Rankings of smart cockpit component suppliers in China (Jan.-May 2025): Strong performance from China’s local players; Desay SV leads select markets

The smart cockpit stands at the forefront of the automotive intelligence race, as supply chain competition continues to reshape the market landscape.

According to data compiled by the Gasgoo Automotive Research Institute, the market remained highly fragmented for the Jan.–May 2025 period, yet a few dominant players pulled ahead across key segments. Desay SV led the cockpit domain controller market, Qualcomm commanded 75.9% of the cockpit domain controller chip segment, and iFLYTEK secured a 40.3% share in smart speech solution market—highlighting a widening gap between industry front-runners and the broader field.

The rise of China's local players drove a significant shift in the smart cockpit landscape. Across core segments—from cockpit domain controller and head-up display (HUD) to integrated center console display and smart speech solution—Chinese suppliers steadily gained ground. Companies like Desay SV and ECARX made strong advances in the cockpit domain controller market, while Foryou Multimedia led the way in HUDs. In center displays, local brands—including BYD—held four of the top five positions. The smart speech solution market was similarly dominated by iFLYTEK and AISpeech. With rapid innovation, agile execution, and cost advantages, China's tech ecosystem is not only challenging but increasingly outpacing traditional global giants.

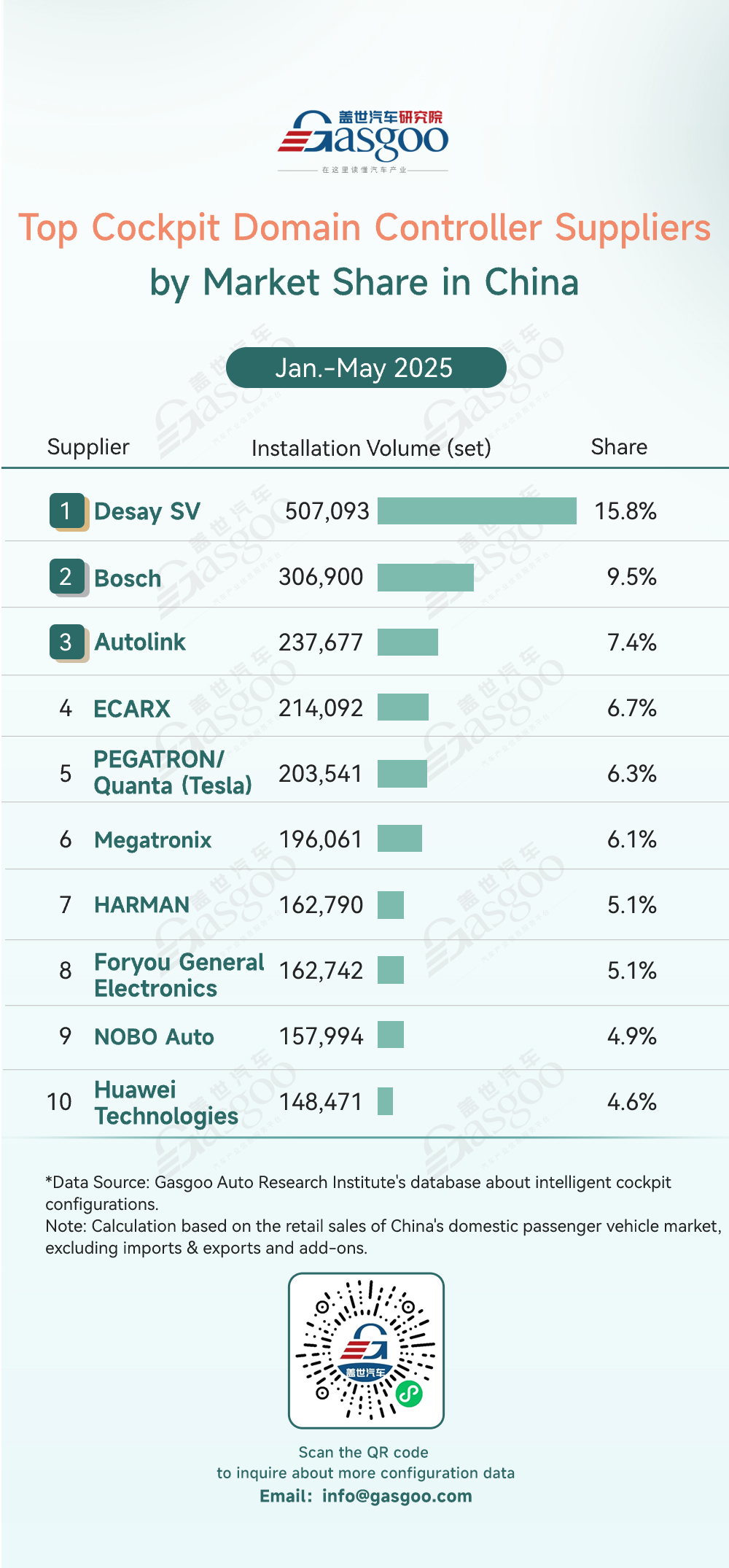

Top cockpit domain controller suppliers

Desay SV: 507,093 sets installed, 15.8% market share

Bosch: 306,900 sets installed, 9.5% market share

Autolink: 237,677 sets installed, 7.4% market share

ECARX: 214,092 sets installed, 6.7% market share

PEGATRON/Quanta (Tesla): 203,541 sets installed, 6.3% market share

Megatronix: 196,061 sets installed, 6.1% market share

HARMAN: 162,790 sets installed, 5.1% market share

Foryou General Electronics: 162,742 sets installed, 5.1% market share

NOBO Auto: 157,994 sets installed, 4.9% market share

Huawei Technologies: 148,471 sets installed, 4.6% market share

The cockpit domain controller market exhibited a clear concentration among leading players. Desay SV stood out with 507,093 sets installed (15.8% share)—roughly one-sixth of the total volume. The combined share of the top three suppliers—Desay SV (15.8%), Bosch (9.5%), and Autolink (7.4%)—reached 32.7%, underscoring a relatively high level of market consolidation.

In addition, suppliers such as ECARX (6.7%), PEGATRON/Quanta (Tesla, 6.3%), and Megatronix (6.1%) showed little separation in market share, indicating that competition in this segment remained intense and relatively fragmented.

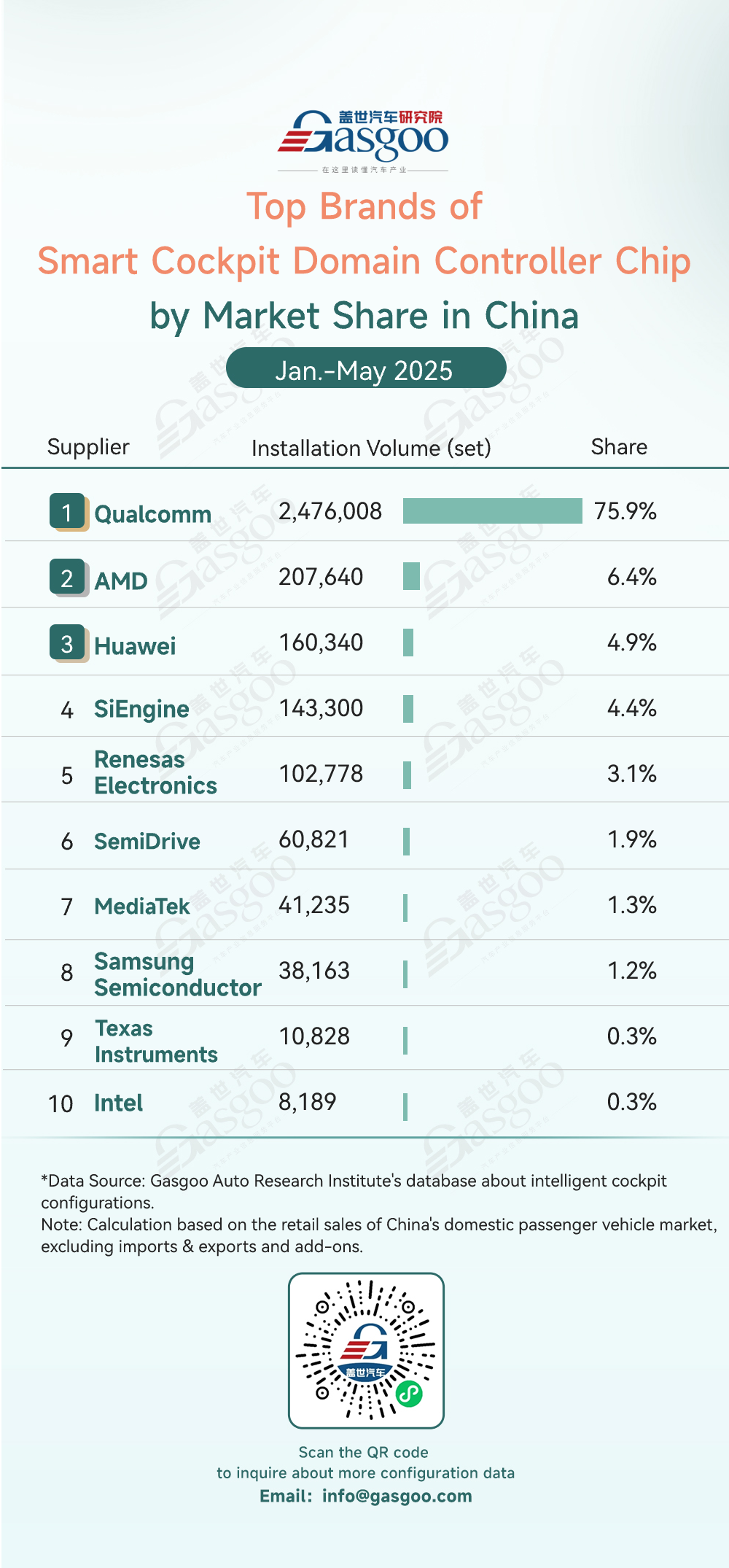

Top brands of smart cockpit domain controller chip

Qualcomm: 2,476,008 units installed, 75.9% market share

AMD: 207,640 units installed, 6.4% market share

Huawei: 160,340 units installed, 4.9% market share

SiEngine: 143,300 units installed, 4.4% market share

Renesas Electronics: 102,778 units installed, 3.1% market share

SemiDrive: 60,821 units installed, 1.9% market share

MediaTek: 41,235 units installed, 1.3% market share

Samsung Semiconductor: 38,163 units installed, 1.2% market share

Texas Instruments: 10,828 units installed, 0.3% market share

Intel: 8,189 units installed, 0.3% market share

In the cockpit domain controller chip market, Qualcomm led the way with 2,476,008 units installed (75.9% share). AMD ranked second with a 6.4% share, while China's local players such as Huawei (4.9%) and SiEngine (4.4%) together held nearly 10%. Notably, SiEngine's 7nm SE1000-I chip gained rapid traction among brands like Geely and FAW, reflecting an accelerating trend toward domestic substitution in the sector.

This year marks the arrival of the 5nm process era for cockpit domain chips. Chinese suppliers face increasing pressure to accelerate innovation in AI computing power and cockpit-driving integration chips, as they contend with both Qualcomm's dominant ecosystem and growing in-house development efforts from automakers.

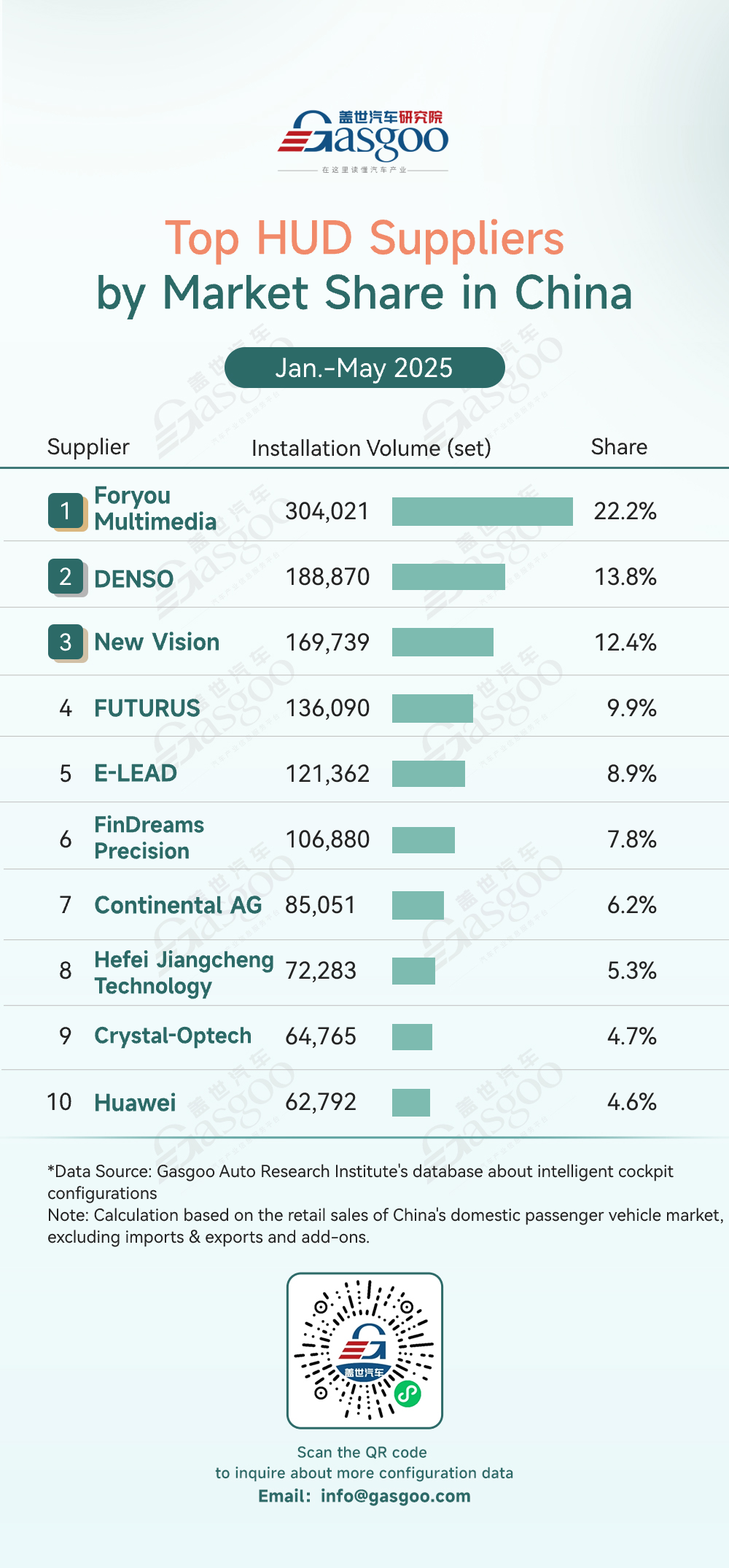

Top HUD suppliers

Foryou Multimedia: 304,021 sets installed, 22.2% market share

DENSO: 188,870 sets installed, 13.8% market share

New Vision: 169,739 sets installed, 12.4% market share

FUTURUS: 136,090 sets installed, 9.9% market share

E-LEAD: 121,362 sets installed, 8.9% market share

FinDreams Precision: 106,880 sets installed, 7.8% market share

Continental AG: 85,051 sets installed, 6.2% market share

Hefei Jiangcheng Technology: 72,283 sets installed, 5.3% market share

Crystal-Optech: 64,765 sets installed, 4.7% market share

Huawei: 62,792 sets installed, 4.6% market share

Foryou Multimedia led the HUD market with a dominant 304,021 sets installed (22.2% share)—demonstrating its capability to scale HUD technology across mid- to high-end models. Competition in the second tier intensified, with DENSO (13.8%), New Vision (12.4%), and FUTURUS (9.9%) separated by less than four percentage points. In the third tier, FinDreams Precision rapidly ramped up volumes through BYD's vertical integration, reaching a 7.8% share, while Huawei entered the rankings with 4.6%, showing untapped growth potential.

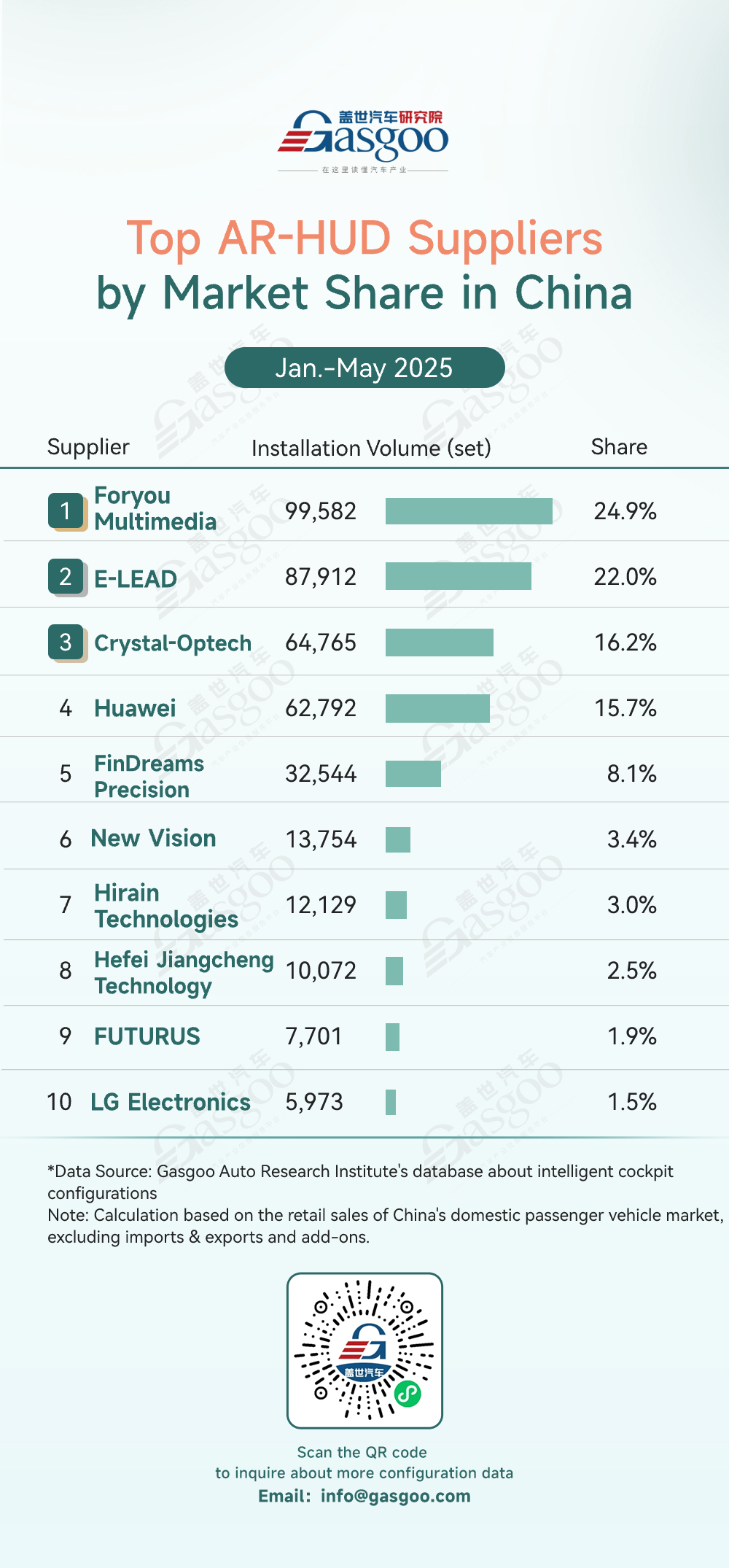

Top AR-HUD suppliers

Foryou Multimedia: 99,582 sets installed, 24.9% market share

E-LEAD: 87,912 sets installed, 22.0% market share

Crystal-Optech: 64,765 sets installed, 16.2% market share

Huawei: 62,792 sets installed, 15.7% market share

FinDreams Precision: 32,544 sets installed, 8.1% market share

New Vision: 13,754 sets installed, 3.4% market share

Hirain Technologies: 12,129 sets installed, 3.0% market share

Hefei Jiangcheng Technology: 10,072 sets installed, 2.5% market share

FUTURUS: 7,701 sets installed, 1.9% market share

LG Electronics: 5,973 sets installed, 1.5% market share

Foryou Multimedia again took the lead with 99,582 sets installed (24.9% share). The company had launched various products—including dual focal plane AR-HUD, oblique projection AR-HUD, and virtual panoramic display (VPD)—which had already reached mass production. E-LEAD ranked second with a 22.0% share, driven by its glasses-free 3D AR-HUD technology that gained market traction. Crystal-Optech, in third place with 16.2%, achieved mass installations on models from Changan DEEPAL, VOYAH, and Changan Mazda. Notably, it secured all AR-HUD and W-HUD projects for Jaguar Land Rover's EMA platform, becoming the first Chinese HUD supplier to break into a top-tier global OEM.

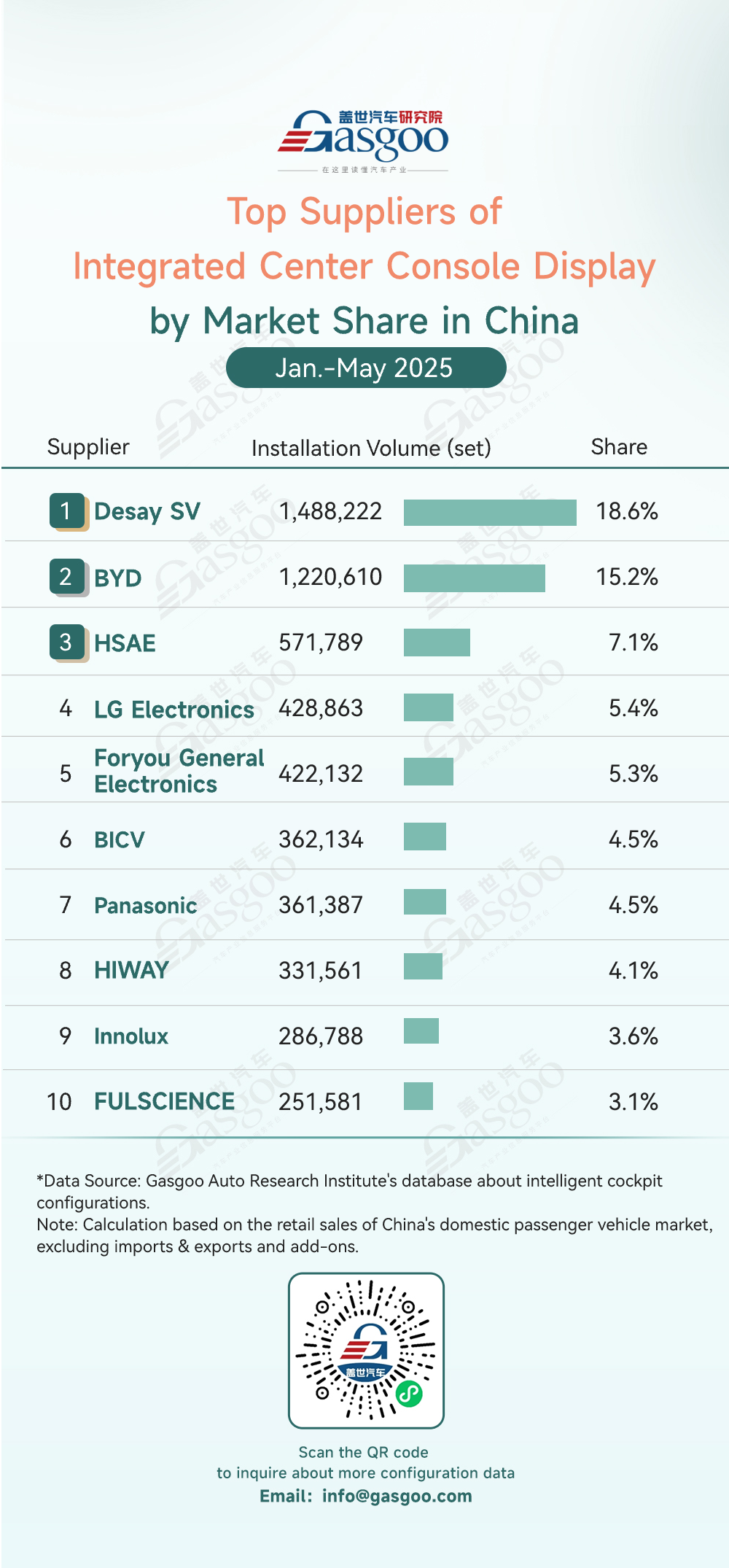

Top suppliers of integrated center console display

Desay SV: 1,488,222 sets installed, 18.6% market share

BYD: 1,220,610 sets installed, 15.2% market share

HSAE: 571,789 sets installed, 7.1% market share

LG Electronics: 428,863 sets installed, 5.4% market share

Foryou General Electronics: 422,132 sets installed, 5.3% market share

BICV: 362,134 sets installed, 4.5% market share

Panasonic: 361,387 sets installed, 4.5% market share

HIWAY: 331,561 sets installed, 4.1% market share

Innolux: 286,788 sets installed, 3.6% market share

FULSCIENCE: 251,581 sets installed, 3.1% market share

China's local suppliers dominated the integrated center console display market. Four of the top five vendors—Desay SV, BYD, HSAE, and Foryou General Electronics—were Chinese companies, collectively accounting for over 50% of total share. Desay SV led the segment with 1.488 million sets installed (18.6%), followed closely by BYD with 1.221 million sets (15.2%). While increasing standardization drove continued demand growth, product homogenization intensified competition. Looking ahead, the competitive edge shifted toward "software-defined displays"—with success hinging on innovation in algorithms, software, and content ecosystems.

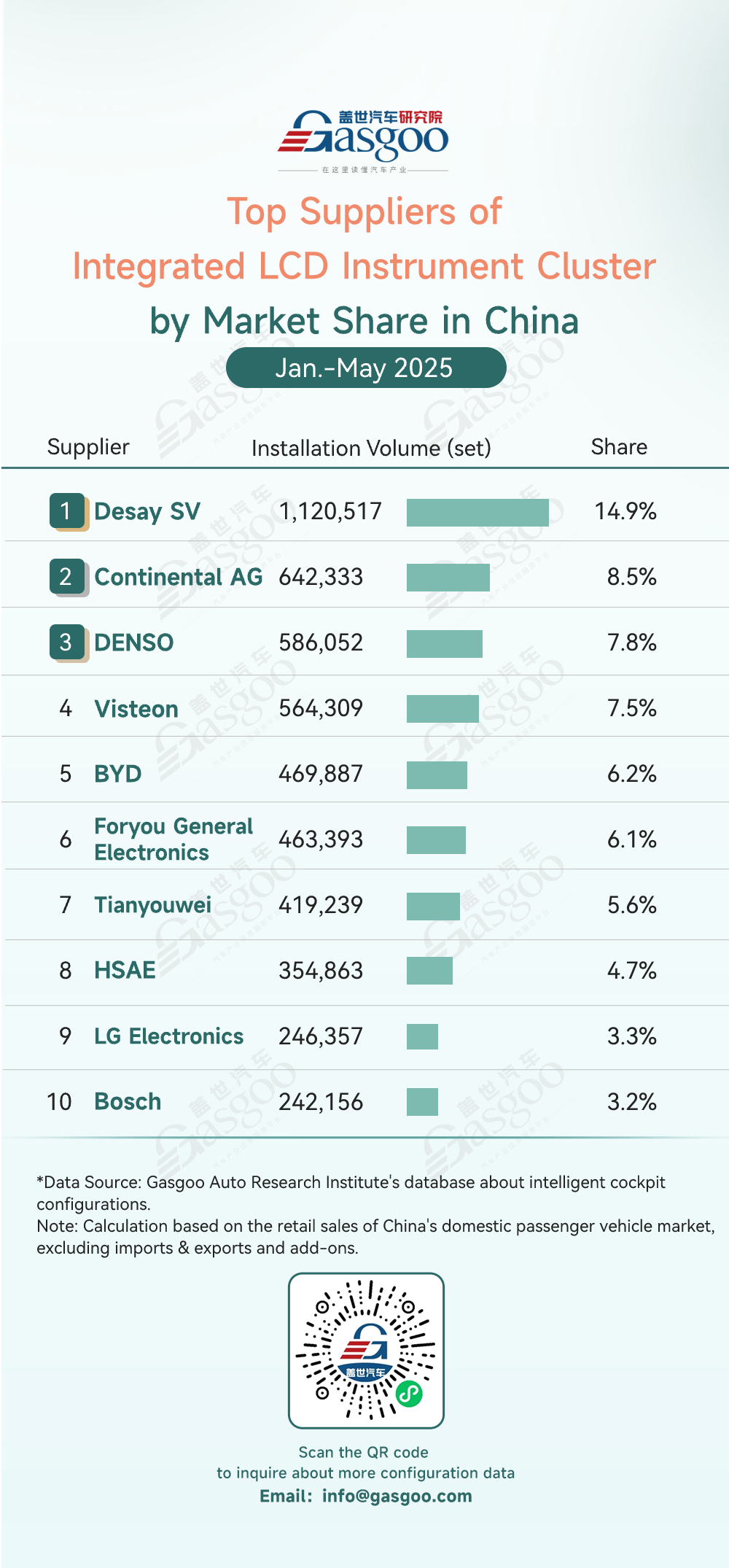

Top suppliers of integrated LCD instrument cluster

Desay SV: 1,120,517 sets installed, 14.9% market share

Continental AG: 642,333 sets installed, 8.5% market share

DENSO: 586,052 sets installed, 7.8% market share

Visteon: 564,309 sets installed, 7.5% market share

BYD: 469,887 sets installed, 6.2% market share

Foryou General Electronics: 463,393 sets installed, 6.1% market share

Tianyouwei: 419,239 sets installed, 5.6% market share

HSAE: 354,863 sets installed, 4.7% market share

LG Electronics: 246,357 sets installed, 3.3% market share

Bosch: 242,156 sets installed, 3.2% market share

The integrated LCD instrument cluster market showed a "one dominant player among many strong contenders" landscape. Desay SV led the way with 1.12 million sets installed (14.9% share). A second tier of global players—including Continental AG(8.5%), DENSO (7.8%), and Visteon (7.5%)—followed. Chinese suppliers made notable gains: BYD (6.2%) leveraged its in-house vehicle integration to break into the top five, while Foryou General Electronics (6.1%), Tianyouwei (5.6%), and HSAE (4.7%) showed strong momentum. The top 10 players collectively held around 68% of the market, with cost-performance emerging as a key driver of share expansion.

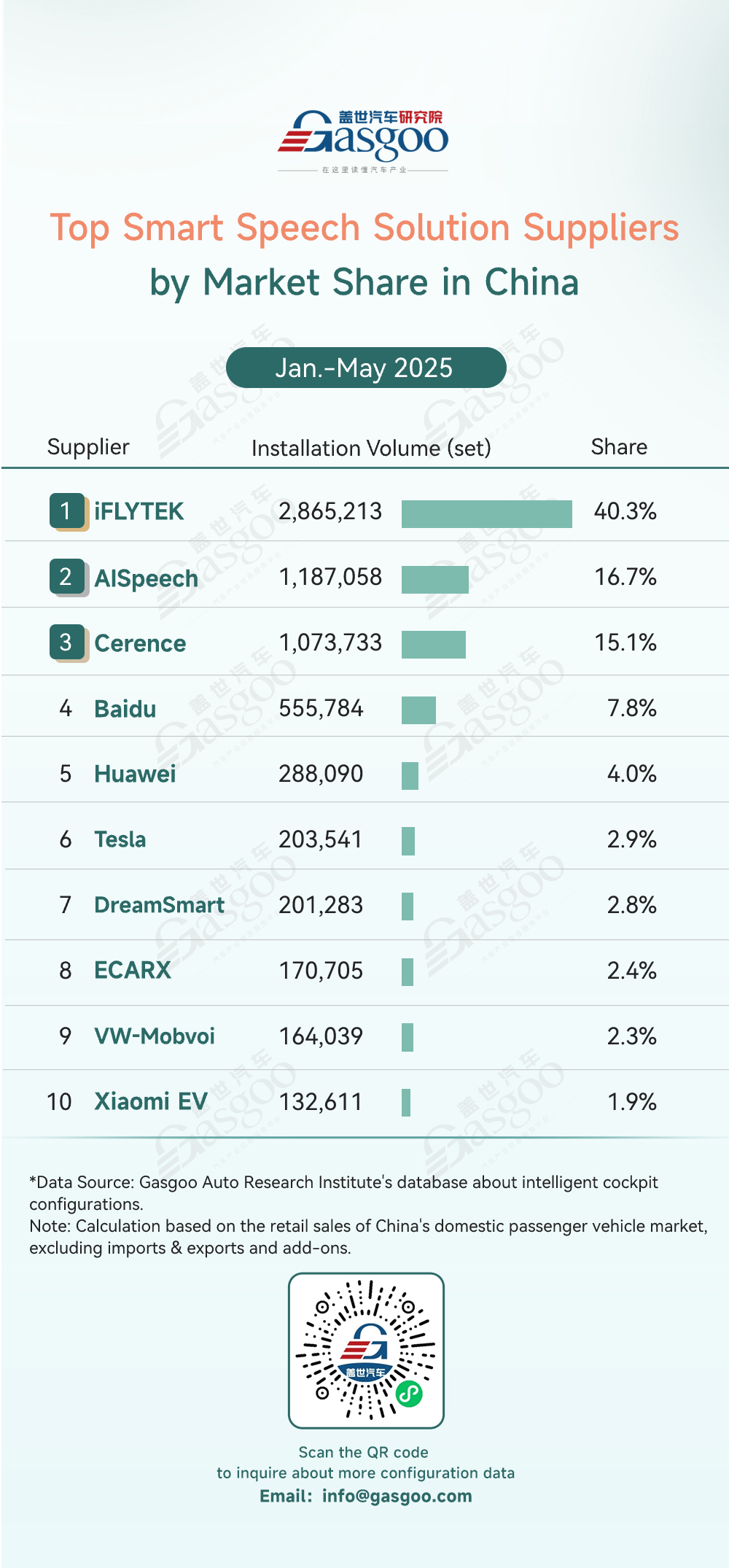

Top smart speech solution suppliers

iFLYTEK: 2,865,213 sets installed, 40.3% market share

AISpeech: 1,187,058 sets installed, 16.7% market share

Cerence: 1,073,733 sets installed, 15.1% market share

Baidu: 555,784 sets installed, 7.8% market share

Huawei: 288,090 sets installed, 4.0% market share

Tesla: 203,541 sets installed, 2.9% market share

DreamSmart: 201,283 sets installed, 2.8% market share

ECARX: 170,705 sets installed, 2.4% market share

VW-Mobvoi: 164,039 sets installed, 2.3% market share

Xiaomi EV: 132,611 sets installed, 1.9% market share

In the smart speech solution market, the top three suppliers—iFLYTEK (40.3%), AISpeech, and Cerence—collectively held 71.1% of the total share, indicating a highly concentrated landscape. iFLYTEK solidified its position as the market leader with a dominant 40.3% share. Chinese suppliers such as iFLYTEK, AISpeech, Baidu, and Huawei led the rankings, contributing over 75% of total volume, underscoring the strong competitiveness of China's localized supply chain in the smart cockpit domain.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com