Top 10 destination countries by China's passenger vehicle exports

Mexico: 41,503 units in May and 189,273 units (+24.2% YoY) from January to May

UAE: 46,536 units in May and 177,091 units (+61.0% YoY) from January to May

Russia: 20,097 units in May and 146,210 units (-55.3% YoY) from January to May

Brazil: 45,893 units in May and 133,619 units (-14.9% YoY) from January to May

Belgium: 30,697 units in May and 123,552 units (+0.7% YoY) from January to May

UK: 28,050 units in May and 103,801 units (+2.6% YoY) from January to May

Australia: 26,533 units in May and 99,398 units (+35.8% YoY) from January to May

Saudi Arabia: 23,455 units in May and 95,961 units (+30.7% YoY) from January to May

Malaysia: 14,549 units in May and 61,948 units (+43.7% YoY) from January to May

Spain: 12,893 units in May and 60,536 units (+50.3% YoY) from January to May

According to data compiled by the Gasgoo Automotive Research Institute, China's passenger vehicle exports for the Jan.–May 2025 period showed increasing market diversification, shaped by varying local policies and geopolitical factors. In Mexico, for example, exports reached 41,503 units in May alone, bringing total five-month exports to 189,273 units (+24.2% YoY). The growth rate remained stable compared with the 24.3% increase recorded for the Jan.–Apr. 2025 period, solidifying Mexico's position as the top export destination.

The United Arab Emirates (UAE) remained China's top passenger vehicle export market in the Middle East, with 177,091 units shipped from January to May—up 61.0% YoY and slightly above the 58.5% growth in the previous period. Saudi Arabia ranked second with a 30.7% increase. Both markets actively advanced new energy vehicle (NEV) adoption and cross-border investment, supported by the UAE's smart mobility push and Saudi Arabia's "Vision 2030" program.

In Russia, exports dropped sharply, falling to 20,097 units in May and totaling 146,210 units in the first five months (-55.3% YoY). Soaring inflation, rising interest rates, and a sharp increase in vehicle scrappage taxes weighed heavily on consumer confidence and end-user prices, leading to a steep contraction in demand. In the short term, Chinese passenger vehicle exports to Russia faced significant headwinds.

The Latin American and European markets showed signs of modest recovery for the Jan.–May 2025 period. In Brazil—the region's largest economy—the YoY export decline narrowed to 14.9%. On July 1, BYD rolled out its first locally assembled vehicle at its Camaçari plant in Bahia, marking a key milestone in its global expansion strategy and opening new opportunities in the Latin American auto market. In Europe, the United Kingdom (UK) saw its export decline ease to 2.6%, while Belgium recorded slight growth of 0.7%. Spain maintained strong momentum, as Chinese automakers continued to gain traction in local markets.

Top 10 destination countries by China's new energy passenger vehicle exports

Belgium: 30,362 units in May and 119,307 units (+3.9% YoY) from January to May

Brazil: 34,802 units in May and 102,764 units (−20.5% YoY) from January to May

UK: 21,115 units in May and 71,564 units (+5.8% YoY) from January to May

Mexico: 12,278 units in May and 69,103 units (+165.2% YoY) from January to May

Australia: 9,569 units in May and 41,548 units (+6.8% YoY) from January to May

Thailand: 6,975 units in May and 38,278 units (+10.8% YoY) from January to May

UAE: 8,293 units in May and 36,464 units (+18.8% YoY) from January to May

Spain: 8,606 units in May and 32,572 units (+35.0% YoY) from January to May

Israel: 8,188 units in May and 32,163 units (+109.6% YoY) from January to May

Indonesia: 7,578 units in May and 30,208 units (+103.9% YoY) from January to May

Export rankings for Chinese NEVs showed a clear shift in focus—from traditional mature markets toward policy-driven emerging ones—highlighting a growing trend of regional diversification.

Backed by regional trade agreements and electric vehicle (EV)-friendly policies, Mexico and Southeast Asia emerged as China's fastest-growing export destination markets. From January to May 2025, China exported 69,103 NEVs to Mexico (+ 165.2% YoY). Although the growth slowed slightly, momentum remained strong. In Southeast Asia, countries like Thailand and Indonesia accelerated efforts to improve NEV policy frameworks, including corporate income tax exemptions for EV-related industries.

In Indonesia, exports rose 103.9% YoY. The government pledged tax incentives to Chinese automakers such as BYD Auto and GAC AION to support local production. On July 1, XPENG began operations at its first overseas plant in West Java, developed with Handal Indonesia Motor. The X9, its first locally-produced model in Indonesia, adopted a complete knockdown (CKD) process. Chinese NEV makers are accelerating their presence in Southeast Asia to enhance localization and export capacity.

In the Middle East, markets like the UAE and Israel saw rapidly growing demand for NEVs. In Israel, sales rose 109.6% YoY for the Jan.-May period. The country's technological strengths in battery materials and battery management systems supported the growth of its high-tech NEV market and fueled import demand for Chinese models.

Tightening carbon emission standards accelerated the shift from fuel vehicles to NEVs in Spain and Belgium. Chinese brands continued to gain market share in Europe, driven by strong cost performance and robust supply chains. Spain rose from ninth to eighth in China's NEV export rankings (+35.0% YoY). In the UK, exports reached 71,564 units in the first five months (+5.8% YoY), reversing the 0.7% decline seen in the Jan.–Apr. period.

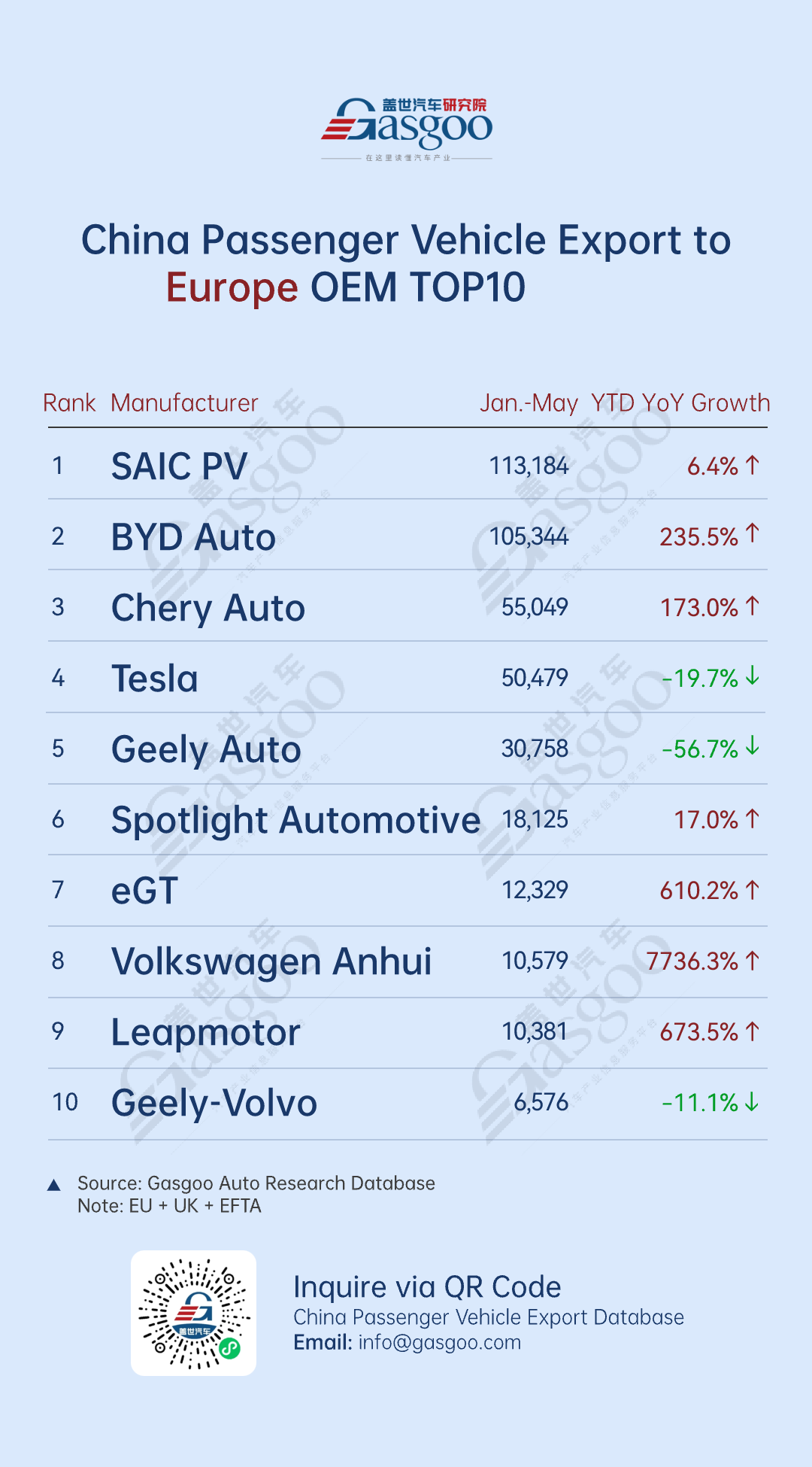

Top 10 Chinese automakers by passenger vehicle exports to Europe (Jan.-May 2025)

SAIC PV: 113,184 units, up 6.4% year-on-year

BYD Auto: 105,344 units, up 235.5% year-on-year

Chery Auto: 55,049 units, up 173.0% year-on-year

Tesla: 50,479 units, down 19.7% year-on-year

Geely Auto: 30,758 units, down 56.7% year-on-year

Spotlight Automotive: 18,125 units, up 17.0% year-on-year

eGT: 12,329 units, up 610.2% year-on-year

Volkswagen Anhui: 10,579 units, up 7736.3% year-on-year

Leapmotor: 10,381 units, up 673.5% year-on-year

Geely-Volvo: 6,576 units, down 11.1% year-on-year

China's top 10 passenger vehicle exporters to Europe held their rankings steady from January to May, reflecting a stable market structure. SAIC PV and BYD Auto remained firmly in the lead, each exporting over 100,000 units. BYD Auto recorded over 230% YoY growth, widening its lead over third-place Chery Auto by more than 50,000 units. In May, BYD Auto established its European headquarters and R&D center in Budapest, reinforcing its brand and distribution strategy in the region.

Emerging players such as eGT, Volkswagen Anhui, and Leapmotor posted strong growth, with Volkswagen Anhui skyrocketing 7,736.3% YoY, highlighting the combined effect of China's manufacturing scale and European brand strength. Joint ventures like Spotlight Automotive also gained a foothold in Europe, with clearer product positioning and growing brand recognition.

Exports from Tesla and Geely-Volvo declined by 19.7% and 11.1% YoY, respectively. Geely Auto exports plunged 56.7% over a year earlier, reflecting mounting pressure amid intensifying competition. The sharp drop was likely driven by a high base effect and increased rivalry across brands.

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia (Jan.-May 2025)

BYD Auto: 52,618 units, up 154.7% year-on-year

Geely Auto: 38,670 units, up 82.2% year-on-year

Chery Auto: 30,013 units, up 123.3% year-on-year

Changan Auto: 12,208 units, down 5.4% year-on-year

Jiangsu Yueda Kia: 8,360 units, up 35.8% year-on-year

Tesla: 8,041 units, up 26.1% year-on-year

XPENG: 7,229 units

Great Wall Motor: 6,884 units, down 1.9% year-on-year

Jiangling Motors: 6,584 units, up 5.1% year-on-year

SAIC PV: 5,783 units, down 45.7% year-on-year

Chinese automakers saw rising exports to Southeast Asia, with a preliminary lead group beginning to take shape. BYD Auto ranked first with 52,618 units (+154.7% YoY), reinforcing its position in core markets like Thailand while expanding its presence in Indonesia and Malaysia. Geely Auto and Chery Auto followed with 38,670 and 30,013 units, respectively—up 82.2% and 123.3%—demonstrating strong adaptability across diverse Southeast Asian markets.

Several traditional automakers saw mixed results. Changan Auto and SAIC PV posted YoY declines of 5.4% and 45.7%, while SAIC-GM-Wuling dropped out of the top 10, reflecting challenges in localization and product fit. In contrast, NEV brands like Tesla and XPENG gained momentum. Tesla rose to sixth place with 4,512 units sold in May, as Southeast Asia's demand for high-tech EVs continued to grow.

Overall, Chinese automakers have accelerated their expansion into Southeast Asia, leveraging favorable policies and strong cost-performance to scale up exports. The region has become a key growth market following Europe and Latin America.

Top 10 Chinese automakers by passenger vehicle exports to North America (Jan.-May 2025)

BYD Auto: 58,074 units, up 205.2% year-on-year

SAIC-GM-Wuling: 43,511 units, up 12.3% year-on-year

Chery Auto: 16,771 units, up 31.2% year-on-year

Changan-Ford: 13,655 units, down 14.5% year-on-year

Jiangsu Yueda Kia: 13,618 units, up 3.9% year-on-year

SAIC-GM: 13,571 units, up 29.7% year-on-year

SAIC PV: 12,055 units, down 66.3% year-on-year

Geely Auto: 11,038 units, down 7.0% year-on-year

GAC Trumpchi: 8,161 units, up 390.4% year-on-year

Great Wall Motor: 7,468 units, up 55.3% year-on-year

BYD Auto led Chinese passenger vehicle exports to North America with 58,074 units from January to May (+205.2% YoY), underscoring its rising EV competitiveness and market recognition. In 2024, the company reported over 40,000 battery electric vehicle and plug-in hybrid electric vehicle sales in Mexico, supported by 50+ dealerships. Sales momentum continued, with 2025 volumes expected to reach 80,000 units. SAIC-GM-Wuling followed with 43,511 units (+12.3% YoY), reflecting steady performance and a widening gap among leading exporters.

Chery Auto and GAC Trumpchi posted YoY export growth of 31.2% and 390.4%, respectively, with GAC Trumpchi's surge standing out. Its GS3 and EMPOW55 models performed well, while the company partnered with Stellantis to rebadge the GS5 and EMPOW55 as the "Dodge Journey" and "Dodge Attitude" for the Mexican market. Though brand visibility diminished post-rebadging, leveraging Stellantis' distribution channels underscored recognition of GAC's product strength. Despite the two companies' joint venture withdrawal from China, their overseas collaboration has opened new growth opportunities.

Great Wall Motor recorded 55.3% YoY growth, further expanding the presence of Chinese brands in North America. With improving local manufacturing capacity and growing brand influence, Chinese automakers are poised for deeper market penetration and stronger brand building in the region.

Meanwhile, SAIC PV and Geely Auto saw export declines of 66.3% and 7.0% over a year earlier, respectively, while Changan-Ford dropped 14.5%. The North American market remains challenging for some Chinese automakers.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America (Jan.-May 2025)

BYD Auto: 82,451 units, down 24.2% year-on-year

Chery Auto: 51,333 units, up 29.4% year-on-year

Great Wall Motor: 33,642 units, up 55.0% year-on-year

Jiangsu Yueda Kia: 20,672 units, up 1.3% year-on-year

Geely Auto: 11,900 units, down 5.9% year-on-year

DFSK: 11,502 units, up 156.1% year-on-year

Jiangling Motor: 9,759 units, up 92.9% year-on-year

SAIC-GM-Wuling: 7,786 units, down 33.1% year-on-year

SAIC PV: 7,100 units, up 1.4% year-on-year

Changan Auto: 6,835 units, down 19.2% year-on-year

Chinese automakers showed divergent performance in Latin America. BYD Auto remained the top exporter, leading by over 30,000 units, with early success in key markets like Brazil. Chery Auto and Great Wall Motor achieved 30% and 55% year-on-year leap, respectively, aided by flexible product strategies and localization. DFSK and Jiangling Motor posted strong gains—up 156.1% and 92.9%—by focusing on mini commercial vehicles and compact SUVs like the "Territory", meeting demand for practical, cost-effective models.

Meanwhile, companies like SAIC-GM-Wuling faced mounting challenges (-33.1% YoY), reflecting intensified competition and growing policy uncertainty. Geopolitical risks such as gang violence, economic instability, and tightening global trade conditions added further pressure. While some countries introduced NEV incentives, their limited scale has yet to drive substantial market growth.

Looking ahead, Chinese automakers will need to deepen local production and partnerships, enhance product adaptability, and strengthen their resilience to navigate the complex and shifting landscape in Latin America—and to capture emerging growth opportunities.

Top 10 Chinese automakers by passenger vehicle exports to Middle East (Jan.-May 2025)

Chery Auto: 50,750 units, down 8.2% year-on-year

Geely Auto: 43,967 units, up 11.3% year-on-year

BYD Auto: 42,666 units, up 247.8% year-on-year

SAIC PV: 39,429 units, down 9.3% year-on-year

Jiangsu Yueda Kia: 38,207 units, up 55.7% year-on-year

FAW-Toyota: 31,828 units, up 211.7% year-on-year

Beijing Hyundai: 22,077 units, up 190.0% year-on-year

Southeast Auto: 20,660 units, up 971.0% year-on-year

Great Wall Motor: 17,049 units, up 96.6% year-on-year

Changan Auto: 15,556 units, down 3.4% year-on-year

The Middle East market continued to grow rapidly, with Chery Auto maintaining its top position at 50,750 units. Despite a slight YoY decline, its diversified product lineup and strong after-sales network ensured sustained competitiveness and customer loyalty. In 2025, a regional parts hub co-developed with JD Logistics became one of the largest in the Middle East, further strengthening Chery Auto's service advantage in the region.

Geely Auto and BYD Auto recorded export growth of 11.3% and 247.8%, respectively. BYD Auto in particular accelerated its market share expansion, driven by its advanced NEV technology and strong brand appeal, contributing to the region's overall export growth.

SAIC PV and Changan Auto saw modest export declines but are shifting strategies to better align with the Middle East's diverse market. Strengthening NEV policies, charging infrastructure, and eco-consciousness continue to create new openings for Chinese brands.

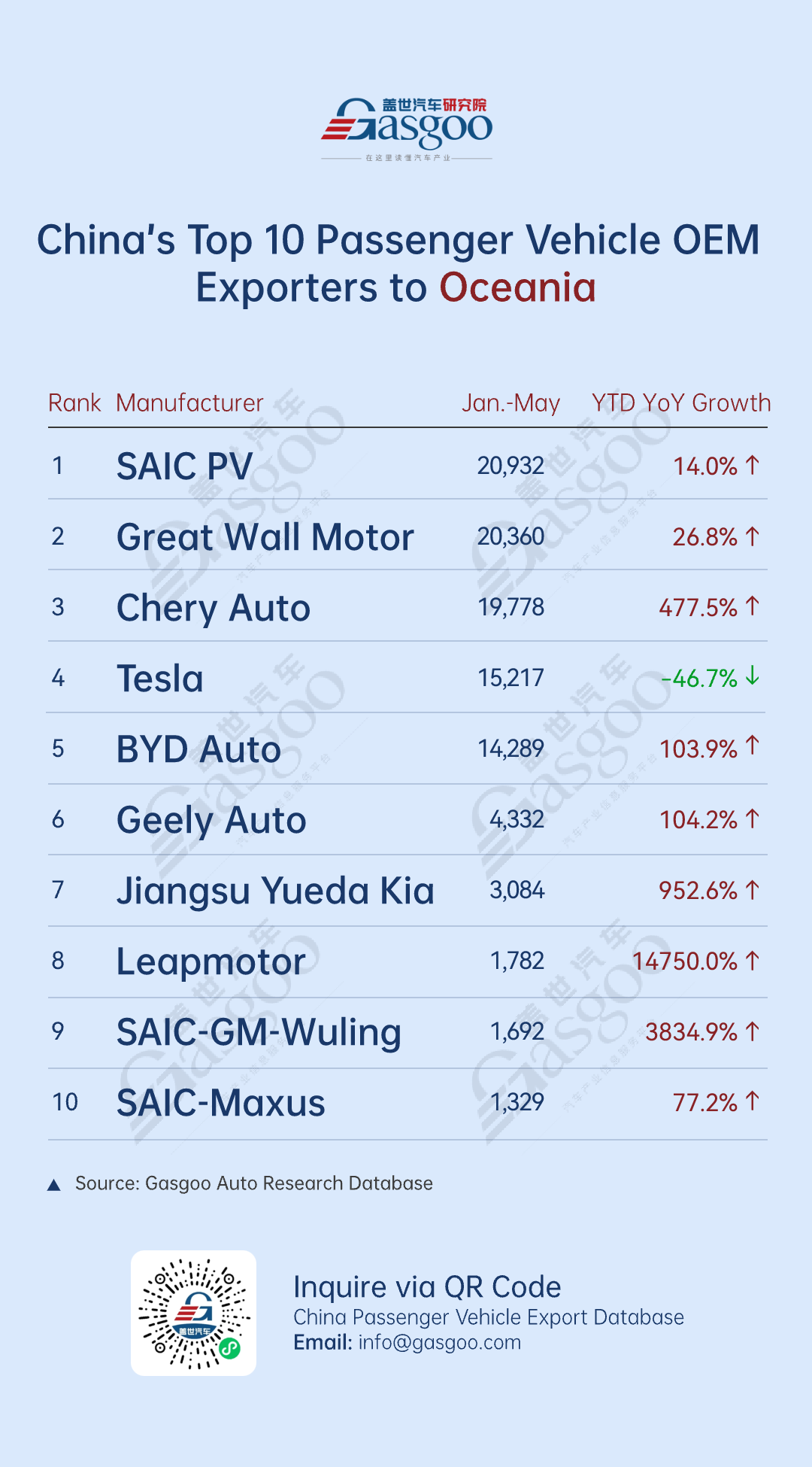

Top 10 Chinese automakers by passenger vehicle exports to Oceania (Jan.-May 2025)

SAIC PV: 20,932 units, up 14.0% year-on-year

Great Wall Motor: 20,360 units, up 26.8% year-on-year

Chery Auto: 19,778 units, up 477.5% year-on-year

Tesla: 15,217 units, down 46.7% year-on-year

BYD Auto: 14,289 units, up 103.9% year-on-year

Geely Auto: 4,332 units, up 104.2% year-on-year

Jiangsu Yueda Kia: 3,084 units, up 952.6% year-on-year

Leapmotor: 1,782 units, up 14,750.0% year-on-year

SAIC-GM-Wuling: 1,692 units, up 3,834.9% year-on-year

SAIC-Maxus: 1,329 units, up 77.2% year-on-year

From January to May 2025, Oceania sustained strong demand for Chinese vehicles, with steady growth overall. Leading brands advanced localization, electrification, and branding in tandem, refining export structures. Leapmotor emerged as a breakout performer with 1,782 units exported (+14,750.0% YoY)—and aims to cover 65% of Australia's market segments within three years.

Chery Auto saw a 477.5% YoY surge in Oceania, exporting 19,778 units to rank third overall. With a diverse lineup—such as the OMODA 5 and Tiggo 4 Pro—and flexible market strategies, the brand demonstrated strong growth potential. BYD Auto maintained its leadership in NEVs with a 103.9% increase, while SAIC-GM-Wuling posted a whopping 3,834.9% year-on-year surge, signaling rising competitiveness.

As major automakers ramp up efforts in Oceania, competition is shifting from volume to brand influence and service. Tesla saw a 46.7% YoY decline, with its limited product range and premium pricing facing headwinds amid tighter policies and rising competition. Going forward, success will hinge on how well brands align with local demand and deliver localized support.