In the first half of this year, China's new energy vehicle (NEV) industry chain competitive landscape was defined by two key trends: supply chain integration and domestic substitution.

The leader effect is especially pronounced in the power battery and core NEV component sectors: CATL and FinDreams Battery together held a 68.2% share, forming the industry foundation. The FinDreams' entities achieved full-chain coverage, ranking the top three across nine key categories—including power battery, electric motor controller, onboard chargers (OBC), and electrical compressor.

Meanwhile, the localization process accelerated and deepened, with domestic companies capturing over 65% of the power semiconductor device (dedicated to e-drive) market. Automakers' vertical integration strategies became a key factor—brands like BYD, Tesla, and NIO drove technology closed loops through in-house core component development, shifting the industry from isolated competition to system-level ecosystem rivalry.

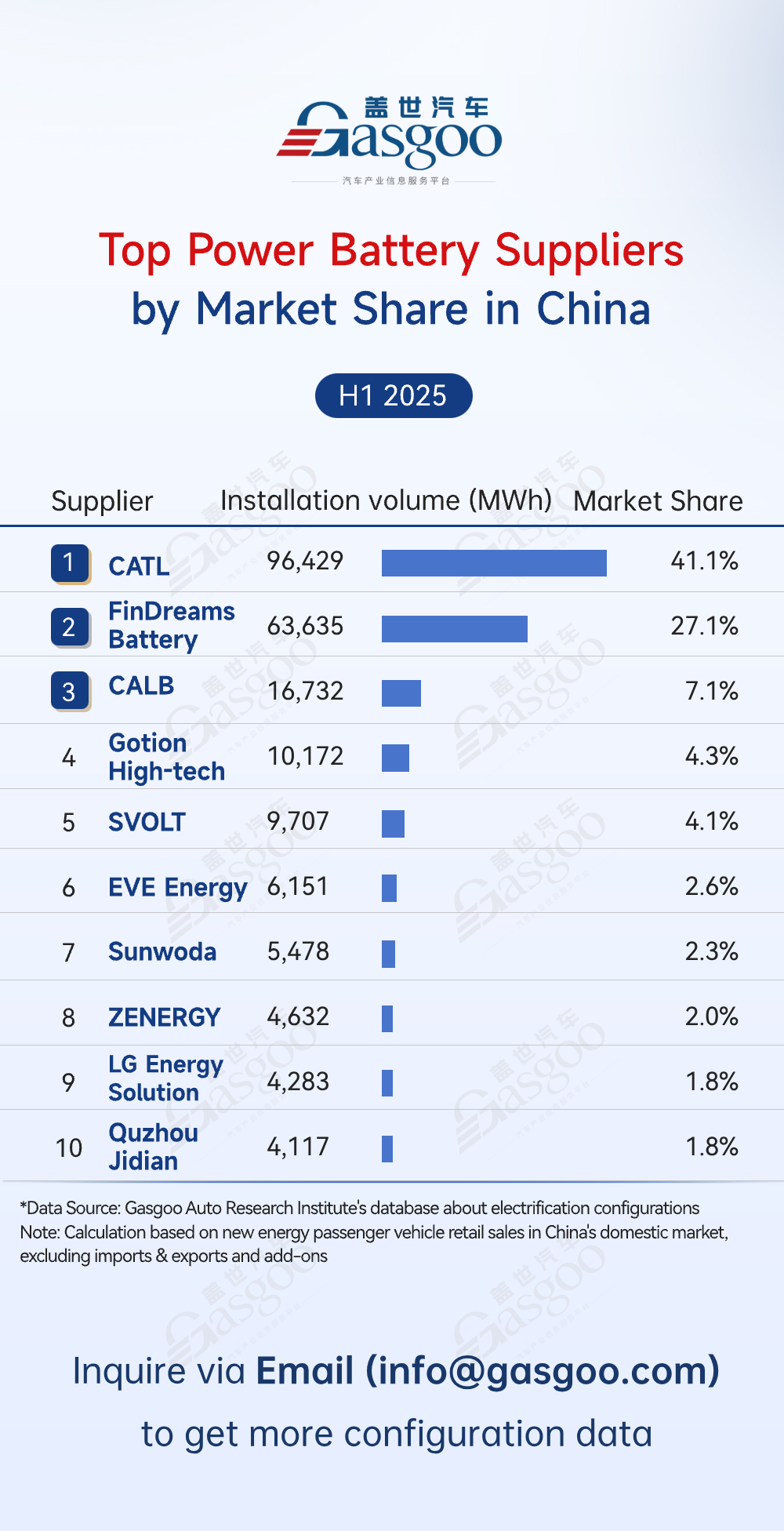

Top power battery suppliers

CATL: 96,429 MWh installed, 41.1% market share

FinDreams Battery: 63,635 MWh installed, 27.1% market share

CALB: 16,732 MWh installed, 7.1% market share

Gotion High-tech: 10,172 MWh installed, 4.3% market share

SVOLT: 9,707 MWh installed, 4.1% market share

EVE Energy: 6,151 MWh installed, 2.6% market share

Sunwoda: 5,478 MWh installed, 2.3% market share

ZENERGY: 4,632 MWh installed, 2.0% market share

LG Energy Solution: 4,283 MWh installed, 1.8% market share

Quzhou Jidian: 4,117 MWh installed, 1.8% market share

The rankings of power battery suppliers revealed a pronounced leader effect in the market. CATL and FinDreams Battery together held a 68.2% market share. The top 5 suppliers accounted for 84% collectively, indicating a highly concentrated and relatively stable market landscape. Meanwhile, other suppliers each held between 1% and 3%, reflecting fierce and fragmented competition.In this context, market stability was largely driven by technological innovation, while new entrants sought to challenge the established order through differentiated strategies. Nevertheless, the scale advantages of the leading players persisted in the short term.

Top power battery pack suppliers

FinDreams Battery: 1,711,591 sets installed, 32.3% market share

CATL: 1,034,057 sets installed, 19.5% market share

Tesla: 264,907 sets installed, 5.0% market share

REPT: 252,613 sets installed, 4.8% market share

Shanju Battery: 246,771 sets installed, 4.7% market share

CALB: 229,038 sets installed, 4.3% market share

SVOLT: 225,258 sets installed, 4.2% market share

Gotion High-tech: 202,220 sets installed, 3.8% market share

Leapmotor: 176,899 sets installed, 3.3% market share

EVE Energy: 84,983 sets installed, 1.6% market share

According to the rankings above, a clear trend of OEM in-house production emerged. FinDreams Battery and CATL together held 51.8% of the market share, highlighting a strong top-tier effect that reflected their scale advantages and deep supply chain integration. Automakers' in-house production has exceeded 50% of the market, indicating that OEMs were strengthening vertical integration to reduce costs and enhance technological control. Meanwhile, most other suppliers held between 1% and 5% market share, illustrating a fragmented yet highly competitive landscape.

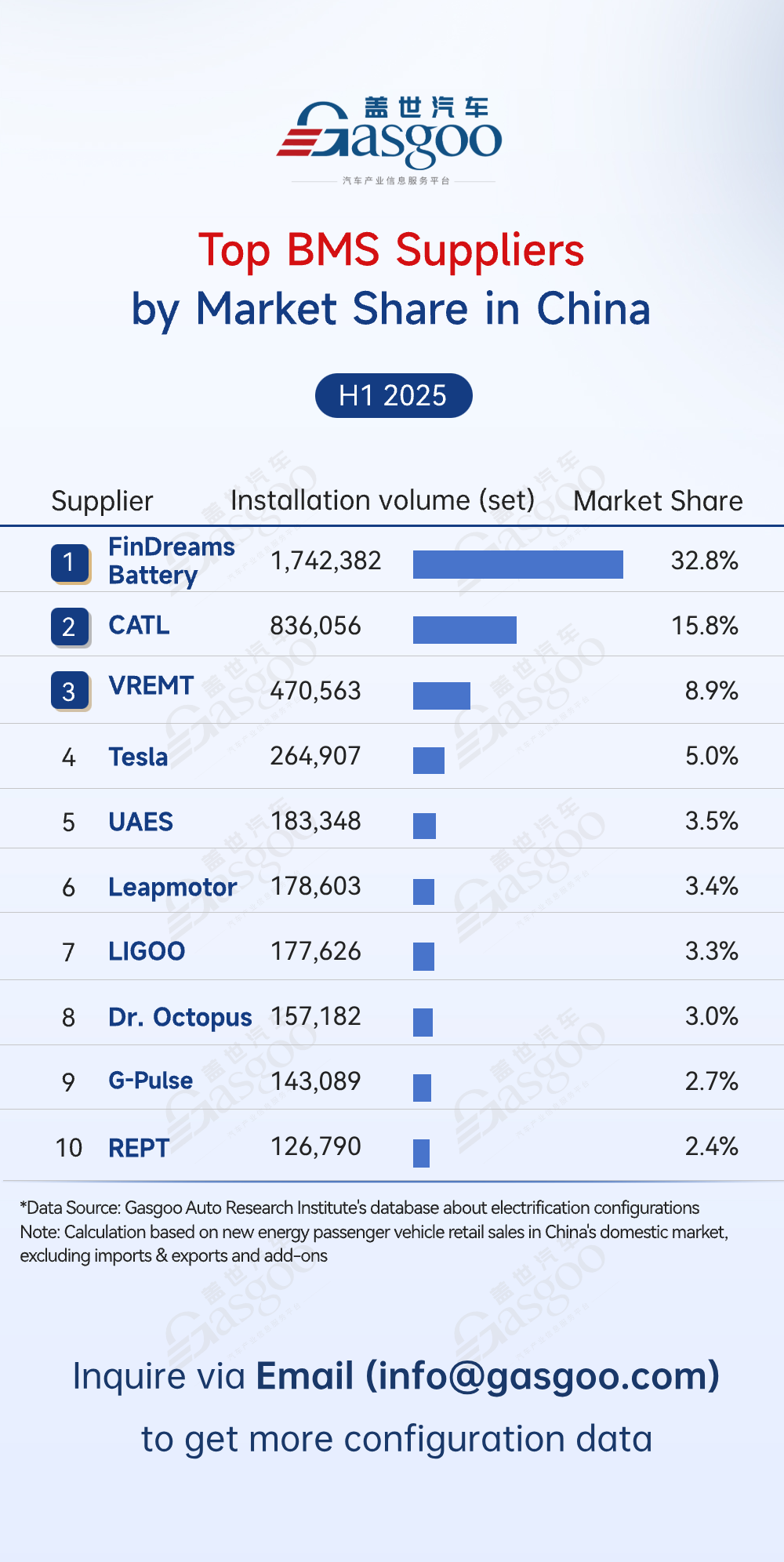

Top BMS suppliers

FinDreams Battery: 1,742,382 sets installed, 32.8% market share

CATL: 836,056 sets installed, 15.8% market share

VREMT: 470,563 sets installed, 8.9% market share

Tesla: 264,907 sets installed, 5.0% market share

UAES: 183,348 sets installed, 3.5% market share

Leapmotor: 178,603 sets installed, 3.4% market share

LIGOO: 177,626 sets installed, 3.3% market share

Dr. Octopus: 157,182 sets installed, 3.0% market share

G-Pulse: 143,089 sets installed, 2.7% market share

REPT: 126,790 sets installed, 2.4% market share

From the BMS supplier rankings, FinDreams Battery (32.8%) and CATL (15.8%) together secured 48.6% of the market. VREMT ranked third with an 8.9% market share (470,563 sets installed). Additionally, automakers like Tesla (5.0%) and Leapmotor (3.4%) are increasingly pursuing in-house BMS development to achieve vertical integration and enhance supply chain security, highlighting a clear trend of original equipment manufacturer (OEM) self-developed BMS solutions.

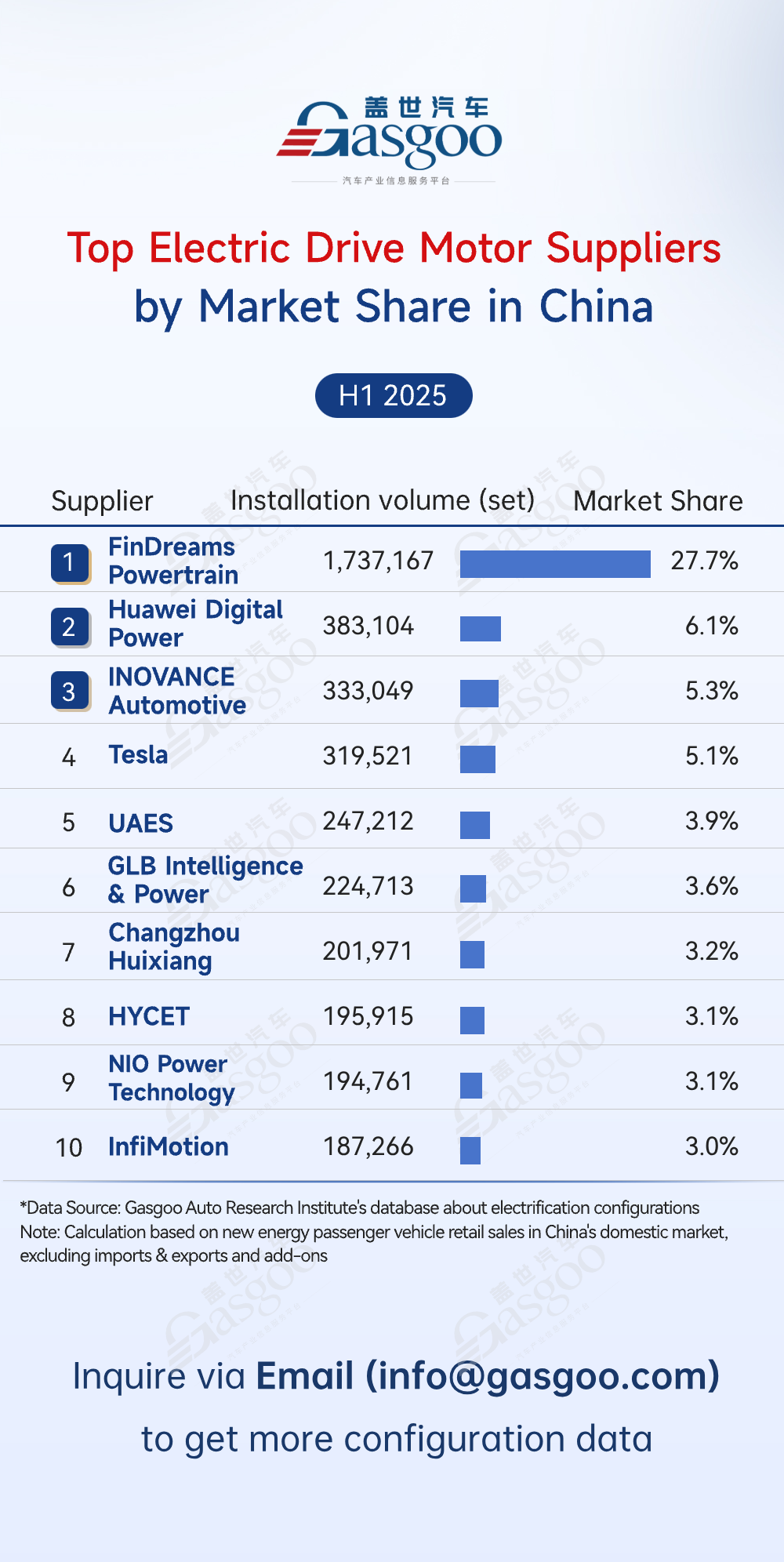

Top electric drive motor suppliers

FinDreams Powertrain: 1,737,167 sets installed, 27.7% market share

Huawei Digital Power: 383,104 sets installed, 6.1% market share

INOVANCE Automotive: 333,049 sets installed, 5.3% market share

Tesla: 319,521 sets installed, 5.1% market share

UAES: 247,212 sets installed, 3.9% market share

GLB Intelligence & Power: 224,713 sets installed, 3.6% market share

Changzhou Huixiang: 201,971 sets installed, 3.2% market share

HYCET: 195,915 sets installed, 3.1% market share

NIO Power Technology: 194,761 sets installed, 3.1% market share

InfiMotion: 187,266 sets installed, 3.0% market share

According to the rankings above, FinDreams Powertrain holds a commanding lead with 1,737,167 units installed (27.7% share). Huawei Digital Power (6.1%) and INOVANCE Automotive (5.3%) ranked second and third, respectively. The top 10 suppliers together accounted for 64.1% of the market, indicating a moderate level of concentration. Moreover, a pronounced leader effect is evident, requiring emerging players to continuously innovate in order to increase their market share.

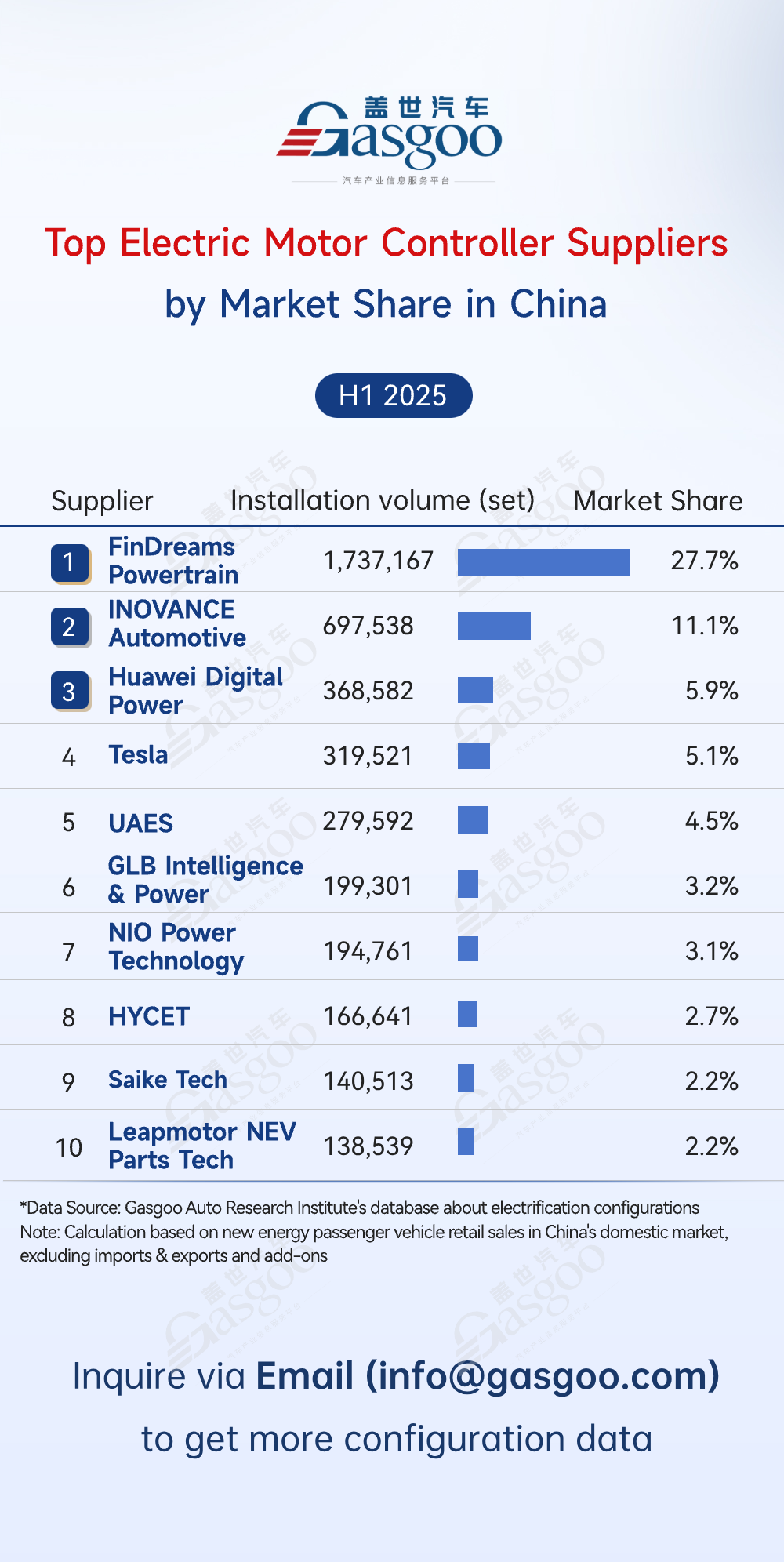

Top electric motor controller suppliers

FinDreams Powertrain: 1,737,167 sets installed, 27.7% market share

INOVANCE Automotive: 697,538 sets installed, 11.1% market share

Huawei Digital Power: 368,582 sets installed, 5.9% market share

Tesla: 319,521 sets installed, 5.1% market share

UAES: 279,592 sets installed, 4.5% market share

GLB Intelligence & Power: 199,301 sets installed, 3.2% market share

NIO Power Technology: 194,761 sets installed, 3.1% market share

HYCET: 166,641 sets installed, 2.7% market share

Saike Tech: 140,513 sets installed, 2.2% market share

Leapmotor NEV Parts Tech: 138,539 sets installed, 2.2% market share

FinDreams Powertrain led the electric motor controller market with a 27.7% share, building a strong moat through technological barriers and economies of scale. OEM in-house development or OEM-affiliated suppliers—including FinDreams Powertrain, Tesla, NIO Power Technology, HYCET, and Leapmotor NEV Parts Tech—collectively secured over 40% of the market. During this technology iteration window, innovations such as 800V high-voltage platforms and SiC materials are expected to be key breakthrough factors.

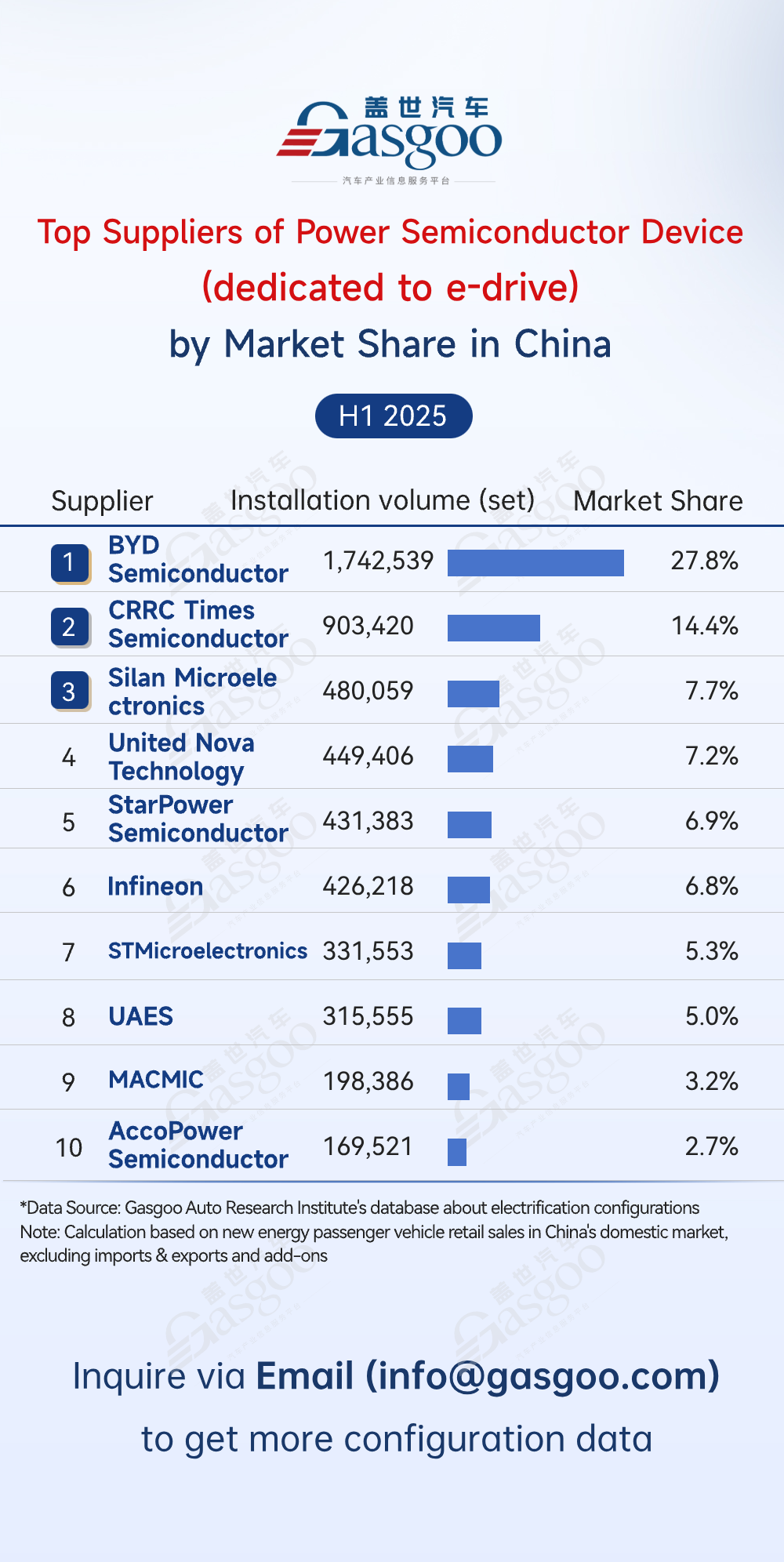

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 1,742,539 sets installed, 27.8% market share

CRRC Times Semiconductor: 903,420 sets installed, 14.4% market share

Silan Microelectronics: 480,059 sets installed, 7.7% market share

United Nova Technology: 449,406 sets installed, 7.2% market share

StarPower Semiconductor: 431,383 sets installed, 6.9% market share

Infineon: 426,218 sets installed, 6.8% market share

STMicroelectronics: 331,553 sets installed, 5.3% market share

UAES: 315,555 sets installed, 5.0% market share

MACMIC: 198,386 sets installed, 3.2% market share

AccoPower Semiconductor: 169,521 sets installed, 2.7% market share

BYD Semiconductor led the pack decisively with a 27.8% market share, followed closely by CRRC Times Semiconductor at 14.4%. The top 3 suppliers—BYD Semiconductor, CRRC Times Semiconductor, and Silan Microelectronics—together held 49.9%, indicating high concentration where technological barriers and economies of scale reinforced the dominance of major players. Additionally, seven of the top suppliers were Chinese companies, collectively securing over 65% of the market, reflecting accelerated domestic substitution. However, global giants Infineon (6.8%) and STMicroelectronics (5.3%) still maintained key positions, underscoring ongoing international competitive pressure.

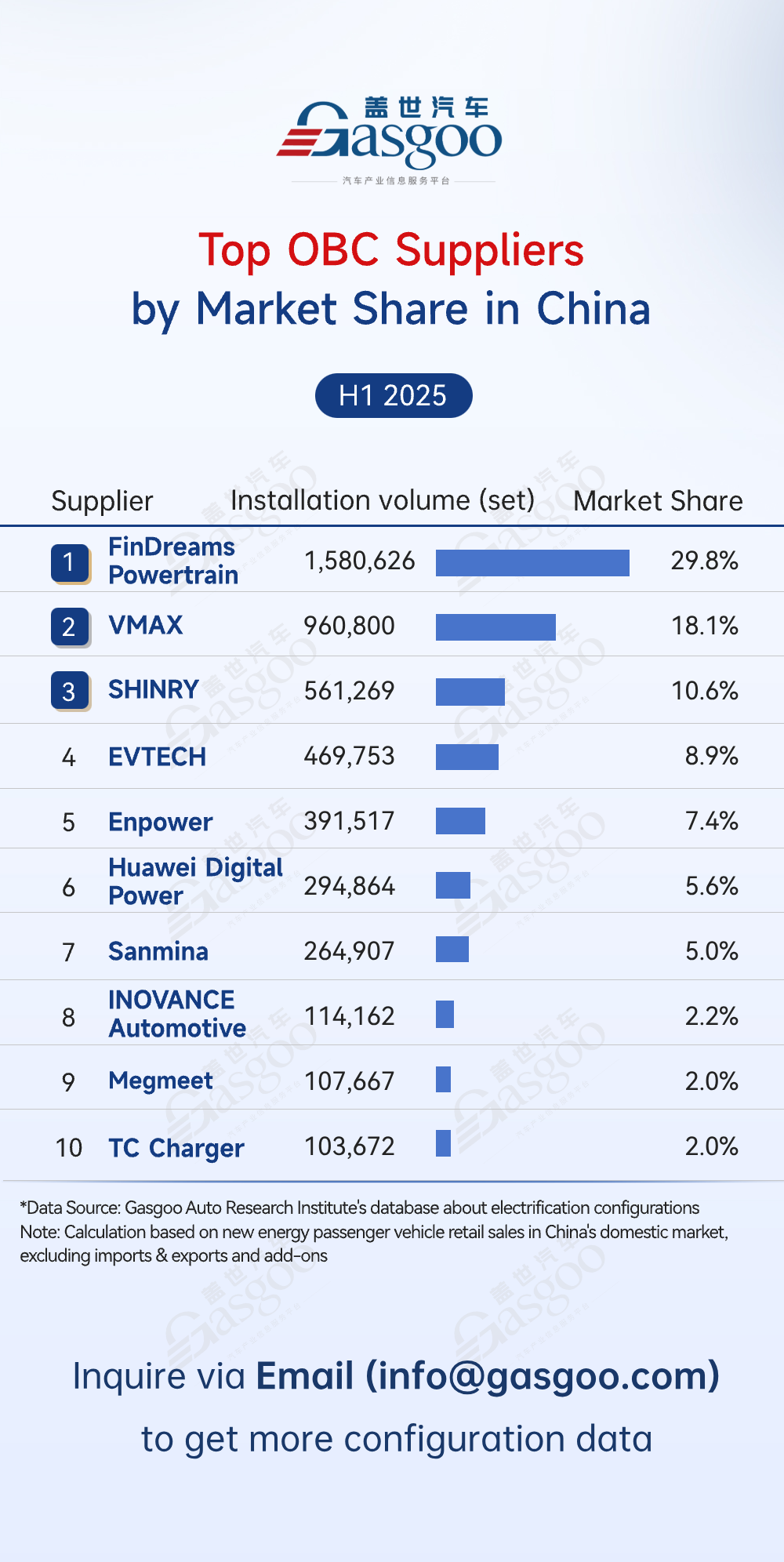

Top OBC suppliers

FinDreams Powertrain: 1,580,626 sets installed, 29.8% market share

VMAX: 960,800 sets installed, 18.1% market share

SHINRY: 561,269 sets installed, 10.6% market share

EVTECH: 469,753 sets installed, 8.9% market share

Enpower: 391,517 sets installed, 7.4% market share

Huawei Digital Power: 294,864 sets installed, 5.6% market share

Sanmina: 264,907 sets installed, 5.0% market share

INOVANCE Automotive: 114,162 sets installed, 2.2% market share

Megmeet: 107,667 sets installed, 2.0% market share

TC Charger: 103,672 sets installed, 2.0% market share

FinDreams Powertrain's nearly 30% market share demonstrated strong competitiveness, followed closely by VMAX and SHINRY with 18.1% and 10.6% respectively. The top 5 suppliers (FinDreams Powertrain, VMAX, SHINRY, EVTECH, and Enpower) together secured 75% of the market, indicating that leading companies dominated the competitive landscape through scale and technological advantages. Overall, the competitive landscape remained relatively stable, with high barriers for new entrants.

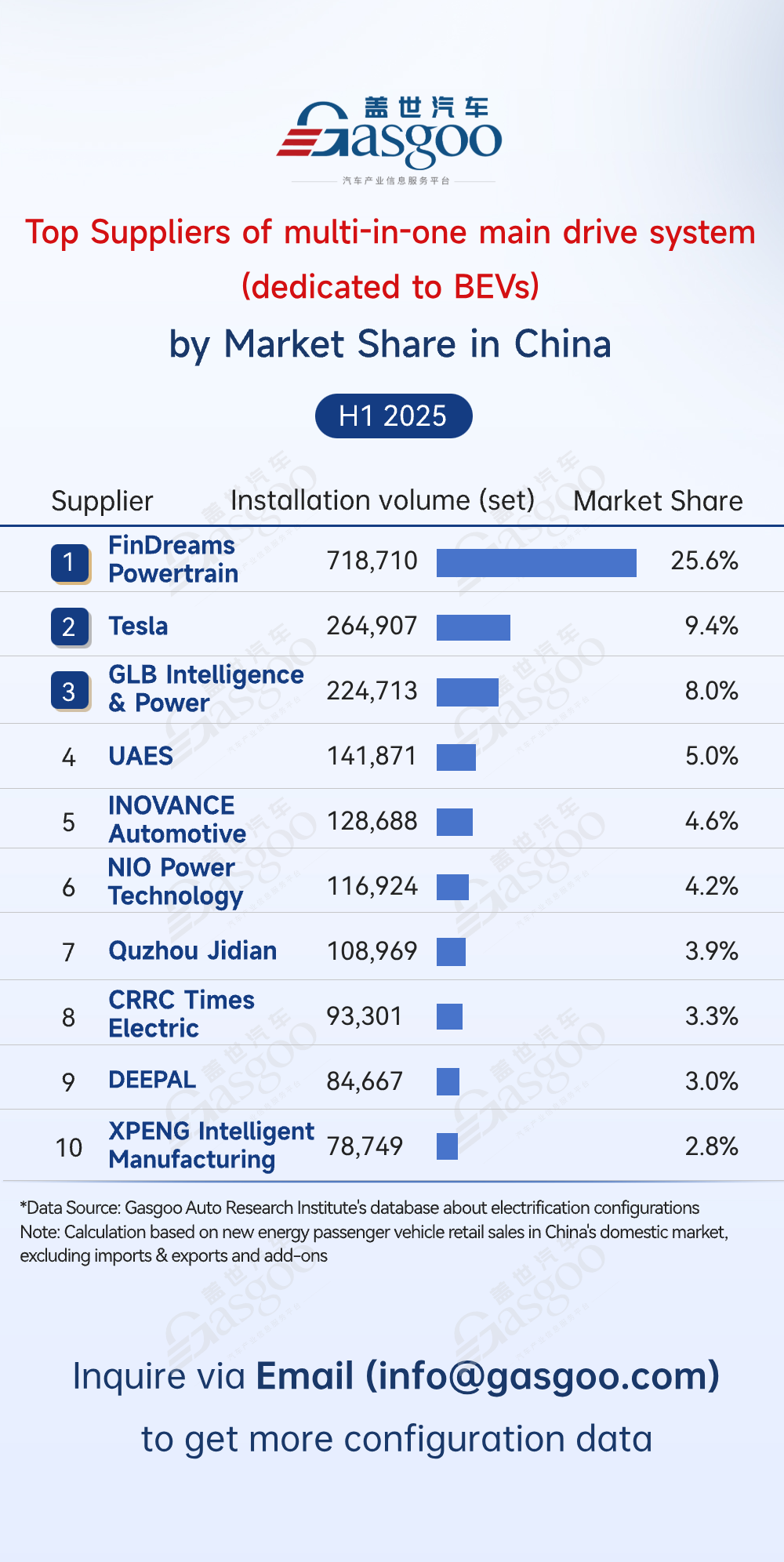

Top Suppliers of multi-in-one main drive system (dedicated to BEVs)

FinDreams Powertrain: 718,710 sets installed, 25.6% market share

Tesla: 264,907 sets installed, 9.4% market share

GLB Intelligence & Power: 224,713 sets installed, 8.0% market share

UAES: 141,871 sets installed, 5.0% market share

INOVANCE Automotive: 128,688 sets installed, 4.6% market share

NIO Power Technology: 116,924 sets installed, 4.2% market share

Quzhou Jidian: 108,969 sets installed, 3.9% market share

CRRC Times Electric: 93,301 sets installed, 3.3% market share

DEEPAL: 84,667 sets installed, 3.0% market share

XPENG Intelligent Manufacturing: 78,749 sets installed, 2.8% market share

FinDreams Powertrain held a dominant position with a 25.6% share, underscoring its leading technology and scale advantages in the multi-in-one main drive system (dedicated to BEVs) market. The second tier, represented by Tesla (9.4%) and GLB Intelligence & Power (8.0%), reflected a diverse competitive landscape where both OEM self-supply and independent suppliers coexist. Most suppliers on the list held market shares between 2% and 5%, indicating a relatively fragmented market with intense competition.

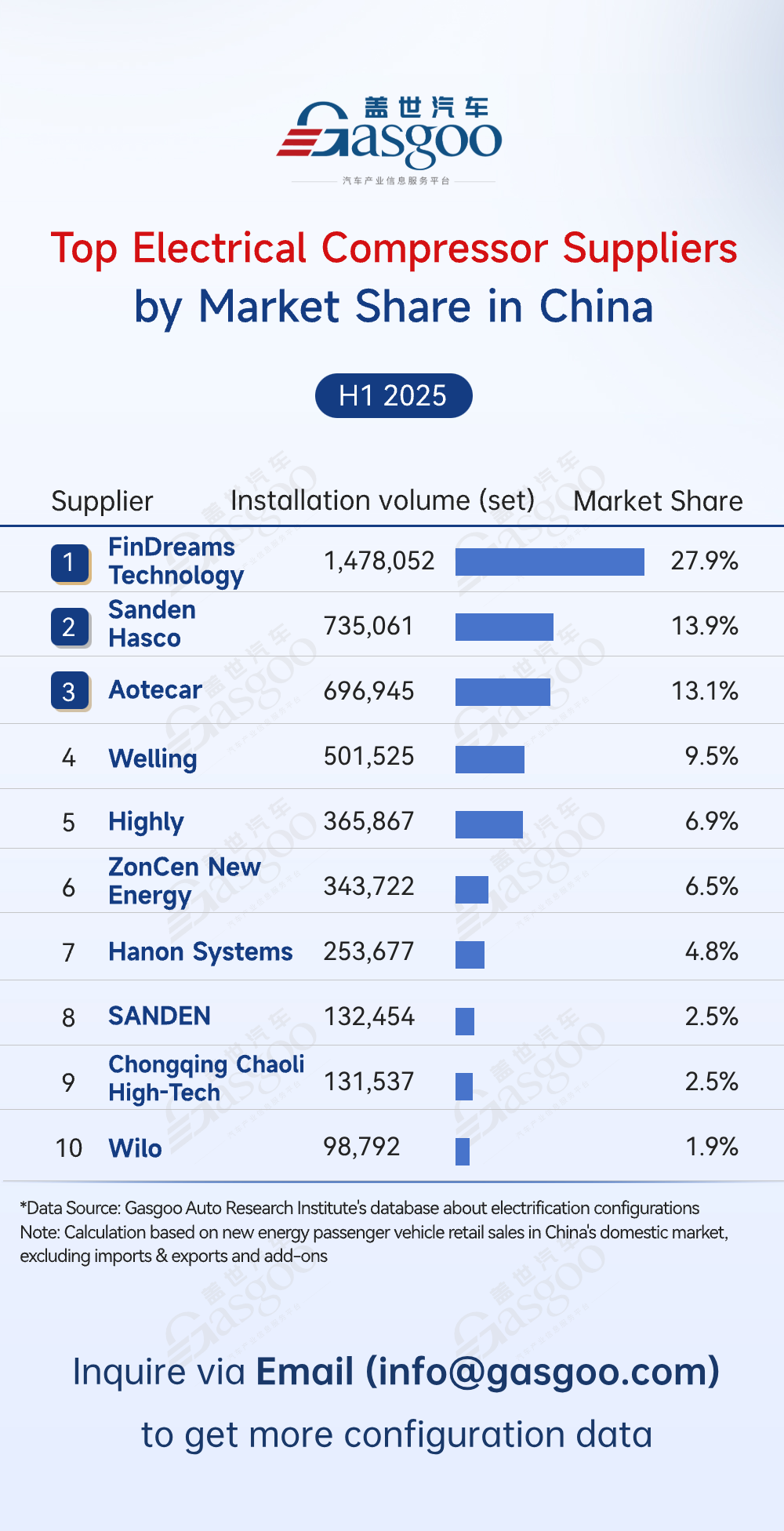

Top electrical compressor suppliers

FinDreams Technology: 1,478,052 sets installed, 27.9% market share

Sanden Hasco: 735,061 sets installed, 13.9% market share

Aotecar: 696,945 sets installed, 13.1% market share

Welling: 501,525 sets installed, 9.5% market share

Highly: 365,867 sets installed, 6.9% market share

ZonCen New Energy: 343,722 sets installed, 6.5% market share

Hanon Systems: 253,677 sets installed, 4.8% market share

SANDEN: 132,454 sets installed, 2.5% market share

Chongqing Chaoli High-Tech: 131,537 sets installed, 2.5% market share

Wilo: 98,792 sets installed, 1.9% market share

From the rankings of electrical compressor suppliers, FinDreams Technology took the lead with a 27.9% share (1,478,052 sets installed). Sanden Hasco and Aotecar followed closely with shares of 13.9% and 13.1%, respectively. Notably, the top 5 suppliers (FinDreams Technology, Sanden Hasco, Aotecar, Welling, and Highly) collectively held 71.3% of the market, indicating a highly concentrated landscape. For new entrants, technological advancement and deeper collaboration with OEMs will be key to breaking into the market.