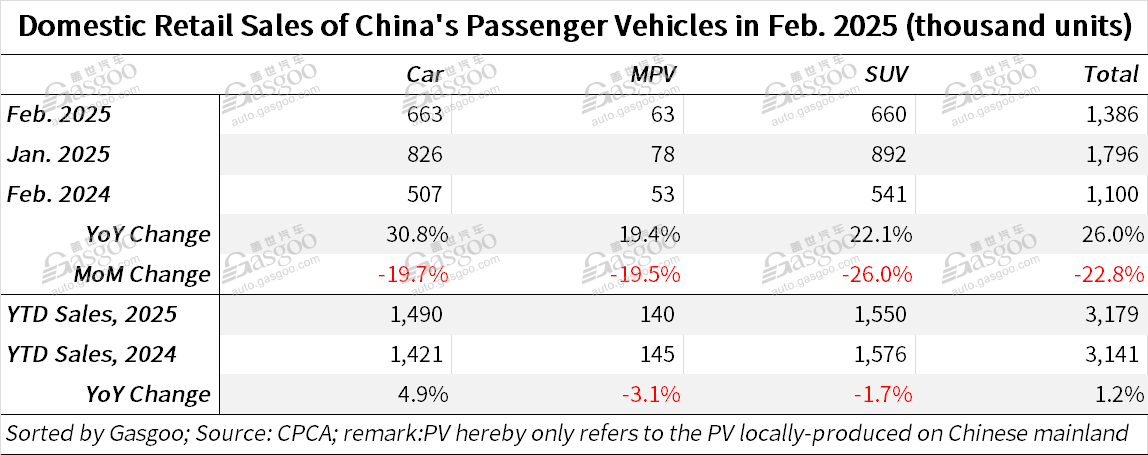

Shanghai (Gasgoo)- In February 2025, China's passenger vehicle (PV) retail sales reached 1.386 million units, marking a 26% year-on-year (YoY) increase, despite a 22.8% decline month-on-month (MoM), according to data from the China Passenger Car Association ("CPCA").

Cumulative PV retail sales for the Jan.-Feb. period totaled 3.179 million units, reflecting a 1.2% YoY growth.

The new energy passenger vehicle (NEPV) sector saw an even stronger performance, with February retail sales reaching 686,000 units, surging 79.7% YoY, though down 7.8% from January. Its Jan.-Feb. total stood at 1.43 million units, a 35.5% YoY jump.

Several factors contributed to this market strength. According to the CPCA, with the Chinese New Year holiday starting on January 29, 2025, February marked the first full month of post-holiday sales activity. Additionally, government policies promoting vehicle replacement and trade-ins began taking effect, while automakers stabilized pricing strategies, leading to a relatively mild price war compared to previous years.

Despite initial concerns over macroeconomic conditions, both domestic and global factors exceeded expectations, boosting consumer confidence. Automakers also maintained aggressive marketing efforts during the Chinese New Year holiday, and the low sales base of February 2024 provided a favorable comparison, helping the market achieve a strong post-holiday rebound.

In early February, long-distance holiday travel and cold weather heightened consumer concerns over new energy vehicle (NEV) range and charging, leading to a seasonal decline in NEV penetration. However, as temperatures warmed and work resumed post-holiday, demand quickly rebounded. Automakers intensified promotions on plug-in hybrid electric vehicle (PHEV) models, particularly leveraging governmental subsidies for vehicle replacement and trade-ins, further stimulating sales.

Additionally, the rise of China's AI sector, exemplified by DeepSeek, has reshaped the global AI landscape, offering low-cost, high-performance solutions that facilitate rapid in-vehicle AI integration. The Chinese government's recent policy positioning smart NEVs as next-generation intelligent terminals has also accelerated investment in smart cockpits and autonomous driving technologies, creating further market momentum.

China's self-owned brands dominated the PV market, with February retail sales reaching 910,000 units, a 51% YoY spike, despite a 17% MoM decline. Their domestic market share hit 65.6%, up 10.6 percentage points YoY, while their wholesale market share rose to 71%, up 12 percentage points YoY.

In contrast, mainstream joint ventures struggled in February with their combined sales falling to 330,000 units, down 2% YoY and 33% MoM. German brands held 17% market share, dropping 4.3 percentage points YoY, while Japanese brands slipped to 10.7%, down 3.7 percentage points YoY. U.S. brands accounted for 5% of the market, declining 1.4 percentage points YoY.

The premium PV segment also faced setbacks, with February retail sales reaching 150,000 units, down 8% YoY and 30% MoM. Overall, premium brands held a 10.8% market share, a 4 percentage point decline YoY, though traditional premium brands performed relatively well.

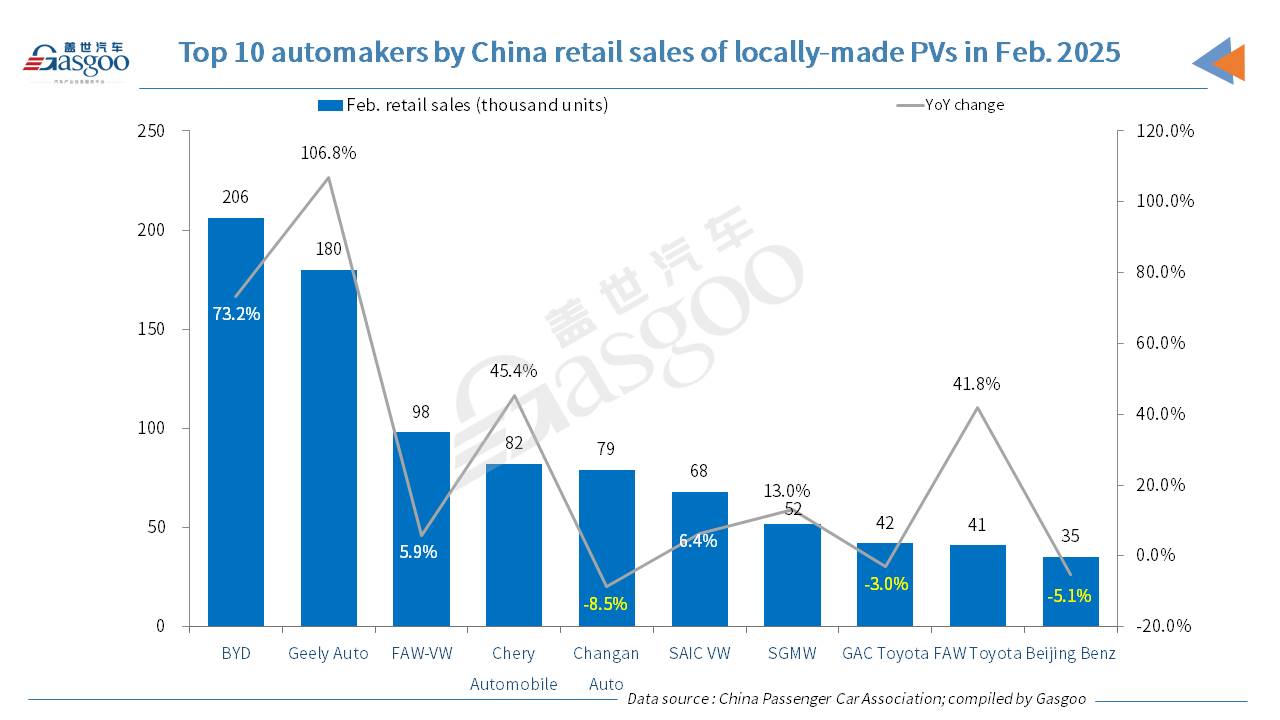

Among the top 10 automakers by domestic retail sales of locally-made PVs, BYD ranked highest with a sales volume of around 206,000 units, which soared 73.2% over a year earlier. Geely Auto was credited the fastest-growing one with a 106.8% YoY spike.

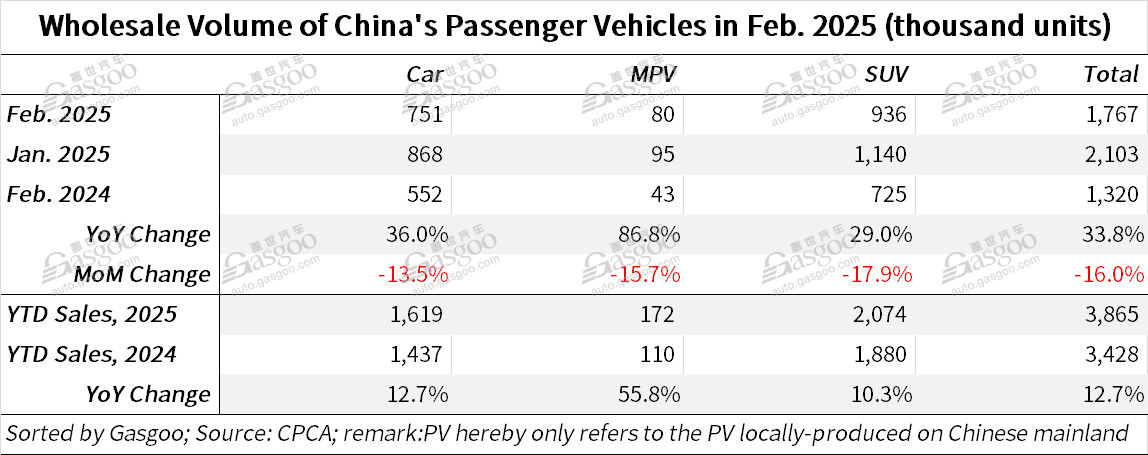

In February 2025, China's PV wholesale sales reached 1.767 million units, setting a new record for the month with a 33.8% year-on-year (YoY) increase, despite a 16% decline from January. For the first two months of the year, cumulative PV wholesale volume totaled 3.865 million units, reflecting a 12.7% YoY growth.

Stronger YoY growth in wholesale sales compared to retail sales were driven in part by limited dealer inventory clearance, said the CPCA.

The NEPV segment remained a key growth driver, with February wholesale volume hitting 830,000 units, marking a 79.6% YoY surge, though down 6.7% MoM. For the Jan.-Feb. period of the year, total NEPV wholesale volume reached 1.719 million units, zooming up 48% YoY.

China's wholly-owned automakers led the wholesale market in February, selling 1.25 million units, a 60% YoY hike, though down 13% from January. Mainstream joint ventures recorded 360,000 units in wholesales, an 8% YoY growth, but a 19% MoM decline. The premium PV segment, however, struggled, with 160,000 units wholesaled, down 23% YoY and 26% MoM.

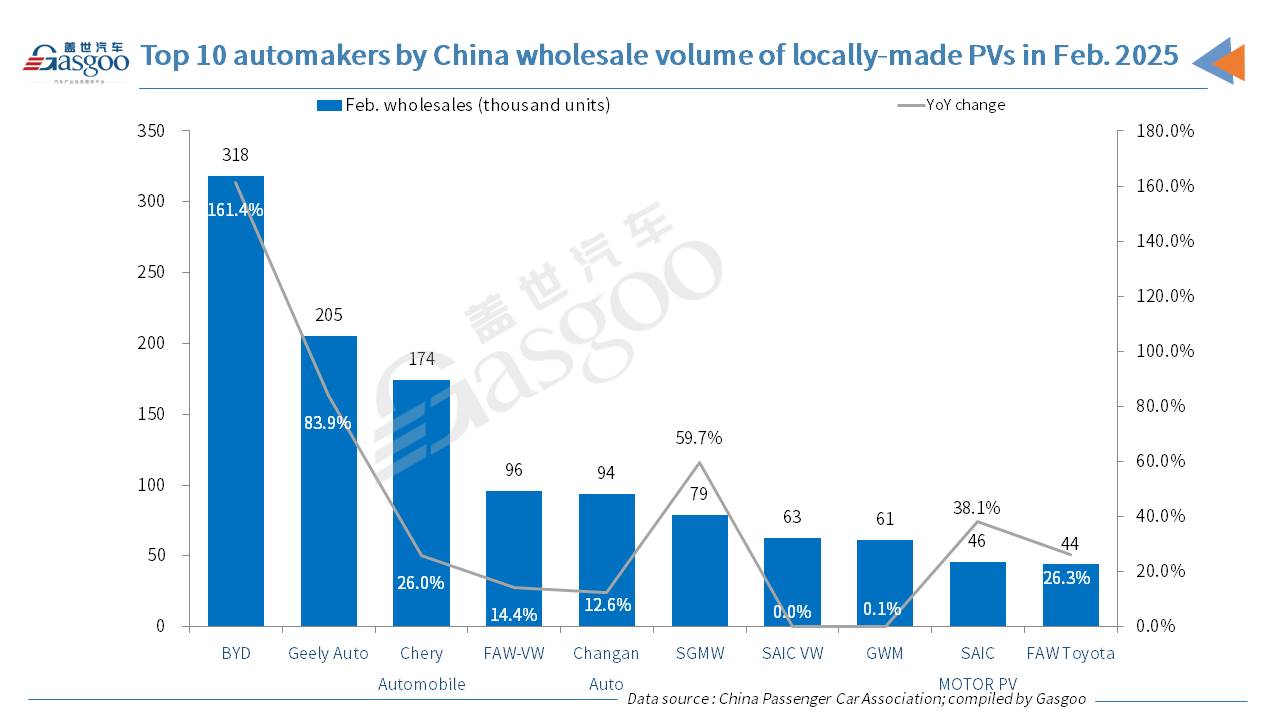

The wholesale PV market saw divergent performance among leading automakers. Geely Auto, Chery Automobile, and Changan Auto stood out with strong YoY and MoM growth. In February, three automakers in China surpassed 100,000 units in wholesales, down from five in January, but on par with last year's level. These three companies accounted for 39% of China's total wholesale sales. Among the 33 automakers exceeding 10,000 units in wholesales, 10 posted MoM growth, with five achieving over 10% growth, including GAC Honda, SAIC-GM-Wuling, and GAC AION, which demonstrated notable momentum.

China's PV production remained resilient, with 1.736 million units manufactured in February, up 38.7% YoY, though down 17.4% MoM. Total production for Jan.-Feb. period reached 3.829 million units, reflecting a 16.5% YoY increase. Despite the Chinese New Year break, February's output was just 60,000 units shy of the 2017 historical high of 1.79 million units, demonstrating robust industry performance and significant contributions to local economic stability.

Production trends varied by segment. Premium PV production fell 17% YoY and 25% MoM, while joint ventures saw a 10% YoY increase, albeit with a 27% MoM decline. China's self-owned automakers led growth, ramping up production by 66% YoY, despite a 13% drop from January.

China's automobile exports continued their strong momentum from 2024. In the first two months of 2025, China's vehicle exports totaled 970,000 units, up 17% YoY.

According to the CPCA's data, in February alone, China's PV exports—including both complete vehicles and CKD units—reached 349,000 units, marking an 11% YoY rise, though down 8% from January. Their year-to-date (YTD) volume amounted to 730,000 units, sliding 6% from a year earlier.