial Completion of Cash Injections into NIO China

On June 29, 2020, the Company announced that the strategic investors have substantially completed the cash injection obligations for the first two installments of their investments in NIO China. As of today, NIO (Anhui) Holding Co., Ltd., or NIO Anhui, the legal entity of NIO China wholly owned by the Company prior to the investments, has received from the investors the RMB5 billion cash investments for the first two installments in full.

As previously disclosed by the Company, from April to June 2020, for investments into NIO Anhui, the Company entered into an investment agreement, as amended and supplemented by supplemental investment agreements and a shareholders agreement, as amended and supplemented by supplemental shareholders agreements with Hefei City Construction and Investment Holding (Group) Co., Ltd., CMG-SDIC Capital Co., Ltd. and Anhui Provincial Emerging Industry Investment Co., Ltd., and, as applicable, their respective designated funds, Jianheng New Energy Fund, Advanced Manufacturing Industry Investment Fund, Anhui Provincial Sanzhong Yichuang Industry Development Fund Co., Ltd. and New Energy Automobile Fund.

NIO has also injected its cash investment of RMB1.278 billion for the first installment and RMB1.278 billion for the second installment and is fulfilling its other obligations, including injecting the Asset Consideration into NIO Anhui, in accordance with the definitive agreements.

Completion of Offering of American Depositary Shares

In June 2020, NIO completed the offering of 72,000,000 American depositary shares, each representing one Class A ordinary share of the Company, at a price of US$5.95 per ADS, and an additional overallotment of 10,800,000 American depositary shares.

NIO plans to use the net proceeds from the ADS Offering mainly to fund its cash investments in NIO China, as well as other working capital needs. The Company expects NIO China to use the cash investments for research and development of products, services and technology, development of our manufacturing facilities and roll-out of our supply chain, operation and development of our sales and service network and general business support purpose.

CEO and CFO Comments

“We achieved a record-high quarterly deliveries of 10,331 ES8 and ES6 vehicles in total in the second quarter of 2020 and expect to deliver 11,000 to 11,500 vehicles in the third quarter as the momentum continues,” said William Bin Li, founder, chairman and chief executive officer of NIO. “The current constraints on the productions will be lifted in the near future and we are confident that our production capacity can meet the accelerated demand of our models.”

“Beyond the strong order growth, we are proud to reach a milestone quarter with respect to the key financial metrics of the Company, highlighted with the historically high vehicle gross margin of 9.7%, lowest-ever operating losses and more importantly, a positive cash flow from operations for the first time in our history. We will continue to focus on improving operating efficiency across the company. Meanwhile, we stay committed to investing in the technologies and services to provide our users with the best products and experience in the future and to strengthening our leadership in the smart EV sector,” concluded Mr. Li.

“With the strong deliveries in the second quarter 2020, our vehicle margin significantly exceeded our target of over 5%, attributed to the increasing scale, higher average revenue per vehicle, reduced material costs and improved manufacturing efficiency,” added Wei Feng, NIO’s chief financial officer. “Additionally, we have demonstrated our capabilities to generate positive cash flow from operations, through the continuous improvement of our operational efficiency and our significantly optimized cash flow management. We will continue to enhance our efficiencies across the company in the rest of 2020 and beyond.”

Financial Results for the Second Quarter of 2020

Revenues

Total revenues were RMB3,718.9 million (US$526.4 million) in the second quarter of 2020, representing an increase of 146.5% from the second quarter of 2019 and an increase of 171.1% from the first quarter of 2020.

Vehicle sales were RMB3,486.1 million (US$493.4 million) in the second quarter of 2020, representing an increase of 146.5% from the second quarter of 2019 and an increase of 177.6% from the first quarter of 2020. The increase in vehicle sales of the second quarter of 2020, compared to the second quarter of 2019, was mainly contributed by the sales of the ES6 which began deliveries in late June 2019. The increase in vehicle sales of the second quarter of 2020, compared to the first quarter of 2020, was due to the increase of vehicle deliveries recovered from the COVID-19 outbreak in China.

Other sales in the second quarter of 2020 were RMB232.8 million (US$33.0 million), representing an increase of 147.7% from the second quarter of 2019 and an increase of 100.0% from the first quarter of 2020. The increase in other sales of the second quarter of 2020, compared to the second quarter of 2019, was mainly attributed to increased revenues derived from the home chargers installed, service package and energy package subscribed, and accessories sold, which were in line with the increased vehicle sales in the second quarter of 2020.

Cost of Sales and Gross Margin

Cost of sales in the second quarter of 2020 was RMB3,405.8 million (US$482.1 million), representing an increase of 69.2% from the second quarter of 2019 and an increase of 121.2% from the first quarter of 2020. The increase in cost of sales compared to the second quarter of 2019 was mainly driven by the increase of delivery volume of the ES6 and the ES8 in the second quarter of 2020.

Gross profit in the second quarter of 2020 was RMB313.1 million (US$44.3 million), representing an increase of RMB817.3 million from a gross loss of RMB504.2 million in the second quarter of 2019 and an increase of RMB480.6 million from a gross loss of RMB167.5 million in the first quarter of 2020. The increase of gross profit compared to the second quarter of 2019 was mainly contributed by increased vehicle sales, and incurrence of the one-off cost in relation to the Company’s voluntary battery recall in the second quarter of 2019.

Gross margin in the second quarter of 2020 was 8.4%, compared with negative 33.4% in the second quarter of 2019 and negative 12.2% in the first quarter of 2020. The increase of gross margin compared to the second quarter of 2019 was mainly driven by the increase of vehicle margin in the second quarter of 2020.

Vehicle margin in the second quarter of 2020 was 9.7%, compared with negative 24.1% in the second quarter of 2019 and negative 7.4% in the first quarter of 2020. The increase of vehicle margin compared to the second quarter of 2019 and the first quarter of 2020 was mainly driven by the decrease in purchase price of certain materials and lower unit manufacturing cost attributed from increased production volume of the ES6 and the ES8 in the second quarter of 2020. Besides above, the increase of vehicle margin in the second quarter of 2020 compared to the second quarter of 2019 was also attributable to the impact of the one-off cost in relation to the Company’s voluntary battery recall in the second quarter of 2019.

Operating Expenses

Research and development expenses in the second quarter of 2020 were RMB545.2 million (US$77.2 million), representing a decrease of 58.1% from the second quarter of 2019 and an increase of 4.4% from the first quarter of 2020. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB533.5 million (US$75.5 million), representing a decrease of 58.4% from the second quarter of 2019 and an increase of 3.7% from the first quarter of 2020. The decrease in research and development expenses over the second quarter of 2019 was primarily attributable to the incurrence of expenses relating to rigorous testing activities of ES6 in the second quarter of 2019 before its mass production. Research and development expenses remained relatively stable compared with the first quarter of 2020, which mainly consisted of costs incurred for recurring projects, while mass investment stage has not yet reached for new projects.

Selling, general and administrative expenses in the second quarter of 2020 were RMB936.8 million (US$132.6 million), representing a decrease of 34.1% from the second quarter of 2019 and an increase of 10.4% from the first quarter of 2020. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB904.5 million (US$128.0 million), representing a decrease of 33.1% from the second quarter of 2019 and an increase of 9.7% from the first quarter of 2020. The decrease in selling, general and administrative expenses over the second quarter of 2019 was primarily driven by the Company’s overall cost-saving efforts and the improved operating efficiency in marketing and other supporting functions. The increase in selling, general and administrative expenses over the first quarter of 2020 was primarily attributed to increased marketing and promotional activities and costs recovered from the COVID-19 outbreak in the first quarter of 2020.

Loss from Operations

Loss from operations was RMB1,160.0 million (US$164.2 million) in the second quarter of 2020, representing a decrease of 64.0% from the second quarter of 2019 and a decrease of 26.1% from the first quarter of 2020. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,114.7 million (US$157.8 million) in the second quarter of 2020, representing a decrease of 64.4% from the second quarter of 2019 and a decrease of 27.5% from the first quarter of 2020.

Share-based Compensation Expenses

Share-based compensation expenses in the second quarter of 2020 were RMB45.3 million (US$6.4 million), representing a decrease of 50.9% from the second quarter of 2019 and an increase of 39.8% from the first quarter of 2020. The decrease in share-based compensation expenses over the second quarter of 2019 was primarily due to less options granted driven by the decline in the number of employees, and the impact of part of the share-based compensation expenses being recognized by using the accelerated method, under which the expenses decrease gradually over the vesting period. The increase in share-based compensation expenses over the first quarter of 2020 was primarily attributed to the incremental options granted in the second quarter of 2020.

Net Loss and Earnings Per Share

Net loss was RMB1,176.7 million (US$166.5 million) in the second quarter of 2020, representing a decrease of 64.2% from the second quarter of 2019 and a decrease of 30.4% from the first quarter of 2020. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,131.4 million (US$160.1 million) in the second quarter of 2020, representing a decrease of 64.6% from the second quarter of 2019 and a decrease of 31.8% from the first quarter of 2020.

Net loss attributable to NIO’s ordinary shareholders was RMB1,207.8 million (US$171.0 million) in the second quarter of 2020, representing a decrease of 63.6% from the second quarter of 2019 and a decrease of 29.9% from the first quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,131.0 million (US$160.1 million).

Basic and diluted net loss per ADS were both RMB1.15 (US$0.16) in the second quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.08 (US$0.15).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB11.2 billion (US$1.6 billion) as of June 30, 2020. The Company operates with continuous loss and negative equity. The Company’s continuous operation depends on the successful implementation of the management's plans which considers the improvements in its operating cash flows and the consummation of the investments in NIO China from strategic investors. Based on its evaluation which considers the progress of the investments in NIO China, the Company believes that its existing working capital, the funds from the investments in NIO China and available loan facilities will be sufficient to support the Company's continuous operations and developments in the next twelve months.

Business Outlook

For the third quarter of 2020, the Company expects:

Deliveries of the vehicles to be between 11,000 and 11,500 vehicles, representing an increase of approximately 129.2% to 139.6% from the same quarter of 2019, and an increase of approximately 6.5% to 11.3% from the second quarter of 2020.

Total revenues to be between RMB4,047.5 million (US$572.9 million) and RMB4,212.3 million (US$596.2 million), representing an increase of approximately 120.4% to 129.3% from the same quarter of 2019, and an increase of approximately 8.8% to 13.3% from the second quarter of 2020.

This business outlook reflects the Company's current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com