Leapmotor’s Europe exports posts 725% YoY surge丨China’s passenger vehicle exporters overview (Jan.-Sept. 2025)

From January to September 2025, China's passenger vehicle exports showed a diversified regional pattern, with strong performance from leading brands and intensified competition between established and emerging players. BYD Auto ranked first in Southeast Asia, Latin America, underscoring the core competitiveness of Chinese automakers in new energy technology and global market expansion.

Emerging players posted phenomenal growth—Leapmotor recorded a 725.7% YoY surge in Europe, highlighting how Chinese automakers are breaking through rapidly with differentiated products and targeted regional strategies.

Market polarization is intensifying: Tesla's exports to Europe declined YoY, while SAIC PV saw sharp drops in North America and Southeast Asia. Growth pressure on some traditional joint ventures underscores that global competition has entered a phase defined by product strength, supply chain resilience, and localized operations—where precise market alignment and rapid technology iteration are key to winning.

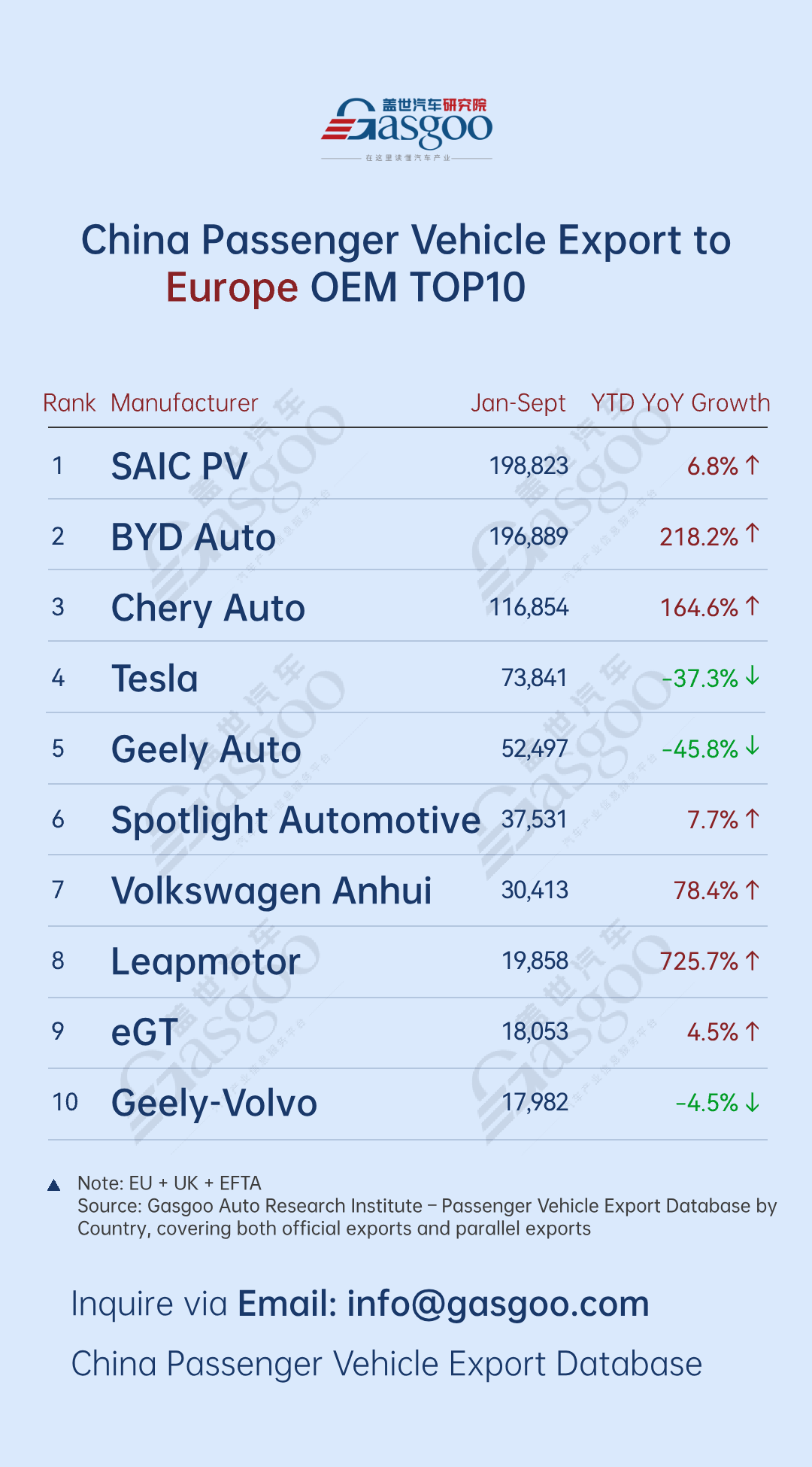

Top 10 Chinese automakers by passenger vehicle exports to Europe

SAIC PV: 198,823 units, up 6.8% year-on-year

BYD Auto: 196,889 units, up 218.2% year-on-year

Chery Auto: 116,854 units, up 164.6% year-on-year

Tesla: 73,841 units, down 37.3% year-on-year

Geely Auto: 52,497 units, down 45.8% year-on-year

Spotlight Automotive: 37,531 units, up 7.7% year-on-year

Volkswagen Anhui: 30,413 units, up 78.4% year-on-year

Leapmotor: 19,858 units, up 725.7% year-on-year

eGT: 18,053 units, up 4.5% year-on-year

Geely-Volvo: 17,982 units, down 4.5% year-on-year

The European market shows a clear pattern of high concentration among top players, rapid growth of emerging forces, and intensified differentiation among automakers.

SAIC PV led with 198,823 units (+6.8% YoY), reflecting steady growth; BYD Auto followed closely with 196,889 units (+218.2% YoY), narrowing the gap to just 1,934 units and highlighting its strong momentum in electrification and globalization; Chery Auto ranked third with 116,854 units (+164.6% YoY), showing solid expansion in Europe. Together, SAIC PV, BYD Auto, and Chery Auto exported about 512,600 units, taking 67.2% of the top 10 total — forming a clear first-tier dominance in the European market.

Emerging players are becoming increasingly eye-catching. Leapmotor exported 19,858 units, a staggering 725.7% YoY increase, positioning itself as a rising force among Chinese brands entering Europe with a sharp, differentiated product strategy. Meanwhile, Volkswagen Anhui exported 30,413 units, up 78.4% YoY, signaling a notable breakthrough for joint ventures — a new variable in China's passenger vehicle exports to Europe.

Meanwhile, market divergence has intensified. Tesla exported 73,841 units, down 37.3% YoY; Geely Auto exported 52,497 units, down 45.8% YoY; and Geely-Volvo also saw a 4.5% YoY decline. These results likely reflect intensified competition from the surge of Chinese brands in Europe, accelerated electrification among local European automakers, and internal factors such as product cycles and strategic adjustments.

Overall, Chinese brands continue to deepen their presence in Europe. The combination of established leaders and emerging challengers is driving sustained export growth. However, the widening gap in growth rates among companies signals an increasingly fierce competitive landscape, where product strength, supply chain resilience, and localized operations will be the decisive factors for success in the European market.

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia

BYD Auto: 109,848 units, up 133.5% year-on-year

Chery Auto: 63,438 units, up 141.4% year-on-year

Geely Auto: 57,709 units, up 33.7% year-on-year

Changan Auto: 26,041 units, up 55.9% year-on-year

Great Wall Motor: 15,064 units, up 33.0% year-on-year

SAIC PV: 14,871 units, down 22.7% year-on-year

Jiangsu Yueda Kia: 13,055 units, up 5.6% year-on-year

Tesla: 11,989 units, up 9.3% year-on-year

Jiangling Motor: 10,826 units, up 3.7% year-on-year

XPENG: 10,019 units

From January to September, China's passenger vehicle exports to Southeast Asia continued to rise. BYD Auto led the market with 109,848 units, up 133.5% YoY, highlighting its strong technological foundation in new energy and deep market penetration. Chery Auto followed with 63,438 units, a surge of 141.4% YoY, while Geely Auto ranked third with 57,709 units, up 33.7% YoY, reflecting steady gains from diversified products and expanding brand influence. Changan Auto and Great Wall Motor also maintained solid growth, underscoring the sustained momentum of Chinese brands in Southeast Asia.

Overall, Chinese brands are gaining stronger traction in Southeast Asia's export market, driven increasingly by the rapid growth of new energy models. As companies adopt different technological paths and market strategies, market differentiation is becoming more apparent. Leading players are further consolidating their advantages through product competitiveness and channel strength. As a result, Southeast Asia—now a core hub for China's passenger vehicle exports—is entering a new phase defined by refined, high-intensity competition.

Top 10 Chinese automakers by passenger vehicle exports to North America

SAIC-GM-Wuling: 83,617 units, up 11.1% year-on-year

BYD Auto: 78,375 units, up 101.4% year-on-year

Changan-Ford: 25,951 units, down 23.0% year-on-year

Chery Auto: 25,279 units, up 12.9% year-on-year

SAIC PV: 22,618 units, down 55.7% year-on-year

Jiangsu Yueda Kia: 22,244 units, up 3.2% year-on-year

Geely Auto: 21,660 units, up 0.8% year-on-year

SAIC-GM: 20,711 units, down 56.3% year-on-year

GAC Trumpchi: 12,658 units, up 34.0% year-on-year

Great Wall Motor: 10,842 units, up 71.6% year-on-year

The North American market is showing an increasingly polarized landscape. Automakers leading in electrification and transformation continue to post strong growth: SAIC-GM-Wuling topped the list with 83,617 units, up 11.1% YoY, followed closely by BYD Auto with 78,375 units, up 101.4%. GAC Trumpchi and Great Wall Motor also delivered impressive growth of 34.0% and 71.6%, respectively. These results highlight the advantages of Chinese automakers in new energy technology and global product strategy, with NEVs emerging as the key driver unlocking growth in the North American market.

Traditional joint ventures face growth bottlenecks: SAIC-GM and SAIC PV both fell over 55%, while Changan Ford dropped 23.0%. Mid-tier brands such as Chery Auto (+12.9%), Jiangsu Yueda Kia, and Geely remained largely flat, showing stable yet limited momentum.

Overall, Chinese automakers' exports to North America are in a key phase of "NEV rise vs. traditional adjustment," where electrification and global operation capabilities will define future competitiveness.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America

BYD Auto: 116,678 units, down 0.5% year-on-year

Chery Auto: 96,150 units, up 17.5% year-on-year

Great Wall Motor: 48,704 units, up 57.0% year-on-year

Jiangsu Yueda Kia: 35,544 units, down 7.2% year-on-year

Jiangling Motor: 28,211 units, up 87.4% year-on-year

Geely Auto: 18,657 units, unchanged year-on-year

SAIC-GM-Wuling: 16,690 units, down 30.2% year-on-year

SAIC PV: 15,225 units, up 22.6% year-on-year

DFSK: 14,808 units, up 60.8% year-on-year

Changan Auto: 14,337 units, down 17.9% year-on-year

From January to September, the performance of Chinese automakers in the Latin American market showed further divergence. BYD Auto led with 116,678 units exported, slightly down 0.5% YoY due to intensified global competition and a high base effect. Chery Auto followed with 96,150 units, up 17.5% YoY, narrowing the gap through its strong lineup of affordable models and deep local channels. Great Wall Motor (+57.0% YoY), Jiangling Motor (+87.4% YoY), SAIC PV (+22.6% YoY), and DFSK (+60.8% YoY) emerged as key growth drivers.

In contrast, some automakers faced mounting pressure: SAIC-GM-Wuling saw exports drop 30.2% YoY, while Changan Auto declined 17.9%, indicating a need to refine their regional strategies and optimize product portfolios.

Overall, competition in the Latin American market has entered a stage of precision play. Automakers must focus on product differentiation, deeper localization, and faster technology iteration. Only by aligning with the region's energy structure and consumer preferences can they achieve sustainable growth in this key export market.

Top 10 Chinese automakers by passenger vehicle exports to Middle East

Chery Auto: 190,573 units, down 32.9% year-on-year

BYD Auto: 87,135 units, up 114.8% year-on-year

SAIC PV: 70,907 units, down 4.1% year-on-year

Geely Auto: 64,036 units, down 2.6% year-on-year

Jiangsu Yueda Kia: 63,532 units, up 23.4% year-on-year

FAW-Toyota: 61,525 units, up 123.1% year-on-year

Changan Auto: 60,607 units, up 44.7% year-on-year

Great Wall Motor: 40,404 units, up 144.3% year-on-year

Southeast Auto: 37,237 units, up 236.9% year-on-year

Beijing Hyundai: 31,604 units, up 63.9% year-on-year

From January to September, the competitive landscape of the Middle Eastern market showed a clear pattern of "traditional leaders adjusting while emerging players surge." Among the established leaders, Chery remained at the top with over 190,573 units exported, though its volume declined 32.9% YoY due to intensified competition and a high base effect. SAIC Motor and Geely also posted slight decreases of 4.1% and 2.6%, respectively, underscoring the need for traditional players to accelerate strategic adjustments to stay competitive in the region.

In contrast, BYD Auto surged 114.8% YoY, driven by its strong NEV lineup. FAW-Toyota and Great Wall Motor grew over 120%, with Great Wall Motor up 144.3%. Changan Auto and Beijing Hyundai also posted double-digit growth, underscoring rising recognition of Chinese and joint-venture brands in the Middle East, especially for NEVs and smart models.

Overall, the Middle East has become a strategic stronghold for Chinese automakers. The pace of NEV transition and differentiated product strategies are now key drivers of growth. To maintain their market positions, established players must accelerate alignment with regional energy structures and consumer preferences, while emerging brands need to strengthen product competitiveness and channel networks to achieve sustainable expansion in this vital market.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com