China's passenger vehicle market post YoY growth in both Jan.-Aug. retail sales, wholesale

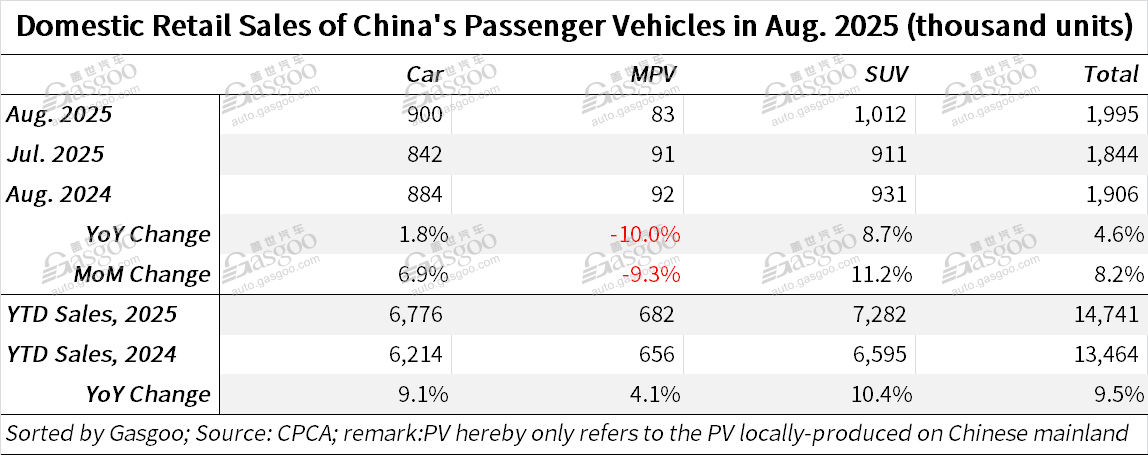

Shanghai (Gasgoo)- China's passenger vehicle retail sales reached 1.995 million units in August, 2025, rising 4.6% year-on-year and 8.2% month-on-month, according to according to according to data from the China Passenger Car Association ("CPCA"). Cumulative retail sales for the year climbed to 14.741 million units, up 9.5% from a year earlier.

For clarity, the PVs mentioned here are all locally produced on the Chinese mainland.

Growth has moderated compared with the rapid acceleration in the first half, when retail expansion peaked at 11% by June, but the August tally still set a new record, surpassing the previous high of 1.92 million units in August 2023 by 3.7%. The data reflects a more gradual but sustained upward trajectory consistent with forecasts of a "low start, strong middle, stable finish" pattern for 2025.

Industry analysts note that the easing of intense price wars has brought greater stability to the market. In August, 23 models were discounted, fewer than the 29 seen a year ago. Promotional intensity for new energy vehicles (NEVs) held at 10.7%, slightly above last month and 2.5 percentage points higher than last year. Traditional internal combustion engine (ICE) vehicles saw promotions steady at 22.9%, marginally lower than July but edging up compared with the same period last year.

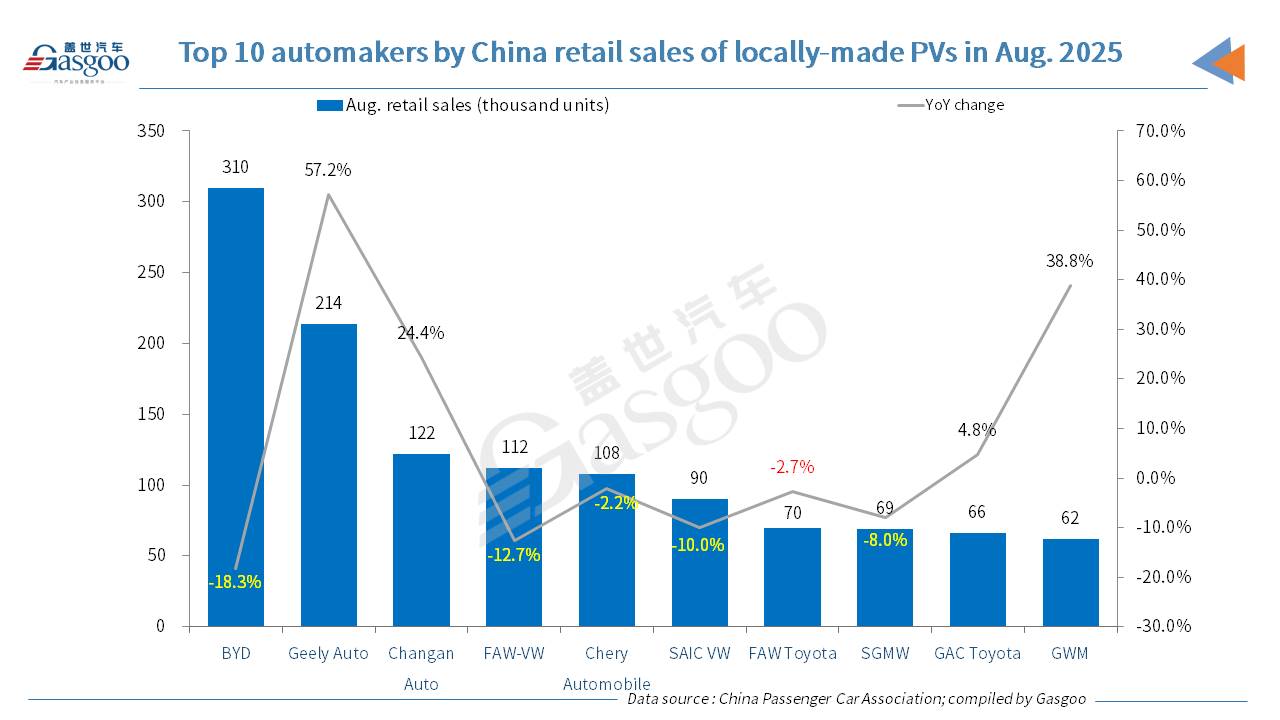

China's self-owned brands continued to strengthen their hold, with retail sales of 1.32 million units in August, up 9% year-on-year. Their market share reached 65.7%, an increase of 2.3 percentage points from last year, and averaged 64% for the first eight months—6.2 percentage points higher than the year-ago period. Established players such as Geely Auto, Chery Automobile, Changan Auto, and Great Wall Motor have gained ground through accelerated transformation and their success in both NEVs and exports.

By contrast, mainstream joint ventures faced pressure. Their combined sales fell 2% year-on-year to 470,000 units in August, though they edged up from July. German marques accounted for 14.2% of the market, down 2.4 percentage points, while Japanese brands slipped to 12.5%. U.S. brands improved slightly to 6%, with South Korean and other European brands showing marginal increases.

Premium vehicle brands also lost ground, with retail sales of 210,000 units in August down 5% year-on-year, though month-on-month growth rebounded by 21%. Their market share slipped to 10.5%, highlighting the stronger pressure facing premium marques compared with mainstream joint ventures.

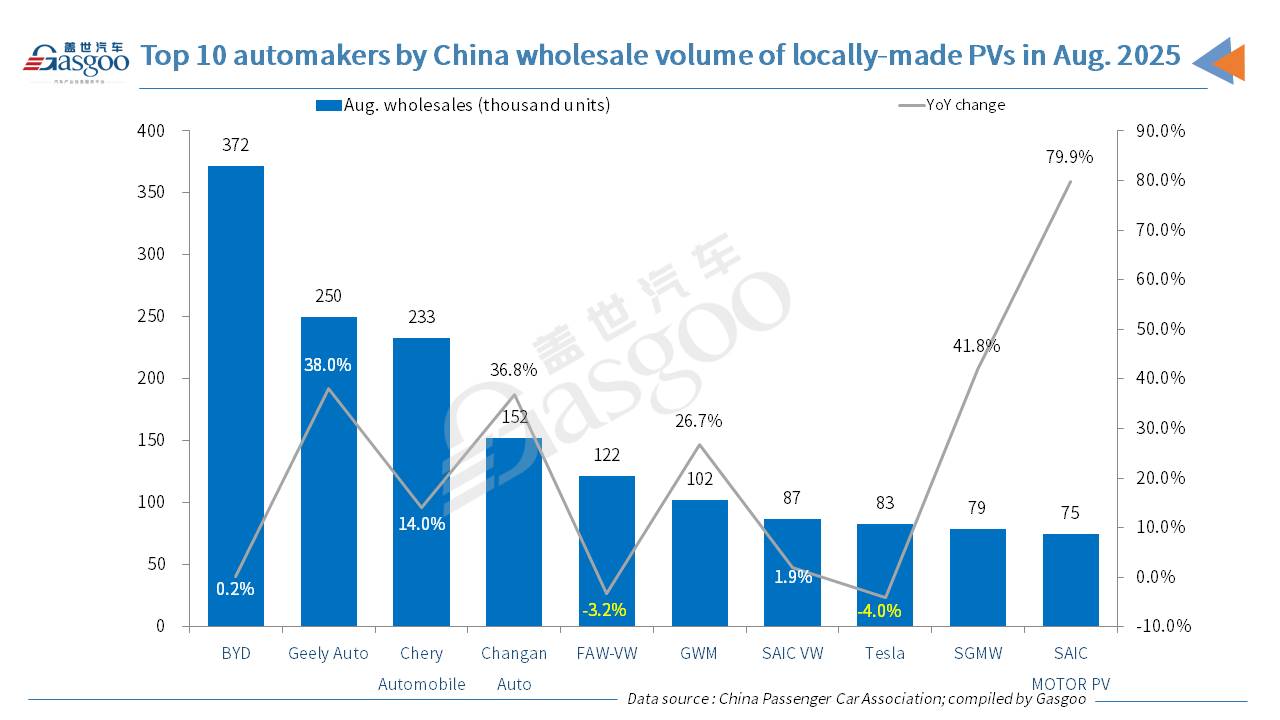

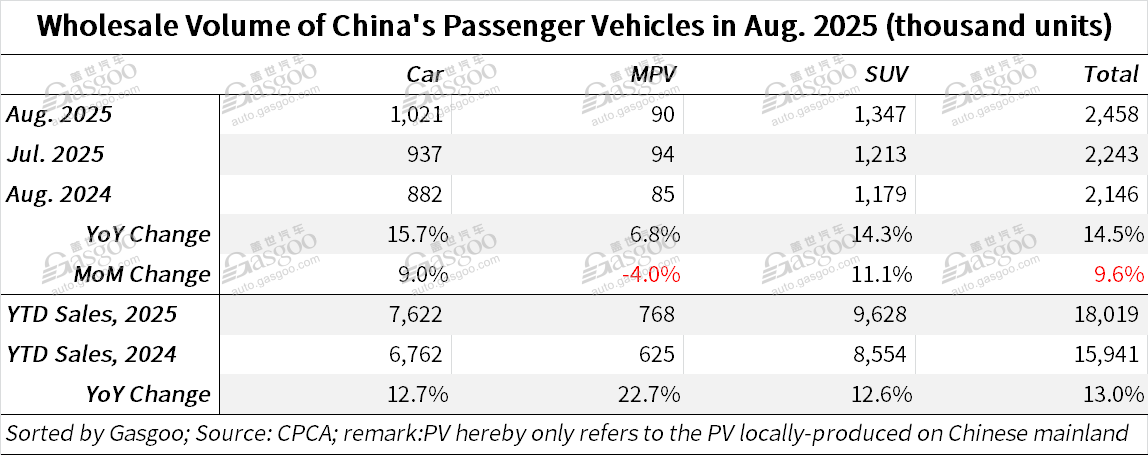

China's passenger vehicle wholesales surged more strongly than retail, hitting 2.458 million units in August, up 14.5% year-on-year and 9.6% month-on-month, setting a new record for the month. Jan.-Aug. cumulative wholesales reached 18.019 million units, up 13% year on year.

China's indigenous brands led wholesale growth with 1.72 million units in August, up 20% over a year ago, while joint ventures gained 4% and premium brands 2%.

The wholesale rankings continued to shift, with mid-tier automakers showing signs of catching up. Geely Auto, Dongfeng Nissan, XPENG, Xiaomi EV, and Leapmotor all posted strong month-on-month growth. In August, six passenger vehicle makers exceeded 100,000 units in sales, up from five a month earlier and accounting for half of the market. Automakers in the 50,000–100,000 unit range held a 23% share, while those in the 10,000–50,000 unit range accounted for 24.9%.

According to preliminary customs data, China exported 763,000 vehicles in August—including complete units and CKD kits—worth $12.8 billion. From January to August, total exports reached 4.93 million units, up 20.5% year-on-year, with export value climbing 10.8% to $84.3 billion.

Passenger vehicle exports accounted for nearly two-thirds of the total, reaching 499,000 units in August, up 20.2% year-on-year and 3.1% month-on-month, according to the CPCA's data. Cumulative passenger vehicle exports rose 11.3% from a year earlier to 3.471 million units in the first eight months. NEVs were a key driver, making up 41.3% of August's exports—17 percentage points higher than a year earlier. Chinese brands dominated with 429,000 units shipped, a 28% year on year increase, while joint ventures and premium marques saw exports slip 12% over the previous year to 70,000 units.

Production also expanded, with passenger vehicle output reaching 2.406 million units in August, up 11.3% year-on-year and 6.7% from July. Cumulative production for the first eight months climbed 13.1% to 17.893 million units. The August total exceeded the previous record for the same month, set in 2023, by 160,000 units.

Growth was uneven across segments: in August, premium vehicle production fell 14% from last year, joint venture brands slipped 1%, while China's wholly-owned brands surged 20%, reflecting their growing dominance in the industry.

New energy passenger vehicle's manufacturing continued its strong momentum. In August, output reached 1.256 million units, a 21% increase year-on-year and up 9.1% from July. Year-to-date production totaled 8.85 million units, expanding 33.5%.

Wholesale volume of new energy passenger vehicles stood at 1.282 million units in August, up 22.3% from last year and 7.8% from July. Cumulative wholesale sales hit 8.931 million units, also reflecting 33.5% year-on-year growth.

Retail sales of new energy passenger vehicles reached 1.101 million units in August, rising 7.5% year-on-year and 11.6% month-on-month. Between January and August, their retail sales grew 25.8% over the prior-year period to 7.556 million units.

Overseas demand for new energy passenger vehicles remained a bright spot. Automakers exported 204,000 units in August, more than doubling year-on-year despite a 6.5% decline from July. Total exports for the first eight months soared 63.9% year on year to 1.416 million units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com