Analysis: Net profits among domestic manufacturers in the first half of 2011

Gasgoo.com (Shanghai) - Following rapid growth in the Chinese automobile industry in 2009 and 2010, the first half of 2011 has seen the industry slow down considerably, as competition between manufacturers continues to accelerate. With these factors in place, what sort of changes can be expected to be seen in incomes and net profits?

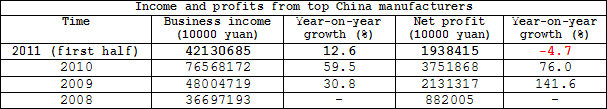

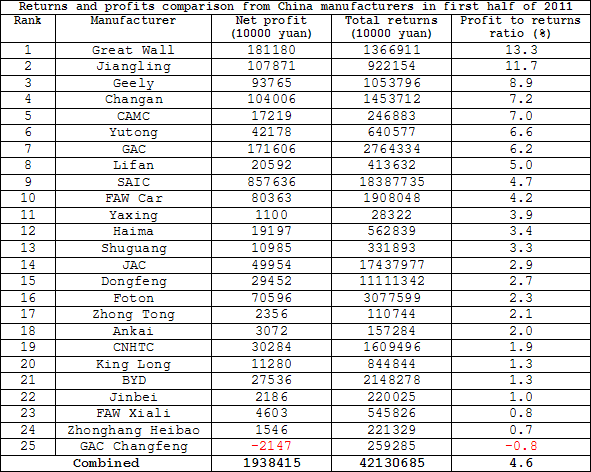

According to Gasgoo.com (Chinese) statistics, average income for the 25 leading manufacturers only grew 12.6 percent from 2010. This is in stark contrast to the previous two years, which saw year-on-year growth rates of 30.8 percent and 59.5 percent, respectively. Net profit, meanwhile, experienced a negative growth rate of 4.7 percent. When looking at net profit as a ratio of total returns, the industry this year achieved an average rate of 4.6 percent, which while higher than the 4.4 percent in 2009, is still below the 4.9 percent in 2010.

Among the country's top 25 manufacturers, only nine managed to have a net profit to total revenue ratio over the industry average of 4.6 percent in the first half of this year: Great Wall, Jiangling, Geely, Changan, CAMC, Yutong, GAC, Lifan and SAIC. Great Wall increased the fastest in this category, rising from 9.5 percent in 2010 to 13.3 percent this year. The manufacturer's income increased 49.8 percent from last year, while its net profit grew 109.0 percent. Great Wall was followed by SAIC, whose net profit ratio increased from 4.0 percent to 4.7 percent. SAIC's income and net profit rose 24.6 percent and 46.1 percent, respectively. SAIC's impressive growth is reportedly due to a large amount of its bonds and other investments maturing, increasing its total gains.

Geely and bus manufacturer Yutong also witnessed commendable rates of 8.9 percent and 6.6 percent respectively. Jiangling, Changan, CAMC, GAC and Lifan, while still over the industry average, had rates which were lower than in 2010.

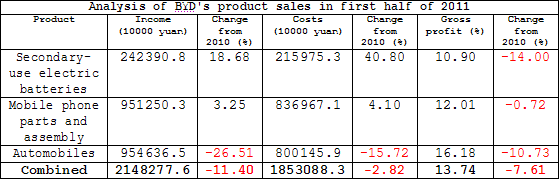

At the other end of the spectrum, there were 16 manufacturers who had net profit ratios under the industry average. Among them, BYD's performance was particularly worthy of attention, with the company's net profit ratio falling from 10.0 percent last year to 1.3 percent this year. BYD's net profit fell an astounding 88.6 percent to 275 million yuan this year.

Automobiles were BYD's core business in 2009 and 2010, constituting 53 percent and 46 percent of the manufacturer's returns respectively. Although they still form the main part of BYD's business, income from automobiles has fallen a significant 26.51 percent this year. BYD has seen better results in its battery and mobile phone ventures, however, as automobiles remain its primary driver, it is clear to see why the manufacturer's performance is so weak this year. Poor sales and constant delays in introducing its own brand venture are cited as the main reasons for BYD's poor sales.

After BYD, Jinbei's net profit ratio dropped the most at 8.1 percent. Meanwhile, GAC, Changfeng made a net loss of 21.46 million yuan this year. Poor sales, increasing costs (primarily due to the rising value of the yen) and decreasing value of properties have been cited as key reasons for the manufacturer's poor performance.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com